Basic Stats

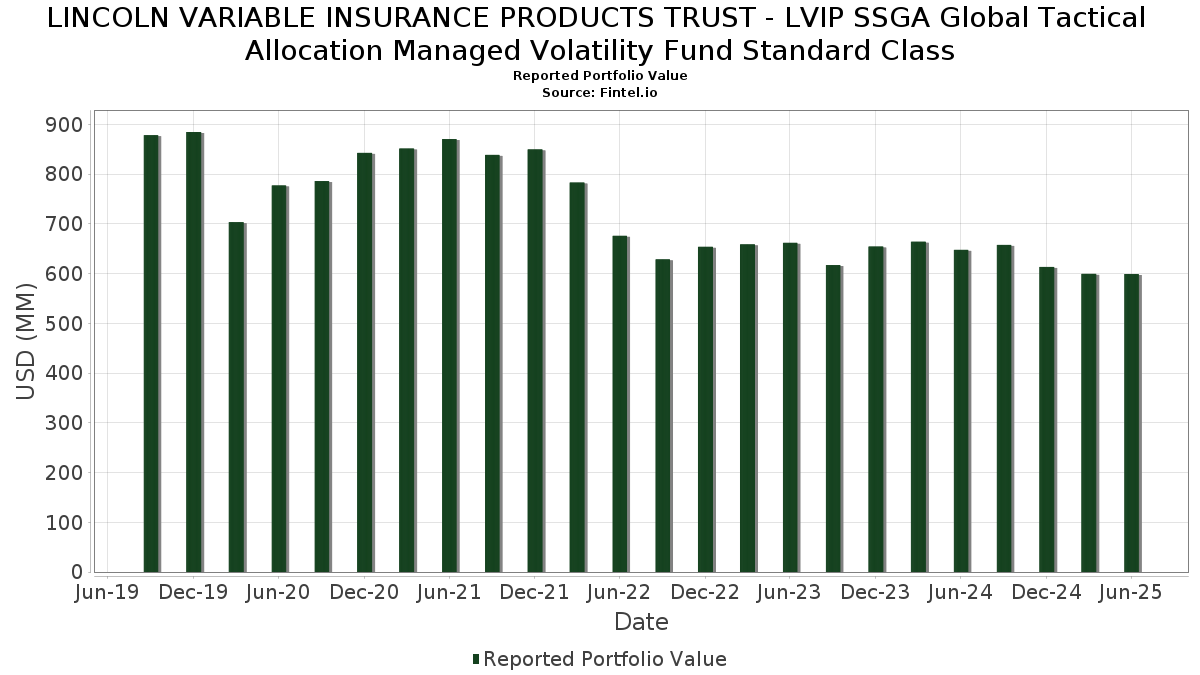

| Portfolio Value | $ 599,271,938 |

| Current Positions | 35 |

Latest Holdings, Performance, AUM (from 13F, 13D)

LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP SSGA Global Tactical Allocation Managed Volatility Fund Standard Class has disclosed 35 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 599,271,938 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). LINCOLN VARIABLE INSURANCE PRODUCTS TRUST - LVIP SSGA Global Tactical Allocation Managed Volatility Fund Standard Class’s top holdings are LVIP SSgA Bond Index Fund (US:US5348986630) , LVIP SSgA Large Cap 100 Fund (US:US5348986226) , LVIP SSgA Developed International Fund (US:US5348986481) , SPDR Series Trust - SPDR Portfolio TIPS ETF (US:SPIP) , and SPDR S&P 500 ETF (US:SPY) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.06 | 36.55 | 6.0916 | 4.1736 | |

| 10.82 | 109.82 | 18.3045 | 2.4115 | |

| 0.61 | 25.90 | 4.3164 | 1.4489 | |

| 0.91 | 20.49 | 3.4158 | 1.4439 | |

| 0.09 | 8.84 | 1.4736 | 0.6725 | |

| 0.45 | 11.56 | 1.9272 | 0.4368 | |

| 0.60 | 25.60 | 4.2675 | 0.4031 | |

| 4.47 | 70.31 | 11.7185 | 0.1814 | |

| 0.03 | 9.65 | 1.6081 | 0.0884 | |

| 0.11 | 11.87 | 1.9783 | 0.0790 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.15 | 14.40 | 2.4005 | -2.3605 | |

| 1.25 | 11.25 | 1.8756 | -1.8497 | |

| 36.44 | 36.44 | 6.0743 | -1.2212 | |

| 1.75 | 45.53 | 7.5882 | -0.2370 | |

| 0.14 | 1.82 | 0.3037 | -0.1973 | |

| 0.12 | 11.54 | 1.9227 | -0.0660 | |

| 0.08 | 11.37 | 1.8958 | -0.0505 | |

| 0.26 | 8.65 | 1.4420 | -0.0464 | |

| 0.22 | 5.86 | 0.9764 | -0.0279 | |

| 0.29 | 11.68 | 1.9470 | -0.0232 |

13F and Fund Filings

This form was filed on 2025-08-06 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US5348986630 / LVIP SSgA Bond Index Fund | 10.82 | 13.87 | 109.82 | 15.15 | 18.3045 | 2.4115 | |||

| US5348986226 / LVIP SSgA Large Cap 100 Fund | 4.47 | -8.66 | 70.31 | 1.55 | 11.7185 | 0.1814 | |||

| US5348986481 / LVIP SSgA Developed International Fund | 5.26 | -10.56 | 51.94 | 0.85 | 8.6566 | 0.0750 | |||

| SPIP / SPDR Series Trust - SPDR Portfolio TIPS ETF | 1.75 | -1.86 | 45.53 | -3.05 | 7.5882 | -0.2370 | |||

| SPY / SPDR S&P 500 ETF | 0.06 | 187.49 | 36.55 | 217.53 | 6.0916 | 4.1736 | |||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 36.44 | -16.76 | 36.44 | -16.76 | 6.0743 | -1.2212 | |||

| SPSM / SPDR Series Trust - SPDR Portfolio S&P 600 Small Cap ETF | 0.61 | 43.99 | 25.90 | 50.49 | 4.3164 | 1.4489 | |||

| SPEM / SPDR Index Shares Funds - SPDR Portfolio Emerging Markets ETF | 0.60 | 1.70 | 25.60 | 10.41 | 4.2675 | 0.4031 | |||

| US4749038539 / LVIP SSgA S&P 500 Index Fund | 0.73 | -8.30 | 23.48 | 1.68 | 3.9129 | 0.0654 | |||

| SPLB / SPDR Series Trust - SPDR Portfolio Long Term Corporate Bond ETF | 0.91 | 73.18 | 20.49 | 73.18 | 3.4158 | 1.4439 | |||

| US5348986556 / LVIP SSgA International Index Fund | 1.15 | -54.81 | 14.40 | -49.59 | 2.4005 | -2.3605 | |||

| XLC / The Select Sector SPDR Trust - The Communication Services Select Sector SPDR Fund | 0.11 | -7.46 | 11.87 | 4.13 | 1.9783 | 0.0790 | |||

| WIP / SPDR Series Trust - SPDR FTSE International Government Inflation-Protected Bond ETF | 0.29 | -7.09 | 11.68 | -1.20 | 1.9470 | -0.0232 | |||

| US4749031013 / LVIP SSgA Small Cap Index Fund | 0.36 | -7.26 | 11.58 | 0.52 | 1.9308 | 0.0104 | |||

| SPAB / SPDR Series Trust - SPDR Portfolio Aggregate Bond ETF | 0.45 | 28.97 | 11.56 | 29.27 | 1.9272 | 0.4368 | |||

| US5348986143 / LVIP SSgA Small-Mid Cap 200 Fund | 0.91 | -8.68 | 11.56 | -0.47 | 1.9265 | -0.0086 | |||

| JNK / SPDR Series Trust - SPDR Bloomberg High Yield Bond ETF | 0.12 | -7.37 | 11.54 | -5.62 | 1.9227 | -0.0660 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.08 | -13.17 | 11.37 | -11.82 | 1.8958 | -0.0505 | |||

| US5348986309 / LVIP SSgA Emerging Markets Fund | 1.25 | -55.11 | 11.25 | -49.66 | 1.8756 | -1.8497 | |||

| XLP / The Select Sector SPDR Trust - The Consumer Staples Select Sector SPDR Fund | 0.14 | -6.36 | 11.24 | -8.65 | 1.8738 | 0.0036 | |||

| GLD / SPDR Gold Trust | 0.03 | 0.00 | 9.65 | 5.79 | 1.6081 | 0.0884 | |||

| RWR / SPDR Series Trust - SPDR Dow Jones REIT ETF | 0.09 | 12.08 | 8.84 | 49.72 | 1.4736 | 0.6725 | |||

| SPIB / SPDR Series Trust - SPDR Portfolio Intermediate Term Corporate Bond ETF | 0.26 | -4.12 | 8.65 | -3.15 | 1.4420 | -0.0464 | |||

| SPTL / SPDR Series Trust - SPDR Portfolio Long Term Treasury ETF | 0.22 | -0.32 | 5.86 | -2.80 | 0.9764 | -0.0279 | |||

| PDBC / Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF | 0.14 | -36.66 | 1.82 | -39.39 | 0.3037 | -0.1973 | |||

| S+P500 EMINI FUT SEP25 / DE (000000000) | 0.19 | 0.0315 | 0.0315 | ||||||

| NIKKEI 225 (OSE) SEP25 / DE (000000000) | 0.04 | 0.0073 | 0.0073 | ||||||

| E-MINI RUSS 2000 SEP25 / DE (000000000) | 0.03 | 0.0049 | 0.0049 | ||||||

| EURO FX CURR FUT SEP25 / DFE (000000000) | 0.03 | 0.0042 | 0.0042 | ||||||

| S+P MID 400 EMINI SEP25 / DE (000000000) | 0.02 | 0.0039 | 0.0039 | ||||||

| MSCI EMGMKT SEP25 / DE (000000000) | 0.01 | 0.0017 | 0.0017 | ||||||

| BP CURRENCY FUT SEP25 / DFE (000000000) | 0.01 | 0.0014 | 0.0014 | ||||||

| JPN YEN CURR FUT SEP25 / DFE (000000000) | 0.00 | 0.0003 | 0.0003 | ||||||

| EURO STOXX 50 SEP25 / DE (000000000) | -0.00 | -0.0008 | -0.0008 | ||||||

| FTSE 100 IDX FUT SEP25 / DE (000000000) | -0.01 | -0.0008 | -0.0008 |