Basic Stats

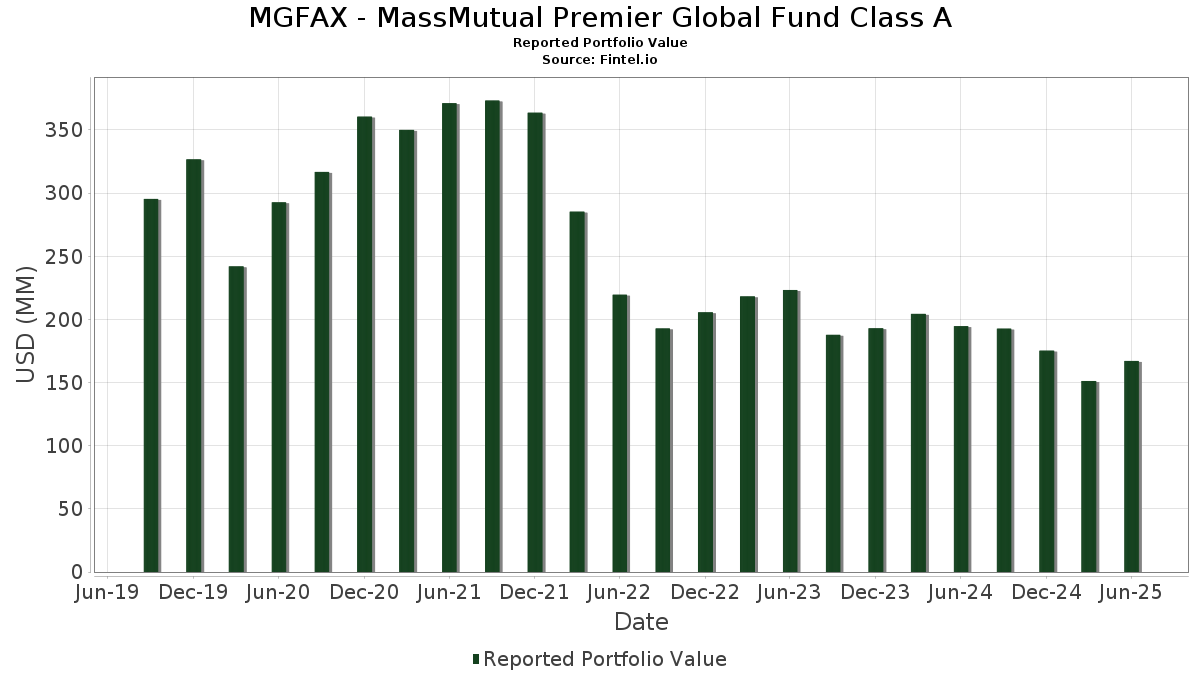

| Portfolio Value | $ 167,095,788 |

| Current Positions | 63 |

Latest Holdings, Performance, AUM (from 13F, 13D)

MGFAX - MassMutual Premier Global Fund Class A has disclosed 63 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 167,095,788 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). MGFAX - MassMutual Premier Global Fund Class A’s top holdings are Meta Platforms, Inc. (US:META) , Alphabet Inc. (US:GOOGL) , SAP SE (DE:SAP) , NVIDIA Corporation (US:NVDA) , and DLF Limited (IN:DLF) . MGFAX - MassMutual Premier Global Fund Class A’s new positions include State Street Navigator Securities Lending Government Money Market Portfolio (US:US8575093013) , Arm Holdings plc - Depositary Receipt (Common Stock) (US:ARM) , ServiceNow, Inc. (US:NOW) , Stryker Corporation (US:SYK) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 3.82 | 2.3115 | 1.0031 | |

| 0.04 | 7.09 | 4.2958 | 0.9846 | |

| 0.00 | 3.68 | 2.2277 | 0.9732 | |

| 1.48 | 1.48 | 0.8969 | 0.8969 | |

| 0.00 | 1.73 | 1.0473 | 0.8083 | |

| 1.14 | 0.6892 | 0.6892 | ||

| 0.01 | 1.12 | 0.6766 | 0.6766 | |

| 0.01 | 4.99 | 3.0254 | 0.6508 | |

| 0.06 | 4.58 | 2.7738 | 0.5682 | |

| 0.02 | 2.45 | 1.4866 | 0.5188 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.6356 | ||

