Basic Stats

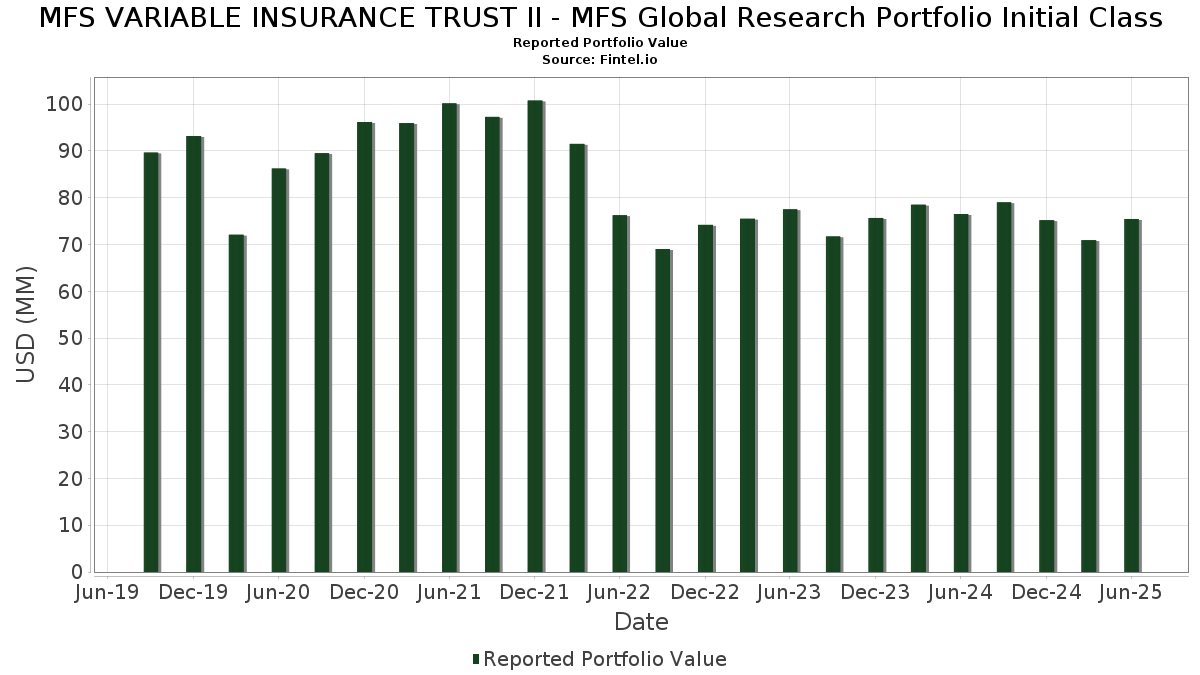

| Portfolio Value | $ 75,439,193 |

| Current Positions | 128 |

Latest Holdings, Performance, AUM (from 13F, 13D)

MFS VARIABLE INSURANCE TRUST II - MFS Global Research Portfolio Initial Class has disclosed 128 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 75,439,193 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). MFS VARIABLE INSURANCE TRUST II - MFS Global Research Portfolio Initial Class’s top holdings are Microsoft Corporation (US:MSFT) , Amazon.com, Inc. (US:AMZN) , Meta Platforms, Inc. (US:META) , NVIDIA Corporation (US:NVDA) , and Mastercard Incorporated (US:MA) . MFS VARIABLE INSURANCE TRUST II - MFS Global Research Portfolio Initial Class’s new positions include National Grid plc (GB:NG.) , James Hardie Industries plc - Depositary Receipt (Common Stock) (AU:JHX) , Union Pacific Corporation (US:UNP) , Daikin Industries,Ltd. (JP:6367) , and Atlas Copco AB (publ) (DE:ACO4) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 1.73 | 2.2975 | 2.2975 | |

