Basic Stats

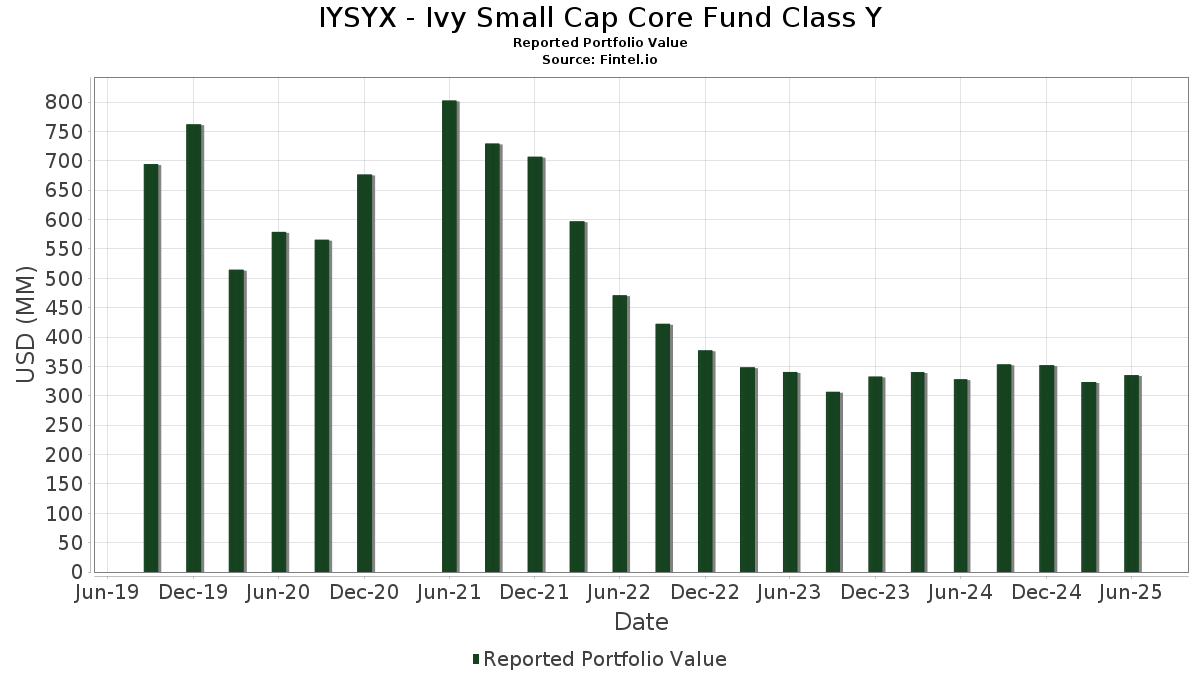

| Portfolio Value | $ 335,158,990 |

| Current Positions | 125 |

Latest Holdings, Performance, AUM (from 13F, 13D)

IYSYX - Ivy Small Cap Core Fund Class Y has disclosed 125 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 335,158,990 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). IYSYX - Ivy Small Cap Core Fund Class Y’s top holdings are East West Bancorp, Inc. (US:EWBC) , Casey's General Stores, Inc. (US:CASY) , AXIS Capital Holdings Limited (DE:AXV) , Guidewire Software, Inc. (US:GWRE) , and Webster Financial Corporation (US:WBS) . IYSYX - Ivy Small Cap Core Fund Class Y’s new positions include Synovus Financial Corp. (US:SNV) , Astera Labs, Inc. (US:ALAB) , Tecnoglass Inc. (US:TGLS) , Life Time Group Holdings, Inc. (US:LTH) , and Carpenter Technology Corporation (US:CRS) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.03 | 1.65 | 0.4936 | 0.4936 | |

