Basic Stats

| Portfolio Value | $ 213,268,000 |

| Current Positions | 103 |

Latest Holdings, Performance, AUM (from 13F, 13D)

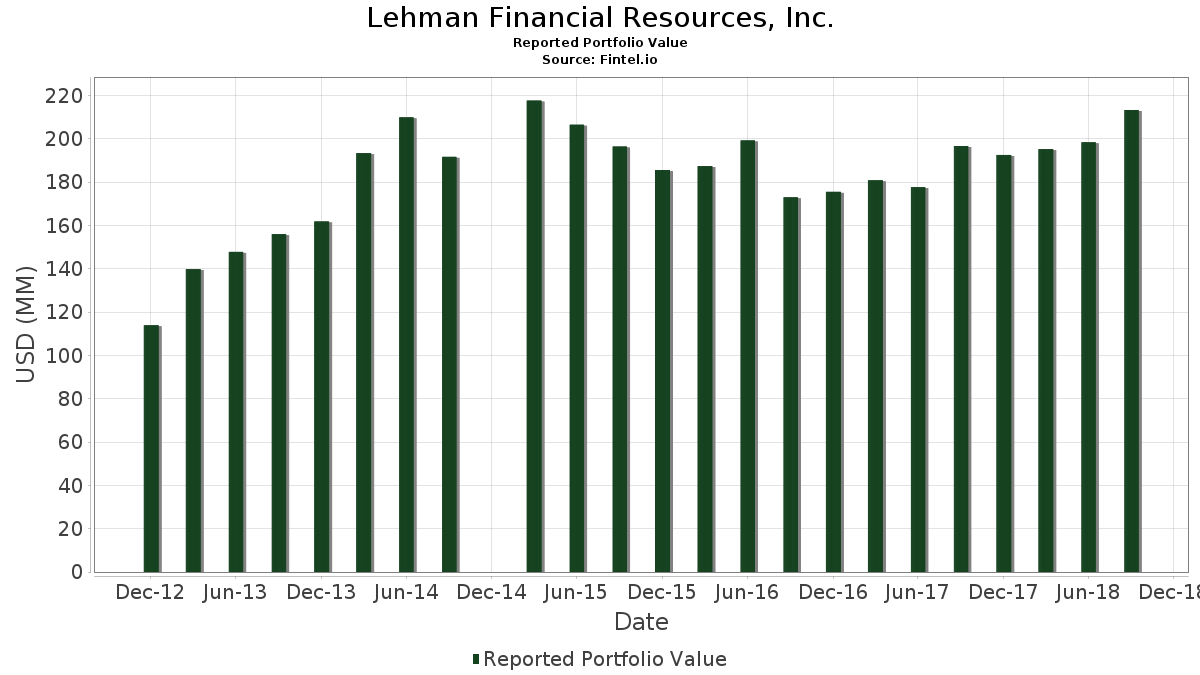

Lehman Financial Resources, Inc. has disclosed 103 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 213,268,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Lehman Financial Resources, Inc.’s top holdings are NextEra Energy, Inc. (US:NEE) , XPLR Infrastructure, LP - Limited Partnership (US:NEP) , Berkshire Hathaway Inc. (US:BRK.B) , iShares Trust - iShares Core S&P 500 ETF (US:IVV) , and Pfizer Inc. (US:PFE) . Lehman Financial Resources, Inc.’s new positions include Fidelity Covington Trust - Fidelity Dividend ETF for Rising Rates (US:FDRR) , Advanced Micro Devices, Inc. (US:AMD) , iShares Trust - iShares U.S. Equity Factor ETF (US:LRGF) , Caesars Entertainment, Inc. (US:CZR) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.45 | 21.83 | 10.2355 | 10.2355 | |

| 0.03 | 9.53 | 4.4704 | 4.4704 | |

| 0.07 | 5.56 | 2.6061 | 2.6061 | |

| 0.05 | 4.18 | 1.9581 | 1.9581 | |

| 0.06 | 2.84 | 1.3312 | 1.3312 | |

| 0.10 | 2.42 | 1.1333 | 1.1333 | |

| 0.02 | 1.66 | 0.7765 | 0.7765 | |

| 0.01 | 1.44 | 0.6761 | 0.6761 | |

| 0.02 | 1.31 | 0.6138 | 0.6138 | |

| 0.01 | 1.28 | 0.6011 | 0.6011 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.29 | 48.32 | 22.6551 | -1.0453 | |

| 0.05 | 0.19 | 0.0886 | -0.4800 | |

| 0.06 | 2.18 | 1.0208 | -0.2636 | |

| 0.17 | 1.91 | 0.8937 | -0.2500 | |

| 0.13 | 5.86 | 2.7496 | -0.2486 | |

| 0.06 | 4.30 | 2.0167 | -0.2188 | |

| 0.29 | 8.48 | 3.9767 | -0.1995 | |

| 0.13 | 5.80 | 2.7205 | -0.1829 | |

| 0.03 | 4.21 | 1.9759 | -0.1775 | |

| 0.14 | 2.98 | 1.3982 | -0.1664 |

13F and Fund Filings

This form was filed on 2018-11-14 for the reporting period 2018-09-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NEE / NextEra Energy, Inc. | 0.29 | 2.41 | 48.32 | 2.76 | 22.6551 | -1.0453 | |||

| NEP / XPLR Infrastructure, LP - Limited Partnership | 0.45 | 2.27 | 21.83 | 6.29 | 10.2355 | 10.2355 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.05 | 0.22 | 9.94 | 14.96 | 4.6594 | 0.3022 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.03 | 0.00 | 9.53 | 7.21 | 4.4704 | 4.4704 | |||

| PFE / Pfizer Inc. | 0.20 | -1.64 | 8.70 | 19.48 | 4.0775 | 0.4089 | |||

| BAC / Bank of America Corporation | 0.29 | -2.04 | 8.48 | 2.37 | 3.9767 | -0.1995 | |||

| KBE / SPDR Series Trust - SPDR S&P Bank ETF | 0.13 | -0.16 | 5.86 | -1.41 | 2.7496 | -0.2486 | |||

| CSCO / Cisco Systems, Inc. | 0.12 | 1.76 | 5.85 | 15.06 | 2.7449 | 0.1802 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.13 | -0.23 | 5.80 | 0.73 | 2.7205 | -0.1829 | |||

| VT / Vanguard International Equity Index Funds - Vanguard Total World Stock ETF | 0.07 | 0.00 | 5.56 | 3.35 | 2.6061 | 2.6061 | |||

| MMP / Magellan Midstream Partners L.P. | 0.06 | -1.09 | 4.30 | -3.02 | 2.0167 | -0.2188 | |||

| CVX / Chevron Corporation | 0.03 | 2.00 | 4.21 | -1.36 | 1.9759 | -0.1775 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.05 | 577.68 | 4.18 | 609.00 | 1.9581 | 1.9581 | |||

| BTZ / BlackRock Credit Allocation Income Trust | 0.31 | 0.01 | 3.78 | 1.34 | 1.7719 | -0.1077 | |||

| UPS / United Parcel Service, Inc. | 0.03 | 1.29 | 3.66 | 11.33 | 1.7180 | 0.0591 | |||

| MRK / Merck & Co., Inc. | 0.05 | 2.49 | 3.42 | 19.76 | 1.6060 | 0.1643 | |||

| O / Realty Income Corporation | 0.06 | -3.77 | 3.20 | 1.78 | 1.4991 | -0.0842 | |||

| BTT / Blackrock Municipal 2030 Target Term Trust | 0.14 | 0.00 | 2.98 | -3.93 | 1.3982 | -0.1664 | |||

| TOTL / SSGA Active Trust - SPDR DoubleLine Total Return Tactical ETF | 0.06 | 0.00 | 2.84 | -0.63 | 1.3312 | 1.3312 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.09 | -1.95 | 2.60 | 1.80 | 1.2196 | -0.0683 | |||

| PCI / PGIM ETF Trust - PGIM Corporate Bond 5-10 Year ETF | 0.10 | -0.98 | 2.42 | 1.34 | 1.1333 | 1.1333 | |||

| GM / General Motors Company | 0.06 | 0.00 | 2.18 | -14.56 | 1.0208 | -0.2636 | |||

| GE / General Electric Company | 0.17 | 1.24 | 1.91 | -16.00 | 0.8937 | -0.2500 | |||

| / BlackRock Municipal 2020 Term Trust | 0.13 | 0.00 | 1.89 | -1.72 | 0.8857 | -0.0831 | |||

| GILD / Gilead Sciences, Inc. | 0.02 | 0.70 | 1.68 | 9.76 | 0.7854 | 0.0162 | |||

| HDV / iShares Trust - iShares Core High Dividend ETF | 0.02 | -2.28 | 1.66 | 4.09 | 0.7765 | 0.7765 | |||

| JNJ / Johnson & Johnson | 0.01 | 2.92 | 1.60 | 17.22 | 0.7502 | 0.0622 | |||

| AAPL / Apple Inc. | 0.01 | 34.09 | 1.55 | 63.58 | 0.7287 | 0.2498 | |||

| IBB / iShares Trust - iShares Biotechnology ETF | 0.01 | 1.52 | 1.44 | 12.74 | 0.6761 | 0.6761 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.02 | -2.74 | 1.31 | 4.64 | 0.6138 | 0.6138 | |||

| VDE / Vanguard World Fund - Vanguard Energy ETF | 0.01 | 0.00 | 1.28 | 0.08 | 0.6011 | 0.6011 | |||

| SRPT / Sarepta Therapeutics, Inc. | 0.01 | 0.00 | 1.04 | 22.21 | 0.4876 | 0.0587 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 28.63 | 0.96 | 32.19 | 0.4506 | 0.0841 | |||

| DUK / Duke Energy Corporation | 0.01 | 1.71 | 0.95 | 2.91 | 0.4473 | -0.0199 | |||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | 0.05 | -1.36 | 0.94 | -18.19 | 0.4408 | 0.4408 | |||

| SLV / iShares Silver Trust | 0.07 | 0.00 | 0.90 | -9.37 | 0.4215 | -0.0785 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 43.62 | 0.86 | 69.37 | 0.4018 | 0.1468 | |||

| T / AT&T Inc. | 0.02 | 20.96 | 0.77 | 26.48 | 0.3606 | 0.0541 | |||

| EXC / Exelon Corporation | 0.02 | -1.43 | 0.75 | 1.07 | 0.3535 | -0.0225 | |||

| LHX / L3Harris Technologies, Inc. | 0.00 | 0.00 | 0.75 | 17.03 | 0.3512 | 0.0286 | |||

| PG / The Procter & Gamble Company | 0.01 | 13.28 | 0.75 | 20.65 | 0.3507 | 0.0382 | |||

| V / Visa Inc. | 0.00 | 1.19 | 0.71 | 14.63 | 0.3343 | 0.0208 | |||

| GG / Goldcorp, Inc. | 0.06 | -1.23 | 0.65 | -26.60 | 0.3067 | -0.1425 | |||

| F / Ford Motor Company | 0.07 | -3.03 | 0.65 | -18.95 | 0.3048 | -0.0995 | |||

| AABA / Altaba Inc | 0.01 | 216.67 | 0.65 | 195.43 | 0.3034 | 0.1930 | |||

| VEU / Vanguard International Equity Index Funds - Vanguard FTSE All-World ex-US ETF | 0.01 | -75.16 | 0.64 | -73.78 | 0.2987 | 0.2987 | |||

| GLD / SPDR Gold Trust | 0.01 | 0.00 | 0.61 | -4.95 | 0.2884 | -0.0378 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 1.05 | 0.61 | 8.29 | 0.2879 | 0.0021 | |||

| VZ / Verizon Communications Inc. | 0.01 | 34.09 | 0.61 | 42.29 | 0.2856 | 0.0698 | |||

| BA / The Boeing Company | 0.00 | 43.98 | 0.58 | 59.67 | 0.2710 | 0.0885 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.87 | 0.57 | -14.54 | 0.2673 | -0.0689 | |||

| MSFT / Microsoft Corporation | 0.00 | 36.62 | 0.55 | 58.29 | 0.2598 | 0.0833 | |||

| VOD / Vodafone Group Public Limited Company - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 0.55 | -10.73 | 0.2574 | -0.0526 | |||

| DIS / The Walt Disney Company | 0.00 | 30.41 | 0.54 | 45.68 | 0.2527 | 0.0662 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.01 | 1.63 | 0.45 | 0.45 | 0.2091 | -0.0147 | |||

| C / Citigroup Inc. | 0.01 | 13.57 | 0.42 | 21.74 | 0.1969 | 0.0230 | |||

| CCT / Comcast Corporation - Preferred Security | 0.03 | 0.00 | 0.40 | -2.19 | 0.1885 | -0.0187 | |||

| COP / ConocoPhillips | 0.01 | 42.92 | 0.40 | 58.96 | 0.1871 | 0.0606 | |||

| WFC / Wells Fargo & Company | 0.01 | 0.00 | 0.40 | -5.26 | 0.1857 | -0.0250 | |||

| PKW / Invesco Exchange-Traded Fund Trust - Invesco BuyBack Achievers ETF | 0.01 | 0.00 | 0.39 | 7.50 | 0.1815 | -0.0000 | |||

| AEP / American Electric Power Company, Inc. | 0.01 | 0.04 | 0.37 | 2.48 | 0.1744 | -0.0085 | |||

| HD / The Home Depot, Inc. | 0.00 | 6.35 | 0.35 | 13.03 | 0.1627 | 0.0080 | |||

| UNP / Union Pacific Corporation | 0.00 | 7.35 | 0.34 | 23.47 | 0.1604 | 0.0207 | |||

| IBM / International Business Machines Corporation | 0.00 | 2,149.00 | 0.34 | 1,689.47 | 0.1594 | 0.1594 | |||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.00 | 0.00 | 0.34 | 9.03 | 0.1585 | 0.0022 | |||

| EMR / Emerson Electric Co. | 0.00 | 44.67 | 0.33 | 60.00 | 0.1538 | 0.0505 | |||

| FDRR / Fidelity Covington Trust - Fidelity Dividend ETF for Rising Rates | 0.01 | 0.32 | 0.1505 | 0.1505 | |||||

| DOW / Dow Inc. | 0.00 | 40.03 | 0.31 | 36.44 | 0.1440 | 0.0305 | |||

| ORCL / Oracle Corporation | 0.01 | 72.24 | 0.30 | 132.03 | 0.1393 | 0.1393 | |||

| ED / Consolidated Edison, Inc. | 0.00 | 0.00 | 0.28 | -2.40 | 0.1336 | -0.0136 | |||

| INTC / Intel Corporation | 0.01 | 26.12 | 0.28 | 20.25 | 0.1336 | 0.0142 | |||

| WTRG / Essential Utilities, Inc. | 0.01 | 8.55 | 0.28 | 14.23 | 0.1318 | 0.0078 | |||

| MO / Altria Group, Inc. | 0.00 | 9.53 | 0.28 | 16.25 | 0.1308 | 0.0098 | |||

| VTIAX / Vanguard Star Funds - Vanguard Total International Stock Index Fund Admiral | 0.01 | 0.00 | 0.28 | 0.00 | 0.1289 | 0.1289 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.00 | 0.00 | 0.27 | 4.71 | 0.1252 | 0.1252 | |||

| RDS.A / Shell Plc - ADR (Representing Ordinary Shares - Class A) | 0.00 | 0.00 | 0.26 | -2.24 | 0.1229 | -0.0122 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.26 | 0.1214 | 0.1214 | |||||

| NSC / Norfolk Southern Corporation | 0.00 | 0.00 | 0.26 | 19.44 | 0.1210 | 0.0121 | |||

| AMGN / Amgen Inc. | 0.00 | 301.67 | 0.25 | 492.86 | 0.1168 | 0.1168 | |||

| GLW / Corning Incorporated | 0.01 | 3,031.70 | 0.25 | 6,075.00 | 0.1158 | 0.1158 | |||

| ONVO / Organovo Holdings, Inc. | 0.21 | 16.54 | 0.24 | -4.30 | 0.1149 | -0.0142 | |||

| BMY / Bristol-Myers Squibb Company | 0.00 | 5.11 | 0.24 | 18.36 | 0.1149 | 0.0105 | |||

| WMT / Walmart Inc. | 0.00 | 8.32 | 0.24 | 19.02 | 0.1144 | 0.0111 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 0.24 | 0.1111 | 0.1111 | |||||

| COST / Costco Wholesale Corporation | 0.00 | 405.00 | 0.24 | 848.00 | 0.1111 | 0.1111 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.24 | 0.1111 | 0.1111 | |||||

| LVS / Las Vegas Sands Corp. | 0.00 | 0.23 | 0.1055 | 0.1055 | |||||

| MCD / McDonald's Corporation | 0.00 | 645.00 | 0.22 | 1,217.65 | 0.1050 | 0.1050 | |||

| INTF / iShares Trust - iShares International Equity Factor ETF | 0.01 | 0.00 | 0.22 | 1.36 | 0.1050 | -0.0064 | |||

| WASH / Washington Trust Bancorp, Inc. | 0.00 | -9.09 | 0.22 | 52.41 | 0.1036 | 0.1036 | |||

| KMB / Kimberly-Clark Corporation | 0.00 | 0.16 | 0.22 | 8.37 | 0.1032 | 0.0008 | |||

| USB / U.S. Bancorp | 0.00 | 0.22 | 0.1027 | 0.1027 | |||||

| PEP / PepsiCo, Inc. | 0.00 | 147.15 | 0.22 | 198.63 | 0.1022 | 0.1022 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -68.03 | 0.21 | -40.06 | 0.0989 | 0.0989 | |||

| LRGF / iShares Trust - iShares U.S. Equity Factor ETF | 0.01 | 0.20 | 0.0942 | 0.0942 | |||||

| OPK / OPKO Health, Inc. | 0.05 | -77.17 | 0.19 | -83.24 | 0.0886 | -0.4800 | |||

| SGYPQ / SYNERGY PHARMACEUTICALS INC DEL | 0.10 | 17.95 | 0.16 | 15.71 | 0.0760 | 0.0054 | |||

| IAU / iShares Gold Trust | 0.01 | 0.00 | 0.12 | -5.34 | 0.0581 | -0.0079 | |||

| CZR / Caesars Entertainment, Inc. | 0.01 | 0.12 | 0.0577 | 0.0577 | |||||

| FSK / FS KKR Capital Corp. | 0.02 | -2.87 | 0.11 | -7.56 | 0.0516 | 0.0516 | |||

| SIRI / Sirius XM Holdings Inc. | 0.02 | 0.00 | 0.10 | -6.54 | 0.0469 | -0.0070 | |||

| US6706871026 / Nuveen Municipal 2021 Trgt Trm | 0.01 | 0.00 | 0.10 | 0.00 | 0.0460 | 0.0460 | |||

| VISL / Vislink Technologies, Inc. | 0.02 | 36.54 | 0.01 | -10.00 | 0.0042 | -0.0008 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.1270 | ||||

| HBI / Hanesbrands Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 |