Basic Stats

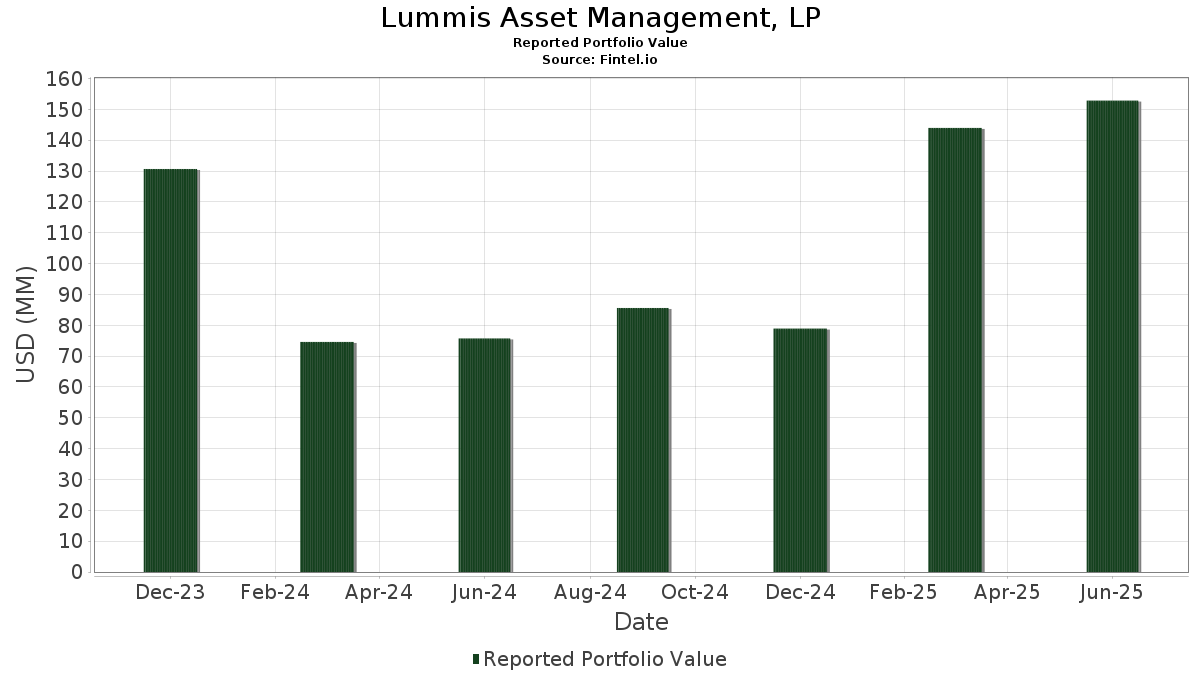

| Portfolio Value | $ 152,850,323 |

| Current Positions | 160 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Lummis Asset Management, LP has disclosed 160 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 152,850,323 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Lummis Asset Management, LP’s top holdings are Microsoft Corporation (US:MSFT) , Matador Resources Company (US:MTDR) , Apple Inc. (US:AAPL) , Berkshire Hathaway Inc. (US:BRK.B) , and Oracle Corporation (US:ORCL) . Lummis Asset Management, LP’s new positions include Amrize AG (CH:AMRZ) , First National Bank Alaska (US:FBAK) , Aon plc (US:AON) , Liberty Media Corporation (US:BATRR) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 17.03 | 10.7768 | 1.8152 | |

| 0.03 | 7.51 | 4.7496 | 1.5100 | |

| 0.05 | 6.18 | 3.9084 | 1.0377 | |

| 0.17 | 4.10 | 2.5949 | 0.7994 | |

| 0.01 | 3.90 | 2.4656 | 0.3813 | |

| 0.01 | 0.48 | 0.3131 | 0.3131 | |

| 0.03 | 6.25 | 3.9550 | 0.2752 | |

| 0.00 | 0.42 | 0.2653 | 0.2569 | |

| 0.00 | 0.36 | 0.2270 | 0.2141 | |

| 0.01 | 1.71 | 1.0835 | 0.1407 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.05 | 10.71 | 6.7766 | -2.9700 | |

