Basic Stats

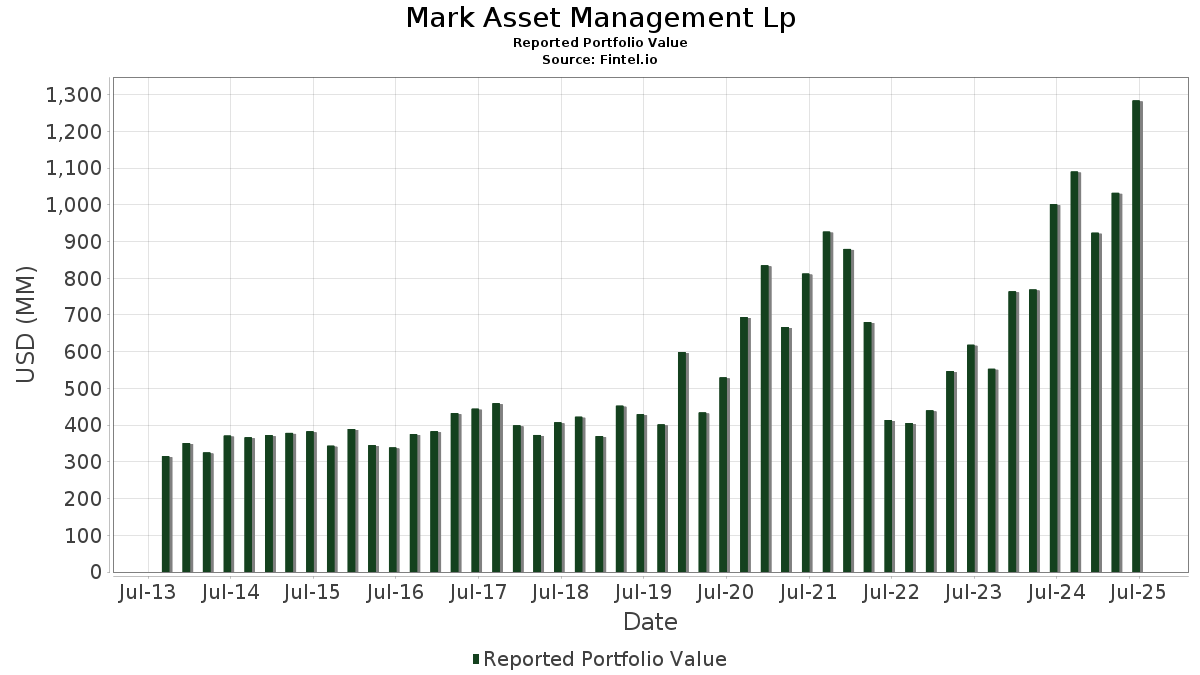

| Portfolio Value | $ 1,283,751,150 |

| Current Positions | 52 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Mark Asset Management Lp has disclosed 52 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,283,751,150 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Mark Asset Management Lp’s top holdings are SPDR S&P 500 ETF (US:SPY) , NVIDIA Corporation (US:NVDA) , Meta Platforms, Inc. (US:META) , Amazon.com, Inc. (US:AMZN) , and Netflix, Inc. (US:NFLX) . Mark Asset Management Lp’s new positions include Capital One Financial Corporation (US:COF) , Chime Financial, Inc. (US:CHYM) , Riot Platforms, Inc. (US:RIOT) , Kenvue Inc. (US:KVUE) , and Howard Hughes Holdings Inc. (US:HHH) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.56 | 349.09 | 27.1926 | 24.4833 | |

| 0.04 | 47.93 | 3.7335 | 1.5962 | |

| 0.46 | 72.78 | 5.6692 | 1.5679 | |

| 0.08 | 16.48 | 1.2836 | 1.2836 | |

| 0.18 | 29.23 | 2.2768 | 1.0694 | |

| 0.07 | 38.08 | 2.9661 | 0.7790 | |

| 0.15 | 33.76 | 2.6294 | 0.6638 | |

| 0.09 | 46.93 | 3.6556 | 0.6555 | |

| 0.23 | 7.99 | 0.6225 | 0.6225 | |

| 0.13 | 36.00 | 2.8043 | 0.6028 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.13 | 27.40 | 2.1341 | -1.2484 | |

