Basic Stats

| Portfolio Value | $ 28,551,300,592 |

| Current Positions | 80 |

Latest Holdings, Performance, AUM (from 13F, 13D)

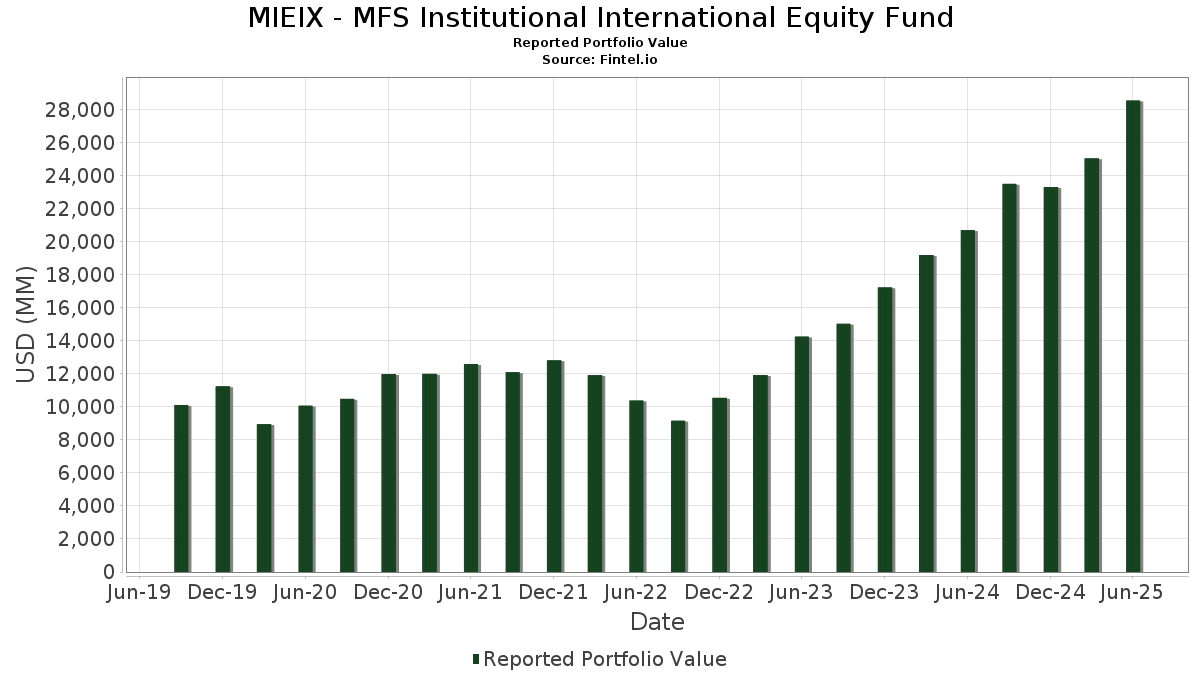

MIEIX - MFS Institutional International Equity Fund has disclosed 80 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 28,551,300,592 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). MIEIX - MFS Institutional International Equity Fund’s top holdings are Hitachi, Ltd. (DE:HIA1) , SAP SE (DE:SAP) , L'Air Liquide S.A. (FR:AI) , Schneider Electric S.E. - Depositary Receipt (Common Stock) (US:SBGSY) , and Rolls-Royce Holdings plc (GB:RR.) . MIEIX - MFS Institutional International Equity Fund’s new positions include BNP Paribas SA (CH:BNP) , NatWest Group plc (MX:NWG N) , LY Corporation (JP:4689) , Suzuki Motor Corporation - Depositary Receipt (Common Stock) (US:SZKMY) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 4.93 | 443.18 | 1.5389 | 1.5389 | |

| 48.55 | 340.83 | 1.1835 | 1.1835 | |

| 68.60 | 252.66 | 0.8773 | 0.8773 | |

| 410.50 | 410.54 | 1.4255 | 0.8495 | |

| 11.81 | 143.00 | 0.4965 | 0.4965 | |

| 29.22 | 853.33 | 2.9630 | 0.4720 | |

| 51.84 | 688.46 | 2.3906 | 0.4618 | |

| 2.66 | 602.15 | 2.0909 | 0.3935 | |

| 12.53 | 415.25 | 1.4419 | 0.3735 | |

| 8.27 | 476.95 | 1.6561 | 0.3085 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 7.79 | 181.84 | 0.6314 | -0.5586 | |

