Basic Stats

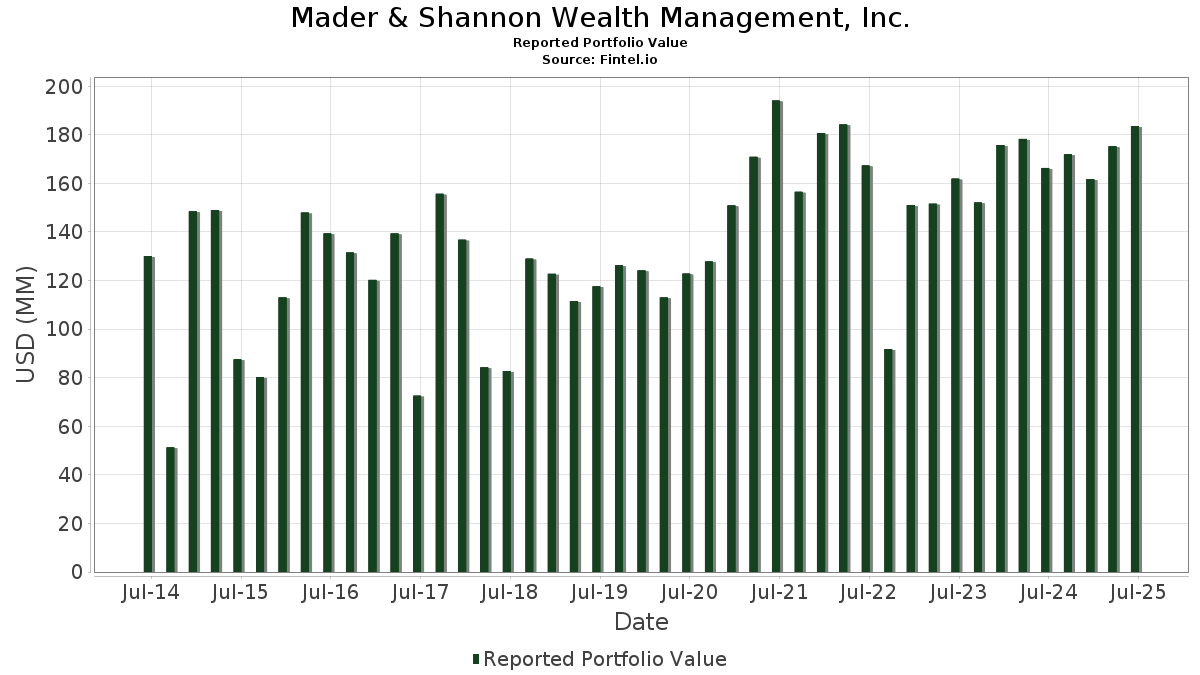

| Portfolio Value | $ 183,593,169 |

| Current Positions | 22 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Mader & Shannon Wealth Management, Inc. has disclosed 22 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 183,593,169 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Mader & Shannon Wealth Management, Inc.’s top holdings are iShares Trust - iShares 1-3 Year Treasury Bond ETF (US:SHY) , SPDR Gold Trust (US:GLD) , iShares Gold Trust (US:IAU) , iShares Trust - iShares 0-3 Month Treasury Bond ETF (US:SGOV) , and iShares Trust - iShares Short Treasury Bond ETF (US:SHV) . Mader & Shannon Wealth Management, Inc.’s new positions include iShares Trust - iShares U.S. Home Construction ETF (US:ITB) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.44 | 36.76 | 20.0206 | 20.0206 | |

| 0.03 | 3.26 | 1.7739 | 1.7739 | |

| 0.02 | 3.29 | 1.7906 | 0.3582 | |

| 0.01 | 6.24 | 3.3994 | 0.3120 | |

| 0.02 | 5.12 | 2.7862 | 0.2765 | |

| 0.04 | 7.83 | 4.2662 | 0.2750 | |

| 0.07 | 2.78 | 1.5116 | 0.2501 | |

| 0.02 | 2.75 | 1.4990 | 0.1286 | |

| 0.05 | 2.33 | 1.2685 | 0.1092 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 24.91 | 13.5669 | -4.0103 | |

| 0.40 | 24.88 | 13.5529 | -3.9659 | |

| 0.01 | 4.59 | 2.4989 | -1.8968 | |

| 0.15 | 7.75 | 4.2219 | -1.8261 | |

| 0.01 | 5.86 | 3.1919 | -0.8909 | |

| 0.19 | 18.94 | 10.3155 | -0.4048 | |

| 0.09 | 10.12 | 5.5104 | -0.2057 | |

| 0.02 | 2.42 | 1.3200 | -0.1045 | |

| 0.14 | 6.28 | 3.4214 | -0.0842 | |

| 0.02 | 2.92 | 1.5889 | -0.0488 |

13F and Fund Filings

This form was filed on 2025-07-31 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.44 | 36.76 | 20.0206 | 20.0206 | |||||

| GLD / SPDR Gold Trust | 0.08 | -23.58 | 24.91 | -19.15 | 13.5669 | -4.0103 | |||

| IAU / iShares Gold Trust | 0.40 | -23.38 | 24.88 | -18.96 | 13.5529 | -3.9659 | |||

| SGOV / iShares Trust - iShares 0-3 Month Treasury Bond ETF | 0.19 | 0.77 | 18.94 | 0.79 | 10.3155 | -0.4048 | |||

| SHV / iShares Trust - iShares Short Treasury Bond ETF | 0.09 | 1.01 | 10.12 | 0.98 | 5.5104 | -0.2057 | |||

| CDW / CDW Corporation | 0.04 | 0.47 | 7.83 | 11.97 | 4.2662 | 0.2750 | |||

| AFK / VanEck ETF Trust - VanEck Africa Index ETF | 0.15 | -35.43 | 7.75 | -26.88 | 4.2219 | -1.8261 | |||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.14 | 0.52 | 6.28 | 2.23 | 3.4214 | -0.0842 | |||

| MLM / Martin Marietta Materials, Inc. | 0.01 | 0.45 | 6.24 | 15.34 | 3.3994 | 0.3120 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | 0.50 | 5.86 | -18.10 | 3.1919 | -0.8909 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 0.85 | 5.12 | 16.30 | 2.7862 | 0.2765 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | -0.03 | 4.59 | -40.46 | 2.4989 | -1.8968 | |||

| FSLR / First Solar, Inc. | 0.02 | 0.01 | 3.29 | 30.96 | 1.7906 | 0.3582 | |||

| ITB / iShares Trust - iShares U.S. Home Construction ETF | 0.03 | 3.26 | 1.7739 | 1.7739 | |||||

| DHI / D.R. Horton, Inc. | 0.02 | 0.21 | 2.92 | 1.64 | 1.5889 | -0.0488 | |||

| DINO / HF Sinclair Corporation | 0.07 | 0.46 | 2.78 | 25.51 | 1.5116 | 0.2501 | |||

| MPC / Marathon Petroleum Corporation | 0.02 | 0.49 | 2.75 | 14.62 | 1.4990 | 0.1286 | |||

| VLO / Valero Energy Corporation | 0.02 | 0.53 | 2.43 | 2.31 | 1.3259 | -0.0315 | |||

| PSX / Phillips 66 | 0.02 | 0.46 | 2.42 | -2.92 | 1.3200 | -0.1045 | |||

| FCX / Freeport-McMoRan Inc. | 0.05 | 0.10 | 2.33 | 14.62 | 1.2685 | 0.1092 | |||

| XLB / The Select Sector SPDR Trust - The Materials Select Sector SPDR Fund | 0.02 | 0.04 | 1.91 | 2.19 | 1.0409 | -0.0263 | |||

| WMT / Walmart Inc. | 0.00 | -16.66 | 0.24 | -7.48 | 0.1285 | -0.0165 | |||

| SHYG / iShares Trust - iShares 0-5 Year High Yield Corporate Bond ETF | 0.00 | -100.00 | 0.00 | 0.0000 |