Basic Stats

| Portfolio Value | $ 2,472,476,471 |

| Current Positions | 295 |

Latest Holdings, Performance, AUM (from 13F, 13D)

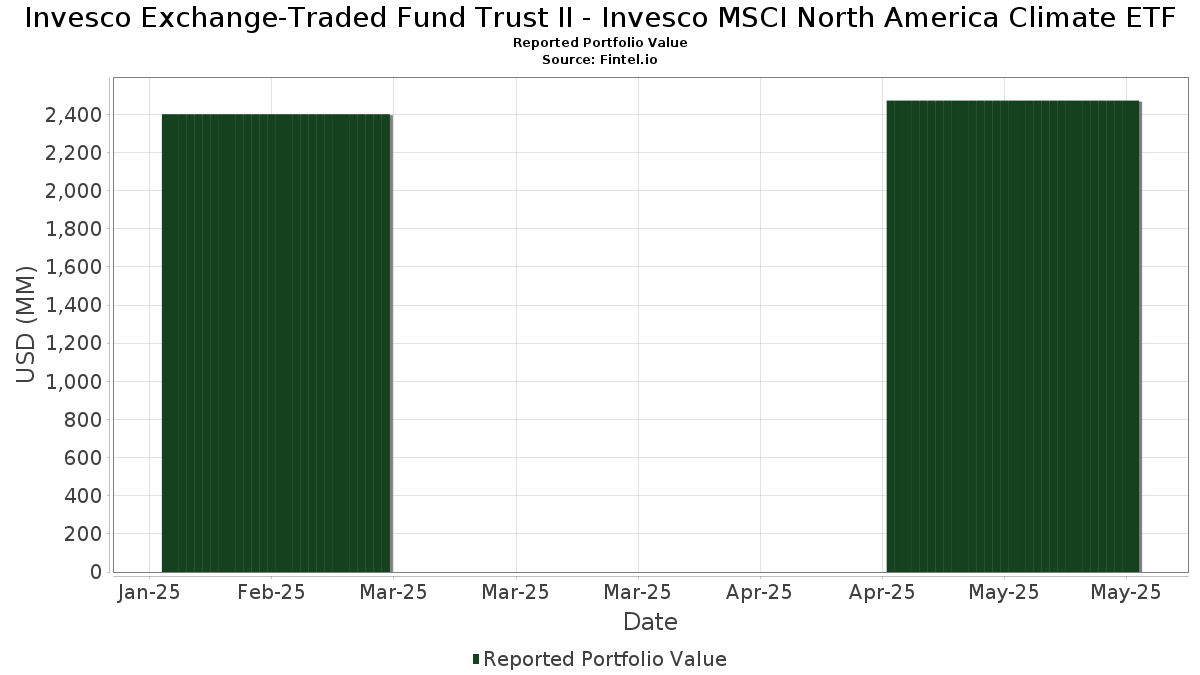

Invesco Exchange-Traded Fund Trust II - Invesco MSCI North America Climate ETF has disclosed 295 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 2,472,476,471 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Invesco Exchange-Traded Fund Trust II - Invesco MSCI North America Climate ETF’s top holdings are NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Meta Platforms, Inc. (US:META) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.32 | 147.63 | 5.9922 | 0.8579 | |

| 1.10 | 149.20 | 6.0560 | 0.4904 | |

| 0.20 | 49.06 | 1.9912 | 0.3601 | |

| 0.13 | 45.39 | 1.8425 | 0.2947 | |

| 6.74 | 6.74 | 0.2734 | 0.2734 | |

| 0.10 | 13.27 | 0.5388 | 0.1941 | |

| 0.02 | 24.62 | 0.9994 | 0.1926 | |

| 0.04 | 8.23 | 0.3340 | 0.1374 | |

| 2.57 | 2.57 | 0.1043 | 0.1043 | |

| 0.06 | 13.61 | 0.5524 | 0.0914 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.69 | 138.11 | 5.6061 | -1.1016 | |

| 0.04 | 12.83 | 0.5207 | -0.2924 | |

| 0.04 | 27.36 | 1.1107 | -0.2649 | |

| 0.00 | 0.00 | -0.1470 | ||

| 0.43 | 87.40 | 3.5476 | -0.1042 | |

| 0.02 | 8.42 | 0.3420 | -0.1031 | |

| 0.03 | 5.09 | 0.2067 | -0.0917 | |

| 0.07 | 5.47 | 0.2222 | -0.0806 | |

| 0.13 | 10.24 | 0.4158 | -0.0791 | |

| 0.09 | 16.20 | 0.6575 | -0.0768 |

13F and Fund Filings

This form was filed on 2025-07-29 for the reporting period 2025-05-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 1.10 | 4.57 | 149.20 | 13.12 | 6.0560 | 0.4904 | |||

| MSFT / Microsoft Corporation | 0.32 | 4.63 | 147.63 | 21.33 | 5.9922 | 0.8579 | |||

| AAPL / Apple Inc. | 0.69 | 4.62 | 138.11 | -13.11 | 5.6061 | -1.1016 | |||

| AMZN / Amazon.com, Inc. | 0.43 | 4.58 | 87.40 | 0.99 | 3.5476 | -0.1042 | |||

| META / Meta Platforms, Inc. | 0.10 | 4.66 | 64.70 | 1.42 | 2.6262 | -0.0658 | |||

| GOOGL / Alphabet Inc. | 0.31 | 4.62 | 54.06 | 5.51 | 2.1942 | 0.0323 | |||

| AVGO / Broadcom Inc. | 0.20 | 4.56 | 49.06 | 26.91 | 1.9912 | 0.3601 | |||

| TSLA / Tesla, Inc. | 0.13 | 4.65 | 45.39 | 23.75 | 1.8425 | 0.2947 | |||

| JPM / JPMorgan Chase & Co. | 0.13 | 4.37 | 34.79 | 4.12 | 1.4120 | 0.0021 | |||