| 0.02 | 1.65 | 0.4916 | 0.4916 | |

| 0.02 | 1.54 | 0.4602 | 0.4602 | |

| 0.05 | 1.49 | 0.4434 | 0.4434 | |

| 0.00 | 1.31 | 0.3904 | 0.3904 | |

| 0.01 | 1.23 | 0.3682 | 0.3682 | |

| 1.99 | 1.99 | 0.5930 | 0.3662 | |

| 1.99 | 1.99 | 0.5930 | 0.3662 | |

| 1.99 | 1.99 | 0.5930 | 0.3662 | |

| 1.99 | 1.99 | 0.5930 | 0.3662 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 4.48 | 1.3363 | -1.2943 | |

| 0.00 | 1.70 | 0.5081 | -0.6319 | |

| 0.26 | 2.96 | 0.8818 | -0.3963 | |

| 0.05 | 2.46 | 0.7338 | -0.3855 | |

| 0.17 | 1.73 | 0.5172 | -0.3066 | |

| 0.02 | 2.80 | 0.8356 | -0.3020 | |

| 0.10 | 4.37 | 1.3041 | -0.2545 | |

| 0.06 | 1.55 | 0.4632 | -0.2388 | |

| 0.07 | 3.26 | 0.9723 | -0.1735 | |

| 0.03 | 2.16 | 0.6442 | -0.1631 |

13F and Fund Filings

This form was filed on 2025-08-27 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| EWBC / East West Bancorp, Inc. | 0.07 | -1.41 | 6.89 | 10.90 | 2.0554 | 0.1350 | |||

| CASY / Casey's General Stores, Inc. | 0.01 | -1.42 | 6.50 | 15.90 | 1.9381 | 0.2052 | |||

| AXV / AXIS Capital Holdings Limited | 0.06 | -1.42 | 6.02 | 2.10 | 1.7948 | -0.0267 | |||

| GWRE / Guidewire Software, Inc. | 0.03 | -1.41 | 5.96 | 23.89 | 1.7792 | 0.2910 | |||

| WBS / Webster Financial Corporation | 0.10 | -1.42 | 5.56 | 4.41 | 1.6593 | 0.0126 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.02 | -1.41 | 4.87 | -3.24 | 1.4519 | -0.1031 | |||

| RS / Reliance, Inc. | 0.02 | -1.42 | 4.80 | 7.16 | 1.4336 | 0.0474 | |||

| PNFP / Pinnacle Financial Partners, Inc. | 0.04 | -1.42 | 4.80 | 2.63 | 1.4315 | -0.0136 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.02 | -1.41 | 4.55 | -0.68 | 1.3582 | -0.0589 | |||

| KMPR / Kemper Corporation | 0.07 | -1.41 | 4.53 | -4.83 | 1.3513 | -0.1199 | |||

| SMTC / Semtech Corporation | 0.10 | -1.42 | 4.49 | 29.37 | 1.3408 | 0.2668 | |||

| EXE / Expand Energy Corporation | 0.04 | -49.89 | 4.48 | -47.37 | 1.3363 | -1.2943 | |||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.04 | -1.41 | 4.43 | -6.83 | 1.3230 | -0.1485 | |||

| COHR / Coherent Corp. | 0.05 | -1.41 | 4.41 | 35.45 | 1.3155 | 0.3089 | |||

| INSM / Insmed Incorporated | 0.04 | -15.55 | 4.41 | 11.40 | 1.3153 | 0.0918 | |||

| EXLS / ExlService Holdings, Inc. | 0.10 | -6.52 | 4.37 | -13.31 | 1.3041 | -0.2545 | |||

| PR / Permian Resources Corporation | 0.32 | -1.42 | 4.32 | -3.05 | 1.2893 | -0.0888 | |||

| SSB / SouthState Corporation | 0.05 | -1.41 | 4.31 | -2.25 | 1.2857 | -0.0773 | |||

| MTSI / MACOM Technology Solutions Holdings, Inc. | 0.03 | -1.41 | 4.22 | 40.75 | 1.2604 | 0.3323 | |||

| WCC / WESCO International, Inc. | 0.02 | -1.41 | 4.18 | 17.58 | 1.2476 | 0.1479 | |||

| KEX / Kirby Corporation | 0.04 | -1.42 | 4.17 | 10.70 | 1.2437 | 0.0793 | |||

| LECO / Lincoln Electric Holdings, Inc. | 0.02 | -1.42 | 4.08 | 8.05 | 1.2175 | 0.0498 | |||

| SF / Stifel Financial Corp. | 0.04 | -1.42 | 4.07 | 8.54 | 1.2143 | 0.0550 | |||

| ONB / Old National Bancorp | 0.19 | -1.42 | 3.98 | -0.72 | 1.1888 | -0.0520 | |||

| FSS / Federal Signal Corporation | 0.04 | -1.41 | 3.94 | 42.64 | 1.1747 | 0.3213 | |||

| COLB / Columbia Banking System, Inc. | 0.16 | -1.42 | 3.79 | -7.59 | 1.1304 | -0.1371 | |||

| CPT / Camden Property Trust | 0.03 | -1.42 | 3.75 | -9.16 | 1.1186 | -0.1575 | |||

| EHC / Encompass Health Corporation | 0.03 | -12.38 | 3.69 | 6.09 | 1.1014 | 0.0256 | |||

| QTWO / Q2 Holdings, Inc. | 0.04 | -1.42 | 3.67 | 15.30 | 1.0949 | 0.1110 | |||

| TXRH / Texas Roadhouse, Inc. | 0.02 | -10.13 | 3.63 | 1.09 | 1.0829 | -0.0273 | |||

| VRNS / Varonis Systems, Inc. | 0.07 | -1.42 | 3.59 | 23.70 | 1.0715 | 0.1738 | |||

| NBIX / Neurocrine Biosciences, Inc. | 0.03 | -1.41 | 3.30 | 12.07 | 0.9834 | 0.0738 | |||

| SR / Spire Inc. | 0.05 | 0.00 | 3.30 | -6.71 | 0.9832 | -0.1091 | |||

| BRX / Brixmor Property Group Inc. | 0.13 | -1.42 | 3.29 | -3.32 | 0.9830 | -0.0705 | |||

| MTX / Minerals Technologies Inc. | 0.06 | 8.74 | 3.29 | -5.81 | 0.9818 | -0.0982 | |||

| FR / First Industrial Realty Trust, Inc. | 0.07 | -1.42 | 3.26 | -12.09 | 0.9723 | -0.1735 | |||

| CLH / Clean Harbors, Inc. | 0.01 | -1.42 | 3.25 | 15.65 | 0.9700 | 0.1007 | |||

| WSFS / WSFS Financial Corporation | 0.06 | -1.41 | 3.15 | 4.55 | 0.9403 | 0.0082 | |||

| WNS / WNS (Holdings) Limited | 0.05 | -1.41 | 3.13 | 1.39 | 0.9336 | -0.0206 | |||

| ARMK / Aramark | 0.07 | -1.42 | 3.04 | 19.61 | 0.9065 | 0.1209 | |||

| BPMC / Blueprint Medicines Corporation | 0.02 | -31.39 | 2.96 | -0.64 | 0.8819 | -0.0379 | |||

| LBRT / Liberty Energy Inc. | 0.26 | -1.41 | 2.96 | -28.50 | 0.8818 | -0.3963 | |||

| ACA / Arcosa, Inc. | 0.03 | 36.90 | 2.95 | 53.94 | 0.8798 | 0.2875 | |||

| ZWS / Zurn Elkay Water Solutions Corporation | 0.08 | -1.42 | 2.93 | 9.32 | 0.8750 | 0.0456 | |||

| EAT / Brinker International, Inc. | 0.02 | -10.36 | 2.92 | 8.43 | 0.8718 | 0.0388 | |||

| CWST / Casella Waste Systems, Inc. | 0.03 | -1.41 | 2.90 | 2.01 | 0.8646 | -0.0137 | |||

| KRG / Kite Realty Group Trust | 0.13 | -1.41 | 2.89 | -0.17 | 0.8613 | -0.0328 | |||

| DT / Dynatrace, Inc. | 0.05 | -1.41 | 2.87 | 15.43 | 0.8575 | 0.0877 | |||

| SLAB / Silicon Laboratories Inc. | 0.02 | -1.41 | 2.80 | 29.05 | 0.8364 | 0.1648 | |||

| NTRA / Natera, Inc. | 0.02 | -36.29 | 2.80 | -23.89 | 0.8356 | -0.3020 | |||

| EG0 / Essent Group Ltd. | 0.05 | -1.41 | 2.78 | 3.69 | 0.8300 | 0.0008 | |||

| IMAX / IMAX Corporation | 0.10 | -1.42 | 2.71 | 4.64 | 0.8077 | 0.0076 | |||

| TTEK / Tetra Tech, Inc. | 0.08 | -1.41 | 2.71 | 21.18 | 0.8077 | 0.1171 | |||

| BKH / Black Hills Corporation | 0.05 | -1.41 | 2.64 | -8.79 | 0.7865 | -0.1072 | |||

| JLL / Jones Lang LaSalle Incorporated | 0.01 | -1.42 | 2.62 | 1.71 | 0.7803 | -0.0147 | |||

| TMDX / TransMedics Group, Inc. | 0.02 | -1.41 | 2.56 | 96.40 | 0.7641 | 0.3609 | |||

| LGND / Ligand Pharmaceuticals Incorporated | 0.02 | -1.42 | 2.56 | 6.59 | 0.7624 | 0.0212 | |||

| DOC / Healthpeak Properties, Inc. | 0.15 | -1.41 | 2.54 | -14.63 | 0.7576 | -0.1620 | |||

| AIT / Applied Industrial Technologies, Inc. | 0.01 | 64.85 | 2.50 | 70.10 | 0.7451 | 0.2910 | |||

| HALO / Halozyme Therapeutics, Inc. | 0.05 | -16.67 | 2.46 | -32.07 | 0.7338 | -0.3855 | |||

| GGG / Graco Inc. | 0.03 | -1.42 | 2.46 | 1.49 | 0.7338 | -0.0154 | |||

| KBR / KBR, Inc. | 0.05 | -1.42 | 2.45 | -5.12 | 0.7302 | -0.0673 | |||

| BCC / Boise Cascade Company | 0.03 | -1.42 | 2.40 | -12.73 | 0.7161 | -0.1343 | |||

| AXSM / Axsome Therapeutics, Inc. | 0.02 | 44.54 | 2.39 | 29.41 | 0.7117 | 0.1416 | |||

| ABM / ABM Industries Incorporated | 0.05 | -1.42 | 2.34 | -1.76 | 0.6993 | -0.0381 | |||

| WSC / WillScot Holdings Corporation | 0.09 | -1.42 | 2.34 | -2.83 | 0.6975 | -0.0464 | |||

| EXAS / Exact Sciences Corporation | 0.04 | -1.41 | 2.33 | 21.02 | 0.6942 | 0.0998 | |||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.05 | -1.41 | 2.30 | 0.26 | 0.6872 | -0.0230 | |||

| KAI / Kadant Inc. | 0.01 | -1.41 | 2.28 | -7.08 | 0.6812 | -0.0787 | |||

| KALU / Kaiser Aluminum Corporation | 0.03 | 17.63 | 2.25 | 55.04 | 0.6699 | 0.2222 | |||

| GTES / Gates Industrial Corporation plc | 0.10 | 39.66 | 2.24 | 74.69 | 0.6673 | 0.2715 | |||

| RRX / Regal Rexnord Corporation | 0.02 | -1.41 | 2.22 | 25.55 | 0.6613 | 0.1154 | |||

| TOL / Toll Brothers, Inc. | 0.02 | -20.50 | 2.20 | -14.04 | 0.6577 | -0.1354 | |||

| PCOR / Procore Technologies, Inc. | 0.03 | -1.42 | 2.18 | 2.15 | 0.6509 | -0.0093 | |||

| LNTH / Lantheus Holdings, Inc. | 0.03 | -1.42 | 2.16 | -17.31 | 0.6442 | -0.1631 | |||

| RGEN / Repligen Corporation | 0.02 | 17.41 | 2.16 | 14.80 | 0.6438 | 0.0625 | |||

| YETI / YETI Holdings, Inc. | 0.07 | -1.42 | 2.13 | -6.12 | 0.6366 | -0.0661 | |||

| GKOS / Glaukos Corporation | 0.02 | -70.92 | 2.07 | -51.97 | 0.6163 | 0.0056 | |||

| IPG / The Interpublic Group of Companies, Inc. | 0.08 | -1.41 | 2.04 | -11.14 | 0.6091 | -0.1012 | |||

| GTLS / Chart Industries, Inc. | 0.01 | -1.41 | 2.03 | 12.46 | 0.6061 | 0.0475 | |||

| TFDXX / Blackrock Liquidity Funds - BlackRock Liquidity Funds FedFund Portfolio Institutional Class | 1.99 | 170.93 | 1.99 | 171.08 | 0.5930 | 0.3662 | |||

| GSAXX / Goldman Sachs Trust - Goldman Sachs Financial Square Government Fund | 1.99 | 170.93 | 1.99 | 171.08 | 0.5930 | 0.3662 | |||

| FIGXX / Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I | 1.99 | 170.93 | 1.99 | 171.08 | 0.5930 | 0.3662 | |||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 1.99 | 170.93 | 1.99 | 171.08 | 0.5930 | 0.3662 | |||

| HLNE / Hamilton Lane Incorporated | 0.01 | 50.71 | 1.98 | 44.10 | 0.5909 | 0.1659 | |||

| TRNO / Terreno Realty Corporation | 0.03 | -1.41 | 1.95 | -12.57 | 0.5832 | -0.1080 | |||

| BWA / BorgWarner Inc. | 0.06 | -1.41 | 1.95 | 15.20 | 0.5815 | 0.0585 | |||

| TECH / Bio-Techne Corporation | 0.04 | -1.42 | 1.93 | -13.49 | 0.5763 | -0.1140 | |||

| JJSF / J&J Snack Foods Corp. | 0.02 | -1.42 | 1.83 | -15.11 | 0.5465 | -0.1207 | |||

| SUPN / Supernus Pharmaceuticals, Inc. | 0.06 | -1.42 | 1.79 | -5.10 | 0.5326 | -0.0491 | |||

| ULS / UL Solutions Inc. | 0.02 | -1.42 | 1.76 | 27.37 | 0.5250 | 0.0978 | |||

| BOX / Box, Inc. | 0.05 | -1.41 | 1.75 | 9.22 | 0.5231 | 0.0265 | |||

| APG / APi Group Corporation | 0.03 | -1.41 | 1.74 | 40.68 | 0.5183 | 0.1367 | |||

| HUN / Huntsman Corporation | 0.17 | -1.42 | 1.73 | -34.95 | 0.5172 | -0.3066 | |||

| PWR / Quanta Services, Inc. | 0.00 | -35.15 | 1.72 | -3.54 | 0.5124 | -0.0381 | |||

| CSL / Carlisle Companies Incorporated | 0.00 | -57.88 | 1.70 | -53.81 | 0.5081 | -0.6319 | |||

| SNV / Synovus Financial Corp. | 0.03 | 1.65 | 0.4936 | 0.4936 | |||||

| ALAB / Astera Labs, Inc. | 0.02 | 1.65 | 0.4916 | 0.4916 | |||||

| PTC / PTC Inc. | 0.01 | -1.41 | 1.65 | 9.66 | 0.4912 | 0.0270 | |||

| NXST / Nexstar Media Group, Inc. | 0.01 | -1.42 | 1.61 | -4.84 | 0.4814 | -0.0430 | |||

| YELP / Yelp Inc. | 0.05 | -1.42 | 1.59 | -8.76 | 0.4758 | -0.0646 | |||

| SHOO / Steven Madden, Ltd. | 0.06 | -24.05 | 1.55 | -31.63 | 0.4632 | -0.2388 | |||

| SPSC / SPS Commerce, Inc. | 0.01 | -1.42 | 1.55 | 1.11 | 0.4629 | -0.0117 | |||

| TGLS / Tecnoglass Inc. | 0.02 | 1.54 | 0.4602 | 0.4602 | |||||

| LZB / La-Z-Boy Incorporated | 0.04 | -1.42 | 1.52 | -6.25 | 0.4525 | -0.0477 | |||

| XPO / XPO, Inc. | 0.01 | -1.41 | 1.51 | 15.76 | 0.4516 | 0.0472 | |||

| INSP / Inspire Medical Systems, Inc. | 0.01 | -1.42 | 1.51 | -19.73 | 0.4493 | -0.1304 | |||

| TMHC / Taylor Morrison Home Corporation | 0.02 | -1.42 | 1.49 | 0.81 | 0.4451 | -0.0122 | |||

| LTH / Life Time Group Holdings, Inc. | 0.05 | 1.49 | 0.4434 | 0.4434 | |||||

| ASGN / ASGN Incorporated | 0.03 | -1.41 | 1.43 | -21.90 | 0.4280 | -0.1398 | |||

| RBRK / Rubrik, Inc. | 0.02 | -1.42 | 1.38 | 44.82 | 0.4127 | 0.1174 | |||

| CRS / Carpenter Technology Corporation | 0.00 | 1.31 | 0.3904 | 0.3904 | |||||

| WK / Workiva Inc. | 0.02 | -1.41 | 1.27 | -11.10 | 0.3775 | -0.0625 | |||

| SPXC / SPX Technologies, Inc. | 0.01 | 1.23 | 0.3682 | 0.3682 | |||||

| KBH / KB Home | 0.02 | -1.41 | 1.19 | -10.14 | 0.3547 | -0.0544 | |||

| RARE / Ultragenyx Pharmaceutical Inc. | 0.03 | -1.41 | 1.10 | -1.08 | 0.3291 | -0.0154 | |||

| WEN / The Wendy's Company | 0.09 | -1.42 | 1.08 | -23.07 | 0.3216 | -0.1115 | |||

| MBUU / Malibu Boats, Inc. | 0.03 | -1.41 | 1.04 | 0.78 | 0.3091 | -0.0090 | |||

| SAIA / Saia, Inc. | 0.00 | 159.60 | 0.96 | 103.62 | 0.2852 | 0.1400 | |||

| RPD / Rapid7, Inc. | 0.03 | -1.42 | 0.76 | -14.01 | 0.2272 | -0.0465 | |||

| INSW / International Seaways, Inc. | 0.02 | -1.42 | 0.76 | 8.27 | 0.2266 | 0.0098 | |||

| FOLD / Amicus Therapeutics, Inc. | 0.13 | -1.41 | 0.75 | -30.77 | 0.2230 | -0.1108 | |||

| FTAI / FTAI Aviation Ltd. | 0.01 | -1.41 | 0.72 | 2.12 | 0.2156 | -0.0031 | |||

| ATKR / Atkore Inc. | 0.01 | -1.42 | 0.56 | 15.94 | 0.1671 | 0.0177 | |||

| ATI / ATI Inc. | 0.00 | 0.05 | 0.0153 | 0.0153 | |||||

| US68218J3014 / OmniAb, Inc. | 0.01 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| US68218J2024 / OmniAb, Inc. | 0.01 | 0.00 | 0.00 | 0.0000 | 0.0000 |