| 0.01 | 1.54 | 2.0408 | 1.3960 | |

| 0.01 | 4.21 | 5.5817 | 1.0394 | |

| 0.05 | 0.71 | 0.9467 | 0.9467 | |

| 0.02 | 0.49 | 0.6467 | 0.6467 | |

| 0.00 | 0.59 | 0.7846 | 0.5922 | |

| 0.00 | 0.43 | 0.5706 | 0.5706 | |

| 0.00 | 0.41 | 0.5487 | 0.5487 | |

| 0.00 | 2.50 | 3.3093 | 0.5229 | |

| 0.02 | 0.38 | 0.5048 | 0.5048 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.22 | 0.22 | 0.2945 | -0.5891 | |

| 0.00 | 0.00 | -0.4724 | ||

| 0.01 | 1.09 | 1.4438 | -0.4025 | |

| 0.00 | 0.69 | 0.9131 | -0.2701 | |

| 0.00 | 0.42 | 0.5514 | -0.2394 | |

| 0.00 | 0.79 | 1.0469 | -0.2272 | |

| 0.00 | 0.43 | 0.5675 | -0.2162 | |

| 0.00 | 0.41 | 0.5409 | -0.2122 | |

| 0.03 | 0.47 | 0.6232 | -0.2050 | |

| 0.01 | 0.59 | 0.7827 | -0.2049 |

13F and Fund Filings

This form was filed on 2025-08-25 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.01 | -2.06 | 4.21 | 29.79 | 5.5817 | 1.0394 | |||

| AMZN / Amazon.com, Inc. | 0.01 | -2.06 | 2.64 | 12.97 | 3.4997 | 0.2270 | |||

| META / Meta Platforms, Inc. | 0.00 | -2.06 | 2.50 | 25.44 | 3.3093 | 0.5229 | |||

| NVDA / NVIDIA Corporation | 0.01 | -18.08 | 2.03 | 19.38 | 2.6893 | 0.3110 | |||

| MA / Mastercard Incorporated | 0.00 | 1.73 | 2.2975 | 2.2975 | |||||

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 0.04 | -2.22 | 1.60 | 27.27 | 2.1173 | 0.3604 | |||

| AVGO / Broadcom Inc. | 0.01 | 103.02 | 1.54 | 234.35 | 2.0408 | 1.3960 | |||

| AAPL / Apple Inc. | 0.01 | 22.08 | 1.18 | 12.70 | 1.5661 | 0.0993 | |||

| HIA1 / Hitachi, Ltd. | 0.04 | -2.07 | 1.10 | 23.52 | 1.4637 | 0.2122 | |||

| GOOGL / Alphabet Inc. | 0.01 | -27.53 | 1.09 | -17.45 | 1.4438 | -0.4025 | |||

| RYSD / NatWest Group plc | 0.14 | -15.64 | 1.00 | 1.11 | 1.3255 | -0.0595 | |||

| CRM / Salesforce, Inc. | 0.00 | -2.05 | 0.96 | -0.41 | 1.2787 | -0.0781 | |||

| ENX / Euronext N.V. | 0.01 | -8.40 | 0.93 | 8.13 | 1.2351 | 0.0285 | |||

| SBGSY / Schneider Electric S.E. - Depositary Receipt (Common Stock) | 0.00 | -2.06 | 0.92 | 12.59 | 1.2218 | 0.0752 | |||

| BARC / Barclays PLC | 0.19 | 21.64 | 0.90 | 50.17 | 1.1950 | 0.3536 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | -2.05 | 0.85 | 3.94 | 1.1214 | -0.0186 | |||

| NNND / Tencent Holdings Limited | 0.01 | -1.52 | 0.83 | -1.07 | 1.1047 | -0.0735 | |||

| LIN / Linde plc | 0.00 | -2.04 | 0.81 | -1.22 | 1.0783 | -0.0754 | |||

| HWM / Howmet Aerospace Inc. | 0.00 | -17.66 | 0.81 | 18.08 | 1.0747 | 0.1139 | |||