| 1.11 | 304.37 | 1.0569 | -0.5354 | |

| 9.48 | 320.69 | 1.1136 | -0.5086 | |

| 5.82 | 578.14 | 2.0075 | -0.4058 | |

| 0.20 | 54.45 | 0.1891 | -0.4036 | |

| 0.68 | 355.37 | 1.2340 | -0.3953 | |

| 1.91 | 623.60 | 2.1653 | -0.3824 | |

| 0.63 | 438.49 | 1.5226 | -0.3604 | |

| 8.82 | 311.51 | 1.0817 | -0.3325 | |

| 5.20 | 333.12 | 1.1567 | -0.3275 |

13F and Fund Filings

This form was filed on 2025-08-26 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| HIA1 / Hitachi, Ltd. | 29.22 | 7.70 | 853.33 | 35.84 | 2.9630 | 0.4720 | |||

| SAP / SAP SE | 2.73 | -1.99 | 829.29 | 12.26 | 2.8796 | -0.0500 | |||

| AI / L'Air Liquide S.A. | 3.96 | 3.11 | 816.60 | 11.78 | 2.8355 | -0.0614 | |||

| SBGSY / Schneider Electric S.E. - Depositary Receipt (Common Stock) | 2.92 | 3.11 | 777.69 | 18.48 | 2.7004 | 0.0974 | |||

| RR. / Rolls-Royce Holdings plc | 51.84 | 3.11 | 688.46 | 41.54 | 2.3906 | 0.4618 | |||

| ROG / Roche Holding AG | 2.05 | 9.82 | 667.82 | 8.78 | 2.3189 | -0.1157 | |||

| CPG / Compass Group PLC | 19.06 | 3.11 | 645.36 | 5.76 | 2.2409 | -0.1790 | |||

| CFR / Compagnie Financière Richemont SA | 3.34 | 8.20 | 628.26 | 16.71 | 2.1815 | 0.0468 | |||

| DB1 / Deutsche Börse AG | 1.91 | -12.29 | 623.60 | -2.94 | 2.1653 | -0.3824 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 2.66 | 3.11 | 602.15 | 40.68 | 2.0909 | 0.3935 | |||

| NOVN / Novartis AG | 4.83 | 8.25 | 585.31 | 17.95 | 2.0324 | 0.0646 | |||

| NESN / Nestlé S.A. | 5.82 | -3.30 | 578.14 | -5.00 | 2.0075 | -0.4058 | |||

| 6758 / Sony Group Corporation | 22.08 | 3.11 | 572.02 | 4.85 | 1.9862 | -0.1771 | |||

| GOB / Compagnie de Saint-Gobain S.A. | 4.27 | 3.11 | 501.64 | 21.75 | 1.7419 | 0.1080 | |||

| REL N / RELX PLC | 9.08 | 0.15 | 490.82 | 7.74 | 1.7043 | -0.1022 | |||

| ENGI / Engie SA | 20.85 | 3.11 | 489.30 | 24.10 | 1.6990 | 0.1355 | |||

| EXPGY / Experian plc - Depositary Receipt (Common Stock) | 9.49 | 3.11 | 488.85 | 14.58 | 1.6975 | 0.0055 | |||

| RYAAY / Ryanair Holdings plc - Depositary Receipt (Common Stock) | 8.27 | 3.11 | 476.95 | 40.34 | 1.6561 | 0.3085 | |||

| BNP / BNP Paribas SA | 4.93 | 443.18 | 1.5389 | 1.5389 | |||||

| ZURN / Zurich Insurance Group AG | 0.63 | -7.84 | 438.49 | -7.65 | 1.5226 | -0.3604 | |||

| CAP / Capgemini SE | 2.52 | 3.11 | 430.20 | 17.81 | 1.4938 | 0.0458 | |||

| AMS / Amadeus IT Group, S.A. | 5.06 | 2.15 | 426.08 | 12.24 | 1.4795 | -0.0259 | |||