| GOOG / Alphabet Inc. | 0.18 | 4.69 | 31.53 | 5.07 | 1.2798 | 0.0135 | |||

| V / Visa Inc. | 0.08 | 4.68 | 29.81 | 5.39 | 1.2100 | 0.0164 | |||

| LLY / Eli Lilly and Company | 0.04 | 4.76 | 27.36 | -16.06 | 1.1107 | -0.2649 | |||

| NFLX / Netflix, Inc. | 0.02 | 4.60 | 24.62 | 28.78 | 0.9994 | 0.1926 | |||

| MA / Mastercard Incorporated | 0.04 | 4.44 | 23.78 | 6.12 | 0.9651 | 0.0196 | |||

| XOM / Exxon Mobil Corporation | 0.21 | 4.83 | 21.20 | -3.67 | 0.8607 | -0.0682 | |||

| COST / Costco Wholesale Corporation | 0.02 | 4.65 | 21.07 | 3.81 | 0.8554 | -0.0013 | |||

| WMT / Walmart Inc. | 0.21 | 4.61 | 20.88 | 4.72 | 0.8476 | 0.0062 | |||

| PG / The Procter & Gamble Company | 0.12 | 4.62 | 19.79 | 2.25 | 0.8031 | -0.0135 | |||

| JNJ / Johnson & Johnson | 0.13 | 4.63 | 19.49 | -1.59 | 0.7912 | -0.0446 | |||

| HD / The Home Depot, Inc. | 0.05 | 4.77 | 17.98 | -2.71 | 0.7296 | -0.0500 | |||

| ABBV / AbbVie Inc. | 0.09 | 4.55 | 16.20 | -6.92 | 0.6575 | -0.0768 | |||

| KO / The Coca-Cola Company | 0.22 | 4.73 | 15.86 | 6.04 | 0.6438 | 0.0126 | |||

| BAC / Bank of America Corporation | 0.34 | 4.59 | 14.84 | 0.11 | 0.6023 | -0.0231 | |||

| GE / General Electric Company | 0.06 | 4.86 | 13.61 | 24.58 | 0.5524 | 0.0914 | |||

| CSCO / Cisco Systems, Inc. | 0.21 | 4.96 | 13.39 | 3.20 | 0.5433 | -0.0040 | |||

| PLTR / Palantir Technologies Inc. | 0.10 | 4.72 | 13.27 | 62.51 | 0.5388 | 0.1941 | |||

| ORCL / Oracle Corporation | 0.08 | 4.91 | 12.87 | 4.57 | 0.5226 | 0.0031 | |||

| ABT / Abbott Laboratories | 0.10 | 4.76 | 12.83 | 1.40 | 0.5208 | -0.0132 | |||

| UNH / UnitedHealth Group Incorporated | 0.04 | 4.74 | 12.83 | -33.42 | 0.5207 | -0.2924 | |||

| CRM / Salesforce, Inc. | 0.05 | 4.79 | 12.81 | -6.64 | 0.5201 | -0.0590 | |||

| WFC / Wells Fargo & Company | 0.16 | 4.75 | 12.13 | 0.01 | 0.4924 | -0.0194 | |||

| MCD / McDonald's Corporation | 0.04 | 4.41 | 12.05 | 6.29 | 0.4893 | 0.0107 | |||

| LIN / Linde plc | 0.02 | 5.25 | 11.66 | 5.37 | 0.4731 | 0.0063 | |||

| IBM / International Business Machines Corporation | 0.04 | 4.88 | 11.64 | 7.63 | 0.4725 | 0.0161 | |||

| CVX / Chevron Corporation | 0.08 | 4.88 | 11.60 | -9.61 | 0.4709 | -0.0707 | |||

| INTU / Intuit Inc. | 0.02 | 4.96 | 11.36 | 28.84 | 0.4611 | 0.0890 | |||

| NOW / ServiceNow, Inc. | 0.01 | 4.24 | 11.31 | 13.36 | 0.4590 | 0.0381 | |||

| DIS / The Walt Disney Company | 0.10 | 4.71 | 10.89 | 4.01 | 0.4418 | 0.0002 | |||

| T / AT&T Inc. | 0.38 | 4.90 | 10.61 | 6.40 | 0.4308 | 0.0099 | |||

| MRK / Merck & Co., Inc. | 0.13 | 4.86 | 10.24 | -12.66 | 0.4158 | -0.0791 | |||

| BSX / Boston Scientific Corporation | 0.10 | 4.48 | 10.11 | 5.96 | 0.4105 | 0.0078 | |||

| ACN / Accenture plc | 0.03 | 4.77 | 10.10 | -4.75 | 0.4098 | -0.0375 | |||

| GS / The Goldman Sachs Group, Inc. | 0.02 | 5.14 | 10.00 | 1.45 | 0.4058 | -0.0100 | |||

| ISRG / Intuitive Surgical, Inc. | 0.02 | 5.12 | 9.96 | 1.30 | 0.4041 | -0.0106 | |||

| PEP / PepsiCo, Inc. | 0.07 | 4.85 | 9.82 | -10.19 | 0.3984 | -0.0628 | |||

| SPGI / S&P Global Inc. | 0.02 | 5.02 | 9.80 | 0.92 | 0.3978 | -0.0120 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 4.85 | 9.67 | 15.37 | 0.3925 | 0.0388 | |||

| VZ / Verizon Communications Inc. | 0.22 | 4.71 | 9.65 | 6.79 | 0.3918 | 0.0104 | |||