| JNJ / Johnson & Johnson | 0.01 | -2.05 | 0.81 | -9.82 | 1.0722 | -0.1829 | |||

| ABBV / AbbVie Inc. | 0.00 | -2.05 | 0.79 | -13.20 | 1.0469 | -0.2272 | |||

| ACN / Accenture plc | 0.00 | -2.04 | 0.76 | -6.17 | 1.0103 | -0.1268 | |||

| ROG / Roche Holding AG | 0.00 | -2.08 | 0.75 | -2.97 | 0.9981 | -0.0887 | |||

| FP / TotalEnergies SE | 0.01 | 3.17 | 0.74 | -2.12 | 0.9796 | -0.0764 | |||

| CNSWF / Constellation Software Inc. | 0.00 | -1.97 | 0.73 | 13.55 | 0.9676 | 0.0673 | |||

| ETN / Eaton Corporation plc | 0.00 | -2.04 | 0.72 | 28.80 | 0.9549 | 0.1710 | |||

| SCHW / The Charles Schwab Corporation | 0.01 | -2.06 | 0.71 | 14.06 | 0.9479 | 0.0709 | |||

| NG. / National Grid plc | 0.05 | 0.71 | 0.9467 | 0.9467 | |||||

| CI / The Cigna Group | 0.00 | -2.06 | 0.69 | -1.70 | 0.9189 | -0.0672 | |||

| AON / Aon plc | 0.00 | -8.83 | 0.69 | -18.48 | 0.9131 | -0.2701 | |||

| BAER / Julius Bär Gruppe AG | 0.01 | -2.06 | 0.66 | -4.08 | 0.8732 | -0.0889 | |||

| CFR / Compagnie Financière Richemont SA | 0.00 | -2.07 | 0.65 | 5.69 | 0.8622 | 0.0002 | |||

| BNP / BNP Paribas SA | 0.01 | -2.05 | 0.65 | 5.88 | 0.8593 | 0.0010 | |||

| HD / The Home Depot, Inc. | 0.00 | -2.09 | 0.62 | -2.06 | 0.8202 | -0.0641 | |||

| B3SA3 / B3 S.A. - Brasil, Bolsa, Balcão | 0.23 | -2.06 | 0.61 | 23.39 | 0.8128 | 0.1180 | |||

| DUK / Duke Energy Corporation | 0.01 | -2.06 | 0.61 | -5.27 | 0.8106 | -0.0929 | |||

| EMR / Emerson Electric Co. | 0.00 | 5.75 | 0.61 | 28.69 | 0.8100 | 0.1448 | |||

| RTX / RTX Corporation | 0.00 | 111.04 | 0.59 | 328.26 | 0.7846 | 0.5922 | |||

| COP / ConocoPhillips | 0.01 | -2.06 | 0.59 | -16.31 | 0.7827 | -0.2049 | |||

| TEAM / Atlassian Corporation | 0.00 | 31.36 | 0.59 | 25.75 | 0.7783 | 0.1245 | |||

| BIRG / Bank of Ireland Group plc | 0.04 | -2.06 | 0.58 | 17.78 | 0.7740 | 0.0802 | |||

| MDT / Medtronic plc | 0.01 | -2.05 | 0.58 | -4.96 | 0.7628 | -0.0850 | |||

| ASML / ASML Holding N.V. | 0.00 | -2.06 | 0.57 | 18.05 | 0.7558 | 0.0802 | |||

| TD / The Toronto-Dominion Bank | 0.01 | -2.06 | 0.57 | 20.13 | 0.7531 | 0.0916 | |||

| SPF / Spotify Technology S.A. | 0.00 | -2.12 | 0.57 | 36.63 | 0.7520 | 0.1704 | |||

| BSX / Boston Scientific Corporation | 0.01 | -2.06 | 0.57 | 4.24 | 0.7511 | -0.0096 | |||

| TYL / Tyler Technologies, Inc. | 0.00 | 13.95 | 0.55 | 16.24 | 0.7319 | 0.0667 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.00 | -2.05 | 0.55 | 13.20 | 0.7282 | 0.0480 | |||

| CB / Chubb Limited | 0.00 | -2.10 | 0.54 | -6.09 | 0.7165 | -0.0892 | |||

| EPAM / EPAM Systems, Inc. | 0.00 | -2.07 | 0.54 | 2.49 | 0.7117 | -0.0211 | |||

| MRVL / Marvell Technology, Inc. | 0.01 | -2.05 | 0.52 | 23.15 | 0.6854 | 0.0975 | |||

| CDNS / Cadence Design Systems, Inc. | 0.00 | -23.49 | 0.51 | -7.41 | 0.6800 | -0.0947 | |||

| ARMK / Aramark | 0.01 | -2.06 | 0.51 | 18.88 | 0.6768 | 0.0751 | |||

| LSEG / London Stock Exchange Group plc | 0.00 | -2.07 | 0.50 | -3.63 | 0.6694 | -0.0639 | |||

| HDFCB / HDFC Bank Ltd | 0.02 | -2.06 | 0.50 | 7.26 | 0.6667 | 0.0106 | |||

| CAP / Capgemini SE | 0.00 | -2.07 | 0.50 | 11.83 | 0.6648 | 0.0374 | |||

| JHX / James Hardie Industries plc - Depositary Receipt (Common Stock) | 0.02 | 0.49 | 0.6467 | 0.6467 | |||||

| NESN / Nestlé S.A. | 0.00 | -2.07 | 0.48 | -3.82 | 0.6348 | -0.0620 | |||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.00 | -2.07 | 0.47 | -17.94 | 0.6258 | -0.1787 | |||

| BBD / Banco Bradesco S.A. - Depositary Receipt (Common Stock) | 0.15 | -2.06 | 0.47 | 35.73 | 0.6253 | 0.1387 | |||

| PM / Philip Morris International Inc. | 0.00 | -2.04 | 0.47 | 12.41 | 0.6253 | 0.0378 | |||

| PCG / PG&E Corporation | 0.03 | -2.06 | 0.47 | -20.64 | 0.6232 | -0.2050 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | -8.42 | 0.47 | -12.50 | 0.6228 | -0.1281 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | -2.06 | 0.47 | -10.06 | 0.6170 | -0.1075 | |||

| CRH / CRH plc | 0.00 | -2.06 | 0.46 | 2.23 | 0.6076 | -0.0202 | |||

| GD / General Dynamics Corporation | 0.00 | -2.08 | 0.45 | 4.86 | 0.6011 | -0.0048 | |||

| PEP / PepsiCo, Inc. | 0.00 | 24.79 | 0.45 | 10.12 | 0.5915 | 0.0230 | |||

| LRCX / Lam Research Corporation | 0.00 | -2.07 | 0.44 | 31.14 | 0.5815 | 0.1132 | |||

| TE Connectivity PLC / EC (IE000IVNQZ81) | 0.00 | -2.06 | 0.43 | 17.03 | 0.5748 | 0.0555 | |||

| 4GNB / Wal-Mart de México, S.A.B. de C.V. | 0.13 | -2.06 | 0.43 | 17.66 | 0.5748 | 0.0594 | |||

| SHW / The Sherwin-Williams Company | 0.00 | -15.30 | 0.43 | -16.80 | 0.5724 | -0.1534 | |||

| CTVA / Corteva, Inc. | 0.01 | -2.06 | 0.43 | 16.17 | 0.5720 | 0.0512 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.43 | 0.5706 | 0.5706 | |||||

| RRX / Regal Rexnord Corporation | 0.00 | 10.12 | 0.43 | 40.20 | 0.5692 | 0.1405 | |||

| FI / Fiserv, Inc. | 0.00 | -2.05 | 0.43 | -23.61 | 0.5675 | -0.2162 | |||

| USFD / US Foods Holding Corp. | 0.01 | -2.05 | 0.43 | 15.14 | 0.5661 | 0.0473 | |||

| STE / STERIS plc | 0.00 | -2.06 | 0.42 | 3.94 | 0.5597 | -0.0097 | |||

| BDX / Becton, Dickinson and Company | 0.00 | -2.07 | 0.42 | -26.42 | 0.5514 | -0.2394 | |||

| 6367 / Daikin Industries,Ltd. | 0.00 | 0.41 | 0.5487 | 0.5487 | |||||

| CME / CME Group Inc. | 0.00 | -2.04 | 0.41 | 1.74 | 0.5431 | -0.0205 | |||

| GALP / Galp Energia, SGPS, S.A. | 0.02 | 8.95 | 0.41 | 13.65 | 0.5420 | 0.0383 | |||

| IT / Gartner, Inc. | 0.00 | -21.23 | 0.41 | -24.21 | 0.5409 | -0.2122 | |||

| A / Agilent Technologies, Inc. | 0.00 | -2.08 | 0.41 | -1.22 | 0.5388 | -0.0372 | |||

| MFZ / Mitsubishi UFJ Financial Group, Inc. | 0.03 | -1.99 | 0.41 | 0.00 | 0.5387 | -0.0306 | |||

| NDSN / Nordson Corporation | 0.00 | -2.10 | 0.40 | 3.92 | 0.5290 | -0.0080 | |||

| ACO4 / Atlas Copco AB (publ) | 0.02 | 0.38 | 0.5048 | 0.5048 | |||||

| AMT / American Tower Corporation | 0.00 | 0.37 | 0.4915 | 0.4915 | |||||

| 1299 / AIA Group Limited | 0.04 | -1.96 | 0.36 | 16.23 | 0.4757 | 0.0438 | |||

| 6CMB / Croda International Plc | 0.01 | 44.76 | 0.36 | 53.65 | 0.4754 | 0.1479 | |||

| LNG / Cheniere Energy, Inc. | 0.00 | 0.36 | 0.4715 | 0.4715 | |||||

| WAT / Waters Corporation | 0.00 | -2.05 | 0.35 | -7.43 | 0.4638 | -0.0643 | |||

| KPN / Koninklijke KPN N.V. | 0.07 | 0.35 | 0.4630 | 0.4630 | |||||

| FLUT / Flutter Entertainment plc | 0.00 | -2.03 | 0.34 | 26.47 | 0.4566 | 0.0750 | |||

| OKTA / Okta, Inc. | 0.00 | -2.04 | 0.34 | -6.83 | 0.4525 | -0.0609 | |||

| G1A / GEA Group Aktiengesellschaft | 0.00 | -11.93 | 0.34 | 1.80 | 0.4508 | -0.0166 | |||

| DIP / KDDI Corporation | 0.02 | 64.41 | 0.33 | 79.57 | 0.4431 | 0.1823 | |||

| AKZA / Akzo Nobel N.V. | 0.00 | 88.91 | 0.33 | 114.29 | 0.4379 | 0.2222 | |||

| 6758 / Sony Group Corporation | 0.01 | 0.33 | 0.4362 | 0.4362 | |||||

| VLO / Valero Energy Corporation | 0.00 | -2.06 | 0.33 | -0.31 | 0.4328 | -0.0257 | |||

| PFE / Pfizer Inc. | 0.01 | -2.06 | 0.32 | -6.36 | 0.4309 | -0.0548 | |||

| MDLZ / Mondelez International, Inc. | 0.00 | -2.06 | 0.31 | -2.82 | 0.4122 | -0.0350 | |||

| WTKWY / Wolters Kluwer N.V. - Depositary Receipt (Common Stock) | 0.00 | -2.06 | 0.31 | 5.44 | 0.4116 | -0.0004 | |||

