Basic Stats

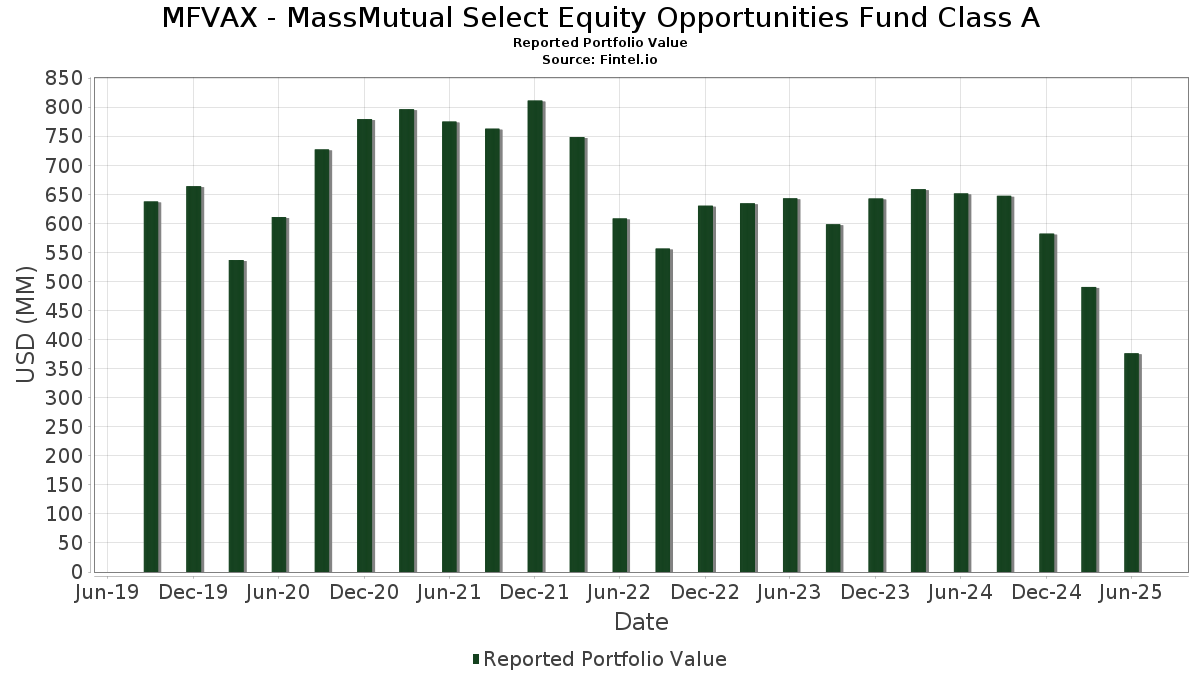

| Portfolio Value | $ 376,379,536 |

| Current Positions | 68 |

Latest Holdings, Performance, AUM (from 13F, 13D)

MFVAX - MassMutual Select Equity Opportunities Fund Class A has disclosed 68 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 376,379,536 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). MFVAX - MassMutual Select Equity Opportunities Fund Class A’s top holdings are Microsoft Corporation (US:MSFT) , Chubb Limited (US:CB) , Broadcom Inc. (US:AVGO) , Intuit Inc. (US:INTU) , and The TJX Companies, Inc. (US:TJX) . MFVAX - MassMutual Select Equity Opportunities Fund Class A’s new positions include Eli Lilly and Company (US:LLY) , Zoetis Inc. (US:ZTS) , Citigroup Inc. (US:C) , The Home Depot, Inc. (US:HD) , and Salesforce, Inc. (US:CRM) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 8.19 | 2.1783 | 2.1783 | |

| 0.05 | 13.66 | 3.6349 | 1.9081 | |

| 0.06 | 10.42 | 2.7720 | 1.1468 | |

| 0.02 | 3.79 | 1.0086 | 1.0086 | |

| 0.12 | 3.80 | 1.0104 | 0.8691 | |

| 0.03 | 15.94 | 4.2392 | 0.7739 | |

| 0.03 | 2.81 | 0.7473 | 0.7473 | |

| 0.03 | 10.81 | 2.8766 | 0.6056 | |

| 0.01 | 2.06 | 0.5482 | 0.5482 | |

| 0.02 | 9.36 | 2.4893 | 0.5213 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 1.55 | 0.4135 | -2.1539 | |