| RY / Royal Bank of Canada | 0.08 | 4.73 | 9.62 | 11.64 | 0.3904 | 0.0268 | |||

| ADBE / Adobe Inc. | 0.02 | 5.09 | 9.07 | -0.54 | 0.3680 | -0.0166 | |||

| AMD / Advanced Micro Devices, Inc. | 0.08 | 4.36 | 8.84 | 15.73 | 0.3587 | 0.0365 | |||

| QCOM / QUALCOMM Incorporated | 0.06 | 4.62 | 8.68 | -3.35 | 0.3522 | -0.0266 | |||

| AXP / American Express Company | 0.03 | 5.16 | 8.58 | 2.74 | 0.3481 | -0.0041 | |||

| CAT / Caterpillar Inc. | 0.02 | 4.96 | 8.57 | 6.21 | 0.3478 | 0.0074 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.02 | 4.90 | 8.42 | -20.11 | 0.3420 | -0.1031 | |||

| AMGN / Amgen Inc. | 0.03 | 4.95 | 8.31 | -1.82 | 0.3372 | -0.0199 | |||

| TXN / Texas Instruments Incorporated | 0.05 | 4.23 | 8.30 | -2.76 | 0.3370 | -0.0233 | |||

| MS / Morgan Stanley | 0.06 | 4.89 | 8.24 | 0.89 | 0.3344 | -0.0102 | |||

| COF / Capital One Financial Corporation | 0.04 | 87.27 | 8.23 | 76.63 | 0.3340 | 0.1374 | |||

| AMAT / Applied Materials, Inc. | 0.05 | 5.25 | 8.19 | 4.37 | 0.3322 | 0.0013 | |||

| UBER / Uber Technologies, Inc. | 0.10 | 4.64 | 8.10 | 15.87 | 0.3287 | 0.0338 | |||

| PGR / The Progressive Corporation | 0.03 | 3.98 | 8.03 | 5.06 | 0.3260 | 0.0034 | |||

| DE / Deere & Company | 0.02 | 5.61 | 7.97 | 11.20 | 0.3236 | 0.0211 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.03 | 5.03 | 7.94 | 3.19 | 0.3221 | -0.0024 | |||

| C / Citigroup Inc. | 0.10 | 4.58 | 7.85 | -1.48 | 0.3188 | -0.0176 | |||

| GILD / Gilead Sciences, Inc. | 0.07 | 4.46 | 7.79 | 0.59 | 0.3163 | -0.0106 | |||

| TMUS / T-Mobile US, Inc. | 0.03 | 4.46 | 7.59 | -6.18 | 0.3082 | -0.0333 | |||

| PFE / Pfizer Inc. | 0.32 | 4.95 | 7.56 | -6.73 | 0.3071 | -0.0352 | |||

| UNP / Union Pacific Corporation | 0.03 | 5.31 | 7.56 | -5.38 | 0.3067 | -0.0303 | |||

| BLK / BlackRock, Inc. | 0.01 | 4.05 | 7.45 | 4.29 | 0.3022 | 0.0009 | |||

| ETN / Eaton Corporation plc | 0.02 | 4.08 | 7.42 | 13.61 | 0.3012 | 0.0256 | |||

| TJX / The TJX Companies, Inc. | 0.06 | 4.96 | 7.40 | 6.75 | 0.3005 | 0.0079 | |||

| LRCX / Lam Research Corporation | 0.09 | 5.11 | 7.40 | 10.67 | 0.3003 | 0.0182 | |||

| ADI / Analog Devices, Inc. | 0.03 | 4.52 | 7.14 | -2.79 | 0.2900 | -0.0201 | |||

| NEE / NextEra Energy, Inc. | 0.10 | 4.46 | 7.14 | 5.15 | 0.2899 | 0.0033 | |||

| CMCSA / Comcast Corporation | 0.21 | 4.98 | 7.10 | 1.15 | 0.2881 | -0.0080 | |||

| ADP / Automatic Data Processing, Inc. | 0.02 | 5.49 | 7.07 | 8.94 | 0.2869 | 0.0131 | |||

| SCHW / The Charles Schwab Corporation | 0.08 | 4.47 | 7.06 | 16.05 | 0.2865 | 0.0298 | |||

| APH / Amphenol Corporation | 0.08 | 5.43 | 6.88 | 42.36 | 0.2794 | 0.0754 | |||

| TD / The Toronto-Dominion Bank | 0.10 | 4.70 | 6.85 | 19.98 | 0.2779 | 0.0371 | |||

| GEV / GE Vernova Inc. | 0.01 | 5.27 | 6.81 | 48.55 | 0.2766 | 0.0830 | |||

| PANW / Palo Alto Networks, Inc. | 0.04 | 4.89 | 6.80 | 6.00 | 0.2760 | 0.0053 | |||

| SYK / Stryker Corporation | 0.02 | 5.72 | 6.76 | 4.76 | 0.2745 | 0.0021 | |||

| Invesco Private Prime Fund / STIV (N/A) | 6.74 | 6.74 | 0.2734 | 0.2734 | |||||

| SHOP / Shopify Inc. | 0.06 | 4.63 | 6.59 | -0.81 | 0.2674 | -0.0128 | |||

| ENB / Enbridge Inc. | 0.14 | 4.72 | 6.55 | 13.37 | 0.2657 | 0.0220 | |||

| PLD / Prologis, Inc. | 0.06 | 4.99 | 6.46 | -7.99 | 0.2621 | -0.0341 | |||

| WELL / Welltower Inc. | 0.04 | 3.85 | 6.36 | 4.37 | 0.2581 | 0.0010 | |||

| MCK / McKesson Corporation | 0.01 | 5.62 | 6.35 | 18.71 | 0.2578 | 0.0320 | |||

| DHR / Danaher Corporation | 0.03 | 3.95 | 6.31 | -4.97 | 0.2560 | -0.0241 | |||