| GLEN / Glencore plc | 0.08 | 31.46 | 0.31 | 39.19 | 0.4103 | 0.0988 | |||

| 8630 / Sompo Holdings, Inc. | 0.01 | -1.92 | 0.31 | -2.54 | 0.4081 | -0.0334 | |||

| JBHT / J.B. Hunt Transport Services, Inc. | 0.00 | -2.06 | 0.31 | -4.95 | 0.4077 | -0.0452 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0.01 | -2.06 | 0.31 | -1.29 | 0.4050 | -0.0283 | |||

| CLNX / Cellnex Telecom, S.A. | 0.01 | -2.06 | 0.31 | 7.02 | 0.4048 | 0.0056 | |||

| DGE / Diageo plc | 0.01 | 11.73 | 0.30 | 7.66 | 0.3915 | 0.0068 | |||

| WTB / Whitbread plc | 0.01 | -2.06 | 0.29 | 19.42 | 0.3838 | 0.0442 | |||

| JMT / Jerónimo Martins, SGPS, S.A. | 0.01 | -2.06 | 0.29 | 16.73 | 0.3804 | 0.0360 | |||

| HUBS / HubSpot, Inc. | 0.00 | -2.09 | 0.29 | -4.67 | 0.3802 | -0.0407 | |||

| MCO / Moody's Corporation | 0.00 | -2.09 | 0.28 | 5.62 | 0.3745 | -0.0005 | |||

| TRU / TransUnion | 0.00 | -2.06 | 0.27 | 4.21 | 0.3607 | -0.0061 | |||

| FTI / TechnipFMC plc | 0.01 | -2.07 | 0.25 | 6.28 | 0.3375 | 0.0026 | |||

| QGEN / Qiagen N.V. | 0.01 | -2.05 | 0.25 | 17.59 | 0.3373 | 0.0335 | |||

| CL / Colgate-Palmolive Company | 0.00 | 14.84 | 0.25 | 11.21 | 0.3302 | 0.0172 | |||

| 669 / Techtronic Industries Company Limited | 0.02 | -2.22 | 0.24 | -10.74 | 0.3207 | -0.0588 | |||

| KVUE / Kenvue Inc. | 0.01 | -2.06 | 0.23 | -14.87 | 0.3050 | -0.0718 | |||

| D4S / Daiichi Sankyo Company, Limited | 0.01 | -2.02 | 0.23 | -2.59 | 0.3006 | -0.0248 | |||

| 1193 / China Resources Gas Group Limited | 0.09 | 13.95 | 0.23 | -2.17 | 0.2987 | -0.0244 | |||

| US55291X1090 / MFS Institutional Money Market Portfolio | 0.22 | -64.80 | 0.22 | -64.76 | 0.2945 | -0.5891 | |||

| AISF / Advanced Info Service Public Company Limited | 0.03 | -15.18 | 0.22 | -9.92 | 0.2904 | -0.0498 | |||

| NXPI / NXP Semiconductors N.V. | 0.00 | -2.01 | 0.21 | 12.70 | 0.2828 | 0.0177 | |||

| KAO / Kao Corporation | 0.00 | 0.00 | 0.19 | 3.87 | 0.2497 | -0.0041 | |||

| 600519 / Kweichow Moutai Co., Ltd. | 0.00 | 0.00 | 0.18 | -8.29 | 0.2348 | -0.0365 | |||

| LEG / LEG Immobilien SE | 0.00 | -34.65 | 0.14 | -18.02 | 0.1872 | -0.0540 | |||

| 291 / China Resources Beer (Holdings) Company Limited | 0.04 | -2.56 | 0.12 | -14.18 | 0.1605 | -0.0381 | |||

| CDW / CDW Corporation | 0.00 | -2.06 | 0.12 | 9.26 | 0.1573 | 0.0051 | |||

| CP / Canadian Pacific Kansas City Limited | 0.00 | -100.00 | 0.00 | -100.00 | -0.4724 | ||||

| CA21037X1345 / CONSTELLATION SOFTWARE INC | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 |