Basic Stats

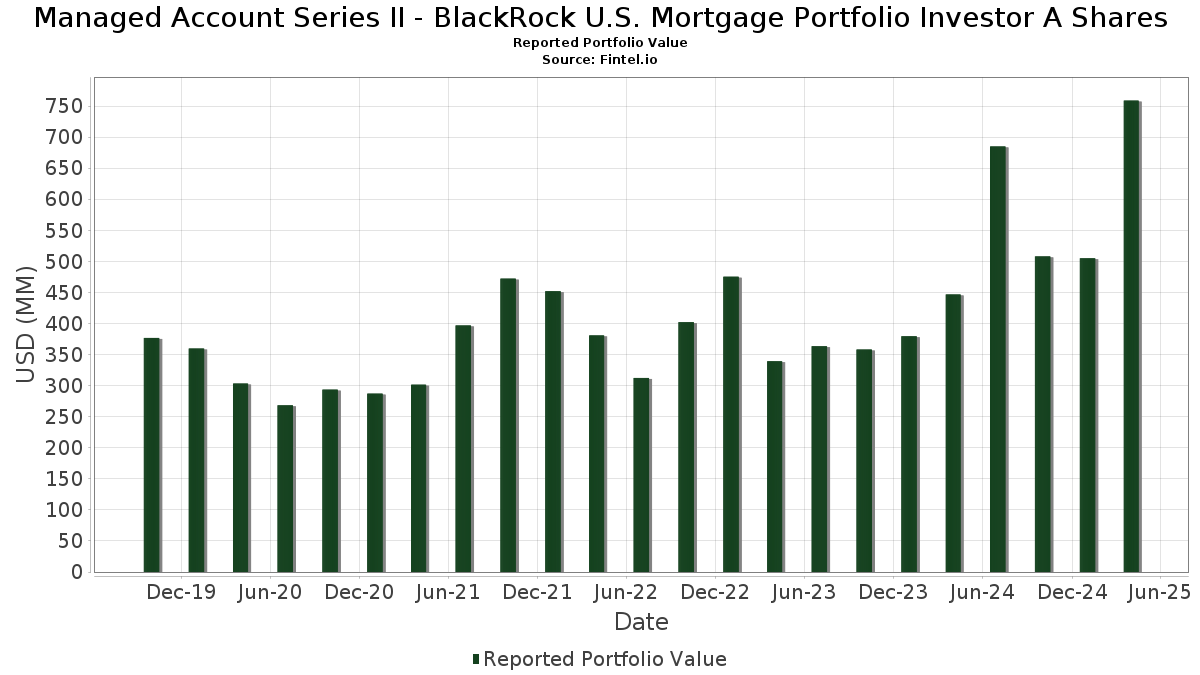

| Portfolio Value | $ 758,764,403 |

| Current Positions | 1,332 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Managed Account Series II - BlackRock U.S. Mortgage Portfolio Investor A Shares has disclosed 1,332 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 758,764,403 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Managed Account Series II - BlackRock U.S. Mortgage Portfolio Investor A Shares’s top holdings are FNMA 30YR TBA 2.5% 4/25/50 TO BE ANNOUNCED 2.50000000 (US:US01F0226591) , FNMA TBA 30 YR 5.5 SINGLE FAMILY MORTGAGE (US:US01F0526560) , Uniform Mortgage-Backed Security, TBA (US:US01F0206536) , Ginnie Mae (US:US21H0226553) , and GNMA II 30 YR TBA 2% MAY 21 TO BE ANNOUNCED 2.00000000 (US:US21H0206597) . Managed Account Series II - BlackRock U.S. Mortgage Portfolio Investor A Shares’s new positions include FNMA 30YR TBA 2.5% 4/25/50 TO BE ANNOUNCED 2.50000000 (US:US01F0226591) , FNMA TBA 30 YR 5.5 SINGLE FAMILY MORTGAGE (US:US01F0526560) , Uniform Mortgage-Backed Security, TBA (US:US01F0206536) , Ginnie Mae (US:US21H0226553) , and GNMA II 30 YR TBA 2% MAY 21 TO BE ANNOUNCED 2.00000000 (US:US21H0206597) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 20.68 | 5.2276 | 5.2276 | ||

| 20.68 | 5.2276 | 5.2276 | ||

| 20.68 | 5.2276 | 5.2276 | ||

| 1.86 | 0.4706 | 1.8572 | ||

| 5.99 | 1.5134 | 1.3854 | ||

| 2.53 | 2.53 | 0.6402 | 0.6402 | |

| 2.53 | 2.53 | 0.6402 | 0.6402 | |

| 2.53 | 2.53 | 0.6402 | 0.6402 | |

| 1.55 | 0.3916 | 0.3916 | ||

| 1.55 | 0.3916 | 0.3916 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 5.65 | 1.4291 | -2.9193 | ||

| -0.32 | -0.0805 | -2.8682 | ||

| 0.04 | 0.0101 | -2.5613 | ||

| 12.81 | 3.2391 | -1.7261 | ||

| 2.50 | 0.6308 | -0.6105 | ||

| -1.84 | -0.4651 | -0.4651 | ||

| 0.04 | 0.0114 | -0.0936 | ||

| -0.30 | -0.0754 | -0.0754 | ||

| -0.30 | -0.0754 | -0.0754 | ||

| -0.30 | -0.0754 | -0.0754 |

13F and Fund Filings

This form was filed on 2025-06-26 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| U.S. Treasury Bills / STIV (US912797NN35) | 20.68 | 5.2276 | 5.2276 | ||||||

| U.S. Treasury Bills / STIV (US912797NN35) | 20.68 | 5.2276 | 5.2276 | ||||||

| U.S. Treasury Bills / STIV (US912797NN35) | 20.68 | 5.2276 | 5.2276 | ||||||

| US01F0226591 / FNMA 30YR TBA 2.5% 4/25/50 TO BE ANNOUNCED 2.50000000 | 12.81 | -30.82 | 3.2391 | -1.7261 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 12.72 | -2.89 | 3.2150 | 0.2770 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 12.72 | -2.89 | 3.2150 | 0.2770 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 12.72 | -2.89 | 3.2150 | 0.2770 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 8.74 | -1.57 | 2.2096 | 0.2176 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 8.74 | -1.57 | 2.2096 | 0.2176 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 8.74 | -1.57 | 2.2096 | 0.2176 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 6.05 | -2.23 | 1.5304 | 0.1412 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 6.05 | -2.23 | 1.5304 | 0.1412 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 6.05 | -2.23 | 1.5304 | 0.1412 | |||||

| US01F0526560 / FNMA TBA 30 YR 5.5 SINGLE FAMILY MORTGAGE | 5.99 | 1,776.80 | 1.5134 | 1.3854 | |||||

| US01F0206536 / Uniform Mortgage-Backed Security, TBA | 5.65 | -65.15 | 1.4291 | -2.9193 | |||||

| US21H0226553 / Ginnie Mae | 5.18 | 3.95 | 1.3096 | -0.0262 | |||||

| US21H0206597 / GNMA II 30 YR TBA 2% MAY 21 TO BE ANNOUNCED 2.00000000 | 4.89 | 3.30 | 1.2351 | -0.0329 | |||||

| US3132DWD260 / FHLG 30YR 3.5% 06/52#SD8221 | 4.57 | 0.26 | 1.1556 | 0.1329 | |||||

| US38383R4L85 / Government National Mortgage Association, Series 2022-88, Class IA | 4.15 | -0.84 | 1.0499 | 0.1103 | |||||

| US38382VHH50 / Government National Mortgage Association, Series 2021-97, Class LI | 3.19 | -2.24 | 0.8059 | 0.0742 | |||||

| US43789XAE40 / Homeward Opportunities Fund I Trust, Series 2020-2, Class B1 | 3.03 | 5.65 | 0.7661 | 0.1225 | |||||

| US3140XHA987 / FANNIE MAE POOL FN FS1831 | 2.87 | 0.88 | 0.7260 | 0.0872 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.78 | 4.24 | 0.7027 | 0.1044 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.78 | 4.24 | 0.7027 | 0.1044 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.78 | 4.24 | 0.7027 | 0.1044 | |||||

| US38382QME79 / Government National Mortgage Association, Series 2021-64, Class IH | 2.72 | -2.02 | 0.6873 | 0.0647 | |||||

| US85214RAC79 / Spruce Hill Mortgage Loan Trust, Series 2020-SH2, Class B1 | 2.69 | 0.94 | 0.6795 | 0.0820 | |||||

| US38382RHG65 / Government National Mortgage Association, Series 2021-58, Class IY | 2.67 | -2.34 | 0.6750 | 0.0615 | |||||

| US64831KAN63 / New Residential Mortgage Loan Trust, Series 2022-SFR1, Class F | 2.63 | 3.54 | 0.6656 | 0.0951 | |||||

| US43789XAD66 / Homeward Opportunities Fund I Trust, Series 2020-2, Class M1 | 2.56 | 3.18 | 0.6473 | 0.0907 | |||||

| Dreyfus Treasury Prime Cash Management Institutional Shares / STIV (N/A) | 2.53 | 2.53 | 0.6402 | 0.6402 | |||||

| Dreyfus Treasury Prime Cash Management Institutional Shares / STIV (N/A) | 2.53 | 2.53 | 0.6402 | 0.6402 | |||||

| Dreyfus Treasury Prime Cash Management Institutional Shares / STIV (N/A) | 2.53 | 2.53 | 0.6402 | 0.6402 | |||||

| US01F0406516 / Uniform Mortgage-Backed Security, TBA | 2.50 | -46.12 | 0.6308 | -0.6105 | |||||

| US74333YAN85 / Progress Residential Trust, Series 2022-SFR1, Class F | 2.33 | -2.43 | 0.5891 | 0.0533 | |||||

| US75887NAW92 / Regatta VI Funding Ltd | 2.05 | -0.05 | 0.5182 | 0.0579 | |||||

| US64132YAQ52 / Neuberger Berman Loan Advisers CLO 34 Ltd | 1.97 | -1.85 | 0.4969 | 0.0477 | |||||

| US74333XAN03 / Progress Residential Trust, Series 2021-SFR11, Class F | 1.92 | 1.32 | 0.4860 | 0.0603 | |||||

| Government National Mortgage Association Variable Rate Notes, Series 2024-96, Class FL / ABS-MBS (US38384PC321) | 1.89 | -5.22 | 0.4772 | 0.0304 | |||||

| Government National Mortgage Association Variable Rate Notes, Series 2024-96, Class FL / ABS-MBS (US38384PC321) | 1.89 | -5.22 | 0.4772 | 0.0304 | |||||

| Government National Mortgage Association Variable Rate Notes, Series 2024-96, Class FL / ABS-MBS (US38384PC321) | 1.89 | -5.22 | 0.4772 | 0.0304 | |||||

| US64828XAG88 / New Residential Mortgage Loan Trust 2020-RPL1 | 1.88 | 3.18 | 0.4761 | 0.0665 | |||||

| US21H0606556 / Ginnie Mae | 1.86 | -135.98 | 0.4706 | 1.8572 | |||||

| US12666BAF22 / Countrywide Asset-Backed Certificates | 1.81 | -0.93 | 0.4578 | 0.0476 | |||||

| CarVal CLO I Ltd., Series 2018-1A, Class AR / ABS-CBDO (US146865AJ95) | 1.78 | -4.25 | 0.4505 | 0.0330 | |||||

| CarVal CLO I Ltd., Series 2018-1A, Class AR / ABS-CBDO (US146865AJ95) | 1.78 | -4.25 | 0.4505 | 0.0330 | |||||

| CarVal CLO I Ltd., Series 2018-1A, Class AR / ABS-CBDO (US146865AJ95) | 1.78 | -4.25 | 0.4505 | 0.0330 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.78 | -5.58 | 0.4490 | 0.0268 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.78 | -5.58 | 0.4490 | 0.0268 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.78 | -5.58 | 0.4490 | 0.0268 | |||||

| US05492VAF22 / BBCMS Mortgage Trust 2020-C7 | 1.72 | 1.90 | 0.4336 | 0.0560 | |||||

| US43730XAG97 / Home Partners of America 2021-3 Trust | 1.63 | 1.43 | 0.4114 | 0.0515 | |||||

| US35564CGD39 / Seasoned Loans Structured Transaction Trust Series 2020-2 | 1.57 | -12.32 | 0.3960 | -0.0049 | |||||

| US94989NBK28 / Wells Fargo Commercial Mortgage Trust, Series 2015-C30, Class B | 1.56 | 0.32 | 0.3943 | 0.0456 | |||||

| US00971FAA93 / AJAX Mortgage Loan Trust | 1.56 | -4.78 | 0.3932 | 0.0268 | |||||

| US12434GAA31 / BX Commercial Mortgage Trust 2023-XL3 | 1.55 | -0.45 | 0.3928 | 0.0427 | |||||

| BX Trust, Series 2025-VLT6, Class A / ABS-MBS (US12433KAA51) | 1.55 | 0.3916 | 0.3916 | ||||||

| BX Trust, Series 2025-VLT6, Class A / ABS-MBS (US12433KAA51) | 1.55 | 0.3916 | 0.3916 | ||||||

| BX Trust, Series 2025-VLT6, Class A / ABS-MBS (US12433KAA51) | 1.55 | 0.3916 | 0.3916 | ||||||

| US23243WAE84 / CWABS Trust, Series 2006-18, Class M1 | 1.53 | -5.61 | 0.3868 | 0.0231 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.52 | -5.18 | 0.3843 | 0.0246 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.52 | -5.18 | 0.3843 | 0.0246 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.52 | -5.18 | 0.3843 | 0.0246 | |||||

| US92258DAR89 / Velocity Commercial Capital Loan Trust, Series 2021-4, Class M5 | 1.52 | 10.58 | 0.3831 | 0.0757 | |||||

| US149791AP09 / Cayuga Park CLO Ltd | 1.50 | -0.27 | 0.3790 | 0.0416 | |||||

| US35564CHL46 / Seasoned Loans Structured Transaction Trust Series 2020-3 | 1.49 | -15.38 | 0.3770 | -0.0184 | |||||

| US52473FAA30 / Legacy Mortgage Asset Trust 2019-SL2 | 1.48 | -7.74 | 0.3738 | 0.0143 | |||||

