Basic Stats

| Portfolio Value | $ 414,491,673 |

| Current Positions | 185 |

Latest Holdings, Performance, AUM (from 13F, 13D)

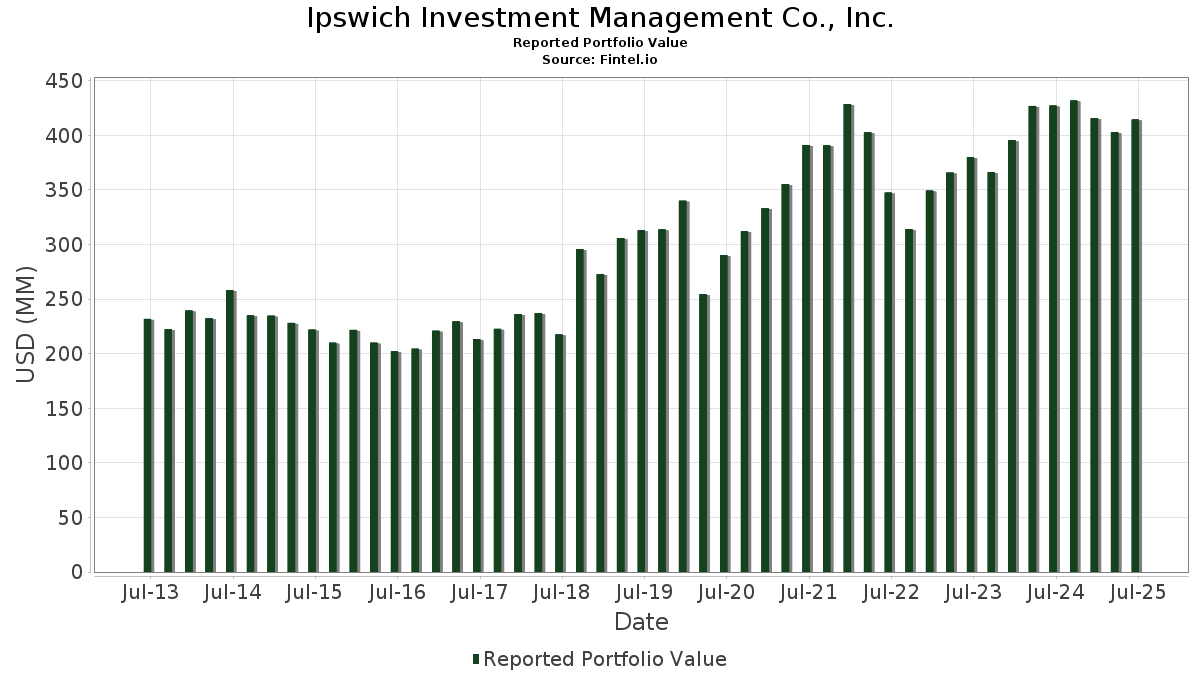

Ipswich Investment Management Co., Inc. has disclosed 185 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 414,491,673 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Ipswich Investment Management Co., Inc.’s top holdings are Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Costco Wholesale Corporation (US:COST) , iShares Trust - iShares Russell 3000 ETF (US:IWV) , and JPMorgan Chase & Co. (US:JPM) . Ipswich Investment Management Co., Inc.’s new positions include Constellation Energy Corporation (US:CEG) , Amphenol Corporation (US:APH) , Fastenal Company (US:FAST) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.06 | 31.51 | 7.6019 | 1.6568 | |

| 0.08 | 12.05 | 2.9073 | 0.8176 | |

| 0.05 | 13.20 | 3.1846 | 0.4532 | |

| 0.01 | 1.82 | 0.4402 | 0.4402 | |

| 0.05 | 3.74 | 0.9032 | 0.3250 | |

| 0.01 | 1.96 | 0.4718 | 0.3046 | |

| 0.01 | 4.49 | 1.0842 | 0.3023 | |

| 0.03 | 6.62 | 1.5964 | 0.3002 | |

| 0.05 | 10.71 | 2.5836 | 0.2686 | |

| 0.06 | 10.83 | 2.6129 | 0.2508 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.09 | 17.90 | 4.3192 | -0.4997 | |

