Basic Stats

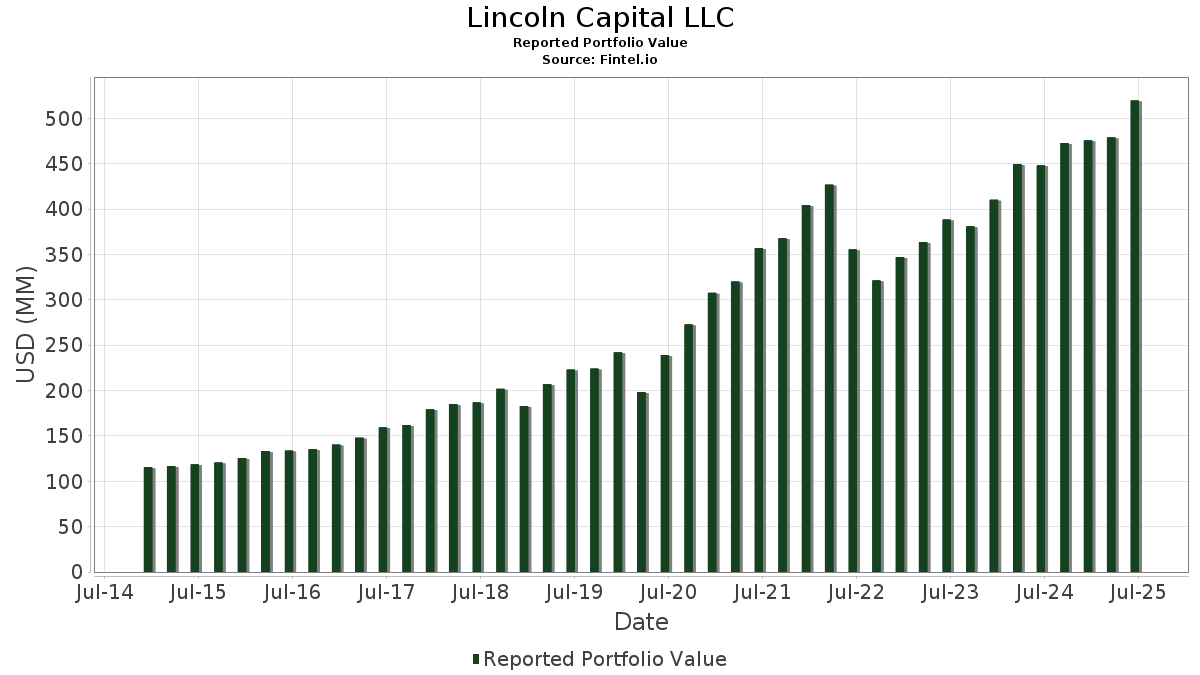

| Portfolio Value | $ 519,666,676 |

| Current Positions | 123 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Lincoln Capital LLC has disclosed 123 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 519,666,676 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Lincoln Capital LLC’s top holdings are Berkshire Hathaway Inc. (US:BRK.B) , Berkshire Hathaway Inc. (US:BRK.A) , Markel Group Inc. (US:MKL) , Costco Wholesale Corporation (US:COST) , and Mastercard Incorporated (US:MA) . Lincoln Capital LLC’s new positions include Caterpillar Inc. (US:CAT) , W. R. Berkley Corporation (US:WRB) , Chevron Corporation (US:CVX) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 21.82 | 4.1988 | 1.1482 | |

| 0.08 | 10.51 | 2.0222 | 0.5079 | |

| 0.08 | 17.85 | 3.4344 | 0.4643 | |

| 0.16 | 28.11 | 5.4093 | 0.3437 | |

| 0.16 | 11.85 | 2.2804 | 0.3021 | |

| 0.02 | 35.20 | 6.7737 | 0.2087 | |

| 0.61 | 6.14 | 1.1815 | 0.1890 | |

| 0.03 | 8.46 | 1.6282 | 0.1838 | |

| 0.00 | 0.91 | 0.1742 | 0.1742 | |

| 0.03 | 7.25 | 1.3945 | 0.1728 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 46.56 | 8.9590 | -1.4383 | |

