Basic Stats

| Portfolio Value | $ 2,728,198,980 |

| Current Positions | 129 |

Latest Holdings, Performance, AUM (from 13F, 13D)

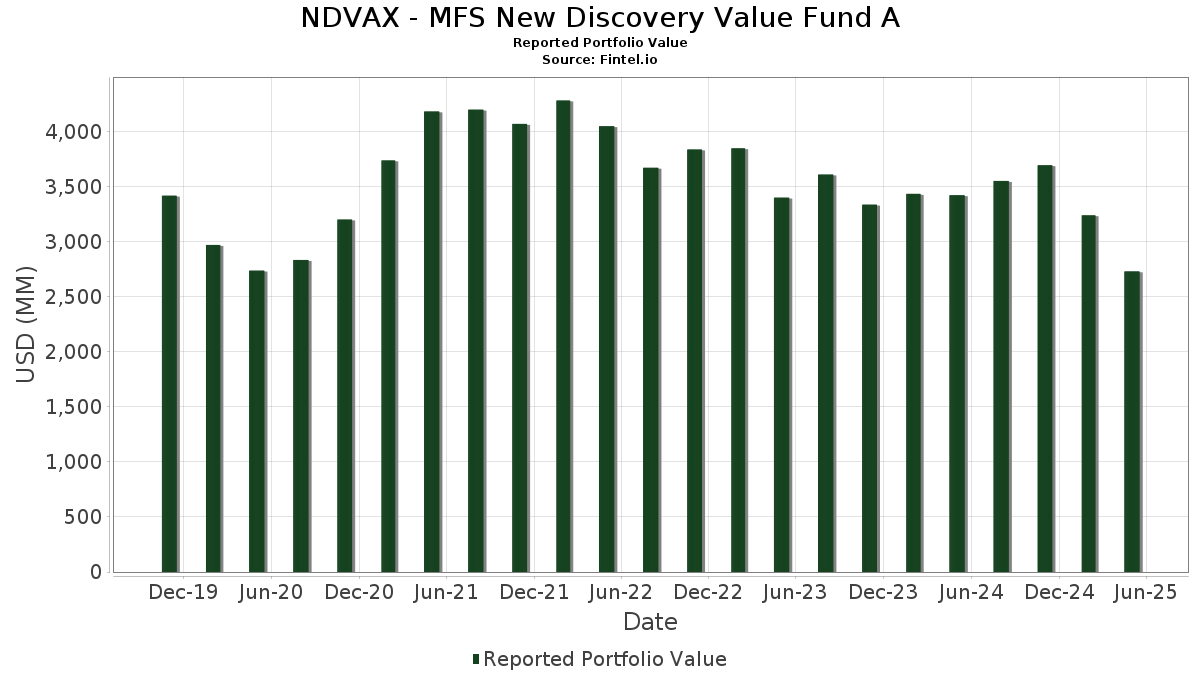

NDVAX - MFS New Discovery Value Fund A has disclosed 129 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 2,728,198,980 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). NDVAX - MFS New Discovery Value Fund A’s top holdings are Air Lease Corporation (US:AL) , Portland General Electric Company (US:POR) , Popular, Inc. (US:BPOP) , Prestige Consumer Healthcare Inc. (US:PBH) , and Prosperity Bancshares, Inc. (US:PB) . NDVAX - MFS New Discovery Value Fund A’s new positions include Hancock Whitney Corporation (US:HWC) , SmartStop Self Storage REIT, Inc. (US:SMA) , Four Corners Property Trust, Inc. (US:FCPT) , Rexford Industrial Realty, Inc. (US:REXR) , and Nexstar Media Group, Inc. (DE:NXZ) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.57 | 31.26 | 1.1491 | 1.1491 | |