| 0.09 | 9.91 | 2.3904 | -0.4308 | |

| 0.02 | 7.61 | 1.8362 | -0.4181 | |

| 0.00 | 1.77 | 0.4275 | -0.3684 | |

| 0.04 | 7.15 | 1.7244 | -0.3409 | |

| 0.03 | 8.82 | 2.1275 | -0.3191 | |

| 0.03 | 7.06 | 1.7022 | -0.3017 | |

| 0.04 | 5.65 | 1.3620 | -0.2897 | |

| 0.00 | 4.79 | 1.1558 | -0.2400 | |

| 0.01 | 2.18 | 0.5257 | -0.2264 |

13F and Fund Filings

This form was filed on 2025-07-16 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.06 | -0.73 | 31.51 | 31.53 | 7.6019 | 1.6568 | |||

| AAPL / Apple Inc. | 0.09 | -0.18 | 17.90 | -7.81 | 4.3192 | -0.4997 | |||

| COST / Costco Wholesale Corporation | 0.01 | -0.58 | 14.53 | 4.06 | 3.5043 | 0.0403 | |||

| IWV / iShares Trust - iShares Russell 3000 ETF | 0.04 | -0.72 | 13.30 | 9.70 | 3.2082 | 0.2000 | |||

| JPM / JPMorgan Chase & Co. | 0.05 | 1.48 | 13.20 | 19.93 | 3.1846 | 0.4532 | |||

| NVDA / NVIDIA Corporation | 0.08 | -1.83 | 12.05 | 43.11 | 2.9073 | 0.8176 | |||

| GOOGL / Alphabet Inc. | 0.06 | -0.15 | 10.83 | 13.78 | 2.6129 | 0.2508 | |||

| AMZN / Amazon.com, Inc. | 0.05 | -0.44 | 10.71 | 14.79 | 2.5836 | 0.2686 | |||

| V / Visa Inc. | 0.03 | 0.01 | 9.92 | 1.32 | 2.3922 | -0.0364 | |||

| XOM / Exxon Mobil Corporation | 0.09 | -3.84 | 9.91 | -12.84 | 2.3904 | -0.4308 | |||

| PGR / The Progressive Corporation | 0.03 | -5.14 | 8.82 | -10.55 | 2.1275 | -0.3191 | |||

| TXN / Texas Instruments Incorporated | 0.04 | -4.19 | 7.83 | 10.70 | 1.8896 | 0.1337 | |||

| WSO / Watsco, Inc. | 0.02 | -3.56 | 7.61 | -16.22 | 1.8362 | -0.4181 | |||

| PG / The Procter & Gamble Company | 0.04 | -8.13 | 7.15 | -14.11 | 1.7244 | -0.3409 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.03 | -2.48 | 7.06 | -12.63 | 1.7022 | -0.3017 | |||

| ACN / Accenture plc | 0.02 | -3.49 | 6.66 | -7.55 | 1.6061 | -0.1811 | |||

| PANW / Palo Alto Networks, Inc. | 0.03 | 5.64 | 6.62 | 26.69 | 1.5964 | 0.3002 | |||

| CAT / Caterpillar Inc. | 0.02 | -1.25 | 6.61 | 16.25 | 1.5952 | 0.1836 | |||

| LIN / Linde plc | 0.01 | -0.02 | 6.18 | 0.73 | 1.4900 | -0.0315 | |||

| TJX / The TJX Companies, Inc. | 0.05 | 0.07 | 6.06 | 1.46 | 1.4615 | -0.0202 | |||

| JNJ / Johnson & Johnson | 0.04 | -2.88 | 5.92 | -10.54 | 1.4290 | -0.2142 | |||

| CVX / Chevron Corporation | 0.04 | -0.90 | 5.65 | -15.18 | 1.3620 | -0.2897 | |||

| OKE / ONEOK, Inc. | 0.07 | 8.96 | 5.42 | -10.36 | 1.3066 | -0.1927 | |||

| CB / Chubb Limited | 0.02 | 0.06 | 5.19 | -4.01 | 1.2531 | -0.0897 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.08 | 4.44 | 5.18 | 3.81 | 1.2491 | 0.0113 | |||