| 0.00 | 38.63 | 7.4329 | -1.1988 | |

| 0.04 | 35.05 | 6.7442 | -0.5354 | |

| 0.03 | 9.47 | 1.8225 | -0.3671 | |

| 0.08 | 4.07 | 0.7824 | -0.2625 | |

| 0.05 | 4.88 | 0.9392 | -0.2446 | |

| 0.06 | 34.71 | 6.6798 | -0.1585 | |

| 0.08 | 5.69 | 1.0956 | -0.1480 | |

| 0.09 | 17.31 | 3.3316 | -0.1435 | |

| 0.06 | 11.58 | 2.2290 | -0.1378 |

13F and Fund Filings

This form was filed on 2025-07-11 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BRK.B / Berkshire Hathaway Inc. | 0.10 | 0.24 | 46.56 | -6.50 | 8.9590 | -1.4383 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 38.63 | -6.57 | 7.4329 | -1.1988 | |||

| MKL / Markel Group Inc. | 0.02 | 0.06 | 35.20 | 11.95 | 6.7737 | 0.2087 | |||

| COST / Costco Wholesale Corporation | 0.04 | -0.56 | 35.05 | 0.52 | 6.7442 | -0.5354 | |||

| MA / Mastercard Incorporated | 0.06 | -0.53 | 34.71 | 5.99 | 6.6798 | -0.1585 | |||

| GOOGL / Alphabet Inc. | 0.16 | -0.42 | 28.11 | 15.87 | 5.4093 | 0.3437 | |||

| MSFT / Microsoft Corporation | 0.04 | 10.14 | 21.82 | 49.34 | 4.1988 | 1.1482 | |||

| AMZN / Amazon.com, Inc. | 0.08 | -0.97 | 17.85 | 25.47 | 3.4344 | 0.4643 | |||

| DHR / Danaher Corporation | 0.09 | 1.14 | 17.31 | 4.03 | 3.3316 | -0.1435 | |||

| SBUX / Starbucks Corporation | 0.16 | -0.59 | 15.11 | 11.43 | 2.9079 | 0.0762 | |||

| CARR / Carrier Global Corporation | 0.16 | 1.62 | 11.85 | 25.08 | 2.2804 | 0.3021 | |||

| AAPL / Apple Inc. | 0.06 | -0.51 | 11.58 | 2.19 | 2.2290 | -0.1378 | |||

| DIS / The Walt Disney Company | 0.08 | 0.62 | 10.51 | 44.90 | 2.0222 | 0.5079 | |||

| MCD / McDonald's Corporation | 0.03 | -1.37 | 9.47 | -9.69 | 1.8225 | -0.3671 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | -0.59 | 8.46 | 22.32 | 1.6282 | 0.1838 | |||

| ROP / Roper Technologies, Inc. | 0.01 | -0.13 | 7.61 | 2.69 | 1.4642 | -0.0830 | |||

| OTIS / Otis Worldwide Corporation | 0.07 | 0.48 | 7.30 | 0.55 | 1.4041 | -0.1111 | |||

| MAR / Marriott International, Inc. | 0.03 | -0.00 | 7.25 | 23.84 | 1.3945 | 0.1728 | |||

| LIN / Linde plc | 0.01 | -0.73 | 6.44 | 2.45 | 1.2396 | -0.0732 | |||

| HGTY / Hagerty, Inc. | 0.61 | 9.37 | 6.14 | 29.16 | 1.1815 | 0.1890 | |||

| AXP / American Express Company | 0.02 | -1.76 | 6.12 | 24.14 | 1.1768 | 0.1481 | |||

| MCO / Moody's Corporation | 0.01 | 0.00 | 5.96 | 16.67 | 1.1478 | 0.0802 | |||

| BK / The Bank of New York Mellon Corporation | 0.06 | -0.11 | 5.71 | 19.27 | 1.0996 | 0.0992 | |||

| KO / The Coca-Cola Company | 0.08 | -0.15 | 5.69 | -4.42 | 1.0956 | -0.1480 | |||

| SCHW / The Charles Schwab Corporation | 0.06 | -0.15 | 5.62 | 18.96 | 1.0808 | 0.0950 | |||

| UNP / Union Pacific Corporation | 0.02 | -1.32 | 4.93 | 4.69 | 0.9491 | -0.0346 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.05 | -4.06 | 4.88 | -13.92 | 0.9392 | -0.2446 | |||

| FWONK / Formula One Group | 0.04 | -0.89 | 4.32 | 22.77 | 0.8323 | 0.0967 | |||

| CPRT / Copart, Inc. | 0.08 | 0.03 | 4.07 | -18.76 | 0.7824 | -0.2625 | |||

| TRV / The Travelers Companies, Inc. | 0.01 | -0.61 | 3.89 | 1.75 | 0.7482 | -0.0496 | |||

| JNJ / Johnson & Johnson | 0.02 | -1.49 | 3.76 | -4.62 | 0.7233 | -0.0994 | |||

| OXY / Occidental Petroleum Corporation | 0.07 | -0.62 | 3.01 | 4.48 | 0.5792 | -0.0224 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.16 | 2.79 | 17.46 | 0.5360 | 0.0409 | |||

| CB / Chubb Limited | 0.01 | 35.68 | 2.74 | 35.33 | 0.5265 | 0.1043 | |||

| BLK / BlackRock, Inc. | 0.00 | -0.91 | 2.73 | 17.20 | 0.5260 | 0.0390 | |||

| VLTO / Veralto Corporation | 0.02 | 0.64 | 2.44 | 13.93 | 0.4691 | 0.0223 | |||

| FAST / Fastenal Company | 0.06 | 100.00 | 2.43 | 3.14 | 0.4685 | -0.0244 | |||

| BDX / Becton, Dickinson and Company | 0.01 | -0.57 | 2.37 | -14.31 | 0.4552 | -0.1213 | |||

| CGGR / Capital Group Growth ETF | 0.06 | 2.85 | 2.35 | 28.33 | 0.4526 | 0.0700 | |||

| APH / Amphenol Corporation | 0.02 | 0.00 | 2.35 | 50.22 | 0.4525 | 0.1256 | |||

| GOOG / Alphabet Inc. | 0.01 | -4.81 | 2.33 | 9.74 | 0.4489 | 0.0050 | |||

| DE / Deere & Company | 0.00 | 0.02 | 2.27 | 11.83 | 0.4368 | 0.0131 | |||

| LPX / Louisiana-Pacific Corporation | 0.03 | -0.70 | 2.16 | 1.55 | 0.4154 | -0.0285 | |||

| WMT / Walmart Inc. | 0.02 | 0.01 | 2.15 | 3.12 | 0.4132 | -0.0217 | |||

| PEP / PepsiCo, Inc. | 0.02 | -0.53 | 2.10 | -8.44 | 0.4050 | -0.0750 | |||

| ECL / Ecolab Inc. | 0.01 | -0.69 | 1.91 | 13.02 | 0.3677 | 0.0146 | |||

| CSGP / CoStar Group, Inc. | 0.02 | 0.07 | 1.71 | -0.52 | 0.3294 | -0.0298 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | 0.07 | 1.62 | 27.27 | 0.3127 | 0.0461 | |||

| ESAB / ESAB Corporation | 0.01 | 0.00 | 1.53 | 6.71 | 0.2938 | -0.0049 | |||

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.02 | 0.01 | 1.51 | 9.00 | 0.2914 | 0.0013 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.00 | 0.42 | 1.48 | 25.13 | 0.2857 | 0.0381 | |||

| CINF / Cincinnati Financial Corporation | 0.01 | 0.00 | 1.46 | 12.05 | 0.2810 | 0.0088 | |||

| MSCI / MSCI Inc. | 0.00 | 0.00 | 1.45 | 7.12 | 0.2782 | -0.0036 | |||

| HD / The Home Depot, Inc. | 0.00 | -0.86 | 1.31 | 2.58 | 0.2529 | -0.0147 | |||

| BAM / Brookfield Asset Management Ltd. | 0.02 | 0.00 | 1.28 | 11.70 | 0.2463 | 0.0071 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.02 | -0.39 | 1.24 | 12.38 | 0.2395 | 0.0084 | |||

| SPGI / S&P Global Inc. | 0.00 | 0.00 | 1.24 | 13.11 | 0.2391 | 0.0096 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.01 | -0.37 | 1.10 | 12.59 | 0.2118 | 0.0078 | |||

| USMV / iShares Trust - iShares MSCI USA Min Vol Factor ETF | 0.01 | -0.01 | 1.00 | 4.28 | 0.1924 | -0.0078 | |||

| PG / The Procter & Gamble Company | 0.01 | -1.57 | 1.00 | -6.66 | 0.1916 | -0.0310 | |||

| CGUS / Capital Group Core Equity ETF | 0.03 | 7.68 | 0.99 | 27.03 | 0.1900 | 0.0277 | |||

| NVDA / NVIDIA Corporation | 0.01 | 8.99 | 0.95 | 74.22 | 0.1835 | 0.0692 | |||

| WCN / Waste Connections, Inc. | 0.01 | 0.00 | 0.95 | -5.59 | 0.1819 | -0.0273 | |||

| TSLA / Tesla, Inc. | 0.00 | 67.59 | 0.92 | 123.73 | 0.1779 | 0.0916 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.91 | 0.1742 | 0.1742 | |||||

| CL / Colgate-Palmolive Company | 0.01 | -0.92 | 0.87 | -6.07 | 0.1668 | -0.0257 | |||

| BN / Brookfield Corporation | 0.01 | 0.00 | 0.83 | 23.63 | 0.1602 | 0.0195 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.00 | 6.87 | 0.83 | 21.86 | 0.1589 | 0.0176 | |||

| META / Meta Platforms, Inc. | 0.00 | 4.82 | 0.82 | 54.63 | 0.1576 | 0.0471 | |||

| AMAT / Applied Materials, Inc. | 0.00 | -0.47 | 0.81 | 31.82 | 0.1564 | 0.0276 | |||

| CGXU / Capital Group International Focus Equity ETF | 0.03 | 0.00 | 0.81 | 15.01 | 0.1563 | 0.0087 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -13.38 | 0.78 | -13.77 | 0.1508 | -0.0390 | |||

| NKE / NIKE, Inc. | 0.01 | 0.00 | 0.78 | 24.48 | 0.1499 | 0.0193 | |||

| ACN / Accenture plc | 0.00 | 0.00 | 0.77 | 5.33 | 0.1484 | -0.0046 | |||

| V / Visa Inc. | 0.00 | 0.00 | 0.76 | 7.23 | 0.1455 | -0.0019 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.00 | -0.55 | 0.74 | 8.22 | 0.1420 | -0.0003 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 0.71 | 17.08 | 0.1360 | 0.0101 | |||

| SYK / Stryker Corporation | 0.00 | 0.00 | 0.70 | 13.73 | 0.1355 | 0.0061 | |||

| JBTM / JBT Marel Corporation | 0.01 | 0.00 | 0.68 | 26.97 | 0.1307 | 0.0190 | |||

| MTD / Mettler-Toledo International Inc. | 0.00 | 0.00 | 0.68 | 17.19 | 0.1300 | 0.0095 | |||

| CGGO / Capital Group Global Growth Equity ETF | 0.02 | 4.11 | 0.66 | 21.83 | 0.1279 | 0.0141 | |||

| CGDV / Capital Group Dividend Value ETF | 0.02 | -2.72 | 0.65 | 15.12 | 0.1247 | 0.0073 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.64 | 5.25 | 0.1237 | -0.0038 | |||

| DGRO / iShares Trust - iShares Core Dividend Growth ETF | 0.01 | 1.58 | 0.63 | 11.27 | 0.1217 | 0.0029 | |||

| UPS / United Parcel Service, Inc. | 0.01 | -0.33 | 0.62 | 4.06 | 0.1184 | -0.0053 | |||

| AMT / American Tower Corporation | 0.00 | 0.00 | 0.60 | 0.00 | 0.1148 | -0.0097 | |||

| XYL / Xylem Inc. | 0.00 | 0.00 | 0.58 | 15.77 | 0.1117 | 0.0070 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.01 | 2.62 | 0.57 | 15.32 | 0.1102 | 0.0065 | |||

| WFC / Wells Fargo & Company | 0.01 | 0.03 | 0.56 | 20.91 | 0.1081 | 0.0112 | |||

| PSX / Phillips 66 | 0.00 | -2.71 | 0.53 | 15.09 | 0.1029 | 0.0058 | |||

| CGDG / Capital Group Dividend Growers ETF | 0.02 | 7.17 | 0.52 | 19.21 | 0.0992 | 0.0089 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.01 | -1.30 | 0.49 | 9.17 | 0.0940 | 0.0006 | |||

