Basic Stats

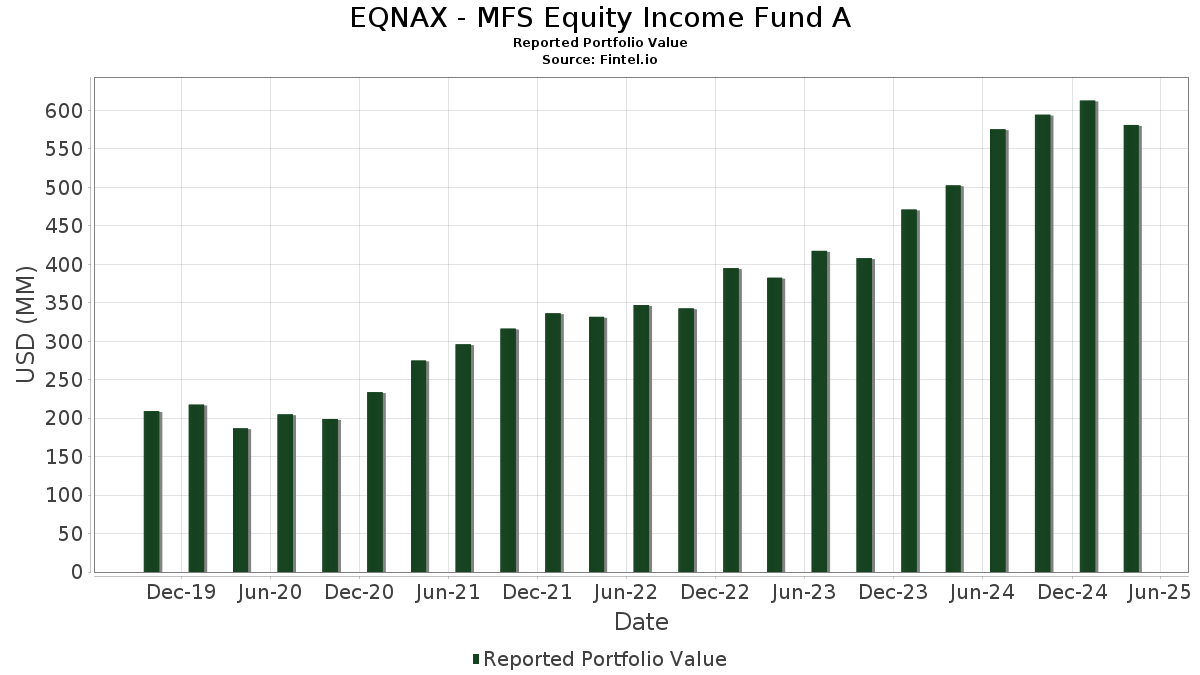

| Portfolio Value | $ 581,206,816 |

| Current Positions | 98 |

Latest Holdings, Performance, AUM (from 13F, 13D)

EQNAX - MFS Equity Income Fund A has disclosed 98 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 581,206,816 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). EQNAX - MFS Equity Income Fund A’s top holdings are Wells Fargo & Company (US:WFC) , AbbVie Inc. (US:ABBV) , JPMorgan Chase & Co. (US:JPM) , The Cigna Group (US:CI) , and Pfizer Inc. (US:PFE) . EQNAX - MFS Equity Income Fund A’s new positions include Mastercard Incorporated (US:MA) , Lincoln National Corporation (US:LNC) , Humana Inc. (US:HUM) , Broadcom Inc. (US:AVGO) , and T-Mobile US, Inc. (US:TMUS) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.17 | 8.98 | 1.5227 | 1.5227 | |

| 0.01 | 4.23 | 0.7168 | 0.7168 | |

| 0.12 | 3.77 | 0.6401 | 0.6401 | |

| 0.01 | 3.46 | 0.5863 | 0.5863 | |

| 0.15 | 7.62 | 1.2922 | 0.5520 | |

| 0.02 | 3.23 | 0.5485 | 0.5485 | |

| 0.01 | 3.13 | 0.5303 | 0.5303 | |

| 0.04 | 2.93 | 0.4970 | 0.4970 | |

| 0.32 | 8.99 | 1.5245 | 0.4417 | |

| 0.04 | 14.14 | 2.3989 | 0.4196 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 10.13 | 1.7191 | -1.3694 | |

| 0.03 | 6.00 | 1.0183 | -1.0955 | |

| 0.04 | 7.48 | 1.2694 | -0.5771 | |

| 0.06 | 14.57 | 2.4708 | -0.5298 | |

| 0.07 | 11.80 | 2.0018 | -0.4508 | |

| 0.07 | 6.49 | 1.1010 | -0.3964 | |

| 0.15 | 9.03 | 1.5326 | -0.3791 | |

| 0.05 | 9.48 | 1.6086 | -0.3684 | |

| 0.04 | 10.53 | 1.7870 | -0.2436 | |

| 0.30 | 1.44 | 0.2440 | -0.2409 |

13F and Fund Filings

This form was filed on 2025-06-24 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| WFC / Wells Fargo & Company | 0.25 | 0.00 | 17.58 | -9.89 | 2.9814 | -0.1736 | |||

| ABBV / AbbVie Inc. | 0.08 | 0.00 | 15.16 | 6.09 | 2.5717 | 0.2601 | |||

| JPM / JPMorgan Chase & Co. | 0.06 | -14.19 | 14.57 | -21.47 | 2.4708 | -0.5298 | |||

| CI / The Cigna Group | 0.04 | 0.00 | 14.14 | 15.58 | 2.3989 | 0.4196 | |||

| PFE / Pfizer Inc. | 0.51 | 0.00 | 12.40 | -7.95 | 2.1026 | -0.0758 | |||

| QCOM / QUALCOMM Incorporated | 0.08 | 0.00 | 11.91 | -14.15 | 2.0195 | -0.2238 | |||

| GOOGL / Alphabet Inc. | 0.07 | 0.00 | 11.80 | -22.17 | 2.0018 | -0.4508 | |||

| MCK / McKesson Corporation | 0.02 | -25.48 | 11.05 | -10.69 | 1.8745 | -0.1269 | |||

| HD / The Home Depot, Inc. | 0.03 | 0.00 | 10.67 | -12.50 | 1.8106 | -0.1626 | |||

| AMP / Ameriprise Financial, Inc. | 0.02 | 0.00 | 10.63 | -13.32 | 1.8035 | -0.1805 | |||

| AXP / American Express Company | 0.04 | 0.00 | 10.53 | -16.08 | 1.7870 | -0.2436 | |||

| BAC / Bank of America Corporation | 0.26 | 0.00 | 10.34 | -13.87 | 1.7545 | -0.1880 | |||

| MSFT / Microsoft Corporation | 0.03 | -44.26 | 10.13 | -46.92 | 1.7191 | -1.3694 | |||

| BPOP / Popular, Inc. | 0.10 | 0.00 | 9.84 | -7.30 | 1.6684 | -0.0480 | |||

| TT / Trane Technologies plc | 0.03 | 0.00 | 9.73 | 5.67 | 1.6506 | 0.1610 | |||

| MDT / Medtronic plc | 0.11 | 0.00 | 9.53 | -6.67 | 1.6161 | -0.0352 | |||

| AMZN / Amazon.com, Inc. | 0.05 | 0.00 | 9.48 | -22.40 | 1.6086 | -0.3684 | |||

| KMB / Kimberly-Clark Corporation | 0.07 | 0.00 | 9.46 | 1.39 | 1.6052 | 0.0955 | |||

| C / Citigroup Inc. | 0.14 | 0.00 | 9.24 | -16.03 | 1.5669 | -0.2125 | |||

| US21871X1090 / Corebridge Financial, Inc. | 0.31 | 0.00 | 9.19 | -12.24 | 1.5595 | -0.1350 | |||

| MAS / Masco Corporation | 0.15 | 0.00 | 9.03 | -23.55 | 1.5326 | -0.3791 | |||

| FINGF / Finning International Inc. | 0.32 | 18.78 | 8.99 | 34.27 | 1.5245 | 0.4417 | |||

| SYF / Synchrony Financial | 0.17 | 8.98 | 1.5227 | 1.5227 | |||||

| WPC / W. P. Carey Inc. | 0.14 | 0.00 | 8.96 | 11.68 | 1.5201 | 0.2221 | |||

| NTRS / Northern Trust Corporation | 0.09 | 0.00 | 8.91 | -16.30 | 1.5113 | -0.2107 | |||

| JNJ / Johnson & Johnson | 0.05 | 0.00 | 8.08 | 2.73 | 1.3709 | 0.0984 | |||

| RTPPF / Rio Tinto Group | 0.13 | 0.00 | 8.02 | -1.24 | 1.3600 | 0.0467 | |||

| FTI / TechnipFMC plc | 0.28 | 21.06 | 7.99 | 13.47 | 1.3558 | 0.2165 | |||

| NEE.PRT / NextEra Energy, Inc. - Debt/Equity Composite Units | 0.18 | 0.00 | 7.72 | -5.02 | 1.3089 | -0.0052 | |||

| EQH / Equitable Holdings, Inc. | 0.15 | 58.53 | 7.62 | 72.92 | 1.2922 | 0.5520 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.04 | -17.68 | 7.48 | -34.45 | 1.2694 | -0.5771 | |||

| PSX / Phillips 66 | 0.07 | 0.00 | 6.98 | -11.71 | 1.1843 | -0.0950 | |||

| ENB / Enbridge Inc. | 0.15 | 0.00 | 6.96 | 8.14 | 1.1808 | 0.1395 | |||

| CUZ / Cousins Properties Incorporated | 0.24 | 56.49 | 6.54 | 41.17 | 1.1094 | 0.3600 | |||

| IBDRY / Iberdrola, S.A. - Depositary Receipt (Common Stock) | 0.36 | 0.00 | 6.51 | 27.57 | 1.1044 | 0.2788 | |||

| TGT / Target Corporation | 0.07 | 0.00 | 6.49 | -29.88 | 1.1010 | -0.3964 | |||

| HIW / Highwoods Properties, Inc. | 0.22 | 0.00 | 6.22 | -4.53 | 1.0552 | 0.0012 | |||

| AAPL / Apple Inc. | 0.03 | -48.98 | 6.00 | -54.06 | 1.0183 | -1.0955 | |||

| OMC / Omnicom Group Inc. | 0.08 | 0.00 | 5.98 | -12.24 | 1.0143 | -0.0880 | |||

| ETN / Eaton Corporation plc | 0.02 | 0.00 | 5.96 | -9.82 | 1.0111 | -0.0582 | |||

| EPRT / Essential Properties Realty Trust, Inc. | 0.18 | 0.00 | 5.63 | 0.23 | 0.9557 | 0.0463 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 5.47 | 3.91 | 0.9279 | 0.0763 | |||

| GILD / Gilead Sciences, Inc. | 0.05 | 0.00 | 5.38 | 9.60 | 0.9121 | 0.1185 | |||

| GOB / Compagnie de Saint-Gobain S.A. | 0.05 | 0.00 | 5.02 | 16.44 | 0.8520 | 0.1542 | |||

| MO / Altria Group, Inc. | 0.08 | 0.00 | 4.92 | 13.23 | 0.8347 | 0.1318 | |||

| CL / Colgate-Palmolive Company | 0.05 | 0.00 | 4.88 | 6.34 | 0.8281 | 0.0854 | |||

| MDLZ / Mondelez International, Inc. | 0.07 | 0.00 | 4.85 | 17.48 | 0.8219 | 0.1548 | |||

| MFC / Manulife Financial Corporation | 0.16 | 0.00 | 4.84 | 2.48 | 0.8203 | 0.0570 | |||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 0.33 | 0.00 | 4.63 | 0.65 | 0.7855 | 0.0412 | |||

| AMAT / Applied Materials, Inc. | 0.03 | 0.00 | 4.62 | -16.43 | 0.7835 | -0.1106 | |||

| GE / General Electric Company | 0.02 | 0.00 | 4.50 | -0.99 | 0.7640 | 0.0281 | |||

| OGN / Organon & Co. | 0.35 | 0.00 | 4.50 | -16.89 | 0.7635 | -0.1127 | |||

| PM / Philip Morris International Inc. | 0.03 | 0.00 | 4.43 | 31.61 | 0.7522 | 0.2072 | |||

| DUK / Duke Energy Corporation | 0.04 | 0.00 | 4.30 | 8.95 | 0.7291 | 0.0910 | |||

| SAN / Santander UK plc - Preferred Stock | 0.04 | 0.00 | 4.25 | 1.09 | 0.7215 | 0.0410 | |||

| MA / Mastercard Incorporated | 0.01 | 4.23 | 0.7168 | 0.7168 | |||||

| NFG / National Fuel Gas Company | 0.05 | 0.00 | 4.21 | 9.63 | 0.7148 | 0.0931 | |||

| LRCX / Lam Research Corporation | 0.06 | 0.00 | 4.20 | -11.56 | 0.7125 | -0.0559 | |||

| PCG.PRX / PG&E Corporation - Preferred Security | 0.10 | 0.00 | 4.20 | 2.99 | 0.7122 | 0.0527 | |||

| ARMK / Aramark | 0.12 | 23.10 | 4.15 | 5.76 | 0.7036 | 0.0692 | |||

| EOG / EOG Resources, Inc. | 0.04 | 0.00 | 4.14 | -12.31 | 0.7023 | -0.0613 | |||

| GIS / General Mills, Inc. | 0.07 | 0.00 | 4.13 | -5.65 | 0.6998 | -0.0075 | |||

| LNC / Lincoln National Corporation | 0.12 | 3.77 | 0.6401 | 0.6401 | |||||

| BA.PRA / The Boeing Company - Preferred Security | 0.06 | 0.00 | 3.68 | 2.31 | 0.6235 | 0.0424 | |||