| LOW / Lowe's Companies, Inc. | 0.03 | 5.41 | 6.24 | -4.29 | 0.2534 | -0.0219 | |||

| CME / CME Group Inc. | 0.02 | 5.57 | 6.23 | 20.23 | 0.2530 | 0.0342 | |||

| MDLZ / Mondelez International, Inc. | 0.09 | 4.36 | 6.20 | 9.67 | 0.2518 | 0.0131 | |||

| WM / Waste Management, Inc. | 0.03 | 4.46 | 6.09 | 8.13 | 0.2473 | 0.0095 | |||

| TT / Trane Technologies plc | 0.01 | 4.20 | 6.08 | 26.75 | 0.2466 | 0.0444 | |||

| AMT / American Tower Corporation | 0.03 | 3.86 | 6.04 | 8.42 | 0.2453 | 0.0101 | |||

| CB / Chubb Limited | 0.02 | 4.72 | 6.03 | 9.03 | 0.2446 | 0.0113 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | 5.59 | 6.00 | -2.73 | 0.2435 | -0.0167 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.01 | 6.14 | 5.99 | 28.40 | 0.2431 | 0.0463 | |||

| MELI / MercadoLibre, Inc. | 0.00 | 4.07 | 5.96 | 25.73 | 0.2420 | 0.0419 | |||

| MDT / Medtronic plc | 0.07 | 4.49 | 5.96 | -5.77 | 0.2419 | -0.0250 | |||

| ICE / Intercontinental Exchange, Inc. | 0.03 | 4.96 | 5.94 | 8.93 | 0.2411 | 0.0110 | |||

| COP / ConocoPhillips | 0.07 | 4.64 | 5.92 | -9.91 | 0.2405 | -0.0371 | |||

| KLAC / KLA Corporation | 0.01 | 6.14 | 5.91 | 13.32 | 0.2400 | 0.0199 | |||

| FCX / Freeport-McMoRan Inc. | 0.15 | 5.19 | 5.68 | 9.67 | 0.2306 | 0.0120 | |||

| TDG / TransDigm Group Incorporated | 0.00 | 5.78 | 5.64 | 13.61 | 0.2291 | 0.0195 | |||

| CP / Canadian Pacific Kansas City Limited | 0.07 | 4.47 | 5.61 | 8.88 | 0.2276 | 0.0103 | |||

| WPM / Wheaton Precious Metals Corp. | 0.06 | 4.56 | 5.60 | 30.43 | 0.2274 | 0.0461 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.02 | 3.83 | 5.49 | -2.64 | 0.2230 | -0.0151 | |||

| PH / Parker-Hannifin Corporation | 0.01 | 4.18 | 5.49 | 3.59 | 0.2228 | -0.0008 | |||

| AEM / Agnico Eagle Mines Limited | 0.05 | 4.73 | 5.49 | 27.37 | 0.2227 | 0.0409 | |||

| SBUX / Starbucks Corporation | 0.07 | 5.24 | 5.47 | -23.71 | 0.2222 | -0.0806 | |||

| MCO / Moody's Corporation | 0.01 | 4.03 | 5.36 | -1.05 | 0.2177 | -0.0110 | |||

| CL / Colgate-Palmolive Company | 0.06 | 4.34 | 5.35 | 6.36 | 0.2172 | 0.0049 | |||

| TEL / TE Connectivity plc | 0.03 | 4.47 | 5.34 | 8.56 | 0.2168 | 0.0092 | |||

| MU / Micron Technology, Inc. | 0.06 | 4.26 | 5.34 | 5.18 | 0.2167 | 0.0025 | |||

| ECL / Ecolab Inc. | 0.02 | 3.78 | 5.34 | 2.46 | 0.2166 | -0.0032 | |||

| BMO / Bank of Montreal | 0.05 | 4.68 | 5.32 | 8.64 | 0.2160 | 0.0093 | |||

| BX / Blackstone Inc. | 0.04 | 5.59 | 5.27 | -9.09 | 0.2139 | -0.0307 | |||

| EQIX / Equinix, Inc. | 0.01 | 5.86 | 5.22 | 4.00 | 0.2119 | 0.0001 | |||

| BN / Brookfield Corporation | 0.09 | 4.75 | 5.14 | 3.88 | 0.2088 | -0.0002 | |||

| BMY / Bristol-Myers Squibb Company | 0.11 | 4.73 | 5.14 | -15.18 | 0.2086 | -0.0471 | |||

| FI / Fiserv, Inc. | 0.03 | 4.27 | 5.09 | -27.98 | 0.2067 | -0.0917 | |||

| HWM / Howmet Aerospace Inc. | 0.03 | 5.60 | 5.09 | 31.35 | 0.2067 | 0.0431 | |||

| CEG / Constellation Energy Corporation | 0.02 | 5.71 | 5.07 | 29.18 | 0.2056 | 0.0401 | |||

| EMR / Emerson Electric Co. | 0.04 | 6.03 | 4.90 | 4.08 | 0.1989 | 0.0002 | |||

| JCI / Johnson Controls International plc | 0.05 | 5.16 | 4.90 | 24.44 | 0.1988 | 0.0327 | |||

| CVS / CVS Health Corporation | 0.08 | 5.28 | 4.89 | 2.58 | 0.1987 | -0.0027 | |||

| BK / The Bank of New York Mellon Corporation | 0.05 | 4.08 | 4.82 | 3.68 | 0.1957 | -0.0005 | |||

| ELV / Elevance Health, Inc. | 0.01 | 5.47 | 4.80 | 2.00 | 0.1947 | -0.0037 | |||

| CI / The Cigna Group | 0.02 | 4.28 | 4.79 | 6.91 | 0.1946 | 0.0054 | |||

| ADSK / Autodesk, Inc. | 0.02 | 4.16 | 4.78 | 12.51 | 0.1939 | 0.0147 | |||

| SNOW / Snowflake Inc. | 0.02 | 3.55 | 4.74 | 20.27 | 0.1925 | 0.0261 | |||

| ANET / Arista Networks Inc | 0.05 | 4.59 | 4.74 | -2.61 | 0.1923 | -0.0130 | |||

| SHW / The Sherwin-Williams Company | 0.01 | 4.02 | 4.70 | 3.03 | 0.1906 | -0.0017 | |||

| RSG / Republic Services, Inc. | 0.02 | 4.75 | 4.70 | 13.73 | 0.1906 | 0.0163 | |||

| CNSWF / Constellation Software Inc. | 0.00 | 3.11 | 4.68 | 7.79 | 0.1899 | 0.0067 | |||

| CTAS / Cintas Corporation | 0.02 | 5.38 | 4.67 | 15.04 | 0.1895 | 0.0182 | |||

| BNS / The Bank of Nova Scotia | 0.09 | 4.67 | 4.65 | 12.12 | 0.1889 | 0.0137 | |||

| COR / Cencora, Inc. | 0.02 | 6.20 | 4.62 | 22.01 | 0.1877 | 0.0277 | |||

| MMM / 3M Company | 0.03 | 5.46 | 4.60 | 0.88 | 0.1867 | -0.0057 | |||

| MAR / Marriott International, Inc. | 0.02 | 5.94 | 4.60 | -0.35 | 0.1867 | -0.0081 | |||

| AJG / Arthur J. Gallagher & Co. | 0.01 | 4.74 | 4.58 | 7.74 | 0.1859 | 0.0065 | |||

| CNI / Canadian National Railway Company | 0.04 | 4.70 | 4.57 | 7.88 | 0.1856 | 0.0067 | |||

| SNPS / Synopsys, Inc. | 0.01 | 5.49 | 4.54 | 7.03 | 0.1841 | 0.0053 | |||

| WMB / The Williams Companies, Inc. | 0.07 | 4.32 | 4.52 | 8.50 | 0.1835 | 0.0077 | |||

| CM / Canadian Imperial Bank of Commerce | 0.07 | 4.75 | 4.48 | 16.95 | 0.1818 | 0.0202 | |||

| EOG / EOG Resources, Inc. | 0.04 | 5.13 | 4.46 | -10.09 | 0.1809 | -0.0282 | |||

| WSP / WSP Global Inc. | 0.02 | 5.30 | 4.44 | 20.25 | 0.1803 | 0.0244 | |||

| AON / Aon plc | 0.01 | 5.85 | 4.44 | -3.73 | 0.1801 | -0.0144 | |||

| NEM / Newmont Corporation | 0.08 | 5.53 | 4.42 | 29.88 | 0.1793 | 0.0358 | |||

| APP / AppLovin Corporation | 0.01 | 4.58 | 4.38 | 26.18 | 0.1776 | 0.0313 | |||

| TRI / Thomson Reuters Corporation | 0.02 | 3.53 | 4.37 | 14.36 | 0.1775 | 0.0161 | |||

| CSX / CSX Corporation | 0.14 | 4.70 | 4.35 | 3.32 | 0.1767 | -0.0011 | |||

| ROP / Roper Technologies, Inc. | 0.01 | 6.57 | 4.34 | 3.98 | 0.1762 | 0.0000 | |||

| INTC / Intel Corporation | 0.22 | 5.11 | 4.34 | -13.40 | 0.1760 | -0.0353 | |||

| CDNS / Cadence Design Systems, Inc. | 0.02 | 3.77 | 4.33 | 18.92 | 0.1756 | 0.0221 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.00 | 4.10 | 4.31 | 3.63 | 0.1748 | -0.0006 | |||

| AIG / American International Group, Inc. | 0.05 | 4.61 | 4.29 | 6.75 | 0.1740 | 0.0046 | |||

| KKR / KKR & Co. Inc. | 0.04 | 4.02 | 4.28 | -6.81 | 0.1737 | -0.0201 | |||

| SPG / Simon Property Group, Inc. | 0.03 | 4.05 | 4.27 | -8.82 | 0.1733 | -0.0243 | |||

| ED / Consolidated Edison, Inc. | 0.04 | 3.96 | 4.21 | 7.00 | 0.1707 | 0.0048 | |||

| ZTS / Zoetis Inc. | 0.02 | 5.33 | 4.19 | 6.19 | 0.1700 | 0.0036 | |||

| ITW / Illinois Tool Works Inc. | 0.02 | 3.30 | 4.17 | -4.10 | 0.1691 | -0.0142 | |||

| DOV / Dover Corporation | 0.02 | 4.52 | 4.14 | -6.53 | 0.1679 | -0.0188 | |||

| PPG / PPG Industries, Inc. | 0.04 | 5.21 | 4.12 | 2.95 | 0.1670 | -0.0016 | |||

| TRV / The Travelers Companies, Inc. | 0.01 | 5.52 | 4.11 | 12.55 | 0.1668 | 0.0127 | |||

| NKE / NIKE, Inc. | 0.07 | 4.20 | 4.09 | -20.52 | 0.1662 | -0.0512 | |||

| CTVA / Corteva, Inc. | 0.06 | 4.67 | 4.09 | 17.67 | 0.1660 | 0.0193 | |||

| MFC / Manulife Financial Corporation | 0.13 | 3.86 | 4.06 | 5.54 | 0.1647 | 0.0025 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.08 | 5.52 | 4.04 | -2.08 | 0.1640 | -0.0101 | |||

| KMB / Kimberly-Clark Corporation | 0.03 | 5.61 | 4.02 | 6.92 | 0.1630 | 0.0045 | |||