| ISP / Intesa Sanpaolo S.p.A. | 73.81 | -14.44 | 425.30 | -4.24 | 1.4768 | -0.2845 | |||

| INGA / ING Groep N.V. - Depositary Receipt (Common Stock) | 19.16 | -14.64 | 420.29 | -4.34 | 1.4594 | -0.2828 | |||

| SEH / Shin-Etsu Chemical Co., Ltd. | 12.53 | 32.51 | 415.25 | 54.12 | 1.4419 | 0.3735 | |||

| MITS N / Mitsubishi Electric Corporation | 19.11 | 3.11 | 412.94 | 22.00 | 1.4339 | 0.0916 | |||

| US55291X1090 / MFS Institutional Money Market Portfolio | 410.50 | 182.64 | 410.54 | 182.64 | 1.4255 | 0.8495 | |||

| BEI / Beiersdorf Aktiengesellschaft | 3.26 | 3.11 | 409.69 | 0.02 | 1.4226 | -0.2018 | |||

| 1299 / AIA Group Limited | 45.04 | -3.81 | 403.92 | 14.12 | 1.4026 | -0.0011 | |||

| LSE N / London Stock Exchange Group plc | 2.74 | 3.11 | 399.28 | 1.50 | 1.3864 | -0.1735 | |||

| MRK / Marks Electrical Group PLC | 3.02 | 17.99 | 391.95 | 11.69 | 1.3610 | -0.0307 | |||

| CBGB / Carlsberg A/S | 2.77 | 3.11 | 391.90 | 14.70 | 1.3608 | 0.0059 | |||

| 8316 / Sumitomo Mitsui Financial Group, Inc. | 15.19 | 27.03 | 383.32 | 25.63 | 1.3310 | 0.1211 | |||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.68 | 3.11 | 355.37 | -13.51 | 1.2340 | -0.3953 | |||

| NWG N / NatWest Group plc | 48.55 | 340.83 | 1.1835 | 1.1835 | |||||

| NNND / Tencent Holdings Limited | 5.20 | -11.48 | 333.12 | -11.00 | 1.1567 | -0.3275 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 4.78 | 3.11 | 331.98 | 3.25 | 1.1528 | -0.1223 | |||

| UBSG / UBS Group AG | 9.48 | -29.01 | 320.69 | -21.60 | 1.1136 | -0.5086 | |||

| CHKP / Check Point Software Technologies Ltd. | 1.44 | 3.11 | 318.89 | 0.09 | 1.1073 | -0.1561 | |||

| A5G / AIB Group plc | 38.44 | 0.00 | 316.30 | 26.75 | 1.0983 | 0.1088 | |||

| DKILF / Daikin Industries,Ltd. | 2.66 | 3.11 | 314.93 | 12.28 | 1.0935 | -0.0187 | |||

| DEVL / DBS Group Holdings Ltd | 8.82 | -15.12 | 311.51 | -12.65 | 1.0817 | -0.3325 | |||

| EL / EssilorLuxottica Société anonyme | 1.11 | -20.51 | 304.37 | -24.20 | 1.0569 | -0.5354 | |||

| DNO / DENSO Corporation | 22.46 | 3.11 | 304.27 | 12.56 | 1.0565 | -0.0154 | |||

| TSCO / Tesco PLC | 54.78 | 3.11 | 301.73 | 32.21 | 1.0477 | 0.1427 | |||

| 9999 / NetEase, Inc. | 11.07 | -6.03 | 297.69 | 22.55 | 1.0337 | 0.0704 | |||

| ENI / Eni S.p.A. | 18.34 | 3.11 | 297.24 | 8.21 | 1.0321 | -0.0572 | |||

| LR / Legrand SA | 2.19 | 3.11 | 292.63 | 30.19 | 1.0161 | 0.1248 | |||

| LIN / Linde plc | 0.60 | 3.11 | 282.97 | 3.89 | 0.9826 | -0.0975 | |||

| RI / Pernod Ricard SA | 2.83 | 33.65 | 281.86 | 34.09 | 0.9787 | 0.1451 | |||

| 8630 / Sompo Holdings, Inc. | 9.14 | 67.41 | 275.72 | 66.63 | 0.9574 | 0.3012 | |||

| CNI / Canadian National Railway Company | 2.62 | 3.11 | 272.36 | 10.07 | 0.9457 | -0.0355 | |||

| S6M / Seven & i Holdings Co., Ltd. | 16.78 | 3.11 | 270.69 | 14.45 | 0.9399 | 0.0020 | |||

| FJI / FUJIFILM Holdings Corporation | 11.67 | 16.43 | 254.52 | 32.70 | 0.8838 | 0.1232 | |||

| 4689 / LY Corporation | 68.60 | 252.66 | 0.8773 | 0.8773 | |||||

| TD / The Toronto-Dominion Bank | 3.40 | -13.47 | 249.95 | 6.22 | 0.8679 | -0.0653 | |||

| MTX / MTU Aero Engines AG | 0.56 | 21.17 | 248.64 | 55.45 | 0.8633 | 0.2291 | |||

| QGEN / Qiagen N.V. | 4.91 | 3.11 | 236.37 | 25.22 | 0.8208 | 0.0722 | |||

| 4543 / Terumo Corporation | 12.29 | 3.11 | 226.25 | 1.06 | 0.7856 | -0.1022 | |||

| GALP / Galp Energia, SGPS, S.A. | 12.21 | 19.37 | 223.92 | 24.50 | 0.7775 | 0.0643 | |||

| IFC / Intact Financial Corporation | 0.94 | 3.11 | 219.40 | 17.35 | 0.7618 | 0.0205 | |||

| ML / Compagnie Générale des Établissements Michelin Société en commandite par actions | 5.55 | -8.64 | 206.22 | -3.27 | 0.7161 | -0.1293 | |||

| EDEN / Edenred SE | 6.60 | -2.62 | 204.35 | -7.58 | 0.7096 | -0.1672 | |||

| SU / Suncor Energy Inc. | 5.37 | -9.47 | 201.08 | -12.42 | 0.6982 | -0.2122 | |||

| PRU / Prudential plc | 16.02 | 3.11 | 200.67 | 19.72 | 0.6968 | 0.0321 | |||

| DGE / Diageo plc | 7.88 | 3.11 | 197.75 | -0.82 | 0.6866 | -0.1040 | |||

| OLY1 / Olympus Corporation | 16.24 | 3.11 | 193.42 | -6.51 | 0.6716 | -0.1488 | |||

| 3092 / ZOZO, Inc. | 17.05 | 3.11 | 184.34 | 16.04 | 0.6401 | 0.0101 | |||

| HDFCB / HDFC Bank Ltd | 7.79 | -44.70 | 181.84 | -39.40 | 0.6314 | -0.5586 | |||

| RIO / Rio Tinto Group | 3.03 | 3.11 | 176.76 | 0.50 | 0.6138 | -0.0837 | |||

| SOON / Sonova Holding AG | 0.55 | 3.11 | 164.18 | 5.39 | 0.5701 | -0.0477 | |||

| DSY / Dassault Systèmes SE - Depositary Receipt (Common Stock) | 4.36 | 3.11 | 157.75 | -2.06 | 0.5478 | -0.0909 | |||

| BAER / Julius Bär Gruppe AG | 2.28 | 3.11 | 153.92 | 0.91 | 0.5344 | -0.0704 | |||

| KYR / Kyocera Corporation | 12.26 | -12.79 | 147.59 | -6.85 | 0.5125 | -0.1158 | |||

| SZKMY / Suzuki Motor Corporation - Depositary Receipt (Common Stock) | 11.81 | 143.00 | 0.4965 | 0.4965 | |||||

| TCS / Tata Consultancy Services Limited | 2.95 | 3.11 | 119.22 | -0.95 | 0.4140 | -0.0634 | |||

| 6273 / SMC Corporation | 0.31 | -23.95 | 113.15 | -22.77 | 0.3929 | -0.1880 | |||

| HYB / HOYA Corporation | 0.91 | 3.12 | 108.69 | 8.90 | 0.3774 | -0.0184 | |||

| 4922 / KOSÉ Corporation | 2.24 | 3.11 | 88.14 | -2.22 | 0.3060 | -0.0514 | |||

| SIKA / Sika AG | 0.20 | -67.49 | 54.45 | -63.57 | 0.1891 | -0.4036 |