| 0.02 | 7.79 | 4.9309 | -1.1232 | |

| 0.34 | 4.27 | 2.7009 | -0.6384 | |

| 0.34 | 15.89 | 10.0521 | -0.6347 | |

| 0.00 | 1.67 | 1.0592 | -0.6099 | |

| 0.00 | 2.89 | 1.8286 | -0.3970 | |

| 0.01 | 2.82 | 1.7844 | -0.3903 | |

| 0.02 | 2.48 | 1.5702 | -0.3147 | |

| 0.04 | 3.51 | 2.2187 | -0.2981 | |

| 0.02 | 3.28 | 2.0746 | -0.2135 |

13F and Fund Filings

This form was filed on 2025-08-11 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.03 | -0.22 | 17.03 | 31.98 | 10.7768 | 1.8152 | |||

| MTDR / Matador Resources Company | 0.34 | 0.91 | 15.89 | 3.24 | 10.0521 | -0.6347 | |||

| AAPL / Apple Inc. | 0.05 | -27.26 | 10.71 | -23.69 | 6.7766 | -2.9700 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.02 | -0.40 | 7.79 | -10.61 | 4.9309 | -1.1232 | |||

| ORCL / Oracle Corporation | 0.03 | -0.79 | 7.51 | 60.91 | 4.7496 | 1.5100 | |||

| GOOG / Alphabet Inc. | 0.03 | -0.09 | 6.25 | 17.97 | 3.9550 | 0.2752 | |||

| ABT / Abbott Laboratories | 0.05 | 45.95 | 6.18 | 49.43 | 3.9084 | 1.0377 | |||

| GD / General Dynamics Corporation | 0.02 | -0.62 | 4.48 | 9.00 | 2.8364 | -0.0201 | |||

| BSM / Black Stone Minerals, L.P. - Limited Partnership | 0.34 | 0.00 | 4.27 | -11.23 | 2.7009 | -0.6384 | |||

| TFPM / Triple Flag Precious Metals Corp. | 0.17 | 25.05 | 4.10 | 58.61 | 2.5949 | 0.7994 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | -0.27 | 3.90 | 29.82 | 2.4656 | 0.3813 | |||

| AIG / American International Group, Inc. | 0.04 | -1.05 | 3.51 | -3.23 | 2.2187 | -0.2981 | |||

| GOLF / Acushnet Holdings Corp. | 0.04 | -2.31 | 3.30 | 5.43 | 2.0877 | -0.0856 | |||

| AMT / American Tower Corporation | 0.02 | 0.00 | 3.28 | -0.49 | 2.0746 | -0.2135 | |||

| ROST / Ross Stores, Inc. | 0.02 | -0.69 | 2.98 | 0.68 | 1.8865 | -0.1703 | |||

| EQIX / Equinix, Inc. | 0.00 | 0.00 | 2.89 | -9.83 | 1.8286 | -0.3970 | |||

| AYI / Acuity Inc. | 0.01 | -0.80 | 2.83 | 15.92 | 1.7921 | 0.0954 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | -1.71 | 2.82 | -9.96 | 1.7844 | -0.3903 | |||

| WFC / Wells Fargo & Company | 0.03 | -0.76 | 2.67 | 10.38 | 1.6894 | 0.0099 | |||

| PEP / PepsiCo, Inc. | 0.02 | -3.97 | 2.48 | -8.59 | 1.5702 | -0.3147 | |||

| XOM / Exxon Mobil Corporation | 0.02 | 0.00 | 2.31 | -2.90 | 1.4615 | -0.1904 | |||

| JNJ / Johnson & Johnson | 0.01 | -1.06 | 2.23 | 1.09 | 1.4119 | -0.1214 | |||

| SCHW / The Charles Schwab Corporation | 0.02 | -1.36 | 1.85 | 16.11 | 1.1722 | 0.0642 | |||

| GTX / Garrett Motion Inc. | 0.18 | -21.74 | 1.84 | -3.86 | 1.1667 | -0.1653 | |||

| DG / Dollar General Corporation | 0.01 | -1.23 | 1.71 | 26.16 | 1.0835 | 0.1407 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 1.67 | -30.38 | 1.0592 | -0.6099 | |||

| KO / The Coca-Cola Company | 0.02 | -0.99 | 1.62 | -2.87 | 1.0273 | -0.1334 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 0.00 | 1.55 | 16.88 | 0.9816 | 0.0594 | |||

| SCHO / Schwab Strategic Trust - Schwab Short-Term U.S. Treasury ETF | 0.05 | -0.56 | 1.30 | -0.38 | 0.8201 | -0.0836 | |||

| ABBV / AbbVie Inc. | 0.01 | 0.00 | 1.23 | 1.48 | 0.7805 | -0.0638 | |||

| COP / ConocoPhillips | 0.01 | 0.00 | 1.20 | -1.80 | 0.7593 | -0.0887 | |||

| VGK / Vanguard International Equity Index Funds - Vanguard FTSE Europe ETF | 0.02 | 5.89 | 1.19 | 16.96 | 0.7550 | 0.0460 | |||

| DVN / Devon Energy Corporation | 0.04 | -0.15 | 1.15 | -13.37 | 0.7302 | -0.1945 | |||

| PG / The Procter & Gamble Company | 0.01 | 0.00 | 1.03 | -5.59 | 0.6519 | -0.1062 | |||

| VXUS / Vanguard STAR Funds - Vanguard Total International Stock ETF | 0.01 | 6.49 | 0.97 | 18.46 | 0.6137 | 0.0450 | |||

| AMGN / Amgen Inc. | 0.00 | 0.00 | 0.96 | -0.93 | 0.6079 | -0.0655 | |||

| WMB / The Williams Companies, Inc. | 0.02 | -0.29 | 0.95 | 4.53 | 0.5992 | -0.0297 | |||

| CVX / Chevron Corporation | 0.01 | -2.75 | 0.94 | 10.20 | 0.5949 | 0.0019 | |||

| FFIN / First Financial Bankshares, Inc. | 0.03 | 0.00 | 0.88 | 0.92 | 0.5563 | -0.0491 | |||

| SSB / SouthState Corporation | 0.01 | -1.64 | 0.87 | -0.46 | 0.5474 | -0.0563 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | 0.00 | 0.76 | 4.51 | 0.4840 | -0.0240 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.63 | 1.60 | 0.4014 | -0.0325 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.60 | 13.96 | 0.3774 | 0.0139 | |||

| WTM / White Mountains Insurance Group, Ltd. | 0.00 | 0.00 | 0.57 | -0.87 | 0.3602 | -0.0387 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 0.00 | 0.48 | 24.48 | 0.3029 | 0.0356 | |||

| AMRZ / Amrize AG | 0.01 | 0.48 | 0.3131 | 0.3131 | |||||

| RTX / RTX Corporation | 0.00 | 2,848.91 | 0.42 | 3,391.67 | 0.2653 | 0.2569 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -5.83 | 0.38 | -12.64 | 0.2406 | -0.0621 | |||

| PSX / Phillips 66 | 0.00 | 1,907.33 | 0.36 | 1,888.89 | 0.2270 | 0.2141 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | -32.73 | 0.33 | -25.57 | 0.2064 | -0.0981 | |||

| APH / Amphenol Corporation | 0.00 | 0.00 | 0.32 | 50.47 | 0.2022 | 0.0548 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.31 | -3.79 | 0.1932 | -0.0275 | |||

| O / Realty Income Corporation | 0.01 | -17.13 | 0.30 | -17.81 | 0.1905 | -0.0636 | |||

| PFE / Pfizer Inc. | 0.01 | 0.00 | 0.28 | 0.72 | 0.1760 | -0.0158 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.00 | 0.25 | 18.10 | 0.1574 | 0.0112 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.23 | 37.65 | 0.1483 | 0.0302 | |||

| CLX / The Clorox Company | 0.00 | 0.00 | 0.22 | -12.20 | 0.1370 | -0.0344 | |||

| BN / Brookfield Corporation | 0.00 | 0.00 | 0.20 | 17.86 | 0.1257 | 0.0088 | |||

| BSV / Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF | 0.00 | 0.00 | 0.19 | 0.52 | 0.1225 | -0.0112 | |||

| NUV / Nuveen Municipal Value Fund, Inc. | 0.02 | 0.00 | 0.19 | -0.52 | 0.1210 | -0.0130 | |||

| ATO / Atmos Energy Corporation | 0.00 | 0.00 | 0.17 | -0.57 | 0.1100 | -0.0111 | |||

| GLD / SPDR Gold Trust | 0.00 | 0.00 | 0.16 | 5.96 | 0.1047 | -0.0004 | |||

| CET / Central Securities Corporation | 0.00 | 0.00 | 0.15 | 6.62 | 0.0919 | -0.0029 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | 0.00 | 0.13 | -1.48 | 0.0843 | -0.0101 | |||

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.00 | 0.00 | 0.13 | 0.76 | 0.0836 | -0.0080 | |||

| XEL / Xcel Energy Inc. | 0.00 | -61.63 | 0.13 | -63.14 | 0.0818 | -0.1615 | |||

| FBAK / First National Bank Alaska | 0.00 | 0.12 | 0.0771 | 0.0771 | |||||

| DKS / DICK'S Sporting Goods, Inc. | 0.00 | 0.00 | 0.11 | 12.63 | 0.0678 | 0.0017 | |||

| BG / Bunge Global SA | 0.00 | 0.00 | 0.08 | 5.13 | 0.0525 | -0.0022 | |||

| V / Visa Inc. | 0.00 | 0.00 | 0.08 | 1.27 | 0.0510 | -0.0043 | |||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.08 | -5.88 | 0.0508 | -0.0088 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 0.00 | 0.08 | 10.29 | 0.0478 | 0.0003 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.00 | 0.00 | 0.07 | -2.67 | 0.0467 | -0.0059 | |||

| Canadian Pac Railway / (13645T100) | 0.00 | 0.07 | 0.0000 | ||||||

| NVDA / NVIDIA Corporation | 0.00 | 0.00 | 0.06 | 46.51 | 0.0400 | 0.0099 | |||

| FDS / FactSet Research Systems Inc. | 0.00 | 0.00 | 0.06 | -1.59 | 0.0396 | -0.0046 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.00 | 0.00 | 0.06 | -9.23 | 0.0379 | -0.0079 | |||

| DUK / Duke Energy Corporation | 0.00 | 0.00 | 0.06 | -1.67 | 0.0373 | -0.0050 | |||

| MDLZ / Mondelez International, Inc. | 0.00 | 0.00 | 0.06 | 0.00 | 0.0352 | -0.0037 | |||

| MINT / PIMCO ETF Trust - PIMCO Enhanced Short Maturity Active Exchange-Traded Fund | 0.00 | 0.00 | 0.05 | 0.00 | 0.0344 | -0.0034 | |||

| CVS / CVS Health Corporation | 0.00 | 0.00 | 0.05 | -1.89 | 0.0332 | -0.0039 | |||

| CFR / Cullen/Frost Bankers, Inc. | 0.00 | 0.00 | 0.05 | 4.08 | 0.0323 | -0.0022 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | 0.00 | 0.05 | -3.92 | 0.0311 | -0.0044 | |||

| LUV / Southwest Airlines Co. | 0.00 | 0.00 | 0.05 | -4.00 | 0.0308 | -0.0042 | |||

| IP / International Paper Company | 0.00 | 0.00 | 0.05 | 4.44 | 0.0301 | -0.0016 | |||

| Brookfield Asset Mgm / (112585104) | 0.00 | 0.04 | 0.0000 | ||||||

| NFLX / Netflix, Inc. | 0.00 | 0.00 | 0.04 | 7.89 | 0.0261 | -0.0007 | |||

| KMI / Kinder Morgan, Inc. | 0.00 | 0.00 | 0.04 | 2.56 | 0.0255 | -0.0019 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.00 | 0.00 | 0.04 | 12.50 | 0.0233 | 0.0005 | |||

| ADSK / Autodesk, Inc. | 0.00 | 0.00 | 0.03 | 17.24 | 0.0217 | 0.0016 | |||

| CAG / Conagra Brands, Inc. | 0.00 | 0.00 | 0.03 | -24.32 | 0.0183 | -0.0075 | |||

| TXN / Texas Instruments Incorporated | 0.00 | 0.00 | 0.03 | 18.18 | 0.0167 | 0.0008 | |||

| ACN / Accenture plc | 0.00 | 0.00 | 0.03 | -3.70 | 0.0165 | -0.0024 | |||

| LW / Lamb Weston Holdings, Inc. | 0.00 | 0.00 | 0.03 | -3.85 | 0.0163 | -0.0020 | |||

| PBT / Permian Basin Royalty Trust | 0.00 | 0.00 | 0.02 | 22.22 | 0.0146 | 0.0019 | |||

| HHH / Howard Hughes Holdings Inc. | 0.00 | 0.00 | 0.02 | -12.00 | 0.0145 | -0.0030 | |||

| WMT / Walmart Inc. | 0.00 | 0.00 | 0.02 | 10.00 | 0.0145 | 0.0002 | |||

| FI / Fiserv, Inc. | 0.00 | 0.00 | 0.02 | -21.43 | 0.0140 | -0.0057 | |||

| TPG / TPG Inc. | 0.00 | 0.00 | 0.02 | 11.76 | 0.0126 | 0.0001 | |||

| PGR / The Progressive Corporation | 0.00 | 0.00 | 0.02 | -5.00 | 0.0123 | -0.0020 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.00 | 0.02 | 72.73 | 0.0122 | 0.0041 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | 0.00 | 0.02 | 28.57 | 0.0119 | 0.0017 | |||

| MDT / Medtronic plc | 0.00 | 0.00 | 0.02 | -5.26 | 0.0117 | -0.0015 | |||

| AZO / AutoZone, Inc. | 0.00 | 0.00 | 0.02 | -5.26 | 0.0117 | -0.0015 | |||

| VRT / Vertiv Holdings Co | 0.00 | 0.00 | 0.02 | 80.00 | 0.0115 | 0.0044 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 0.00 | 0.02 | 30.77 | 0.0110 | 0.0014 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 0.02 | 30.77 | 0.0108 | 0.0018 | |||

| AON / Aon plc | 0.00 | 0.02 | 0.0000 | ||||||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.02 | 0.00 | 0.0095 | -0.0009 | |||

| LYB / LyondellBasell Industries N.V. | 0.00 | 0.00 | 0.01 | -17.65 | 0.0093 | -0.0028 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 0.00 | 0.01 | -41.67 | 0.0091 | -0.0077 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.00 | 0.00 | 0.01 | 7.69 | 0.0089 | -0.0007 | |||

| DOW / Dow Inc. | 0.00 | 0.00 | 0.01 | -31.58 | 0.0085 | -0.0049 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | 0.00 | 0.01 | -14.29 | 0.0082 | -0.0016 | |||

| APA / APA Corporation | 0.00 | 0.00 | 0.01 | -14.29 | 0.0081 | -0.0021 | |||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0.00 | 0.00 | 0.01 | 0.00 | 0.0079 | -0.0007 | |||

| DHR / Danaher Corporation | 0.00 | 0.00 | 0.01 | -8.33 | 0.0074 | -0.0010 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.00 | 0.00 | 0.01 | 11.11 | 0.0067 | -0.0000 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 0.01 | 0.00 | 0.0063 | -0.0003 | |||

| DD / DuPont de Nemours, Inc. | 0.00 | 0.00 | 0.01 | 12.50 | 0.0059 | -0.0002 | |||

| LIN / Linde plc | 0.00 | 0.00 | 0.01 | 0.00 | 0.0056 | -0.0005 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0.00 | -95.04 | 0.01 | -95.70 | 0.0055 | -0.1240 | |||

| CSX / CSX Corporation | 0.00 | 0.00 | 0.01 | 16.67 | 0.0047 | 0.0000 | |||

| ELV / Elevance Health, Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0044 | -0.0010 | |||

| EOG / EOG Resources, Inc. | 0.00 | 0.00 | 0.01 | -14.29 | 0.0044 | -0.0008 | |||

| BATRR / Liberty Media Corporation | 0.00 | 0.01 | 0.0000 | ||||||

| QCOM / QUALCOMM Incorporated | 0.00 | 0.00 | 0.01 | 0.00 | 0.0042 | -0.0002 | |||

| ZTS / Zoetis Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0039 | -0.0006 | |||

| STEL / Stellar Bancorp, Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0035 | -0.0003 | |||

| EXE / Expand Energy Corporation | 0.00 | 0.00 | 0.01 | 25.00 | 0.0032 | -0.0001 | |||

| CRM / Salesforce, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0028 | -0.0002 | |||

| NEE / NextEra Energy, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0027 | -0.0003 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.00 | 33.33 | 0.0027 | 0.0001 | |||

| EW / Edwards Lifesciences Corporation | 0.00 | 0.00 | 0.00 | 33.33 | 0.0026 | -0.0000 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.00 | 1,400.00 | 0.00 | 0.00 | 0.0027 | -0.0003 | |||

| LUNMF / Lundin Mining Corporation | 0.00 | 0.00 | 0.00 | 50.00 | 0.0024 | 0.0004 | |||

| ADBE / Adobe Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0022 | -0.0002 | |||

| PAYX / Paychex, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0020 | -0.0003 | |||

| HSY / The Hershey Company | 0.00 | 0.00 | 0.00 | 50.00 | 0.0020 | 0.0003 | |||

| SLV / iShares Silver Trust | 0.00 | 0.00 | 0.00 | 0.00 | 0.0018 | -0.0001 | |||

| Intrcontinentalexchange / (45865V100) | 0.00 | 0.00 | 0.0000 | ||||||

| TCEHY / Tencent Holdings Limited - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.00 | 0.00 | 0.0015 | -0.0001 | |||

| URI / United Rentals, Inc. | 0.00 | 0.00 | 0.00 | 100.00 | 0.0014 | 0.0001 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.00 | 0.00 | 0.0014 | -0.0001 | |||

| PLD / Prologis, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0014 | -0.0002 | |||

| VLTO / Veralto Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 0.0012 | -0.0001 | |||

| NERD / Listed Funds Trust - Roundhill Video Games ETF | 0.00 | 0.00 | 0.00 | 0.00 | 0.0011 | 0.0002 | |||

| UAL / United Airlines Holdings, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0011 | 0.0001 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.00 | 0.00 | 0.0010 | 0.0004 | ||||

| FECCF / Frontera Energy Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 0.0010 | -0.0001 | |||

| ALGN / Align Technology, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0010 | 0.0001 | |||

| CBOE / Cboe Global Markets, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0009 | -0.0001 | |||

| IR / Ingersoll Rand Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0008 | -0.0000 | |||

| HON / Honeywell International Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0007 | 0.0000 | |||

| NOC / Northrop Grumman Corporation | 0.00 | 0.00 | 0.00 | 0.00 | 0.0006 | -0.0001 | |||

| CME / CME Group Inc. | 0.00 | 0.00 | 0.00 | 0.0005 | -0.0000 | ||||

| FUN / Six Flags Entertainment Corporation | 0.00 | 0.00 | 0.00 | 0.0005 | -0.0001 | ||||

| SEG / Seaport Entertainment Group Inc. | 0.00 | 0.00 | 0.00 | 0.0004 | -0.0001 | ||||

| GEHC / GE HealthCare Technologies Inc. | 0.00 | 0.00 | 0.00 | 0.0002 | -0.0000 | ||||

| LLYVK / Liberty Live Group | 0.00 | 0.00 | 0.00 | 0.0001 | 0.0000 | ||||

| MIDD / The Middleby Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RTX / RTX Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VDC / Vanguard World Fund - Vanguard Consumer Staples ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BBVA / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 |