Basic Stats

| Portfolio Value | $ 204,341,567 |

| Current Positions | 45 |

Latest Holdings, Performance, AUM (from 13F, 13D)

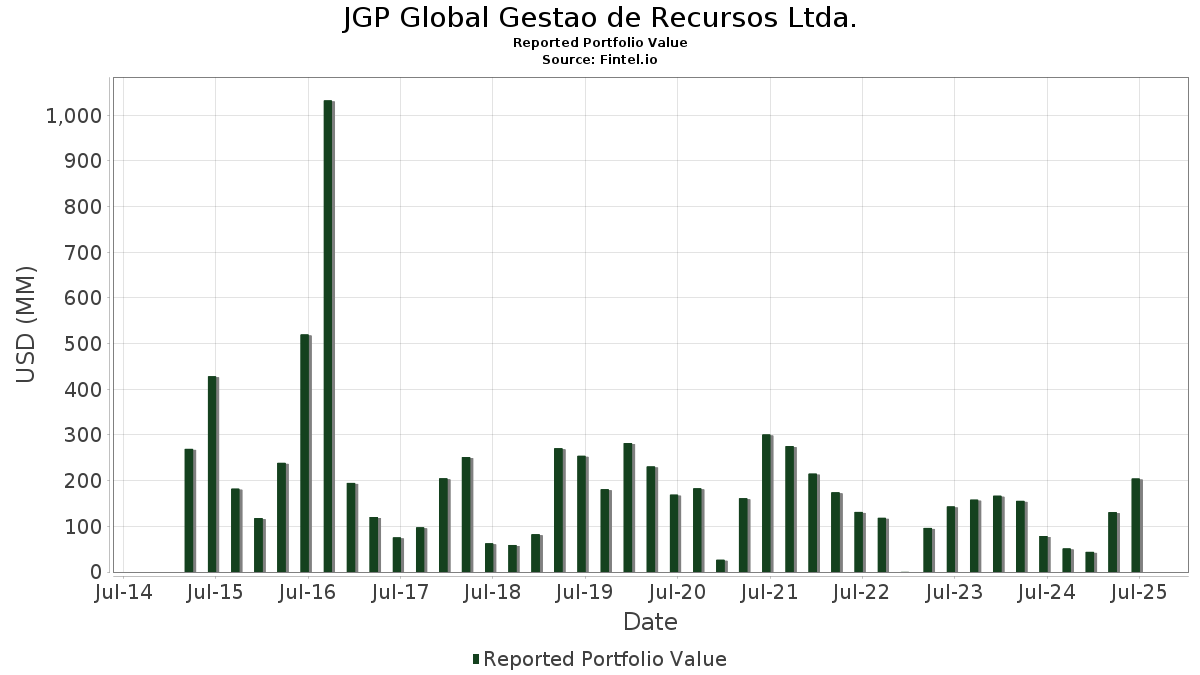

JGP Global Gestao de Recursos Ltda. has disclosed 45 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 204,341,567 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). JGP Global Gestao de Recursos Ltda.’s top holdings are StoneCo Ltd. (US:STNE) , New Gold Inc. (US:NGD) , XP Inc. (US:XP) , Kratos Defense & Security Solutions, Inc. (US:KTOS) , and iShares Bitcoin Trust ETF (US:IBIT) . JGP Global Gestao de Recursos Ltda.’s new positions include Kratos Defense & Security Solutions, Inc. (US:KTOS) , iShares Bitcoin Trust ETF (US:IBIT) , Perpetua Resources Corp. (US:PPTA) , Telefônica Brasil S.A. - Depositary Receipt (Common Stock) (US:VIV) , and Cohen Circle Acquisition Corp. I (US:CCIR) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.28 | 13.01 | 6.3648 | 6.3648 | |

| 0.20 | 12.24 | 5.9909 | 5.9909 | |

| 0.77 | 10.55 | 5.1627 | 5.1627 | |

| 0.45 | 5.46 | 2.6735 | 2.6735 | |

| 0.10 | 1.14 | 0.5579 | 0.5579 | |

| 0.01 | 1.12 | 0.5477 | 0.5477 | |

| 0.01 | 0.93 | 0.4566 | 0.4566 | |

| 0.08 | 0.83 | 0.4055 | 0.4055 | |

| 0.01 | 0.79 | 0.3851 | 0.3851 | |

| 0.01 | 0.77 | 0.3781 | 0.3781 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 10.59 | 52.41 | 25.6485 | -4.6719 | |

| 0.01 | 2.90 | 1.4210 | -1.0754 | |

| 0.00 | 0.39 | 0.1891 | -0.3495 | |

| 0.00 | 1.05 | 0.5116 | -0.3378 | |

| 0.02 | 0.79 | 0.3870 | -0.3257 | |

| 0.02 | 1.32 | 0.6443 | -0.2508 | |

| 0.00 | 0.31 | 0.1502 | -0.2451 | |

| 0.00 | 0.62 | 0.3039 | -0.2336 | |

| 0.01 | 0.31 | 0.1521 | -0.1619 | |

| 0.00 | 0.31 | 0.1514 | -0.1397 |

13F and Fund Filings

This form was filed on 2025-07-22 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| STNE / StoneCo Ltd. | 4.55 | 1.82 | 73.05 | 55.85 | 35.7496 | -0.0930 | |||

| NGD / New Gold Inc. | 10.59 | -0.94 | 52.41 | 32.17 | 25.6485 | -4.6719 | |||

| XP / XP Inc. | 0.85 | 7.43 | 17.26 | 57.82 | 8.4446 | 0.0840 | |||

| KTOS / Kratos Defense & Security Solutions, Inc. | 0.28 | 13.01 | 6.3648 | 6.3648 | |||||

