Basic Stats

| Portfolio Value | $ 984,740,735 |

| Current Positions | 112 |

Latest Holdings, Performance, AUM (from 13F, 13D)

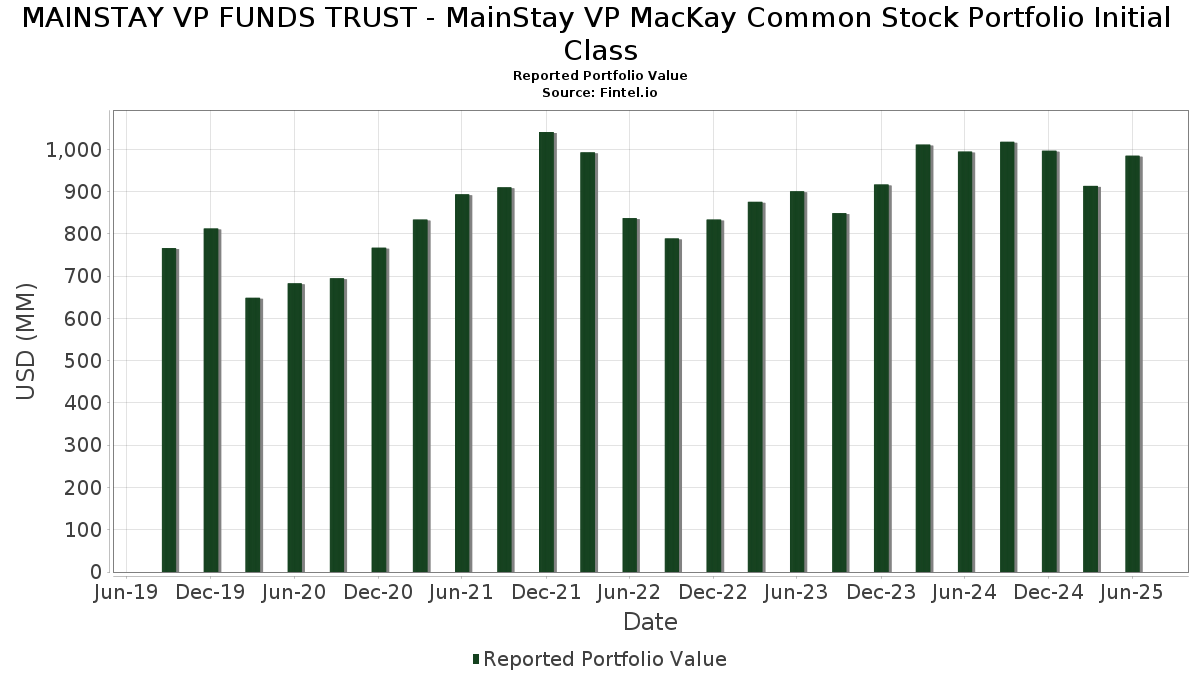

MAINSTAY VP FUNDS TRUST - MainStay VP MacKay Common Stock Portfolio Initial Class has disclosed 112 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 984,740,735 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). MAINSTAY VP FUNDS TRUST - MainStay VP MacKay Common Stock Portfolio Initial Class’s top holdings are NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Visa Inc. (US:V) , and Eli Lilly and Company (US:LLY) . MAINSTAY VP FUNDS TRUST - MainStay VP MacKay Common Stock Portfolio Initial Class’s new positions include General Motors Company (US:GM) , Carvana Co. (US:CVNA) , Carnival Corporation & plc (US:CCL) , Willis Towers Watson Public Limited Company (DE:WTY) , and Cintas Corporation (US:CTAS) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.44 | 70.06 | 7.1102 | 1.8582 | |

| 0.04 | 28.78 | 2.9206 | 1.1939 | |

| 0.12 | 57.55 | 5.8399 | 1.0942 | |

| 0.14 | 30.08 | 3.0530 | 0.8429 | |

| 0.05 | 18.58 | 1.8856 | 0.3489 | |

| 0.06 | 8.29 | 0.8414 | 0.3320 | |

| 0.06 | 12.53 | 1.2713 | 0.2917 | |

| 0.02 | 5.24 | 0.5314 | 0.2233 | |

| 0.04 | 6.64 | 0.6741 | 0.2136 | |

| 0.03 | 9.67 | 0.9812 | 0.2114 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.06 | 10.20 | 1.0350 | -0.9198 | |

