Basic Stats

| Portfolio Value | $ 448,038,830 |

| Current Positions | 30 |

Latest Holdings, Performance, AUM (from 13F, 13D)

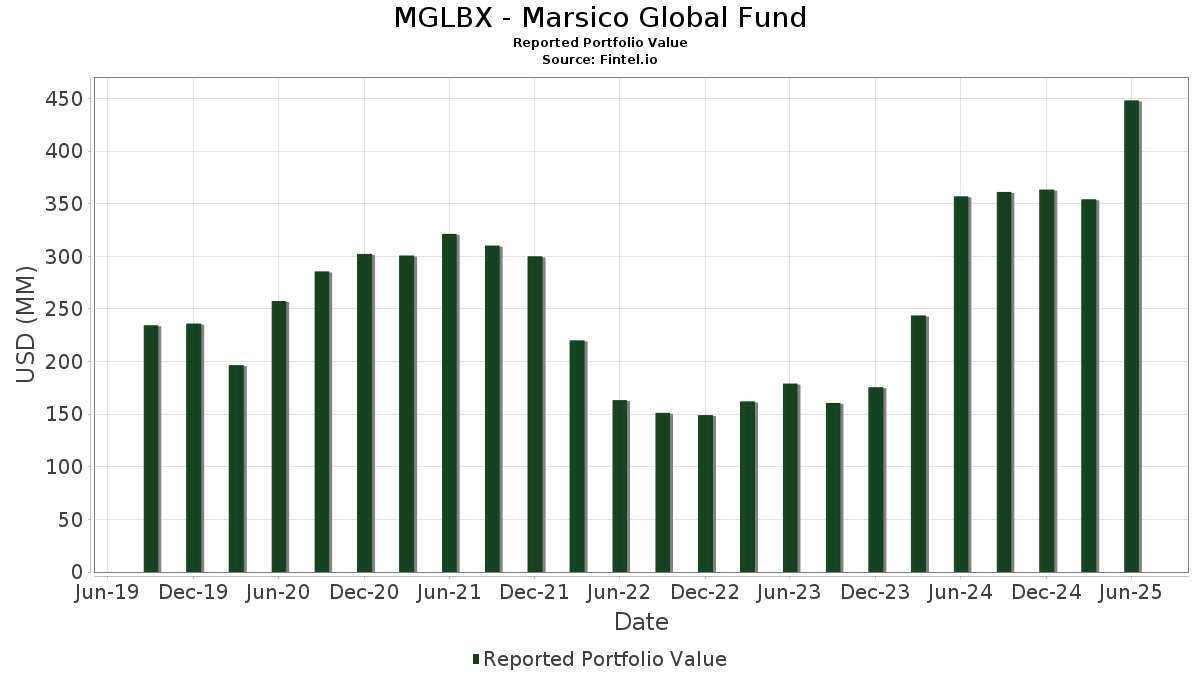

MGLBX - Marsico Global Fund has disclosed 30 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 448,038,830 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). MGLBX - Marsico Global Fund’s top holdings are Rolls-Royce Holdings plc (GB:RR.) , Meta Platforms, Inc. (US:META) , Spotify Technology S.A. (US:SPOT) , SAP SE - Depositary Receipt (Common Stock) (US:SAP) , and Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) . MGLBX - Marsico Global Fund’s new positions include Nintendo Co., Ltd. - Depositary Receipt (Common Stock) (US:NTDOY) , The Progressive Corporation (US:PGR) , Siemens Energy AG - Depositary Receipt (Common Stock) (US:SMNEY) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.09 | 14.82 | 3.3101 | 3.3101 | |

| 0.28 | 10.25 | 2.2895 | 2.2895 | |

| 0.20 | 22.69 | 5.0673 | 2.2690 | |

| 0.41 | 9.82 | 2.1942 | 2.1942 | |

| 0.03 | 17.09 | 3.8179 | 1.7664 | |

| 0.03 | 18.48 | 4.1269 | 1.1134 | |

| 0.02 | 4.78 | 1.0668 | 1.0668 | |

| 0.08 | 18.18 | 4.0599 | 0.6840 | |

| 0.14 | 9.12 | 2.0382 | 0.6790 | |

| 0.01 | 12.91 | 2.8848 | 0.6564 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 21.56 | 21.56 | 4.8168 | -5.8319 | |

| 0.02 | 6.99 | 1.5621 | -1.1652 | |

| 0.04 | 8.96 | 2.0025 | -0.9013 | |

| 0.08 | 23.75 | 5.3060 | -0.6223 | |

| 0.00 | 11.96 | 2.6709 | -0.6070 | |

| 0.08 | 7.62 | 1.7026 | -0.5809 | |

| 0.00 | 10.79 | 2.4112 | -0.5267 | |

| 0.15 | 8.57 | 1.9135 | -0.3344 | |

| 0.03 | 12.78 | 2.8548 | -0.2957 | |

| 0.02 | 12.51 | 2.7947 | -0.1641 |

13F and Fund Filings

This form was filed on 2025-08-27 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| RR. / Rolls-Royce Holdings plc | 2.11 | 0.00 | 28.08 | 37.28 | 6.2723 | 0.4892 | |||

| META / Meta Platforms, Inc. | 0.03 | 0.00 | 24.96 | 28.06 | 5.5752 | 0.0649 | |||

| SPOT / Spotify Technology S.A. | 0.03 | 0.00 | 24.83 | 39.51 | 5.5461 | 0.5144 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.08 | 0.00 | 23.75 | 13.29 | 5.3060 | -0.6223 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.10 | 0.00 | 22.74 | 36.44 | 5.0806 | 0.3675 | |||

| ENR / Siemens Energy AG | 0.20 | 15.52 | 22.69 | 129.21 | 5.0673 | 2.2690 | |||

| NFLX / Netflix, Inc. | 0.02 | 0.00 | 22.60 | 43.60 | 5.0477 | 0.5987 | |||

| US8574928888 / State Street Institutional Treasury Money Market Fund | 21.56 | -42.75 | 21.56 | -42.75 | 4.8168 | -5.8319 | |||

| GE / General Electric Company | 0.08 | 0.00 | 19.81 | 28.60 | 4.4244 | 0.0698 | |||

| GEV / GE Vernova Inc. | 0.03 | 0.00 | 18.48 | 73.34 | 4.1269 | 1.1134 | |||

| AMZN / Amazon.com, Inc. | 0.08 | 32.00 | 18.18 | 52.22 | 4.0599 | 0.6840 | |||

| MSFT / Microsoft Corporation | 0.03 | 77.77 | 17.09 | 135.56 | 3.8179 | 1.7664 | |||

| NVDA / NVIDIA Corporation | 0.09 | 14.82 | 3.3101 | 3.3101 | |||||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 14.11 | 20.95 | 3.1507 | -0.1466 | |||

| SAF / Safran SA | 0.04 | 0.00 | 13.15 | 24.20 | 2.9373 | -0.0561 | |||

| COST / Costco Wholesale Corporation | 0.01 | 56.54 | 12.91 | 63.84 | 2.8848 | 0.6564 | |||

| RACE / Ferrari N.V. | 0.03 | 0.00 | 12.78 | 14.69 | 2.8548 | -0.2957 | |||

| JPM / JPMorgan Chase & Co. | 0.04 | 24.45 | 12.69 | 47.08 | 2.8337 | 0.3952 | |||

| SNPS / Synopsys, Inc. | 0.02 | 0.00 | 12.51 | 19.55 | 2.7947 | -0.1641 | |||

| CNSWF / Constellation Software Inc. | 0.00 | -10.93 | 11.96 | 3.13 | 2.6709 | -0.6070 | |||

| RMS / Hermès International Société en commandite par actions | 0.00 | 0.00 | 10.79 | 3.88 | 2.4112 | -0.5267 | |||

| DTE / Deutsche Telekom AG | 0.28 | 10.25 | 2.2895 | 2.2895 | |||||

| NTDOY / Nintendo Co., Ltd. - Depositary Receipt (Common Stock) | 0.41 | 9.82 | 2.1942 | 2.1942 | |||||

| TCEHY / Tencent Holdings Limited - Depositary Receipt (Common Stock) | 0.14 | 38.26 | 9.12 | 88.32 | 2.0382 | 0.6790 | |||

| AIR / Airbus SE | 0.04 | -26.42 | 8.96 | -12.73 | 2.0025 | -0.9013 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.15 | -3.66 | 8.57 | 7.75 | 1.9135 | -0.3344 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.08 | 1,400.00 | 7.62 | -5.62 | 1.7026 | -0.5809 | |||

| UNH / UnitedHealth Group Incorporated | 0.02 | 33.19 | 6.99 | -28.93 | 1.5621 | -1.1652 | |||

| PGR / The Progressive Corporation | 0.02 | 4.78 | 1.0668 | 1.0668 | |||||

| SMNEY / Siemens Energy AG - Depositary Receipt (Common Stock) | 0.01 | 1.44 | 0.3209 | 0.3209 |