| 0.00 | 0.00 | -1.6356 | ||

| 0.10 | 1.62 | 0.9813 | -1.3453 | |

| 0.08 | 13.95 | 8.4499 | -1.2462 | |

| 0.03 | 1.06 | 0.6442 | -1.1138 | |

| 0.00 | 2.17 | 1.3144 | -0.8684 | |

| 0.11 | 3.68 | 2.2300 | -0.8373 | |

| 0.04 | 0.52 | 0.3139 | -0.7135 | |

| 0.01 | 6.81 | 4.1236 | -0.6627 | |

| 0.02 | 5.34 | 3.2346 | -0.6210 |

13F and Fund Filings

This form was filed on 2025-08-25 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| META / Meta Platforms, Inc. | 0.02 | -11.64 | 15.12 | 13.16 | 9.1602 | 0.3217 | |||

| GOOGL / Alphabet Inc. | 0.08 | -16.51 | 13.95 | -4.85 | 8.4499 | -1.2462 | |||

| SAP / SAP SE | 0.02 | -4.61 | 7.48 | 9.29 | 4.5320 | 0.0048 | |||

| NVDA / NVIDIA Corporation | 0.04 | -2.83 | 7.09 | 41.63 | 4.2958 | 0.9846 | |||

| DLF / DLF Limited | 0.70 | -5.72 | 6.87 | 16.39 | 4.1649 | 0.2585 | |||

| SPGI / S&P Global Inc. | 0.01 | -9.36 | 6.81 | -5.94 | 4.1236 | -0.6627 | |||

| INTU / Intuit Inc. | 0.01 | -1.95 | 5.79 | 25.79 | 3.5071 | 0.4629 | |||

| AIR / Airbus SE | 0.03 | -7.97 | 5.44 | 9.21 | 3.2968 | 0.0009 | |||

| ADI / Analog Devices, Inc. | 0.02 | -22.39 | 5.34 | -8.41 | 3.2346 | -0.6210 | |||

| V / Visa Inc. | 0.01 | -3.12 | 5.28 | -1.86 | 3.1978 | -0.3594 | |||

| MSFT / Microsoft Corporation | 0.01 | 4.98 | 4.99 | 39.08 | 3.0254 | 0.6508 | |||

| LLY / Eli Lilly and Company | 0.01 | -3.12 | 4.65 | -8.56 | 2.8156 | -0.5462 | |||

| MRVL / Marvell Technology, Inc. | 0.06 | 9.22 | 4.58 | 37.31 | 2.7738 | 0.5682 | |||

| AVGO / Broadcom Inc. | 0.01 | 17.16 | 3.82 | 92.87 | 2.3115 | 1.0031 | |||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 0.11 | 0.00 | 3.68 | -20.62 | 2.2300 | -0.8373 | |||

| NFLX / Netflix, Inc. | 0.00 | 35.00 | 3.68 | 93.93 | 2.2277 | 0.9732 | |||

| IBN / ICICI Bank Limited - Depositary Receipt (Common Stock) | 0.09 | -2.58 | 2.99 | 3.97 | 1.8093 | -0.0906 | |||

| AMZN / Amazon.com, Inc. | 0.01 | -2.01 | 2.83 | 13.01 | 1.7159 | 0.0579 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -3.12 | 2.51 | 6.30 | 1.5226 | -0.0413 | |||

| SHOP / Shopify Inc. | 0.02 | 38.69 | 2.45 | 67.67 | 1.4866 | 0.5188 | |||

| 1N8 / Adyen N.V. | 0.00 | 33.30 | 2.43 | 60.11 | 1.4739 | 0.4689 | |||

| AMS / Amadeus IT Group, S.A. | 0.03 | -9.16 | 2.41 | 0.29 | 1.4611 | -0.1297 | |||

| 6861 / Keyence Corporation | 0.01 | -4.76 | 2.41 | -2.55 | 1.4595 | -0.1760 | |||

| LONN / Lonza Group AG | 0.00 | 16.86 | 2.20 | 35.66 | 1.3323 | 0.2601 | |||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.00 | -21.74 | 2.17 | -34.27 | 1.3144 | -0.8684 | |||

| EFX / Equifax Inc. | 0.01 | -15.89 | 2.07 | -10.45 | 1.2563 | -0.2750 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.03 | -1.67 | 1.78 | -1.00 | 1.0785 | -0.1110 | |||

| BSX / Boston Scientific Corporation | 0.02 | 26.85 | 1.78 | 35.08 | 1.0780 | 0.2065 | |||

| SPF / Spotify Technology S.A. | 0.00 | 242.92 | 1.73 | 378.67 | 1.0473 | 0.8083 | |||