| USB / U.S. Bancorp | 0.09 | 4.48 | 4.01 | -2.90 | 0.1628 | -0.0115 | |||

| EW / Edwards Lifesciences Corporation | 0.05 | 5.95 | 4.01 | 15.70 | 0.1628 | 0.0165 | |||

| CARR / Carrier Global Corporation | 0.06 | 5.76 | 4.01 | 16.21 | 0.1627 | 0.0171 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.02 | 3.32 | 4.00 | -6.41 | 0.1623 | -0.0180 | |||

| PCAR / PACCAR Inc | 0.04 | 5.26 | 3.94 | -7.87 | 0.1601 | -0.0206 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.05 | 4.51 | 3.93 | 1.58 | 0.1596 | -0.0037 | |||

| CMI / Cummins Inc. | 0.01 | 4.31 | 3.90 | -8.91 | 0.1581 | -0.0224 | |||

| FTNT / Fortinet, Inc. | 0.04 | 3.94 | 3.89 | -2.06 | 0.1580 | -0.0097 | |||

| LBLCF / Loblaw Companies Limited | 0.02 | 5.98 | 3.87 | 35.74 | 0.1569 | 0.0367 | |||

| O / Realty Income Corporation | 0.07 | 4.52 | 3.84 | 3.79 | 0.1558 | -0.0003 | |||

| PYPL / PayPal Holdings, Inc. | 0.05 | 4.39 | 3.83 | 3.26 | 0.1557 | -0.0011 | |||

| HCA / HCA Healthcare, Inc. | 0.01 | 3.79 | 3.83 | 29.25 | 0.1555 | 0.0304 | |||

| AVB / AvalonBay Communities, Inc. | 0.02 | 6.30 | 3.83 | -2.82 | 0.1554 | -0.0109 | |||

| BDX / Becton, Dickinson and Company | 0.02 | 5.44 | 3.79 | -19.32 | 0.1540 | -0.0444 | |||

| AXON / Axon Enterprise, Inc. | 0.01 | 4.07 | 3.78 | 47.79 | 0.1534 | 0.0455 | |||

| NDAQ / Nasdaq, Inc. | 0.05 | 6.09 | 3.77 | 7.06 | 0.1532 | 0.0044 | |||

| OTIS / Otis Worldwide Corporation | 0.04 | 4.52 | 3.76 | -0.11 | 0.1527 | -0.0062 | |||

| NSC / Norfolk Southern Corporation | 0.02 | 4.16 | 3.74 | 4.74 | 0.1517 | 0.0011 | |||

| MSI / Motorola Solutions, Inc. | 0.01 | 3.24 | 3.74 | -2.61 | 0.1516 | -0.0102 | |||

| YUM / Yum! Brands, Inc. | 0.03 | 5.28 | 3.73 | -3.09 | 0.1514 | -0.0110 | |||

| SLF / Sun Life Financial Inc. | 0.06 | 4.43 | 3.70 | 20.22 | 0.1504 | 0.0203 | |||

| AZO / AutoZone, Inc. | 0.00 | 5.76 | 3.70 | 13.03 | 0.1503 | 0.0121 | |||

| WDAY / Workday, Inc. | 0.01 | 5.95 | 3.69 | -0.35 | 0.1497 | -0.0065 | |||

| EXC / Exelon Corporation | 0.08 | 4.67 | 3.69 | 3.77 | 0.1496 | -0.0003 | |||

| KMI / Kinder Morgan, Inc. | 0.13 | 4.66 | 3.66 | 8.27 | 0.1487 | 0.0059 | |||

| DASH / DoorDash, Inc. | 0.02 | 6.23 | 3.65 | 11.70 | 0.1481 | 0.0103 | |||

| MSTR / Strategy Inc | 0.01 | 5.60 | 3.63 | 52.62 | 0.1475 | 0.0470 | |||

| GM / General Motors Company | 0.07 | 4.47 | 3.61 | 5.49 | 0.1466 | 0.0021 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.01 | 3.22 | 3.59 | 7.77 | 0.1459 | 0.0052 | |||

| TRP / TC Energy Corporation | 0.07 | 4.75 | 3.59 | 17.87 | 0.1457 | 0.0172 | |||

| KDP / Keurig Dr Pepper Inc. | 0.11 | 4.66 | 3.58 | 5.14 | 0.1454 | 0.0016 | |||

| CAH / Cardinal Health, Inc. | 0.02 | 4.14 | 3.58 | 24.22 | 0.1453 | 0.0237 | |||

| DLR / Digital Realty Trust, Inc. | 0.02 | 5.75 | 3.55 | 16.03 | 0.1443 | 0.0150 | |||

| UPS / United Parcel Service, Inc. | 0.04 | 4.50 | 3.55 | -14.37 | 0.1442 | -0.0309 | |||

| HEIA / Heico Corp. - Class A | 0.01 | 2.81 | 3.52 | 13.73 | 0.1429 | 0.0123 | |||

| ABNB / Airbnb, Inc. | 0.03 | 4.03 | 3.51 | -3.36 | 0.1424 | -0.0108 | |||

| REG / Regency Centers Corporation | 0.05 | 4.30 | 3.50 | -1.88 | 0.1419 | -0.0085 | |||

| LNG / Cheniere Energy, Inc. | 0.01 | 5.28 | 3.47 | 9.15 | 0.1409 | 0.0067 | |||

| GLW / Corning Incorporated | 0.07 | 4.72 | 3.47 | 3.55 | 0.1408 | -0.0006 | |||

| AWK / American Water Works Company, Inc. | 0.02 | 4.25 | 3.46 | 9.63 | 0.1406 | 0.0073 | |||

| PAYX / Paychex, Inc. | 0.02 | 6.55 | 3.45 | 10.94 | 0.1400 | 0.0088 | |||

| NTIOF / National Bank of Canada | 0.04 | 4.69 | 3.44 | 23.05 | 0.1398 | 0.0217 | |||

| CRH / CRH plc | 0.04 | 4.75 | 3.42 | -6.84 | 0.1388 | -0.0161 | |||

| PWR / Quanta Services, Inc. | 0.01 | 5.91 | 3.40 | 39.76 | 0.1380 | 0.0353 | |||

| SLB / Schlumberger Limited | 0.10 | 4.71 | 3.38 | -16.94 | 0.1373 | -0.0345 | |||

| AMP / Ameriprise Financial, Inc. | 0.01 | 6.66 | 3.36 | 1.08 | 0.1363 | -0.0039 | |||

| AME / AMETEK, Inc. | 0.02 | 5.94 | 3.35 | 0.03 | 0.1360 | -0.0053 | |||

| EQR / Equity Residential | 0.05 | 4.24 | 3.33 | -1.42 | 0.1350 | -0.0074 | |||

| ALL / The Allstate Corporation | 0.02 | 5.92 | 3.31 | 11.66 | 0.1345 | 0.0092 | |||

| FLUT / Flutter Entertainment plc | 0.01 | 3.58 | 3.29 | -6.71 | 0.1337 | -0.0153 | |||

| APO / Apollo Global Management, Inc. | 0.03 | 3.97 | 3.29 | -8.97 | 0.1335 | -0.0190 | |||

| TFC / Truist Financial Corporation | 0.08 | 4.74 | 3.28 | -10.74 | 0.1333 | -0.0219 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.04 | 4.13 | 3.27 | 3.95 | 0.1326 | 0.0000 | |||

| SYY / Sysco Corporation | 0.04 | 4.55 | 3.25 | 1.03 | 0.1319 | -0.0038 | |||

| VTR / Ventas, Inc. | 0.05 | 4.48 | 3.25 | -2.93 | 0.1319 | -0.0094 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | 6.16 | 3.25 | -6.34 | 0.1318 | -0.0145 | |||

| VICI / VICI Properties Inc. | 0.10 | 4.69 | 3.25 | 2.17 | 0.1317 | -0.0023 | |||

| ROST / Ross Stores, Inc. | 0.02 | 3.67 | 3.23 | 3.49 | 0.1313 | -0.0006 | |||

| AFL / Aflac Incorporated | 0.03 | 5.48 | 3.21 | -0.25 | 0.1305 | -0.0055 | |||

| KVUE / Kenvue Inc. | 0.13 | 4.54 | 3.21 | 5.73 | 0.1304 | 0.0022 | |||

| ES / Eversource Energy | 0.05 | 4.51 | 3.21 | 7.50 | 0.1304 | 0.0043 | |||

| PRU / Prudential Financial, Inc. | 0.03 | 6.23 | 3.20 | -4.13 | 0.1301 | -0.0110 | |||

| HES / Hess Corporation | 0.02 | 3.89 | 3.19 | -7.80 | 0.1295 | -0.0165 | |||

| NXPI / NXP Semiconductors N.V. | 0.02 | 4.80 | 3.17 | -7.09 | 0.1288 | -0.0153 | |||

| ARES / Ares Management Corporation | 0.02 | 3.94 | 3.16 | 0.64 | 0.1284 | -0.0043 | |||

| QSR / Restaurant Brands International Inc. | 0.04 | 4.23 | 3.16 | 13.37 | 0.1284 | 0.0107 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.02 | 5.43 | 3.15 | 15.09 | 0.1279 | 0.0124 | |||

| EFX / Equifax Inc. | 0.01 | 6.02 | 3.15 | 14.23 | 0.1278 | 0.0115 | |||

| GIS / General Mills, Inc. | 0.06 | 4.54 | 3.13 | -6.43 | 0.1270 | -0.0141 | |||

| MET / MetLife, Inc. | 0.04 | 4.65 | 3.10 | -4.58 | 0.1260 | -0.0113 | |||

| F / Ford Motor Company | 0.30 | 4.97 | 3.10 | 14.10 | 0.1259 | 0.0112 | |||

| BKR / Baker Hughes Company | 0.08 | 4.53 | 3.07 | -13.14 | 0.1248 | -0.0246 | |||

| OKE / ONEOK, Inc. | 0.04 | 5.86 | 3.07 | -14.74 | 0.1244 | -0.0273 | |||

| PBA / Pembina Pipeline Corporation | 0.08 | 4.38 | 3.06 | 0.00 | 0.1243 | -0.0049 | |||

| PSA / Public Storage | 0.01 | 6.37 | 3.05 | 8.05 | 0.1237 | 0.0047 | |||

| FAST / Fastenal Company | 0.07 | 109.42 | 3.02 | 14.29 | 0.1225 | 0.0111 | |||

| MRVL / Marvell Technology, Inc. | 0.05 | 4.54 | 2.98 | -31.48 | 0.1211 | -0.0626 | |||

| FANG / Diamondback Energy, Inc. | 0.02 | 3.78 | 2.97 | -12.17 | 0.1207 | -0.0221 | |||

| GWW / W.W. Grainger, Inc. | 0.00 | 6.78 | 2.96 | 13.70 | 0.1203 | 0.0103 | |||

| IT / Gartner, Inc. | 0.01 | 6.41 | 2.96 | -6.81 | 0.1200 | -0.0139 | |||

| PCG / PG&E Corporation | 0.18 | 4.54 | 2.96 | 8.00 | 0.1199 | 0.0045 | |||

| CTRA / Coterra Energy Inc. | 0.12 | 4.65 | 2.96 | -5.74 | 0.1199 | -0.0124 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.01 | 3.75 | 2.95 | -27.21 | 0.1199 | -0.0513 | |||

| PSX / Phillips 66 | 0.03 | 5.72 | 2.95 | -7.48 | 0.1195 | -0.0148 | |||

| CPRT / Copart, Inc. | 0.06 | 4.70 | 2.92 | -1.65 | 0.1186 | -0.0068 | |||

| URI / United Rentals, Inc. | 0.00 | 3.94 | 2.90 | 14.61 | 0.1175 | 0.0109 | |||

| CHD / Church & Dwight Co., Inc. | 0.03 | 4.70 | 2.89 | -7.43 | 0.1173 | -0.0144 | |||

| KIM / Kimco Realty Corporation | 0.14 | 4.75 | 2.89 | 0.77 | 0.1173 | -0.0037 | |||

| IR / Ingersoll Rand Inc. | 0.04 | 4.38 | 2.89 | 0.52 | 0.1172 | -0.0040 | |||

| HSY / The Hershey Company | 0.02 | 6.73 | 2.87 | -0.69 | 0.1164 | -0.0055 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.03 | 5.44 | 2.86 | -6.84 | 0.1161 | -0.0135 | |||

| WY / Weyerhaeuser Company | 0.11 | 5.35 | 2.85 | -9.31 | 0.1158 | -0.0170 | |||

| CBRE / CBRE Group, Inc. | 0.02 | 6.53 | 2.84 | -6.15 | 0.1151 | -0.0124 | |||

| DD / DuPont de Nemours, Inc. | 0.04 | 4.26 | 2.83 | -14.83 | 0.1149 | -0.0254 | |||

| DVN / Devon Energy Corporation | 0.09 | 4.74 | 2.82 | -12.50 | 0.1146 | -0.0215 | |||

| GRMN / Garmin Ltd. | 0.01 | 6.06 | 2.82 | -5.94 | 0.1144 | -0.0121 | |||

| VMC / Vulcan Materials Company | 0.01 | 7.64 | 2.81 | 15.38 | 0.1142 | 0.0113 | |||

| IRM / Iron Mountain Incorporated | 0.03 | 3.66 | 2.77 | 9.82 | 0.1126 | 0.0060 | |||

| AVY / Avery Dennison Corporation | 0.02 | 6.60 | 2.75 | 0.81 | 0.1117 | -0.0035 | |||

| FIS / Fidelity National Information Services, Inc. | 0.03 | 6.26 | 2.70 | 18.98 | 0.1097 | 0.0138 | |||

| COIN / Coinbase Global, Inc. | 0.01 | 5.69 | 2.69 | 20.89 | 0.1092 | 0.0153 | |||

| IQV / IQVIA Holdings Inc. | 0.02 | 4.16 | 2.69 | -22.58 | 0.1091 | -0.0374 | |||

| A / Agilent Technologies, Inc. | 0.02 | 5.43 | 2.68 | -7.76 | 0.1086 | -0.0138 | |||

| Invesco Private Government Fund / STIV (N/A) | 2.57 | 2.57 | 0.1043 | 0.1043 | |||||

| FERG / Ferguson Enterprises Inc. | 0.01 | 3.54 | 2.56 | 6.36 | 0.1039 | 0.0023 | |||

| FDX / FedEx Corporation | 0.01 | 6.30 | 2.53 | -11.81 | 0.1027 | -0.0184 | |||

| MCHP / Microchip Technology Incorporated | 0.04 | 4.67 | 2.53 | 3.23 | 0.1026 | -0.0007 | |||

| HST / Host Hotels & Resorts, Inc. | 0.16 | 4.74 | 2.50 | 0.60 | 0.1014 | -0.0034 | |||

| TGT / Target Corporation | 0.03 | 3.72 | 2.45 | -21.50 | 0.0996 | -0.0323 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.03 | 3.70 | 2.41 | -16.25 | 0.0977 | -0.0236 | |||

| IPG / The Interpublic Group of Companies, Inc. | 0.10 | 4.59 | 2.38 | -8.54 | 0.0965 | -0.0132 | |||

| FICO / Fair Isaac Corporation | 0.00 | 3.62 | 2.37 | -5.19 | 0.0963 | -0.0093 | |||

| DOC / Healthpeak Properties, Inc. | 0.14 | 4.71 | 2.36 | -10.89 | 0.0960 | -0.0160 | |||

| OMC / Omnicom Group Inc. | 0.03 | 6.72 | 2.35 | -5.32 | 0.0955 | -0.0093 | |||

| EIX / Edison International | 0.04 | 3.91 | 2.35 | 6.19 | 0.0954 | 0.0020 | |||

| XYZ / Block, Inc. | 0.04 | 3.98 | 2.30 | -1.67 | 0.0933 | -0.0053 | |||

| NUE / Nucor Corporation | 0.02 | 5.95 | 2.27 | -15.72 | 0.0921 | -0.0215 | |||

| HAL / Halliburton Company | 0.12 | 4.61 | 2.26 | -22.28 | 0.0918 | -0.0310 | |||

| HPQ / HP Inc. | 0.09 | 4.65 | 2.22 | -15.60 | 0.0901 | -0.0209 | |||

| CVNA / Carvana Co. | 0.01 | 5.22 | 2.19 | 47.67 | 0.0889 | 0.0263 | |||

| DHI / D.R. Horton, Inc. | 0.02 | 2.89 | 2.12 | -4.21 | 0.0859 | -0.0073 | |||

| TTD / The Trade Desk, Inc. | 0.03 | 4.67 | 1.91 | 11.99 | 0.0773 | 0.0055 | |||

| LEN / Lennar Corporation | 0.02 | 2.72 | 1.90 | -8.93 | 0.0771 | -0.0109 | |||

| DFS / Discover Financial Services | 0.00 | -100.00 | 0.00 | -100.00 | -0.1470 |