| 0.02 | 11.99 | 0.9342 | -0.6941 | |

| 0.03 | 1.71 | 0.1334 | -0.6665 | |

| 0.17 | 13.84 | 1.0782 | -0.5225 | |

| 0.00 | 0.91 | 0.0710 | -0.4957 | |

| 0.00 | 0.00 | -0.3877 | ||

| 0.24 | 29.23 | 2.2772 | -0.3864 | |

| 0.23 | 33.50 | 2.6092 | -0.2864 | |

| 1.63 | 20.98 | 1.6340 | -0.2152 | |

| 0.07 | 9.95 | 0.7748 | -0.1967 |

13F and Fund Filings

This form was filed on 2025-08-14 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | Put | 0.56 | 1,030.00 | 349.09 | 1,148.11 | 27.1926 | 24.4833 | ||

| NVDA / NVIDIA Corporation | 0.46 | 17.92 | 72.78 | 71.89 | 5.6692 | 1.5679 | |||

| META / Meta Platforms, Inc. | 0.09 | -0.11 | 65.25 | 27.93 | 5.0829 | 0.1420 | |||

| AMZN / Amazon.com, Inc. | 0.23 | 13.29 | 49.40 | 30.64 | 3.8479 | 0.1851 | |||

| NFLX / Netflix, Inc. | 0.04 | 51.27 | 47.93 | 117.23 | 3.7335 | 1.5962 | |||

| MSFT / Microsoft Corporation | 0.09 | 14.36 | 46.93 | 51.53 | 3.6556 | 0.6555 | |||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | 0.24 | -0.07 | 39.10 | 51.35 | 3.0455 | 0.5432 | |||

| GEV / GE Vernova Inc. | 0.07 | -2.70 | 38.08 | 68.65 | 2.9661 | 0.7790 | |||

| FLUT / Flutter Entertainment plc | 0.13 | 22.81 | 36.00 | 58.40 | 2.8043 | 0.6028 | |||

| GOOGL / Alphabet Inc. | 0.20 | 11.31 | 34.80 | 26.85 | 2.7112 | 0.0532 | |||

| ORCL / Oracle Corporation | 0.15 | 6.38 | 33.76 | 66.35 | 2.6294 | 0.6638 | |||

| RTX / RTX Corporation | 0.23 | 1.65 | 33.50 | 12.05 | 2.6092 | -0.2864 | |||

| BA / The Boeing Company | 0.14 | 6.48 | 29.25 | 30.81 | 2.2782 | 0.1125 | |||

| DIS / The Walt Disney Company | 0.24 | -15.38 | 29.23 | 6.31 | 2.2772 | -0.3864 | |||

| NVDA / NVIDIA Corporation | Call | 0.18 | 60.87 | 29.23 | 134.52 | 2.2768 | 1.0694 | ||

| AAPL / Apple Inc. | 0.13 | -15.06 | 27.40 | -21.54 | 2.1341 | -1.2484 | |||

| DUOL / Duolingo, Inc. | 0.06 | -9.74 | 23.68 | 19.17 | 1.8444 | -0.0802 | |||

| GE / General Electric Company | 0.09 | -0.61 | 23.29 | 27.82 | 1.8143 | 0.0492 | |||

| WYNN / Wynn Resorts, Limited | 0.23 | 9.56 | 21.39 | 22.90 | 1.6659 | -0.0197 | |||

| PARA / Paramount Global | 1.63 | 1.88 | 20.98 | 9.88 | 1.6340 | -0.2152 | |||

| TSLA / Tesla, Inc. | Call | 0.06 | 0.00 | 19.06 | 22.57 | 1.4847 | -0.0216 | ||

| SBUX / Starbucks Corporation | 0.19 | 104.47 | 17.80 | 91.00 | 1.3865 | 0.4838 | |||

| SPOT / Spotify Technology S.A. | 0.02 | 0.67 | 17.42 | 40.44 | 1.3572 | 0.1555 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.02 | 6.16 | 16.74 | 28.39 | 1.3042 | 0.0410 | |||

| COF / Capital One Financial Corporation | 0.08 | 16.48 | 1.2836 | 1.2836 | |||||