| IBIT / iShares Bitcoin Trust ETF | 0.20 | 12.24 | 5.9909 | 5.9909 | |||||

| NU / Nu Holdings Ltd. | 0.77 | 10.55 | 5.1627 | 5.1627 | |||||

| PPTA / Perpetua Resources Corp. | 0.45 | 5.46 | 2.6735 | 2.6735 | |||||

| ONC / BeOne Medicines AG - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 2.90 | -11.06 | 1.4210 | -1.0754 | |||

| INCY / Incyte Corporation | 0.02 | 0.00 | 1.32 | 12.48 | 0.6443 | -0.2508 | |||

| VIV / Telefônica Brasil S.A. - Depositary Receipt (Common Stock) | 0.10 | 1.14 | 0.5579 | 0.5579 | |||||

| NVDA / NVIDIA Corporation | 0.01 | 1.12 | 0.5477 | 0.5477 | |||||

| LLY / Eli Lilly and Company | 0.00 | -0.30 | 1.05 | -5.86 | 0.5116 | -0.3378 | |||

| GOOG / Alphabet Inc. | 0.01 | 0.93 | 0.4566 | 0.4566 | |||||

| CCIR / Cohen Circle Acquisition Corp. I | 0.08 | 0.83 | 0.4055 | 0.4055 | |||||

| SFTBY / SoftBank Group Corp. - Depositary Receipt (Common Stock) | 0.02 | -41.26 | 0.79 | -15.24 | 0.3870 | -0.3257 | |||

| BN / Brookfield Corporation | 0.01 | 0.79 | 0.3851 | 0.3851 | |||||

| MRVL / Marvell Technology, Inc. | 0.01 | 0.77 | 0.3781 | 0.3781 | |||||

| ABBV / AbbVie Inc. | 0.00 | -0.27 | 0.62 | -11.54 | 0.3039 | -0.2336 | |||

| ACAD / ACADIA Pharmaceuticals Inc. | 0.03 | 0.00 | 0.58 | 29.98 | 0.2845 | -0.0578 | |||

| MU / Micron Technology, Inc. | 0.00 | 0.51 | 0.2498 | 0.2498 | |||||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | 0.49 | 0.2396 | 0.2396 | |||||

| ABT / Abbott Laboratories | 0.00 | -0.27 | 0.45 | 2.26 | 0.2221 | -0.1173 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -0.25 | 0.44 | 9.43 | 0.2162 | -0.0924 | |||

| AGI / Alamos Gold Inc. | 0.02 | 0.02 | 0.41 | -0.73 | 0.2009 | -0.1151 | |||

| AEM / Agnico Eagle Mines Limited | 0.00 | -49.99 | 0.39 | -45.17 | 0.1891 | -0.3495 | |||

| BSX / Boston Scientific Corporation | 0.00 | -0.25 | 0.38 | 6.11 | 0.1873 | -0.0883 | |||

| MDGL / Madrigal Pharmaceuticals, Inc. | 0.00 | 0.00 | 0.38 | -8.76 | 0.1838 | -0.1305 | |||

| JNJ / Johnson & Johnson | 0.00 | -0.26 | 0.35 | -8.09 | 0.1725 | -0.1209 | |||

| SMMT / Summit Therapeutics Inc. | 0.02 | 0.00 | 0.33 | 10.14 | 0.1600 | -0.0666 | |||

| INSM / Insmed Incorporated | 0.00 | 0.00 | 0.32 | 31.67 | 0.1550 | -0.0286 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | -0.27 | 0.31 | -24.39 | 0.1521 | -0.1619 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -0.26 | 0.31 | -18.68 | 0.1514 | -0.1397 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -0.30 | 0.31 | -40.70 | 0.1502 | -0.2451 | |||

| ZTS / Zoetis Inc. | 0.00 | -0.25 | 0.31 | -5.57 | 0.1497 | -0.0979 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | -0.27 | 0.28 | -1.05 | 0.1381 | -0.0806 | |||

| DHR / Danaher Corporation | 0.00 | -0.30 | 0.27 | -3.97 | 0.1305 | -0.0817 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | -0.34 | 0.26 | -8.51 | 0.1266 | -0.0895 | |||

| RYTM / Rhythm Pharmaceuticals, Inc. | 0.00 | 0.00 | 0.24 | 19.31 | 0.1183 | -0.0366 | |||

| 08X / Pony AI Inc. - Depositary Receipt (Common Stock) | 0.02 | 0.24 | 0.1156 | 0.1156 | |||||

| MCK / McKesson Corporation | 0.00 | -0.32 | 0.23 | 8.61 | 0.1112 | -0.0489 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | 0.20 | 0.0982 | 0.0982 | |||||

| ABCL / AbCellera Biologics Inc. | 0.02 | 0.00 | 0.06 | 55.26 | 0.0291 | -0.0005 | |||

| KOD / Kodiak Sciences Inc. | 0.01 | 0.00 | 0.04 | 33.33 | 0.0199 | -0.0035 | |||

| CERS / Cerus Corporation | 0.01 | 0.00 | 0.02 | 0.00 | 0.0085 | -0.0046 | |||

| OI SA-ADR / ADR (670851500) | 0.05 | 0.01 | 0.0000 | ||||||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.0367 | |||

| PPLT / abrdn Platinum ETF Trust - abrdn Physical Platinum Shares ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CPRI / Capri Holdings Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PROSY / Prosus N.V. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 |