| BATS / British American Tobacco p.l.c. | 0.08 | 0.00 | 3.66 | 9.45 | 0.6210 | 0.0800 | |||

| NEE / NextEra Energy, Inc. | 0.05 | 0.00 | 3.64 | -6.55 | 0.6173 | -0.0126 | |||

| LDOS / Leidos Holdings, Inc. | 0.02 | 0.00 | 3.63 | 3.62 | 0.6165 | 0.0492 | |||

| PEP / PepsiCo, Inc. | 0.03 | 0.00 | 3.55 | -10.04 | 0.6020 | -0.0361 | |||

| CSX / CSX Corporation | 0.13 | 0.00 | 3.53 | -14.59 | 0.5988 | -0.0699 | |||

| ZURVY / Zurich Insurance Group AG - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 3.51 | 16.40 | 0.5949 | 0.1074 | |||

| NRG / NRG Energy, Inc. | 0.03 | 0.00 | 3.47 | 6.96 | 0.5892 | 0.0639 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.02 | 0.00 | 3.46 | -20.04 | 0.5877 | -0.1132 | |||

| HUM / Humana Inc. | 0.01 | 3.46 | 0.5863 | 0.5863 | |||||

| JCI / Johnson Controls International plc | 0.04 | 0.00 | 3.44 | 7.56 | 0.5839 | 0.0662 | |||

| FP / TotalEnergies SE | 0.06 | 0.00 | 3.26 | -2.39 | 0.5537 | 0.0129 | |||

| TJX / The TJX Companies, Inc. | 0.03 | 0.00 | 3.26 | 3.13 | 0.5527 | 0.0416 | |||

| COP / ConocoPhillips | 0.04 | 0.00 | 3.26 | -9.83 | 0.5526 | -0.0318 | |||

| SWK / Stanley Black & Decker, Inc. | 0.05 | 0.00 | 3.24 | -31.84 | 0.5501 | -0.2197 | |||

| AVGO / Broadcom Inc. | 0.02 | 3.23 | 0.5485 | 0.5485 | |||||

| EIX / Edison International | 0.06 | 0.00 | 3.14 | -0.91 | 0.5333 | 0.0201 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 3.13 | 0.5303 | 0.5303 | |||||

| HIG / The Hartford Insurance Group, Inc. | 0.02 | 0.00 | 3.00 | 9.97 | 0.5090 | 0.0676 | |||

| ETR / Entergy Corporation | 0.04 | 2.93 | 0.4970 | 0.4970 | |||||

| EMN / Eastman Chemical Company | 0.04 | 0.00 | 2.90 | -22.72 | 0.4921 | -0.1152 | |||

| CRM / Salesforce, Inc. | 0.01 | 0.00 | 2.84 | -21.36 | 0.4822 | -0.1025 | |||

| J / Jacobs Solutions Inc. | 0.02 | 0.00 | 2.81 | -11.68 | 0.4773 | -0.0379 | |||

| XOM / Exxon Mobil Corporation | 0.03 | 0.00 | 2.69 | -1.14 | 0.4571 | 0.0162 | |||

| AGCO / AGCO Corporation | 0.03 | 0.00 | 2.39 | -18.76 | 0.4054 | -0.0705 | |||

| UNP / Union Pacific Corporation | 0.01 | 0.00 | 2.33 | -12.99 | 0.3957 | -0.0379 | |||

| TCLAF / Transcontinental Inc. | 0.16 | 2.24 | 0.3798 | 0.3798 | |||||

| IP / International Paper Company | 0.05 | 2.18 | 0.3703 | 0.3703 | |||||

| US55291X1090 / MFS Institutional Money Market Portfolio | 1.87 | -41.70 | 1.87 | -41.71 | 0.3175 | -0.2019 | |||

| PBR.A / Petróleo Brasileiro S.A. - Petrobras - Depositary Receipt (Common Stock) | 0.17 | 1.87 | 0.3174 | 0.3174 | |||||

| VFC / V.F. Corporation | 0.15 | 31.37 | 1.83 | -39.90 | 0.3110 | -0.1825 | |||

| PCG.PRX / PG&E Corporation - Preferred Security | 1.74 | 2.11 | 0.2957 | 0.0195 | |||||

| XGGB / Gerdau S.A. - Preferred Stock | 0.59 | 0.00 | 1.55 | -10.36 | 0.2629 | -0.0168 | |||

| NWL / Newell Brands Inc. | 0.30 | 0.00 | 1.44 | -52.02 | 0.2440 | -0.2409 | |||

| GLCNF / Glencore plc | 0.29 | 0.00 | 0.96 | -25.04 | 0.1620 | -0.0441 |