Basic Stats

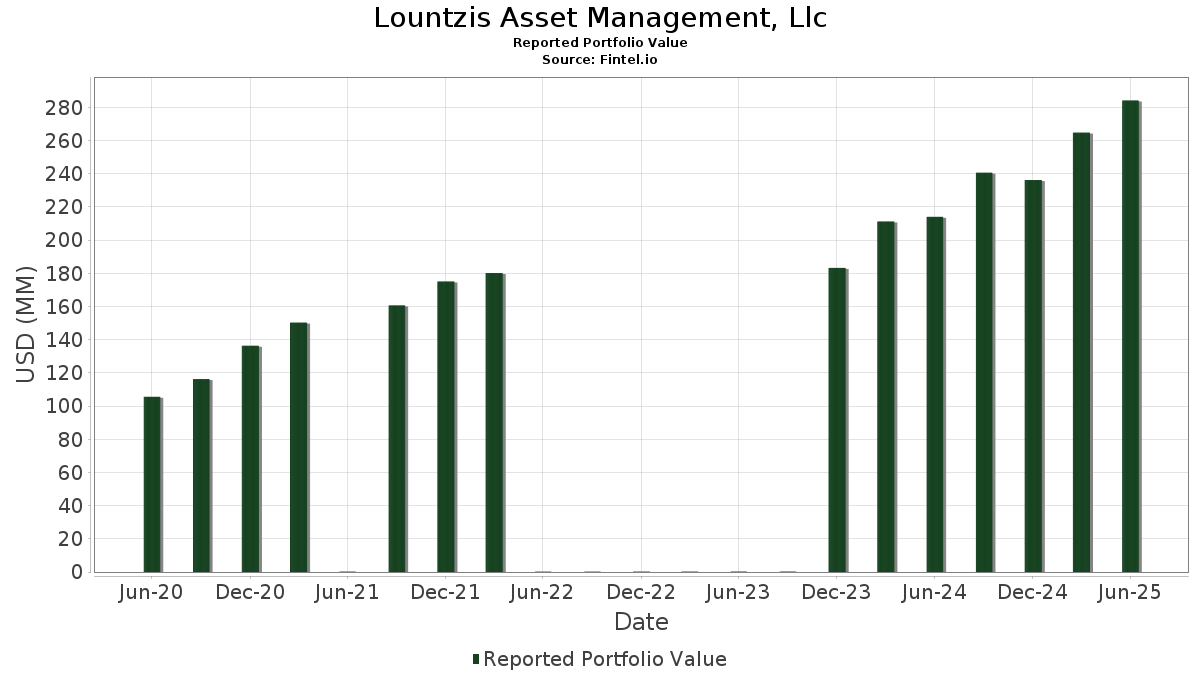

| Portfolio Value | $ 284,057,744 |

| Current Positions | 53 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Lountzis Asset Management, Llc has disclosed 53 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 284,057,744 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Lountzis Asset Management, Llc’s top holdings are Berkshire Hathaway Inc. (US:BRK.B) , Applied Materials, Inc. (US:AMAT) , Wells Fargo & Company (US:WFC) , Oracle Corporation (US:ORCL) , and The Progressive Corporation (US:PGR) . Lountzis Asset Management, Llc’s new positions include Rolls-Royce Holdings plc (US:RYCEF) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.09 | 19.75 | 6.9533 | 2.1702 | |

| 0.12 | 22.02 | 7.7502 | 0.9016 | |

| 0.03 | 17.54 | 6.1757 | 0.8149 | |

| 0.03 | 5.59 | 1.9688 | 0.6633 | |

| 0.25 | 19.98 | 7.0352 | 0.4926 | |

| 0.11 | 14.08 | 4.9577 | 0.4012 | |

| 0.25 | 11.47 | 4.0377 | 0.2266 | |

| 0.29 | 2.88 | 1.0121 | 0.2015 | |

| 0.01 | 2.41 | 0.8483 | 0.0521 | |

| 0.00 | 0.72 | 0.2552 | 0.0512 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.14 | 65.76 | 23.1494 | -4.0044 | |

