Basic Stats

| Portfolio Value | $ 6,193,287,740 |

| Current Positions | 42 |

Latest Holdings, Performance, AUM (from 13F, 13D)

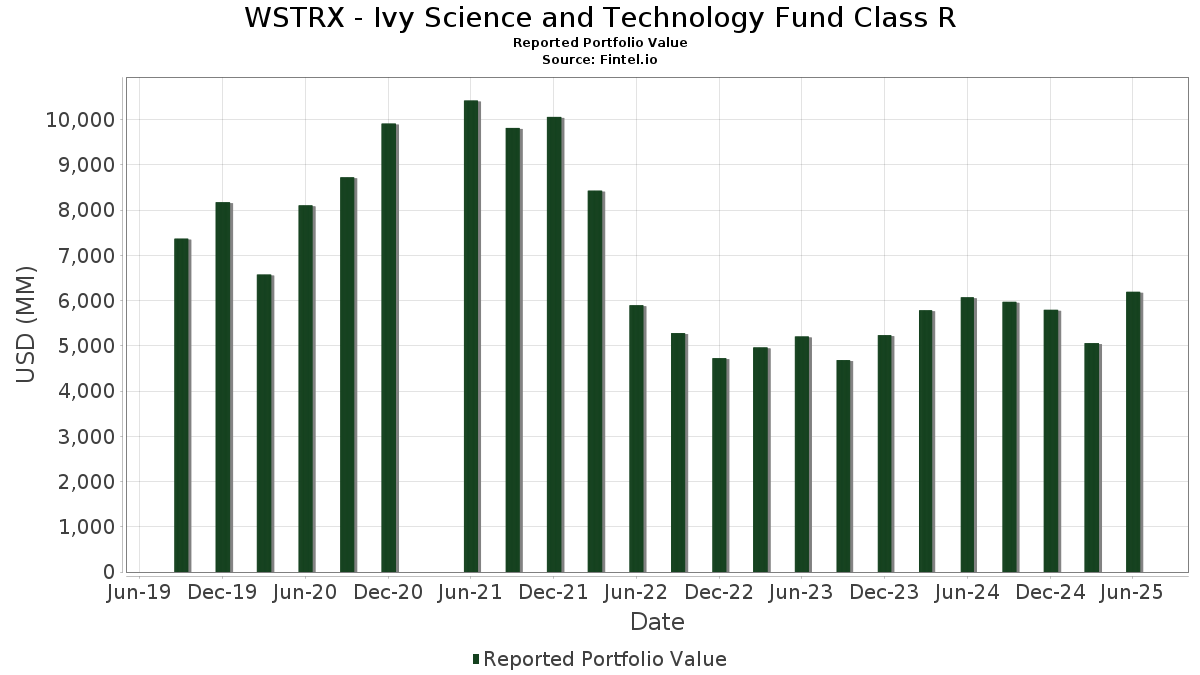

WSTRX - Ivy Science and Technology Fund Class R has disclosed 42 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 6,193,287,740 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). WSTRX - Ivy Science and Technology Fund Class R’s top holdings are NVIDIA Corporation (US:NVDA) , Seagate Technology Holdings plc (US:STX) , Meta Platforms, Inc. (US:META) , Microsoft Corporation (US:MSFT) , and Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) . WSTRX - Ivy Science and Technology Fund Class R’s new positions include Alnylam Pharmaceuticals, Inc. (US:ALNY) , Equinix, Inc. (US:EQIX) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 3.07 | 484.71 | 7.8282 | 2.9884 | |

| 3.35 | 482.80 | 7.7973 | 1.8944 | |

| 0.19 | 61.39 | 0.9915 | 0.9915 | |

| 1.14 | 161.29 | 2.6048 | 0.8962 | |

| 0.26 | 91.16 | 1.4723 | 0.5865 | |

| 1.36 | 307.54 | 4.9667 | 0.5097 | |

| 0.04 | 29.23 | 0.4720 | 0.4720 | |

| 1.11 | 306.20 | 4.9452 | 0.3800 | |

| 0.11 | 152.24 | 2.4587 | 0.3623 | |

| 1.20 | 148.15 | 2.3926 | 0.3273 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.6902 | ||

| 0.71 | 217.17 | 3.5074 | -1.4878 | |

| 1.09 | 239.42 | 3.8666 | -1.2362 | |

| 0.00 | 0.00 | -0.9776 | ||

| 0.00 | 0.00 | -0.9542 | ||

| 0.70 | 346.26 | 5.5921 | -0.7439 | |

| 0.09 | 49.24 | 0.7953 | -0.5784 | |

| 0.63 | 468.25 | 7.5622 | -0.5598 | |

| 1.02 | 50.00 | 0.8074 | -0.3327 | |

| 0.40 | 121.88 | 1.9683 | -0.3039 |

13F and Fund Filings

This form was filed on 2025-08-27 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 3.07 | 35.85 | 484.71 | 98.04 | 7.8282 | 2.9884 | |||

| STX / Seagate Technology Holdings plc | 3.35 | -4.81 | 482.80 | 61.73 | 7.7973 | 1.8944 | |||

| META / Meta Platforms, Inc. | 0.63 | -10.98 | 468.25 | 14.00 | 7.5622 | -0.5598 | |||

| MSFT / Microsoft Corporation | 0.70 | -18.45 | 346.26 | 8.06 | 5.5921 | -0.7439 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 1.36 | 0.00 | 307.54 | 36.44 | 4.9667 | 0.5097 | |||

| AVGO / Broadcom Inc. | 1.11 | -19.44 | 306.20 | 32.63 | 4.9452 | 0.3800 | |||

| AMZN / Amazon.com, Inc. | 1.09 | -19.54 | 239.42 | -7.22 | 3.8666 | -1.2362 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.71 | -24.11 | 217.17 | -14.03 | 3.5074 | -1.4878 | |||

| LRCX / Lam Research Corporation | 1.77 | 0.00 | 171.86 | 33.89 | 2.7756 | 0.2374 | |||

| CDW / CDW Corporation | 0.96 | 17.80 | 171.38 | 31.28 | 2.7677 | 0.1863 | |||

| AMD / Advanced Micro Devices, Inc. | 1.14 | 35.15 | 161.29 | 86.67 | 2.6048 | 0.8962 | |||

| NFLX / Netflix, Inc. | 0.11 | 0.00 | 152.24 | 43.60 | 2.4587 | 0.3623 | |||

| MU / Micron Technology, Inc. | 1.20 | 0.00 | 148.15 | 41.85 | 2.3926 | 0.3273 | |||

| MELI / MercadoLibre, Inc. | 0.06 | -6.70 | 145.92 | 25.00 | 2.3567 | 0.0482 | |||

| UBER / Uber Technologies, Inc. | 1.54 | -11.34 | 144.06 | 13.53 | 2.3266 | -0.1825 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.17 | 0.00 | 135.25 | 20.94 | 2.1842 | -0.0271 | |||

| TTWO / Take-Two Interactive Software, Inc. | 0.56 | 0.00 | 134.96 | 17.18 | 2.1797 | -0.0979 | |||

| INTU / Intuit Inc. | 0.17 | -17.96 | 134.44 | -1.68 | 2.1712 | -0.0816 | |||

| SN / SharkNinja, Inc. | 1.27 | 4.35 | 125.98 | 23.84 | 2.0346 | 0.0230 | |||

| ANET / Arista Networks Inc | 1.22 | 0.00 | 124.68 | 32.05 | 2.0135 | 0.1465 | |||

| HWM / Howmet Aerospace Inc. | 0.67 | 0.00 | 124.23 | 43.48 | 2.0063 | 0.2942 | |||

| CDNS / Cadence Design Systems, Inc. | 0.40 | -12.46 | 121.88 | 6.06 | 1.9683 | -0.3039 | |||

| ZBRA / Zebra Technologies Corporation | 0.37 | 13.03 | 113.25 | 23.35 | 1.8290 | 0.0135 | |||

| DASH / DoorDash, Inc. | 0.46 | 0.00 | 112.95 | 34.87 | 1.8242 | 0.1682 | |||

| SHOP / Shopify Inc. | 0.94 | 0.00 | 108.00 | 20.81 | 1.7442 | -0.0235 | |||

| BSX / Boston Scientific Corporation | 1.00 | 0.00 | 107.69 | 6.47 | 1.7392 | -0.2608 | |||

| DKNG / DraftKings Inc. | 2.38 | 0.00 | 102.23 | 29.15 | 1.6511 | 0.0858 | |||

| COIN / Coinbase Global, Inc. | 0.26 | 0.00 | 91.16 | 103.50 | 1.4723 | 0.5865 | |||

| ISRG / Intuitive Surgical, Inc. | 0.15 | 0.00 | 82.40 | 9.72 | 1.3307 | -0.1543 | |||

| U / Unity Software Inc. | 3.32 | 0.00 | 80.41 | 23.53 | 1.2987 | 0.0115 | |||

| 6B6 / monday.com Ltd. | 0.24 | -17.83 | 76.88 | 6.28 | 1.2417 | -0.1888 | |||

| SNOW / Snowflake Inc. | 0.34 | -23.05 | 76.06 | 17.81 | 1.2284 | -0.0482 | |||

| GTM / ZoomInfo Technologies Inc. | 7.51 | 0.00 | 76.00 | 1.20 | 1.2274 | -0.2576 | |||

| ADI / Analog Devices, Inc. | 0.28 | 0.00 | 67.29 | 18.02 | 1.0868 | -0.0407 | |||

| ALNY / Alnylam Pharmaceuticals, Inc. | 0.19 | 61.39 | 0.9915 | 0.9915 | |||||

| CPRT / Copart, Inc. | 1.02 | 0.00 | 50.00 | -13.29 | 0.8074 | -0.3327 | |||

| HUBS / HubSpot, Inc. | 0.09 | -27.25 | 49.24 | -29.12 | 0.7953 | -0.5784 | |||

| EQIX / Equinix, Inc. | 0.04 | 29.23 | 0.4720 | 0.4720 | |||||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 15.11 | 52.17 | 15.11 | 52.17 | 0.2440 | 0.0477 | |||

| FIGXX / Fidelity Colchester Street Trust - Fidelity Institutional Money Market Funds Government Portfolio Class I | 15.11 | 52.17 | 15.11 | 52.17 | 0.2440 | 0.0477 | |||

| TFDXX / Blackrock Liquidity Funds - BlackRock Liquidity Funds FedFund Portfolio Institutional Class | 15.11 | 52.17 | 15.11 | 52.17 | 0.2440 | 0.0477 | |||

| GSAXX / Goldman Sachs Trust - Goldman Sachs Financial Square Government Fund | 15.11 | 52.17 | 15.11 | 52.17 | 0.2440 | 0.0477 | |||

| GOV / Insulet Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.6902 | ||||

| ONTO / Onto Innovation Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9776 | ||||

| ALAB / Astera Labs, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9542 |