Basic Stats

| Portfolio Value | $ 99,071,000 |

| Current Positions | 133 |

Latest Holdings, Performance, AUM (from 13F, 13D)

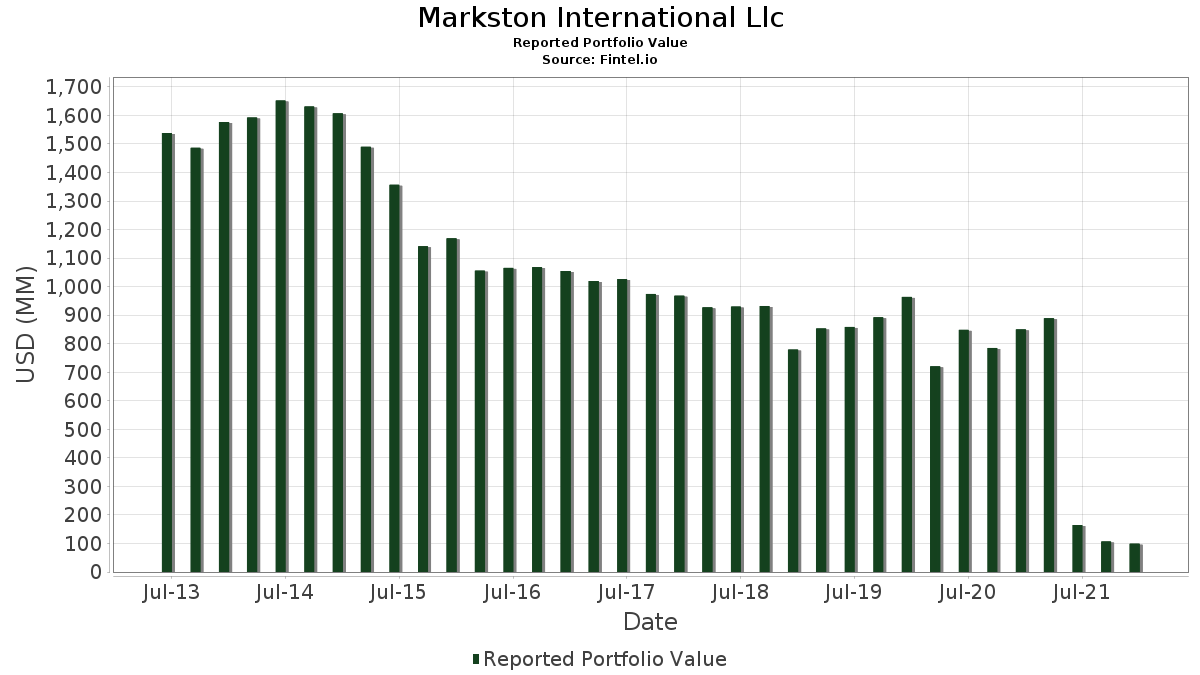

Markston International Llc has disclosed 133 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 99,071,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Markston International Llc’s top holdings are Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , Alphabet Inc. (US:GOOGL) , PayPal Holdings, Inc. (US:PYPL) , and Meta Platforms, Inc. (US:META) . Markston International Llc’s new positions include Dow Inc. (US:DOW) , New Residential Investment Corp (US:NRZ) , MARA Holdings, Inc. (US:MARA) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.06 | 10.49 | 10.5894 | 1.3372 | |

| 0.03 | 9.36 | 9.4508 | 1.1573 | |

| 0.00 | 6.08 | 6.1350 | 0.8488 | |

| 0.01 | 2.28 | 2.3024 | 0.6180 | |

| 0.01 | 2.28 | 2.3004 | 0.5243 | |

| 0.00 | 2.96 | 2.9878 | 0.4346 | |

| 0.00 | 1.58 | 1.5928 | 0.4178 | |

| 0.02 | 2.56 | 2.5850 | 0.3792 | |

| 0.00 | 0.65 | 0.6531 | 0.1821 | |

| 0.01 | 1.49 | 1.5070 | 0.1532 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.02 | 3.43 | 3.4622 | -1.0422 | |

