Basic Stats

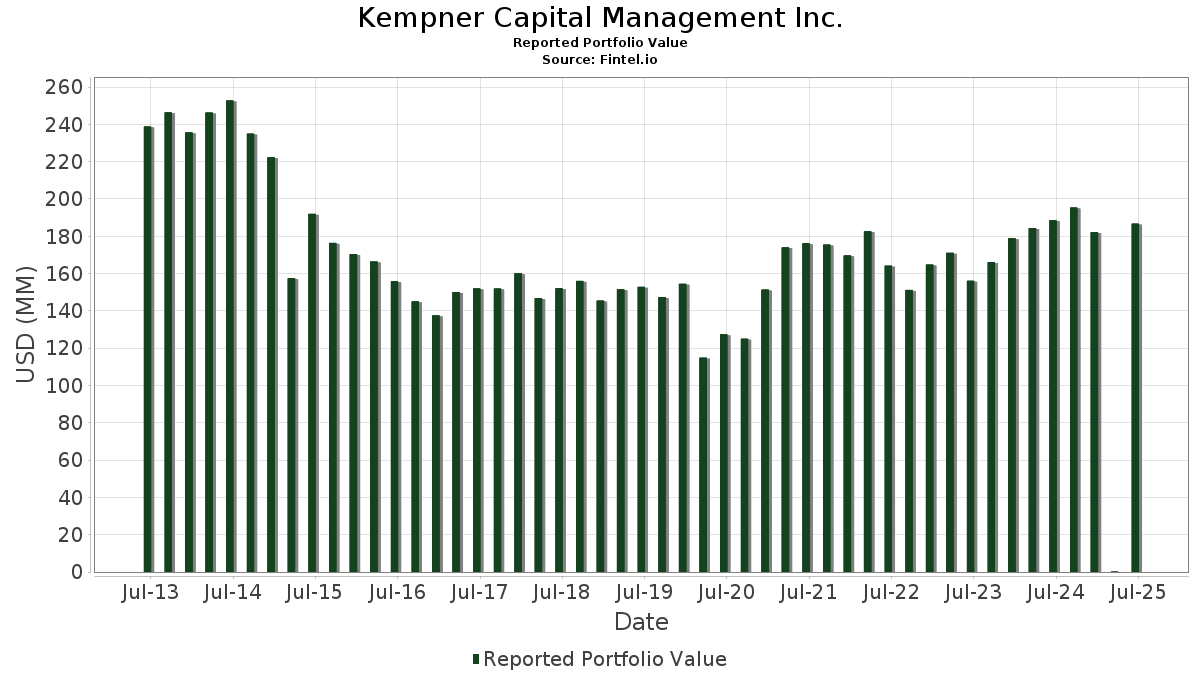

| Portfolio Value | $ 186,722,000 |

| Current Positions | 46 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Kempner Capital Management Inc. has disclosed 46 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 186,722,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Kempner Capital Management Inc.’s top holdings are Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) , Micron Technology, Inc. (US:MU) , Black Stone Minerals, L.P. - Limited Partnership (US:BSM) , The Walt Disney Company (US:DIS) , and Bank of America Corporation (US:BAC) . Kempner Capital Management Inc.’s new positions include Global Payments Inc. (US:GPN) , Sonoco Products Company (US:SON) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.08 | 6.23 | 3.3381 | 3.3381 | |

| 0.06 | 13.73 | 7.3526 | 3.0519 | |

| 0.09 | 11.61 | 6.2173 | 1.6115 | |

| 0.03 | 5.30 | 2.8390 | 1.4675 | |

| 0.01 | 4.66 | 2.4935 | 1.1997 | |

| 0.76 | 9.93 | 5.3191 | 1.0341 | |

| 0.04 | 1.92 | 1.0277 | 1.0277 | |

| 0.06 | 7.77 | 4.1597 | 0.6805 | |

| 0.21 | 6.29 | 3.3713 | 0.5158 | |

| 0.07 | 6.25 | 3.3445 | 0.4136 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.11 | 3.70 | 1.9816 | -0.5937 | |

| 0.09 | 4.87 | 2.6071 | -0.5698 | |

| 0.09 | 5.04 | 2.7003 | -0.5368 | |

| 0.05 | 5.58 | 2.9863 | -0.4760 | |

| 0.07 | 5.42 | 2.9000 | -0.4660 | |

| 0.05 | 2.73 | 1.4647 | -0.4082 | |

| 0.12 | 3.66 | 1.9612 | -0.3687 | |

| 0.09 | 6.06 | 3.2449 | -0.3040 | |

| 0.16 | 5.50 | 2.9445 | -0.2667 | |

| 0.07 | 2.11 | 1.1316 | -0.2106 |

13F and Fund Filings

This form was filed on 2025-07-15 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.06 | 31.66 | 13.73 | 196,028.57 | 7.3526 | 3.0519 | |||

| MU / Micron Technology, Inc. | 0.09 | 0.00 | 11.61 | 145,012.50 | 6.2173 | 1.6115 | |||

| BSM / Black Stone Minerals, L.P. - Limited Partnership | 0.76 | 52.29 | 9.93 | 141,785.71 | 5.3191 | 1.0341 | |||

| DIS / The Walt Disney Company | 0.06 | 0.00 | 7.77 | 129,350.00 | 4.1597 | 0.6805 | |||

| BAC / Bank of America Corporation | 0.13 | 0.00 | 6.36 | 127,040.00 | 3.4045 | 0.2496 | |||

| ST / Sensata Technologies Holding plc | 0.21 | 0.00 | 6.29 | 125,800.00 | 3.3713 | 0.5158 | |||

| C / Citigroup Inc. | 0.07 | 0.00 | 6.25 | 124,800.00 | 3.3445 | 0.4136 | |||

| GPN / Global Payments Inc. | 0.08 | 6.23 | 3.3381 | 3.3381 | |||||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.09 | 0.00 | 6.06 | 100,883.33 | 3.2449 | -0.3040 | |||

| XOM / Exxon Mobil Corporation | 0.05 | 0.00 | 5.58 | 92,833.33 | 2.9863 | -0.4760 | |||

| LNC / Lincoln National Corporation | 0.16 | 0.00 | 5.50 | 109,860.00 | 2.9445 | -0.2667 | |||

| MRK / Merck & Co., Inc. | 0.07 | 2.67 | 5.42 | 108,200.00 | 2.9000 | -0.4660 | |||

| CSCO / Cisco Systems, Inc. | 0.08 | 0.00 | 5.39 | 134,725.00 | 2.8883 | 0.1886 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.06 | 47.72 | 5.33 | 133,275.00 | 2.8572 | 0.3348 | |||

| EQH / Equitable Holdings, Inc. | 0.09 | 0.00 | 5.32 | 132,825.00 | 2.8475 | 0.0691 | |||

| GOOG / Alphabet Inc. | 0.03 | 91.62 | 5.30 | 264,950.00 | 2.8390 | 1.4675 | |||

| CIWV / Citizens Financial Corp. | 0.12 | 0.00 | 5.28 | 132,000.00 | 2.8299 | 0.1071 | |||

| TSN / Tyson Foods, Inc. | 0.09 | 0.00 | 5.04 | 100,740.00 | 2.7003 | -0.5368 | |||

| CNMD / CONMED Corporation | 0.09 | 0.00 | 4.87 | 97,260.00 | 2.6071 | -0.5698 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 239.98 | 4.66 | 232,700.00 | 2.4935 | 1.1997 | |||

| TFC / Truist Financial Corporation | 0.11 | 0.00 | 4.59 | 114,575.00 | 2.4566 | -0.0140 | |||

| CFR / Cullen/Frost Bankers, Inc. | 0.04 | -2.77 | 4.52 | 112,900.00 | 2.4207 | -0.1270 | |||

| EASTERLY GOVERN REIT / (27616P103) | 0.19 | 4.32 | 0.0000 | ||||||

| TER / Teradyne, Inc. | 0.05 | 0.00 | 4.13 | 137,500.00 | 2.2108 | 0.0767 | |||

| SLB / Schlumberger Limited | 0.11 | 0.00 | 3.70 | 92,400.00 | 1.9816 | -0.5937 | |||

| BAX / Baxter International Inc. | 0.12 | 0.00 | 3.66 | 91,450.00 | 1.9612 | -0.3687 | |||

| IFF / International Flavors & Fragrances Inc. | 0.05 | 0.00 | 3.49 | 116,133.33 | 1.8675 | -0.2036 | |||

| CB / Chubb Limited | 0.01 | 0.00 | 3.46 | 115,333.33 | 1.8546 | -0.1764 | |||

| O / Realty Income Corporation | 0.05 | 0.00 | 3.16 | 105,300.00 | 1.6934 | -0.0985 | |||

| LYB / LyondellBasell Industries N.V. | 0.05 | 0.00 | 2.73 | 91,066.67 | 1.4647 | -0.4082 | |||

| FMC / FMC Corporation | 0.06 | 0.00 | 2.56 | 128,000.00 | 1.3721 | -0.0849 | |||

| EG / Everest Group, Ltd. | 0.01 | 0.00 | 2.20 | 110,000.00 | 1.1793 | -0.1455 | |||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.07 | 0.00 | 2.11 | 105,550.00 | 1.1316 | -0.2106 | |||

| SON / Sonoco Products Company | 0.04 | 1.92 | 1.0277 | 1.0277 | |||||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 1.92 | 191,400.00 | 1.0256 | -0.0848 | |||

| FANG / Diamondback Energy, Inc. | 0.01 | 0.00 | 1.35 | 134,800.00 | 0.7225 | -0.1605 | |||

| ISRA / VanEck ETF Trust - VanEck Israel ETF | 0.02 | 0.00 | 1.17 | 0.6245 | 0.0904 | ||||

| EOSE / Eos Energy Enterprises, Inc. | 0.17 | 0.00 | 0.90 | 0.4799 | 0.1079 | ||||

| KMI / Kinder Morgan, Inc. | 0.03 | 0.00 | 0.83 | 0.4440 | -0.0091 | ||||

| BHP / BHP Group Limited - Depositary Receipt (Common Stock) | 0.02 | 0.00 | 0.73 | 0.3893 | -0.0237 | ||||

| AWPAX AB SUST INTL THEMATIC A / MMF (01879X103) | 0.02 | 0.53 | 0.0000 | ||||||

| SBI / Western Asset Intermediate Muni Fund Inc. | 0.05 | 0.00 | 0.36 | 0.1923 | -0.0177 | ||||

| PK / Park Hotels & Resorts Inc. | 0.02 | 0.00 | 0.23 | 0.1205 | -0.0118 | ||||

| WBD / Warner Bros. Discovery, Inc. | 0.01 | 0.00 | 0.13 | 0.0686 | 0.0010 | ||||

| SVC / Service Properties Trust | 0.05 | 0.00 | 0.11 | 0.0605 | -0.0093 | ||||

| ENZB / Enzo Biochem, Inc. | 0.03 | 0.00 | 0.02 | 0.0091 | 0.0040 | ||||

| ES / Eversource Energy | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DTEGY / Deutsche Telekom AG - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NOVAQ / Sunnova Energy International Inc. | 0.01 | 0.00 | 0.00 | 0.0000 | -0.0034 | ||||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LHX / L3Harris Technologies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |