Basic Stats

| Portfolio Value | $ 263,955,975 |

| Current Positions | 56 |

Latest Holdings, Performance, AUM (from 13F, 13D)

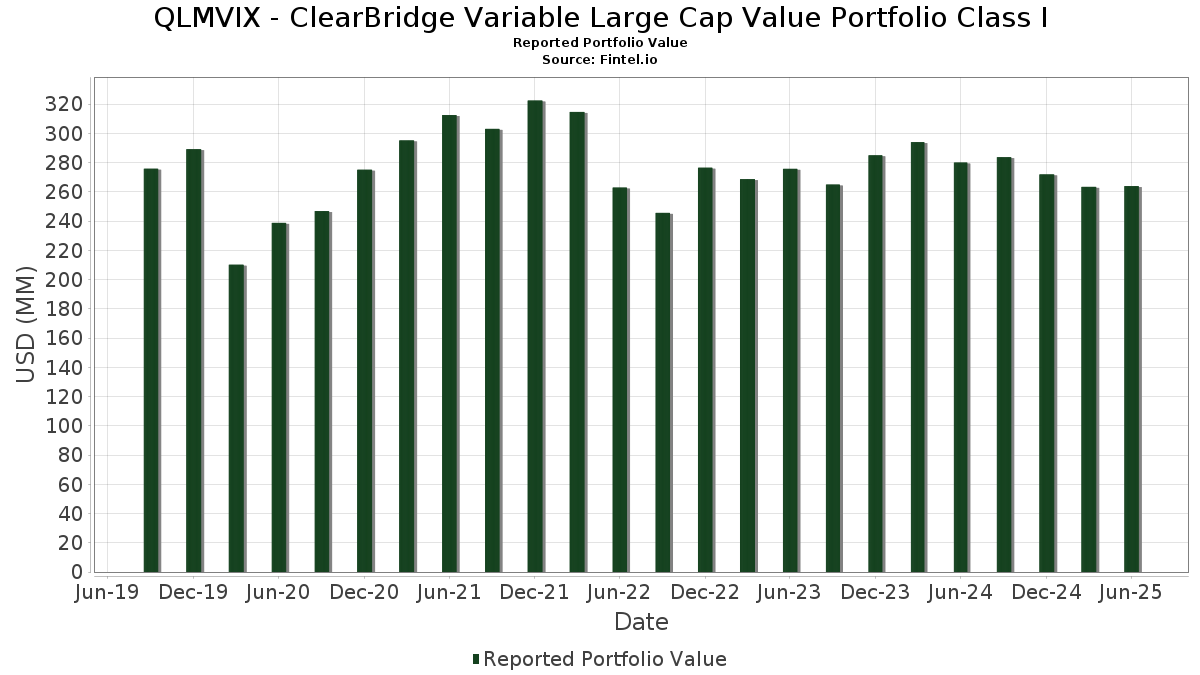

QLMVIX - ClearBridge Variable Large Cap Value Portfolio Class I has disclosed 56 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 263,955,975 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). QLMVIX - ClearBridge Variable Large Cap Value Portfolio Class I’s top holdings are JPMorgan Chase & Co. (US:JPM) , Sempra (US:SRE) , Air Products and Chemicals, Inc. (US:APD) , Microchip Technology Incorporated (US:MCHP) , and McKesson Corporation (US:MCK) . QLMVIX - ClearBridge Variable Large Cap Value Portfolio Class I’s new positions include The Boeing Company (US:BA) , AstraZeneca PLC - Depositary Receipt (Common Stock) (US:AZN) , Strats Trust For Procter & Gambel Security - Preferred Security (US:GJR) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 2.56 | 0.9681 | 0.9681 | |

| 0.04 | 2.48 | 0.9395 | 0.9395 | |

| 0.11 | 7.89 | 2.9876 | 0.9269 | |

| 0.02 | 2.44 | 0.9232 | 0.9232 | |

| 0.02 | 2.44 | 0.9227 | 0.9227 | |

| 0.02 | 6.15 | 2.3280 | 0.9103 | |

| 0.05 | 15.49 | 5.8677 | 0.8898 | |

| 0.01 | 6.40 | 2.4222 | 0.6796 | |

| 0.07 | 6.83 | 2.5863 | 0.3615 | |

| 0.01 | 4.13 | 1.5623 | 0.3391 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.16 | 5.11 | 1.9342 | -1.0629 | |

| 0.02 | 2.59 | 0.9810 | -1.0469 | |

| 0.02 | 5.45 | 2.0635 | -0.9923 | |

| 0.01 | 2.66 | 1.0077 | -0.7658 | |

| 0.00 | 0.00 | -0.6807 | ||

| 0.03 | 5.14 | 1.9461 | -0.6487 | |

| 0.05 | 2.75 | 1.0403 | -0.6228 | |

| 1.52 | 1.52 | 0.5775 | -0.3756 | |

| 1.52 | 1.52 | 0.5775 | -0.3756 | |

| 0.01 | 4.18 | 1.5816 | -0.3645 |

13F and Fund Filings

This form was filed on 2025-08-26 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| JPM / JPMorgan Chase & Co. | 0.05 | 0.00 | 15.49 | 18.19 | 5.8677 | 0.8898 | |||

| SRE / Sempra | 0.14 | 0.00 | 10.64 | 6.18 | 4.0310 | 0.2246 | |||

| APD / Air Products and Chemicals, Inc. | 0.03 | 0.00 | 8.43 | -4.36 | 3.1908 | -0.1543 | |||

| MCHP / Microchip Technology Incorporated | 0.11 | 0.00 | 7.89 | 45.37 | 2.9876 | 0.9269 | |||

| MCK / McKesson Corporation | 0.01 | 0.00 | 7.47 | 8.89 | 2.8299 | 0.2241 | |||

| SCHW / The Charles Schwab Corporation | 0.07 | 0.00 | 6.83 | 16.56 | 2.5863 | 0.3615 | |||

| DE / Deere & Company | 0.01 | 28.64 | 6.40 | 39.35 | 2.4222 | 0.6796 | |||

| BAC / Bank of America Corporation | 0.13 | 0.00 | 6.34 | 13.41 | 2.4023 | 0.2782 | |||

| TRV / The Travelers Companies, Inc. | 0.02 | 0.00 | 6.30 | 1.17 | 2.3860 | 0.0213 | |||

| AVGO / Broadcom Inc. | 0.02 | 0.00 | 6.15 | 64.64 | 2.3280 | 0.9103 | |||

| INTC / Intel Corporation | 0.27 | 0.00 | 6.08 | -1.36 | 2.3020 | -0.0380 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | 0.00 | 5.91 | -8.80 | 2.2386 | -0.2222 | |||

| V / Visa Inc. | 0.02 | 0.00 | 5.85 | 1.32 | 2.2148 | 0.0229 | |||

| XPO / XPO, Inc. | 0.04 | 0.00 | 5.48 | 17.40 | 2.0758 | 0.3029 | |||

| UNH / UnitedHealth Group Incorporated | 0.02 | 13.67 | 5.45 | -32.30 | 2.0635 | -0.9923 | |||

| CVS / CVS Health Corporation | 0.08 | 0.00 | 5.35 | 1.81 | 2.0273 | 0.0309 | |||

| MLM / Martin Marietta Materials, Inc. | 0.01 | 0.00 | 5.26 | 14.81 | 1.9934 | 0.2526 | |||

| CVX / Chevron Corporation | 0.04 | 0.00 | 5.23 | -14.40 | 1.9804 | -0.3394 | |||

| PH / Parker-Hannifin Corporation | 0.01 | 0.00 | 5.17 | 14.90 | 1.9575 | 0.2495 | |||

| BDX / Becton, Dickinson and Company | 0.03 | 0.00 | 5.14 | -24.81 | 1.9461 | -0.6487 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.16 | -28.76 | 5.11 | -35.29 | 1.9342 | -1.0629 | |||

| AXP / American Express Company | 0.02 | -21.77 | 5.04 | -7.25 | 1.9096 | -0.1549 | |||

| COP / ConocoPhillips | 0.06 | 0.00 | 5.04 | -14.54 | 1.9073 | -0.3306 | |||

| SHW / The Sherwin-Williams Company | 0.01 | 0.00 | 4.91 | -1.66 | 1.8596 | -0.0366 | |||

| RTX / RTX Corporation | 0.03 | -9.89 | 4.79 | -0.66 | 1.8147 | -0.0169 | |||

| MSI / Motorola Solutions, Inc. | 0.01 | 0.00 | 4.79 | -3.97 | 1.8140 | -0.0798 | |||

| JNJ / Johnson & Johnson | 0.03 | 0.00 | 4.71 | -7.90 | 1.7844 | -0.1580 | |||

| WEC / WEC Energy Group, Inc. | 0.04 | 0.00 | 4.63 | -4.38 | 1.7522 | -0.0852 | |||

| PGR / The Progressive Corporation | 0.02 | 0.00 | 4.62 | -5.70 | 1.7491 | -0.1107 | |||

| HD / The Home Depot, Inc. | 0.01 | 0.00 | 4.50 | 0.04 | 1.7045 | -0.0038 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.02 | 0.00 | 4.48 | -10.41 | 1.6958 | -0.2019 | |||

| HLN / Haleon plc - Depositary Receipt (Common Stock) | 0.41 | 0.00 | 4.29 | 0.80 | 1.6247 | 0.0083 | |||

| COF / Capital One Financial Corporation | 0.02 | -26.10 | 4.28 | -12.31 | 1.6196 | -0.2323 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | 0.00 | 4.18 | -18.52 | 1.5816 | -0.3645 | |||

| META / Meta Platforms, Inc. | 0.01 | 0.00 | 4.13 | 28.07 | 1.5623 | 0.3391 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.04 | 1,400.00 | 4.06 | -5.63 | 1.5360 | -0.0959 | |||

| CMCSA / Comcast Corporation | 0.11 | 0.00 | 3.95 | -3.28 | 1.4960 | -0.0548 | |||

| AMT / American Tower Corporation | 0.02 | 0.00 | 3.75 | 1.57 | 1.4192 | 0.0183 | |||

| USB / U.S. Bancorp | 0.08 | 0.00 | 3.41 | 7.17 | 1.2916 | 0.0833 | |||

| OTIS / Otis Worldwide Corporation | 0.03 | 0.00 | 3.30 | -4.04 | 1.2495 | -0.0562 | |||

| VLTO / Veralto Corporation | 0.03 | 0.00 | 3.23 | 3.59 | 1.2234 | 0.0393 | |||

| MSFT / Microsoft Corporation | 0.01 | 0.00 | 2.93 | 32.52 | 1.1099 | 0.2701 | |||

| GOOGL / Alphabet Inc. | 0.02 | 0.00 | 2.85 | 13.94 | 1.0778 | 0.1296 | |||

| EIX / Edison International | 0.05 | -28.38 | 2.75 | -37.29 | 1.0403 | -0.6228 | |||

| NOC / Northrop Grumman Corporation | 0.01 | -41.66 | 2.66 | -43.04 | 1.0077 | -0.7658 | |||

| ITW / Illinois Tool Works Inc. | 0.01 | 0.00 | 2.62 | -0.30 | 0.9923 | -0.0057 | |||

| PEP / PepsiCo, Inc. | 0.02 | -44.92 | 2.59 | -51.50 | 0.9810 | -1.0469 | |||

| BA / The Boeing Company | 0.01 | 2.56 | 0.9681 | 0.9681 | |||||

| DIS / The Walt Disney Company | 0.02 | 0.00 | 2.52 | 25.66 | 0.9534 | 0.1926 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.04 | 2.48 | 0.9395 | 0.9395 | |||||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.02 | 2.44 | 0.9232 | 0.9232 | |||||

| XOM / Exxon Mobil Corporation | 0.02 | 2.44 | 0.9227 | 0.9227 | |||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 2.20 | -0.63 | 0.8339 | -0.0073 | |||

| SBUX / Starbucks Corporation | 0.02 | 0.00 | 1.85 | -6.61 | 0.7010 | -0.0514 | |||

| JTSXX / JPMorgan Trust I. - JPMorgan 100% U.S. Treasury Securities Money Market Fund Inst | 1.52 | -39.25 | 1.52 | -39.28 | 0.5775 | -0.3756 | |||

| US52470G4780 / WA Premier Institutional U.S. Treasury Reserves-Premium Shares | 1.52 | -39.25 | 1.52 | -39.28 | 0.5775 | -0.3756 | |||

| VG / Venture Global, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6807 |