Basic Stats

| Portfolio Value | $ 1,544,676,568 |

| Current Positions | 683 |

Latest Holdings, Performance, AUM (from 13F, 13D)

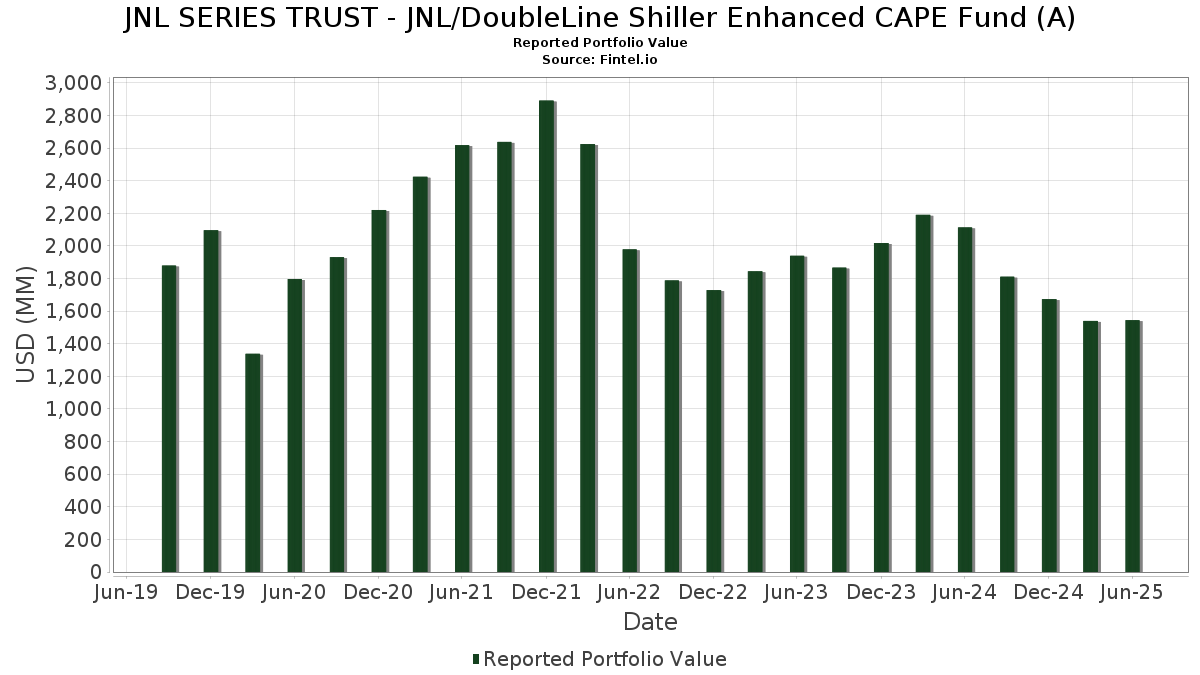

JNL SERIES TRUST - JNL/DoubleLine Shiller Enhanced CAPE Fund (A) has disclosed 683 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,544,676,568 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). JNL SERIES TRUST - JNL/DoubleLine Shiller Enhanced CAPE Fund (A)’s top holdings are United States Treasury Note/Bond (US:US91282CBJ99) , United States Treasury Note/Bond - When Issued (US:US91282CBT71) , United States Treasury Note/Bond (US:US91282CBH34) , United States Treasury Note/Bond (US:US91282CBC47) , and United States Treasury Note/Bond (US:US91282CAV37) . JNL SERIES TRUST - JNL/DoubleLine Shiller Enhanced CAPE Fund (A)’s new positions include United States Treasury Note/Bond (US:US91282CBJ99) , United States Treasury Note/Bond - When Issued (US:US91282CBT71) , United States Treasury Note/Bond (US:US91282CBH34) , United States Treasury Note/Bond (US:US91282CBC47) , and United States Treasury Note/Bond (US:US91282CAV37) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 29.90 | 1.9325 | 1.9325 | ||

| 16.73 | 1.0813 | 1.0813 | ||

| 9.87 | 0.6381 | 0.6381 | ||

| 9.45 | 0.6109 | 0.6109 | ||

| 9.23 | 0.5967 | 0.5967 | ||

| 6.42 | 0.4148 | 0.4148 | ||

| 6.31 | 0.4078 | 0.4078 | ||

| 5.00 | 0.3229 | 0.3229 | ||

| 4.94 | 0.3195 | 0.3195 | ||

| 4.54 | 0.2934 | 0.2934 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 18.47 | 18.47 | 1.1941 | -2.7259 | |

| 44.39 | 2.8693 | -1.2519 | ||

| 1.83 | 0.1183 | -1.1678 | ||

| 42.89 | 2.7725 | -1.0633 | ||

| 6.69 | 0.4323 | -0.1473 | ||

| 10.56 | 0.6823 | -0.0993 | ||

| 4.27 | 0.2761 | -0.0821 | ||

| 0.55 | 0.0358 | -0.0591 | ||

| 0.57 | 0.0368 | -0.0574 | ||

| 0.52 | 0.0335 | -0.0494 |

13F and Fund Filings

This form was filed on 2025-08-27 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US91282CBJ99 / United States Treasury Note/Bond | 75.05 | 1.25 | 4.8512 | 0.0371 | |||||

| US91282CBT71 / United States Treasury Note/Bond - When Issued | 57.40 | 0.78 | 3.7102 | 0.0112 | |||||

| US91282CBH34 / United States Treasury Note/Bond | 54.96 | 0.86 | 3.5524 | 0.0137 | |||||

| US91282CBC47 / United States Treasury Note/Bond | 44.39 | -30.05 | 2.8693 | -1.2519 | |||||

| US91282CAV37 / United States Treasury Note/Bond | 42.89 | -27.38 | 2.7725 | -1.0633 | |||||

| US91282CCZ23 / United States Treasury Note/Bond | 38.62 | 0.81 | 2.4967 | 0.0084 | |||||

| US91282CCP41 / United States Treasury Note/Bond - When Issued | 33.33 | 0.83 | 2.1544 | 0.0077 | |||||

| Treasury, United States Department of / STIV (US912797PG65) | 29.90 | 1.9325 | 1.9325 | ||||||

| US912828ZE35 / United States Treasury Note/Bond | 25.05 | 1.05 | 1.6195 | 0.0093 | |||||

| US91282CCF68 / United States Treasury Note/Bond | 21.64 | 0.79 | 1.3988 | 0.0044 | |||||

| 46628D437 / JNL Government Money Market Fund | 18.47 | -69.40 | 18.47 | -69.40 | 1.1941 | -2.7259 | |||

| PRPM 2025-NQM2 Trust / ABS-MBS (US693983AA68) | 16.73 | 1.0813 | 1.0813 | ||||||

| US92925CEU27 / Washington Mutural Asset-Backed Certificates WMABS | 12.45 | -0.41 | 0.8051 | -0.0071 | |||||

| Verus Securitization Trust 2024-1 / ABS-MBS (US92540EAA10) | 10.56 | -12.28 | 0.6823 | -0.0993 | |||||

| US05684NAE13 / Bain Capital Credit CLO 2022-3 Ltd | 10.50 | 0.01 | 0.6787 | -0.0032 | |||||

| US48585JAA88 / Katayma CLO I Ltd | 10.04 | 0.02 | 0.6493 | -0.0029 | |||||

| Cedar Funding IX CLO Ltd / ABS-CBDO (US15033EAN85) | 10.04 | 0.32 | 0.6489 | -0.0010 | |||||

| Warwick Capital CLO 4 Ltd. / ABS-CBDO (US93655QAA31) | 10.03 | 0.23 | 0.6482 | -0.0016 | |||||

| OCTAGON INVESTMENT PARTNERS 20-R LTD / ABS-CBDO (US67576WBA99) | 10.02 | 0.17 | 0.6478 | -0.0020 | |||||

| US83614BAQ23 / Sound Point CLO XXIII | 10.00 | -0.03 | 0.6467 | -0.0032 | |||||

| OBX 2025-NQM8 Trust / ABS-MBS (US67449AAA34) | 9.87 | 0.6381 | 0.6381 | ||||||

| US17322WAE49 / Citigroup Mortgage Loan Trust 2014-6 | 9.73 | -4.74 | 0.6288 | -0.0344 | |||||

| Park Blue CLO 2022-1 Ltd / ABS-CBDO (US70016WAQ78) | 9.72 | 0.20 | 0.6283 | -0.0017 | |||||

| US48585JAE01 / Katayma CLO I Ltd | 9.53 | 0.15 | 0.6159 | -0.0020 | |||||

| GCAT 2025-NQM1 Trust / ABS-MBS (US36171GAA94) | 9.45 | 0.6109 | 0.6109 | ||||||

| BNP / BNP Paribas SA | 9.23 | 0.5967 | 0.5967 | ||||||

| US55286MAA80 / MFA 2023-NQM3 TRUST SER 2023-NQM3 CL A1 V/R REGD 144A P/P 0.00000000 | 8.17 | -4.31 | 0.5284 | -0.0264 | |||||

| US07132LAL36 / Battalion CLO XI Ltd | 8.02 | 0.25 | 0.5184 | -0.0011 | |||||

| Generate CLO 9 LTD / ABS-CBDO (US37147LAN91) | 7.52 | 0.36 | 0.4860 | -0.0005 | |||||

| Verus Securitization Trust 2024-9 / ABS-MBS (US92540RAC88) | 7.48 | -4.48 | 0.4837 | -0.0251 | |||||

| US03328JAA51 / Anchorage Capital CLO 19 Ltd | 7.00 | 0.04 | 0.4527 | -0.0019 | |||||

| Tesla Sustainable Energy Trust 2024-1 / ABS-CBDO (US88164AAB08) | 6.78 | -3.49 | 0.4383 | -0.0180 | |||||

| US76119DAD12 / Residential Mortgage Loan Trust 2019-2 | 6.69 | -25.07 | 0.4323 | -0.1473 | |||||

| US89624GAA13 / Trimaran Cavu Ltd., Series 2021-3A, Class A | 6.51 | 0.20 | 0.4211 | -0.0012 | |||||

| US91282CEJ62 / United States Treasury Inflation Indexed Bonds | 6.42 | 0.4148 | 0.4148 | ||||||

| TOTAL RETURN SWAP - INDEX / DE (N/A) | 6.31 | 0.4078 | 0.4078 | ||||||

| Research-Driven Pagaya Motor Asset Trust 2025-1 / ABS-CBDO (US76089YAA73) | 5.91 | -4.77 | 0.3818 | -0.0210 | |||||

| US3136BCC731 / FANNIE MAE-ACES SER 2020-M49 CL 1A1 V/R 1.25570000 | 5.79 | -2.08 | 0.3745 | -0.0098 | |||||

| US85573QAA85 / STARWOOD MORTGAGE RESIDENTIAL TRUST 2021-5 | 5.73 | -2.77 | 0.3703 | -0.0123 | |||||

| Compass Datacenters Issuer II, LLC / ABS-CBDO (US20469AAA79) | 5.54 | 0.36 | 0.3583 | -0.0004 | |||||

| Affirm Asset Securitization Trust 2024-A / ABS-CBDO (US00834BAA52) | 5.53 | -0.25 | 0.3573 | -0.0026 | |||||

| US073880AK24 / Bear Stearns ARM Trust 2007-1 | 5.04 | 1.39 | 0.3257 | 0.0029 | |||||

| Battalion CLO XXIII Ltd. / ABS-CBDO (US07135LAL09) | 5.03 | 0.60 | 0.3253 | 0.0004 | |||||

| Elmwood CLO II Ltd / ABS-CBDO (US29001LAW19) | 5.02 | 0.24 | 0.3243 | -0.0007 | |||||

| CBAM 2017-1 Ltd / ABS-CBDO (US14987LAC54) | 5.01 | 0.20 | 0.3240 | -0.0008 | |||||

| US12481KAS78 / CBAM 2017-2 Ltd | 5.01 | 0.24 | 0.3240 | -0.0007 | |||||

| TOTAL RETURN SWAP - INDEX / DE (N/A) | 5.00 | 0.3229 | 0.3229 | ||||||

| Wellington Management Clo 4 Ltd / ABS-CBDO (US94957LAA70) | 4.98 | -0.24 | 0.3222 | -0.0022 | |||||

| US76134KAA25 / Retained Vantage Data Centers Issuer LLC | 4.95 | 0.45 | 0.3199 | -0.0000 | |||||

| TOTAL RETURN SWAP - INDEX / DE (N/A) | 4.94 | 0.3195 | 0.3195 | ||||||

| US95003WAA45 / Wells Fargo Commercial Mortgage Trust 2022-ONL | 4.93 | 0.92 | 0.3190 | 0.0015 | |||||

