Basic Stats

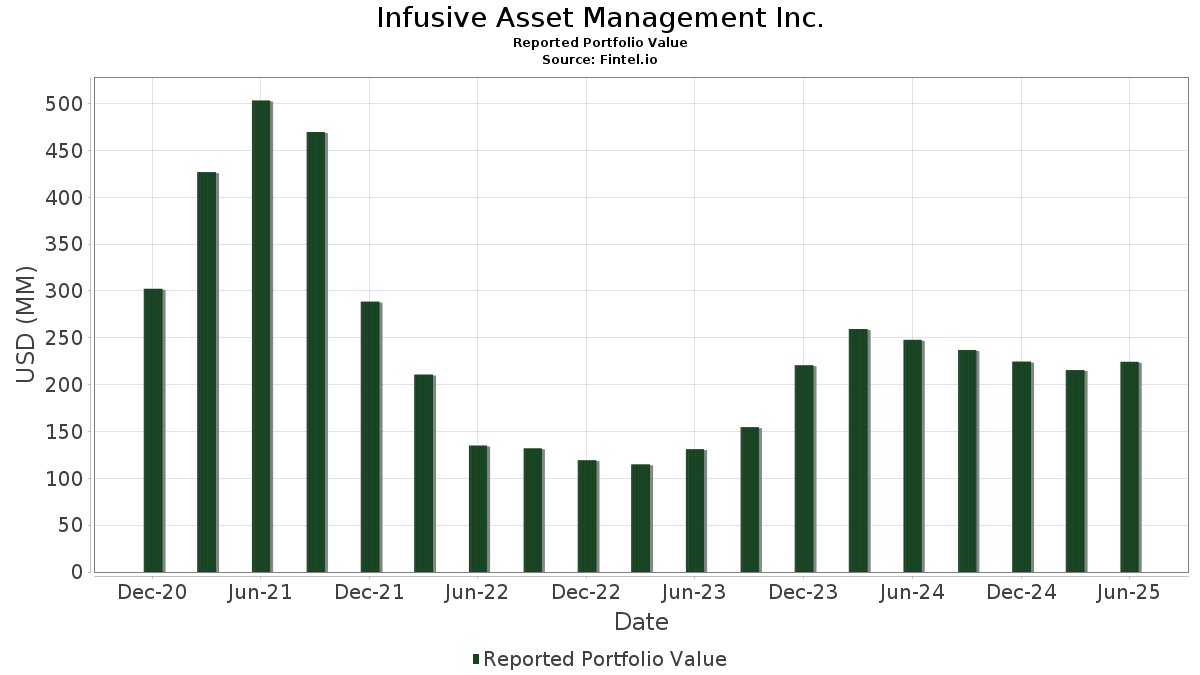

| Portfolio Value | $ 224,326,880 |

| Current Positions | 32 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Infusive Asset Management Inc. has disclosed 32 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 224,326,880 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Infusive Asset Management Inc.’s top holdings are Alphabet Inc. (US:GOOGL) , Amazon.com, Inc. (US:AMZN) , Meta Platforms, Inc. (US:META) , Costco Wholesale Corporation (US:COST) , and Walmart Inc. (US:WMT) . Infusive Asset Management Inc.’s new positions include Toyota Motor Corporation - Depositary Receipt (Common Stock) (US:TM) , Norwegian Cruise Line Holdings Ltd. (US:NCLH) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.13 | 23.57 | 10.5080 | 4.6286 | |

| 0.01 | 5.35 | 2.3838 | 2.3838 | |

| 0.04 | 5.27 | 2.3477 | 2.3477 | |

| 0.15 | 4.56 | 2.0314 | 1.3461 | |

| 0.02 | 2.83 | 1.2610 | 1.2610 | |

| 0.09 | 2.81 | 1.2535 | 1.2535 | |

| 0.08 | 18.54 | 8.2665 | 1.2435 | |

| 0.02 | 3.74 | 1.6690 | 1.0299 | |

| 0.02 | 3.59 | 1.5996 | 0.8984 | |

| 0.02 | 15.92 | 7.0987 | 0.7815 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 1.53 | 0.6811 | -1.9433 | |

| 0.06 | 9.47 | 4.2207 | -1.6885 | |

| 0.11 | 7.52 | 3.3505 | -1.2258 | |

| 0.03 | 1.93 | 0.8617 | -1.0658 | |

| 0.12 | 3.47 | 1.5472 | -1.0619 | |

| 0.03 | 9.61 | 4.2844 | -0.4658 | |

| 0.00 | 3.23 | 1.4400 | -0.3022 | |

| 0.06 | 5.52 | 2.4600 | -0.2342 | |

| 0.02 | 4.00 | 1.7847 | -0.2178 | |

| 0.02 | 6.25 | 2.7855 | -0.1823 |

13F and Fund Filings

This form was filed on 2025-08-14 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| GOOGL / Alphabet Inc. | 0.13 | 63.25 | 23.57 | 86.06 | 10.5080 | 4.6286 | |||