| 0.03 | 1.68 | 1.6998 | -0.6371 | |

| 0.02 | 2.57 | 2.5921 | -0.6025 | |

| 0.05 | 2.07 | 2.0854 | -0.5072 | |

| 0.01 | 1.35 | 1.3637 | -0.4021 | |

| 0.00 | 1.22 | 1.2284 | -0.3820 | |

| 0.01 | 1.18 | 1.1880 | -0.3484 | |

| 0.03 | 1.52 | 1.5393 | -0.3435 | |

| 0.01 | 2.16 | 2.1803 | -0.2971 | |

| 0.01 | 3.27 | 3.2976 | -0.2845 |

13F and Fund Filings

This form was filed on 2022-01-21 for the reporting period 2021-12-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.06 | -15.40 | 10.49 | 6.16 | 10.5894 | 1.3372 | |||

| MSFT / Microsoft Corporation | 0.03 | -11.40 | 9.36 | 5.70 | 9.4508 | 1.1573 | |||

| GOOGL / Alphabet Inc. | 0.00 | -0.66 | 6.08 | 7.65 | 6.1350 | 0.8488 | |||

| PYPL / PayPal Holdings, Inc. | 0.02 | -1.61 | 3.43 | -28.71 | 3.4622 | -1.0422 | |||

| META / Meta Platforms, Inc. | 0.01 | -13.85 | 3.27 | -14.61 | 3.2976 | -0.2845 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 2.96 | 8.54 | 2.9878 | 0.4346 | |||

| DIS / The Walt Disney Company | 0.02 | -17.80 | 2.57 | -24.74 | 2.5921 | -0.6025 | |||

| CVS / CVS Health Corporation | 0.02 | -10.58 | 2.56 | 8.70 | 2.5850 | 0.3792 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | -0.47 | 2.28 | 26.79 | 2.3024 | 0.6180 | |||

| UNP / Union Pacific Corporation | 0.01 | -6.51 | 2.28 | 20.14 | 2.3004 | 0.5243 | |||

| AMJ / JPMorgan Alerian MLP Index ETN - Corporate Bond/Note | 0.01 | -15.60 | 2.16 | -18.37 | 2.1803 | -0.2971 | |||

| BAC.PRB / Bank of America Corporation - Preferred Stock | 0.05 | -28.82 | 2.07 | -25.39 | 2.0854 | -0.5072 | |||

| LBRDK / Liberty Broadband Corporation | 0.01 | -8.73 | 2.06 | -14.85 | 2.0844 | -0.1861 | |||

| LSXMK / Liberty Media Corp. (New Liberty SiriusXM) Series C | 0.04 | -14.89 | 2.06 | -8.83 | 2.0743 | -0.0361 | |||

| RTX / RTX Corporation | 0.02 | -8.79 | 1.91 | -8.70 | 1.9289 | -0.0307 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -19.28 | 1.75 | -11.59 | 1.7634 | -0.0867 | |||

| CMCSA / Comcast Corporation | 0.03 | -25.03 | 1.68 | -32.53 | 1.6998 | -0.6371 | |||

| ORCL / Oracle Corporation | 0.02 | -21.03 | 1.61 | -20.93 | 1.6241 | -0.2812 | |||

| HD / The Home Depot, Inc. | 0.00 | -0.50 | 1.58 | 25.74 | 1.5928 | 0.4178 | |||

| AIG / American International Group, Inc. | 0.03 | -26.80 | 1.52 | -24.17 | 1.5393 | -0.3435 | |||

| ABBV / AbbVie Inc. | 0.01 | -17.76 | 1.49 | 3.25 | 1.5070 | 0.1532 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.01 | 1.86 | 1.47 | -18.29 | 1.4787 | -0.2000 | |||

| BA / The Boeing Company | 0.01 | -6.14 | 1.42 | -14.05 | 1.4323 | -0.1135 | |||

| MS / Morgan Stanley | 0.01 | -28.98 | 1.35 | -28.37 | 1.3637 | -0.4021 | |||

| WFC / Wells Fargo & Company | 0.03 | -23.81 | 1.30 | -21.28 | 1.3142 | -0.2344 | |||

| PEP / PepsiCo, Inc. | 0.01 | -10.61 | 1.22 | 3.22 | 1.2294 | 0.1246 | |||

| GS.PRJ / Goldman Sachs Group, 5.50% Dep Shares Fixd/Float Non-Cumul Preferred Stock Ser J | 0.00 | -30.05 | 1.22 | -29.24 | 1.2284 | -0.3820 | |||

| AXP / American Express Company | 0.01 | -26.59 | 1.18 | -28.28 | 1.1880 | -0.3484 | |||

| MDT / Medtronic plc | 0.01 | -4.62 | 1.17 | -21.31 | 1.1779 | -0.2105 | |||

| HON / Honeywell International Inc. | 0.01 | -0.41 | 1.07 | -2.20 | 1.0780 | 0.0556 | |||

| TCEHY / Tencent Holdings Limited - Depositary Receipt (Common Stock) | 0.02 | -0.49 | 1.00 | -2.91 | 1.0094 | 0.0450 | |||

| V / Visa Inc. | 0.00 | -0.37 | 0.98 | -3.07 | 0.9892 | 0.0426 | |||

| TRV / The Travelers Companies, Inc. | 0.01 | -0.39 | 0.92 | 2.46 | 0.9266 | 0.0877 | |||

| C.WSA / Citigroup, Inc. | 0.00 | -0.75 | 0.85 | 8.25 | 0.8610 | 0.1232 | |||

| CSX / CSX Corporation | 0.02 | -23.61 | 0.84 | -3.46 | 0.8438 | 0.0330 | |||

| C / Citigroup Inc. | 0.01 | -0.51 | 0.78 | -14.38 | 0.7873 | -0.0656 | |||

| TEL / TE Connectivity plc | 0.00 | -0.42 | 0.72 | 17.10 | 0.7257 | 0.1509 | |||

| MRK / Merck & Co., Inc. | 0.01 | -0.36 | 0.72 | 1.70 | 0.7237 | 0.0637 | |||

| MPC / Marathon Petroleum Corporation | 0.01 | -30.05 | 0.71 | -27.55 | 0.7167 | -0.2009 | |||

| ROK / Rockwell Automation, Inc. | 0.00 | -0.40 | 0.70 | 18.18 | 0.7086 | 0.1524 | |||

| T / AT&T Inc. | 0.03 | -25.29 | 0.70 | -31.96 | 0.7025 | -0.2553 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.00 | 0.65 | 28.63 | 0.6531 | 0.1821 | |||

| ABT / Abbott Laboratories | 0.00 | -0.20 | 0.65 | 19.00 | 0.6510 | 0.1436 | |||

| JNJ / Johnson & Johnson | 0.00 | -22.50 | 0.55 | -17.91 | 0.5552 | -0.0721 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | -0.41 | 0.54 | 22.85 | 0.5481 | 0.1343 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -20.59 | 0.52 | -19.81 | 0.5229 | -0.0820 | |||

| LSXMA / Liberty Media Corp. (New Liberty SiriusXM) Series A | 0.01 | -0.42 | 0.47 | 7.36 | 0.4714 | 0.0641 | |||

| CB / Chubb Limited | 0.00 | -0.41 | 0.47 | 10.93 | 0.4714 | 0.0772 | |||

| USB / U.S. Bancorp | 0.01 | -32.05 | 0.45 | -35.78 | 0.4512 | -0.2005 | |||

| MSGS / Madison Square Garden Sports Corp. | 0.00 | -5.20 | 0.43 | -11.39 | 0.4320 | -0.0202 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.01 | -25.93 | 0.37 | -17.84 | 0.3765 | -0.0486 | |||

| DFS / Discover Financial Services | 0.00 | -0.28 | 0.37 | -6.12 | 0.3715 | 0.0044 | |||

| PFE / Pfizer Inc. | 0.01 | -10.96 | 0.37 | 22.26 | 0.3715 | 0.0896 | |||

| ENB / Enbridge Inc. | 0.01 | -0.44 | 0.35 | -2.21 | 0.3573 | 0.0184 | |||

| LBRDA / Liberty Broadband Corporation | 0.00 | -3.85 | 0.35 | -8.31 | 0.3563 | -0.0042 | |||

| COP / ConocoPhillips | 0.00 | -25.20 | 0.34 | -20.19 | 0.3472 | -0.0563 | |||

| DOW / Dow Inc. | 0.00 | -0.49 | 0.33 | 18.48 | 0.3301 | 0.0717 | |||

| FWONK / Formula One Group | 0.01 | -0.35 | 0.32 | 22.73 | 0.3270 | 0.0799 | |||

| EBAY / eBay Inc. | 0.00 | -0.40 | 0.32 | -5.09 | 0.3200 | 0.0073 | |||

| PM / Philip Morris International Inc. | 0.00 | -0.39 | 0.31 | -0.32 | 0.3169 | 0.0220 | |||

| FOXA / Fox Corporation | 0.01 | -22.17 | 0.30 | -28.40 | 0.3028 | -0.0895 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.00 | 0.00 | 0.30 | 6.03 | 0.3018 | 0.0378 | |||

| PG / The Procter & Gamble Company | 0.00 | -36.43 | 0.29 | -25.71 | 0.2887 | -0.0718 | |||

| MDLZ / Mondelez International, Inc. | 0.00 | -0.39 | 0.28 | 13.15 | 0.2867 | 0.0517 | |||

| J / Jacobs Solutions Inc. | 0.00 | -0.41 | 0.27 | 4.30 | 0.2695 | 0.0298 | |||

| PSX / Phillips 66 | 0.00 | -25.78 | 0.27 | -23.41 | 0.2675 | -0.0565 | |||

| TCOM / Trip.com Group Limited - Depositary Receipt (Common Stock) | 0.01 | -0.40 | 0.25 | -20.32 | 0.2534 | -0.0416 | |||

| CAT / Caterpillar Inc. | 0.00 | -0.44 | 0.23 | 7.31 | 0.2372 | 0.0322 | |||

| BK / The Bank of New York Mellon Corporation | 0.00 | -7.49 | 0.23 | 3.67 | 0.2281 | 0.0240 | |||

| SLB / Schlumberger Limited | 0.01 | -0.47 | 0.22 | 0.45 | 0.2241 | 0.0172 | |||

| CARR / Carrier Global Corporation | 0.00 | -31.68 | 0.21 | -28.52 | 0.2150 | -0.0640 | |||

| TXN / Texas Instruments Incorporated | 0.00 | -0.35 | 0.21 | -2.30 | 0.2140 | 0.0108 | |||

| BMY / Bristol-Myers Squibb Company | 0.00 | -0.43 | 0.20 | 4.64 | 0.2049 | 0.0233 | |||

| DOW / Dow Inc. | 0.00 | 0.18 | 0.0000 | ||||||

| MSGE / Madison Square Garden Entertainment Corp. | 0.00 | -7.42 | 0.17 | -10.71 | 0.1766 | -0.0069 | |||

| WTM / White Mountains Insurance Group, Ltd. | 0.00 | 0.00 | 0.17 | -5.49 | 0.1736 | 0.0032 | |||

| IFF / International Flavors & Fragrances Inc. | 0.00 | -0.48 | 0.16 | 12.06 | 0.1595 | 0.0275 | |||

| LBTYK / Liberty Global Ltd. | 0.00 | -0.72 | 0.14 | -8.00 | 0.1393 | -0.0011 | |||

| GBTC / Grayscale Bitcoin Trust (BTC) | 0.00 | 0.00 | 0.12 | 1.68 | 0.1221 | 0.0107 | |||

| OTIS / Otis Worldwide Corporation | 0.00 | -38.54 | 0.11 | -35.09 | 0.1120 | -0.0481 | |||

| IBKR / Interactive Brokers Group, Inc. | 0.00 | 0.00 | 0.11 | 27.59 | 0.1120 | 0.0306 | |||

| HXL / Hexcel Corporation | 0.00 | 0.00 | 0.09 | -12.50 | 0.0919 | -0.0055 | |||

| MSTR / Strategy Inc | 0.00 | 0.00 | 0.08 | -6.67 | 0.0848 | 0.0005 | |||

| VRSN / VeriSign, Inc. | 0.00 | 0.00 | 0.08 | 22.58 | 0.0767 | 0.0187 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.00 | 0.00 | 0.07 | 19.35 | 0.0747 | 0.0166 | |||

| ASGN / ASGN Incorporated | 0.00 | -4.17 | 0.07 | 4.41 | 0.0717 | 0.0080 | |||

| AES / The AES Corporation | 0.00 | 0.00 | 0.05 | 6.52 | 0.0495 | 0.0064 | |||

| LYV / Live Nation Entertainment, Inc. | 0.00 | 0.00 | 0.05 | 33.33 | 0.0485 | 0.0147 | |||

| AER / AerCap Holdings N.V. | 0.00 | 0.00 | 0.04 | 11.43 | 0.0394 | 0.0066 | |||

| WYNN / Wynn Resorts, Limited | 0.00 | 0.00 | 0.03 | 0.00 | 0.0333 | 0.0024 | |||

| MAR / Marriott International, Inc. | 0.00 | -64.29 | 0.03 | -60.24 | 0.0333 | -0.0444 | |||

| MTN / Vail Resorts, Inc. | 0.00 | 0.00 | 0.03 | 0.00 | 0.0283 | 0.0020 | |||

| SCHW / The Charles Schwab Corporation | 0.00 | 0.00 | 0.03 | 12.50 | 0.0273 | 0.0048 | |||

| Y / Alleghany Corp. | 0.00 | 0.00 | 0.03 | 8.00 | 0.0273 | 0.0038 | |||

| WRK / WestRock Company | 0.00 | 0.00 | 0.03 | -10.71 | 0.0252 | -0.0010 | |||

| ICUI / ICU Medical, Inc. | 0.00 | 0.00 | 0.02 | 4.35 | 0.0242 | 0.0027 | |||

| / ViacomCBS Inc | 0.00 | -0.67 | 0.02 | -24.14 | 0.0222 | -0.0049 | |||

| TA / TravelCenters of America Inc | 0.00 | 0.00 | 0.02 | 5.88 | 0.0182 | 0.0023 | |||

| DTE / DTE Energy Company | 0.00 | 0.00 | 0.02 | 6.25 | 0.0172 | 0.0022 | |||

| NFG / National Fuel Gas Company | 0.00 | 0.00 | 0.02 | 23.08 | 0.0162 | 0.0040 | |||

| AJRD / Aerojet Rocketdyne Holdings Inc | 0.00 | 0.00 | 0.02 | 6.67 | 0.0162 | 0.0021 | |||

| ETSY / Etsy, Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0151 | 0.0011 | |||

| OKE / ONEOK, Inc. | 0.00 | 0.00 | 0.01 | 7.14 | 0.0151 | 0.0020 | |||

| FWONA / Formula One Group | 0.00 | 0.00 | 0.01 | 27.27 | 0.0141 | 0.0038 | |||

| OGN / Organon & Co. | 0.00 | -3.79 | 0.01 | -13.33 | 0.0131 | -0.0009 | |||

| GLDM / World Gold Trust - SPDR Gold MiniShares Trust | 0.00 | 0.00 | 0.01 | 0.00 | 0.0131 | 0.0010 | |||

| NRZ / New Residential Investment Corp | 0.00 | 0.01 | 0.0111 | 0.0111 | |||||

| LGF.B / Lions Gate Entertainment Corp. | 0.00 | 0.00 | 0.01 | 25.00 | 0.0101 | 0.0026 | |||

| TWNK / Hostess Brands Inc - Class A | 0.00 | -20.00 | 0.01 | -11.11 | 0.0081 | -0.0004 | |||

| BOX / Box, Inc. | 0.00 | -10.00 | 0.01 | 0.00 | 0.0081 | 0.0006 | |||

| PFF / iShares Trust - iShares Preferred and Income Securities ETF | 0.00 | 0.00 | 0.01 | 0.00 | 0.0081 | 0.0006 | |||

| NGVT / Ingevity Corporation | 0.00 | 0.00 | 0.01 | 0.00 | 0.0071 | 0.0005 | |||

| BKH / Black Hills Corporation | 0.00 | 0.00 | 0.01 | 0.00 | 0.0071 | 0.0005 | |||

| FRPH / FRP Holdings, Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0061 | 0.0004 | |||

| OBTC / Osprey Bitcoin Trust | 0.00 | 0.01 | 0.0000 | ||||||

| LUMN / Lumen Technologies, Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0061 | 0.0004 | |||

| DXC / DXC Technology Company | 0.00 | 0.00 | 0.01 | -14.29 | 0.0061 | -0.0005 | |||

| BATRK / Atlanta Braves Holdings, Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0050 | 0.0004 | |||

| NLY.PRF / Annaly Capital Management, Inc. - Preferred Stock | 0.00 | -36.36 | 0.01 | -44.44 | 0.0050 | -0.0034 | |||

| VAC / Marriott Vacations Worldwide Corporation | 0.00 | -59.62 | 0.00 | -50.00 | 0.0040 | -0.0035 | |||

| ADS / Bread Financial Holdings Inc | 0.00 | 0.00 | 0.00 | -33.33 | 0.0040 | -0.0016 | |||

| KDP / Keurig Dr Pepper Inc. | 0.00 | 0.00 | 0.00 | 33.33 | 0.0040 | 0.0012 | |||

| NNBR / NN, Inc. | 0.00 | 0.00 | 0.00 | -20.00 | 0.0040 | -0.0006 | |||

| TAST / Carrols Restaurant Group, Inc. | 0.00 | -52.63 | 0.00 | -57.14 | 0.0030 | -0.0035 | |||

| DTM / DT Midstream, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0030 | 0.0002 | |||

| BATRA / Atlanta Braves Holdings, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0030 | 0.0002 | |||

| MARA / MARA Holdings, Inc. | 0.00 | 0.00 | 0.0030 | 0.0030 | |||||

| ACCO / ACCO Brands Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 0.0020 | 0.0001 | |||

| QRTEP / Qurate Retail Inc - 8% PRF REDEEM 15/03/2031 USD 100 - Ser A | 0.00 | 0.00 | 0.00 | 0.00 | 0.0020 | 0.0001 | |||

| OLED / Universal Display Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 0.0020 | 0.0001 | |||

| US9021041085 / II-VI, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0010 | 0.0001 | |||

| WCC / WESCO International, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0010 | 0.0001 | |||

| WCC.PRA / WESCO International, Inc. - Preferred Stock | 0.00 | 0.00 | 0.00 | 0.00 | 0.0010 | 0.0001 | |||

| PUTNAM HIGH INCOME SECURITIES / rights (429RGT020) | 0.00 | 0.00 | 0.0000 | ||||||

| PATI / Patriot Transportation Holding, Inc. | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| DS / Drive Shack Inc | 0.00 | -50.00 | 0.00 | -100.00 | -0.0009 | ||||

| SABR / Sabre Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0009 | ||||

| AMCX / AMC Networks Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0159 | ||||

| KO / The Coca-Cola Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0515 | ||||

| VTRS / Viatris Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0009 | ||||

| AKRX / Akorn, Inc. | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| MCD / McDonald's Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.2210 | ||||

| UDR / UDR, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0318 | ||||

| PEAK / Healthpeak Properties, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0375 | ||||

| ACTA / Actua Corporation | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| CWGL / Crimson Wine Group, Ltd. | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| VZ / Verizon Communications Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0393 |