| 0.07 | 19.31 | 6.7970 | -0.5822 | |

| 0.01 | 3.38 | 1.1915 | -0.5300 | |

| 0.11 | 12.05 | 4.2434 | -0.4909 | |

| 0.04 | 5.04 | 1.7755 | -0.1547 | |

| 0.04 | 6.69 | 2.3543 | -0.1418 | |

| 0.02 | 3.83 | 1.3491 | -0.1015 | |

| 0.00 | 0.69 | 0.2430 | -0.0548 | |

| 0.00 | 0.73 | 0.2566 | -0.0448 | |

| 0.01 | 0.91 | 0.3203 | -0.0348 |

13F and Fund Filings

This form was filed on 2025-07-31 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BRK.B / Berkshire Hathaway Inc. | 0.14 | -0.00 | 65.76 | -8.51 | 23.1494 | -4.0044 | |||

| AMAT / Applied Materials, Inc. | 0.12 | 0.03 | 22.02 | 21.45 | 7.7502 | 0.9016 | |||

| WFC / Wells Fargo & Company | 0.25 | 0.00 | 19.98 | 15.40 | 7.0352 | 0.4926 | |||

| ORCL / Oracle Corporation | 0.09 | 0.00 | 19.75 | 56.01 | 6.9533 | 2.1702 | |||

| PGR / The Progressive Corporation | 0.07 | -0.14 | 19.31 | -1.15 | 6.7970 | -0.5822 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.03 | 0.04 | 17.54 | 23.63 | 6.1757 | 0.8149 | |||

| KKR / KKR & Co. Inc. | 0.11 | 0.00 | 14.08 | 16.77 | 4.9577 | 0.4012 | |||

| CDNS / Cadence Design Systems, Inc. | 0.04 | 0.04 | 13.69 | 7.88 | 4.8197 | 0.0253 | |||

| BRO / Brown & Brown, Inc. | 0.11 | -0.33 | 12.05 | -3.81 | 4.2434 | -0.4909 | |||

| USB / U.S. Bancorp | 0.25 | -0.14 | 11.47 | 13.70 | 4.0377 | 0.2266 | |||

| GOOGL / Alphabet Inc. | 0.05 | -1.91 | 8.60 | 7.63 | 3.0288 | 0.0087 | |||

| PCOR / Procore Technologies, Inc. | 0.10 | -0.05 | 6.79 | 7.40 | 2.3919 | 0.0016 | |||

| ZTS / Zoetis Inc. | 0.04 | 0.00 | 6.69 | 1.23 | 2.3543 | -0.1418 | |||

| NET / Cloudflare, Inc. | 0.03 | 0.00 | 5.59 | 61.85 | 1.9688 | 0.6633 | |||

| PEP / PepsiCo, Inc. | 0.04 | 0.00 | 5.04 | -1.29 | 1.7755 | -0.1547 | |||

| MLM / Martin Marietta Materials, Inc. | 0.01 | 0.00 | 4.67 | 9.17 | 1.6431 | 0.0277 | |||

| LOW / Lowe's Companies, Inc. | 0.02 | 0.00 | 3.83 | -0.18 | 1.3491 | -0.1015 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 0.00 | 3.38 | -25.72 | 1.1915 | -0.5300 | |||

| SKYT / SkyWater Technology, Inc. | 0.29 | 0.08 | 2.88 | 34.03 | 1.0121 | 0.2015 | |||

| LH / Labcorp Holdings Inc. | 0.01 | 0.00 | 2.41 | 14.33 | 0.8483 | 0.0521 | |||

| CNSWF / Constellation Software Inc. | 0.00 | 0.00 | 1.15 | 2.95 | 0.4058 | -0.0170 | |||

| ABT / Abbott Laboratories | 0.01 | 0.00 | 1.04 | 4.54 | 0.3651 | -0.0097 | |||

| GOOG / Alphabet Inc. | 0.01 | 0.00 | 1.03 | 9.22 | 0.3633 | 0.0063 | |||

| MHK / Mohawk Industries, Inc. | 0.01 | -1.42 | 0.91 | -3.19 | 0.3203 | -0.0348 | |||

| WSFS / WSFS Financial Corporation | 0.02 | 0.00 | 0.83 | 5.21 | 0.2918 | -0.0057 | |||

| BK / The Bank of New York Mellon Corporation | 0.01 | 0.00 | 0.80 | 14.76 | 0.2823 | 0.0183 | |||

| ICE / Intercontinental Exchange, Inc. | 0.00 | 0.00 | 0.75 | 12.18 | 0.2629 | 0.0115 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 0.00 | 0.75 | -0.80 | 0.2625 | -0.0214 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.73 | -8.66 | 0.2566 | -0.0448 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.72 | 34.32 | 0.2552 | 0.0512 | |||

| YUM / Yum! Brands, Inc. | 0.00 | -12.69 | 0.69 | -12.44 | 0.2430 | -0.0548 | |||

| MSFT / Microsoft Corporation | 0.00 | 0.00 | 0.69 | 27.22 | 0.2420 | 0.0378 | |||

| AON / Aon plc | 0.00 | 0.00 | 0.68 | 3.83 | 0.2386 | -0.0079 | |||

| FWONK / Formula One Group | 0.01 | 0.00 | 0.62 | 18.92 | 0.2170 | 0.0213 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.00 | 0.61 | -4.37 | 0.2156 | -0.0262 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 0.00 | 0.58 | 12.52 | 0.2026 | 0.0094 | |||

| ERF / EUROFINS SCIENTIFIC SE COMMON STOCK EUR.1 | 0.01 | 0.00 | 0.53 | 16.26 | 0.1865 | 0.0145 | |||

| FRFHF / Fairfax Financial Holdings Limited | 0.00 | 0.00 | 0.47 | 17.66 | 0.1666 | 0.0145 | |||

| SCHW / The Charles Schwab Corporation | 0.01 | 0.00 | 0.47 | 13.77 | 0.1659 | 0.0094 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.00 | 0.44 | 24.86 | 0.1557 | 0.0218 | |||

| GEF / Greif, Inc. | 0.01 | 0.00 | 0.39 | 22.33 | 0.1373 | 0.0170 | |||

| JNJ / Johnson & Johnson | 0.00 | 0.00 | 0.38 | -1.79 | 0.1351 | -0.0124 | |||

| AAPL / Apple Inc. | 0.00 | 0.00 | 0.37 | -2.38 | 0.1302 | -0.0129 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -7.03 | 0.35 | 10.00 | 0.1241 | 0.0032 | |||

| J / Jacobs Solutions Inc. | 0.00 | 0.00 | 0.35 | 7.67 | 0.1236 | 0.0001 | |||

| V / Visa Inc. | 0.00 | 0.00 | 0.34 | 5.20 | 0.1213 | -0.0024 | |||

| ELV / Elevance Health, Inc. | 0.00 | 0.00 | 0.29 | -6.09 | 0.1034 | -0.0147 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.28 | 4.87 | 0.0989 | -0.0022 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.28 | 8.56 | 0.0983 | 0.0010 | |||

| FWONA / Formula One Group | 0.00 | -6.92 | 0.27 | 10.57 | 0.0958 | 0.0028 | |||

| CACC / Credit Acceptance Corporation | 0.00 | -16.84 | 0.25 | -12.94 | 0.0877 | -0.0206 | |||

| RYCEF / Rolls-Royce Holdings plc | 0.02 | 0.23 | 0.0000 | ||||||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 0.23 | -11.33 | 0.0801 | -0.0166 |