| US05591XAC56 / BRSP 2021-FL1, Ltd. | 4.78 | 0.02 | 0.3091 | -0.0014 | |||||

| US87277JAA97 / TRTX 2022-FL5 Issuer Ltd | 4.56 | -7.81 | 0.2947 | -0.0265 | |||||

| BNP / BNP Paribas SA | 4.54 | 0.2934 | 0.2934 | ||||||

| US912810PS15 / United States Treasury Inflation Indexed Bonds | 4.53 | 0.2926 | 0.2926 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 4.36 | -5.85 | 0.2818 | -0.0190 | |||||

| US14318FAE43 / Carlyle US CLO 2023-3 Ltd | 4.28 | 0.21 | 0.2770 | -0.0007 | |||||

| US69547EAC84 / PAID_21-5 | 4.27 | -22.56 | 0.2761 | -0.0821 | |||||

| US44040JAA60 / Horizon Aircraft Finance III Ltd., Series 2019-2, Class A | 4.26 | -8.89 | 0.2756 | -0.0283 | |||||

| US81377XAD49 / Securitized Asset Backed Receivables LLC Trust 2006-WM4 | 4.23 | 2.77 | 0.2733 | 0.0061 | |||||

| Carvana Auto Receivables Trust 2024-P3 / ABS-CBDO (US146919AD71) | 4.09 | 0.39 | 0.2643 | -0.0002 | |||||

| Sound Point CLO 40 Ltd / ABS-CBDO (US83617CAA27) | 4.02 | 0.37 | 0.2596 | -0.0003 | |||||

| OFSI BSL XI Ltd / ABS-CBDO (US67115PAQ81) | 4.01 | 0.23 | 0.2592 | -0.0006 | |||||

| Magnetite Xlii Ltd / ABS-CBDO (US55955XAA46) | 4.01 | 0.17 | 0.2591 | -0.0008 | |||||

| OCP CLO 2020-18 Ltd / ABS-CBDO (US671078AW31) | 4.01 | 0.15 | 0.2590 | -0.0008 | |||||

| Wellfleet CLO 2022-1 Ltd / ABS-CBDO (US94950TAQ22) | 4.01 | 0.13 | 0.2589 | -0.0008 | |||||

| US47048JAX19 / Jamestown CLO IX Ltd | 4.00 | 0.13 | 0.2588 | -0.0009 | |||||

| Verus Securitization Trust 2024-3 / ABS-MBS (US92540MAA36) | 3.98 | -12.44 | 0.2576 | -0.0380 | |||||

| OBX 2024-NQM10 Trust / ABS-MBS (US67119MAA62) | 3.91 | -7.24 | 0.2525 | -0.0209 | |||||

| Connecticut Avenue Securities Trust 2025-R04 / ABS-MBS (US20755TAA97) | 3.80 | 0.2454 | 0.2454 | ||||||

| T1OW34 / American Tower Corporation - Depositary Receipt (Common Stock) | 3.76 | -1.83 | 0.2430 | -0.0057 | |||||

| BSPRT 2023-FL10 Issuer LLC / ABS-CBDO (US05610VAC63) | 3.71 | -0.05 | 0.2400 | -0.0012 | |||||

| US29429CAD74 / Citigroup Commercial Mortgage Trust 2016-P3 | 3.69 | 0.57 | 0.2383 | 0.0002 | |||||

| US54251RAD52 / Long Beach Mortgage Loan Trust, Series 2006-6, Class 2A3 | 3.62 | 3.61 | 0.2340 | 0.0071 | |||||

| BDS 2024-FL13 LLC / ABS-CBDO (US05555MAA71) | 3.61 | 0.22 | 0.2331 | -0.0006 | |||||

| US14040HCU77 / Capital One Financial Corp | 3.60 | -2.78 | 0.2327 | -0.0078 | |||||

| US52475WAA45 / LEGACY MORTGAGE ASSET TRUST 2021-GS4 SER 2021-GS4 CL A1 V/R REGD 144A P/P 1.65000000 | 3.57 | -4.26 | 0.2308 | -0.0115 | |||||

| Avant Loans Funding Trust 2024-REV1 / ABS-CBDO (US05352UAA43) | 3.54 | -0.70 | 0.2288 | -0.0027 | |||||

| MF1 2024-FL14 LLC / ABS-CBDO (US55416AAA79) | 3.51 | 0.26 | 0.2271 | -0.0005 | |||||

| MF1 2024-FL15 LLC / ABS-CBDO (US58003MAA45) | 3.51 | 0.23 | 0.2270 | -0.0005 | |||||

| US55282XAE04 / MF1 Multifamily Housing Mortgage Loan Trust | 3.50 | -0.34 | 0.2259 | -0.0018 | |||||

| US30227FAA84 / Extended Stay America Trust | 3.46 | -0.86 | 0.2235 | -0.0030 | |||||

| MF1 2025-FL17 LLC / ABS-CBDO (US55287HAA86) | 3.44 | 0.03 | 0.2226 | -0.0010 | |||||

| AREIT 2025-CRE10 LTD / ABS-CBDO (US00193DAA63) | 3.44 | 0.15 | 0.2225 | -0.0007 | |||||

| LoanCore 2025-CRE8 Issuer LLC / ABS-CBDO (US53947FAA93) | 3.44 | -0.17 | 0.2223 | -0.0015 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3.43 | -1.35 | 0.2218 | -0.0041 | |||||

| US590210AD27 / Merrill Lynch Mortgage Investors Trust, Series MLCC 2006-2 | 3.43 | 1.60 | 0.2214 | 0.0025 | |||||

| BNP / BNP Paribas SA | 3.43 | 0.2214 | 0.2214 | ||||||

| Upgrade Master Pass-Thru Trust Series 2025-ST2 / ABS-CBDO (US91534JAB89) | 3.39 | 0.2192 | 0.2192 | ||||||

| US91282CFR79 / United States Treasury Inflation Indexed Bonds | 3.35 | 0.2168 | 0.2168 | ||||||

| US30166RAG20 / Exeter Automobile Receivables Trust | 3.33 | 0.94 | 0.2150 | 0.0010 | |||||

| US41162GAA04 / HarborView Mortgage Loan Trust 2006-11 | 3.28 | 1.02 | 0.2120 | 0.0012 | |||||

| Chase Auto Owner Trust 2024-5 / ABS-CBDO (US16144QAD79) | 3.18 | 0.57 | 0.2058 | 0.0002 | |||||

| US52474XAA37 / LEGACY MORTGAGE ASSET TRUST SER 2021-GS3 CL A1 V/R REGD 144A P/P 0.00000000 | 3.12 | -2.56 | 0.2019 | -0.0062 | |||||

| US19685EAA91 / COLT 2022-2 Mortgage Loan Trust | 3.12 | -1.36 | 0.2016 | -0.0037 | |||||

| US55285AAA51 / MF1 2022-FL9 LLC SER 2022-FL9 CL A V/R REGD 144A P/P 2.96000000 | 3.11 | -4.48 | 0.2014 | -0.0104 | |||||

| BRSP Ltd / ABS-CBDO (US05613BAA17) | 3.08 | 0.16 | 0.1991 | -0.0006 | |||||

| GLS Auto Select Receivables Trust 2024-4 / ABS-CBDO (US36271BAE11) | 3.01 | 0.17 | 0.1948 | -0.0006 | |||||

| Vibrant CLO XR, Ltd. / ABS-CBDO (US92563MAA53) | 3.01 | -0.03 | 0.1946 | -0.0009 | |||||

| OCP CLO 2017-14 Ltd / ABS-CBDO (US67097QAN51) | 3.01 | 0.17 | 0.1945 | -0.0006 | |||||

| US22824DAC39 / ABS FLOAT SER.2021-1A CL.A1A | 3.00 | 0.10 | 0.1941 | -0.0007 | |||||

| Affirm Asset Securitization Trust 2024-B / ABS-CBDO (US00835AAB44) | 3.00 | -0.43 | 0.1939 | -0.0018 | |||||

| US80307AAA79 / SAPPHIRE AVIATION FINANCE II LTD | 2.91 | -5.24 | 0.1882 | -0.0114 | |||||

| US19521UAA16 / Cologix Data Centers US Issuer LLC | 2.90 | 0.87 | 0.1877 | 0.0007 | |||||

| US30323CAA80 / FS Rialto 2021-FL3 | 2.89 | -11.13 | 0.1869 | -0.0244 | |||||

| TOTAL RETURN SWAP - INDEX / DE (N/A) | 2.87 | 0.1852 | 0.1852 | ||||||

| US53946PAA84 / LoanCore 2022-CRE7 Issuer Ltd | 2.82 | -5.52 | 0.1825 | -0.0115 | |||||

| BNP / BNP Paribas SA | 2.82 | 0.1823 | 0.1823 | ||||||

| US02151EAE23 / Alternative Loan Trust 2007-23CB | 2.79 | -1.59 | 0.1803 | -0.0038 | |||||

| PRPM 2024-NQM4 Trust / ABS-MBS (US69381UAA51) | 2.74 | -3.55 | 0.1773 | -0.0074 | |||||

| US74143JAA97 / PRET 2021-RN3 LLC | 2.70 | -3.85 | 0.1746 | -0.0079 | |||||

| TOTAL RETURN SWAP - INDEX / DE (N/A) | 2.70 | 0.1744 | 0.1744 | ||||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 2.68 | 0.94 | 0.1732 | 0.0008 | |||||

| US599191AA16 / Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd | 2.62 | -13.79 | 0.1693 | -0.0280 | |||||

| US48275EAA47 / KREF 2022-FL3 Ltd | 2.60 | -13.54 | 0.1681 | -0.0272 | |||||

| US03464JAA97 / Angel Oak Mortgage Trust 2021-7 | 2.60 | 0.00 | 0.1679 | -0.0008 | |||||

| US25755TAE01 / Domino's Pizza Master Issuer LLC | 2.59 | 0.08 | 0.1674 | -0.0007 | |||||

| US12598PAA57 / COLT 2021-RPL1 Trust | 2.59 | -1.89 | 0.1674 | -0.0040 | |||||

| TOTAL RETURN SWAP - INDEX / DE (N/A) | 2.55 | 0.1651 | 0.1651 | ||||||

| CPRL34 / Canadian Pacific Kansas City Limited - Depositary Receipt (Common Stock) | 2.51 | -1.49 | 0.1622 | -0.0032 | |||||

| US63942MAA80 / Navient Private Education Refi Loan Trust 2022-A | 2.51 | -3.39 | 0.1621 | -0.0065 | |||||

| US86362HAA14 / Structured Adjustable Rate Mortgage Loan Trust Series 2006-11 | 2.51 | -2.68 | 0.1621 | -0.0053 | |||||

| Bain Capital Credit CLO 2024-6 Ltd / ABS-CBDO (US05685XAA63) | 2.50 | 0.20 | 0.1619 | -0.0004 | |||||

| US67577EAC57 / Octagon 56 Ltd | 2.50 | 0.60 | 0.1617 | 0.0002 | |||||

| Mars, Incorporated / DBT (US571676AY11) | 2.50 | -1.81 | 0.1616 | -0.0037 | |||||

| Trestles CLO VI Ltd / ABS-CBDO (US894940AQ82) | 2.49 | 0.20 | 0.1612 | -0.0005 | |||||

| US3136BAHX59 / Fannie Mae REMICS | 2.49 | -2.88 | 0.1612 | -0.0056 | |||||

| Bank5 2024-5YR10 / ABS-MBS (US06604AAM62) | 2.48 | 3.51 | 0.1603 | 0.0047 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.44 | 0.1579 | 0.1579 | ||||||

| US06540DBN49 / Bank 2021-BNK36 | 2.44 | -4.05 | 0.1576 | -0.0074 | |||||

| Dell International L.L.C. / DBT (US24703DBP50) | 2.42 | 1.55 | 0.1563 | 0.0017 | |||||

| US93934XAC74 / Washington Mutual Asset-Backed CertificatesTrust, Series 2006-HE5, Class 2A2 | 2.42 | 4.18 | 0.1563 | 0.0056 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.40 | 0.1553 | 0.1553 | ||||||

| US55284JAA79 / MF1 2022-FL8 Ltd | 2.40 | -12.56 | 0.1553 | -0.0232 | |||||

| US03881VBA61 / Arbor Multifamily Mortgage Securities Trust 2021-MF2 | 2.40 | -3.74 | 0.1549 | -0.0068 | |||||

| Great Wolf Trust 2024-WOLF / ABS-MBS (US39152MAA36) | 2.38 | 0.08 | 0.1541 | -0.0006 | |||||

| NYC Commercial Mortgage Trust 2025-3BP / ABS-MBS (US67120UAA51) | 2.37 | 0.94 | 0.1534 | 0.0007 | |||||

| US05608RAE53 / BX Trust | 2.37 | 0.21 | 0.1530 | -0.0004 | |||||

| US30225VAK35 / Extra Space Storage LP | 2.34 | 1.12 | 0.1514 | 0.0010 | |||||

| US025537AY74 / AMERICAN ELECTRIC POWER REGD 5.20000000 | 2.34 | -1.89 | 0.1510 | -0.0037 | |||||

| US872480AE88 / TIF Funding II LLC | 2.34 | -2.26 | 0.1510 | -0.0042 | |||||

| Penske Truck Leasing Co., L.P. / DBT (US709599CB81) | 2.34 | 1.08 | 0.1510 | 0.0009 | |||||

| US36168HAD61 / GCAT 2021-NQM4 Trust | 2.33 | -0.38 | 0.1506 | -0.0013 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 2.33 | -2.31 | 0.1506 | -0.0043 | |||||

| Bank of America Corporation / DBT (US06051GMK21) | 2.32 | -2.39 | 0.1502 | -0.0044 | |||||

| US90205FAA84 / 280 Park Avenue 2017-280P Mortgage Trust | 2.30 | 0.66 | 0.1486 | 0.0002 | |||||

| ACREC 2025-Fl3 LLC / ABS-CBDO (US00112HAA59) | 2.29 | -0.17 | 0.1480 | -0.0009 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 2.28 | -3.27 | 0.1475 | -0.0057 | |||||

| BBCMS Mortgage Trust 2025-C32 / ABS-CBDO (US07337AAJ51) | 2.27 | -1.61 | 0.1466 | -0.0031 | |||||

| US30319YAA64 / FS RIALTO | 2.26 | -20.44 | 0.1460 | -0.0383 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.25 | -1.06 | 0.1454 | -0.0023 | |||||

| US576323AP42 / MasTec Inc | 2.23 | 1.09 | 0.1443 | 0.0009 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 2.23 | -2.92 | 0.1441 | -0.0050 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.21 | -2.73 | 0.1428 | -0.0047 | |||||

| US05523RAD98 / BAE Systems PLC | 2.21 | 0.1427 | 0.1427 | ||||||

| US07335YAA47 / BDS 2021-FL10 LTD / BDS 2021-FL10 LLC 1ML+135 12/18/2036 144A | 2.20 | -18.13 | 0.1422 | -0.0323 | |||||

| BX Commercial Mortgage Trust 2024-GPA3 / ABS-MBS (US123910AA98) | 2.19 | 0.32 | 0.1414 | -0.0002 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.19 | -3.96 | 0.1413 | -0.0065 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 2.16 | 0.1393 | 0.1393 | ||||||

| DAL / Delta Air Lines, Inc. - Depositary Receipt (Common Stock) | 2.15 | 0.1391 | 0.1391 | ||||||

| US05591XAA90 / BRSP 2021-FL1 Ltd | 2.15 | -1.01 | 0.1388 | -0.0021 | |||||

| R1SG34 / Republic Services, Inc. - Depositary Receipt (Common Stock) | 2.14 | 66.41 | 0.1384 | 0.0548 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 2.14 | -3.17 | 0.1380 | -0.0052 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.13 | -6.04 | 0.1379 | -0.0095 | |||||

| Evergy Kansas Central, Inc. / DBT (US30036FAE16) | 2.12 | 187.28 | 0.1373 | 0.0892 | |||||

| US542514TU86 / Long Beach Mortgage Loan Trust 2006-2 | 2.12 | 0.86 | 0.1370 | 0.0005 | |||||

| US89788MAQ50 / Truist Financial Corp | 2.11 | 0.48 | 0.1365 | 0.0000 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.10 | -2.19 | 0.1357 | -0.0037 | |||||

| US53948HAA41 / LoanCore 2021-CRE6 Issuer Ltd | 2.10 | -8.67 | 0.1354 | -0.0136 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.09 | -2.61 | 0.1350 | -0.0043 | |||||

| US12593FBG81 / COMM 2015-LC21 Mortgage Trust | 2.07 | -20.79 | 0.1338 | -0.0359 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.06 | -3.65 | 0.1330 | -0.0057 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.05 | 0.1324 | 0.1324 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.05 | -23.25 | 0.1324 | -0.0409 | |||||

| US97064FAA30 / Willis Engine Structured Trust V | 2.04 | -2.02 | 0.1318 | -0.0033 | |||||

| BMO 2024-5C5 Mortgage Trust / ABS-CBDO (US05593RAD44) | 2.03 | -6.06 | 0.1313 | -0.0091 | |||||

| US3133KQK880 / UMBS | 2.02 | -2.83 | 0.1308 | -0.0044 | |||||

| US85236WCE49 / STWD Trust | 2.02 | 0.1305 | 0.1305 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.01 | -5.27 | 0.1302 | -0.0079 | |||||

| Bridge Street CLO I Ltd / ABS-CBDO (US10805YAL56) | 2.01 | 0.25 | 0.1297 | -0.0003 | |||||

| Carval CLO X-C Ltd. / ABS-CBDO (US146918AA59) | 2.01 | 0.25 | 0.1296 | -0.0003 | |||||

| US83614VAC90 / Sound Point CLO XXIX Ltd | 2.00 | 0.25 | 0.1296 | -0.0003 | |||||

| Benefit Street Partners Clo XXXVII Ltd / ABS-CBDO (US08182TAA79) | 2.00 | 0.35 | 0.1295 | -0.0002 | |||||

| US61946NAB47 / Mosaic Solar Loan Trust 2020-1 | 2.00 | -3.79 | 0.1295 | -0.0058 | |||||

| US04941YAJ82 / Atlas Senior Loan Fund XI Ltd | 2.00 | -0.05 | 0.1295 | -0.0006 | |||||

| US83614VAE56 / Sound Point CLO XXIX Ltd., Series 2021-1A, Class B1 | 2.00 | 0.05 | 0.1293 | -0.0005 | |||||

| US90276WAQ06 / UBS COML MTG TR 2017-C7 3.586% 12/15/2050 | 2.00 | 0.1293 | 0.1293 | ||||||

| US48275RAA59 / KREF, Series 2021-FL2, Class A | 2.00 | -14.88 | 0.1290 | -0.0233 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.99 | -5.19 | 0.1287 | -0.0077 | |||||

| US05602CAE49 / BSPRT 2021-FL7 Issuer Ltd | 1.99 | -0.45 | 0.1286 | -0.0012 | |||||

| US62475WAA36 / MTN Commercial Mortgage Trust, Series 2022-LPFL, Class A | 1.98 | 0.1279 | 0.1279 | ||||||

| Mariner Finance Issuance Trust 2025-A / ABS-CBDO (US567920AB93) | 1.97 | 0.1276 | 0.1276 | ||||||

| J.P. Morgan Mortgage Trust 2025-NQM2 / ABS-MBS (US46590SAD99) | 1.97 | 0.1276 | 0.1276 | ||||||

| US3137FUY819 / Freddie Mac REMICS | 1.97 | -3.24 | 0.1273 | -0.0048 | |||||

| SoFi Consumer Loan Program 2025-1 Trust / ABS-CBDO (US83406YAA91) | 1.96 | 0.1269 | 0.1269 | ||||||

| US78432WAA18 / SFO Commercial Mortgage Trust 2021-555 | 1.96 | 0.1269 | 0.1269 | ||||||

| US08163BBF76 / Benchmark 2020-B22 Mortgage Trust | 1.96 | -4.12 | 0.1265 | -0.0060 | |||||

| US95000DBJ90 / WELLS FARGO COMMERCIAL MORTGAGE TRUST 2016-C34 WFCM 2016-C34 B | 1.94 | 0.88 | 0.1255 | 0.0005 | |||||

| US01627AAA60 / Aligned Data Centers Issuer LLC, Series 2021-1A, Class A2 | 1.93 | 0.84 | 0.1249 | 0.0005 | |||||

| US87612BBQ41 / CORPORATE BONDS | 1.92 | 0.63 | 0.1243 | 0.0002 | |||||

| US36262TAA16 / GPMT 2021-FL4 LTD | 1.92 | -0.83 | 0.1242 | -0.0016 | |||||

| US40436XAJ63 / Highbridge Loan Management 3-2014 | 1.91 | 0.42 | 0.1234 | -0.0001 | |||||

| TOTAL RETURN SWAP - INDEX / DE (N/A) | 1.91 | 0.1234 | 0.1234 | ||||||

| US87612BBN10 / CORP. NOTE | 1.90 | -0.42 | 0.1228 | -0.0011 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.89 | 0.1221 | 0.1221 | ||||||

| US63874MAL63 / Natixis Commercial Mortgage Securities Trust 2018-FL1 | 1.88 | -0.11 | 0.1212 | -0.0007 | |||||

| US78485GAG91 / SREIT 21-FLWR B 144A FRN (L+92.59) 07-15-36 | 1.87 | 0.54 | 0.1209 | 0.0001 | |||||

| Athene Global Funding / DBT (US04685A3W95) | 1.86 | -2.57 | 0.1201 | -0.0038 | |||||

| US25755TAH32 / Domino's Pizza Master Issuer LLC | 1.85 | 0.11 | 0.1196 | -0.0005 | |||||

| DK0009391104 / JYSKE REALKREDIT A/S /DKK/ REGD SER 321E 1.00000000 | 1.85 | 1.15 | 0.1193 | 0.0008 | |||||

| US02660TBF93 / AMERICAN HOME MORTGAGE INVESTM AHM 2004 2 M1 | 1.84 | -0.22 | 0.1191 | -0.0008 | |||||

| US36264KAX81 / GS Mortgage Securities Trust 2020-GSA2 | 1.84 | -4.43 | 0.1186 | -0.0061 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.83 | -5.17 | 0.1186 | -0.0070 | |||||

| Prime Security Services Borrower LLC / LON (03765VAQ3) | 1.83 | 0.1184 | 0.1184 | ||||||

| US912828ZV59 / United States Treasury Note/Bond | 1.83 | -90.76 | 0.1183 | -1.1678 | |||||

| US02150LAF40 / CWALT 2007-12T1 A6 | 1.82 | 1.45 | 0.1177 | 0.0012 | |||||

| ROCK Trust 2024-CNTR / ABS-MBS (US74970WAA80) | 1.80 | 1.23 | 0.1166 | 0.0008 | |||||

| VEGAS Trust 2024-TI / ABS-MBS (US92254AAA51) | 1.80 | 0.67 | 0.1161 | 0.0002 | |||||

| Athene Global Funding / DBT (US04685A4C23) | 1.79 | 1.07 | 0.1156 | 0.0007 | |||||

| US31418EUL28 / Federal National Mortgage Association, Inc. | 1.78 | -3.36 | 0.1152 | -0.0045 | |||||

| US30165JAF30 / Exeter Automobile Receivables Trust, Series 2021-4A, Class D | 1.78 | -24.96 | 0.1151 | -0.0390 | |||||

| US36264BAA89 / GPMT LTD. GPMT 2021 FL3 A 144A | 1.78 | -17.64 | 0.1150 | -0.0253 | |||||

| US3137FQLW10 / FREDDIE MAC FHR 4940 FE | 1.77 | -2.90 | 0.1146 | -0.0040 | |||||

| US12524AAA79 / CEDR TRUST | 1.77 | 1.84 | 0.1144 | 0.0016 | |||||

| US31418EVE75 / Federal National Mortgage Association, Inc. | 1.77 | -1.67 | 0.1142 | -0.0025 | |||||

| BFLD 2024-VICT Mortgage Trust / ABS-MBS (US05555VAA70) | 1.75 | 0.23 | 0.1134 | -0.0002 | |||||

| Wells Fargo Commercial Mortgage Trust 2025-C64 / ABS-CBDO (US95004BAX91) | 1.75 | -2.45 | 0.1132 | -0.0034 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.75 | -9.47 | 0.1132 | -0.0124 | |||||

| US47760QAB95 / Jimmy Johns Funding LLC, Series 2017-1A, Class A2II | 1.73 | -1.25 | 0.1120 | -0.0020 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 1.73 | 0.1115 | 0.1115 | ||||||

| Morgan Stanley Capital I Trust 2024-NSTB / ABS-MBS (US61690BAA08) | 1.71 | 0.82 | 0.1108 | 0.0004 | |||||

| US12807CAA18 / CAL Funding IV Ltd | 1.68 | -3.28 | 0.1086 | -0.0042 | |||||

| US3136B0PZ38 / Fannie Mae REMICS | 1.67 | -4.01 | 0.1082 | -0.0051 | |||||

| US50203JAA60 / LFT CRE 2021-FL1 Ltd | 1.67 | -22.52 | 0.1081 | -0.0321 | |||||

| NRG Energy, Inc. / LON (62937NBC0) | 1.67 | 55,600.00 | 0.1081 | 0.1079 | |||||

| 1011778 B.C. Unlimited Liability Company / LON (C6901LAM9) | 1.67 | 0.36 | 0.1078 | -0.0002 | |||||

| Go Daddy Operating Company, LLC / LON (38017BAX4) | 1.67 | 0.36 | 0.1077 | -0.0001 | |||||

| US589331AE71 / Merck & Company 5.950% Debentures 12/01/28 | 1.67 | -2.40 | 0.1077 | -0.0031 | |||||

| Molex Electronic Technologies, LLC / DBT (US60856BAE48) | 1.65 | 0.1068 | 0.1068 | ||||||

| US3137BSZ553 / Freddie Mac REMICS | 1.64 | -2.90 | 0.1061 | -0.0037 | |||||

| US92257NAA46 / Velocity Commercial Capital Loan Trust 2019-2 | 1.63 | -5.24 | 0.1053 | -0.0063 | |||||

| US00138CAU27 / Corebridge Global Funding | 1.62 | -2.88 | 0.1047 | -0.0036 | |||||

| US90270YAG44 / UBS-Barclays Commercial Mortgage Trust 2013-C5 | 1.62 | 1.25 | 0.1047 | 0.0008 | |||||

| Avant Loans Funding Trust 2025-REV1 / ABS-CBDO (US05352BAB45) | 1.60 | -0.43 | 0.1037 | -0.0009 | |||||

| US87342RAG92 / Taco Bell Funding LLC | 1.59 | 0.51 | 0.1029 | 0.0000 | |||||

| US05610HAA14 / BX Commercial Mortgage Trust 2022-LP2 | 1.59 | -13.51 | 0.1027 | -0.0166 | |||||

| US617525AA88 / MORGAN STANLEY CAPITAL INC MSAC 2007 HE3 A1 144A | 1.59 | 1.99 | 0.1026 | 0.0015 | |||||

| A2RW34 / Arrow Electronics, Inc. - Depositary Receipt (Common Stock) | 1.59 | 1.15 | 0.1025 | 0.0007 | |||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 1.58 | 0.83 | 0.1024 | 0.0004 | |||||

| US29444UBF21 / Equinix Inc | 1.58 | 1.09 | 0.1022 | 0.0006 | |||||

| TOTAL RETURN SWAP - INDEX / DE (N/A) | 1.58 | 0.1022 | 0.1022 | ||||||

| US513076BB49 / LAMAR MEDIA TERM B 1LN 01/30/2027 | 1.58 | 0.13 | 0.1019 | -0.0004 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.57 | -9.64 | 0.1012 | -0.0113 | |||||

| US16411RAK59 / Cheniere Energy Inc | 1.55 | 0.97 | 0.1005 | 0.0006 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 1.55 | 0.59 | 0.1000 | 0.0001 | |||||

| Labcorp Holdings Inc. / DBT (US50540RAZ55) | 1.54 | 1.45 | 0.0993 | 0.0010 | |||||

| US286181AK85 / Element Fleet Management Corp | 1.53 | 0.39 | 0.0992 | -0.0001 | |||||

| AU3FN0029609 / AAI Ltd | 1.53 | 0.93 | 0.0987 | 0.0004 | |||||

| TOTAL RETURN SWAP - INDEX / DE (N/A) | 1.52 | 0.0984 | 0.0984 | ||||||

| US62912XAF15 / NGPL PipeCo LLC | 1.52 | -0.20 | 0.0980 | -0.0007 | |||||

| US055983AA86 / BSPRT 2022-FL8 Issuer Ltd | 1.51 | -23.40 | 0.0977 | -0.0305 | |||||

| AerCap Ireland Capital Designated Activity Company / DBT (US00774MBG96) | 1.51 | 0.13 | 0.0977 | -0.0003 | |||||

| Rio Tinto Finance (USA) plc / DBT (US76720AAS50) | 1.51 | -1.82 | 0.0976 | -0.0023 | |||||

| Affirm Master Trust / ABS-CBDO (US00833BAB45) | 1.51 | 0.07 | 0.0973 | -0.0004 | |||||

| Battalion CLO XX Ltd. / ABS-CBDO (US07134UAS69) | 1.51 | 1.07 | 0.0973 | 0.0005 | |||||

| CIFC Funding 2021-V Ltd / ABS-CBDO (US12565EAJ01) | 1.50 | 0.74 | 0.0972 | 0.0002 | |||||

| ACA / Crédit Agricole S.A. | 1.50 | 0.47 | 0.0970 | -0.0000 | |||||

| US78486BAA26 / STARWOOD COMMERCIAL MORTGAGE T STWD 2021 FL2 A 144A | 1.50 | -27.98 | 0.0969 | -0.0382 | |||||

| US92660FAK03 / Videotron Ltd | 1.49 | 0.20 | 0.0965 | -0.0003 | |||||

| US05608XAA00 / BXMT LTD BXMT 2020 FL3 A 144A | 1.49 | -2.49 | 0.0963 | -0.0030 | |||||

| VICI / VICI Properties Inc. | 1.49 | 0.47 | 0.0962 | -0.0000 | |||||

| US12803RAA23 / CaixaBank SA | 1.49 | 0.27 | 0.0961 | -0.0002 | |||||

| US46651CAS70 / JP Morgan Chase Commercial Mortgage Securities Cor | 1.49 | 2.13 | 0.0960 | 0.0016 | |||||

| US61744CNC63 / Morgan Stanley ABS Capital I Inc Trust 2005-HE2 | 1.48 | -3.95 | 0.0958 | -0.0044 | |||||

| US29273VAR15 / Energy Transfer LP | 1.48 | -2.82 | 0.0958 | -0.0032 | |||||

| US05609KAA79 / BX Commercial Mortgage Trust 2021-XL2 | 1.48 | -26.50 | 0.0955 | -0.0351 | |||||

| US74834LBA70 / Quest Diagnostics Inc. | 1.48 | -1.53 | 0.0954 | -0.0020 | |||||

| US40390JAA07 / HGI CRE CLO 2021-FL2 Ltd | 1.46 | -1.28 | 0.0945 | -0.0017 | |||||

| US78485KAE55 / STWD 2022-FL3 Ltd | 1.46 | 0.00 | 0.0943 | -0.0005 | |||||

| US63940PAD78 / Navient Private Education Refi Loan Trust 2018-A | 1.45 | -12.68 | 0.0940 | -0.0141 | |||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 1.45 | 1.26 | 0.0937 | 0.0008 | |||||

| EFXD / Equifax Inc. - Depositary Receipt (Common Stock) | 1.44 | 0.84 | 0.0934 | 0.0004 | |||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 1.44 | -1.64 | 0.0929 | -0.0020 | |||||

| JETD / MAX Airlines -3X Inverse Leveraged ETNs due May 28, 2043 - Structured Product | 1.44 | -1.17 | 0.0929 | -0.0016 | |||||

| US80282KBF21 / Santander Holdings USA, Inc. | 1.44 | 1.13 | 0.0928 | 0.0006 | |||||

| CRH SMW Finance Designated Activity Company / DBT (US12704PAB40) | 1.43 | 1.42 | 0.0924 | 0.0008 | |||||

| Q1UA34 / Quanta Services, Inc. - Depositary Receipt (Common Stock) | 1.43 | -2.06 | 0.0922 | -0.0024 | |||||

| US058933AT98 / Banc of America Funding Trust, Series 2006-D, Class 6A1 | 1.42 | -0.56 | 0.0918 | -0.0010 | |||||

| SOLV / Solventum Corporation | 1.42 | -2.61 | 0.0918 | -0.0029 | |||||

| GreenSky Home Improvement Issuer Trust 2025-1 / ABS-CBDO (US39571NAD84) | 1.42 | -5.47 | 0.0917 | -0.0058 | |||||

| National Securities Clearing Corporation / DBT (US637639AQ81) | 1.41 | 0.0914 | 0.0914 | ||||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 1.41 | -1.74 | 0.0913 | -0.0021 | |||||

| US28176EAD04 / Edwards Lifesciences Corp Bond | 1.40 | -1.69 | 0.0905 | -0.0020 | |||||

| US68389XCF06 / Oracle Corp | 1.40 | -2.99 | 0.0903 | -0.0032 | |||||

| D1TE34 / DTE Energy Company - Depositary Receipt (Common Stock) | 1.39 | 0.58 | 0.0900 | 0.0001 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 1.39 | 1.09 | 0.0900 | 0.0005 | |||||

| Hyundai Capital America / DBT (US44891ADG94) | 1.38 | 1.10 | 0.0892 | 0.0006 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.37 | -10.08 | 0.0888 | -0.0105 | |||||

| BNP / BNP Paribas SA | 1.37 | 0.0885 | 0.0885 | ||||||

| Z1BH34 / Zimmer Biomet Holdings, Inc. - Depositary Receipt (Common Stock) | 1.36 | -1.45 | 0.0880 | -0.0017 | |||||

| XS1040508167 / Imperial Brands Finance plc | 1.36 | 0.0877 | 0.0877 | ||||||

| Apa Corp. / DBT (US03743QAF54) | 1.35 | 0.52 | 0.0875 | 0.0001 | |||||

| Trans Union, LLC / LON (89334GBG8) | 1.34 | 0.22 | 0.0866 | -0.0003 | |||||

| US958667AC17 / WESTERN MIDSTREAM OPERAT SR UNSECURED 02/30 4.05 | 1.34 | 0.98 | 0.0864 | 0.0004 | |||||

| APi Group DE, Inc. / LON (00186XAN3) | 1.33 | 0.38 | 0.0862 | -0.0001 | |||||

| US12545CAU45 / CHL Mortgage Pass-Through Trust 2007-10 | 1.31 | -0.38 | 0.0845 | -0.0007 | |||||

| G1PC34 / Genuine Parts Company - Depositary Receipt (Common Stock) | 1.30 | -1.51 | 0.0843 | -0.0017 | |||||

| US53948PAA66 / Loanpal Solar Loan 2021-1 Ltd | 1.30 | -3.77 | 0.0843 | -0.0037 | |||||

| US53948NAA19 / LOANPAL SOLAR LOAN LTD LPSLT 2020-3GS A | 1.30 | -0.23 | 0.0841 | -0.0006 | |||||

| US05551VAA17 / BBCMS Trust | 1.30 | -2.70 | 0.0837 | -0.0028 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 1.29 | 1.57 | 0.0834 | 0.0009 | |||||

| US05551VBL62 / BBCMS Trust | 1.29 | -2.87 | 0.0832 | -0.0028 | |||||

| US39809PAG00 / Greystone Commercial Real Estate Notes | 1.29 | -0.16 | 0.0831 | -0.0005 | |||||

| A3KL1L / Citigroup Inc. - Preferred Stock | 1.28 | 0.47 | 0.0827 | 0.0000 | |||||

| US14687AAS78 / Carvana Auto Receivable Trust Series 2020-P1 Class D | 1.28 | 0.47 | 0.0825 | 0.0001 | |||||

| Glencore Funding LLC / DBT (US378272BW77) | 1.28 | -2.67 | 0.0825 | -0.0027 | |||||

| US39809PAA30 / Greystone CRE Notes 2021-FL3 Ltd | 1.26 | -26.55 | 0.0818 | -0.0300 | |||||

| US744573AW69 / Public Service Enterprise Group Inc | 1.26 | -2.18 | 0.0814 | -0.0022 | |||||

| US55037LAA26 / LUNRR 2020 1A A 144A | 1.25 | -3.32 | 0.0810 | -0.0032 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.25 | -0.56 | 0.0808 | -0.0008 | |||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 1.24 | -6.89 | 0.0804 | -0.0064 | |||||

| US38380Y4F93 / Government National Mortgage Association | 1.24 | -0.48 | 0.0801 | -0.0008 | |||||

| US14855MAA62 / Castlelake Aircraft Securitization Trust, Series 2019-1A, Class A | 1.24 | -22.28 | 0.0800 | -0.0235 | |||||

| Corpay Technologies Operating Company LLC / LON (33903RAZ2) | 1.24 | 0.08 | 0.0800 | -0.0003 | |||||

| EFN / Element Fleet Management Corp. | 1.23 | 0.82 | 0.0798 | 0.0003 | |||||

| US53947XAA00 / LoanCore 2021-CRE5 Issuer Ltd | 1.23 | -37.53 | 0.0794 | -0.0482 | |||||

| US75575WAA45 / Ready Capital Mortgage Financing 2021-FL7 LLC | 1.22 | -36.38 | 0.0791 | -0.0458 | |||||

| Siemens Funding B.V. / DBT (US82622RAA41) | 1.22 | 0.0787 | 0.0787 | ||||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 1.21 | 1.85 | 0.0782 | 0.0011 | |||||

| Holcim Finance US LLC / DBT (US43475RAB24) | 1.21 | 0.0782 | 0.0782 | ||||||

| SYY / Sysco Corporation - Depositary Receipt (Common Stock) | 1.21 | 1.09 | 0.0780 | 0.0005 | |||||

| US05606DAS71 / BX 22-PSB A 144A FRN (TSFR1M+245.1) 08-15-29/08-16-27 | 1.20 | -17.83 | 0.0778 | -0.0173 | |||||

| Tricolor Auto Securitization Trust 2025-2 / ABS-CBDO (US89617QAA85) | 1.20 | 0.0777 | 0.0777 | ||||||

| Enel Finance International N.V. / DBT (US29278GBD97) | 1.20 | 0.76 | 0.0774 | 0.0002 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.20 | -2.77 | 0.0773 | -0.0026 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 1.19 | 1.02 | 0.0768 | 0.0004 | |||||

| Ginnie Mae REMIC Trust 2024-025 / ABS-MBS (US38384JM760) | 1.19 | -3.02 | 0.0768 | -0.0028 | |||||

| Atlassian Corporation / DBT (US049468AA91) | 1.19 | 0.85 | 0.0767 | 0.0002 | |||||

| US29273VAS97 / Energy Transfer LP | 1.19 | 0.68 | 0.0767 | 0.0001 | |||||

| US67077MBA53 / Nutrien Ltd | 1.18 | -2.24 | 0.0764 | -0.0021 | |||||

| US95000U3G61 / Wells Fargo & Co | 1.17 | 0.51 | 0.0758 | 0.0001 | |||||

| NOCG34 / Northrop Grumman Corporation - Depositary Receipt (Common Stock) | 1.17 | 0.0757 | 0.0757 | ||||||

| Bunge Limited Finance Corp. / DBT (US120568BE94) | 1.16 | -2.03 | 0.0751 | -0.0020 | |||||

| US361448BE25 / GATX Corp. | 1.16 | -1.70 | 0.0748 | -0.0016 | |||||

| US59001ABA97 / Meritage Homes Corp Bond | 1.15 | -2.21 | 0.0745 | -0.0020 | |||||

| US126694R752 / Alternative Loan Trust, Series 2006-OA2, Class A1 | 1.15 | -0.86 | 0.0745 | -0.0010 | |||||

| US38380HMV14 / Government National Mortgage Association | 1.15 | -2.71 | 0.0742 | -0.0025 | |||||

| US92538QAA85 / VERUS SECURITIZATION TRUST 2021-7 1.829% 10/25/2066 144A | 1.15 | -1.97 | 0.0741 | -0.0018 | |||||

| BBCMS Mortgage Trust 2025-5C34 / ABS-CBDO (US07337BAG95) | 1.14 | 0.0739 | 0.0739 | ||||||

| CAH / Cardinal Health, Inc. - Depositary Receipt (Common Stock) | 1.14 | -1.80 | 0.0739 | -0.0017 | |||||

| Kinder Morgan Kansas, Inc. / DBT (US494553AD27) | 1.14 | -2.06 | 0.0739 | -0.0019 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 1.14 | 0.0738 | 0.0738 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1.14 | -2.65 | 0.0738 | -0.0024 | |||||

| US55336VAS97 / MPLX L.P. | 1.14 | -1.98 | 0.0737 | -0.0018 | |||||

| Calpine Corporation / LON (13134MBW2) | 1.14 | 0.35 | 0.0735 | -0.0001 | |||||

| US573874AP91 / Marvell Technology Inc | 1.13 | -1.90 | 0.0733 | -0.0018 | |||||

| Reynolds Consumer Products LLC / LON (76171JAE1) | 1.13 | 0.00 | 0.0731 | -0.0003 | |||||

| Burlington Coat Factory Warehouse Corporation / LON (121575AL8) | 1.13 | 16.63 | 0.0730 | 0.0101 | |||||

| NFG / National Fuel Gas Company | 1.12 | 1.00 | 0.0722 | 0.0004 | |||||

| Canadian Imperial Bank Of Commerce / DBT (US13607PVQ44) | 1.11 | 1.00 | 0.0716 | 0.0004 | |||||

| Affirm Master Trust / ABS-CBDO (US00833BAC28) | 1.11 | 0.18 | 0.0715 | -0.0002 | |||||

| Rentokil Terminix Funding, LLC / DBT (US760130AA26) | 1.10 | 0.0712 | 0.0712 | ||||||

| US744573AV86 / Public Service Enterprise Group Inc | 1.10 | -2.22 | 0.0711 | -0.0020 | |||||

| US16411QAG64 / Cheniere Energy Partners LP | 1.10 | 1.29 | 0.0710 | 0.0006 | |||||

| US05401AAS06 / Avolon Holdings Funding Ltd | 1.10 | 0.83 | 0.0708 | 0.0002 | |||||

| BIIB / Biogen Inc. - Depositary Receipt (Common Stock) | 1.09 | 0.0706 | 0.0706 | ||||||

| US74143FAA75 / PRET_21-RN2 | 1.08 | -7.90 | 0.0701 | -0.0064 | |||||

| US12532BAD91 / CFCRE Commercial Mortgage Trust 2016-C7 | 1.08 | 0.0695 | 0.0695 | ||||||

| US63170MAA18 / Nassau 2018-I Ltd | 1.07 | -30.71 | 0.0689 | -0.0309 | |||||

| US05530QAQ38 / BAT International Finance plc | 1.06 | -7.69 | 0.0683 | -0.0060 | |||||

| US00928QAU58 / Aircastle Ltd | 1.05 | 1.25 | 0.0680 | 0.0005 | |||||

| Goldman Sachs Bank USA / DBT (US38151LAE02) | 1.03 | -2.73 | 0.0668 | -0.0022 | |||||

| US168831AA32 / Chile Electricity PEC SpA | 1.02 | 0.89 | 0.0662 | 0.0003 | |||||

| US14453MAC82 / CARR 2006-NC4 V/R 10/25/36 1.86800000 | 1.01 | -13.85 | 0.0656 | -0.0109 | |||||

| US81377JAC71 / Securitized Asset-Backed Receivables LLC Trust, Series 2007-HE1, Class A2B | 1.01 | 0.20 | 0.0650 | -0.0001 | |||||

| Upgrade Master Pass-Thru Trust Series 2025-ST4 / ABS-CBDO (US91533MAA45) | 1.00 | 0.0646 | 0.0646 | ||||||

| US50155QAJ94 / Kyndryl Holdings, Inc. | 0.99 | 0.81 | 0.0641 | 0.0002 | |||||

| US26863LAG95 / ELP Commercial Mortgage Trust | 0.99 | 0.0638 | 0.0638 | ||||||

| WMG Acquisition Corp. / LON (92929LBA5) | 0.98 | 0.41 | 0.0634 | 0.0000 | |||||

| IQVIA Inc. / LON (44969CBP4) | 0.98 | 0.10 | 0.0632 | -0.0002 | |||||

| US88233FAK66 / Vistra Operations Co. LLC, Term Loan | 0.97 | 0.41 | 0.0629 | -0.0001 | |||||

| Wyndham Hotels & Resorts, Inc. / LON (98310CAF9) | 0.97 | 0.10 | 0.0628 | -0.0002 | |||||

| US46284NAV10 / Iron Mountain, Inc. 2023 Term Loan B | 0.97 | 0.31 | 0.0627 | -0.0001 | |||||

| H.B. Fuller Company / LON (40409VAW4) | 0.97 | 0.31 | 0.0627 | -0.0001 | |||||

| I1LM34 / Illumina, Inc. - Depositary Receipt (Common Stock) | 0.97 | 0.21 | 0.0624 | -0.0001 | |||||

| Flutter Financing B.V. / LON (N3313EAG5) | 0.96 | 0.10 | 0.0623 | -0.0003 | |||||

| US12591VAK70 / Commercial Mortgage Trust, Series 2014-CR16, Class C | 0.95 | 0.32 | 0.0616 | -0.0001 | |||||

| US72703PAD50 / Planet Fitness Master Issuer LLC | 0.95 | 0.64 | 0.0612 | 0.0001 | |||||

| Glencore Funding LLC / DBT (US378272BY34) | 0.94 | 0.64 | 0.0608 | 0.0001 | |||||

| Energizer Holdings, Inc. / LON (29267YAW2) | 0.94 | 0.32 | 0.0607 | -0.0001 | |||||

| Colossus Acquireco LLC / LON (N/A) | 0.93 | 0.0600 | 0.0600 | ||||||

| SS&C Technologies Inc. / LON (78466DBJ2) | 0.92 | -0.33 | 0.0594 | -0.0005 | |||||

| Z1BH34 / Zimmer Biomet Holdings, Inc. - Depositary Receipt (Common Stock) | 0.91 | -2.36 | 0.0589 | -0.0017 | |||||

| Somnigroup International Inc / LON (88025BAP6) | 0.91 | 0.0589 | 0.0589 | ||||||

| US05609KAG40 / BX Commercial Mortgage Trust 2021-XL2 | 0.91 | 0.0588 | 0.0588 | ||||||

| US37959PAA57 / SEACO 20-1A A 144A 2.17% 10-17-40/03-18-30 | 0.90 | -4.56 | 0.0581 | -0.0031 | |||||

| Bank5 2025-5YR13 / ABS-CBDO (US06650CAM55) | 0.90 | -4.98 | 0.0579 | -0.0034 | |||||

| US12434LAA26 / BXMT 2020-FL2 A | 0.89 | -8.87 | 0.0578 | -0.0059 | |||||

| USL6388GAB60 / Millicom International Cellular SA | 0.89 | 1.37 | 0.0574 | 0.0005 | |||||

| US30313LAG77 / FREMF 2019-KF69 B | 0.88 | 0.11 | 0.0571 | -0.0002 | |||||

| US12635RAX61 / CSAIL 2015-C4 Commercial Mortgage Trust | 0.87 | 0.0565 | 0.0565 | ||||||

| US03881BAW37 / Arbor Multifamily Mortgage Securities Trust 2020-MF1 | 0.87 | -4.71 | 0.0562 | -0.0031 | |||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 0.87 | -1.25 | 0.0561 | -0.0009 | |||||

| US3136B3QC72 / Fannie Mae REMICS | 0.87 | -3.78 | 0.0560 | -0.0025 | |||||

| Foundry JV Holdco LLC / DBT (US350930AB92) | 0.87 | 0.93 | 0.0559 | 0.0003 | |||||

| US863576AA29 / Structured Asset Securities Corp Trust 2005-5 | 0.86 | -7.43 | 0.0556 | -0.0048 | |||||

| US74923HAN17 / RALI Series 2007-QS4 Trust | 0.86 | -2.39 | 0.0554 | -0.0016 | |||||

| USP13435AD71 / Banco Internacional del Peru SAA Interbank | 0.85 | 0.47 | 0.0548 | 0.0000 | |||||

| Marvell Technology, Inc. / DBT (US573874AR57) | 0.85 | 0.0547 | 0.0547 | ||||||

| US05530QAN07 / BAT International Finance PLC | 0.84 | 0.84 | 0.0546 | 0.0002 | |||||

| Icon Investments Six Designated Activity Company / DBT (US45115AAA25) | 0.83 | 0.12 | 0.0538 | -0.0002 | |||||

| US22966RAE62 / CubeSmart LP | 0.83 | 1.22 | 0.0537 | 0.0004 | |||||

| Connecticut Avenue Securities Trust 2024-R06 / ABS-MBS (US20755RAB15) | 0.82 | -26.96 | 0.0531 | -0.0199 | |||||

| US91682NAC74 / Upstart Securitization Trust 2021-4 | 0.82 | -32.92 | 0.0528 | -0.0263 | |||||

| US06051GHT94 / Bank of America Corp. | 0.81 | -9.57 | 0.0526 | -0.0058 | |||||

| NRUC / National Rural Utilities Cooperative Finance Corporation - Corporate Bond/Note | 0.81 | -7.95 | 0.0524 | -0.0048 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0.81 | -3.46 | 0.0523 | -0.0022 | |||||

| US009733AA45 / Ajax Mortgage Loan Trust 2021-C | 0.80 | -5.20 | 0.0519 | -0.0031 | |||||

| USP5015VAP15 / Guatemala Government Bond | 0.79 | 1.02 | 0.0513 | 0.0003 | |||||

| XS2310058891 / DBS Group Holdings Ltd | 0.78 | 0.77 | 0.0507 | 0.0001 | |||||

| Six Flags Entertainment Corporation / LON (15018LAN1) | 0.78 | 0.52 | 0.0504 | -0.0000 | |||||

| US32027NWQ05 / First Franklin Mortgage Loan Trust, Series 2005-FF10, Class A6M | 0.77 | -2.15 | 0.0500 | -0.0013 | |||||

| SON / Sonoco Products Company | 0.77 | 0.26 | 0.0495 | -0.0001 | |||||

| Wells Fargo Commercial Mortgage Trust 2025-C64 / ABS-MBS (US95004BAS07) | 0.76 | -37.66 | 0.0494 | -0.0302 | |||||

| USP66208AA02 / Mexico Generadora de Energia S de rl | 0.76 | -4.03 | 0.0493 | -0.0023 | |||||

| E1XC34 / Exelon Corporation - Depositary Receipt (Common Stock) | 0.76 | -1.94 | 0.0490 | -0.0012 | |||||

| US02666TAA51 / American Homes 4 Rent LP | 0.76 | 0.53 | 0.0488 | 0.0000 | |||||

| US13607H6M92 / Canadian Imperial Bank of Commerce | 0.75 | -5.63 | 0.0488 | -0.0032 | |||||

| US50212YAC84 / LPL Holdings, Inc. | 0.74 | 0.68 | 0.0482 | 0.0001 | |||||

| PYPL / PayPal Holdings, Inc. - Depositary Receipt (Common Stock) | 0.74 | -2.23 | 0.0481 | -0.0013 | |||||

| US00774MBC82 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 0.73 | 0.69 | 0.0473 | 0.0001 | |||||

| C1NP34 / CenterPoint Energy, Inc. - Depositary Receipt (Common Stock) | 0.73 | -15.12 | 0.0472 | -0.0087 | |||||

| US85350EAB20 / Standard Industries, Inc., Term Loan B | 0.73 | -0.95 | 0.0472 | -0.0007 | |||||

| US61946PAB94 / MSAIC 2020 2A B 144A | 0.72 | -3.72 | 0.0469 | -0.0020 | |||||

| US04002VAA98 / AREIT Trust, Series 2022-CRE6, Class A | 0.72 | -0.28 | 0.0465 | -0.0003 | |||||

| Veralto Corporation / DBT (US92338CAB90) | 0.72 | 0.00 | 0.0464 | -0.0002 | |||||

| US842587DM64 / SOUTHERN CO SR UNSECURED 10/25 5.15 | 0.72 | 0.00 | 0.0463 | -0.0002 | |||||

| US232434AU41 / Alternative Loan Trust 2006-OC8 | 0.72 | -6.04 | 0.0463 | -0.0032 | |||||

| US67103HAM97 / OREILLY AUTOMOTIVE INC 5.75% 11/20/2026 | 0.70 | -2.77 | 0.0453 | -0.0015 | |||||

| US05606DAC20 / BX TRUST | 0.70 | 0.0452 | 0.0452 | ||||||

| US74922UAC71 / Rali Series 2007-Qs8 Trust | 0.70 | 0.00 | 0.0451 | -0.0002 | |||||

| US71568QAC15 / Perusahaan Listrik Negara PT | 0.69 | 135.71 | 0.0448 | 0.0257 | |||||

| US096630AF58 / Boardwalk Pipelines, L.P. 4.45%, Due 07/15/2027 | 0.69 | -1.56 | 0.0448 | -0.0009 | |||||

| XS2314514477 / Bank Negara Indonesia Persero Tbk PT | 0.69 | 1.17 | 0.0447 | 0.0003 | |||||

| USG54897AA45 / Lima Metro Line 2 Finance Ltd | 0.69 | -1.15 | 0.0445 | -0.0007 | |||||

| USP16259AN67 / BBVA Bancomer SA/Texas | 0.69 | 43.13 | 0.0444 | 0.0132 | |||||

| US18976GAR74 / CitiMortgage Alternative Loan Trust Series 2007-A6 | 0.68 | -1.16 | 0.0442 | -0.0007 | |||||

| M1TB34 / M&T Bank Corporation - Depositary Receipt (Common Stock) | 0.68 | 0.89 | 0.0442 | 0.0002 | |||||

| D1RI34 / Darden Restaurants, Inc. - Depositary Receipt (Common Stock) | 0.68 | -2.01 | 0.0441 | -0.0011 | |||||

| US05971U2D82 / Banco de Credito del Peru | 0.68 | 0.74 | 0.0439 | 0.0001 | |||||

| US87612BBL53 / CORP. NOTE | 0.68 | -10.32 | 0.0438 | -0.0053 | |||||

| TOTAL RETURN SWAP - INDEX / DE (N/A) | 0.68 | 0.0436 | 0.0436 | ||||||

| US924934AA00 / Verus Securitization Trust, Series 2023-5, Class A1 | 0.67 | -13.48 | 0.0436 | -0.0071 | |||||

| SCCU Auto Receivables Trust 2024-1 / ABS-CBDO (US78436RAC43) | 0.67 | -31.67 | 0.0434 | -0.0204 | |||||

| US25152BAE83 / Deutsche Alt-A Securities Mortgage Loan Trust Series 2007-2 | 0.66 | -0.91 | 0.0424 | -0.0006 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0.65 | -1.51 | 0.0422 | -0.0008 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0.65 | 0.0422 | 0.0422 | ||||||

| USE0R75QAA61 / AI Candelaria Spain SLU | 0.65 | -8.33 | 0.0420 | -0.0040 | |||||

| Veralto Corporation / DBT (US92338CAD56) | 0.65 | -11.70 | 0.0420 | -0.0058 | |||||

| US681936BK50 / Omega Healthcare Investors Inc | 0.65 | 0.93 | 0.0420 | 0.0002 | |||||

| USP13458AB34 / Banco Industrial SA | 0.65 | 0.16 | 0.0417 | -0.0001 | |||||

| US04285AAC99 / CORP CMO | 0.64 | -6.28 | 0.0416 | -0.0030 | |||||

| US78016EZP59 / Royal Bank of Canada | 0.64 | -2.14 | 0.0415 | -0.0011 | |||||

| US11135FBB67 / Broadcom Inc | 0.64 | -1.69 | 0.0415 | -0.0009 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0.64 | -1.08 | 0.0414 | -0.0007 | |||||

| US49255PAA12 / Kestrel Aircraft Funding Ltd | 0.64 | -8.86 | 0.0413 | -0.0042 | |||||

| US808513BZ79 / Charles Schwab Corp/The | 0.64 | -2.45 | 0.0412 | -0.0012 | |||||

| US55284AAA60 / MF1 2021-FL7 Ltd | 0.63 | -36.23 | 0.0409 | -0.0235 | |||||

| ANG.PRD / American National Group Inc. - Preferred Stock | 0.63 | 1.45 | 0.0407 | 0.0004 | |||||

| US65473PAN50 / NiSource Inc | 0.63 | -1.42 | 0.0404 | -0.0008 | |||||

| PFP 2024-11 Ltd / ABS-CBDO (US69291WAA09) | 0.62 | -9.52 | 0.0400 | -0.0044 | |||||

| USG11176AA54 / Bioceanico Sovereign Certificate Ltd | 0.62 | -4.33 | 0.0400 | -0.0020 | |||||

| US37940XAN21 / Global Payments Inc | 0.61 | 0.16 | 0.0397 | -0.0001 | |||||

| US71647NAY58 / Petrobras Global Finance BV | 0.61 | 0.83 | 0.0395 | 0.0001 | |||||

| S1HW34 / The Sherwin-Williams Company - Depositary Receipt (Common Stock) | 0.61 | -1.93 | 0.0394 | -0.0010 | |||||

| USP09252AK62 / Banco de Bogota SA | 0.60 | -0.17 | 0.0389 | -0.0003 | |||||

| US69377FAA49 / Freeport Indonesia PT | 0.60 | 0.50 | 0.0388 | 0.0000 | |||||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 0.60 | -2.61 | 0.0387 | -0.0013 | |||||

| BNP / BNP Paribas SA | 0.60 | 0.0385 | 0.0385 | ||||||

| AIG / American International Group, Inc. - Depositary Receipt (Common Stock) | 0.59 | 0.0383 | 0.0383 | ||||||

| IFSPE / Intercorp Financial Services Inc | 0.58 | 0.52 | 0.0377 | 0.0000 | |||||

| US29250NBX21 / ENBRIDGE INC SR UNSEC 6.0% 11-15-28 | 0.58 | -11.01 | 0.0377 | -0.0048 | |||||

| USP1507SAG23 / Banco Santander Mexico SA Institucion de Banca Multiple Grupo Financiero Santand | 0.58 | 0.00 | 0.0375 | -0.0001 | |||||

| US92872VAA17 / VOLT_21-NPL8 | 0.57 | -60.76 | 0.0368 | -0.0574 | |||||

| USN53766AA41 / MV24 Capital BV | 0.57 | -2.07 | 0.0367 | -0.0009 | |||||

| US90353TAG58 / Uber Technologies Inc | 0.56 | -9.68 | 0.0362 | -0.0041 | |||||

| US866677AF41 / Sun Communities Operating LP | 0.55 | 1.47 | 0.0359 | 0.0003 | |||||

| US96041AAC09 / WESTLAKE AUTOMOBILE RECEIVABLES TRUST 2023-4 SER 2023-4A CL A2 REGD 144A P/P 6.23000000 | 0.55 | -62.11 | 0.0358 | -0.0591 | |||||

| Gen Digital Inc. / LON (66877AAG3) | 0.55 | 0.73 | 0.0358 | 0.0001 | |||||

| WTRG / Essential Utilities, Inc. | 0.54 | -2.16 | 0.0352 | -0.0009 | |||||

| Froneri Lux Finco Sarl / LON (G3679YAK8) | 0.54 | -0.55 | 0.0350 | -0.0004 | |||||

| USP4909LAA81 / GNL Quintero SA | 0.53 | 26.14 | 0.0340 | 0.0069 | |||||

| US55316VAA26 / MHC Commercial Mortgage Trust 2021-MHC | 0.52 | -59.40 | 0.0335 | -0.0494 | |||||

| BIRG / Bank of Ireland Group plc | 0.52 | 0.78 | 0.0333 | 0.0001 | |||||

| USL4R02QAA86 / Guara Norte Sarl | 0.51 | -38.15 | 0.0329 | -0.0206 | |||||

| N1IS34 / NiSource Inc. - Depositary Receipt (Common Stock) | 0.50 | -10.55 | 0.0323 | -0.0040 | |||||

| SUZ.30 / Suzano Austria GmbH | 0.50 | 2.25 | 0.0323 | 0.0006 | |||||

| FI4000223532 / Kojamo Oyj | 0.50 | 2.04 | 0.0323 | 0.0005 | |||||

| USP56243AD31 / InRetail Shopping Malls | 0.50 | -16.30 | 0.0322 | -0.0064 | |||||

| US69033DAD93 / Oversea-Chinese Banking Corp Ltd | 0.50 | 0.61 | 0.0321 | 0.0001 | |||||

| USP7372BAA19 / Orazul Energy Egenor SCA | 0.49 | 0.61 | 0.0320 | 0.0000 | |||||

| US30296EAA73 / FREMF 2017-KF30 Mortgage Trust | 0.49 | 0.41 | 0.0319 | -0.0001 | |||||

| US12659LAC63 / Credit Suisse Mortgage Trust, Series 2020-SPT1, Class A3 | 0.49 | 0.61 | 0.0319 | 0.0001 | |||||

| XS2230275633 / United Overseas Bank Ltd | 0.49 | 1.24 | 0.0317 | 0.0002 | |||||

| XS1636266832 / Adani Ports & Special Economic Zone Ltd | 0.48 | 2.77 | 0.0312 | 0.0007 | |||||

| US14686RAA05 / Carvana Auto Receivables Trust 2023-N3 | 0.48 | -52.49 | 0.0310 | -0.0344 | |||||

| US92873EAA82 / VOLT_21-NP10 | 0.47 | -37.14 | 0.0307 | -0.0184 | |||||

| USP1451JAA18 / Banco Nacional de Comercio Exterior SNC/Cayman Islands | 0.47 | 1.07 | 0.0306 | 0.0001 | |||||

| US03465AAC36 / AOMT_20-6 | 0.46 | -1.08 | 0.0298 | -0.0004 | |||||

| Alterra Mountain Company / LON (46124CAQ0) | 0.46 | 0.44 | 0.0297 | -0.0000 | |||||

| US17309KAN72 / Citimortgage Alternative Loan Trust, Series 2006-A3 | 0.46 | -2.55 | 0.0296 | -0.0010 | |||||

| US751151AG64 / RALI Series 2006-QS12 Trust | 0.46 | 0.89 | 0.0294 | 0.0001 | |||||

| FirstEnergy Transmission, LLC / DBT (US33767BAG41) | 0.45 | 1.57 | 0.0293 | 0.0003 | |||||

| US30294VAA17 / FREMF 2016-KF18 Mortgage Trust | 0.45 | 0.00 | 0.0292 | -0.0001 | |||||

| US05592AAA88 / BPR Trust 2021-TY | 0.45 | 0.67 | 0.0291 | 0.0000 | |||||

| Diageo Investment Corporation / DBT (US25245BAC19) | 0.45 | 0.0290 | 0.0290 | ||||||

| Vestis Corporation / LON (92550HAE3) | 0.45 | -3.89 | 0.0288 | -0.0013 | |||||

| H1BA34 / Huntington Bancshares Incorporated - Depositary Receipt (Common Stock) | 0.44 | 1.37 | 0.0287 | 0.0002 | |||||

| US225401BC11 / UBS Group AG | 0.44 | 0.00 | 0.0285 | -0.0001 | |||||

| Carvana Auto Receivables Trust 2024-P1 / ABS-CBDO (US14688NAB55) | 0.44 | -51.86 | 0.0285 | -0.0309 | |||||

| US115236AB74 / Brown & Brown Inc | 0.44 | 0.92 | 0.0283 | 0.0001 | |||||

| US36254KAP75 / GS MORTGAGE SECURITIES TRUST 2017-GS8 SER 2017-GS8 CL XA V/R REGD 1.12270600 | 0.43 | -11.61 | 0.0281 | -0.0038 | |||||

| US83406GAA85 / Sofi Alternative Trust 2021-1 | 0.43 | -27.23 | 0.0280 | -0.0107 | |||||

| USP3713CAB48 / Empresa Electrica Cochrane SpA | 0.43 | -18.63 | 0.0277 | -0.0064 | |||||

| USY4S71YAA27 / JSW Hydro Energy Ltd | 0.42 | -1.86 | 0.0273 | -0.0006 | |||||

| US52607KAA16 / Lendbuzz Securitization Trust 2022-1 | 0.42 | -20.91 | 0.0269 | -0.0073 | |||||

| USP7922DAB03 / Prumo Participacoes e Investimentos S/A | 0.41 | -4.83 | 0.0268 | -0.0015 | |||||

| USU63768AA01 / NBM US Holdings Inc | 0.41 | 0.00 | 0.0267 | -0.0001 | |||||

| US00973RAL78 / Aker BP ASA | 0.41 | 0.98 | 0.0266 | 0.0001 | |||||

| US02147QAR39 / Alternative Loan Trust 2006-19CB | 0.41 | -0.98 | 0.0263 | -0.0004 | |||||

| US02209SBQ57 / Altria Group Inc | 0.40 | -9.05 | 0.0260 | -0.0028 | |||||

| US05493NAA00 / BDS 2021-FL9 Ltd | 0.40 | -48.66 | 0.0260 | -0.0248 | |||||

| US45661EBW30 / IndyMac MBS, Inc. | 0.40 | 0.00 | 0.0258 | -0.0001 | |||||

| BEEFBZ / Minerva Luxembourg SA | 0.40 | 0.76 | 0.0258 | 0.0000 | |||||

| USP3579ECP09 / Dominican Republic International Bond | 0.40 | -59.47 | 0.0258 | -0.0380 | |||||

| XS1548865911 / BPRL International Singapore Pte Ltd | 0.40 | 0.0257 | 0.0257 | ||||||

| USG3040LAA01 / Energuate Trust | 0.40 | -0.25 | 0.0257 | -0.0002 | |||||

| USP4954BAF33 / Grupo KUO SAB De CV | 0.39 | 0.51 | 0.0255 | -0.0001 | |||||

| 4O2B / Adani Transmission Ltd | 0.39 | 2.60 | 0.0255 | 0.0005 | |||||

| USG25343AB36 / Cosan Ltd | 0.39 | 0.00 | 0.0253 | -0.0001 | |||||

| US74928EAF07 / RBSSP Resecuritization Trust 2009-2 | 0.39 | -2.26 | 0.0253 | -0.0007 | |||||

| USY4470XAA10 / JSW Infrastructure Ltd | 0.39 | 1.30 | 0.0252 | 0.0002 | |||||

| Delta 2 (LUX) S.a.r.l. / LON (L2465BAW6) | 0.39 | 0.78 | 0.0252 | 0.0000 | |||||

| TOTAL RETURN SWAP - INDEX / DE (N/A) | 0.39 | 0.0252 | 0.0252 | ||||||

| USL15669AA91 / Chile Electricity Lux MPC Sarl | 0.39 | 102.09 | 0.0250 | 0.0126 | |||||

| USP56236AB16 / InRetail Consumer | 0.38 | 0.0245 | 0.0245 | ||||||

| US126117AV22 / CNA Financial Corp. | 0.37 | -9.07 | 0.0240 | -0.0025 | |||||

| R / Ryder System, Inc. | 0.37 | 0.82 | 0.0238 | 0.0001 | |||||

| US02147PAP99 / Alternative Loan Trust 2006-29T1 | 0.37 | 0.27 | 0.0238 | 0.0000 | |||||

| US863579G516 / Structured Adjustable Rate Mortgage Loan Trust 2005-3XS | 0.37 | -0.27 | 0.0236 | -0.0002 | |||||

| TOTAL RETURN SWAP - INDEX / DE (N/A) | 0.36 | 0.0235 | 0.0235 | ||||||

| US25179MBD48 / Devon Energy Corp | 0.36 | -10.15 | 0.0235 | -0.0028 | |||||

| US94989XBL82 / Wells Fargo Commercial Mortgage Trust 2015-NXS4 | 0.36 | 2.56 | 0.0233 | 0.0005 | |||||

| US23311VAH06 / DCP Midstream Operating LP | 0.36 | 1.12 | 0.0233 | 0.0001 | |||||

| USG0398NZ620 / Antofagasta PLC | 0.35 | -31.84 | 0.0227 | -0.0107 | |||||

| US36253PAE25 / GS MORTGAGE SECURITIES TRUST 2017-GS6 SER 2017-GS6 CL XA V/R REGD 1.18867500 | 0.34 | 1.80 | 0.0220 | 0.0003 | |||||

| BRO / Brown & Brown, Inc. | 0.33 | 0.0216 | 0.0216 | ||||||

| Dynasty Acquisition Co., Inc. / LON (26812CAN6) | 0.33 | 0.00 | 0.0214 | -0.0001 | |||||

| USN6000DAA11 / Mong Duong Finance Holdings BV | 0.33 | -10.57 | 0.0213 | -0.0026 | |||||

| US05369AAN19 / Aviation Capital Group LLC | 0.33 | 0.61 | 0.0213 | 0.0000 | |||||

| Trans Union, LLC / LON (89334GBF0) | 0.33 | 0.31 | 0.0212 | -0.0001 | |||||

| US882925AA84 / Theorem Funding Trust 2022-3 | 0.33 | -56.52 | 0.0212 | -0.0277 | |||||

| US95001RAY53 / Wells Fargo Commercial Mortgage Trust 2018-C48 | 0.32 | -9.27 | 0.0209 | -0.0022 | |||||

| US82652RAC34 / Sierra Timeshare 2021-2 Receivables Funding LLC | 0.31 | -13.50 | 0.0204 | -0.0032 | |||||

| COMENG / Cometa Energia SA de CV | 0.31 | 1.97 | 0.0202 | 0.0003 | |||||

| M1CH34 / Microchip Technology Incorporated - Depositary Receipt (Common Stock) | 0.31 | 0.66 | 0.0199 | 0.0001 | |||||

| US69547PAB58 / Pagaya AI Debt Selection Trust, Series 2021-HG1, Class B | 0.31 | 0.33 | 0.0199 | -0.0000 | |||||

| US85572RAA77 / Start Ltd/Bermuda | 0.31 | -3.79 | 0.0198 | -0.0008 | |||||

| FCT / Fincantieri S.p.A. | 0.30 | 1.35 | 0.0195 | 0.0002 | |||||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 0.30 | 0.0195 | 0.0195 | ||||||

| US762010AE64 / RFMSI Series 2006-S4 Trust | 0.30 | 0.67 | 0.0194 | 0.0001 | |||||

| US26884LAG41 / EQT Corp | 0.30 | 0.67 | 0.0194 | 0.0000 | |||||

| US3138EKJ978 / Federal National Mortgage Association, Inc. | 0.30 | -2.62 | 0.0193 | -0.0006 | |||||

| US35671DCE31 / Freeport-McMoRan Inc | 0.30 | 0.68 | 0.0192 | 0.0000 | |||||

| USP2253TJS98 / Cemex SAB de CV | 0.30 | 1.02 | 0.0192 | 0.0001 | |||||

| US92873AAA60 / VOLT XCIV LLC 2.2395% 02/27/2051 144A | 0.29 | -64.69 | 0.0189 | -0.0348 | |||||

| USU9841MAA00 / Wipro IT Services LLC | 0.29 | 0.0188 | 0.0188 | ||||||

| US053611AJ82 / Avery Dennison Corp. | 0.28 | 1.07 | 0.0184 | 0.0001 | |||||

| XS2270576619 / Morocco Government International Bond | 0.28 | 0.0182 | 0.0182 | ||||||

| US61691JAW45 / MORGAN STANLEY CAPITAL I TRUST 2017-H1 SER 2017-H1 CL XA V/R REGD 1.59467800 | 0.28 | -15.20 | 0.0180 | -0.0034 | |||||

| USP3143NBE33 / Corp Nacional del Cobre de Chile | 0.28 | 1.46 | 0.0180 | 0.0002 | |||||

| Froneri Lux Finco Sarl / LON (G3679YAK8) | 0.28 | -49.17 | 0.0180 | -0.0175 | |||||

| US95001MAH34 / WELLS FARGO COMMERCIAL MORTGAGE TRUST 2017-C38 SER 2017-C38 CL XA V/R REGD 1.20864800 | 0.28 | -14.55 | 0.0179 | -0.0032 | |||||

| US07332VBJ35 / BBCMS MORTGAGE TRUST 2017-C1 | 0.27 | -19.47 | 0.0177 | -0.0043 | |||||

| US57110NAD84 / Marlette Funding Trust 2021-1 | 0.27 | -39.36 | 0.0172 | -0.0112 | |||||

| US2254W0NF81 / Credit Suisse First Boston Mortgage Acceptance Corp. | 0.26 | -0.38 | 0.0170 | -0.0001 | |||||

| USP90475AB31 / Telefonica Celular del Paraguay SA | 0.26 | 0.00 | 0.0169 | -0.0001 | |||||

| US67448VAM28 / OBX 2020-EXP2 Trust | 0.26 | -3.03 | 0.0166 | -0.0006 | |||||

| USU63768AB83 / NBM US HOLDING 6.625 8/29 | 0.25 | 0.80 | 0.0162 | 0.0000 | |||||

| US95002BAC72 / Wells Fargo Commercial Mortgage Trust 2019-C53 | 0.25 | 0.0159 | 0.0159 | ||||||

| US06051GLA57 / Bank of America Corp. | 0.24 | 0.00 | 0.0155 | -0.0001 | |||||

| US595017BA15 / CORP. NOTE | 0.23 | 0.00 | 0.0149 | -0.0000 | |||||

| US94985GAH92 / Wells Fargo Alternative Loan 2007-PA3 Trust | 0.22 | -0.45 | 0.0145 | -0.0001 | |||||

| US61946NAA63 / Mosaic Solar Loan Trust 2020-1 | 0.22 | -4.42 | 0.0140 | -0.0008 | |||||

| US05948KR842 / Banc of America Alternative Loan Trust 2006-3 | 0.22 | -1.83 | 0.0139 | -0.0003 | |||||

| US12515DAS36 / CD 2017-CD4 Mortgage Trust | 0.21 | -18.15 | 0.0137 | -0.0031 | |||||

| XS1993965950 / Gold Fields Orogen Holdings BVI Ltd | 0.21 | 0.00 | 0.0134 | -0.0000 | |||||

| US46590LAV45 / JPMDB Commercial Mortgage Securities Trust 2016-C2 | 0.21 | 8.99 | 0.0133 | 0.0010 | |||||

| US63861VAJ61 / Nationwide Building Society | 0.21 | 0.00 | 0.0133 | -0.0001 | |||||

| US06541FBB40 / BANK 2017-BNK4 | 0.20 | -16.05 | 0.0132 | -0.0026 | |||||

| USP29595AB42 / Comision Federal de Electricidad | 0.20 | 1.02 | 0.0129 | 0.0001 | |||||

| US78473JAG76 / SREIT TRUST SREIT 2021 IND B 144A | 0.20 | 0.51 | 0.0129 | 0.0000 | |||||

| XS1457499645 / ONGC Videsh Vankorneft Pte Ltd | 0.20 | -66.55 | 0.0128 | -0.0199 | |||||

| USL9412AAB37 / Ultrapar International SA | 0.20 | 0.51 | 0.0128 | 0.0000 | |||||

| USA08163AA41 / BRF GmbH | 0.20 | -26.77 | 0.0128 | -0.0010 | |||||

| US69370RAK32 / Pertamina Persero PT | 0.20 | 1.03 | 0.0127 | 0.0001 | |||||

| USP30179BQ04 / Comision Federal de Electricidad | 0.20 | 2.09 | 0.0126 | 0.0002 | |||||

| Delta 2 (LUX) S.a.r.l. / LON (L2465BAX4) | 0.20 | 0.52 | 0.0126 | -0.0000 | |||||

| USP7358RAD81 / Oleoducto Central SA | 0.19 | 0.52 | 0.0126 | 0.0000 | |||||

| US958667AF48 / Western Midstream Operating LP | 0.19 | 0.00 | 0.0125 | -0.0000 | |||||

| US03512TAF84 / AngloGold Ashanti Holdings PLC | 0.19 | 1.06 | 0.0123 | 0.0001 | |||||

| New York Life Global Funding / DBT (US64952WFF59) | 0.19 | -9.13 | 0.0123 | -0.0013 | |||||

| Affirm Asset Securitization Trust 2024-X1 / ABS-CBDO (US00834XAA72) | 0.19 | -70.89 | 0.0121 | -0.0294 | |||||

| USP3713QAA50 / Empresa Electrica Angamos SA | 0.19 | -11.43 | 0.0121 | -0.0016 | |||||

| USP3143NBH63 / Corp Nacional del Cobre de Chile | 0.19 | 1.65 | 0.0120 | 0.0001 | |||||

| US20267TAA07 / Commonbond Student Loan Trust 2016-A | 0.18 | -8.76 | 0.0115 | -0.0011 | |||||

| US26884LAF67 / EQT Corp. | 0.17 | 0.60 | 0.0110 | 0.0000 | |||||

| US55283TAA60 / MF1 Multifamily Housing Mortgage Loan Trust | 0.17 | -30.17 | 0.0110 | -0.0048 | |||||

| US127097AG80 / Coterra Energy Inc | 0.17 | 0.00 | 0.0109 | -0.0000 | |||||

| US59001ABD37 / MTH 3 7/8 04/15/29 | 0.15 | 1.33 | 0.0098 | 0.0001 | |||||

| USP09110AB65 / Banco Continental SAECA | 0.15 | 0.68 | 0.0096 | 0.0000 | |||||

| US64952WEE93 / New York Life Global Funding | 0.15 | -9.82 | 0.0095 | -0.0011 | |||||

| Walker & Dunlop, Inc. / LON (93148QAK6) | 0.14 | 0.00 | 0.0094 | 0.0000 | |||||

| Froneri Lux Finco Sarl / LON (G3679YAK8) | 0.14 | -73.58 | 0.0093 | -0.0261 | |||||

| CPI Holdco B LLC / LON (1261MAAB6) | 0.14 | 0.70 | 0.0093 | 0.0000 | |||||

| XS2267100514 / Adani International Container Terminal Pvt Ltd | 0.14 | -1.41 | 0.0091 | -0.0002 | |||||

| US94985JAA88 / WELLS FARGO MORTGAGE BACKED SE WFMBS 2007 7 A1 | 0.14 | 0.73 | 0.0089 | 0.0000 | |||||

| US69546LAA70 / PAID_21-2 | 0.14 | -41.45 | 0.0089 | -0.0063 | |||||

| US17325HBU77 / Citigroup Commercial Mortgage Trust 2017-P7 | 0.14 | -16.46 | 0.0089 | -0.0018 | |||||

| US6944PL2G38 / PACIFIC LIFE GF II REGD V/R 144A P/P 0.00000000 | 0.14 | -9.27 | 0.0089 | -0.0009 | |||||

| A1GI34 / Agilent Technologies, Inc. - Depositary Receipt (Common Stock) | 0.14 | -9.33 | 0.0089 | -0.0009 | |||||

| US40441LAA44 / HGI CRE CLO 2021-FL1 Ltd | 0.13 | 0.00 | 0.0086 | -0.0000 | |||||

| Herc Holdings Inc / LON (42705FAB2) | 0.13 | 0.0084 | 0.0084 | ||||||

| Dynasty Acquisition Co., Inc. / LON (26812CAP1) | 0.13 | 0.80 | 0.0082 | -0.0000 | |||||

| US85816VAA44 / Steele Creek Clo 2017-1 Ltd | 0.12 | -36.73 | 0.0080 | -0.0047 | |||||

| USP40070AB35 / FENIX POWER PERU SA REGD REG S 4.31700000 | 0.11 | 0.00 | 0.0072 | -0.0000 | |||||

| USG77265AA73 / Rutas 2 and 7 Finance Ltd | 0.11 | 0.0072 | 0.0072 | ||||||

| TOTAL RETURN SWAP - INDEX / DE (N/A) | 0.11 | 0.0072 | 0.0072 | ||||||

| US127097AK92 / Coterra Energy Inc | 0.11 | 0.00 | 0.0070 | -0.0000 | |||||

| TOTAL RETURN SWAP - INDEX / DE (N/A) | 0.09 | 0.0061 | 0.0061 | ||||||

| US78355HKW87 / RYDER SYSTEM INC | 0.09 | 1.10 | 0.0060 | 0.0000 | |||||

| US715638DA73 / Peruvian Government International Bond | 0.09 | 0.0059 | 0.0059 | ||||||

| US17325DAJ28 / Citigroup Commercial Mortgage Trust 2016-P5 | 0.09 | -23.42 | 0.0055 | -0.0017 | |||||

| US91835EAA73 / VOLT_21-NPL6 | 0.08 | -49.37 | 0.0052 | -0.0052 | |||||

| US361448BF99 / GATX Corp | 0.08 | 1.30 | 0.0051 | 0.0000 | |||||

| US94986CAA27 / Wells Fargo Mortgage Backed Securities 2007-AR4 Trust | 0.08 | -1.28 | 0.0050 | -0.0001 | |||||

| US12531YAQ17 / CFCRE_16-C4 | 0.08 | -37.19 | 0.0050 | -0.0029 | |||||

| US46645UAV98 / JP Morgan Chase Commercial Mortgage Securities Trust 2016-JP4 | 0.08 | -20.00 | 0.0049 | -0.0012 | |||||

| US05526DBN49 / BAT Capital Corp | 0.07 | 0.00 | 0.0045 | 0.0000 | |||||

| US03836WAB90 / Aqua America Inc. | 0.07 | 1.54 | 0.0043 | 0.0000 | |||||

| US3137APJB72 / Federal Home Loan Mortgage Corporation | 0.06 | -46.43 | 0.0039 | -0.0034 | |||||

| US20048KAG22 / COMM 2018-HCLV Mortgage Trust | 0.06 | 45.00 | 0.0038 | 0.0012 | |||||

| US29429CAJ45 / Citigroup Commercial Mortgage Trust 2016-P3 | 0.06 | -28.40 | 0.0038 | -0.0015 | |||||

| Flame Aggregator LLC / EC (N/A) | 0.00 | 0.04 | 0.0029 | 0.0029 | |||||

| US30166RAF47 / Exeter Automobile Receivables Trust | 0.03 | -87.08 | 0.0020 | -0.0136 | |||||

| US05492NAJ28 / BBCMS_19-BWAY | 0.03 | 0.00 | 0.0020 | -0.0000 | |||||

| US23312LAW81 / DBJPM 16-C1 Mortgage Trust | 0.03 | -56.72 | 0.0019 | -0.0025 | |||||

| US91681PAA75 / Upstart Pass-Through Trust, Series 2021-ST3, Class A | 0.03 | -60.87 | 0.0018 | -0.0027 | |||||

| US46590JAY38 / JPMBB COMMERCIAL MORTGAGE SECURITIES TRUST 2015-C32 SER 2015-C32 CL XA V/R REGD 1.51314700 | 0.03 | -31.58 | 0.0017 | -0.0008 | |||||

| XAN9833RAJ85 / Ziggo Financing Partnership USD Term Loan I | 0.02 | -58.62 | 0.0016 | -0.0022 | |||||

| US61692AAQ58 / Morgan Stanley Capital I Inc | 0.02 | 0.00 | 0.0014 | -0.0000 | |||||

| USP52715AB80 / Interoceanica IV Finance Ltd | 0.01 | -51.72 | 0.0010 | -0.0009 | |||||

| US17290XAY67 / Citigroup Commercial Mortgage Trust 2016-GC37 | 0.01 | -50.00 | 0.0009 | -0.0008 | |||||

| US12591KAF21 / COMM 2013-CCRE12 Mortgage Trust | 0.01 | 0.00 | 0.0008 | -0.0000 | |||||

| US61691ABM45 / Morgan Stanley Capital I Trust 2015-UBS8 | 0.01 | -50.00 | 0.0006 | -0.0005 | |||||

| US36252AAE64 / GS Mortgage Securities Trust 2015-GS1 | 0.01 | -11.11 | 0.0005 | -0.0001 | |||||

| US95000LBC63 / Wells Fargo Commercial Mortgage Trust 2016-C33 | 0.01 | -42.86 | 0.0005 | -0.0004 | |||||

| US46590KAN46 / JP Morgan Chase Commercial Mortgage Securities Trust 2015-JP1 | 0.01 | -61.11 | 0.0005 | -0.0007 | |||||

| US17324TAG40 / Citigroup Commercial Mortgage Trust 2016-GC36 | 0.01 | -58.82 | 0.0005 | -0.0007 | |||||

| US95000AAX54 / Wells Fargo & Company | 0.01 | 0.00 | 0.0004 | 0.0000 | |||||

| Flame Aggregator LLC / EC (N/A) | 0.00 | 0.00 | 0.0003 | 0.0003 | |||||

| US61766LBT52 / Morgan Stanley Bank of America Merrill Lynch Trust 2016-C28 | 0.00 | -72.73 | 0.0002 | -0.0005 | |||||

| Digicel Group Holdings Limited / DBT (US25381HAH12) | 0.00 | -62.50 | 0.0002 | -0.0003 | |||||

| US50219QAY08 / LSTAR Commercial Mortgage Trust 2016-4 | 0.00 | -94.87 | 0.0002 | -0.0024 | |||||

| US12593QBF63 / COMM 2015-CCRE26 Mortgage Trust | 0.00 | 0.0002 | 0.0001 | ||||||

| US36255WAN56 / GS MTG SECS CORP TR 2018-RIVR G 1ML+260 07/15/2035 144A | 0.00 | -60.00 | 0.0001 | -0.0002 | |||||

| US19633FAD33 / Colorado Buyer, Inc., Term Loan | 0.00 | 0.00 | 0.0001 | -0.0000 | |||||

| US12591YBE41 / COMM 2014-UBS3 Mortgage Trust | 0.00 | 0.0001 | 0.0000 | ||||||

| Digicel Group Holdings Limited / DBT (US25381HAR93) | 0.00 | -100.00 | 0.0000 | -0.0000 | |||||

| US36253GAG73 / GS Mortgage Securities Trust 2014-GC24 | 0.00 | 0.0000 | 0.0000 | ||||||

| US12635QBH20 / COMM 2015-CCRE27 Mortgage Trust | 0.00 | -100.00 | 0.0000 | -0.0010 | |||||

| US12593PAX06 / COMM 2015-CCRE25 MORTGAGE TRUST SER 2015-CR25 CL XA V/R REGD 1.02680600 | 0.00 | -100.00 | 0.0000 | -0.0018 | |||||

| NRG Energy, Inc. / LON (62937NBC0) | 0.00 | -100.00 | 0.0000 | -0.0002 | |||||

| TOTAL RETURN SWAP - INDEX / DE (N/A) | -0.17 | -0.0108 | -0.0108 |