Basic Stats

| Portfolio Value | $ 84,484,577 |

| Current Positions | 32 |

Latest Holdings, Performance, AUM (from 13F, 13D)

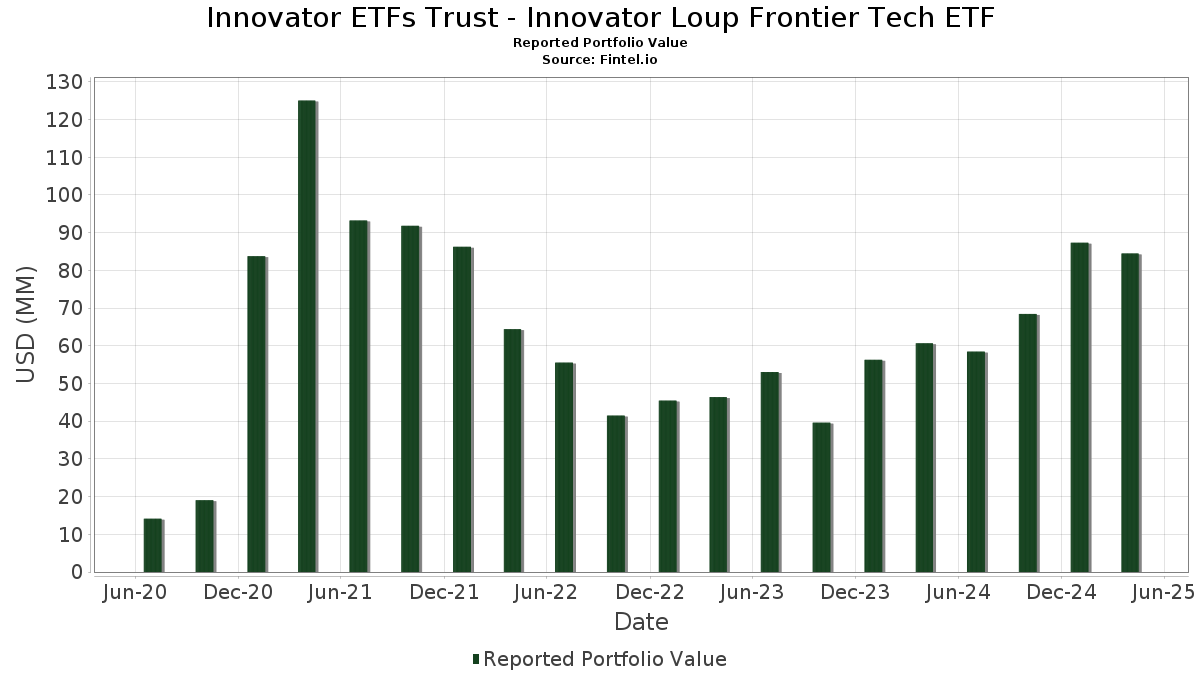

Innovator ETFs Trust - Innovator Loup Frontier Tech ETF has disclosed 32 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 84,484,577 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Innovator ETFs Trust - Innovator Loup Frontier Tech ETF’s top holdings are Reddit, Inc. (US:RDDT) , Astera Labs, Inc. (US:ALAB) , Marvell Technology, Inc. (US:MRVL) , CyberArk Software Ltd. (US:CYBR) , and SK hynix Inc. (KR:000660) . Innovator ETFs Trust - Innovator Loup Frontier Tech ETF’s new positions include CyberArk Software Ltd. (US:CYBR) , Remitly Global, Inc. (US:RELY) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 7.43 | 7.43 | 9.6426 | 9.6426 | |

| 0.01 | 3.57 | 4.6300 | 4.6300 | |

| 0.03 | 2.39 | 3.0964 | 3.0964 | |

| 0.10 | 2.08 | 2.6966 | 2.6966 | |

| 0.06 | 3.73 | 4.8363 | 2.0655 | |

| 0.06 | 3.88 | 5.0406 | 1.4303 | |

| 0.03 | 2.60 | 3.3761 | 0.8201 | |

| 0.28 | 0.28 | 0.3668 | 0.3668 | |

| 0.05 | 2.36 | 3.0614 | 0.3263 | |

| 0.03 | 2.27 | 2.9441 | 0.0922 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 2.01 | 2.6138 | -2.0546 | |

| 0.03 | 2.25 | 2.9202 | -1.3377 | |

| 0.03 | 2.37 | 3.0833 | -0.5020 | |

| 0.03 | 2.13 | 2.7655 | -0.4637 | |

| 0.03 | 3.50 | 4.5383 | -0.3208 | |

| 0.01 | 2.29 | 2.9713 | -0.2894 | |

| 0.00 | 2.33 | 3.0264 | -0.2851 | |

| 0.19 | 2.39 | 3.1009 | -0.2845 | |

| 0.06 | 2.31 | 2.9971 | -0.2550 | |

| 0.00 | 2.15 | 2.7900 | -0.2459 |

13F and Fund Filings

This form was filed on 2025-06-24 for the reporting period 2025-04-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Mount Vernon Liquid Assets Portfolio, LLC / STIV (N/A) | 7.43 | 7.43 | 9.6426 | 9.6426 | |||||

| RDDT / Reddit, Inc. | 0.04 | 76.18 | 4.19 | 2.93 | 5.4362 | -0.0714 | |||

| ALAB / Astera Labs, Inc. | 0.06 | 126.07 | 3.88 | 45.56 | 5.0406 | 1.4303 | |||

| MRVL / Marvell Technology, Inc. | 0.06 | 251.89 | 3.73 | 82.06 | 4.8363 | 2.0655 | |||

| CYBR / CyberArk Software Ltd. | 0.01 | 3.57 | 4.6300 | 4.6300 | |||||

| 000660 / SK hynix Inc. | 0.03 | 6.92 | 3.50 | -2.62 | 4.5383 | -0.3208 | |||

| HOOD / Robinhood Markets, Inc. | 0.06 | 7.88 | 2.75 | 2.00 | 3.5746 | -0.0803 | |||

| VRT / Vertiv Holdings Co | 0.03 | 88.76 | 2.60 | 37.71 | 3.3761 | 0.8201 | |||

| MELI / MercadoLibre, Inc. | 0.00 | -11.85 | 2.45 | 6.91 | 3.1743 | 0.0779 | |||

| HUBS / HubSpot, Inc. | 0.00 | 30.87 | 2.41 | 2.65 | 3.1231 | -0.0489 | |||

| AVAV / AeroVironment, Inc. | 0.02 | 22.43 | 2.40 | 2.96 | 3.1137 | -0.0392 | |||

| NU / Nu Holdings Ltd. | 0.19 | 1.73 | 2.39 | -4.48 | 3.1009 | -0.2845 | |||

| UBER / Uber Technologies, Inc. | 0.03 | 2.39 | 3.0964 | 3.0964 | |||||

| CIEN / Ciena Corporation | 0.04 | 37.81 | 2.38 | 6.20 | 3.0915 | 0.0566 | |||

| CLS / Celestica Inc. | 0.03 | 29.72 | 2.37 | -10.35 | 3.0833 | -0.5020 | |||

| CCJ / Cameco Corporation | 0.05 | 27.80 | 2.36 | 16.73 | 3.0614 | 0.3263 | |||

| AXON / Axon Enterprise, Inc. | 0.00 | 1.33 | 2.33 | -4.70 | 3.0264 | -0.2851 | |||

| CFLT / Confluent, Inc. | 0.10 | 33.00 | 2.32 | 6.68 | 3.0091 | 0.0684 | |||

| GLBE / Global-E Online Ltd. | 0.06 | 60.26 | 2.31 | -3.91 | 2.9971 | -0.2550 | |||

| SNOW / Snowflake Inc. | 0.01 | 8.13 | 2.29 | -4.98 | 2.9713 | -0.2894 | |||

| LRCX / Lam Research Corporation | 0.03 | 16.93 | 2.28 | 3.40 | 2.9586 | -0.0249 | |||

| TTWO / Take-Two Interactive Software, Inc. | 0.01 | -15.83 | 2.28 | 5.86 | 2.9570 | 0.0445 | |||

| ANET / Arista Networks Inc | 0.03 | 50.76 | 2.27 | 7.64 | 2.9441 | 0.0922 | |||

| NTNX / Nutanix, Inc. | 0.03 | -2.87 | 2.26 | -2.96 | 2.9374 | -0.2188 | |||

| MDB / MongoDB, Inc. | 0.01 | 53.26 | 2.26 | -3.46 | 2.9361 | -0.2350 | |||

| MU / Micron Technology, Inc. | 0.03 | -15.21 | 2.25 | -28.49 | 2.9202 | -1.3377 | |||

| ONTO / Onto Innovation Inc. | 0.02 | 66.58 | 2.21 | -0.81 | 2.8727 | -0.1460 | |||

| ADYEY / Adyen N.V. - Depositary Receipt (Common Stock) | 0.00 | -2.83 | 2.15 | -4.15 | 2.7900 | -0.2459 | |||

| FOUR / Shift4 Payments, Inc. | 0.03 | 30.83 | 2.13 | -10.69 | 2.7655 | -0.4637 | |||

| RELY / Remitly Global, Inc. | 0.10 | 2.08 | 2.6966 | 2.6966 | |||||

| ASML / ASML Holding N.V. | 0.00 | -33.67 | 2.01 | -41.62 | 2.6138 | -2.0546 | |||

| US BANK MMDA - USBGFS 9 / STIV (N/A) | 0.28 | 0.28 | 0.3668 | 0.3668 |