| BC / Brunello Cucinelli S.p.A. | 0.01 | -3.13 | 1.65 | 2.80 | 1.0015 | -0.0624 | |||

| MAR / Marriott International, Inc. | 0.01 | -3.12 | 1.64 | 11.14 | 0.9914 | 0.0173 | |||

| ACO4 / Atlas Copco AB (publ) | 0.10 | -54.45 | 1.62 | -53.97 | 0.9813 | -1.3453 | |||

| CPK / Capcom Co., Ltd. | 0.05 | 24.13 | 1.58 | 71.93 | 0.9576 | 0.3493 | |||

| EL / EssilorLuxottica Société anonyme | 0.01 | -11.08 | 1.56 | -15.07 | 0.9458 | -0.2703 | |||

| NICE / NICE Ltd. - Depositary Receipt (Common Stock) | 0.01 | -2.72 | 1.56 | 6.58 | 0.9421 | -0.0229 | |||

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 0.04 | 38.71 | 1.55 | 79.63 | 0.9406 | 0.3689 | |||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 1.48 | 1.48 | 0.8969 | 0.8969 | |||||

| ALV / Allianz SE | 0.00 | -1.77 | 1.28 | 4.39 | 0.7774 | -0.0356 | |||

| LRCX / Lam Research Corporation | 0.01 | 13.69 | 1.24 | 52.27 | 0.7519 | 0.2126 | |||

| MA / Mastercard Incorporated | 0.00 | 135.14 | 1.22 | 141.19 | 0.7381 | 0.4038 | |||

| NNND / Tencent Holdings Limited | 0.02 | -3.59 | 1.21 | -2.82 | 0.7315 | -0.0905 | |||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 1.14 | 0.6892 | 0.6892 | ||||||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | 0.01 | 1.12 | 0.6766 | 0.6766 | |||||

| ALZC / ASSA ABLOY AB (publ) | 0.03 | -61.55 | 1.06 | -59.99 | 0.6442 | -1.1138 | |||

| ECL / Ecolab Inc. | 0.00 | 16.89 | 0.97 | 24.33 | 0.5884 | 0.0713 | |||

| TJX / The TJX Companies, Inc. | 0.01 | 100.82 | 0.96 | 103.81 | 0.5843 | 0.2710 | |||

| HDFCB / HDFC Bank Ltd | 0.04 | -3.12 | 0.89 | 6.09 | 0.5392 | -0.0152 | |||

| SNPS / Synopsys, Inc. | 0.00 | 19.29 | 0.84 | 42.61 | 0.5091 | 0.1193 | |||

| NOW / ServiceNow, Inc. | 0.00 | 0.80 | 0.4839 | 0.4839 | |||||

| BESI / BE Semiconductor Industries N.V. | 0.01 | -0.75 | 0.75 | 43.07 | 0.4571 | 0.1082 | |||

| HYB / HOYA Corporation | 0.01 | -3.17 | 0.72 | 1.97 | 0.4387 | -0.0313 | |||

| IQV / IQVIA Holdings Inc. | 0.00 | -40.19 | 0.69 | -46.58 | 0.4173 | -0.4349 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | -3.21 | 0.68 | 23.68 | 0.4117 | 0.0481 | |||

| RACE / Ferrari N.V. | 0.00 | -2.95 | 0.66 | 11.64 | 0.4013 | 0.0086 | |||

| LIN / Linde plc | 0.00 | -2.76 | 0.53 | -2.04 | 0.3206 | -0.0366 | |||

| TDK / TDK Corporation | 0.04 | -70.23 | 0.52 | -66.65 | 0.3139 | -0.7135 | |||

| UMG / Universal Music Group N.V. | 0.01 | -3.12 | 0.48 | 14.01 | 0.2911 | 0.0125 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -3.15 | 0.46 | -21.10 | 0.2790 | -0.1070 | |||

| SYK / Stryker Corporation | 0.00 | 0.43 | 0.2577 | 0.2577 | |||||

| ASML / ASML Holding N.V. | 0.00 | -40.42 | 0.41 | -27.92 | 0.2503 | -0.1287 | |||

| ZTS / Zoetis Inc. | 0.00 | 49.28 | 0.41 | 41.61 | 0.2455 | 0.0559 | |||

| PHAT / Phathom Pharmaceuticals, Inc. | 0.03 | 0.00 | 0.33 | 53.24 | 0.2009 | 0.0575 | |||

| MONC / Moncler S.p.A. | 0.01 | -3.11 | 0.31 | -10.54 | 0.1906 | -0.0418 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -1.6356 | ||||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -1.6356 |