Basic Stats

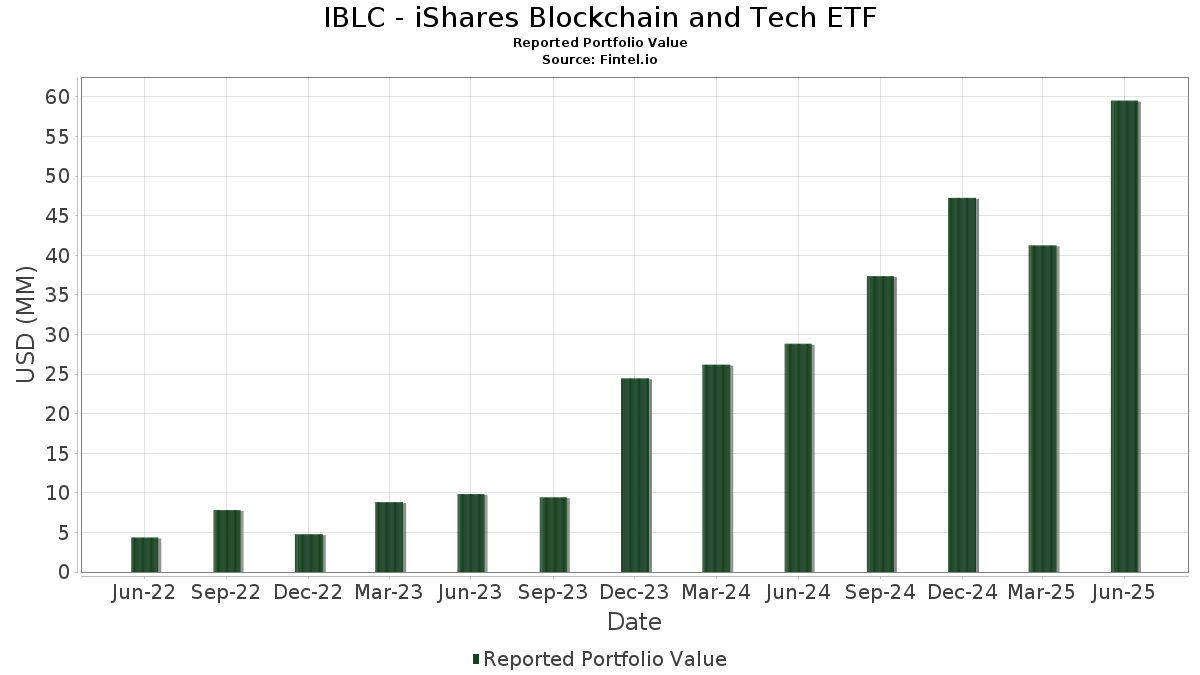

| Portfolio Value | $ 59,537,594 |

| Current Positions | 36 |

Latest Holdings, Performance, AUM (from 13F, 13D)

IBLC - iShares Blockchain and Tech ETF has disclosed 36 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 59,537,594 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). IBLC - iShares Blockchain and Tech ETF’s top holdings are BlackRock Cash Funds: Institutional, SL Agency Shares (US:US0669225197) , Coinbase Global, Inc. (US:COIN) , MARA Holdings, Inc. (US:MARA) , Core Scientific, Inc. (US:CORZ) , and Riot Platforms, Inc. (US:RIOT) . IBLC - iShares Blockchain and Tech ETF’s new positions include Galaxy Digital Inc. (US:GLXY) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.09 | 1.95 | 4.3324 | 4.3324 | |

| 0.02 | 6.69 | 14.8894 | 3.5469 | |

| 0.23 | 3.97 | 8.8269 | 2.5204 | |

| 0.18 | 2.69 | 5.9820 | 1.8287 | |

| 0.01 | 0.61 | 1.3669 | 0.4315 | |

| 0.30 | 4.77 | 10.6072 | 0.3271 | |

| 0.15 | 0.30 | 0.6610 | 0.2593 | |

| 0.20 | 0.97 | 2.1573 | 0.2158 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 14.71 | 14.72 | 32.7331 | -12.5733 | |

| 0.00 | 1.52 | 3.3858 | -1.3994 | |

| 0.02 | 1.57 | 3.4826 | -0.9710 | |

| 0.07 | 0.82 | 1.8191 | -0.8028 | |

| 0.01 | 1.75 | 3.9004 | -0.6383 | |

| 0.01 | 1.78 | 3.9662 | -0.6247 | |

| 0.01 | 0.20 | 0.4549 | -0.5974 | |

| 0.01 | 1.95 | 4.3453 | -0.5437 | |

| 0.01 | 0.64 | 1.4262 | -0.5359 | |

| 0.13 | 1.31 | 2.9084 | -0.3408 |

13F and Fund Filings

This form was filed on 2025-08-26 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US0669225197 / BlackRock Cash Funds: Institutional, SL Agency Shares | 14.71 | 14.36 | 14.72 | 14.35 | 32.7331 | -12.5733 | |||

| COIN / Coinbase Global, Inc. | 0.02 | 2.10 | 6.69 | 107.76 | 14.8894 | 3.5469 | |||

| MARA / MARA Holdings, Inc. | 0.30 | 19.77 | 4.77 | 63.32 | 10.6072 | 0.3271 | |||

| CORZ / Core Scientific, Inc. | 0.23 | -6.04 | 3.97 | 121.55 | 8.8269 | 2.5204 | |||

| RIOT / Riot Platforms, Inc. | 0.30 | -4.50 | 3.38 | 51.57 | 7.5195 | -0.3327 | |||

| CLSK / CleanSpark, Inc. | 0.25 | -6.14 | 2.71 | 54.09 | 6.0335 | -0.1651 | |||

| IREN / IREN Limited | 0.18 | -4.72 | 2.69 | 128.07 | 5.9820 | 1.8287 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 1.85 | 1.95 | 40.71 | 4.3453 | -0.5437 | |||

| GLXY / Galaxy Digital Inc. | 0.09 | 1.95 | 4.3324 | 4.3324 | |||||

| NVDA / NVIDIA Corporation | 0.01 | -6.20 | 1.78 | 36.73 | 3.9662 | -0.6247 | |||

| IBM / International Business Machines Corporation | 0.01 | 14.73 | 1.75 | 36.00 | 3.9004 | -0.6383 | |||

| HUT / Hut 8 Corp. | 0.09 | -6.06 | 1.75 | 50.47 | 3.8856 | -0.2043 | |||

| NNND / Tencent Holdings Limited | 0.02 | 22.73 | 1.57 | 23.72 | 3.4826 | -0.9710 | |||

| MA / Mastercard Incorporated | 0.00 | 9.23 | 1.52 | 11.99 | 3.3858 | -1.3994 | |||

| APLD / Applied Digital Corporation | 0.13 | -20.93 | 1.31 | 41.60 | 2.9084 | -0.3408 | |||

| WULF / TeraWulf Inc. | 0.26 | -5.71 | 1.13 | 51.27 | 2.5143 | -0.1163 | |||

| CIFR / Cipher Mining Inc. | 0.20 | -15.38 | 0.97 | 75.86 | 2.1573 | 0.2158 | |||

| BTDR / Bitdeer Technologies Group | 0.07 | -15.54 | 0.82 | 9.81 | 1.8191 | -0.8028 | |||

| PYPL / PayPal Holdings, Inc. | 0.01 | 1.01 | 0.64 | 15.08 | 1.4262 | -0.5359 | |||

| HOOD / Robinhood Markets, Inc. | 0.01 | 2.80 | 0.61 | 131.70 | 1.3669 | 0.4315 | |||

| BTBT / Bit Digital, Inc. | 0.18 | 26.71 | 0.40 | 37.33 | 0.8923 | -0.1358 | |||

| BITF / Bitfarms Ltd. | 0.42 | 20.06 | 0.35 | 28.00 | 0.7832 | -0.1854 | |||

| XYZ / Block, Inc. | 0.00 | 1.10 | 0.32 | 26.56 | 0.7211 | -0.1818 | |||

| 863 / OSL Group Limited | 0.15 | 50.75 | 0.30 | 160.53 | 0.6610 | 0.2593 | |||

| HIVE / HIVE Digital Technologies Ltd. | 0.16 | 8.74 | 0.29 | 34.72 | 0.6488 | -0.1119 | |||

| CAN / Canaan Inc. - Depositary Receipt (Common Stock) | 0.36 | 39.80 | 0.22 | -1.77 | 0.4950 | -0.3006 | |||

| EXOD / Exodus Movement, Inc. | 0.01 | 8.55 | 0.20 | -31.54 | 0.4549 | -0.5974 | |||

| NB2 / Northern Data AG | 0.01 | 7.35 | 0.14 | 16.13 | 0.3224 | -0.1160 | |||

| CNE1000041R8 / CAMBRICON TECHNO | 0.00 | -5.16 | 0.14 | -7.48 | 0.3026 | -0.2162 | |||

| FOXA / Fox Corporation | 0.00 | 0.00 | 0.11 | -0.94 | 0.2342 | -0.1402 | |||

| 4689 / LY Corporation | 0.02 | 3.49 | 0.09 | 12.99 | 0.1941 | -0.0788 | |||

| ADE / Bitcoin Group SE | 0.00 | -44.86 | 0.09 | -21.62 | 0.1941 | -0.1975 | |||

| PST / Poste Italiane S.p.A. | 0.00 | 0.02 | 0.09 | 19.72 | 0.1912 | -0.0600 | |||

| NCTY / The9 Limited - Depositary Receipt (Common Stock) | 0.01 | 14.59 | 0.08 | -40.31 | 0.1715 | -0.2856 | |||

| US0669224778 / BlackRock Cash Funds: Treasury, SL Agency Shares | 0.03 | 0.00 | 0.03 | 0.00 | 0.0667 | -0.0389 | |||

| NT5 / NTT DATA Group Corporation | 0.00 | -98.00 | 0.00 | -97.78 | 0.0062 | -0.3127 | |||

| VYGVQ / Voyager Digital Ltd. | 0.06 | 0.00 | 0.00 | 0.0000 | -0.0000 |