| 0.72 | 26.17 | 0.9619 | 0.9619 | |

| 0.81 | 22.48 | 0.8263 | 0.8263 | |

| 0.63 | 22.07 | 0.8115 | 0.8115 | |

| 0.11 | 18.20 | 0.6690 | 0.6690 | |

| 0.24 | 17.62 | 0.6476 | 0.6476 | |

| 0.57 | 17.19 | 0.6318 | 0.6318 | |

| 0.88 | 16.79 | 0.6172 | 0.6172 | |

| 0.13 | 16.76 | 0.6160 | 0.6160 | |

| 0.25 | 15.74 | 0.5788 | 0.5788 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.22 | 7.41 | 0.2724 | -0.5366 | |

| 33.86 | 33.86 | 1.2448 | -0.4078 | |

| 0.07 | 8.46 | 0.3110 | -0.3853 | |

| 0.00 | 0.00 | -0.3464 | ||

| 11.20 | 11.20 | 0.4117 | -0.2798 | |

| 0.09 | 1.10 | 0.0404 | -0.2655 | |

| 0.53 | 21.59 | 0.7936 | -0.2447 | |

| 0.24 | 25.20 | 0.9265 | -0.2397 | |

| 0.45 | 21.54 | 0.7920 | -0.2391 | |

| 1.22 | 28.55 | 1.0498 | -0.2169 |

13F and Fund Filings

This form was filed on 2025-07-25 for the reporting period 2025-05-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AL / Air Lease Corporation | 0.68 | -16.41 | 39.13 | 0.49 | 1.4386 | 0.2297 | |||

| POR / Portland General Electric Company | 0.91 | -7.63 | 38.50 | -12.64 | 1.4154 | 0.0473 | |||

| BPOP / Popular, Inc. | 0.37 | -7.63 | 37.92 | -4.78 | 1.3941 | 0.1578 | |||

| PBH / Prestige Consumer Healthcare Inc. | 0.43 | -7.63 | 36.97 | -6.63 | 1.3592 | 0.1300 | |||

| PB / Prosperity Bancshares, Inc. | 0.52 | -13.87 | 36.46 | -21.85 | 1.3404 | -0.1078 | |||

| PPBI / Pacific Premier Bancorp, Inc. | 1.66 | -7.63 | 35.11 | -18.03 | 1.2909 | -0.0390 | |||

| SLM / SLM Corporation | 1.07 | -24.62 | 34.73 | -19.18 | 1.2766 | -0.0571 | |||

| NWE / NorthWestern Energy Group, Inc. | 0.62 | -7.63 | 34.58 | -8.62 | 1.2711 | 0.0965 | |||

| THG / The Hanover Insurance Group, Inc. | 0.19 | -20.91 | 34.16 | -18.38 | 1.2557 | -0.0434 | |||

| US55291X1090 / MFS Institutional Money Market Portfolio | 33.86 | -36.39 | 33.86 | -36.39 | 1.2448 | -0.4078 | |||

| EPRT / Essential Properties Realty Trust, Inc. | 1.03 | -7.63 | 33.43 | -8.26 | 1.2289 | 0.0978 | |||

| NOMD / Nomad Foods Limited | 1.88 | -7.63 | 32.92 | -14.48 | 1.2104 | 0.0153 | |||

| FHB / First Hawaiian, Inc. | 1.37 | -7.63 | 32.78 | -18.04 | 1.2052 | -0.0364 | |||

| HWC / Hancock Whitney Corporation | 0.57 | 31.26 | 1.1491 | 1.1491 | |||||

| PAGP / Plains GP Holdings, L.P. - Limited Partnership | 1.76 | -7.63 | 31.04 | -24.74 | 1.1413 | -0.1392 | |||

| SLGN / Silgan Holdings Inc. | 0.56 | -7.63 | 31.04 | -6.34 | 1.1410 | 0.1123 | |||

| VNT / Vontier Corporation | 0.81 | -7.63 | 29.01 | -11.59 | 1.0663 | 0.0479 | |||

| CATY / Cathay General Bancorp | 0.68 | -7.63 | 28.99 | -15.69 | 1.0657 | -0.0017 | |||

| OPCH / Option Care Health, Inc. | 0.89 | -7.63 | 28.97 | -9.89 | 1.0651 | 0.0670 | |||

| AR / Antero Resources Corporation | 0.77 | -15.05 | 28.96 | -13.32 | 1.0647 | 0.0275 | |||

| UGI / UGI Corporation | 0.80 | -7.63 | 28.94 | -2.50 | 1.0639 | 0.1425 | |||

| FIBK / First Interstate BancSystem, Inc. | 1.05 | -12.21 | 28.58 | -22.36 | 1.0506 | -0.0920 | |||

| COLB / Columbia Banking System, Inc. | 1.22 | -19.99 | 28.55 | -30.02 | 1.0498 | -0.2169 | |||

| UCB / United Community Banks, Inc. | 0.98 | -7.63 | 28.23 | -17.64 | 1.0378 | -0.0262 | |||

| AXS / AXIS Capital Holdings Limited | 0.27 | -13.87 | 28.00 | -7.72 | 1.0294 | 0.0875 | |||

| TTMI / TTM Technologies, Inc. | 0.94 | -7.63 | 28.00 | 14.39 | 1.0293 | 0.2695 | |||

| ESI / Element Solutions Inc | 1.31 | 4.85 | 27.92 | -14.14 | 1.0265 | 0.0169 | |||

| CON / Concentra Group Holdings Parent, Inc. | 1.29 | 2.44 | 27.90 | -1.87 | 1.0257 | 0.1431 | |||

| ATMU / Atmus Filtration Technologies Inc. | 0.77 | -7.63 | 27.83 | -16.41 | 1.0230 | -0.0104 | |||

| IRT / Independence Realty Trust, Inc. | 1.48 | -7.63 | 27.53 | -21.24 | 1.0119 | -0.0729 | |||

| EWBC / East West Bancorp, Inc. | 0.29 | -17.14 | 26.90 | -19.98 | 0.9891 | -0.0546 | |||

| OGS / ONE Gas, Inc. | 0.36 | -7.63 | 26.76 | -8.11 | 0.9838 | 0.0797 | |||

| PECO / Phillips Edison & Company, Inc. | 0.75 | -7.63 | 26.67 | -11.95 | 0.9804 | 0.0401 | |||

| NATL / NCR Atleos Corporation | 1.01 | -1.77 | 26.67 | -8.43 | 0.9803 | 0.0763 | |||

| GPK / Graphic Packaging Holding Company | 1.18 | 41.45 | 26.21 | 17.80 | 0.9637 | 0.2729 | |||

| SMA / SmartStop Self Storage REIT, Inc. | 0.72 | 26.17 | 0.9619 | 0.9619 | |||||

| LOPE / Grand Canyon Education, Inc. | 0.13 | -24.90 | 25.70 | -17.37 | 0.9449 | -0.0207 | |||

| UMBF / UMB Financial Corporation | 0.24 | -28.22 | 25.20 | -32.92 | 0.9265 | -0.2397 | |||

| TCBI / Texas Capital Bancshares, Inc. | 0.35 | -14.11 | 25.00 | -22.22 | 0.9192 | -0.0787 | |||

| AIN / Albany International Corp. | 0.38 | -7.63 | 24.86 | -20.30 | 0.9139 | -0.0544 | |||

| HAYW / Hayward Holdings, Inc. | 1.78 | -7.63 | 24.82 | -11.08 | 0.9126 | 0.0460 | |||

| EBC / Eastern Bankshares, Inc. | 1.59 | -7.63 | 23.80 | -22.55 | 0.8751 | -0.0790 | |||

| FTI / TechnipFMC plc | 0.76 | -7.63 | 23.77 | -2.27 | 0.8740 | 0.1189 | |||

| HXL / Hexcel Corporation | 0.45 | -7.63 | 23.67 | -22.91 | 0.8702 | -0.0830 | |||

| BKH / Black Hills Corporation | 0.40 | -7.63 | 23.62 | -11.73 | 0.8685 | 0.0377 | |||

| NJR / New Jersey Resources Corporation | 0.51 | -7.63 | 23.58 | -12.39 | 0.8669 | 0.0314 | |||

| US7587501039 / Regal-Beloit Corp. | 0.17 | 8.13 | 23.30 | 11.50 | 0.8565 | 0.2079 | |||

| TNET / TriNet Group, Inc. | 0.28 | -7.63 | 23.19 | 4.27 | 0.8525 | 0.1621 | |||

| SIGI / Selective Insurance Group, Inc. | 0.26 | -7.63 | 23.08 | -5.52 | 0.8484 | 0.0902 | |||

| CUZ / Cousins Properties Incorporated | 0.82 | -7.63 | 23.08 | -14.52 | 0.8484 | 0.0103 | |||

| VNOM / Viper Energy, Inc. | 0.58 | -12.99 | 22.92 | -25.84 | 0.8427 | -0.1168 | |||

| BRX / Brixmor Property Group Inc. | 0.90 | -7.63 | 22.84 | -16.06 | 0.8398 | -0.0050 | |||

| NVT / nVent Electric plc | 0.35 | -7.63 | 22.76 | 0.73 | 0.8368 | 0.1353 | |||

| DAN / Dana Incorporated | 1.35 | -26.02 | 22.50 | -17.26 | 0.8270 | -0.0170 | |||

| FCPT / Four Corners Property Trust, Inc. | 0.81 | 22.48 | 0.8263 | 0.8263 | |||||

| FLS / Flowserve Corporation | 0.45 | -7.63 | 22.26 | -16.24 | 0.8183 | -0.0067 | |||

| EFN / Element Fleet Management Corp. | 0.93 | -32.80 | 22.13 | -19.96 | 0.8137 | -0.0447 | |||

| TKR / The Timken Company | 0.32 | -1.58 | 22.10 | -16.78 | 0.8126 | -0.0119 | |||

| PR / Permian Resources Corporation | 1.75 | -7.63 | 22.09 | -17.34 | 0.8121 | -0.0175 | |||

| REXR / Rexford Industrial Realty, Inc. | 0.63 | 22.07 | 0.8115 | 0.8115 | |||||

| VC / Visteon Corporation | 0.26 | -7.63 | 21.95 | -10.08 | 0.8070 | 0.0492 | |||

| WTFC / Wintrust Financial Corporation | 0.18 | -26.99 | 21.81 | -29.96 | 0.8018 | -0.1649 | |||

| ACIW / ACI Worldwide, Inc. | 0.47 | -7.63 | 21.73 | -25.50 | 0.7990 | -0.1065 | |||

| MTDR / Matador Resources Company | 0.50 | -7.63 | 21.70 | -24.10 | 0.7977 | -0.0898 | |||

| NVST / Envista Holdings Corporation | 1.18 | -7.63 | 21.62 | -15.54 | 0.7948 | 0.0002 | |||

| LKQ / LKQ Corporation | 0.53 | -32.72 | 21.59 | -35.46 | 0.7936 | -0.2447 | |||

| IP / International Paper Company | 0.45 | -23.56 | 21.54 | -35.15 | 0.7920 | -0.2391 | |||

| AVNT / Avient Corporation | 0.60 | 2.55 | 21.53 | -13.37 | 0.7914 | 0.0200 | |||

| CVBF / CVB Financial Corp. | 1.14 | 6.96 | 21.37 | -0.57 | 0.7858 | 0.1184 | |||

| ESAB / ESAB Corporation | 0.17 | -7.63 | 21.18 | -9.34 | 0.7786 | 0.0534 | |||

| LNC / Lincoln National Corporation | 0.63 | -7.63 | 21.00 | -21.52 | 0.7721 | -0.0586 | |||

| PFSI / PennyMac Financial Services, Inc. | 0.22 | -7.63 | 20.92 | -14.45 | 0.7690 | 0.0100 | |||

| NSIT / Insight Enterprises, Inc. | 0.16 | -7.63 | 20.73 | -21.73 | 0.7622 | -0.0601 | |||