| OTIS / Otis Worldwide Corporation | 0.05 | -0.33 | 4.88 | -4.37 | 1.1774 | -0.0891 | |||

| TPL / Texas Pacific Land Corporation | 0.00 | 6.83 | 4.79 | -14.83 | 1.1558 | -0.2400 | |||

| AMGN / Amgen Inc. | 0.02 | -0.22 | 4.62 | -10.58 | 1.1134 | -0.1674 | |||

| LLY / Eli Lilly and Company | 0.01 | 51.11 | 4.49 | 42.63 | 1.0842 | 0.3023 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.01 | 3.24 | 4.49 | 24.86 | 1.0833 | 0.1909 | |||

| IBM / International Business Machines Corporation | 0.01 | -6.76 | 3.99 | 10.54 | 0.9617 | 0.0668 | |||

| MRK / Merck & Co., Inc. | 0.05 | -3.08 | 3.75 | -14.53 | 0.9055 | -0.1842 | |||

| CCJ / Cameco Corporation | 0.05 | -10.91 | 3.74 | 60.64 | 0.9032 | 0.3250 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.01 | -0.04 | 3.43 | 10.48 | 0.8269 | 0.0569 | |||

| BIPC / Brookfield Infrastructure Corporation | 0.08 | -7.31 | 3.40 | 6.56 | 0.8195 | 0.0284 | |||

| HON / Honeywell International Inc. | 0.01 | -9.40 | 3.28 | -0.33 | 0.7906 | -0.0256 | |||

| KO / The Coca-Cola Company | 0.04 | -0.69 | 2.92 | -1.88 | 0.7038 | -0.0341 | |||

| PEP / PepsiCo, Inc. | 0.02 | -8.94 | 2.86 | -19.83 | 0.6909 | -0.1954 | |||

| GOOG / Alphabet Inc. | 0.02 | -1.59 | 2.75 | 11.75 | 0.6634 | 0.0527 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | 1.63 | 2.50 | -6.69 | 0.6023 | -0.0616 | |||

| EMR / Emerson Electric Co. | 0.02 | -14.37 | 2.43 | 4.15 | 0.5870 | 0.0072 | |||

| GE / General Electric Company | 0.01 | 0.00 | 2.21 | 28.65 | 0.5330 | 0.1067 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.02 | -6.86 | 2.19 | 1.11 | 0.5292 | -0.0092 | |||

| ABBV / AbbVie Inc. | 0.01 | -18.84 | 2.18 | -28.12 | 0.5257 | -0.2264 | |||

| DUK / Duke Energy Corporation | 0.02 | 0.00 | 2.12 | -3.24 | 0.5121 | -0.0324 | |||

| CCOI / Cogent Communications Holdings, Inc. | 0.04 | 2.69 | 2.12 | -19.27 | 0.5105 | -0.1398 | |||

| RTX / RTX Corporation | 0.01 | -5.19 | 1.97 | 4.50 | 0.4765 | 0.0075 | |||

| LEU / Centrus Energy Corp. | 0.01 | -1.43 | 1.96 | 190.49 | 0.4718 | 0.3046 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | -0.76 | 1.92 | 0.16 | 0.4638 | -0.0125 | |||

| MCD / McDonald's Corporation | 0.01 | 0.00 | 1.90 | -6.45 | 0.4585 | -0.0457 | |||

| ABT / Abbott Laboratories | 0.01 | -13.03 | 1.90 | -10.81 | 0.4579 | -0.0703 | |||

| SSD / Simpson Manufacturing Co., Inc. | 0.01 | -19.98 | 1.86 | -20.90 | 0.4495 | -0.1349 | |||

| CMI / Cummins Inc. | 0.01 | -3.61 | 1.83 | 0.71 | 0.4426 | -0.0095 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.01 | 1.82 | 0.4402 | 0.4402 | |||||

| FICO / Fair Isaac Corporation | 0.00 | 0.00 | 1.80 | -0.88 | 0.4353 | -0.0164 | |||

| UNP / Union Pacific Corporation | 0.01 | -27.75 | 1.78 | -29.66 | 0.4304 | -0.1988 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -32.20 | 1.77 | -44.78 | 0.4275 | -0.3684 | |||

| CAC / Camden National Corporation | 0.04 | -0.82 | 1.75 | -0.57 | 0.4216 | -0.0145 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.00 | 1.65 | 17.68 | 0.3983 | 0.0500 | |||

| BNS / The Bank of Nova Scotia | 0.03 | 11.15 | 1.60 | 29.52 | 0.3854 | 0.0793 | |||

| ORCL / Oracle Corporation | 0.01 | 0.00 | 1.57 | 56.46 | 0.3798 | 0.1300 | |||

| HD / The Home Depot, Inc. | 0.00 | -0.12 | 1.51 | -0.07 | 0.3636 | -0.0107 | |||

| SO / The Southern Company | 0.02 | 0.00 | 1.51 | -0.13 | 0.3634 | -0.0109 | |||

| LB / LandBridge Company LLC | 0.02 | 19.67 | 1.50 | 12.41 | 0.3630 | 0.0309 | |||

| CCEP / Coca-Cola Europacific Partners PLC | 0.02 | -1.14 | 1.40 | 5.33 | 0.3383 | 0.0079 | |||

| AMAT / Applied Materials, Inc. | 0.01 | 0.00 | 1.39 | 26.13 | 0.3355 | 0.0619 | |||

| MMM / 3M Company | 0.01 | -33.09 | 1.39 | -30.65 | 0.3343 | -0.1614 | |||

| EQNR / Equinor ASA - Depositary Receipt (Common Stock) | 0.05 | -11.31 | 1.38 | -15.70 | 0.3330 | -0.0733 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.02 | -9.08 | 1.37 | -12.66 | 0.3297 | -0.0585 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0.02 | -4.36 | 1.35 | -9.24 | 0.3248 | -0.0433 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 3.18 | 1.34 | 6.95 | 0.3229 | 0.0124 | |||

| MKC / McCormick & Company, Incorporated | 0.02 | -1.72 | 1.30 | -9.46 | 0.3140 | -0.0428 | |||

| AXP / American Express Company | 0.00 | -1.34 | 1.29 | 17.00 | 0.3106 | 0.0374 | |||

| T / AT&T Inc. | 0.04 | 0.00 | 1.23 | 2.34 | 0.2957 | -0.0015 | |||

| MO / Altria Group, Inc. | 0.02 | 0.00 | 1.22 | -2.32 | 0.2949 | -0.0156 | |||

| CRSP / CRISPR Therapeutics AG | 0.02 | 1.73 | 1.21 | 45.39 | 0.2930 | 0.0857 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.01 | 1,400.00 | 1.20 | -5.57 | 0.2903 | -0.0261 | |||

| DHR / Danaher Corporation | 0.01 | 0.13 | 1.19 | -3.48 | 0.2877 | -0.0190 | |||

| BTI / British American Tobacco p.l.c. - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 1.18 | 14.41 | 0.2855 | 0.0288 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.00 | 1.14 | 73.32 | 0.2745 | 0.1116 | |||

| CRM / Salesforce, Inc. | 0.00 | 12.76 | 1.14 | 14.62 | 0.2743 | 0.0281 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.00 | 1.12 | 64.85 | 0.2705 | 0.1015 | |||

| PFF / iShares Trust - iShares Preferred and Income Securities ETF | 0.03 | -9.37 | 1.04 | -9.58 | 0.2507 | -0.0343 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.01 | 0.34 | 1.03 | 4.87 | 0.2494 | 0.0048 | |||

| CCI / Crown Castle Inc. | 0.01 | 5.91 | 0.98 | 4.46 | 0.2375 | 0.0035 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | -5.26 | 0.97 | -9.38 | 0.2331 | -0.0315 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | -4.07 | 0.96 | -4.38 | 0.2317 | -0.0175 | |||

| CI / The Cigna Group | 0.00 | 0.00 | 0.95 | 0.42 | 0.2284 | -0.0054 | |||

| ROST / Ross Stores, Inc. | 0.01 | 0.00 | 0.94 | -0.21 | 0.2280 | -0.0069 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.02 | -0.23 | 0.93 | 6.14 | 0.2253 | 0.0068 | |||

| CL / Colgate-Palmolive Company | 0.01 | -10.89 | 0.93 | -13.61 | 0.2238 | -0.0425 | |||

| STE / STERIS plc | 0.00 | 106.16 | 0.90 | 118.73 | 0.2171 | 0.1149 | |||

| PM / Philip Morris International Inc. | 0.00 | -40.37 | 0.89 | -31.61 | 0.2142 | -0.1078 | |||

| TGT / Target Corporation | 0.01 | -2.36 | 0.87 | -7.73 | 0.2103 | -0.0241 | |||

| SYY / Sysco Corporation | 0.01 | 0.00 | 0.87 | 0.93 | 0.2102 | -0.0040 | |||

| MAR / Marriott International, Inc. | 0.00 | 0.00 | 0.85 | 14.65 | 0.2040 | 0.0211 | |||

| NEM / Newmont Corporation | 0.01 | -0.70 | 0.83 | 19.91 | 0.1992 | 0.0282 | |||

| NEE / NextEra Energy, Inc. | 0.01 | -3.68 | 0.80 | -5.67 | 0.1927 | -0.0175 | |||

| EG / Everest Group, Ltd. | 0.00 | 0.00 | 0.80 | -6.45 | 0.1927 | -0.0192 | |||

| ADBE / Adobe Inc. | 0.00 | -15.01 | 0.78 | -14.25 | 0.1887 | -0.0377 | |||

| AFL / Aflac Incorporated | 0.01 | -0.67 | 0.78 | -5.71 | 0.1873 | -0.0172 | |||

| BMY / Bristol-Myers Squibb Company | 0.02 | 0.00 | 0.77 | -24.14 | 0.1866 | -0.0663 | |||

| DIS / The Walt Disney Company | 0.01 | -6.23 | 0.75 | 17.85 | 0.1801 | 0.0229 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.73 | 28.02 | 0.1765 | 0.0347 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.00 | 0.00 | 0.73 | 52.52 | 0.1752 | 0.0570 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.02 | 0.00 | 0.72 | -9.13 | 0.1730 | -0.0229 | |||

| MA / Mastercard Incorporated | 0.00 | -40.37 | 0.71 | -38.88 | 0.1712 | -0.1169 | |||

| SHW / The Sherwin-Williams Company | 0.00 | -1.22 | 0.70 | -2.79 | 0.1680 | -0.0099 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | -26.16 | 0.69 | 1.93 | 0.1654 | -0.0014 | |||

| LHX / L3Harris Technologies, Inc. | 0.00 | -42.08 | 0.68 | -30.60 | 0.1633 | -0.0787 | |||

| VZ / Verizon Communications Inc. | 0.02 | 0.00 | 0.67 | -4.57 | 0.1613 | -0.0126 | |||

| SYK / Stryker Corporation | 0.00 | 0.00 | 0.64 | 6.27 | 0.1556 | 0.0050 | |||

| DD / DuPont de Nemours, Inc. | 0.01 | 0.00 | 0.64 | -8.19 | 0.1542 | -0.0185 | |||

| CHD / Church & Dwight Co., Inc. | 0.01 | -1.34 | 0.64 | -13.90 | 0.1542 | -0.0299 | |||

| VRSN / VeriSign, Inc. | 0.00 | 0.00 | 0.64 | 13.73 | 0.1540 | 0.0147 | |||

| BMO / Bank of Montreal | 0.01 | 0.00 | 0.62 | 15.89 | 0.1497 | 0.0168 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 0.00 | 0.57 | 9.63 | 0.1374 | 0.0086 | |||

| HSY / The Hershey Company | 0.00 | 0.00 | 0.54 | -2.88 | 0.1301 | -0.0078 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | -46.06 | 0.54 | -44.10 | 0.1292 | -0.1084 | |||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.00 | 20.10 | 0.53 | 26.25 | 0.1277 | 0.0235 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | 0.00 | 0.52 | -0.96 | 0.1248 | -0.0049 | |||

| DE / Deere & Company | 0.00 | 0.00 | 0.46 | 8.41 | 0.1120 | 0.0057 | |||

| RPM / RPM International Inc. | 0.00 | -2.35 | 0.46 | -7.33 | 0.1100 | -0.0120 | |||

| ED / Consolidated Edison, Inc. | 0.00 | 0.00 | 0.45 | -9.20 | 0.1096 | -0.0146 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.45 | -8.74 | 0.1084 | -0.0139 | |||

| COP / ConocoPhillips | 0.00 | -1.39 | 0.45 | -15.72 | 0.1074 | -0.0237 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.00 | 0.43 | -4.82 | 0.1048 | -0.0085 | |||

| VLTO / Veralto Corporation | 0.00 | 2.00 | 0.43 | 5.88 | 0.1042 | 0.0028 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | -16.63 | 0.43 | -17.12 | 0.1041 | -0.0251 | |||

| MU / Micron Technology, Inc. | 0.00 | 0.00 | 0.41 | 42.01 | 0.0989 | 0.0272 | |||

| ICE / Intercontinental Exchange, Inc. | 0.00 | 2.35 | 0.40 | 8.72 | 0.0964 | 0.0053 | |||

| CPRT / Copart, Inc. | 0.01 | 0.00 | 0.39 | -13.27 | 0.0946 | -0.0176 | |||

| GLW / Corning Incorporated | 0.01 | 0.00 | 0.39 | 15.00 | 0.0944 | 0.0099 | |||

| MS / Morgan Stanley | 0.00 | -2.77 | 0.39 | 17.47 | 0.0943 | 0.0117 | |||

| JKHY / Jack Henry & Associates, Inc. | 0.00 | 0.00 | 0.38 | -1.31 | 0.0909 | -0.0039 | |||

| INTC / Intel Corporation | 0.02 | -3.79 | 0.36 | -5.22 | 0.0877 | -0.0074 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.00 | -1.68 | 0.36 | -1.39 | 0.0859 | -0.0038 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.00 | 0.00 | 0.35 | 9.38 | 0.0846 | 0.0050 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.01 | 0.00 | 0.35 | 11.94 | 0.0837 | 0.0067 | |||

| CTVA / Corteva, Inc. | 0.00 | 0.00 | 0.35 | 18.49 | 0.0836 | 0.0110 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.01 | 10.61 | 0.34 | 9.90 | 0.0830 | 0.0051 | |||

| FTNT / Fortinet, Inc. | 0.00 | 0.00 | 0.34 | 9.77 | 0.0814 | 0.0052 | |||

| PFE / Pfizer Inc. | 0.01 | 0.00 | 0.33 | -4.35 | 0.0798 | -0.0060 | |||

| WFC / Wells Fargo & Company | 0.00 | 0.00 | 0.33 | 11.56 | 0.0793 | 0.0062 | |||

| GIS / General Mills, Inc. | 0.01 | -9.56 | 0.33 | -21.63 | 0.0787 | -0.0246 | |||

| SLB / Schlumberger Limited | 0.01 | -1.64 | 0.32 | -20.39 | 0.0782 | -0.0229 | |||

| PWR / Quanta Services, Inc. | 0.00 | 0.00 | 0.32 | 49.07 | 0.0770 | 0.0237 | |||

| SBUX / Starbucks Corporation | 0.00 | 0.00 | 0.32 | -6.47 | 0.0768 | -0.0078 | |||

| LRCX / Lam Research Corporation | 0.00 | 0.00 | 0.32 | 33.90 | 0.0763 | 0.0177 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.00 | 0.00 | 0.31 | 5.42 | 0.0751 | 0.0019 | |||

| LH / Labcorp Holdings Inc. | 0.00 | -6.15 | 0.30 | 6.01 | 0.0725 | 0.0021 | |||

| GXO / GXO Logistics, Inc. | 0.01 | -14.85 | 0.30 | 6.41 | 0.0722 | 0.0022 | |||

| WM / Waste Management, Inc. | 0.00 | 0.00 | 0.30 | -1.00 | 0.0718 | -0.0029 | |||

| AGM / Federal Agricultural Mortgage Corporation | 0.00 | 0.00 | 0.30 | 3.51 | 0.0712 | 0.0005 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | 0.00 | 0.29 | 27.68 | 0.0692 | 0.0135 | |||

| PSX / Phillips 66 | 0.00 | 0.00 | 0.29 | -3.38 | 0.0691 | -0.0045 | |||

| WAT / Waters Corporation | 0.00 | -3.01 | 0.28 | -8.20 | 0.0678 | -0.0081 | |||

| ZTS / Zoetis Inc. | 0.00 | 0.00 | 0.28 | -5.44 | 0.0673 | -0.0058 | |||

| MPC / Marathon Petroleum Corporation | 0.00 | 0.00 | 0.27 | 13.98 | 0.0651 | 0.0064 | |||

| MEDP / Medpace Holdings, Inc. | 0.00 | 0.00 | 0.27 | 3.08 | 0.0647 | 0.0001 | |||

| CME / CME Group Inc. | 0.00 | 0.00 | 0.26 | 3.57 | 0.0632 | 0.0006 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 0.25 | 10.48 | 0.0613 | 0.0042 | |||

| EFX / Equifax Inc. | 0.00 | 0.00 | 0.25 | 6.84 | 0.0603 | 0.0021 | |||

| MRNA / Moderna, Inc. | 0.01 | 0.25 | 0.0601 | 0.0601 | |||||

| UPS / United Parcel Service, Inc. | 0.00 | 0.00 | 0.24 | -8.27 | 0.0591 | -0.0071 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.00 | 0.00 | 0.24 | -8.02 | 0.0582 | -0.0070 | |||

| DOV / Dover Corporation | 0.00 | 0.00 | 0.24 | 3.98 | 0.0569 | 0.0008 | |||

| SAIA / Saia, Inc. | 0.00 | 0.00 | 0.22 | -21.68 | 0.0542 | -0.0169 | |||

| TTC / The Toro Company | 0.00 | 0.00 | 0.22 | -2.61 | 0.0541 | -0.0032 | |||

| FI / Fiserv, Inc. | 0.00 | 0.00 | 0.22 | -21.91 | 0.0535 | -0.0170 | |||

| CEG / Constellation Energy Corporation | 0.00 | 0.22 | 0.0532 | 0.0532 | |||||

| DKNG / DraftKings Inc. | 0.01 | 0.22 | 0.0528 | 0.0528 | |||||

| MCO / Moody's Corporation | 0.00 | 0.00 | 0.22 | 7.92 | 0.0526 | 0.0024 | |||

| APH / Amphenol Corporation | 0.00 | 0.22 | 0.0524 | 0.0524 | |||||

| MKC.V / McCormick & Company, Incorporated | 0.00 | 0.00 | 0.21 | -8.15 | 0.0518 | -0.0061 | |||

| AKAM / Akamai Technologies, Inc. | 0.00 | -12.49 | 0.21 | -13.47 | 0.0514 | -0.0096 | |||

| IGSB / iShares Trust - iShares 1-5 Year Investment Grade Corporate Bond ETF | 0.00 | 0.00 | 0.21 | 0.96 | 0.0509 | -0.0011 | |||

| CVS / CVS Health Corporation | 0.00 | 0.00 | 0.21 | 1.95 | 0.0506 | -0.0005 | |||

| FAST / Fastenal Company | 0.00 | 0.21 | 0.0505 | 0.0505 | |||||

| CFG / Citizens Financial Group, Inc. | 0.00 | 0.21 | 0.0499 | 0.0499 | |||||

| WRB / W. R. Berkley Corporation | 0.00 | -2.78 | 0.21 | 0.49 | 0.0496 | -0.0012 | |||

| EL / The Estée Lauder Companies Inc. | 0.00 | 0.20 | 0.0492 | 0.0492 | |||||

| BAC / Bank of America Corporation | 0.00 | 0.20 | 0.0485 | 0.0485 | |||||

| RIG / Transocean Ltd. | 0.01 | 0.00 | 0.04 | -17.78 | 0.0091 | -0.0023 | |||

| FURY / Fury Gold Mines Limited | 0.01 | 0.00 | 0.01 | 25.00 | 0.0013 | 0.0002 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DOW / Dow Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BRO / Brown & Brown, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BAX / Baxter International Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NKE / NIKE, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LULU / lululemon athletica inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EXPD / Expeditors International of Washington, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EW / Edwards Lifesciences Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ARCC / Ares Capital Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KMB / Kimberly-Clark Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |