Basic Stats

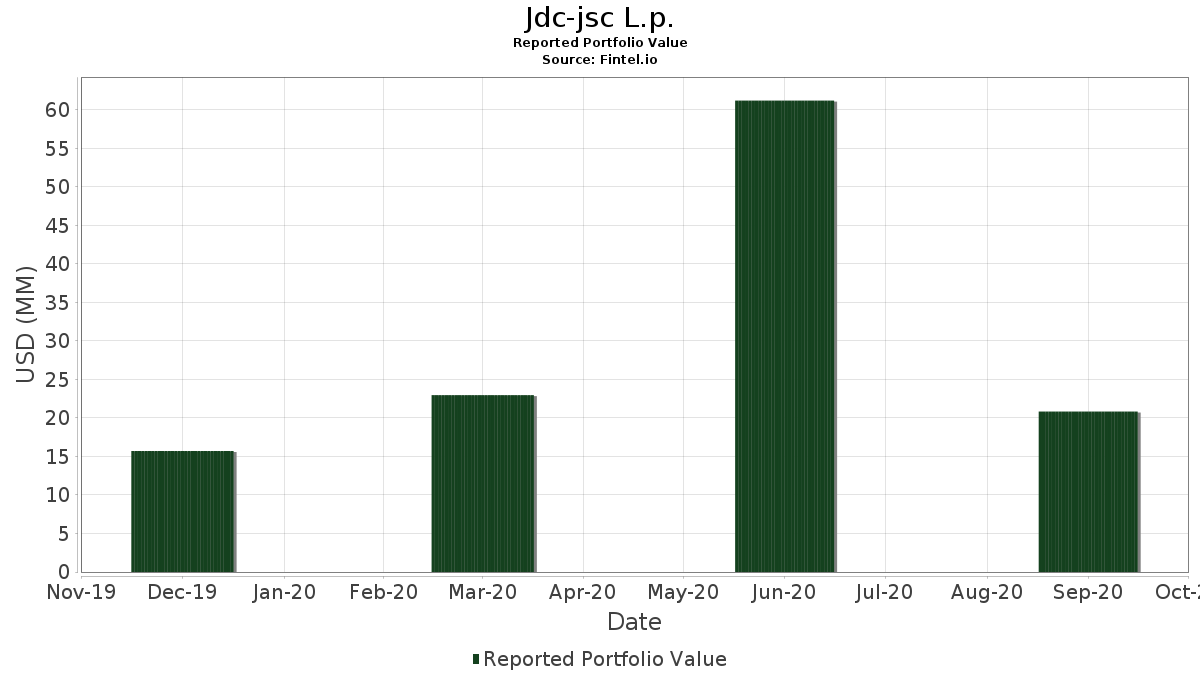

| Portfolio Value | $ 20,835,000 |

| Current Positions | 28 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Jdc-jsc L.p. has disclosed 28 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 20,835,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Jdc-jsc L.p.’s top holdings are Alphabet Inc. (US:GOOGL) , Allergan plc (US:018490100) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , and ASML Holding N.V. (US:ASMLF) . Jdc-jsc L.p.’s new positions include Teladoc Health, Inc. (US:TDOC) , Moderna, Inc. (US:MRNA) , NVIDIA Corporation (US:NVDA) , Advanced Micro Devices, Inc. (US:AMD) , and Repros Therapeutics, Inc. (US:76028H209) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 2.36 | 11.3367 | 11.1978 | |

| 0.00 | 2.56 | 12.3110 | 8.4882 | |

| 0.01 | 1.89 | 9.0857 | 6.2594 | |

| 0.00 | 1.29 | 6.2011 | 6.2011 | |

| 0.01 | 1.37 | 6.5611 | 5.6070 | |

| 0.01 | 0.98 | 4.6988 | 4.6988 | |

| 0.04 | 1.05 | 5.0636 | 3.8776 | |

| 0.00 | 0.79 | 3.7869 | 3.7869 | |

| 0.00 | 0.98 | 4.7036 | 3.5274 | |

| 0.01 | 1.10 | 5.3036 | 3.3660 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.7037 | ||

| 0.00 | 0.00 | -1.8542 | ||

| 0.00 | 0.18 | 0.8447 | -1.3395 | |

| 0.00 | 0.00 | -0.8266 | ||

| 0.00 | 0.00 | -0.7891 | ||

| 0.00 | 0.00 | -0.3055 |

13F and Fund Filings

This form was filed on 2020-11-03 for the reporting period 2020-09-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GOOGL / Alphabet Inc. | 0.00 | 6.06 | 2.56 | 9.62 | 12.3110 | 8.4882 | |||

| 018490100 / Allergan plc | 0.00 | -97.86 | 2.36 | 2,678.82 | 11.3367 | 11.1978 | |||

| MSFT / Microsoft Corporation | 0.01 | 5.88 | 1.89 | 9.42 | 9.0857 | 6.2594 | |||

| AAPL / Apple Inc. | 0.01 | 637.50 | 1.37 | 134.08 | 6.5611 | 5.6070 | |||

| ASMLF / ASML Holding N.V. | 0.00 | 59.09 | 1.29 | 59.51 | 6.2011 | 6.2011 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | -8.33 | 1.10 | -6.83 | 5.3036 | 3.3660 | |||

| T / AT&T Inc. | 0.04 | 54.17 | 1.05 | 45.32 | 5.0636 | 3.8776 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 14.09 | 0.98 | 36.11 | 4.7036 | 3.5274 | |||

| WMT / Walmart Inc. | 0.01 | 0.98 | 4.6988 | 4.6988 | |||||

| TDOC / Teladoc Health, Inc. | 0.00 | 0.79 | 3.7869 | 3.7869 | |||||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | 20.00 | 0.67 | 7.69 | 3.2253 | 3.2253 | |||

| SIVB / SVB Financial Group | 0.00 | 20.45 | 0.64 | 34.60 | 3.0622 | 2.2878 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.60 | 2.8990 | 2.8990 | |||||

| IBM / International Business Machines Corporation | 0.00 | -30.77 | 0.55 | -30.19 | 2.6302 | 1.3478 | |||

| MRNA / Moderna, Inc. | 0.01 | 0.50 | 2.4094 | 2.4094 | |||||

| NVDA / NVIDIA Corporation | 0.00 | 0.43 | 2.0782 | 2.0782 | |||||

| JPM / JPMorgan Chase & Co. | 0.00 | -30.00 | 0.40 | -28.37 | 1.9390 | 1.0177 | |||

| WFC / Wells Fargo & Company | 0.02 | 37.93 | 0.38 | 26.60 | 1.8047 | 1.8047 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | 0.37 | 1.7711 | 1.7711 | |||||

| 76028H209 / Repros Therapeutics, Inc. | 0.01 | 0.36 | 1.7183 | 1.7183 | |||||

| MU / Micron Technology, Inc. | 0.01 | 0.36 | 1.7135 | 1.7135 | |||||

| C / Citigroup Inc. | 0.01 | -28.00 | 0.31 | -39.33 | 1.4879 | 1.4879 | |||

| RKT / Rocket Companies, Inc. | 0.01 | 0.18 | 0.8591 | 0.8591 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | -90.32 | 0.18 | -86.84 | 0.8447 | -1.3395 | |||

| RXT / Rackspace Technology, Inc. | 0.01 | 0.15 | 0.7391 | 0.7391 | |||||

| ZM / Zoom Communications Inc. | 0.00 | -85.71 | 0.14 | -73.50 | 0.6767 | 0.6767 | |||

| US83088V1026 / Slack Technologies Inc | 0.01 | 0.13 | 0.6431 | 0.6431 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 0.05 | 0.09 | 0.4464 | 0.4464 | |||||

| AMZN / Amazon.com, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.7037 | ||||

| CSCO / Cisco Systems, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3055 | ||||

| HON / Honeywell International Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.8266 | ||||

| KO / The Coca-Cola Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.7891 | ||||

| META / Meta Platforms, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.8542 | ||||

| SPY / SPDR S&P 500 ETF | Put | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 |