| HSY / The Hershey Company | 0.00 | 0.00 | 0.48 | -0.82 | 0.0930 | -0.0088 | |||

| HSIC / Henry Schein, Inc. | 0.01 | 0.00 | 0.47 | 13.13 | 0.0914 | 0.0038 | |||

| ORCL / Oracle Corporation | 0.00 | 0.00 | 0.44 | 72.16 | 0.0846 | 0.0312 | |||

| RTX / RTX Corporation | 0.00 | -1.88 | 0.42 | 25.90 | 0.0805 | 0.0112 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.00 | 0.41 | 33.55 | 0.0798 | 0.0151 | |||

| CGIE / Capital Group International Equity ETF | 0.01 | 4.33 | 0.40 | 16.33 | 0.0768 | 0.0051 | |||

| WRB / W. R. Berkley Corporation | 0.01 | 0.38 | 0.0740 | 0.0740 | |||||

| VT / Vanguard International Equity Index Funds - Vanguard Total World Stock ETF | 0.00 | 7.17 | 0.37 | 22.92 | 0.0713 | 0.0085 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 1.47 | 0.35 | 19.26 | 0.0680 | 0.0060 | |||

| IBM / International Business Machines Corporation | 0.00 | -9.53 | 0.35 | 10.44 | 0.0673 | 0.0013 | |||

| MKC / McCormick & Company, Incorporated | 0.00 | 0.00 | 0.35 | 0.29 | 0.0668 | -0.0056 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.01 | -6.10 | 0.34 | -12.44 | 0.0652 | -0.0154 | |||

| GLD / SPDR Gold Trust | 0.00 | 0.00 | 0.31 | -1.90 | 0.0595 | -0.0064 | |||

| USB / U.S. Bancorp | 0.01 | 0.00 | 0.30 | 15.89 | 0.0576 | 0.0037 | |||

| NTRS / Northern Trust Corporation | 0.00 | 0.00 | 0.30 | 41.83 | 0.0568 | 0.0134 | |||

| BAC / Bank of America Corporation | 0.01 | 0.00 | 0.29 | 23.31 | 0.0560 | 0.0067 | |||

| PM / Philip Morris International Inc. | 0.00 | -18.23 | 0.29 | -9.52 | 0.0550 | -0.0108 | |||

| CSCO / Cisco Systems, Inc. | 0.00 | -18.15 | 0.28 | 3.31 | 0.0542 | -0.0028 | |||

| DFAC / Dimensional ETF Trust - Dimensional U.S. Core Equity 2 ETF | 0.01 | 0.00 | 0.28 | 15.83 | 0.0536 | 0.0034 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | 0.00 | 0.27 | 15.02 | 0.0517 | 0.0030 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.00 | 0.00 | 0.27 | 2.69 | 0.0514 | -0.0029 | |||

| PFE / Pfizer Inc. | 0.01 | -15.34 | 0.27 | -8.90 | 0.0513 | -0.0098 | |||

| CVX / Chevron Corporation | 0.00 | 0.24 | 0.0463 | 0.0463 | |||||

| BWXT / BWX Technologies, Inc. | 0.00 | -22.19 | 0.24 | 9.68 | 0.0458 | 0.0004 | |||

| TROW / T. Rowe Price Group, Inc. | 0.00 | 0.00 | 0.23 | 12.08 | 0.0447 | 0.0014 | |||

| SYY / Sysco Corporation | 0.00 | 0.00 | 0.23 | 3.14 | 0.0444 | -0.0022 | |||

| AIRR / First Trust Exchange-Traded Fund VI - First Trust RBA American Industrial Renaissance ETF | 0.00 | 0.23 | 0.0433 | 0.0433 | |||||

| COF / Capital One Financial Corporation | 0.00 | 0.22 | 0.0426 | 0.0426 | |||||

| ITOT / iShares Trust - iShares Core S&P Total U.S. Stock Market ETF | 0.00 | 0.21 | 0.0401 | 0.0401 | |||||

| SSRM / SSR Mining Inc. | 0.01 | 0.00 | 0.13 | 23.30 | 0.0245 | 0.0028 | |||

| GLDG / GoldMining Inc. | 0.01 | 0.00 | 0.01 | -12.50 | 0.0015 | -0.0004 |