Basic Stats

| Portfolio Value | $ 197,964,000 |

| Current Positions | 29 |

Latest Holdings, Performance, AUM (from 13F, 13D)

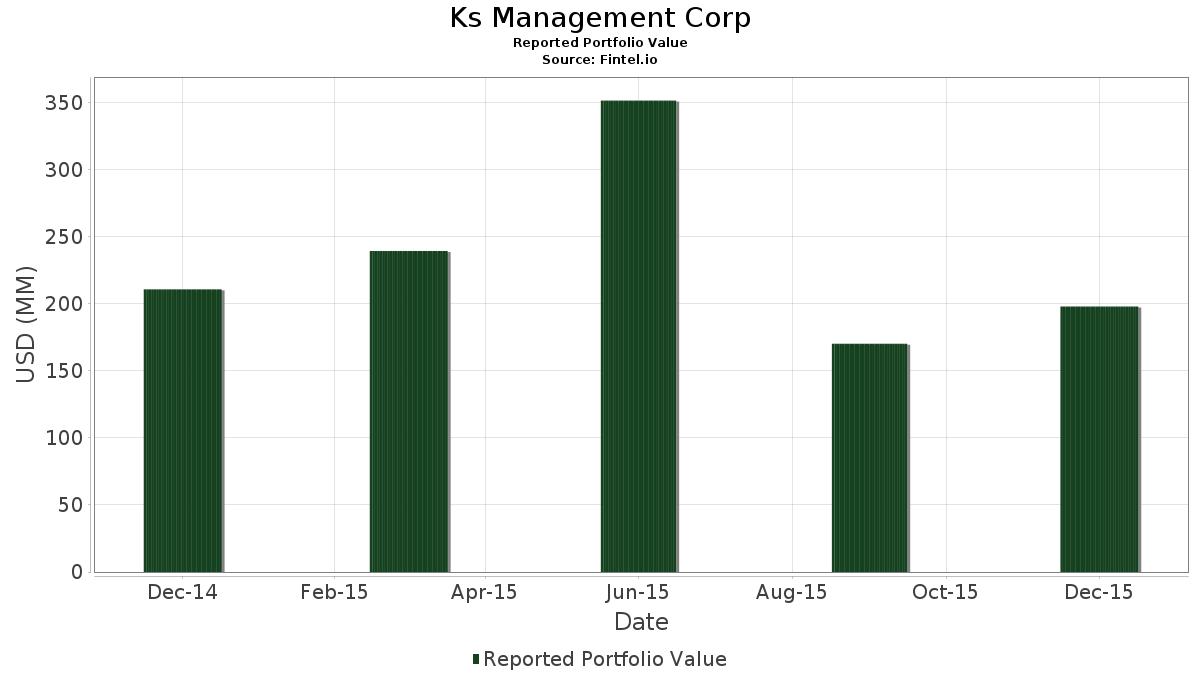

Ks Management Corp has disclosed 29 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 197,964,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Ks Management Corp’s top holdings are SPDR S&P 500 ETF (US:SPY) , Chubb Limited (US:CB) , Cameron International Corporation (US:CAM) , Precision Castparts Corporation (US:PCP) , and Broadcom Corporation (US:BRCM) . Ks Management Corp’s new positions include Chubb Limited (US:CB) , Health Net Inc. (US:HNT) , Airgas, Inc. (US:ARG) , Prenetics Global Limited (US:PRE) , and Keurig Green Mountain, Inc. (US:GMCR) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.64 | 130.48 | 65.9095 | 16.7875 | |

| 0.08 | 10.03 | 5.0661 | 5.0661 | |

| 0.07 | 4.45 | 2.2479 | 2.2479 | |

| 0.14 | 8.83 | 4.4584 | 2.2193 | |

| 0.02 | 2.21 | 1.1179 | 1.1179 | |

| 0.01 | 2.10 | 1.0588 | 1.0588 | |

| 0.02 | 2.99 | 1.5094 | 0.9412 | |

| 0.02 | 1.80 | 0.9093 | 0.9093 | |

| 0.05 | 1.39 | 0.7032 | 0.7032 | |

| 0.01 | 1.38 | 0.6986 | 0.6986 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -5.4845 | ||

| 0.00 | 0.00 | -5.2889 | ||

| 0.02 | 4.21 | 2.1287 | -4.5203 | |

| 0.00 | 0.00 | -2.8853 | ||

| 0.00 | 0.00 | -1.7925 | ||

| 0.00 | 0.00 | -1.6480 | ||

| 0.00 | 0.00 | -1.5945 | ||

| 0.00 | 0.00 | -1.5704 | ||

| 0.00 | 0.00 | -1.1639 | ||

| 0.00 | 0.00 | -1.1539 |

13F and Fund Filings

This form was filed on 2016-02-16 for the reporting period 2015-12-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | Put | 0.64 | 46.69 | 130.48 | 56.06 | 65.9095 | 16.7875 | ||

| CB / Chubb Limited | 0.08 | 10.03 | 5.0661 | 5.0661 | |||||

| CAM / Cameron International Corporation | 0.14 | 124.69 | 8.83 | 131.59 | 4.4584 | 2.2193 | |||

| PCP / Precision Castparts Corporation | 0.03 | -4.35 | 7.81 | -3.40 | 3.9457 | -0.8050 | |||

| BRCM / Broadcom Corporation | 0.10 | -9.96 | 5.96 | 1.22 | 3.0112 | -0.4488 | |||

| LBRDA / Liberty Broadband Corporation | Put | 0.03 | 0.00 | 5.24 | 4.14 | 2.6454 | -0.3092 | ||

| HNT / Health Net Inc. | 0.07 | 4.45 | 2.2479 | 2.2479 | |||||

| TWC / Spectrum Management Holding Company LLC | 0.02 | -64.01 | 4.21 | -62.76 | 2.1287 | -4.5203 | |||

| BRCM / Broadcom Corporation | Put | 0.07 | 34.00 | 3.87 | 50.62 | 1.9569 | 0.4458 | ||

| LBRDA / Liberty Broadband Corporation | 0.02 | 196.69 | 2.99 | 209.00 | 1.5094 | 0.9412 | |||

| ARG / Airgas, Inc. | 0.02 | 2.21 | 1.1179 | 1.1179 | |||||

| PRE / Prenetics Global Limited | 0.01 | 2.10 | 1.0588 | 1.0588 | |||||

| GMCR / Keurig Green Mountain, Inc. | 0.02 | 1.80 | 0.9093 | 0.9093 | |||||

| POM / PEPCO Holdings, Inc. | 0.05 | 1.39 | 0.7032 | 0.7032 | |||||

| ARG / Airgas, Inc. | Put | 0.01 | 1.38 | 0.6986 | 0.6986 | ||||

| PMCS / PMC - Sierra, Inc. | 0.10 | 1.16 | 0.5870 | 0.5870 | |||||

| AVGO / Broadcom Inc. | Put | 0.01 | 0.00 | 1.09 | 16.10 | 0.5501 | 0.5501 | ||

| DYAX / Dyax Corp. | 0.01 | 0.56 | 0.2849 | 0.2849 | |||||

| OPK / OPKO Health, Inc. | 0.05 | 0.00 | 0.51 | 19.63 | 0.2586 | 0.0072 | |||

| OPK / OPKO Health, Inc. | Put | 0.05 | 0.00 | 0.51 | 19.63 | 0.2586 | 0.0072 | ||

| BHI / Baker Hughes Inc. | 0.01 | 0.39 | 0.1980 | 0.1980 | |||||

| PMCS / PMC - Sierra, Inc. | Put | 0.03 | 0.29 | 0.1470 | 0.1470 | ||||

| TRCO / Tribune Media Company | 0.01 | 0.00 | 0.26 | -4.81 | 0.1298 | -0.0288 | |||

| METR / Metro Bancorp, Inc | 0.01 | 0.16 | 0.0808 | 0.0808 | |||||

| ACW / Accuride Corp | 0.07 | 0.00 | 0.12 | -40.10 | 0.0626 | -0.0590 | |||

| LYB / LyondellBasell Industries N.V. | 0.00 | 0.10 | 0.0490 | 0.0490 | |||||

| 87270T106 / Tribune Publishing Co | 0.01 | 0.00 | 0.05 | 0.0237 | 0.0237 | ||||

| QUAD / Quad/Graphics, Inc. | 0.00 | 0.00 | 0.01 | 0.0025 | 0.0025 | ||||

| CYH / Community Health Systems, Inc. | 0.15 | 0.00 | 0.00 | 0.00 | 0.0005 | -0.0001 | |||

| TRAK / ReposiTrak, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -5.2889 | ||||

| OWW / | Put | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | |||

| WMB / The Williams Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2168 | ||||

| WMB / The Williams Companies, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.2168 | |||

| WMGIZ / Wright Medical Group N.V. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1539 | ||||

| ATML / Atmel Corporation | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.2844 | |||

| METI / Merge Tech Inc | 0.00 | -100.00 | 0.00 | -100.00 | -0.2086 | ||||

| HCC / Warrior Met Coal, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.8853 | ||||

| Xoom / XOOM Corp | 0.00 | -100.00 | 0.00 | -100.00 | -0.2174 | ||||

| 002144110 / Altera Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.6480 | ||||

| CYN / Cyngn Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1639 | ||||

| SIRI / Sirius XM Holdings Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0464 | ||||

| HCBK / Hudson City Bancorp, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.7925 | ||||

| CNW / Con-way Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5945 | ||||

| HCBK / Hudson City Bancorp, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.5975 | |||

| ATML / Atmel Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.2844 | ||||

| 885175307 / Thoratec | 0.00 | -100.00 | 0.00 | -100.00 | -1.0035 | ||||

| ADEP / Adept Technology | 0.00 | -100.00 | 0.00 | -100.00 | -0.3807 | ||||

| SLH / Solera Holdings, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5704 | ||||

| SIAL / Sigma-Aldrich Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -5.4845 | ||||

| SLH / Solera Holdings, Inc. | Put | 0.00 | -100.00 | 0.00 | -100.00 | -0.7773 |