Basic Stats

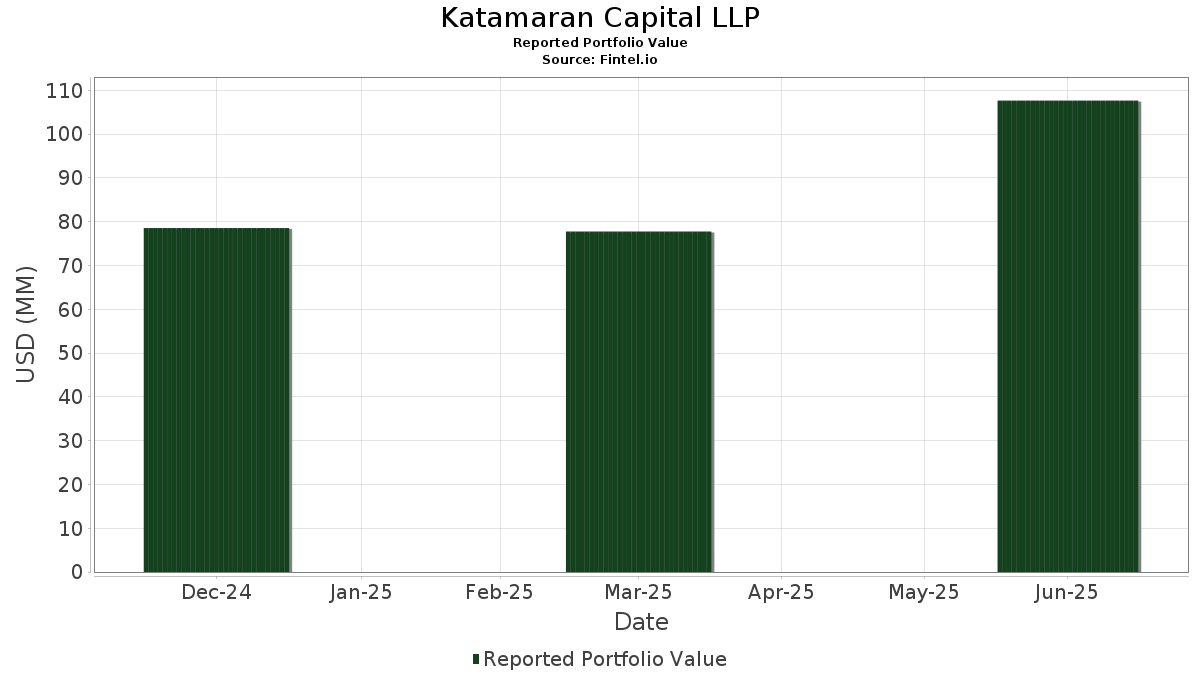

| Portfolio Value | $ 107,675,058 |

| Current Positions | 26 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Katamaran Capital LLP has disclosed 26 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 107,675,058 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Katamaran Capital LLP’s top holdings are Amazon.com, Inc. (US:AMZN) , Mastercard Incorporated (US:MA) , Meta Platforms, Inc. (US:META) , Microsoft Corporation (US:MSFT) , and Visa Inc. (US:V) . Katamaran Capital LLP’s new positions include Fair Isaac Corporation (US:FICO) , Cadence Design Systems, Inc. (US:CDNS) , Motorola Solutions, Inc. (US:MSI) , NVIDIA Corporation (US:NVDA) , and Dollar General Corporation (US:DG) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 7.00 | 6.4979 | 4.5604 | |

| 0.01 | 4.80 | 4.4572 | 4.4572 | |

| 0.00 | 4.62 | 4.2951 | 4.2951 | |

| 0.01 | 4.41 | 4.0924 | 4.0924 | |

| 0.01 | 4.24 | 3.9369 | 3.9369 | |

| 0.02 | 2.87 | 2.6618 | 2.6618 | |

| 0.01 | 8.26 | 7.6712 | 2.6517 | |

| 0.02 | 6.97 | 6.4699 | 2.4904 | |

| 0.03 | 3.75 | 3.4818 | 2.4657 | |

| 0.02 | 2.56 | 2.3761 | 2.3761 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -3.2698 | ||

| 0.00 | 1.22 | 1.1324 | -2.7626 | |

| 0.00 | 0.00 | -2.0046 | ||

| 0.05 | 3.43 | 3.1812 | -1.8396 | |

| 0.01 | 8.15 | 7.5711 | -1.6585 | |

| 0.00 | 3.36 | 3.1221 | -1.4149 | |

| 0.02 | 3.76 | 3.4890 | -0.5027 | |

| 0.06 | 5.15 | 4.7817 | -0.3160 | |

| 0.05 | 4.82 | 4.4723 | -0.1209 |

13F and Fund Filings

This form was filed on 2025-07-24 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AMZN / Amazon.com, Inc. | 0.05 | 56.53 | 10.61 | 80.51 | 9.8510 | 2.2945 | |||

| MA / Mastercard Incorporated | 0.01 | 106.39 | 8.26 | 111.61 | 7.6712 | 2.6517 | |||

| META / Meta Platforms, Inc. | 0.01 | -11.31 | 8.15 | 13.59 | 7.5711 | -1.6585 | |||

| MSFT / Microsoft Corporation | 0.01 | 250.42 | 7.00 | 364.54 | 6.4979 | 4.5604 | |||

| V / Visa Inc. | 0.02 | 122.18 | 6.97 | 125.15 | 6.4699 | 2.4904 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.06 | 31.01 | 5.15 | 29.87 | 4.7817 | -0.3160 | |||

| ADI / Analog Devices, Inc. | 0.02 | 44.25 | 4.90 | 70.24 | 4.5539 | 0.8507 | |||

| LRCX / Lam Research Corporation | 0.05 | 0.68 | 4.82 | 34.80 | 4.4723 | -0.1209 | |||

| QQQ / Invesco QQQ Trust, Series 1 | Put | 0.01 | 4.80 | 4.4572 | 4.4572 | ||||

| FICO / Fair Isaac Corporation | 0.00 | 4.62 | 4.2951 | 4.2951 | |||||

| CDNS / Cadence Design Systems, Inc. | 0.01 | 4.41 | 4.0924 | 4.0924 | |||||

| MSI / Motorola Solutions, Inc. | 0.01 | 4.24 | 3.9369 | 3.9369 | |||||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.02 | -11.30 | 3.76 | 21.01 | 3.4890 | -0.5027 | |||

| TJX / The TJX Companies, Inc. | 0.03 | 367.93 | 3.75 | 374.56 | 3.4818 | 2.4657 | |||

| KO / The Coca-Cola Company | 0.05 | -11.20 | 3.43 | -12.27 | 3.1812 | -1.8396 | |||

| FROG / JFrog Ltd. | 0.08 | 2.29 | 3.41 | 40.30 | 3.1691 | 0.0409 | |||

| SPOT / Spotify Technology S.A. | 0.00 | -31.71 | 3.36 | -4.73 | 3.1221 | -1.4149 | |||

| NVDA / NVIDIA Corporation | 0.02 | 2.87 | 2.6618 | 2.6618 | |||||

| DG / Dollar General Corporation | 0.02 | 2.56 | 2.3761 | 2.3761 | |||||

| NTNX / Nutanix, Inc. | 0.03 | 29.08 | 2.30 | 41.38 | 2.1324 | 0.0436 | |||

| MSCI / MSCI Inc. | 0.00 | 1.81 | 1.6771 | 1.6771 | |||||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 1.74 | 1.6134 | 1.6134 | |||||

| AVGO / Broadcom Inc. | 0.01 | 12.61 | 1.70 | 85.36 | 1.5757 | 0.3989 | |||

| AMBA / Ambarella, Inc. | 0.02 | 1.36 | 1.2636 | 1.2636 | |||||

| PODD / Insulet Corporation | 0.00 | -66.35 | 1.22 | -59.76 | 1.1324 | -2.7626 | |||

| FIX / Comfort Systems USA, Inc. | 0.00 | 0.51 | 0.4736 | 0.4736 | |||||

| SNDK.V / Sandisk Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CRM / Salesforce, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SKX / Skechers U.S.A., Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -3.2698 | ||||

| TEAM / Atlassian Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| INTC / Intel Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -2.0046 | ||||

| PRMB / Primo Brands Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RH / RH | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| T / AT&T Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BRBR / BellRing Brands, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TXN / Texas Instruments Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EQIX / Equinix, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ORCL / Oracle Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PCTY / Paylocity Holding Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |