Basic Stats

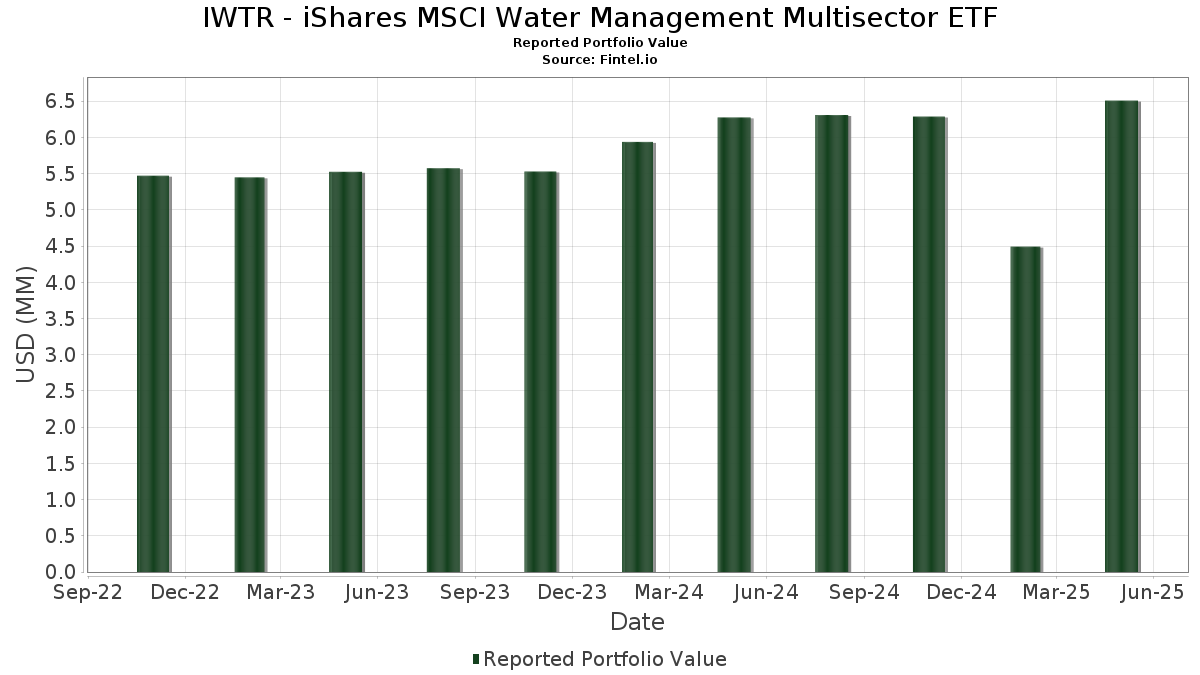

| Portfolio Value | $ 6,508,131 |

| Current Positions | 57 |

Latest Holdings, Performance, AUM (from 13F, 13D)

IWTR - iShares MSCI Water Management Multisector ETF has disclosed 57 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 6,508,131 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). IWTR - iShares MSCI Water Management Multisector ETF’s top holdings are Geberit AG (CH:GEBN) , Xylem Inc. (US:XYL) , Taiwan Semiconductor Manufacturing Company Limited (US:TSMWF) , Core & Main, Inc. (US:CNM) , and Marriott International, Inc. (US:MAR) . IWTR - iShares MSCI Water Management Multisector ETF’s new positions include Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.31 | 0.31 | 4.9096 | 4.8868 | |

| 0.00 | 0.48 | 7.4833 | 1.3626 | |

| 0.02 | 0.33 | 5.1994 | 0.9556 | |

| 0.00 | 0.28 | 4.3113 | 0.7123 | |

| 0.02 | 0.33 | 5.0981 | 0.6098 | |

| 0.00 | 0.32 | 5.0348 | 0.5850 | |

| 0.00 | 0.25 | 3.9182 | 0.5036 | |

| 0.00 | 0.03 | 0.4224 | 0.4224 | |

| 0.00 | 0.15 | 2.3292 | 0.3949 | |

| 0.01 | 0.38 | 5.9258 | 0.3898 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.0998 | ||

| 0.00 | 0.27 | 4.2859 | -1.9038 | |

| 0.02 | 0.30 | 4.6212 | -1.1884 | |

| 0.00 | 0.38 | 5.8876 | -0.7536 | |

| 0.00 | 0.38 | 5.9913 | -0.4635 | |

| 0.03 | 0.12 | 1.9171 | -0.4383 | |

| 0.00 | 0.13 | 1.9966 | -0.2954 | |

| 0.00 | 0.00 | -0.2209 | ||

| 0.01 | 0.38 | 5.9727 | -0.1197 | |

| 0.00 | 0.03 | 0.4563 | -0.0915 |

13F and Fund Filings

This form was filed on 2025-07-25 for the reporting period 2025-05-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GEBN / Geberit AG | 0.00 | 36.89 | 0.48 | 74.18 | 7.4833 | 1.3626 | |||

| XYL / Xylem Inc. | 0.00 | 37.08 | 0.38 | 32.07 | 5.9913 | -0.4635 | |||

| TSMWF / Taiwan Semiconductor Manufacturing Company Limited | 0.01 | 33.33 | 0.38 | 39.42 | 5.9727 | -0.1197 | |||

| CNM / Core & Main, Inc. | 0.01 | 41.68 | 0.38 | 52.21 | 5.9258 | 0.3898 | |||

| MAR / Marriott International, Inc. | 0.00 | 34.02 | 0.38 | 26.09 | 5.8876 | -0.7536 | |||

| ENGI / Engie SA | 0.02 | 44.42 | 0.33 | 74.35 | 5.1994 | 0.9556 | |||

| SBSP3 / Companhia de Saneamento Básico do Estado de São Paulo - SABESP | 0.02 | 26.98 | 0.33 | 61.39 | 5.0981 | 0.6098 | |||

| NXPI / NXP Semiconductors N.V. | 0.00 | 81.51 | 0.32 | 61.00 | 5.0348 | 0.5850 | |||

| US0669225197 / BlackRock Cash Funds: Institutional, SL Agency Shares | 0.31 | 30,461.90 | 0.31 | 31,300.00 | 4.9096 | 4.8868 | |||

| INTC / Intel Corporation | 0.02 | 37.31 | 0.30 | 13.41 | 4.6212 | -1.1884 | |||

| BMI / Badger Meter, Inc. | 0.00 | 44.36 | 0.28 | 70.37 | 4.3113 | 0.7123 | |||

| TXN / Texas Instruments Incorporated | 0.00 | 5.55 | 0.27 | -1.44 | 4.2859 | -1.9038 | |||

| WTS / Watts Water Technologies, Inc. | 0.00 | 44.63 | 0.25 | 64.05 | 3.9182 | 0.5036 | |||

| ZWS / Zurn Elkay Water Solutions Corporation | 0.01 | 45.17 | 0.20 | 48.51 | 3.1147 | 0.1274 | |||

| WIE / Wienerberger AG | 0.00 | 46.85 | 0.16 | 65.26 | 2.4638 | 0.3419 | |||

| KTWIF / Kurita Water Industries Ltd. | 0.00 | 48.15 | 0.15 | 71.26 | 2.3292 | 0.3949 | |||

| MWA / Mueller Water Products, Inc. | 0.01 | 46.34 | 0.15 | 39.42 | 2.2704 | -0.0467 | |||

| FELE / Franklin Electric Co., Inc. | 0.00 | 46.49 | 0.13 | 23.30 | 1.9966 | -0.2954 | |||

| 3711 / ASE Technology Holding Co., Ltd. | 0.03 | 28.57 | 0.12 | 15.09 | 1.9171 | -0.4383 | |||

| EDPFY / EDP - Energias de Portugal, S.A. - Depositary Receipt (Common Stock) | 0.03 | 48.70 | 0.11 | 84.48 | 1.6781 | 0.3826 | |||

| 532830 / Astral Limited | 0.01 | 48.35 | 0.09 | 69.81 | 1.4118 | 0.2288 | |||

| 257 / China Everbright Environment Group Limited | 0.16 | 33.33 | 0.08 | 58.00 | 1.2363 | 0.1075 | |||

| KYDKF / Kyudenko Corporation | 0.00 | 54.55 | 0.06 | 87.88 | 0.9748 | 0.2415 | |||

| ORGJF / Organo Corporation | 0.00 | 37.50 | 0.06 | 56.76 | 0.9176 | 0.0758 | |||

| 0P5 / Genuit Group plc | 0.01 | 33.33 | 0.06 | 61.11 | 0.9104 | 0.1049 | |||

| HUN2 / Beijing Enterprises Water Group Limited | 0.17 | 32.31 | 0.06 | 47.37 | 0.8826 | 0.0385 | |||

| 600900 / China Yangtze Power Co., Ltd. | 0.01 | 54.22 | 0.05 | 70.97 | 0.8365 | 0.1449 | |||

| OEZVY / VERBUND AG - Depositary Receipt (Common Stock) | 0.00 | 56.92 | 0.05 | 64.29 | 0.7328 | 0.0909 | |||

| ACE / Acerinox, S.A. - Depositary Receipt (Common Stock) | 0.00 | 65.45 | 0.04 | 115.79 | 0.6502 | 0.2262 | |||

| 15M1 / Meridian Energy Limited | 0.01 | 66.61 | 0.04 | 69.57 | 0.6092 | 0.0848 | |||

| JMPLF / Johnson Matthey Plc | 0.00 | 66.35 | 0.04 | 117.65 | 0.5782 | 0.1930 | |||

| SAPR11 / Companhia de Saneamento do Paraná - SANEPAR - Debt/Equity Composite Units | 0.01 | 35.69 | 0.04 | 71.43 | 0.5741 | 0.0879 | |||

| TKUMF / Takuma Co., Ltd. | 0.00 | 30.00 | 0.04 | 56.52 | 0.5714 | 0.0505 | |||

| 19 / Swire Pacific Limited | 0.00 | 100.00 | 0.03 | 112.50 | 0.5317 | 0.1633 | |||

| 36T / Genting Singapore Limited | 0.05 | 65.86 | 0.03 | 70.59 | 0.4570 | 0.0592 | |||

| ERII / Energy Recovery, Inc. | 0.00 | 40.55 | 0.03 | 20.83 | 0.4563 | -0.0915 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | 0.03 | 0.4224 | 0.4224 | |||||

| FINOLEXIND / FINOLEX INDUSTRIES LTD. | 0.01 | 72.97 | 0.03 | 136.36 | 0.4187 | 0.1542 | |||

| SA1591410GH0 / ALKHORAYEF WATER & POWER TEC COMMON STOCK | 0.00 | 41.90 | 0.03 | 19.05 | 0.4017 | -0.0754 | |||

| SAPR4 / Companhia de Saneamento do Paraná - SANEPAR - Preferred Stock | 0.02 | 33.33 | 0.03 | 66.67 | 0.3996 | 0.0587 | |||

| XCOP / Companhia Paranaense de Energia - COPEL - Preferred Stock | 0.01 | 86.56 | 0.02 | 155.56 | 0.3647 | 0.1543 | |||

| MRY / Mercury NZ Limited | 0.01 | 76.54 | 0.02 | 91.67 | 0.3609 | 0.0872 | |||

| INE570A01022 / ION Exchange India Ltd | 0.00 | 81.45 | 0.02 | 120.00 | 0.3440 | 0.1013 | |||

| ENIC / Enel Chile S.A. - Depositary Receipt (Common Stock) | 0.27 | 88.64 | 0.02 | 111.11 | 0.3045 | 0.0952 | |||

| IAM / Inversiones Aguas Metropolitanas S.A. | 0.02 | 100.20 | 0.02 | 125.00 | 0.2862 | 0.0963 | |||

| MTWTF / METAWATER Co., Ltd. | 0.00 | 33.33 | 0.02 | 54.55 | 0.2782 | 0.0227 | |||

| 2337 / Macronix International Co., Ltd. | 0.02 | 33.33 | 0.01 | 55.56 | 0.2208 | 0.0002 | |||

| WEL / Welspun Enterprises Ltd | 0.00 | 134.47 | 0.01 | 200.00 | 0.1894 | 0.0963 | |||

| BRAUREACNOR9 / Auren Energia SA | 0.01 | 33.33 | 0.01 | 66.67 | 0.1661 | 0.0304 | |||

| INE689W01016 / Prince Pipes & Fittings Ltd | 0.00 | 190.66 | 0.01 | 350.00 | 0.1541 | 0.0909 | |||

| WHA-R / WHA Corporation Public Company Limited - Depositary Receipt (Common Stock) | 0.09 | 110.87 | 0.01 | 100.00 | 0.1326 | 0.0399 | |||

| MWTCF / Manila Water Company, Inc. | 0.01 | 325.81 | 0.01 | 600.00 | 0.1229 | 0.0874 | |||

| 002460 / Ganfeng Lithium Group Co., Ltd. | 0.00 | 133.33 | 0.01 | 66.67 | 0.0910 | 0.0243 | |||

| VAC / Pierre et Vacances SA | 0.00 | 354.01 | 0.00 | 0.0719 | 0.0504 | ||||

| AMATA-R / Amata Corporation Public Company Limited - Depositary Receipt (Common Stock) | 0.01 | 133.33 | 0.00 | 100.00 | 0.0676 | 0.0033 | |||

| MICRO EURO STOXX JUN25 / DE (000000000) | 0.00 | 0.0183 | 0.0183 | ||||||

| MICRO EMIN RUS2000JUN25 / DE (000000000) | 0.00 | 0.0076 | 0.0076 | ||||||

| 3105 / WIN Semiconductors Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2209 | ||||

| 2303 / United Microelectronics Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -2.0998 |