| US144527AE87 / CARR 2007-FRE1 M1 | 1.45 | 0.35 | 0.3669 | 0.0424 | |||||

| PRET LLC, Series 2024-RN2, Class A1 / ABS-MBS (US69391YAA55) | 1.44 | -3.43 | 0.3633 | 0.0294 | |||||

| PRET LLC, Series 2024-RN2, Class A1 / ABS-MBS (US69391YAA55) | 1.44 | -3.43 | 0.3633 | 0.0294 | |||||

| BX Commercial Mortgage Trust, Series 2024-AIRC, Class A / ABS-MBS (US12433CAA36) | 1.43 | -3.57 | 0.3619 | 0.0289 | |||||

| BX Commercial Mortgage Trust, Series 2024-AIRC, Class A / ABS-MBS (US12433CAA36) | 1.43 | -3.57 | 0.3619 | 0.0289 | |||||

| MFA Trust, Series 2024-NPL1, Class A1 / ABS-MBS (US58004YAA73) | 1.43 | -2.45 | 0.3619 | 0.0326 | |||||

| MFA Trust, Series 2024-NPL1, Class A1 / ABS-MBS (US58004YAA73) | 1.43 | -2.45 | 0.3619 | 0.0326 | |||||

| BX Commercial Mortgage Trust, Series 2024-AIR2, Class A / ABS-MBS (US05613QAA85) | 1.41 | -4.54 | 0.3564 | 0.0252 | |||||

| BX Commercial Mortgage Trust, Series 2024-AIR2, Class A / ABS-MBS (US05613QAA85) | 1.41 | -4.54 | 0.3564 | 0.0252 | |||||

| BX Commercial Mortgage Trust, Series 2024-AIR2, Class A / ABS-MBS (US05613QAA85) | 1.41 | -4.54 | 0.3564 | 0.0252 | |||||

| Regatta 31 Funding Ltd., Series 2025-1A, Class A1 / ABS-CBDO (US758962AA23) | 1.39 | 0.3521 | 0.3521 | ||||||

| Regatta 31 Funding Ltd., Series 2025-1A, Class A1 / ABS-CBDO (US758962AA23) | 1.39 | 0.3521 | 0.3521 | ||||||

| Regatta 31 Funding Ltd., Series 2025-1A, Class A1 / ABS-CBDO (US758962AA23) | 1.39 | 0.3521 | 0.3521 | ||||||

| PRET LLC, Series 2024-NPL4, Class A1 / ABS-MBS (US74143RAA14) | 1.39 | -3.80 | 0.3520 | 0.0274 | |||||

| US05609KAA79 / BX Commercial Mortgage Trust 2021-XL2 | 1.39 | -3.94 | 0.3518 | 0.0267 | |||||

| US12659YAF16 / COLT 2022-3 Mortgage Loan Trust | 1.33 | -1.41 | 0.3360 | 0.0334 | |||||

| US38384ERP24 / Government National Mortgage Association, Series 2023-130, Class OD | 1.30 | -4.34 | 0.3286 | 0.0237 | |||||

| US06744JAA43 / Barclays Mortgage Trust 2021-NPL1 | 1.30 | -8.07 | 0.3281 | 0.0111 | |||||

| Government National Mortgage Association Variable Rate Notes, Series 2024-51, Class TF / ABS-MBS (US38384KUP47) | 1.28 | -6.98 | 0.3237 | 0.0149 | |||||

| Government National Mortgage Association Variable Rate Notes, Series 2024-51, Class TF / ABS-MBS (US38384KUP47) | 1.28 | -6.98 | 0.3237 | 0.0149 | |||||

| Government National Mortgage Association Variable Rate Notes, Series 2024-51, Class TF / ABS-MBS (US38384KUP47) | 1.28 | -6.98 | 0.3237 | 0.0149 | |||||

| US009703AA74 / AJAXM_21-G | 1.25 | -2.34 | 0.3170 | 0.0288 | |||||

| US85236WCE49 / STWD Trust | 1.25 | -0.40 | 0.3154 | 0.0344 | |||||

| US46651YCA64 / JP Morgan Mortgage Trust 2019-9 | 1.25 | 0.3151 | 0.3151 | ||||||

| US05608MAA45 / BX Commercial Mortgage Trust 2020-VIV4 | 1.24 | 1.72 | 0.3138 | 0.0401 | |||||

| US3617XCUF05 / Government National Mortgage Association | 1.24 | 0.41 | 0.3122 | 0.0362 | |||||

| US74333WAN20 / Progress Residential 2021-SFR10 Trust | 1.23 | -3.07 | 0.3112 | 0.0261 | |||||

| US073250BE15 / Bayview Financial Revolving Asset Trust 2004-B | 1.22 | -2.95 | 0.3079 | 0.0264 | |||||

| US92539FAD50 / VERUS_23-INV1 | 1.21 | -0.25 | 0.3054 | 0.0335 | |||||

| Apidos CLO XII, Series 2013-12A, Class BRR / ABS-CBDO (US03764DAP69) | 1.20 | -0.17 | 0.3033 | 0.0339 | |||||

| Apidos CLO XII, Series 2013-12A, Class BRR / ABS-CBDO (US03764DAP69) | 1.20 | -0.17 | 0.3033 | 0.0339 | |||||

| Apidos CLO XII, Series 2013-12A, Class BRR / ABS-CBDO (US03764DAP69) | 1.20 | -0.17 | 0.3033 | 0.0339 | |||||

| US12530KAC36 / CFMT LLC, Series 2023-HB11, Class M2 | 1.20 | 1.01 | 0.3029 | 0.0367 | |||||

| IRV Trust, Series 2025-200P, Class A / ABS-MBS (US45006HAA95) | 1.19 | 0.3013 | 0.3013 | ||||||

| IRV Trust, Series 2025-200P, Class A / ABS-MBS (US45006HAA95) | 1.19 | 0.3013 | 0.3013 | ||||||

| IRV Trust, Series 2025-200P, Class A / ABS-MBS (US45006HAA95) | 1.19 | 0.3013 | 0.3013 | ||||||

| SNDPT / Sounds Point CLO IV-R LTD | 1.19 | -18.74 | 0.3003 | -0.0278 | |||||

| US93364BAC46 / WaMu Mortgage Pass-Through Trust, Series 2007-OA5, Class 2A | 1.18 | -1.92 | 0.2978 | 0.0283 | |||||

| Commercial Mortgage Trust, Series 2024-CBM, Class A2 / ABS-MBS (US12674GAC87) | 1.15 | 80.56 | 0.2913 | 0.1481 | |||||

| Commercial Mortgage Trust, Series 2024-CBM, Class A2 / ABS-MBS (US12674GAC87) | 1.15 | 80.56 | 0.2913 | 0.1481 | |||||

| Commercial Mortgage Trust, Series 2024-CBM, Class A2 / ABS-MBS (US12674GAC87) | 1.15 | 80.56 | 0.2913 | 0.1481 | |||||

| US161636AA34 / Chase Mortgage Finance Trust Series 2007-S6 | 1.15 | -0.95 | 0.2896 | 0.0300 | |||||

| Houston Galleria Mall Trust, Series 2025-HGLR, Class A / ABS-MBS (US44216XAA37) | 1.14 | 1.42 | 0.2880 | 0.0360 | |||||

| Houston Galleria Mall Trust, Series 2025-HGLR, Class A / ABS-MBS (US44216XAA37) | 1.14 | 1.42 | 0.2880 | 0.0360 | |||||

| Houston Galleria Mall Trust, Series 2025-HGLR, Class A / ABS-MBS (US44216XAA37) | 1.14 | 1.42 | 0.2880 | 0.0360 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.12 | -1.75 | 0.2839 | 0.0273 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.12 | -1.75 | 0.2839 | 0.0273 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.12 | -1.75 | 0.2839 | 0.0273 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.12 | -11.52 | 0.2836 | -0.0007 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.12 | -11.52 | 0.2836 | -0.0007 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.12 | -11.52 | 0.2836 | -0.0007 | |||||

| CFMT LLC, Series 2024-HB13, Class M3 / ABS-MBS (US12530VAD73) | 1.11 | 1.55 | 0.2809 | 0.0353 | |||||

| CFMT LLC, Series 2024-HB13, Class M3 / ABS-MBS (US12530VAD73) | 1.11 | 1.55 | 0.2809 | 0.0353 | |||||

| CFMT LLC, Series 2024-HB13, Class M3 / ABS-MBS (US12530VAD73) | 1.11 | 1.55 | 0.2809 | 0.0353 | |||||

| US52525BBH42 / Lehman XS Trust Series 2007-16N | 1.11 | -1.51 | 0.2796 | 0.0276 | |||||

| US55819BAW00 / Madison Park Funding XVIII Ltd | 1.10 | -15.28 | 0.2789 | -0.0132 | |||||

| ARES Commercial Mortgage Trust, Series 2024-IND, Class A / ABS-MBS (US03990DAA54) | 1.09 | -0.37 | 0.2755 | 0.0301 | |||||

| ARES Commercial Mortgage Trust, Series 2024-IND, Class A / ABS-MBS (US03990DAA54) | 1.09 | -0.37 | 0.2755 | 0.0301 | |||||

| ARES Commercial Mortgage Trust, Series 2024-IND, Class A / ABS-MBS (US03990DAA54) | 1.09 | -0.37 | 0.2755 | 0.0301 | |||||

| RAAC Trust, Series 2006-SP3, Class M3 / ABS-O (US74919QAF46) | 1.08 | 0.93 | 0.2740 | 0.0331 | |||||

| RAAC Trust, Series 2006-SP3, Class M3 / ABS-O (US74919QAF46) | 1.08 | 0.93 | 0.2740 | 0.0331 | |||||

| RAAC Trust, Series 2006-SP3, Class M3 / ABS-O (US74919QAF46) | 1.08 | 0.93 | 0.2740 | 0.0331 | |||||

| US85213XAA90 / Spruce Hill Mortgage Loan Trust 2022-SH1 | 1.08 | 2.37 | 0.2738 | 0.0365 | |||||

| US05610HAC79 / BX Commercial Mortgage Trust 2022-LP2 | 1.08 | -0.46 | 0.2727 | 0.0295 | |||||

| Velocity Commercial Capital Loan Trust, Series 2024-5, Class M4 / ABS-MBS (US92261AAM09) | 1.08 | -0.09 | 0.2722 | 0.0306 | |||||

| Velocity Commercial Capital Loan Trust, Series 2024-5, Class M4 / ABS-MBS (US92261AAM09) | 1.08 | -0.09 | 0.2722 | 0.0306 | |||||

| Velocity Commercial Capital Loan Trust, Series 2024-5, Class M4 / ABS-MBS (US92261AAM09) | 1.08 | -0.09 | 0.2722 | 0.0306 | |||||

| US05610HAA14 / BX Commercial Mortgage Trust 2022-LP2 | 1.08 | -4.01 | 0.2720 | 0.0205 | |||||

| LEX Mortgage Trust, Series 2024-BBG, Class A / ABS-MBS (US52885AAA60) | 1.06 | 1.44 | 0.2678 | 0.0335 | |||||

| LEX Mortgage Trust, Series 2024-BBG, Class A / ABS-MBS (US52885AAA60) | 1.06 | 1.44 | 0.2678 | 0.0335 | |||||

| LEX Mortgage Trust, Series 2024-BBG, Class A / ABS-MBS (US52885AAA60) | 1.06 | 1.44 | 0.2678 | 0.0335 | |||||

| BMP, Series 2024-MF23, Class A / ABS-MBS (US05593JAA88) | 1.05 | -0.47 | 0.2665 | 0.0288 | |||||

| BMP, Series 2024-MF23, Class A / ABS-MBS (US05593JAA88) | 1.05 | -0.47 | 0.2665 | 0.0288 | |||||

| BMP, Series 2024-MF23, Class A / ABS-MBS (US05593JAA88) | 1.05 | -0.47 | 0.2665 | 0.0288 | |||||

| US05539BAZ76 / BCAP LLC Trust, Series 2012-RR3, Class 3A8 | 1.04 | -2.16 | 0.2638 | 0.0247 | |||||

| US93935GAE98 / Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2006-6 Trust | 1.04 | -0.67 | 0.2629 | 0.0279 | |||||

| Deutsche Mortgage Securities, Inc., Series 2006-PR1, Class CWA1 / ABS-MBS (US25157GCT76) | 1.03 | -1.72 | 0.2606 | 0.0255 | |||||

| Deutsche Mortgage Securities, Inc., Series 2006-PR1, Class CWA1 / ABS-MBS (US25157GCT76) | 1.03 | -1.72 | 0.2606 | 0.0255 | |||||

| Deutsche Mortgage Securities, Inc., Series 2006-PR1, Class CWA1 / ABS-MBS (US25157GCT76) | 1.03 | -1.72 | 0.2606 | 0.0255 | |||||

| US12650EBQ98 / CSMC Series 2015-6R | 1.02 | -0.29 | 0.2574 | 0.0283 | |||||

| ACRA Trust, Series 2024-NQM1, Class B1 / ABS-MBS (US00112EAF16) | 1.01 | -0.20 | 0.2561 | 0.0283 | |||||

| ACRA Trust, Series 2024-NQM1, Class B1 / ABS-MBS (US00112EAF16) | 1.01 | -0.20 | 0.2561 | 0.0283 | |||||

| Velocity Commercial Capital Loan Trust, Series 2025-RTL1, Class A1 / ABS-MBS (US92262GAA22) | 1.01 | 0.2554 | 0.2554 | ||||||

| Velocity Commercial Capital Loan Trust, Series 2025-RTL1, Class A1 / ABS-MBS (US92262GAA22) | 1.01 | 0.2554 | 0.2554 | ||||||

| Velocity Commercial Capital Loan Trust, Series 2025-RTL1, Class A1 / ABS-MBS (US92262GAA22) | 1.01 | 0.2554 | 0.2554 | ||||||

| ACRA Trust, Series 2024-NQM1, Class M1B / ABS-MBS (US00112EAE41) | 1.01 | -0.40 | 0.2544 | 0.0278 | |||||

| ACRA Trust, Series 2024-NQM1, Class M1B / ABS-MBS (US00112EAE41) | 1.01 | -0.40 | 0.2544 | 0.0278 | |||||

| ACRA Trust, Series 2024-NQM1, Class M1B / ABS-MBS (US00112EAE41) | 1.01 | -0.40 | 0.2544 | 0.0278 | |||||

| Benefit Street Partners CLO XXVII Ltd., Series 2022-27A, Class AR / ABS-CBDO (US08179PAQ54) | 1.00 | -0.70 | 0.2528 | 0.0268 | |||||

| Benefit Street Partners CLO XXVII Ltd., Series 2022-27A, Class AR / ABS-CBDO (US08179PAQ54) | 1.00 | -0.70 | 0.2528 | 0.0268 | |||||

| Benefit Street Partners CLO XXVII Ltd., Series 2022-27A, Class AR / ABS-CBDO (US08179PAQ54) | 1.00 | -0.70 | 0.2528 | 0.0268 | |||||

| Velocity Commercial Capital Loan Trust, Series 2025-1, Class M3 / ABS-MBS (US922955AK55) | 1.00 | 0.2527 | 0.2527 | ||||||

| Velocity Commercial Capital Loan Trust, Series 2025-1, Class M3 / ABS-MBS (US922955AK55) | 1.00 | 0.2527 | 0.2527 | ||||||

| Velocity Commercial Capital Loan Trust, Series 2025-1, Class M3 / ABS-MBS (US922955AK55) | 1.00 | 0.2527 | 0.2527 | ||||||

| US74331UAN81 / Progress Residential 2022-SFR3 Trust | 1.00 | 0.60 | 0.2526 | 0.0298 | |||||

| CIM Trust, Series 2025-I1, Class B1B / ABS-MBS (US12571DAF24) | 1.00 | 2.05 | 0.2520 | 0.0330 | |||||

| CIM Trust, Series 2025-I1, Class B1B / ABS-MBS (US12571DAF24) | 1.00 | 2.05 | 0.2520 | 0.0330 | |||||

| CIM Trust, Series 2025-I1, Class B1B / ABS-MBS (US12571DAF24) | 1.00 | 2.05 | 0.2520 | 0.0330 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.00 | -1.29 | 0.2519 | 0.0255 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.00 | -1.29 | 0.2519 | 0.0255 | |||||

| US05592AAA88 / BPR Trust 2021-TY | 0.99 | -0.30 | 0.2513 | 0.0276 | |||||

| Ellington Financial Mortgage Trust, Series 2023-1, Class B1 / ABS-MBS (US26844QAE70) | 0.99 | 0.2505 | 0.2505 | ||||||

| Ellington Financial Mortgage Trust, Series 2023-1, Class B1 / ABS-MBS (US26844QAE70) | 0.99 | 0.2505 | 0.2505 | ||||||

| Ellington Financial Mortgage Trust, Series 2023-1, Class B1 / ABS-MBS (US26844QAE70) | 0.99 | 0.2505 | 0.2505 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.99 | -3.61 | 0.2501 | 0.0197 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.99 | -3.61 | 0.2501 | 0.0197 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.99 | -3.61 | 0.2501 | 0.0197 | |||||

| US3136B9RB50 / Fannie Mae REMICS | 0.98 | -0.30 | 0.2487 | 0.0273 | |||||

| GSAA Trust, Series 2007-3, Class 1A1A / ABS-O (US3622EAAA85) | 0.98 | -4.84 | 0.2487 | 0.0167 | |||||

| GSAA Trust, Series 2007-3, Class 1A1A / ABS-O (US3622EAAA85) | 0.98 | -4.84 | 0.2487 | 0.0167 | |||||

| GSAA Trust, Series 2007-3, Class 1A1A / ABS-O (US3622EAAA85) | 0.98 | -4.84 | 0.2487 | 0.0167 | |||||

| US76119DAF69 / Residential Mortgage Loan Trust 2019-2 | 0.98 | 1.97 | 0.2482 | 0.0322 | |||||

| US94984TAA79 / Wells Fargo Alternative Loan 2007-PA1 Trust | 0.98 | -1.60 | 0.2482 | 0.0244 | |||||

| US55820JBC36 / Madison Park Funding XXI Ltd | 0.98 | -0.61 | 0.2479 | 0.0267 | |||||

| US76119NAF42 / Residential Mortgage Loan Trust 2019-3 | 0.98 | 2.41 | 0.2468 | 0.0330 | |||||

| US45276KAC18 / IMPERIAL FUND LLC IMPRL 2022 NQM3 A3 144A | 0.97 | 4.42 | 0.2451 | 0.0369 | |||||

| US17312VAD01 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2007 6 1A2A | 0.97 | -3.40 | 0.2444 | 0.0199 | |||||

| PRET LLC, Series 2024-NPL5, Class A1 / ABS-O (US74143QAA31) | 0.96 | -2.04 | 0.2426 | 0.0229 | |||||

| PRET LLC, Series 2024-NPL5, Class A1 / ABS-O (US74143QAA31) | 0.96 | -2.04 | 0.2426 | 0.0229 | |||||

| PRET LLC, Series 2024-NPL5, Class A1 / ABS-O (US74143QAA31) | 0.96 | -2.04 | 0.2426 | 0.0229 | |||||

| US45660LW397 / IndyMac INDX Mortgage Loan Trust 2005-AR31 | 0.96 | -4.67 | 0.2426 | 0.0167 | |||||

| US68236JAA97 / One Bryant Park Trust 2019-OBP | 0.96 | 0.95 | 0.2420 | 0.0292 | |||||

| CIM Trust, Series 2025-NR1, Class A1 / ABS-MBS (US17181YAA82) | 0.96 | 0.2414 | 0.2414 | ||||||

| CIM Trust, Series 2025-NR1, Class A1 / ABS-MBS (US17181YAA82) | 0.96 | 0.2414 | 0.2414 | ||||||

| CIM Trust, Series 2025-NR1, Class A1 / ABS-MBS (US17181YAA82) | 0.96 | 0.2414 | 0.2414 | ||||||

| BFLD Mortgage Trust, Series 2024-WRHS, Class A / ABS-MBS (US05555HAA86) | 0.95 | -0.31 | 0.2411 | 0.0267 | |||||

| BFLD Mortgage Trust, Series 2024-WRHS, Class A / ABS-MBS (US05555HAA86) | 0.95 | -0.31 | 0.2411 | 0.0267 | |||||

| BFLD Mortgage Trust, Series 2024-WRHS, Class A / ABS-MBS (US05555HAA86) | 0.95 | -0.31 | 0.2411 | 0.0267 | |||||

| Gaea Mortgage Loan Trust, Series 2025-A, Class A / ABS-MBS (US362928AA19) | 0.95 | 0.2398 | 0.2398 | ||||||

| Gaea Mortgage Loan Trust, Series 2025-A, Class A / ABS-MBS (US362928AA19) | 0.95 | 0.2398 | 0.2398 | ||||||

| Gaea Mortgage Loan Trust, Series 2025-A, Class A / ABS-MBS (US362928AA19) | 0.95 | 0.2398 | 0.2398 | ||||||

| US78485GAA22 / SREIT 2021-FLWR A | 0.94 | -23.97 | 0.2383 | -0.0397 | |||||

| TCO Commercial Mortgage Trust, Series 2024-DPM, Class A / ABS-MBS (US87231EAA55) | 0.94 | -0.74 | 0.2371 | 0.0252 | |||||

| TCO Commercial Mortgage Trust, Series 2024-DPM, Class A / ABS-MBS (US87231EAA55) | 0.94 | -0.74 | 0.2371 | 0.0252 | |||||

| TCO Commercial Mortgage Trust, Series 2024-DPM, Class A / ABS-MBS (US87231EAA55) | 0.94 | -0.74 | 0.2371 | 0.0252 | |||||

| US74334FAJ75 / PROGRESS RESIDENTIAL 2023-SFR1 E1 TR 6.15% 03/17/2040 144A | 0.93 | 2.08 | 0.2359 | 0.0308 | |||||

| US126671RF54 / Countrywide, Series 2002-BC3, Class M2 | 0.93 | 0.33 | 0.2342 | 0.0270 | |||||

| US92259TAQ40 / Velocity Commercial Capital Loan Trust 2021-1 | 0.92 | -3.75 | 0.2337 | 0.0182 | |||||

| NYMT Trust, Series 2024-RR1, Class A / ABS-MBS (US62956VAA35) | 0.92 | -2.12 | 0.2336 | 0.0218 | |||||

| NYMT Trust, Series 2024-RR1, Class A / ABS-MBS (US62956VAA35) | 0.92 | -2.12 | 0.2336 | 0.0218 | |||||

| NYMT Trust, Series 2024-RR1, Class A / ABS-MBS (US62956VAA35) | 0.92 | -2.12 | 0.2336 | 0.0218 | |||||

| US16163EAJ73 / Chase Mortgage Finance Trust | 0.92 | 0.77 | 0.2325 | 0.0278 | |||||

| PRM5 Trust, Series 2025-PRM5, Class A / ABS-MBS (US693980AA20) | 0.91 | 0.2289 | 0.2289 | ||||||

| PRM5 Trust, Series 2025-PRM5, Class A / ABS-MBS (US693980AA20) | 0.91 | 0.2289 | 0.2289 | ||||||

| PRM5 Trust, Series 2025-PRM5, Class A / ABS-MBS (US693980AA20) | 0.91 | 0.2289 | 0.2289 | ||||||

| CIM Trust, Series 2019-J2, Class B6 / ABS-MBS (US12558TBL08) | 0.90 | 0.2275 | 0.2275 | ||||||

| CIM Trust, Series 2019-J2, Class B6 / ABS-MBS (US12558TBL08) | 0.90 | 0.2275 | 0.2275 | ||||||

| US74924VAD10 / RESIDENTIAL ASSET SECURITIES C RASC 2006 EMX9 1A4 | 0.90 | -1.97 | 0.2264 | 0.0214 | |||||

| US93934FJB94 / Washington Mutual Mortgage Pass-Through Certificates WMALT Series 2005-11 Trust | 0.89 | 0.11 | 0.2249 | 0.0256 | |||||

| BX Commercial Mortgage Trust, Series 2024-XL4, Class A / ABS-MBS (US05611VAA98) | 0.89 | -0.56 | 0.2245 | 0.0241 | |||||

| BX Commercial Mortgage Trust, Series 2024-XL4, Class A / ABS-MBS (US05611VAA98) | 0.89 | -0.56 | 0.2245 | 0.0241 | |||||

| BX Commercial Mortgage Trust, Series 2024-XL4, Class A / ABS-MBS (US05611VAA98) | 0.89 | -0.56 | 0.2245 | 0.0241 | |||||

| US92538NAE76 / Verus Securitization Trust 2022-4 | 0.89 | 0.57 | 0.2241 | 0.0264 | |||||

| Fontainebleau Miami Beach Mortgage Trust, Series 2024-FBLU, Class A / ABS-MBS (US34461WAA80) | 0.88 | 36.32 | 0.2231 | 0.0780 | |||||

| Fontainebleau Miami Beach Mortgage Trust, Series 2024-FBLU, Class A / ABS-MBS (US34461WAA80) | 0.88 | 36.32 | 0.2231 | 0.0780 | |||||

| Fontainebleau Miami Beach Mortgage Trust, Series 2024-FBLU, Class A / ABS-MBS (US34461WAA80) | 0.88 | 36.32 | 0.2231 | 0.0780 | |||||

| US92258XAE31 / Velocity Commercial Capital Loan Trust 2022-1 | 0.88 | -3.40 | 0.2228 | 0.0180 | |||||

| US12665WAC47 / CSMC 2022-ATH2 CSMC 2022-ATH2 A1 | 0.88 | -3.30 | 0.2224 | 0.0183 | |||||

| US05609VAA35 / BX Commercial Mortgage Trust 2021-VOLT | 0.88 | -0.45 | 0.2216 | 0.0241 | |||||

| US12433EAA91 / BX Trust, Series 2022-LBA6, Class A | 0.88 | -0.46 | 0.2213 | 0.0240 | |||||

| Alternative Loan Trust, Series 2006-J4, Class 2A1 / ABS-MBS (US23242WAH25) | 0.88 | -2.02 | 0.2212 | 0.0207 | |||||

| Alternative Loan Trust, Series 2006-J4, Class 2A1 / ABS-MBS (US23242WAH25) | 0.88 | -2.02 | 0.2212 | 0.0207 | |||||

| Alternative Loan Trust, Series 2006-J4, Class 2A1 / ABS-MBS (US23242WAH25) | 0.88 | -2.02 | 0.2212 | 0.0207 | |||||

| US64035DAC02 / Nelnet Student Loan Trust 2021-A | 0.87 | -1.69 | 0.2202 | 0.0215 | |||||

| US1248RHAD96 / Credit-Based Asset Servicing & Securitization LLC, Series 2007-CB6, Class A4 | 0.87 | -2.69 | 0.2195 | 0.0193 | |||||

| BX Commercial Mortgage Trust, Series 2024-MF, Class A / ABS-MBS (US05612EAA64) | 0.87 | -0.34 | 0.2193 | 0.0240 | |||||

| BX Commercial Mortgage Trust, Series 2024-MF, Class A / ABS-MBS (US05612EAA64) | 0.87 | -0.34 | 0.2193 | 0.0240 | |||||

| BX Commercial Mortgage Trust, Series 2024-MF, Class A / ABS-MBS (US05612EAA64) | 0.87 | -0.34 | 0.2193 | 0.0240 | |||||

| US93934TAB89 / Washington Mutural Asset-Backed Certificates WMABS Series 2007-HE2 Trust | 0.86 | 0.23 | 0.2185 | 0.0249 | |||||

| US36264LAJ70 / GS Mortgage Securities Corp. Trust, Series 2021-STAR, Class B | 0.86 | -0.23 | 0.2182 | 0.0240 | |||||

| Foundation Finance Trust, Series 2024-2A, Class B / ABS-O (US35040VAB53) | 0.85 | 0.59 | 0.2161 | 0.0254 | |||||

| Foundation Finance Trust, Series 2024-2A, Class B / ABS-O (US35040VAB53) | 0.85 | 0.59 | 0.2161 | 0.0254 | |||||

| Foundation Finance Trust, Series 2024-2A, Class B / ABS-O (US35040VAB53) | 0.85 | 0.59 | 0.2161 | 0.0254 | |||||

| BX Trust, Series 2024-CNYN, Class A / ABS-MBS (US05612HAA95) | 0.84 | -0.35 | 0.2135 | 0.0234 | |||||

| BX Trust, Series 2024-CNYN, Class A / ABS-MBS (US05612HAA95) | 0.84 | -0.35 | 0.2135 | 0.0234 | |||||

| BX Trust, Series 2024-CNYN, Class A / ABS-MBS (US05612HAA95) | 0.84 | -0.35 | 0.2135 | 0.0234 | |||||

| US74969TAG58 / RMF Buyout Issuance Trust 2021-HB1 | 0.84 | 3.19 | 0.2125 | 0.0298 | |||||

| Voya CLO Ltd., Series 2016-3A, Class A1R2 / ABS-CBDO (US92915HAW34) | 0.84 | -0.71 | 0.2116 | 0.0223 | |||||

| Voya CLO Ltd., Series 2016-3A, Class A1R2 / ABS-CBDO (US92915HAW34) | 0.84 | -0.71 | 0.2116 | 0.0223 | |||||

| Voya CLO Ltd., Series 2016-3A, Class A1R2 / ABS-CBDO (US92915HAW34) | 0.84 | -0.71 | 0.2116 | 0.0223 | |||||

| CONE Trust, Series 2024-DFW1, Class A / ABS-MBS (US20682AAA88) | 0.84 | -0.95 | 0.2113 | 0.0220 | |||||

| CONE Trust, Series 2024-DFW1, Class A / ABS-MBS (US20682AAA88) | 0.84 | -0.95 | 0.2113 | 0.0220 | |||||

| CONE Trust, Series 2024-DFW1, Class A / ABS-MBS (US20682AAA88) | 0.84 | -0.95 | 0.2113 | 0.0220 | |||||

| US66981FAJ93 / AMSR 2020-SFR4 Trust | 0.84 | -1.07 | 0.2112 | 0.0217 | |||||

| KSL Commercial Mortgage Trust, Series 2024-HT2, Class A / ABS-MBS (US500937AA54) | 0.83 | -1.19 | 0.2103 | 0.0214 | |||||

| KSL Commercial Mortgage Trust, Series 2024-HT2, Class A / ABS-MBS (US500937AA54) | 0.83 | -1.19 | 0.2103 | 0.0214 | |||||

| KSL Commercial Mortgage Trust, Series 2024-HT2, Class A / ABS-MBS (US500937AA54) | 0.83 | -1.19 | 0.2103 | 0.0214 | |||||

| BAY Mortgage Trust, Series 2025-LIVN, Class A / ABS-MBS (US072925AA82) | 0.83 | 0.2096 | 0.2096 | ||||||

| BAY Mortgage Trust, Series 2025-LIVN, Class A / ABS-MBS (US072925AA82) | 0.83 | 0.2096 | 0.2096 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.82 | -8.04 | 0.2084 | 0.0073 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.82 | -8.04 | 0.2084 | 0.0073 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.82 | -8.04 | 0.2084 | 0.0073 | |||||

| US92257HAG48 / Velocity Commercial Capital Loan Trust, Series 2019-3, Class M6 | 0.82 | -9.89 | 0.2075 | 0.0034 | |||||

| SMB Private Education Loan Trust, Series 2024-A, Class B / ABS-O (US831943AC95) | 0.82 | 1.49 | 0.2074 | 0.0261 | |||||

| SMB Private Education Loan Trust, Series 2024-A, Class B / ABS-O (US831943AC95) | 0.82 | 1.49 | 0.2074 | 0.0261 | |||||

| SMB Private Education Loan Trust, Series 2024-A, Class B / ABS-O (US831943AC95) | 0.82 | 1.49 | 0.2074 | 0.0261 | |||||

| EQT Trust, Series 2024-EXTR, Class A / ABS-MBS (US29439DAA90) | 0.81 | 1.88 | 0.2052 | 0.0267 | |||||

| EQT Trust, Series 2024-EXTR, Class A / ABS-MBS (US29439DAA90) | 0.81 | 1.88 | 0.2052 | 0.0267 | |||||

| EQT Trust, Series 2024-EXTR, Class A / ABS-MBS (US29439DAA90) | 0.81 | 1.88 | 0.2052 | 0.0267 | |||||

| US12668BAA17 / Alternative Loan Trust 2005-79CB | 0.81 | -3.69 | 0.2043 | 0.0160 | |||||

| US92257HAE99 / Velocity Commercial Capital Loan Trust, Series 2019-3, Class M4 | 0.80 | -9.26 | 0.2033 | 0.0044 | |||||

| BX Trust, Series 2024-VLT4, Class A / ABS-MBS (US05612TAA34) | 0.80 | -1.35 | 0.2030 | 0.0206 | |||||

| BX Trust, Series 2024-VLT4, Class A / ABS-MBS (US05612TAA34) | 0.80 | -1.35 | 0.2030 | 0.0206 | |||||

| BX Trust, Series 2024-VLT4, Class A / ABS-MBS (US05612TAA34) | 0.80 | -1.35 | 0.2030 | 0.0206 | |||||

| GoodLeap Home Improvement Solutions Trust, Series 2024-1A, Class A / ABS-O (US381935AA36) | 0.80 | -9.70 | 0.2026 | 0.0036 | |||||

| GoodLeap Home Improvement Solutions Trust, Series 2024-1A, Class A / ABS-O (US381935AA36) | 0.80 | -9.70 | 0.2026 | 0.0036 | |||||

| GoodLeap Home Improvement Solutions Trust, Series 2024-1A, Class A / ABS-O (US381935AA36) | 0.80 | -9.70 | 0.2026 | 0.0036 | |||||

| BOCA Commercial Mortgage Trust, Series 2024-BOCA, Class A / ABS-MBS (US096817AA90) | 0.80 | -0.75 | 0.2018 | 0.0215 | |||||

| BOCA Commercial Mortgage Trust, Series 2024-BOCA, Class A / ABS-MBS (US096817AA90) | 0.80 | -0.75 | 0.2018 | 0.0215 | |||||

| BOCA Commercial Mortgage Trust, Series 2024-BOCA, Class A / ABS-MBS (US096817AA90) | 0.80 | -0.75 | 0.2018 | 0.0215 | |||||

| Commercial Mortgage Trust, Series 2024-WCL1, Class A / ABS-MBS (US20047DAA28) | 0.80 | 300.50 | 0.2016 | 0.1569 | |||||

| Commercial Mortgage Trust, Series 2024-WCL1, Class A / ABS-MBS (US20047DAA28) | 0.80 | 300.50 | 0.2016 | 0.1569 | |||||

| Symphony CLO XXIV Ltd., Series 2020-24A, Class AR / ABS-CBDO (US87167QAL23) | 0.80 | -3.63 | 0.2012 | 0.0159 | |||||

| Symphony CLO XXIV Ltd., Series 2020-24A, Class AR / ABS-CBDO (US87167QAL23) | 0.80 | -3.63 | 0.2012 | 0.0159 | |||||

| Symphony CLO XXIV Ltd., Series 2020-24A, Class AR / ABS-CBDO (US87167QAL23) | 0.80 | -3.63 | 0.2012 | 0.0159 | |||||

| US200474BF05 / COMM Mortgage Trust | 0.79 | 0.38 | 0.2006 | 0.0233 | |||||

| New Residential Mortgage Loan Trust, Series 2025-NQM1, Class B1 / ABS-MBS (US64832DAG60) | 0.79 | -0.25 | 0.1988 | 0.0218 | |||||

| New Residential Mortgage Loan Trust, Series 2025-NQM1, Class B1 / ABS-MBS (US64832DAG60) | 0.79 | -0.25 | 0.1988 | 0.0218 | |||||

| New Residential Mortgage Loan Trust, Series 2025-NQM1, Class B1 / ABS-MBS (US64832DAG60) | 0.79 | -0.25 | 0.1988 | 0.0218 | |||||

| BX Commercial Mortgage Trust, Series 2024-XL5, Class A / ABS-MBS (US05612GAA13) | 0.79 | -4.85 | 0.1987 | 0.0135 | |||||

| BX Commercial Mortgage Trust, Series 2024-XL5, Class A / ABS-MBS (US05612GAA13) | 0.79 | -4.85 | 0.1987 | 0.0135 | |||||

| BX Commercial Mortgage Trust, Series 2024-XL5, Class A / ABS-MBS (US05612GAA13) | 0.79 | -4.85 | 0.1987 | 0.0135 | |||||

| US33831HAA68 / 510 Loan Acquisition Trust 2020-1 | 0.78 | -4.86 | 0.1982 | 0.0134 | |||||

| US3137H0YY82 / FHLMC CMO IO | 0.78 | -1.14 | 0.1975 | 0.0202 | |||||

| US05606FAA12 / BX TRUST BX 2019 OC11 A 144A | 0.77 | 1.59 | 0.1937 | 0.0244 | |||||

| US48275EAA47 / KREF 2022-FL3 Ltd | 0.77 | -21.03 | 0.1937 | -0.0239 | |||||

| US81378KAC36 / Securitized Asset Backed Receivables LLC Trust 2007-BR1 | 0.76 | -3.05 | 0.1934 | 0.0164 | |||||

| US40390MAA36 / HONO 2021-LULU Mortgage Trust | 0.76 | 0.00 | 0.1927 | 0.0217 | |||||

| US68402VAB80 / Option One Mortgage Loan Trust 2007-FXD1 | 0.76 | -0.52 | 0.1920 | 0.0207 | |||||

| US02660UAE01 / American Home Mortgage Assets Trust, Series 2006-3, Class 2A11 | 0.75 | 0.1904 | 0.1904 | ||||||

| US12668HAF73 / CWL 2006-26 M1 | 0.75 | -0.27 | 0.1889 | 0.0208 | |||||

| US93934FFB31 / Washington Mutual Mortgage Pass-Through Certificates WMALT Trust, Series 2005-9, Class 5A1 | 0.75 | 2.47 | 0.1887 | 0.0251 | |||||

| US93934FME96 / WMALT 2006-2 3CB | 0.74 | 1.92 | 0.1882 | 0.0243 | |||||

| ARES1, Series 2024-IND2, Class A / ABS-MBS (US04021EAA47) | 0.74 | -0.27 | 0.1869 | 0.0205 | |||||

| ARES1, Series 2024-IND2, Class A / ABS-MBS (US04021EAA47) | 0.74 | -0.27 | 0.1869 | 0.0205 | |||||

| ARES1, Series 2024-IND2, Class A / ABS-MBS (US04021EAA47) | 0.74 | -0.27 | 0.1869 | 0.0205 | |||||

| BX Commercial Mortgage Trust, Series 2024-PALM, Class A / ABS-MBS (US05612UAA07) | 0.74 | -0.41 | 0.1865 | 0.0204 | |||||

| US12668BSQ76 / Alternative Loan Trust 2006-6CB | 0.73 | 2.10 | 0.1846 | 0.0241 | |||||

| BX Trust, Series 2024-BIO, Class A / ABS-MBS (US05612AAA43) | 0.73 | -0.95 | 0.1844 | 0.0193 | |||||

| BX Trust, Series 2024-BIO, Class A / ABS-MBS (US05612AAA43) | 0.73 | -0.95 | 0.1844 | 0.0193 | |||||

| BX Trust, Series 2024-BIO, Class A / ABS-MBS (US05612AAA43) | 0.73 | -0.95 | 0.1844 | 0.0193 | |||||

| US05592AAN00 / BPR TRUST 2021-TY 1ML+360 09/23/2023 144A | 0.72 | -3.98 | 0.1830 | 0.0139 | |||||

| US63942EAA64 / Navient Private Education Refi Loan Trust, Series 2021-EA, Class A | 0.71 | -5.21 | 0.1797 | 0.0116 | |||||

| CFMT LLC, Series 2024-HB13, Class M2 / ABS-MBS (US12530VAC90) | 0.71 | 1.58 | 0.1785 | 0.0225 | |||||

| CFMT LLC, Series 2024-HB13, Class M2 / ABS-MBS (US12530VAC90) | 0.71 | 1.58 | 0.1785 | 0.0225 | |||||

| CFMT LLC, Series 2024-HB13, Class M2 / ABS-MBS (US12530VAC90) | 0.71 | 1.58 | 0.1785 | 0.0225 | |||||

| US36270GAJ04 / GS MTG SECS CORP TR 2023-SHIP 7.68138% 09/15/2038 144A | 0.70 | -0.14 | 0.1782 | 0.0199 | |||||

| US46653XAX84 / J.P. MORGAN MORTGAGE TRUST 2021-INV5 | 0.70 | 0.57 | 0.1777 | 0.0208 | |||||

| US05609BCD91 / BX Trust, Series 2021-LBA, Class AJV | 0.70 | -0.85 | 0.1766 | 0.0187 | |||||

| US07388JAC99 / Bear Stearns Asset Backed Securities I Trust 2006-HE8 | 0.69 | -2.39 | 0.1755 | 0.0160 | |||||

| US17323MAF23 / Citigroup Mortgage Loan Trust, Series 2015-A, Class B4 | 0.69 | -12.72 | 0.1753 | -0.0030 | |||||

| US30227FAN06 / Extended Stay America Trust | 0.69 | -3.65 | 0.1736 | 0.0137 | |||||

| US054975AF43 / BBCMS Mortgage Trust, Series 2022-C18, Class ASB | 0.69 | 0.73 | 0.1734 | 0.0206 | |||||

| US30227FAA84 / Extended Stay America Trust | 0.67 | -2.18 | 0.1705 | 0.0158 | |||||

| Voya CLO Ltd., Series 2018-3A, Class A1R2 / ABS-CBDO (US92917KAQ76) | 0.67 | -0.30 | 0.1703 | 0.0188 | |||||

| Voya CLO Ltd., Series 2018-3A, Class A1R2 / ABS-CBDO (US92917KAQ76) | 0.67 | -0.30 | 0.1703 | 0.0188 | |||||

| Voya CLO Ltd., Series 2018-3A, Class A1R2 / ABS-CBDO (US92917KAQ76) | 0.67 | -0.30 | 0.1703 | 0.0188 | |||||

| US45255RAA59 / Impac Secured Assets Trust 2006-3 | 0.67 | -3.18 | 0.1694 | 0.0141 | |||||

| Hudson Yards Mortgage Trust, Series 2025-SPRL, Class A / ABS-MBS (US44855PAA66) | 0.67 | 1.52 | 0.1688 | 0.0214 | |||||

| Hudson Yards Mortgage Trust, Series 2025-SPRL, Class A / ABS-MBS (US44855PAA66) | 0.67 | 1.52 | 0.1688 | 0.0214 | |||||

| Hudson Yards Mortgage Trust, Series 2025-SPRL, Class A / ABS-MBS (US44855PAA66) | 0.67 | 1.52 | 0.1688 | 0.0214 | |||||

| US36242DT521 / GSMPS Mortgage Loan Trust, Series 2005-RP2, Class 1AF | 0.67 | -2.49 | 0.1683 | 0.0153 | |||||

| US929342AA13 / WMRK Commercial Mortgage Trust, Series 2022-WMRK, Class A | 0.66 | -0.75 | 0.1670 | 0.0177 | |||||

| US55318EAA82 / MIRA Trust 2023-MILE | 0.66 | 0.46 | 0.1660 | 0.0195 | |||||

| U.S. Treasury 2-Year Note / DIR (N/A) | 0.65 | 0.1651 | 0.1651 | ||||||

| U.S. Treasury 2-Year Note / DIR (N/A) | 0.65 | 0.1651 | 0.1651 | ||||||

| U.S. Treasury 2-Year Note / DIR (N/A) | 0.65 | 0.1651 | 0.1651 | ||||||

| US87303TAA51 / N/A TTN 2021-MHC A | 0.65 | -0.15 | 0.1649 | 0.0184 | |||||

| US67577WAP68 / Octagon 66 Ltd | 0.65 | -0.46 | 0.1644 | 0.0178 | |||||

| BFLD Mortgage Trust, Series 2024-VICT, Class A / ABS-MBS (US05555VAA70) | 0.65 | -0.46 | 0.1641 | 0.0178 | |||||

| BFLD Mortgage Trust, Series 2024-VICT, Class A / ABS-MBS (US05555VAA70) | 0.65 | -0.46 | 0.1641 | 0.0178 | |||||

| BFLD Mortgage Trust, Series 2024-VICT, Class A / ABS-MBS (US05555VAA70) | 0.65 | -0.46 | 0.1641 | 0.0178 | |||||

| US33835NAA90 / 522 FUNDING CLO LTD MORGN 2018 3A AR 144A | 0.65 | -23.46 | 0.1634 | -0.0260 | |||||

| Carlyle Global Market Strategies CLO Ltd., Series 2015-4A, Class A1RR / ABS-CBDO (US14311NAU81) | 0.64 | -15.06 | 0.1626 | -0.0073 | |||||

| Carlyle Global Market Strategies CLO Ltd., Series 2015-4A, Class A1RR / ABS-CBDO (US14311NAU81) | 0.64 | -15.06 | 0.1626 | -0.0073 | |||||

| Carlyle Global Market Strategies CLO Ltd., Series 2015-4A, Class A1RR / ABS-CBDO (US14311NAU81) | 0.64 | -15.06 | 0.1626 | -0.0073 | |||||

| US95763PND95 / Western Mortgage Reference Notes Series 2021-CL2 | 0.64 | -1.38 | 0.1622 | 0.0163 | |||||

| US68402VAF94 / Option One Mortgage Loan Trust 2007-FXD1 | 0.63 | -2.62 | 0.1602 | 0.0144 | |||||

| US07389YAV39 / Bear Stearns Asset Backed Securities I Trust 2007-HE2 | 0.63 | -2.47 | 0.1598 | 0.0143 | |||||

| GreenSky Home Improvement Issuer Trust, Series 2024-2, Class A2 / ABS-O (US39571XAB01) | 0.63 | 0.1598 | 0.1598 | ||||||

| GreenSky Home Improvement Issuer Trust, Series 2024-2, Class A2 / ABS-O (US39571XAB01) | 0.63 | 0.1598 | 0.1598 | ||||||

| GreenSky Home Improvement Issuer Trust, Series 2024-2, Class A2 / ABS-O (US39571XAB01) | 0.63 | 0.1598 | 0.1598 | ||||||

| US78443CBP86 / SLM Private Credit Student Loan Trust 2004-B | 0.63 | -7.34 | 0.1595 | 0.0066 | |||||

| US46646GAE70 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2016-NINE | 0.63 | 0.48 | 0.1595 | 0.0187 | |||||

| US16165VAK44 / ChaseFlex Trust, Series 2007-1, Class 2A7 | 0.63 | -2.33 | 0.1593 | 0.0144 | |||||

| US06540CBF32 / BANK 2021-BNK35 | 0.63 | 2.44 | 0.1592 | 0.0213 | |||||

| GoodLeap Home Improvement Solutions Trust, Series 2025-1A, Class A / ABS-O (US38237EAA29) | 0.63 | -9.52 | 0.1586 | 0.0030 | |||||

| GoodLeap Home Improvement Solutions Trust, Series 2025-1A, Class A / ABS-O (US38237EAA29) | 0.63 | -9.52 | 0.1586 | 0.0030 | |||||

| GoodLeap Home Improvement Solutions Trust, Series 2025-1A, Class A / ABS-O (US38237EAA29) | 0.63 | -9.52 | 0.1586 | 0.0030 | |||||

| US05608EAA29 / BX Commercial Mortgage Trust 2020-VIV3 | 0.63 | 0.97 | 0.1585 | 0.0192 | |||||

| US12668BVD27 / Alternative Loan Trust 2006-9T1 | 0.63 | -0.16 | 0.1585 | 0.0177 | |||||

| US45660LF954 / INDYMAC INDX MORTGAGE LOAN TRU INDX 2005 AR23 6A1 | 0.62 | -4.45 | 0.1574 | 0.0114 | |||||

| US46646GAA58 / J.P. MORGAN CHASE COMMERCIAL MORTGAGE SE SER 2016-NINE CL A V/R REGD 144A P/P 2.94923700 | 0.62 | 0.81 | 0.1573 | 0.0187 | |||||

| US74922KAE55 / RALI Series Trust, Series 2007-QS1, Class 1A5 | 0.62 | -4.03 | 0.1567 | 0.0120 | |||||

| US64034YAC57 / Nelnet Student Loan Trust 2021-D | 0.62 | 2.50 | 0.1560 | 0.0211 | |||||

| US78472UAL26 / SREIT Trust 2021-MFP | 0.61 | -11.29 | 0.1550 | -0.0002 | |||||

| USU95065AA37 / WELLS FARGO COMMERCIAL MORTGAGE TRUST 2018-AUS | 0.61 | 1.51 | 0.1533 | 0.0193 | |||||

| INV Mortgage Trust, Series 2024-IND, Class A / ABS-MBS (US45000DAA46) | 0.60 | -0.50 | 0.1513 | 0.0163 | |||||

| INV Mortgage Trust, Series 2024-IND, Class A / ABS-MBS (US45000DAA46) | 0.60 | -0.50 | 0.1513 | 0.0163 | |||||

| INV Mortgage Trust, Series 2024-IND, Class A / ABS-MBS (US45000DAA46) | 0.60 | -0.50 | 0.1513 | 0.0163 | |||||

| SoFi Consumer Loan Program Trust, Series 2025-1, Class A / ABS-O (US83406YAA91) | 0.60 | 0.1509 | 0.1509 | ||||||

| SoFi Consumer Loan Program Trust, Series 2025-1, Class A / ABS-O (US83406YAA91) | 0.60 | 0.1509 | 0.1509 | ||||||

| SoFi Consumer Loan Program Trust, Series 2025-1, Class A / ABS-O (US83406YAA91) | 0.60 | 0.1509 | 0.1509 | ||||||

| US3132DMRK35 / Freddie Mac Pool | 0.60 | -0.50 | 0.1505 | 0.0164 | |||||

| US54251TAD19 / Long Beach Mortgage Loan Trust 2006-7 | 0.59 | -0.50 | 0.1498 | 0.0162 | |||||

| US863613AA32 / Structured Asset Securities Corp Mortgage Loan Trust 2007-MLN1 | 0.59 | -1.33 | 0.1497 | 0.0150 | |||||

| US12532BAD91 / CFCRE Commercial Mortgage Trust 2016-C7 | 0.59 | 0.85 | 0.1493 | 0.0180 | |||||

| US3138EQLB64 / Fannie Mae Pool | 0.59 | -2.64 | 0.1491 | 0.0132 | |||||

| DK Trust, Series 2024-SPBX, Class A / ABS-MBS (US23346LAA61) | 0.59 | -0.34 | 0.1490 | 0.0163 | |||||

| DK Trust, Series 2024-SPBX, Class A / ABS-MBS (US23346LAA61) | 0.59 | -0.34 | 0.1490 | 0.0163 | |||||

| DK Trust, Series 2024-SPBX, Class A / ABS-MBS (US23346LAA61) | 0.59 | -0.34 | 0.1490 | 0.0163 | |||||

| US02149JAW62 / CORP CMO | 0.58 | -2.34 | 0.1478 | 0.0135 | |||||

| US07336DAY76 / BBCMS Mortgage Trust, Series 2023-C20, Class XA | 0.58 | -1.85 | 0.1475 | 0.0140 | |||||

| US76111XVZ31 / RFMSI Series 2005-SA3 Trust | 0.58 | -3.17 | 0.1467 | 0.0123 | |||||

| CSTL Commercial Mortgage Trust, Series 2024-GATE, Class A / ABS-MBS (US22945JAA88) | 0.58 | 1.58 | 0.1459 | 0.0182 | |||||

| CSTL Commercial Mortgage Trust, Series 2024-GATE, Class A / ABS-MBS (US22945JAA88) | 0.58 | 1.58 | 0.1459 | 0.0182 | |||||

| CSTL Commercial Mortgage Trust, Series 2024-GATE, Class A / ABS-MBS (US22945JAA88) | 0.58 | 1.58 | 0.1459 | 0.0182 | |||||

| US466330AA51 / JP MORGAN CHASE COMMERCIAL MORTGAGE SECURITIES COR JPMCC 2021-MHC A | 0.58 | -0.17 | 0.1454 | 0.0161 | |||||

| MCR Mortgage Trust, Series 2024-HTL, Class A / ABS-MBS (US55286PAA12) | 0.58 | -0.52 | 0.1454 | 0.0156 | |||||

| MCR Mortgage Trust, Series 2024-HTL, Class A / ABS-MBS (US55286PAA12) | 0.58 | -0.52 | 0.1454 | 0.0156 | |||||

| MCR Mortgage Trust, Series 2024-HTL, Class A / ABS-MBS (US55286PAA12) | 0.58 | -0.52 | 0.1454 | 0.0156 | |||||

| US03881BAS25 / AMMST 2020-MF1 E | 0.57 | -0.69 | 0.1451 | 0.0154 | |||||

| Government National Mortgage Association Variable Rate Notes, Series 2024-6, Class ES / ABS-MBS (US38384G2L39) | 0.57 | 47.15 | 0.1437 | 0.0571 | |||||

| Government National Mortgage Association Variable Rate Notes, Series 2024-6, Class ES / ABS-MBS (US38384G2L39) | 0.57 | 47.15 | 0.1437 | 0.0571 | |||||

| Government National Mortgage Association Variable Rate Notes, Series 2024-6, Class ES / ABS-MBS (US38384G2L39) | 0.57 | 47.15 | 0.1437 | 0.0571 | |||||

| US52604DAA00 / Lendmark Funding Trust 2021-2 | 0.57 | 1.25 | 0.1434 | 0.0177 | |||||

| Great Wolf Trust, Series 2024-WLF2, Class A / ABS-MBS (US362414AA28) | 0.56 | -0.53 | 0.1428 | 0.0154 | |||||

| Great Wolf Trust, Series 2024-WLF2, Class A / ABS-MBS (US362414AA28) | 0.56 | -0.53 | 0.1428 | 0.0154 | |||||

| Great Wolf Trust, Series 2024-WLF2, Class A / ABS-MBS (US362414AA28) | 0.56 | -0.53 | 0.1428 | 0.0154 | |||||

| US78457JAA07 / SMRT, Series 2022-MINI, Class A | 0.56 | -0.35 | 0.1424 | 0.0155 | |||||

| US63942AAB26 / Navient Private Education Loan Trust 2020-I | 0.56 | 346.03 | 0.1422 | 0.1139 | |||||

| US00178YAG61 / AMSR Trust, Series 2023-SFR2, Class F1 | 0.55 | 3.17 | 0.1399 | 0.0196 | |||||

| US04002BAA35 / AREIT_23-CRE8 | 0.55 | -0.72 | 0.1392 | 0.0148 | |||||

| LBA Trust, Series 2024-BOLT, Class A / ABS-MBS (US50177BAA52) | 0.55 | 0.00 | 0.1390 | 0.0156 | |||||

| LBA Trust, Series 2024-BOLT, Class A / ABS-MBS (US50177BAA52) | 0.55 | 0.00 | 0.1390 | 0.0156 | |||||

| LBA Trust, Series 2024-BOLT, Class A / ABS-MBS (US50177BAA52) | 0.55 | 0.00 | 0.1390 | 0.0156 | |||||

| US12668APL34 / Alternative Loan Trust 2005-54CB | 0.55 | 0.55 | 0.1387 | 0.0164 | |||||

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2025-BHR5, Class A / ABS-MBS (US46649WAA71) | 0.55 | 0.1386 | 0.1386 | ||||||

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2025-BHR5, Class A / ABS-MBS (US46649WAA71) | 0.55 | 0.1386 | 0.1386 | ||||||

| US19425AAD63 / College Avenue Student Loans LLC | 0.54 | -3.39 | 0.1372 | 0.0112 | |||||

| US08160BAD64 / BENCHMARK 2018-B5 MORTGAGE TRUST SER 2018-B5 CL A4 REGD 4.20760000 | 0.54 | 1.31 | 0.1368 | 0.0169 | |||||

| Great Wolf Trust, Series 2024-WOLF, Class A / ABS-MBS (US39152MAA36) | 0.54 | -0.55 | 0.1362 | 0.0148 | |||||

| Great Wolf Trust, Series 2024-WOLF, Class A / ABS-MBS (US39152MAA36) | 0.54 | -0.55 | 0.1362 | 0.0148 | |||||

| Great Wolf Trust, Series 2024-WOLF, Class A / ABS-MBS (US39152MAA36) | 0.54 | -0.55 | 0.1362 | 0.0148 | |||||

| BAHA Trust, Series 2024-MAR, Class C / ABS-MBS (US05493XAG51) | 0.54 | -1.47 | 0.1360 | 0.0134 | |||||

| BAHA Trust, Series 2024-MAR, Class C / ABS-MBS (US05493XAG51) | 0.54 | -1.47 | 0.1360 | 0.0134 | |||||

| BAHA Trust, Series 2024-MAR, Class C / ABS-MBS (US05493XAG51) | 0.54 | -1.47 | 0.1360 | 0.0134 | |||||

| US63942EAB48 / Navient Private Education Refi Loan Trust, Series 2021-EA, Class B | 0.53 | -0.93 | 0.1348 | 0.0140 | |||||

| US23246LAA70 / COUNTRYWIDE ASSET BACKED CERTI CWL 2007 BC3 1A | 0.53 | -1.50 | 0.1329 | 0.0132 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-VIS1, Class B2 / ABS-MBS (US465970AF87) | 0.52 | -0.38 | 0.1320 | 0.0143 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-VIS1, Class B2 / ABS-MBS (US465970AF87) | 0.52 | -0.38 | 0.1320 | 0.0143 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-VIS1, Class B2 / ABS-MBS (US465970AF87) | 0.52 | -0.38 | 0.1320 | 0.0143 | |||||

| US92926WAA53 / WAMU MORTGAGE PASS-THROUGH CERTIFICATES SERIES 200 WAMU 2007-OA1 A1A | 0.52 | -2.98 | 0.1318 | 0.0111 | |||||

| US36267CAC91 / GS Mortgage Securities Corp Trust 2023-FUN | 0.52 | -0.57 | 0.1316 | 0.0142 | |||||

| US12643PAU66 / CSMC Series, Series 2010-6R, Class 2A6B | 0.52 | -2.08 | 0.1312 | 0.0122 | |||||

| US542514RM88 / Long Beach Mortgage Loan Trust 2006-1 | 0.51 | -0.39 | 0.1285 | 0.0139 | |||||

| US933631AD53 / WaMu Asset-Backed Certificates WaMu Series 2007-HE1 Trust | 0.50 | -2.15 | 0.1269 | 0.0118 | |||||

| BRAVO Residential Funding Trust, Series 2023-NQM6, Class B1 / ABS-MBS (US10569DAE31) | 0.50 | -0.99 | 0.1267 | 0.0132 | |||||

| BRAVO Residential Funding Trust, Series 2023-NQM6, Class B1 / ABS-MBS (US10569DAE31) | 0.50 | -0.99 | 0.1267 | 0.0132 | |||||

| BRAVO Residential Funding Trust, Series 2023-NQM6, Class B1 / ABS-MBS (US10569DAE31) | 0.50 | -0.99 | 0.1267 | 0.0132 | |||||

| US92539TAE38 / Verus Securitization Trust 2023-4 | 0.50 | -0.60 | 0.1267 | 0.0136 | |||||

| US78472UAA60 / SREIT Trust 2021-MFP | 0.50 | -8.91 | 0.1267 | 0.0031 | |||||

| US55821CAA27 / Atrium CDO Corporation Floating Rate Due 05/28/2030 | 0.50 | -17.90 | 0.1265 | -0.0101 | |||||

| BRAVO Residential Funding Trust, Series 2025-NQM2, Class B1 / ABS-MBS (US10569NAG60) | 0.50 | 0.1263 | 0.1263 | ||||||

| BRAVO Residential Funding Trust, Series 2025-NQM2, Class B1 / ABS-MBS (US10569NAG60) | 0.50 | 0.1263 | 0.1263 | ||||||

| BRAVO Residential Funding Trust, Series 2025-NQM2, Class B1 / ABS-MBS (US10569NAG60) | 0.50 | 0.1263 | 0.1263 | ||||||

| Verus Securitization Trust, Series 2023-2, Class B1 / ABS-MBS (US92539DAE85) | 0.50 | -0.60 | 0.1260 | 0.0134 | |||||

| Verus Securitization Trust, Series 2023-2, Class B1 / ABS-MBS (US92539DAE85) | 0.50 | -0.60 | 0.1260 | 0.0134 | |||||

| Verus Securitization Trust, Series 2023-2, Class B1 / ABS-MBS (US92539DAE85) | 0.50 | -0.60 | 0.1260 | 0.0134 | |||||

| SCG Mortgage Trust, Series 2024-MSP, Class A / ABS-MBS (US78436EAA73) | 0.50 | -0.60 | 0.1259 | 0.0135 | |||||

| SCG Mortgage Trust, Series 2024-MSP, Class A / ABS-MBS (US78436EAA73) | 0.50 | -0.60 | 0.1259 | 0.0135 | |||||

| Verus Securitization Trust, Series 2024-2, Class B2 / ABS-MBS (US92539UAF75) | 0.50 | -1.20 | 0.1256 | 0.0129 | |||||

| Verus Securitization Trust, Series 2024-2, Class B2 / ABS-MBS (US92539UAF75) | 0.50 | -1.20 | 0.1256 | 0.0129 | |||||

| Verus Securitization Trust, Series 2024-2, Class B2 / ABS-MBS (US92539UAF75) | 0.50 | -1.20 | 0.1256 | 0.0129 | |||||

| US45670JAD46 / IndyMac IMSC Mortgage Loan Trust, Series 2007-F2, Class 1A4 | 0.50 | 0.00 | 0.1255 | 0.0140 | |||||

| COLT Mortgage Loan Trust, Series 2024-INV4, Class B1 / ABS-MBS (US19688QAE17) | 0.50 | -0.60 | 0.1253 | 0.0135 | |||||

| COLT Mortgage Loan Trust, Series 2024-INV4, Class B1 / ABS-MBS (US19688QAE17) | 0.50 | -0.60 | 0.1253 | 0.0135 | |||||

| COLT Mortgage Loan Trust, Series 2024-INV4, Class B1 / ABS-MBS (US19688QAE17) | 0.50 | -0.60 | 0.1253 | 0.0135 | |||||

| BANK5 Trust, Series 2024-5YR6, Class A3 / ABS-MBS (US066043AB64) | 0.50 | 1.23 | 0.1253 | 0.0155 | |||||

| BANK5 Trust, Series 2024-5YR6, Class A3 / ABS-MBS (US066043AB64) | 0.50 | 1.23 | 0.1253 | 0.0155 | |||||

| BANK5 Trust, Series 2024-5YR6, Class A3 / ABS-MBS (US066043AB64) | 0.50 | 1.23 | 0.1253 | 0.0155 | |||||

| US55293DAA90 / Merit 2020 | 0.49 | -44.56 | 0.1249 | -0.0750 | |||||

| US94989YBE23 / Wells Fargo Commercial Mortgage Trust | 0.49 | -0.20 | 0.1247 | 0.0138 | |||||

| Verus Securitization Trust, Series 2025-2, Class B1 / ABS-MBS (US92540VAG05) | 0.49 | 0.1245 | 0.1245 | ||||||

| Verus Securitization Trust, Series 2025-2, Class B1 / ABS-MBS (US92540VAG05) | 0.49 | 0.1245 | 0.1245 | ||||||

| Verus Securitization Trust, Series 2025-2, Class B1 / ABS-MBS (US92540VAG05) | 0.49 | 0.1245 | 0.1245 | ||||||

| US126395AQ55 / CSMC Trust, Series 2020-FACT, Class F | 0.49 | -2.96 | 0.1244 | 0.0106 | |||||

| Velocity Commercial Capital Loan Trust, Series 2024-6, Class M4 / ABS-MBS (US92261BAF31) | 0.49 | -0.61 | 0.1243 | 0.0135 | |||||

| Velocity Commercial Capital Loan Trust, Series 2024-6, Class M4 / ABS-MBS (US92261BAF31) | 0.49 | -0.61 | 0.1243 | 0.0135 | |||||

| Velocity Commercial Capital Loan Trust, Series 2024-6, Class M4 / ABS-MBS (US92261BAF31) | 0.49 | -0.61 | 0.1243 | 0.0135 | |||||

| SDAL Trust, Series 2025-DAL, Class A / ABS-MBS (US78437RAA77) | 0.49 | 0.1242 | 0.1242 | ||||||

| SDAL Trust, Series 2025-DAL, Class A / ABS-MBS (US78437RAA77) | 0.49 | 0.1242 | 0.1242 | ||||||

| SDAL Trust, Series 2025-DAL, Class A / ABS-MBS (US78437RAA77) | 0.49 | 0.1242 | 0.1242 | ||||||

| HILT Commercial Mortgage Trust, Series 2024-ORL, Class D / ABS-MBS (US403956AG02) | 0.49 | -1.21 | 0.1240 | 0.0126 | |||||

| HILT Commercial Mortgage Trust, Series 2024-ORL, Class D / ABS-MBS (US403956AG02) | 0.49 | -1.21 | 0.1240 | 0.0126 | |||||

| HILT Commercial Mortgage Trust, Series 2024-ORL, Class D / ABS-MBS (US403956AG02) | 0.49 | -1.21 | 0.1240 | 0.0126 | |||||

| PFS Financing Corp., Series 2025-B, Class B / ABS-O (US69335PFV22) | 0.49 | 0.1235 | 0.1235 | ||||||

| PFS Financing Corp., Series 2025-B, Class B / ABS-O (US69335PFV22) | 0.49 | 0.1235 | 0.1235 | ||||||

| PFS Financing Corp., Series 2025-B, Class B / ABS-O (US69335PFV22) | 0.49 | 0.1235 | 0.1235 | ||||||

| US456610AA20 / IndyMac INDX Mortgage Loan Trust 2006-AR15 | 0.49 | -2.21 | 0.1233 | 0.0114 | |||||

| US00971FAC59 / AJAX Mortgage Loan Trust | 0.49 | 2.75 | 0.1230 | 0.0168 | |||||

| US78448YAB74 / SMB PRIVATE EDUCATION LOAN TRUST | 0.49 | -5.46 | 0.1228 | 0.0077 | |||||

| US12543PAL76 / CHL Mortgage Pass-Through Trust, Series 2006-21, Class A11 | 0.48 | -1.02 | 0.1221 | 0.0125 | |||||

| BRAVO Residential Funding Trust, Series 2025-NQM2, Class B2 / ABS-MBS (US10569NAH44) | 0.48 | 0.1219 | 0.1219 | ||||||

| BRAVO Residential Funding Trust, Series 2025-NQM2, Class B2 / ABS-MBS (US10569NAH44) | 0.48 | 0.1219 | 0.1219 | ||||||

| US63940QAC78 / NAVSL 2018 BA A2B 144A | 0.48 | 0.1216 | 0.1216 | ||||||

| US08163VAD91 / Benchmark 2023-V3 Mortgage Trust | 0.48 | -6.46 | 0.1210 | 0.0062 | |||||

| US06744JAC09 / Barclays Mortgage Trust 2021-NPL1 | 0.47 | 4.43 | 0.1192 | 0.0180 | |||||

| AREIT Ltd., Series 2024-CRE9, Class A / ABS-MBS (US00193AAA25) | 0.47 | -0.85 | 0.1185 | 0.0126 | |||||

| AREIT Ltd., Series 2024-CRE9, Class A / ABS-MBS (US00193AAA25) | 0.47 | -0.85 | 0.1185 | 0.0126 | |||||

| AREIT Ltd., Series 2024-CRE9, Class A / ABS-MBS (US00193AAA25) | 0.47 | -0.85 | 0.1185 | 0.0126 | |||||

| US55284DAA00 / MF1 2021-W10X SER 2021-W10 CL A V/R REGD 144A P/P 1.12287700 | 0.47 | -0.21 | 0.1182 | 0.0132 | |||||

| US3140J8TV50 / Federal National Mortgage Association | 0.47 | 0.43 | 0.1181 | 0.0137 | |||||

| US07324NAB91 / Bayview Commercial Asset Trust 2006-3 | 0.46 | -7.40 | 0.1172 | 0.0050 | |||||

| NYC Commercial Mortgage Trust, Series 2025-3BP, Class A / ABS-MBS (US67120UAA51) | 0.46 | 0.1168 | 0.1168 | ||||||

| NYC Commercial Mortgage Trust, Series 2025-3BP, Class A / ABS-MBS (US67120UAA51) | 0.46 | 0.1168 | 0.1168 | ||||||

| NYC Commercial Mortgage Trust, Series 2025-3BP, Class A / ABS-MBS (US67120UAA51) | 0.46 | 0.1168 | 0.1168 | ||||||

| US94990DAA46 / Wells Fargo Commercial Mortgage Trust 2018-1745 | 0.46 | 2.67 | 0.1168 | 0.0157 | |||||

| US92926SAD80 / WaMu Asset-Backed Certificates WaMu Series | 0.46 | -3.96 | 0.1166 | 0.0087 | |||||

| US93934FMD14 / WASHINGTON MUTUAL MORTGAGE PAS WMALT 2006 2 2CB | 0.46 | 2.68 | 0.1161 | 0.0156 | |||||

| US3622EEAC63 / GSAA Home Equity Trust, Series 2007-9, Class A2A | 0.46 | -0.22 | 0.1159 | 0.0128 | |||||

| US44421GAA13 / Hudson Yards 2019-30HY Mortgage Trust | 0.46 | 1.56 | 0.1154 | 0.0145 | |||||

| US76113NAH61 / Residential Asset Securitization Trust, Series 2006-A7CB, Class 2A2 | 0.46 | -0.87 | 0.1151 | 0.0120 | |||||

| US3622X7AE69 / GSR Mortgage Loan Trust, Series 2006-9F, Class 3A1 | 0.45 | -2.78 | 0.1148 | 0.0099 | |||||

| US36202FB478 / Ginnie Mae II Pool | 0.45 | -0.88 | 0.1146 | 0.0120 | |||||

| US36179V4W70 / GNMA | 0.45 | -0.88 | 0.1142 | 0.0119 | |||||

| US009703AC31 / AJAX Mortgage Loan Trust | 0.45 | 1.58 | 0.1141 | 0.0143 | |||||

| US228925AA15 / CRSO Trust | 0.45 | 0.90 | 0.1136 | 0.0136 | |||||

| US17291NAA90 / Citigroup Commercial Mortgage Trust 2023-SMRT | 0.45 | 1.13 | 0.1133 | 0.0139 | |||||

| Regional Management Issuance Trust, Series 2024-2, Class B / ABS-O (US75907AAB98) | 0.45 | 0.22 | 0.1132 | 0.0131 | |||||

| Regional Management Issuance Trust, Series 2024-2, Class B / ABS-O (US75907AAB98) | 0.45 | 0.22 | 0.1132 | 0.0131 | |||||

| Regional Management Issuance Trust, Series 2024-2, Class B / ABS-O (US75907AAB98) | 0.45 | 0.22 | 0.1132 | 0.0131 | |||||

| US95763PNC13 / Western Mortgage Reference Notes Series 2021-CL2 | 0.45 | -1.32 | 0.1132 | 0.0114 | |||||

| OneMain Direct Auto Receivables Trust, Series 2025-1A, Class D / ABS-O (US682684AD78) | 0.45 | -0.67 | 0.1126 | 0.0120 | |||||

| OneMain Direct Auto Receivables Trust, Series 2025-1A, Class D / ABS-O (US682684AD78) | 0.45 | -0.67 | 0.1126 | 0.0120 | |||||

| OneMain Direct Auto Receivables Trust, Series 2025-1A, Class D / ABS-O (US682684AD78) | 0.45 | -0.67 | 0.1126 | 0.0120 | |||||

| Atrium Hotel Portfolio Trust, Series 2024-ATRM, Class A / ABS-MBS (US04963XAA28) | 0.44 | 0.23 | 0.1118 | 0.0127 | |||||

| Atrium Hotel Portfolio Trust, Series 2024-ATRM, Class A / ABS-MBS (US04963XAA28) | 0.44 | 0.23 | 0.1118 | 0.0127 | |||||

| Atrium Hotel Portfolio Trust, Series 2024-ATRM, Class A / ABS-MBS (US04963XAA28) | 0.44 | 0.23 | 0.1118 | 0.0127 | |||||

| US05609TAL44 / BX TR 2022-VAMF SOFR30A+329.9 01/15/2039 144A | 0.44 | -0.90 | 0.1117 | 0.0117 | |||||

| US05610DAC65 / BX Trust | 0.44 | -0.45 | 0.1116 | 0.0120 | |||||

| US17025AAF93 / COUNTRYWIDE HOME LOANS CWHL 2006 17 A6 | 0.44 | 0.46 | 0.1114 | 0.0130 | |||||

| BAMLL Trust, Series 2025-ASHF, Class A / ABS-MBS (US05494CAA36) | 0.44 | 0.1112 | 0.1112 | ||||||

| BAMLL Trust, Series 2025-ASHF, Class A / ABS-MBS (US05494CAA36) | 0.44 | 0.1112 | 0.1112 | ||||||

| BAMLL Trust, Series 2025-ASHF, Class A / ABS-MBS (US05494CAA36) | 0.44 | 0.1112 | 0.1112 | ||||||

| Hudson Yards Mortgage Trust, Series 2025-SPRL, Class D / ABS-MBS (US44855PAG37) | 0.44 | 1.63 | 0.1105 | 0.0141 | |||||

| Hudson Yards Mortgage Trust, Series 2025-SPRL, Class D / ABS-MBS (US44855PAG37) | 0.44 | 1.63 | 0.1105 | 0.0141 | |||||

| Hudson Yards Mortgage Trust, Series 2025-SPRL, Class D / ABS-MBS (US44855PAG37) | 0.44 | 1.63 | 0.1105 | 0.0141 | |||||

| US07386XAA46 / Bear Stearns ALT-A Trust 2007-1 | 0.44 | 0.23 | 0.1105 | 0.0127 | |||||

| DK Trust, Series 2024-SPBX, Class E / ABS-MBS (US23346LAN82) | 0.44 | -0.91 | 0.1105 | 0.0114 | |||||

| DK Trust, Series 2024-SPBX, Class E / ABS-MBS (US23346LAN82) | 0.44 | -0.91 | 0.1105 | 0.0114 | |||||

| DK Trust, Series 2024-SPBX, Class E / ABS-MBS (US23346LAN82) | 0.44 | -0.91 | 0.1105 | 0.0114 | |||||

| US76042UAC71 / Republic Finance Issuance Trust 2021-A | 0.43 | 0.46 | 0.1099 | 0.0129 | |||||

| BAHA Trust, Series 2024-MAR, Class A / ABS-MBS (US05493XAA81) | 0.43 | 1.41 | 0.1096 | 0.0138 | |||||

| BAHA Trust, Series 2024-MAR, Class A / ABS-MBS (US05493XAA81) | 0.43 | 1.41 | 0.1096 | 0.0138 | |||||

| BX Trust, Series 2024-PAT, Class C / ABS-MBS (US05612FAE51) | 0.43 | -0.92 | 0.1092 | 0.0113 | |||||

| BX Trust, Series 2024-PAT, Class C / ABS-MBS (US05612FAE51) | 0.43 | -0.92 | 0.1092 | 0.0113 | |||||

| BX Trust, Series 2024-PAT, Class C / ABS-MBS (US05612FAE51) | 0.43 | -0.92 | 0.1092 | 0.0113 | |||||

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2024-OMNI, Class A / ABS-MBS (US46593JAA25) | 0.43 | -0.23 | 0.1091 | 0.0120 | |||||

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2024-OMNI, Class A / ABS-MBS (US46593JAA25) | 0.43 | -0.23 | 0.1091 | 0.0120 | |||||

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2024-OMNI, Class A / ABS-MBS (US46593JAA25) | 0.43 | -0.23 | 0.1091 | 0.0120 | |||||

| US83189DAD21 / SMB 2017 B B 144A | 0.43 | 0.94 | 0.1090 | 0.0131 | |||||

| Carlyle US CLO Ltd., Series 2018-2A, Class A1R / ABS-CBDO (US14317PAJ21) | 0.43 | -26.16 | 0.1086 | -0.0218 | |||||

| Carlyle US CLO Ltd., Series 2018-2A, Class A1R / ABS-CBDO (US14317PAJ21) | 0.43 | -26.16 | 0.1086 | -0.0218 | |||||

| Carlyle US CLO Ltd., Series 2018-2A, Class A1R / ABS-CBDO (US14317PAJ21) | 0.43 | -26.16 | 0.1086 | -0.0218 | |||||

| US07325BAB45 / BAYVIEW COMMERCIAL ASSET TRUST BAYC 2006 4A A1 144A | 0.43 | -4.89 | 0.1083 | 0.0073 | |||||

| Regional Management Issuance Trust, Series 2024-2, Class A / ABS-O (US75907AAA16) | 0.43 | 0.23 | 0.1082 | 0.0123 | |||||

| Regional Management Issuance Trust, Series 2024-2, Class A / ABS-O (US75907AAA16) | 0.43 | 0.23 | 0.1082 | 0.0123 | |||||

| Regional Management Issuance Trust, Series 2024-2, Class A / ABS-O (US75907AAA16) | 0.43 | 0.23 | 0.1082 | 0.0123 | |||||

| US55284PAF27 / MFA 2022-NQM1 Trust | 0.43 | 0.95 | 0.1079 | 0.0132 | |||||

| CFMT LLC, Series 2024-HB14, Class M3 / ABS-MBS (US12530XAD30) | 0.43 | 1.67 | 0.1078 | 0.0137 | |||||

| CFMT LLC, Series 2024-HB14, Class M3 / ABS-MBS (US12530XAD30) | 0.43 | 1.67 | 0.1078 | 0.0137 | |||||

| Chase Mortgage Finance Trust, Series 2006-S2, Class 1A16 / ABS-MBS (US16163BAR50) | 0.42 | 0.48 | 0.1064 | 0.0125 | |||||

| Chase Mortgage Finance Trust, Series 2006-S2, Class 1A16 / ABS-MBS (US16163BAR50) | 0.42 | 0.48 | 0.1064 | 0.0125 | |||||

| Chase Mortgage Finance Trust, Series 2006-S2, Class 1A16 / ABS-MBS (US16163BAR50) | 0.42 | 0.48 | 0.1064 | 0.0125 | |||||

| LBA Trust, Series 2024-7IND, Class D / ABS-MBS (US52109XAL29) | 0.42 | -1.88 | 0.1058 | 0.0102 | |||||

| LBA Trust, Series 2024-7IND, Class D / ABS-MBS (US52109XAL29) | 0.42 | -1.88 | 0.1058 | 0.0102 | |||||

| LBA Trust, Series 2024-7IND, Class D / ABS-MBS (US52109XAL29) | 0.42 | -1.88 | 0.1058 | 0.0102 | |||||

| SHR Trust, Series 2024-LXRY, Class A / ABS-MBS (US784234AA47) | 0.42 | -0.71 | 0.1057 | 0.0111 | |||||

| SHR Trust, Series 2024-LXRY, Class A / ABS-MBS (US784234AA47) | 0.42 | -0.71 | 0.1057 | 0.0111 | |||||

| SHR Trust, Series 2024-LXRY, Class A / ABS-MBS (US784234AA47) | 0.42 | -0.71 | 0.1057 | 0.0111 | |||||

| MF1 Multifamily Housing Mortgage Loan Trust, Series 2024-FL14, Class A / ABS-CBDO (US55416AAA79) | 0.42 | -0.48 | 0.1057 | 0.0115 | |||||

| MF1 Multifamily Housing Mortgage Loan Trust, Series 2024-FL14, Class A / ABS-CBDO (US55416AAA79) | 0.42 | -0.48 | 0.1057 | 0.0115 | |||||

| MF1 Multifamily Housing Mortgage Loan Trust, Series 2024-FL14, Class A / ABS-CBDO (US55416AAA79) | 0.42 | -0.48 | 0.1057 | 0.0115 | |||||

| US76113NAM56 / Residential Asset Securitization Trust, Series 2006-A7CB, Class 2A6 | 0.42 | 16.25 | 0.1050 | 0.0249 | |||||

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2024-IGLG, Class A / ABS-MBS (US46593KAA97) | 0.41 | 1.23 | 0.1046 | 0.0129 | |||||

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2024-IGLG, Class A / ABS-MBS (US46593KAA97) | 0.41 | 1.23 | 0.1046 | 0.0129 | |||||

| J.P. Morgan Chase Commercial Mortgage Securities Trust, Series 2024-IGLG, Class A / ABS-MBS (US46593KAA97) | 0.41 | 1.23 | 0.1046 | 0.0129 | |||||

| US05607TAJ16 / BXP Trust | 0.41 | 0.00 | 0.1038 | 0.0117 | |||||

| US152314LQ15 / Centex Home Equity Loan Trust 2004-D | 0.41 | -1.20 | 0.1037 | 0.0104 | |||||

| US12566WAF77 / CitiMortgage Alternative Loan Trust, Series 2007-A5, Class 1A6 | 0.41 | 0.25 | 0.1036 | 0.0120 | |||||

| Alternative Loan Trust, Series 2005-55CW, Class 2A3 / ABS-MBS (US12668AUP82) | 0.41 | -0.98 | 0.1028 | 0.0106 | |||||

| Alternative Loan Trust, Series 2005-55CW, Class 2A3 / ABS-MBS (US12668AUP82) | 0.41 | -0.98 | 0.1028 | 0.0106 | |||||

| Alternative Loan Trust, Series 2005-55CW, Class 2A3 / ABS-MBS (US12668AUP82) | 0.41 | -0.98 | 0.1028 | 0.0106 | |||||

| US07389YAE14 / Bear Stearns Asset-Backed Securities I Trust, Series 2007-HE2, Class 22A | 0.40 | -3.81 | 0.1023 | 0.0080 | |||||

| US3622MWAW34 / GSR Mortgage Loan Trust, Series 2007-3F, Class 4A2 | 0.40 | 11.33 | 0.1020 | 0.0207 | |||||

| US87332PAA84 / TYSN 2023-CRNR A VAR 12/10/2038 144A | 0.40 | 0.76 | 0.1013 | 0.0122 | |||||

| LBA Trust, Series 2024-7IND, Class A / ABS-MBS (US52109XAA63) | 0.40 | -0.50 | 0.1010 | 0.0111 | |||||

| LBA Trust, Series 2024-7IND, Class A / ABS-MBS (US52109XAA63) | 0.40 | -0.50 | 0.1010 | 0.0111 | |||||

| LBA Trust, Series 2024-7IND, Class A / ABS-MBS (US52109XAA63) | 0.40 | -0.50 | 0.1010 | 0.0111 | |||||

| ONNI Commerical Mortgage Trust, Series 2024-APT, Class A / ABS-MBS (US682939AA17) | 0.40 | 1.53 | 0.1009 | 0.0126 | |||||

| ONNI Commerical Mortgage Trust, Series 2024-APT, Class A / ABS-MBS (US682939AA17) | 0.40 | 1.53 | 0.1009 | 0.0126 | |||||

| ONNI Commerical Mortgage Trust, Series 2024-APT, Class A / ABS-MBS (US682939AA17) | 0.40 | 1.53 | 0.1009 | 0.0126 | |||||

| ORL Trust, Series 2024-GLKS, Class A / ABS-MBS (US67120DAA37) | 0.40 | -1.00 | 0.1005 | 0.0105 | |||||

| ORL Trust, Series 2024-GLKS, Class A / ABS-MBS (US67120DAA37) | 0.40 | -1.00 | 0.1005 | 0.0105 | |||||

| US05608RAA32 / BX Trust | 0.40 | -0.75 | 0.1004 | 0.0106 | |||||

| US26245MAC55 / Dryden 55 CLO Ltd | 0.40 | -24.43 | 0.1001 | -0.0174 | |||||

| Cross Mortgage Trust, Series 2025-H2, Class B1B / ABS-MBS (US22758PAH55) | 0.39 | 0.0993 | 0.0993 | ||||||

| Cross Mortgage Trust, Series 2025-H2, Class B1B / ABS-MBS (US22758PAH55) | 0.39 | 0.0993 | 0.0993 | ||||||

| Cross Mortgage Trust, Series 2025-H2, Class B1B / ABS-MBS (US22758PAH55) | 0.39 | 0.0993 | 0.0993 | ||||||

| US3140X83B13 / Fannie Mae Pool | 0.39 | -0.51 | 0.0990 | 0.0108 | |||||

| HOMES Trust, Series 2025-NQM1, Class B1 / ABS-MBS (US43761DAH35) | 0.39 | 0.0985 | 0.0985 | ||||||

| HOMES Trust, Series 2025-NQM1, Class B1 / ABS-MBS (US43761DAH35) | 0.39 | 0.0985 | 0.0985 | ||||||

| HOMES Trust, Series 2025-NQM1, Class B1 / ABS-MBS (US43761DAH35) | 0.39 | 0.0985 | 0.0985 | ||||||

| US78449PAB58 / SMB Private Education Loan Trust 2018-A | 0.39 | -14.32 | 0.0984 | -0.0036 | |||||

| US83192CAD92 / SMB Private Education Loan Trust 2019-B | 0.39 | 2.37 | 0.0982 | 0.0131 | |||||

| US75116EAD40 / RALI SERIES 2007-QH5 TRUST SER 2007-QH5 CL AII V/R REGD 1.93800000 | 0.39 | 3.77 | 0.0975 | 0.0142 | |||||

| BX Commercial Mortgage Trust, Series 2024-KING, Class A / ABS-MBS (US05612RAA77) | 0.38 | -0.52 | 0.0972 | 0.0106 | |||||

| BX Commercial Mortgage Trust, Series 2024-KING, Class A / ABS-MBS (US05612RAA77) | 0.38 | -0.52 | 0.0972 | 0.0106 | |||||

| BX Commercial Mortgage Trust, Series 2024-KING, Class A / ABS-MBS (US05612RAA77) | 0.38 | -0.52 | 0.0972 | 0.0106 | |||||

| PGA Trust, Series 2024-RSR2, Class A / ABS-MBS (US69381CAA53) | 0.38 | -0.53 | 0.0957 | 0.0102 | |||||

| PGA Trust, Series 2024-RSR2, Class A / ABS-MBS (US69381CAA53) | 0.38 | -0.53 | 0.0957 | 0.0102 | |||||

| PGA Trust, Series 2024-RSR2, Class A / ABS-MBS (US69381CAA53) | 0.38 | -0.53 | 0.0957 | 0.0102 | |||||

| US92259LAN82 / Velocity Commercial Capital Loan Trust, Series 2020-1, Class M4 | 0.38 | -3.09 | 0.0952 | 0.0080 | |||||

| HTL Commercial Mortgage Trust, Series 2024-T53, Class E / ABS-MBS (US404300AJ42) | 0.38 | 0.27 | 0.0949 | 0.0109 | |||||

| HTL Commercial Mortgage Trust, Series 2024-T53, Class E / ABS-MBS (US404300AJ42) | 0.38 | 0.27 | 0.0949 | 0.0109 | |||||

| HTL Commercial Mortgage Trust, Series 2024-T53, Class E / ABS-MBS (US404300AJ42) | 0.38 | 0.27 | 0.0949 | 0.0109 | |||||

| New Residential Mortgage Loan Trust, Series 2025-NQM1, Class B2 / ABS-MBS (US64832DAH44) | 0.37 | 0.54 | 0.0948 | 0.0111 | |||||

| New Residential Mortgage Loan Trust, Series 2025-NQM1, Class B2 / ABS-MBS (US64832DAH44) | 0.37 | 0.54 | 0.0948 | 0.0111 | |||||

| New Residential Mortgage Loan Trust, Series 2025-NQM1, Class B2 / ABS-MBS (US64832DAH44) | 0.37 | 0.54 | 0.0948 | 0.0111 | |||||

| US92259MAS52 / Velocity Commercial Capital Loan Trust 2021-2 | 0.37 | 0.81 | 0.0941 | 0.0112 | |||||

| US05602HAA14 / BPR Trust 2022-SSP | 0.37 | -0.54 | 0.0935 | 0.0102 | |||||

| DC Trust, Series 2024-HLTN, Class F / ABS-MBS (US24022FAN06) | 0.37 | -1.60 | 0.0931 | 0.0090 | |||||

| DC Trust, Series 2024-HLTN, Class F / ABS-MBS (US24022FAN06) | 0.37 | -1.60 | 0.0931 | 0.0090 | |||||

| DC Trust, Series 2024-HLTN, Class F / ABS-MBS (US24022FAN06) | 0.37 | -1.60 | 0.0931 | 0.0090 | |||||

| Atrium Hotel Portfolio Trust, Series 2024-ATRM, Class E / ABS-MBS (US04963XAL82) | 0.37 | 69.44 | 0.0927 | 0.0441 | |||||

| Atrium Hotel Portfolio Trust, Series 2024-ATRM, Class E / ABS-MBS (US04963XAL82) | 0.37 | 69.44 | 0.0927 | 0.0441 | |||||

| Atrium Hotel Portfolio Trust, Series 2024-ATRM, Class E / ABS-MBS (US04963XAL82) | 0.37 | 69.44 | 0.0927 | 0.0441 | |||||

| COLT Mortgage Loan Trust, Series 2025-INV2, Class B1 / ABS-MBS (US12673UAE47) | 0.36 | 0.0922 | 0.0922 | ||||||

| COLT Mortgage Loan Trust, Series 2025-INV2, Class B1 / ABS-MBS (US12673UAE47) | 0.36 | 0.0922 | 0.0922 | ||||||

| US68245HAG92 / One Market Plaza Trust 2017-1MKT | 0.36 | -4.71 | 0.0921 | 0.0064 | |||||

| US90117PAC95 / AOTA_15-1211 | 0.36 | -0.55 | 0.0919 | 0.0099 | |||||

| US68373BAA98 / OPEN TR 2023-AIR TSFR1M+308.92 10/15/2028 144A | 0.36 | -0.55 | 0.0913 | 0.0097 | |||||

| US05610DAA00 / BX_23-DELC | 0.36 | -0.55 | 0.0912 | 0.0099 | |||||

| US61769JAC53 / Morgan Stanley Capital I Trust 2019-H6 | 0.36 | 1.69 | 0.0911 | 0.0116 | |||||

| DBWF Mortgage Trust, Series 2024-LCRS, Class A / ABS-MBS (US23307KAA51) | 0.36 | -1.11 | 0.0905 | 0.0094 | |||||

| DBWF Mortgage Trust, Series 2024-LCRS, Class A / ABS-MBS (US23307KAA51) | 0.36 | -1.11 | 0.0905 | 0.0094 | |||||

| DBWF Mortgage Trust, Series 2024-LCRS, Class A / ABS-MBS (US23307KAA51) | 0.36 | -1.11 | 0.0905 | 0.0094 | |||||

| BX Commercial Mortgage Trust, Series 2024-GPA3, Class A / ABS-MBS (US123910AA98) | 0.35 | -6.84 | 0.0897 | 0.0045 | |||||

| BX Commercial Mortgage Trust, Series 2024-GPA3, Class A / ABS-MBS (US123910AA98) | 0.35 | -6.84 | 0.0897 | 0.0045 | |||||

| BX Commercial Mortgage Trust, Series 2024-GPA3, Class A / ABS-MBS (US123910AA98) | 0.35 | -6.84 | 0.0897 | 0.0045 | |||||

| US3137HAD605 / FHLMC Multifamily Structured Pass-Through Certificates, Series KPLB2, Class X | 0.35 | -0.84 | 0.0894 | 0.0093 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL4, Class A1 / ABS-MBS (US79584CAA99) | 0.35 | -0.57 | 0.0881 | 0.0094 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL4, Class A1 / ABS-MBS (US79584CAA99) | 0.35 | -0.57 | 0.0881 | 0.0094 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL4, Class A1 / ABS-MBS (US79584CAA99) | 0.35 | -0.57 | 0.0881 | 0.0094 | |||||

| GS Mortgage Securities Corp. Trust, Series 2025-800D, Class A / ABS-MBS (US36273XAA90) | 0.35 | 0.0876 | 0.0876 | ||||||

| GS Mortgage Securities Corp. Trust, Series 2025-800D, Class A / ABS-MBS (US36273XAA90) | 0.35 | 0.0876 | 0.0876 | ||||||

| GS Mortgage Securities Corp. Trust, Series 2025-800D, Class A / ABS-MBS (US36273XAA90) | 0.35 | 0.0876 | 0.0876 | ||||||

| Velocity Commercial Capital Loan Trust, Series 2025-1, Class M4 / ABS-MBS (US922955AN94) | 0.35 | 0.0874 | 0.0874 | ||||||

| Velocity Commercial Capital Loan Trust, Series 2025-1, Class M4 / ABS-MBS (US922955AN94) | 0.35 | 0.0874 | 0.0874 | ||||||

| Velocity Commercial Capital Loan Trust, Series 2025-1, Class M4 / ABS-MBS (US922955AN94) | 0.35 | 0.0874 | 0.0874 | ||||||

| MCM Trust, Series 2018-NPL2 / ABS-MBS (N/A) | 0.35 | 0.0874 | 0.0874 | ||||||

| MCM Trust, Series 2018-NPL2 / ABS-MBS (N/A) | 0.35 | 0.0874 | 0.0874 | ||||||

| MCM Trust, Series 2018-NPL2 / ABS-MBS (N/A) | 0.35 | 0.0874 | 0.0874 | ||||||

| US02151ABK51 / Alternative Loan Trust 2007-19 | 0.35 | -2.54 | 0.0873 | 0.0078 | |||||

| VEGAS Trust, Series 2024-TI, Class A / ABS-MBS (US92254AAA51) | 0.34 | 0.58 | 0.0871 | 0.0103 | |||||

| VEGAS Trust, Series 2024-TI, Class A / ABS-MBS (US92254AAA51) | 0.34 | 0.58 | 0.0871 | 0.0103 | |||||

| VEGAS Trust, Series 2024-TI, Class A / ABS-MBS (US92254AAA51) | 0.34 | 0.58 | 0.0871 | 0.0103 | |||||

| US04002VAA98 / AREIT Trust, Series 2022-CRE6, Class A | 0.34 | -0.87 | 0.0868 | 0.0090 | |||||

| US75116AAA88 / RALI SERIES 2007-QO2 TRUST SER 2007-QO2 CL A1 V/R REGD 1.85800000 | 0.34 | -5.79 | 0.0865 | 0.0051 | |||||

| US30227FAL40 / Extended Stay America Trust | 0.34 | -2.56 | 0.0865 | 0.0075 | |||||

| WEST Trust, Series 2025-ROSE, Class A / ABS-MBS (US955909AA47) | 0.34 | 0.0863 | 0.0863 | ||||||

| WEST Trust, Series 2025-ROSE, Class A / ABS-MBS (US955909AA47) | 0.34 | 0.0863 | 0.0863 | ||||||

| WEST Trust, Series 2025-ROSE, Class A / ABS-MBS (US955909AA47) | 0.34 | 0.0863 | 0.0863 | ||||||

| US00971FAB76 / AJAX Mortgage Loan Trust | 0.34 | 0.89 | 0.0862 | 0.0105 | |||||

| Cali, Series 2024-SUN, Class A / ABS-MBS (US12988DAA00) | 0.34 | 0.00 | 0.0859 | 0.0095 | |||||

| Cali, Series 2024-SUN, Class A / ABS-MBS (US12988DAA00) | 0.34 | 0.00 | 0.0859 | 0.0095 | |||||

| Cali, Series 2024-SUN, Class A / ABS-MBS (US12988DAA00) | 0.34 | 0.00 | 0.0859 | 0.0095 | |||||

| US03764QBC50 / Apidos CLO XV | 0.34 | -2.31 | 0.0858 | 0.0079 | |||||

| Affirm Master Trust, Series 2025-1A, Class A / ABS-O (US00833BAA61) | 0.34 | 0.0851 | 0.0851 | ||||||

| Affirm Master Trust, Series 2025-1A, Class A / ABS-O (US00833BAA61) | 0.34 | 0.0851 | 0.0851 | ||||||

| Affirm Master Trust, Series 2025-1A, Class A / ABS-O (US00833BAA61) | 0.34 | 0.0851 | 0.0851 | ||||||

| US63941FAC05 / Navient Private Education Refi Loan Trust 2020-A | 0.33 | -6.98 | 0.0842 | 0.0037 | |||||

| US126694E958 / CHL Mortgage Pass-Through Trust 2006-OA4 | 0.33 | -1.19 | 0.0838 | 0.0086 | |||||

| US45254TTL88 / IMPAC SECURED ASSETS CORP. IMSA 2006 1 1A2B | 0.33 | -23.43 | 0.0835 | -0.0133 | |||||

| US05606GAQ47 / BX Trust 2021-VIEW | 0.33 | -0.30 | 0.0833 | 0.0092 | |||||

| VEGAS, Series 2024-GCS, Class D / ABS-MBS (US92254BAC90) | 0.33 | 1.24 | 0.0828 | 0.0101 | |||||

| VEGAS, Series 2024-GCS, Class D / ABS-MBS (US92254BAC90) | 0.33 | 1.24 | 0.0828 | 0.0101 | |||||

| VEGAS, Series 2024-GCS, Class D / ABS-MBS (US92254BAC90) | 0.33 | 1.24 | 0.0828 | 0.0101 | |||||

| BX Commercial Mortgage Trust, Series 2024-MDHS, Class A / ABS-MBS (US12433BAA52) | 0.33 | -1.51 | 0.0825 | 0.0081 | |||||

| BX Commercial Mortgage Trust, Series 2024-MDHS, Class A / ABS-MBS (US12433BAA52) | 0.33 | -1.51 | 0.0825 | 0.0081 | |||||

| BX Commercial Mortgage Trust, Series 2024-MDHS, Class A / ABS-MBS (US12433BAA52) | 0.33 | -1.51 | 0.0825 | 0.0081 | |||||

| US3137FTZS90 / Freddie Mac Multifamily Structured Pass Through Certificates | 0.32 | -9.50 | 0.0821 | 0.0016 | |||||

| Morgan Stanley Residential Mortgage Loan Trust, Series 2025-NQM1, Class B1A / ABS-MBS (US617932AH13) | 0.32 | 0.62 | 0.0819 | 0.0095 | |||||

| Morgan Stanley Residential Mortgage Loan Trust, Series 2025-NQM1, Class B1A / ABS-MBS (US617932AH13) | 0.32 | 0.62 | 0.0819 | 0.0095 | |||||

| U.S. Treasury 10-Year Ultra Note / DIR (N/A) | 0.32 | 0.0814 | 0.0814 | ||||||

| U.S. Treasury 10-Year Ultra Note / DIR (N/A) | 0.32 | 0.0814 | 0.0814 | ||||||

| U.S. Treasury 10-Year Ultra Note / DIR (N/A) | 0.32 | 0.0814 | 0.0814 | ||||||

| PFS Financing Corp., Series 2024-A, Class B / ABS-O (US69335PFD24) | 0.32 | -0.31 | 0.0811 | 0.0089 | |||||

| PFS Financing Corp., Series 2024-A, Class B / ABS-O (US69335PFD24) | 0.32 | -0.31 | 0.0811 | 0.0089 | |||||

| PFS Financing Corp., Series 2024-A, Class B / ABS-O (US69335PFD24) | 0.32 | -0.31 | 0.0811 | 0.0089 | |||||

| US055983AA86 / BSPRT 2022-FL8 Issuer Ltd | 0.32 | -10.86 | 0.0809 | 0.0003 | |||||