| GEV / GE Vernova Inc. | Call | 0.03 | 0.00 | 15.87 | 73.33 | 1.2366 | 0.3494 | ||

| ZS / Zscaler, Inc. | 0.05 | -28.99 | 14.86 | 12.35 | 1.1573 | -0.1237 | |||

| WFC / Wells Fargo & Company | 0.17 | -24.95 | 13.84 | -16.24 | 1.0782 | -0.5225 | |||

| AVGO / Broadcom Inc. | Call | 0.05 | 0.00 | 13.23 | 64.65 | 1.0307 | 0.2522 | ||

| ISRG / Intuitive Surgical, Inc. | 0.02 | -34.98 | 11.99 | -28.66 | 0.9342 | -0.6941 | |||

| PINS / Pinterest, Inc. | 0.30 | 229.67 | 10.64 | 281.36 | 0.8288 | 0.5586 | |||

| BX / Blackstone Inc. | 0.07 | -7.33 | 9.95 | -0.83 | 0.7748 | -0.1967 | |||

| CHYM / Chime Financial, Inc. | 0.23 | 7.99 | 0.6225 | 0.6225 | |||||

| AMZN / Amazon.com, Inc. | Call | 0.04 | -11.39 | 7.68 | 2.17 | 0.5981 | -0.1298 | ||

| DIS / The Walt Disney Company | Call | 0.06 | 0.00 | 7.44 | 25.63 | 0.5796 | 0.0059 | ||

| GOOGL / Alphabet Inc. | Call | 0.04 | 7.05 | 0.5491 | 0.5491 | ||||

| RIOT / Riot Platforms, Inc. | 0.58 | 6.61 | 0.5146 | 0.5146 | |||||

| LVS / Las Vegas Sands Corp. | 0.10 | -23.08 | 4.35 | -13.36 | 0.3389 | -0.1475 | |||

| GOOG / Alphabet Inc. | 0.01 | 0.00 | 2.35 | 13.56 | 0.1827 | -0.0174 | |||

| ZG / Zillow Group, Inc. | 0.03 | -79.76 | 1.71 | -79.27 | 0.1334 | -0.6665 | |||

| SPG / Simon Property Group, Inc. | 0.01 | 0.00 | 1.30 | -3.20 | 0.1013 | -0.0288 | |||

| BATRK / Atlanta Braves Holdings, Inc. | 0.03 | 1.24 | 0.0965 | 0.0965 | |||||

| DKNG / DraftKings Inc. | 0.03 | 1.22 | 0.0952 | 0.0952 | |||||

| MLM / Martin Marietta Materials, Inc. | 0.00 | -2.00 | 1.07 | 12.58 | 0.0837 | -0.0088 | |||

| KVUE / Kenvue Inc. | 0.05 | 1.05 | 0.0816 | 0.0816 | |||||

| SCHW / The Charles Schwab Corporation | 0.01 | 0.91 | 0.0710 | 0.0710 | |||||

| TSLA / Tesla, Inc. | 0.00 | -87.30 | 0.91 | -84.43 | 0.0710 | -0.4957 | |||

| HHH / Howard Hughes Holdings Inc. | 0.01 | 0.62 | 0.0487 | 0.0487 | |||||

| AMT / American Tower Corporation | 0.00 | 0.00 | 0.49 | 1.44 | 0.0383 | -0.0087 | |||

| LQDA / Liquidia Corporation | 0.03 | 0.32 | 0.0248 | 0.0248 | |||||

| BHVN / Biohaven Ltd. | 0.02 | 0.27 | 0.0212 | 0.0212 | |||||

| INBX / Inhibrx Biosciences, Inc. | 0.02 | 0.24 | 0.0189 | 0.0189 | |||||

| ALAB / Astera Labs, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AVGO / Broadcom Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3877 | ||||

| MS / Morgan Stanley | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TOL / Toll Brothers, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| QQQ / Invesco QQQ Trust, Series 1 | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| PLTR / Palantir Technologies Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CEG / Constellation Energy Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TTWO / Take-Two Interactive Software, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LEN / Lennar Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MGM / MGM Resorts International | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SOFI / SoFi Technologies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1915 |