| SMPL / The Simply Good Foods Company | 0.59 | -7.63 | 20.48 | -15.56 | 0.7531 | -0.0000 | |||

| THRY / Thryv Holdings, Inc. | 1.52 | 21.88 | 20.23 | -5.97 | 0.7437 | 0.0758 | |||

| PX / P10, Inc. | 1.86 | -7.63 | 20.20 | -21.45 | 0.7426 | -0.0557 | |||

| KWR / Quaker Chemical Corporation | 0.18 | 20.45 | 19.79 | -6.05 | 0.7276 | 0.0737 | |||

| ASH / Ashland Inc. | 0.39 | -7.63 | 19.14 | -24.81 | 0.7037 | -0.0866 | |||

| HAS / Hasbro, Inc. | 0.29 | -24.78 | 19.13 | -22.93 | 0.7032 | -0.0673 | |||

| KBR / KBR, Inc. | 0.36 | 9.51 | 19.00 | 16.56 | 0.6984 | 0.1925 | |||

| TRS / TriMas Corporation | 0.72 | -7.63 | 18.95 | 18.88 | 0.6968 | 0.2018 | |||

| SARO / StandardAero, Inc. | 0.64 | -7.63 | 18.63 | -4.04 | 0.6849 | 0.0822 | |||

| BRSL / Brightstar Lottery PLC | 1.24 | -7.63 | 18.26 | -23.37 | 0.6713 | -0.0684 | |||

| NXZ / Nexstar Media Group, Inc. | 0.11 | 18.20 | 0.6690 | 0.6690 | |||||

| KMPR / Kemper Corporation | 0.28 | 32.55 | 17.86 | 25.01 | 0.6566 | 0.2131 | |||

| BELFB / Bel Fuse Inc. | 0.24 | 17.62 | 0.6476 | 0.6476 | |||||

| UE / Urban Edge Properties | 0.96 | -7.63 | 17.50 | -18.57 | 0.6432 | -0.0238 | |||

| FORM / FormFactor, Inc. | 0.58 | 37.71 | 17.42 | 23.45 | 0.6404 | 0.2023 | |||

| PLXS / Plexus Corp. | 0.13 | -19.40 | 17.32 | -20.40 | 0.6369 | -0.0388 | |||

| AUB / Atlantic Union Bankshares Corporation | 0.57 | 17.19 | 0.6318 | 0.6318 | |||||

| UA / Under Armour, Inc. | 2.72 | -7.63 | 17.16 | -8.36 | 0.6309 | 0.0496 | |||

| PATK / Patrick Industries, Inc. | 0.20 | -7.63 | 17.06 | -12.46 | 0.6272 | 0.0222 | |||

| XPRO / Expro Group Holdings N.V. | 2.03 | 51.74 | 16.91 | 6.19 | 0.6216 | 0.1273 | |||

| AXTA / Axalta Coating Systems Ltd. | 0.55 | -8.49 | 16.89 | -22.16 | 0.6210 | -0.0527 | |||

| ECG / Everus Construction Group, Inc. | 0.29 | 51.97 | 16.79 | 111.56 | 0.6172 | 0.3708 | |||

| MIR / Mirion Technologies, Inc. | 0.88 | 16.79 | 0.6172 | 0.6172 | |||||

| ATGE / Adtalem Global Education Inc. | 0.13 | 16.76 | 0.6160 | 0.6160 | |||||

| DEI / Douglas Emmett, Inc. | 1.12 | -7.63 | 15.96 | -24.03 | 0.5866 | -0.0654 | |||

| CHEF / The Chefs' Warehouse, Inc. | 0.25 | 15.74 | 0.5788 | 0.5788 | |||||

| NWL / Newell Brands Inc. | 2.97 | 11.63 | 15.74 | -7.85 | 0.5786 | 0.0484 | |||

| HRI / Herc Holdings Inc. | 0.12 | -7.63 | 15.33 | -20.17 | 0.5636 | -0.0326 | |||

| TWO / Two Harbors Investment Corp. | 1.45 | -7.63 | 15.31 | -31.02 | 0.5628 | -0.1261 | |||

| BANC / Banc of California, Inc. | 1.11 | -32.59 | 15.22 | -37.81 | 0.5597 | -0.2002 | |||

| NCNO / nCino, Inc. | 0.58 | -7.63 | 15.21 | -22.41 | 0.5591 | -0.0494 | |||

| BC / Brunswick Corporation | 0.28 | -7.63 | 14.10 | -23.16 | 0.5183 | -0.0513 | |||

| STC / Stewart Information Services Corporation | 0.23 | -7.63 | 14.03 | -21.72 | 0.5157 | -0.0406 | |||

| TOL / Toll Brothers, Inc. | 0.13 | -7.63 | 13.97 | -13.75 | 0.5137 | 0.0108 | |||

| 2IY / Cushman & Wakefield plc | 1.38 | -7.63 | 13.87 | -22.08 | 0.5097 | -0.0427 | |||

| VRNT / Verint Systems Inc. | 0.73 | -7.63 | 12.78 | -28.22 | 0.4699 | -0.0829 | |||

| PTVLF / Pet Valu Holdings Ltd. | 0.55 | 12.29 | 0.4519 | 0.4519 | |||||

| MDU / MDU Resources Group, Inc. | 0.70 | -7.63 | 12.12 | -7.95 | 0.4454 | 0.0368 | |||

| UTZ / Utz Brands, Inc. | 0.91 | 12.02 | 0.4418 | 0.4418 | |||||

| COLM / Columbia Sportswear Company | 0.18 | 11.62 | 0.4273 | 0.4273 | |||||

| KAI / Kadant Inc. | 0.04 | 11.22 | 0.4123 | 0.4123 | |||||

| MGMXX / JPMorgan Trust II - JPMorgan U.S. Government Money Market Fund IM | 11.20 | -49.73 | 11.20 | -49.73 | 0.4117 | -0.2798 | |||

| CC / The Chemours Company | 1.08 | -7.63 | 10.99 | -37.41 | 0.4040 | -0.1411 | |||

| RXO / RXO, Inc. | 0.70 | -7.63 | 10.84 | -29.93 | 0.3986 | -0.0817 | |||

| EHC / Encompass Health Corporation | 0.07 | -68.76 | 8.46 | -62.29 | 0.3110 | -0.3853 | |||

| ICLR / ICON Public Limited Company | 0.06 | -7.63 | 8.36 | -36.68 | 0.3072 | -0.1024 | |||

| AHL.PRF / Aspen Insurance Holdings Limited - Preferred Security | 0.24 | 8.15 | 0.2995 | 0.2995 | |||||

| OGN / Organon & Co. | 0.85 | 3.52 | 7.88 | -35.99 | 0.2895 | -0.0924 | |||

| SDHC / Smith Douglas Homes Corp. | 0.40 | 23.92 | 7.48 | 9.93 | 0.2751 | 0.0638 | |||

| NSA / National Storage Affiliates Trust | 0.22 | -68.08 | 7.41 | -71.57 | 0.2724 | -0.5366 | |||

| HUT / Hut 8 Corp. | 0.47 | -7.63 | 7.24 | -4.38 | 0.2663 | 0.0311 | |||

| 0L8 / Lantheus Holdings, Inc. | 0.08 | 5.81 | 0.2136 | 0.2136 | |||||

| ASTS / AST SpaceMobile, Inc. | 0.22 | 7.15 | 5.15 | -8.81 | 0.1894 | 0.0140 | |||

| DAVA / Endava plc - Depositary Receipt (Common Stock) | 0.20 | -54.16 | 3.12 | -70.41 | 0.1149 | -0.2129 | |||

| TTAN / ServiceTitan, Inc. | 0.03 | -38.47 | 3.05 | -28.30 | 0.1122 | -0.0199 | |||

| ZUMZ / Zumiez Inc. | 0.09 | -87.27 | 1.10 | -88.86 | 0.0404 | -0.2655 | |||

| KRMN / Karman Holdings Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3464 |