| AMZN / Amazon.com, Inc. | 0.08 | 6.26 | 18.54 | 22.53 | 8.2665 | 1.2435 | |||

| META / Meta Platforms, Inc. | 0.02 | -8.66 | 15.92 | 16.98 | 7.0987 | 0.7815 | |||

| COST / Costco Wholesale Corporation | 0.02 | 4.13 | 15.11 | 8.99 | 6.7337 | 0.3024 | |||

| WMT / Walmart Inc. | 0.15 | -5.37 | 15.05 | 5.39 | 6.7107 | 0.0827 | |||

| TSLA / Tesla, Inc. | 0.03 | -23.40 | 9.61 | -6.11 | 4.2844 | -0.4658 | |||

| PG / The Procter & Gamble Company | 0.06 | -20.47 | 9.47 | -25.65 | 4.2207 | -1.6885 | |||

| SHOP / Shopify Inc. | 0.07 | 9.18 | 8.13 | 31.98 | 3.6228 | 0.7654 | |||

| V / Visa Inc. | 0.02 | 7.06 | 7.87 | 8.47 | 3.5070 | 0.1413 | |||

| MA / Mastercard Incorporated | 0.01 | 8.16 | 7.67 | 10.90 | 3.4201 | 0.2095 | |||

| KO / The Coca-Cola Company | 0.11 | -22.85 | 7.52 | -23.79 | 3.3505 | -1.2258 | |||

| RACE / Ferrari N.V. | 0.01 | -11.93 | 6.57 | 1.00 | 2.9299 | -0.0897 | |||

| HD / The Home Depot, Inc. | 0.02 | -2.34 | 6.25 | -2.30 | 2.7855 | -0.1823 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.05 | 22.15 | 6.02 | 4.77 | 2.6842 | 0.0172 | |||

| CL / Colgate-Palmolive Company | 0.06 | -2.03 | 5.52 | -4.96 | 2.4600 | -0.2342 | |||

| SPOT / Spotify Technology S.A. | 0.01 | 5.35 | 2.3838 | 2.3838 | |||||

| DIS / The Walt Disney Company | 0.04 | 5.27 | 2.3477 | 2.3477 | |||||

| MCD / McDonald's Corporation | 0.02 | 18.47 | 4.98 | 10.81 | 2.2217 | 0.1347 | |||

| MELI / MercadoLibre, Inc. | 0.00 | -17.47 | 4.62 | 10.58 | 2.0587 | 0.1205 | |||

| MTCH / Match Group, Inc. | 0.15 | 211.69 | 4.56 | 208.67 | 2.0314 | 1.3461 | |||

| LOW / Lowe's Companies, Inc. | 0.02 | -2.48 | 4.00 | -7.23 | 1.7847 | -0.2178 | |||

| AXP / American Express Company | 0.01 | -2.12 | 3.98 | 16.05 | 1.7761 | 0.1830 | |||

| MDLZ / Mondelez International, Inc. | 0.06 | -2.42 | 3.90 | -3.01 | 1.7402 | -0.1275 | |||

| AAPL / Apple Inc. | 0.02 | 194.32 | 3.74 | 171.82 | 1.6690 | 1.0299 | |||

| SE / Sea Limited - Depositary Receipt (Common Stock) | 0.02 | 93.74 | 3.59 | 137.46 | 1.5996 | 0.8984 | |||

| CCL / Carnival Corporation & plc | 0.12 | -57.13 | 3.47 | -38.28 | 1.5472 | -1.0619 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -31.53 | 3.23 | -13.96 | 1.4400 | -0.3022 | |||

| TM / Toyota Motor Corporation - Depositary Receipt (Common Stock) | 0.02 | 2.83 | 1.2610 | 1.2610 | |||||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 0.09 | 2.81 | 1.2535 | 1.2535 | |||||

| NKE / NIKE, Inc. | 0.03 | -58.42 | 1.93 | -53.46 | 0.8617 | -1.0658 | |||

| NCLH / Norwegian Cruise Line Holdings Ltd. | 0.08 | 1.70 | 0.7599 | 0.7599 | |||||

| PEP / PepsiCo, Inc. | 0.01 | -69.32 | 1.53 | -73.00 | 0.6811 | -1.9433 | |||

| DPZ / Domino's Pizza, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HLT / Hilton Worldwide Holdings Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| KDP / Keurig Dr Pepper Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XYZ / Block, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| STZ / Constellation Brands, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DECK / Deckers Outdoor Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CMG / Chipotle Mexican Grill, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| YUM / Yum! Brands, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TGT / Target Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| TJX / The TJX Companies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |