Basic Stats

| Portfolio Value | $ 460,626,264 |

| Current Positions | 18 |

Latest Holdings, Performance, AUM (from 13F, 13D)

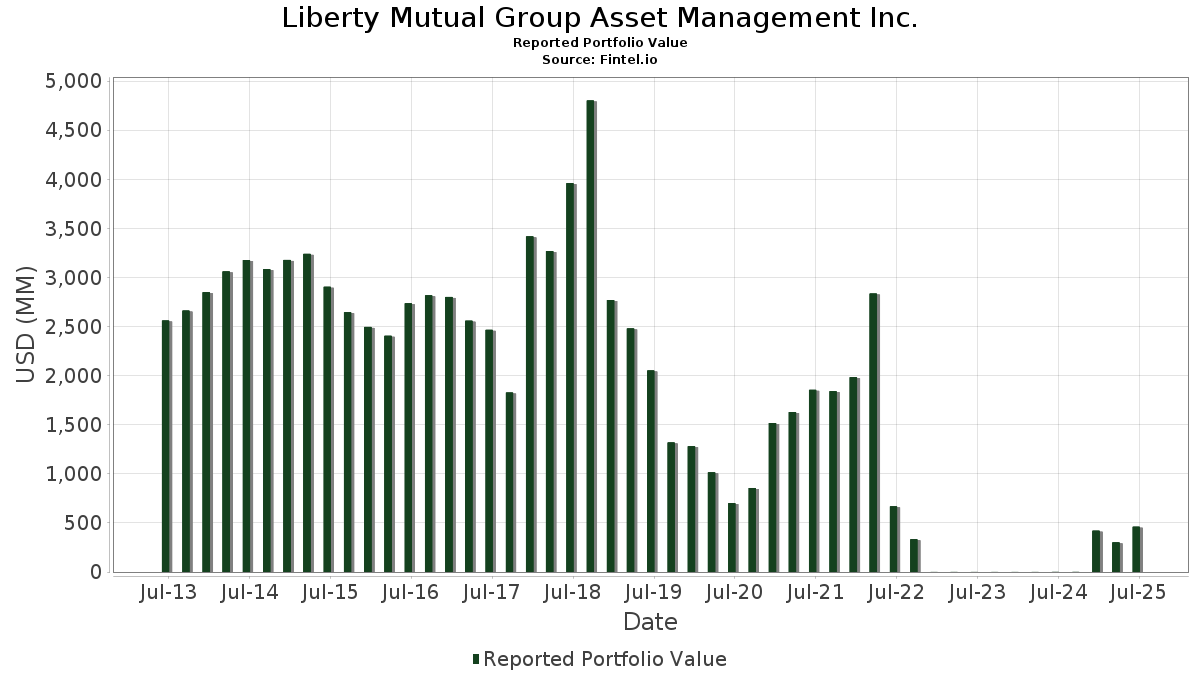

Liberty Mutual Group Asset Management Inc. has disclosed 18 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 460,626,264 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Liberty Mutual Group Asset Management Inc.’s top holdings are iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF (US:HYG) , WisdomTree Trust - WisdomTree Japan Hedged Equity Fund (US:DXJ) , QXO, Inc. (US:QXO) , Invesco Exchange-Traded Fund Trust II - Invesco Senior Loan ETF (US:BKLN) , and Affirm Holdings, Inc. (US:AFRM) . Liberty Mutual Group Asset Management Inc.’s new positions include ServiceTitan, Inc. (US:TTAN) , Samsara Inc. (US:IOT) , Klaviyo, Inc. (US:KVYO) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 2.94 | 237.39 | 51.5369 | 51.5369 | |

| 0.50 | 10.46 | 1.9357 | 1.9357 | |

| 0.02 | 2.46 | 0.5342 | 0.5342 | |

| 0.01 | 1.54 | 0.3349 | 0.3349 | |

| 0.06 | 1.63 | 0.3010 | 0.3010 | |

| 0.16 | 1.35 | 0.2935 | 0.2935 | |

| 0.02 | 0.61 | 0.1330 | 0.1330 | |

| 0.01 | 0.21 | 0.0466 | 0.0466 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.94 | 107.53 | 19.8987 | -5.6798 | |

| 4.08 | 87.94 | 16.2744 | -2.0921 | |

| 0.08 | 2.08 | 0.3851 | -0.5701 | |

| 0.00 | 0.00 | -0.3882 | ||

| 0.01 | 0.74 | 0.1604 | -0.2025 | |

| 0.06 | 0.72 | 0.1341 | -0.1804 | |

| 0.07 | 4.80 | 0.8876 | -0.1539 | |

| 0.32 | 0.76 | 0.1414 | -0.1209 | |

| 0.02 | 0.35 | 0.0654 | -0.0881 | |

| 0.04 | 0.02 | 0.0048 | -0.0093 |

13F and Fund Filings

This form was filed on 2025-07-28 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | 2.94 | 237.39 | 51.5369 | 51.5369 | |||||

| DXJ / WisdomTree Trust - WisdomTree Japan Hedged Equity Fund | 0.94 | 34.67 | 107.53 | 39.67 | 19.8987 | -5.6798 | |||

| QXO / QXO, Inc. | 4.08 | 0.00 | 87.94 | 59.09 | 16.2744 | -2.0921 | |||

| BKLN / Invesco Exchange-Traded Fund Trust II - Invesco Senior Loan ETF | 0.50 | 10.46 | 1.9357 | 1.9357 | |||||

| AFRM / Affirm Holdings, Inc. | 0.07 | 0.00 | 4.80 | 52.98 | 0.8876 | -0.1539 | |||

| TTAN / ServiceTitan, Inc. | 0.02 | 2.46 | 0.5342 | 0.5342 | |||||

| SMC / Summit Midstream Corporation | 0.08 | 0.00 | 2.08 | -27.62 | 0.3851 | -0.5701 | |||

| BRZE / Braze, Inc. | 0.06 | 1.63 | 0.3010 | 0.3010 | |||||

| DASH / DoorDash, Inc. | 0.01 | 1.54 | 0.3349 | 0.3349 | |||||

| CXM / Sprinklr, Inc. | 0.16 | 1.35 | 0.2935 | 0.2935 | |||||

| KORE / KORE Group Holdings, Inc. | 0.32 | 0.00 | 0.76 | -3.30 | 0.1414 | -0.1209 | |||

| RBRK / Rubrik, Inc. | 0.01 | -53.95 | 0.74 | -32.42 | 0.1604 | -0.2025 | |||

| AMPL / Amplitude, Inc. | 0.06 | -37.09 | 0.72 | -23.47 | 0.1341 | -0.1804 | |||

| IOT / Samsara Inc. | 0.02 | 0.61 | 0.1330 | 0.1330 | |||||

| CRGY / Crescent Energy Company | 0.02 | -55.59 | 0.35 | -23.59 | 0.0654 | -0.0881 | |||

| KVYO / Klaviyo, Inc. | 0.01 | 0.21 | 0.0466 | 0.0466 | |||||

| OPEN / Opendoor Technologies Inc. | 0.04 | 0.00 | 0.02 | -47.62 | 0.0048 | -0.0093 | |||

| GCTS.WS / GCT Semiconductor Holding, Inc. - Equity Warrant | 0.12 | 0.00 | 0.01 | 33.33 | 0.0022 | -0.0008 | |||

| FRSH / Freshworks Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TEM / Tempus AI, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3882 | ||||

| AM / Antero Midstream Corporation | 0.03 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| AMPS / Altus Power, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| REPX / Riley Exploration Permian, Inc. | 0.01 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | -100.00 | 0.00 | 0.0000 |