| 0.05 | 38.28 | 3.8851 | -0.7324 | |

| 0.02 | 23.91 | 2.4266 | -0.5495 | |

| 0.02 | 5.39 | 0.5473 | -0.5159 | |

| 0.12 | 21.95 | 2.2272 | -0.5154 | |

| 0.04 | 12.39 | 1.2576 | -0.4515 | |

| 0.25 | 50.43 | 5.1175 | -0.4427 | |

| 0.00 | 0.09 | 0.0093 | -0.4188 | |

| 0.05 | 6.61 | 0.6707 | -0.3910 | |

| 0.00 | 0.81 | 0.0823 | -0.3697 |

13F and Fund Filings

This form was filed on 2025-08-25 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.44 | 0.00 | 70.06 | 45.78 | 7.1102 | 1.8582 | |||

| MSFT / Microsoft Corporation | 0.12 | 0.00 | 57.55 | 32.50 | 5.8399 | 1.0942 | |||

| AAPL / Apple Inc. | 0.25 | 7.30 | 50.43 | -0.90 | 5.1175 | -0.4427 | |||

| V / Visa Inc. | 0.13 | -1.34 | 45.44 | -0.05 | 4.6112 | -0.3563 | |||

| LLY / Eli Lilly and Company | 0.05 | -4.01 | 38.28 | -9.40 | 3.8851 | -0.7324 | |||

| ORCL / Oracle Corporation | 0.14 | -4.88 | 30.08 | 48.74 | 3.0530 | 0.8429 | |||

| MA / Mastercard Incorporated | 0.05 | -2.65 | 29.21 | -0.19 | 2.9645 | -0.2338 | |||

| META / Meta Platforms, Inc. | 0.04 | 42.22 | 28.78 | 82.12 | 2.9206 | 1.1939 | |||

| HD / The Home Depot, Inc. | 0.07 | -1.94 | 24.12 | -1.90 | 2.4479 | -0.2389 | |||

| COST / Costco Wholesale Corporation | 0.02 | -16.12 | 23.91 | -12.20 | 2.4266 | -0.5495 | |||

| IBM / International Business Machines Corporation | 0.08 | -4.17 | 22.46 | 13.60 | 2.2796 | 0.1188 | |||

| ABBV / AbbVie Inc. | 0.12 | -1.30 | 21.95 | -12.56 | 2.2272 | -0.5154 | |||

| APP / AppLovin Corporation | 0.05 | 0.00 | 18.58 | 32.12 | 1.8856 | 0.3489 | |||

| CAT / Caterpillar Inc. | 0.04 | -10.72 | 16.35 | 5.10 | 1.6591 | -0.0407 | |||

| PEP / PepsiCo, Inc. | 0.12 | 0.00 | 16.30 | -11.94 | 1.6543 | -0.3685 | |||

| TJX / The TJX Companies, Inc. | 0.11 | -3.62 | 14.16 | -2.28 | 1.4367 | -0.1465 | |||

| ADBE / Adobe Inc. | 0.03 | -7.63 | 12.68 | -6.82 | 1.2864 | -0.2002 | |||

| VST / Vistra Corp. | 0.06 | -15.32 | 12.53 | 39.75 | 1.2713 | 0.2917 | |||

| AMGN / Amgen Inc. | 0.04 | -11.59 | 12.39 | -20.77 | 1.2576 | -0.4515 | |||

| UNP / Union Pacific Corporation | 0.05 | -5.75 | 12.17 | -8.21 | 1.2354 | -0.2138 | |||

| KLAC / KLA Corporation | 0.01 | -2.40 | 12.03 | 28.61 | 1.2209 | 0.1987 | |||

| GILD / Gilead Sciences, Inc. | 0.11 | 0.00 | 11.81 | -1.06 | 1.1983 | -0.1057 | |||

| LNG / Cheniere Energy, Inc. | 0.05 | -3.67 | 11.05 | 1.38 | 1.1210 | -0.0697 | |||

| ADP / Automatic Data Processing, Inc. | 0.03 | -0.53 | 10.55 | 0.41 | 1.0707 | -0.0775 | |||

| AMP / Ameriprise Financial, Inc. | 0.02 | -3.66 | 10.36 | 6.21 | 1.0513 | -0.0145 | |||

| PG / The Procter & Gamble Company | 0.06 | -45.72 | 10.20 | -47.56 | 1.0350 | -0.9198 | |||

| LRCX / Lam Research Corporation | 0.10 | -0.91 | 10.20 | 32.69 | 1.0348 | 0.1950 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.03 | -9.96 | 9.67 | 37.25 | 0.9812 | 0.2114 | |||

| KR / The Kroger Co. | 0.13 | 0.00 | 9.64 | 5.97 | 0.9785 | -0.0158 | |||

| GWW / W.W. Grainger, Inc. | 0.01 | -1.40 | 9.58 | 3.83 | 0.9721 | -0.0360 | |||

| LMT / Lockheed Martin Corporation | 0.02 | 0.00 | 9.32 | 3.68 | 0.9457 | -0.0365 | |||

| URI / United Rentals, Inc. | 0.01 | 0.00 | 9.01 | 20.22 | 0.9146 | 0.0954 | |||

| VRT / Vertiv Holdings Co | 0.06 | 0.00 | 8.29 | 77.88 | 0.8414 | 0.3320 | |||

| HES / Hess Corporation | 0.06 | 0.00 | 7.91 | -13.27 | 0.8032 | -0.1939 | |||

| ROST / Ross Stores, Inc. | 0.06 | -7.91 | 7.78 | -8.06 | 0.7894 | -0.1351 | |||

| WM / Waste Management, Inc. | 0.03 | 0.00 | 7.68 | -1.16 | 0.7792 | -0.0697 | |||

| TRGP / Targa Resources Corp. | 0.04 | -3.15 | 7.67 | -15.90 | 0.7786 | -0.2183 | |||

| KMB / Kimberly-Clark Corporation | 0.06 | -5.26 | 7.64 | -14.12 | 0.7754 | -0.1968 | |||

| MCO / Moody's Corporation | 0.01 | -1.05 | 7.44 | 6.57 | 0.7551 | -0.0078 | |||

| SHW / The Sherwin-Williams Company | 0.02 | -11.94 | 7.37 | -13.41 | 0.7479 | -0.1821 | |||

| SYY / Sysco Corporation | 0.10 | 0.00 | 7.29 | 0.94 | 0.7395 | -0.0494 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.01 | -9.41 | 7.20 | 15.70 | 0.7305 | 0.0507 | |||

| MSI / Motorola Solutions, Inc. | 0.02 | 16.88 | 6.72 | 12.25 | 0.6815 | 0.0278 | |||

| LPLA / LPL Financial Holdings Inc. | 0.02 | -2.24 | 6.69 | 12.06 | 0.6789 | 0.0265 | |||

| NRG / NRG Energy, Inc. | 0.04 | -6.30 | 6.64 | 57.62 | 0.6741 | 0.2136 | |||

| ITW / Illinois Tool Works Inc. | 0.03 | 0.00 | 6.61 | -0.32 | 0.6710 | -0.0537 | |||

| PAYX / Paychex, Inc. | 0.05 | -27.85 | 6.61 | -31.97 | 0.6707 | -0.3910 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.12 | 0.00 | 6.57 | 11.83 | 0.6667 | 0.0248 | |||

| VRSK / Verisk Analytics, Inc. | 0.02 | -0.95 | 6.31 | 3.67 | 0.6399 | -0.0248 | |||

| TSCO / Tractor Supply Company | 0.12 | -2.82 | 6.30 | -6.93 | 0.6392 | -0.1003 | |||

| ZTS / Zoetis Inc. | 0.04 | -8.03 | 6.30 | -12.89 | 0.6391 | -0.1509 | |||

| NXPI / NXP Semiconductors N.V. | 0.03 | 0.00 | 6.15 | 14.97 | 0.6245 | 0.0396 | |||

| BMY / Bristol-Myers Squibb Company | 0.12 | 0.00 | 5.74 | -24.10 | 0.5830 | -0.2441 | |||

| DAL / Delta Air Lines, Inc. | 0.12 | 0.00 | 5.66 | 12.81 | 0.5747 | 0.0261 | |||

| CL / Colgate-Palmolive Company | 0.06 | 0.00 | 5.57 | -3.00 | 0.5649 | -0.0621 | |||

| DRI / Darden Restaurants, Inc. | 0.02 | 0.00 | 5.45 | 4.91 | 0.5526 | -0.0146 | |||

| COR / Cencora, Inc. | 0.02 | -48.59 | 5.39 | -44.57 | 0.5473 | -0.5159 | |||

| AXP / American Express Company | 0.02 | 56.62 | 5.24 | 85.67 | 0.5314 | 0.2233 | |||

| ADSK / Autodesk, Inc. | 0.02 | -5.54 | 5.19 | 11.70 | 0.5270 | 0.0190 | |||

| MRK / Merck & Co., Inc. | 0.06 | 0.00 | 4.99 | -11.82 | 0.5068 | -0.1120 | |||

| CDW / CDW Corporation | 0.03 | 0.00 | 4.90 | 11.44 | 0.4972 | 0.0168 | |||

| EXPE / Expedia Group, Inc. | 0.03 | -0.90 | 4.85 | -0.55 | 0.4917 | -0.0407 | |||

| IT / Gartner, Inc. | 0.01 | 0.00 | 4.82 | -3.69 | 0.4895 | -0.0578 | |||

| CPAY / Corpay, Inc. | 0.01 | -3.17 | 4.75 | -7.87 | 0.4823 | -0.0813 | |||

| DVN / Devon Energy Corporation | 0.14 | 0.00 | 4.42 | -14.95 | 0.4482 | -0.1192 | |||

| TGT / Target Corporation | 0.04 | 0.00 | 4.37 | -5.47 | 0.4438 | -0.0617 | |||

| WSM / Williams-Sonoma, Inc. | 0.03 | 0.00 | 4.13 | 3.35 | 0.4190 | -0.0176 | |||

| NTAP / NetApp, Inc. | 0.04 | 0.00 | 4.11 | 21.30 | 0.4167 | 0.0468 | |||

| UPS / United Parcel Service, Inc. | 0.04 | 0.00 | 3.96 | -8.23 | 0.4019 | -0.0697 | |||

| GDDY / GoDaddy Inc. | 0.02 | 0.00 | 3.86 | -0.05 | 0.3919 | -0.0303 | |||

| WAT / Waters Corporation | 0.01 | -9.77 | 3.84 | -14.54 | 0.3894 | -0.1013 | |||

| LULU / lululemon athletica inc. | 0.01 | 0.00 | 3.48 | -16.08 | 0.3528 | -0.0998 | |||

| EQH / Equitable Holdings, Inc. | 0.06 | -5.63 | 3.44 | 1.62 | 0.3495 | -0.0208 | |||

| BBY / Best Buy Co., Inc. | 0.05 | 0.00 | 3.34 | -8.80 | 0.3388 | -0.0612 | |||

| LII / Lennox International Inc. | 0.01 | 0.00 | 3.26 | 2.23 | 0.3304 | -0.0177 | |||

| BURL / Burlington Stores, Inc. | 0.01 | 0.00 | 3.25 | -2.40 | 0.3300 | -0.0340 | |||

| LVS / Las Vegas Sands Corp. | 0.07 | 0.00 | 3.08 | 12.62 | 0.3125 | 0.0138 | |||

| JNJ / Johnson & Johnson | 0.02 | -28.85 | 3.05 | -34.45 | 0.3091 | -0.1988 | |||

| ULTA / Ulta Beauty, Inc. | 0.01 | 0.00 | 2.89 | 27.60 | 0.2929 | 0.0458 | |||

| HSY / The Hershey Company | 0.02 | 0.00 | 2.61 | -2.94 | 0.2649 | -0.0291 | |||

| BAH / Booz Allen Hamilton Holding Corporation | 0.02 | 0.00 | 2.57 | -0.43 | 0.2611 | -0.0213 | |||

| 56064L488 / MainStay US Government Liquidity Fund | 2.57 | 9.31 | 2.57 | 9.32 | 0.2608 | 0.0039 | |||

| DVA / DaVita Inc. | 0.02 | 0.00 | 2.52 | -6.87 | 0.2560 | -0.0400 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.01 | 0.00 | 2.52 | -1.83 | 0.2554 | -0.0248 | |||

| TRV / The Travelers Companies, Inc. | 0.01 | 0.00 | 2.35 | 1.16 | 0.2385 | -0.0154 | |||

| CHTR / Charter Communications, Inc. | 0.01 | 0.00 | 2.31 | 10.93 | 0.2349 | 0.0069 | |||

| MANH / Manhattan Associates, Inc. | 0.01 | 0.00 | 1.98 | 14.18 | 0.2010 | 0.0113 | |||

| WMS / Advanced Drainage Systems, Inc. | 0.02 | 0.00 | 1.92 | 5.68 | 0.1944 | -0.0036 | |||

| MEDP / Medpace Holdings, Inc. | 0.01 | 0.00 | 1.91 | 2.97 | 0.1934 | -0.0088 | |||

| GM / General Motors Company | 0.04 | 1.80 | 0.1826 | 0.1826 | |||||

| EBAY / eBay Inc. | 0.02 | 1.79 | 0.1814 | 0.1814 | |||||

| CVNA / Carvana Co. | 0.01 | 1.75 | 0.1780 | 0.1780 | |||||

| HAL / Halliburton Company | 0.08 | -18.38 | 1.61 | -34.43 | 0.1637 | -0.1051 | |||

| FTNT / Fortinet, Inc. | 0.02 | 1.59 | 0.1616 | 0.1616 | |||||

| NKE / NIKE, Inc. | 0.02 | -52.31 | 1.51 | -46.66 | 0.1531 | -0.1558 | |||

| AON / Aon plc | 0.00 | 280.13 | 1.47 | 240.37 | 0.1489 | 0.1017 | |||

| POOL / Pool Corporation | 0.00 | 0.00 | 1.23 | -8.45 | 0.1243 | -0.0219 | |||

| KO / The Coca-Cola Company | 0.02 | -62.15 | 1.22 | -62.62 | 0.1237 | -0.2326 | |||

| CLX / The Clorox Company | 0.01 | 0.00 | 1.18 | -18.45 | 0.1194 | -0.0383 | |||

| CCL / Carnival Corporation & plc | 0.04 | 1.15 | 0.1169 | 0.1169 | |||||

| WTY / Willis Towers Watson Public Limited Company | 0.00 | 1.05 | 0.1065 | 0.1065 | |||||

| SCCO / Southern Copper Corporation | 0.01 | -1.06 | 0.96 | 7.13 | 0.0977 | -0.0005 | |||

| MCHP / Microchip Technology Incorporated | 0.01 | -7.65 | 0.85 | 34.34 | 0.0862 | 0.0171 | |||

| DE / Deere & Company | 0.00 | -81.90 | 0.81 | -80.39 | 0.0823 | -0.3697 | |||

| WMG / Warner Music Group Corp. | 0.03 | 0.00 | 0.78 | -13.18 | 0.0796 | -0.0190 | |||

| CTAS / Cintas Corporation | 0.00 | 0.57 | 0.0577 | 0.0577 | |||||

| UAL / United Airlines Holdings, Inc. | 0.01 | 0.52 | 0.0532 | 0.0532 | |||||

| BR / Broadridge Financial Solutions, Inc. | 0.00 | 0.25 | 0.0252 | 0.0252 | |||||

| MMM / 3M Company | 0.00 | 0.11 | 0.0108 | 0.0108 | |||||

| EME / EMCOR Group, Inc. | 0.00 | -99.46 | 0.09 | -97.43 | 0.0093 | -0.4188 | |||

| NVR / NVR, Inc. | 0.00 | 0.00 | 0.08 | 2.53 | 0.0082 | -0.0005 | |||

| VLTO / Veralto Corporation | 0.00 | 0.07 | 0.0075 | 0.0075 |