| 0.01 | 0.15 | 0.0406 | -0.5756 | |

| 0.01 | 1.07 | 0.2859 | -0.4407 | |

| 0.04 | 8.54 | 2.2706 | -0.4249 | |

| 0.06 | 10.31 | 2.7420 | -0.3723 | |

| 0.17 | 3.48 | 0.9271 | -0.3209 | |

| 0.06 | 4.51 | 1.2000 | -0.2845 | |

| 0.01 | 1.99 | 0.5281 | -0.2373 | |

| 0.03 | 9.24 | 2.4582 | -0.2283 | |

| 0.01 | 4.38 | 1.1651 | -0.2266 |

13F and Fund Filings

This form was filed on 2025-08-25 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.03 | -29.09 | 15.94 | -6.04 | 4.2392 | 0.7739 | |||

| CB / Chubb Limited | 0.05 | -17.33 | 13.68 | -20.69 | 3.6399 | 0.1150 | |||

| AVGO / Broadcom Inc. | 0.05 | -1.79 | 13.66 | 61.69 | 3.6349 | 1.9081 | |||

| INTU / Intuit Inc. | 0.02 | -37.93 | 13.53 | -20.37 | 3.5991 | 0.1274 | |||

| TJX / The TJX Companies, Inc. | 0.10 | -24.86 | 12.96 | -23.82 | 3.4467 | -0.0282 | |||

| TXN / Texas Instruments Incorporated | 0.06 | -22.73 | 12.42 | -10.72 | 3.3032 | 0.4615 | |||

| LIN / Linde plc | 0.03 | -24.95 | 12.41 | -24.37 | 3.3025 | -0.0516 | |||

| MCD / McDonald's Corporation | 0.04 | -21.39 | 11.92 | -26.48 | 3.1713 | -0.1416 | |||

| MA / Mastercard Incorporated | 0.02 | -27.92 | 11.84 | -26.10 | 3.1510 | -0.1239 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.05 | -18.85 | 11.72 | -27.30 | 3.1181 | -0.1760 | |||

| KO / The Coca-Cola Company | 0.16 | -22.30 | 11.63 | -23.24 | 3.0947 | -0.0018 | |||

| SPGI / S&P Global Inc. | 0.02 | -22.75 | 11.20 | -19.84 | 2.9784 | 0.1248 | |||

| AXP / American Express Company | 0.03 | -17.94 | 10.81 | -2.71 | 2.8766 | 0.6056 | |||

| HON / Honeywell International Inc. | 0.05 | -32.68 | 10.50 | -25.97 | 2.7932 | -0.1046 | |||

| GOOGL / Alphabet Inc. | 0.06 | 14.95 | 10.42 | 30.99 | 2.7720 | 1.1468 | |||

| PG / The Procter & Gamble Company | 0.06 | -27.66 | 10.31 | -32.37 | 2.7420 | -0.3723 | |||

| DHR / Danaher Corporation | 0.05 | -23.06 | 10.20 | -25.86 | 2.7127 | -0.0975 | |||

| SYK / Stryker Corporation | 0.02 | -25.98 | 9.56 | -21.34 | 2.5433 | 0.0601 | |||

| V / Visa Inc. | 0.03 | -25.98 | 9.47 | -25.01 | 2.5194 | -0.0611 | |||

| NOC / Northrop Grumman Corporation | 0.02 | -0.51 | 9.36 | -2.84 | 2.4893 | 0.5213 | |||

| ACN / Accenture plc | 0.03 | -26.63 | 9.24 | -29.72 | 2.4582 | -0.2283 | |||

| AAPL / Apple Inc. | 0.04 | -29.95 | 8.54 | -35.30 | 2.2706 | -0.4249 | |||

| LLY / Eli Lilly and Company | 0.01 | 8.19 | 2.1783 | 2.1783 | |||||

| MET / MetLife, Inc. | 0.07 | -13.70 | 5.62 | -13.56 | 1.4954 | 0.1666 | |||

| QCOM / QUALCOMM Incorporated | 0.03 | -16.45 | 5.18 | -13.39 | 1.3769 | 0.1560 | |||

| COP / ConocoPhillips | 0.06 | -18.36 | 4.99 | -30.23 | 1.3274 | -0.1339 | |||

| WFC / Wells Fargo & Company | 0.06 | -44.37 | 4.51 | -37.92 | 1.2000 | -0.2845 | |||

| ELV / Elevance Health, Inc. | 0.01 | -28.10 | 4.38 | -35.71 | 1.1651 | -0.2266 | |||

| FITB / Fifth Third Bancorp | 0.09 | -23.17 | 3.89 | -19.39 | 1.0340 | 0.0488 | |||

| KMB / Kimberly-Clark Corporation | 0.03 | -17.36 | 3.87 | -25.09 | 1.0289 | -0.0260 | |||

| AEE / Ameren Corporation | 0.04 | -25.33 | 3.82 | -28.57 | 1.0169 | -0.0765 | |||

| CSX / CSX Corporation | 0.12 | 395.32 | 3.80 | 449.64 | 1.0104 | 0.8691 | |||

| ZTS / Zoetis Inc. | 0.02 | 3.79 | 1.0086 | 1.0086 | |||||

| SCHW / The Charles Schwab Corporation | 0.04 | -30.52 | 3.76 | -19.02 | 1.0000 | 0.0515 | |||

| FP / TotalEnergies SE | 0.06 | -24.60 | 3.73 | -28.24 | 0.9932 | -0.0698 | |||

| UNP / Union Pacific Corporation | 0.02 | -25.98 | 3.59 | -27.91 | 0.9551 | -0.0625 | |||

| KVUE / Kenvue Inc. | 0.17 | -34.63 | 3.48 | -42.95 | 0.9271 | -0.3209 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.07 | -26.24 | 3.37 | -35.74 | 0.8958 | -0.1751 | |||

| SO / The Southern Company | 0.04 | -24.22 | 3.33 | -24.32 | 0.8868 | -0.0131 | |||

| BA / The Boeing Company | 0.02 | -19.29 | 3.33 | -0.83 | 0.8863 | 0.1998 | |||

| EQR / Equity Residential | 0.05 | -18.87 | 3.19 | -23.51 | 0.8492 | -0.0034 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.03 | -20.47 | 3.08 | -35.93 | 0.8201 | -0.1627 | |||

| GE / General Electric Company | 0.01 | -52.21 | 3.06 | -38.55 | 0.8148 | -0.2035 | |||

| BDX / Becton, Dickinson and Company | 0.02 | -17.06 | 3.01 | -37.64 | 0.8019 | -0.1856 | |||

| SWK / Stanley Black & Decker, Inc. | 0.04 | -20.97 | 2.99 | -30.36 | 0.7948 | -0.0817 | |||

| LHX / L3Harris Technologies, Inc. | 0.01 | -35.36 | 2.93 | -22.54 | 0.7807 | 0.0067 | |||

| C / Citigroup Inc. | 0.03 | 2.81 | 0.7473 | 0.7473 | |||||

| LVS / Las Vegas Sands Corp. | 0.06 | -16.14 | 2.44 | -5.57 | 0.6494 | 0.1213 | |||

| IP / International Paper Company | 0.05 | -11.62 | 2.35 | -22.44 | 0.6254 | 0.0062 | |||

| CF / CF Industries Holdings, Inc. | 0.02 | -34.51 | 2.22 | -22.89 | 0.5898 | 0.0022 | |||

| HD / The Home Depot, Inc. | 0.01 | 2.06 | 0.5482 | 0.5482 | |||||

| PM / Philip Morris International Inc. | 0.01 | -53.81 | 1.99 | -47.01 | 0.5281 | -0.2373 | |||

| USB / U.S. Bancorp | 0.04 | -2.09 | 1.70 | 4.89 | 0.4514 | 0.1210 | |||

| FTV / Fortive Corporation | 0.03 | -3.59 | 1.68 | -31.34 | 0.4466 | -0.0529 | |||

| CRM / Salesforce, Inc. | 0.01 | 1.66 | 0.4403 | 0.4403 | |||||

| CL / Colgate-Palmolive Company | 0.02 | -90.90 | 1.55 | -90.82 | 0.4135 | -2.1539 | |||

| 005930 / Samsung Electronics Co., Ltd. | 0.04 | -22.05 | 1.55 | -12.77 | 0.4128 | 0.0495 | |||

| DIS / The Walt Disney Company | 0.01 | -21.52 | 1.54 | -1.41 | 0.4091 | 0.0904 | |||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 1.48 | 0.3938 | 0.3938 | ||||||

| VTRS / Viatris Inc. | 0.16 | -22.11 | 1.42 | -20.16 | 0.3775 | 0.0144 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0.02 | -21.40 | 1.17 | -25.40 | 0.3119 | -0.0093 | |||

| AIG / American International Group, Inc. | 0.01 | -69.30 | 1.07 | -69.79 | 0.2859 | -0.4407 | |||

| VW-V / Volkswagen AG - Preferred Stock | 0.01 | -18.28 | 0.80 | -14.77 | 0.2135 | 0.0210 | |||

| RAL / Ralliant Corporation | 0.01 | 0.52 | 0.1385 | 0.1385 | |||||

| WY / Weyerhaeuser Company | 0.01 | -94.23 | 0.15 | -94.96 | 0.0406 | -0.5756 | |||

| US76105Y1091 / T. Rowe Price Government Reserve Fund | 0.00 | 2,000.00 | 0.00 | 0.0000 | 0.0000 | ||||

| US76105Y1091 / T. Rowe Price Government Reserve Fund | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| US76105Y1091 / T. Rowe Price Government Reserve Fund | 0.00 | -83.33 | 0.00 | 0.0000 | -0.0000 |