Basic Stats

| Portfolio Value | $ 199,713,505 |

| Current Positions | 20 |

Latest Holdings, Performance, AUM (from 13F, 13D)

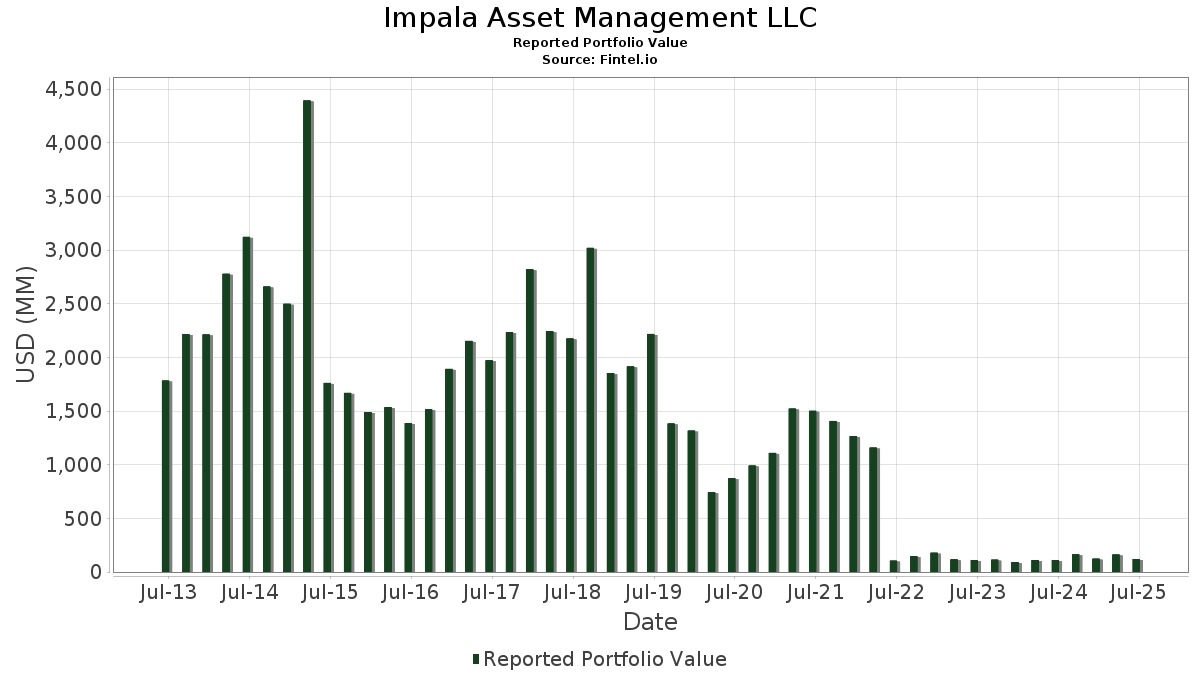

Impala Asset Management LLC has disclosed 20 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 199,713,505 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Impala Asset Management LLC’s top holdings are Ero Copper Corp. (US:ERO) , Academy Sports and Outdoors, Inc. (US:ASO) , The Buckle, Inc. (US:BKE) , Century Aluminum Company (US:CENX) , and Huntsman Corporation (US:HUN) . Impala Asset Management LLC’s new positions include Nintendo Co., Ltd. - Depositary Receipt (Common Stock) (US:NTDOY) , Chevron Corporation (US:CVX) , iShares, Inc. - iShares MSCI Brazil ETF (US:EWZ) , Hudbay Minerals Inc. (US:HBM) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.16 | 12.64 | 6.3280 | 2.9728 | |

| 0.07 | 5.47 | 2.7378 | 2.7378 | |

| 0.48 | 21.61 | 10.8227 | 2.2538 | |

| 1.70 | 28.49 | 14.2672 | 1.8433 | |

| 0.03 | 3.33 | 1.6679 | 1.6679 | |

| 0.09 | 3.04 | 1.5239 | 0.8805 | |

| 0.07 | 1.72 | 0.8611 | 0.8611 | |

| 0.01 | 1.57 | 0.7885 | 0.7885 | |

| 0.01 | 1.43 | 0.7170 | 0.7170 | |

| 0.03 | 0.98 | 0.4912 | 0.4912 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.29 | 11.60 | 5.8106 | -3.9235 | |

| 0.80 | 14.49 | 7.2535 | -3.3980 | |

| 0.36 | 16.19 | 8.1075 | -2.0950 | |

| 0.02 | 1.17 | 0.5834 | -1.3487 | |

| 0.10 | 8.20 | 4.1070 | -1.2477 | |

| 0.02 | 2.02 | 1.0110 | -0.6054 |

13F and Fund Filings

This form was filed on 2025-08-27 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| ERO / Ero Copper Corp. | 1.70 | 2.98 | 28.49 | 41.20 | 14.2672 | 1.8433 | |||

| ASO / Academy Sports and Outdoors, Inc. | 0.48 | 57.93 | 21.61 | 55.31 | 10.8227 | 2.2538 | |||

| BKE / The Buckle, Inc. | 0.36 | -17.37 | 16.19 | -2.29 | 8.1075 | -2.0950 | |||

| CENX / Century Aluminum Company | 0.80 | -13.76 | 14.49 | -16.27 | 7.2535 | -3.3980 | |||

| HUN / Huntsman Corporation | 1.16 | 259.00 | 12.64 | 131.91 | 6.3280 | 2.9728 | |||

| TECK / Teck Resources Limited | 0.29 | -33.78 | 11.60 | -26.60 | 5.8106 | -3.9235 | |||

| ANF / Abercrombie & Fitch Co. | 0.10 | -13.07 | 8.20 | -5.69 | 4.1070 | -1.2477 | |||

| ARCELORMITTAL SA LUXEMBOURG / NY REGISTRY SH (03938L023) | 0.19 | 5.87 | 0.0000 | ||||||

| ARCB / ArcBest Corporation | 0.07 | 5.47 | 2.7378 | 2.7378 | |||||

| NGD / New Gold Inc. | 0.94 | -6.00 | 4.65 | 25.42 | 2.3298 | 0.0457 | |||

| UPS / United Parcel Service, Inc. | 0.03 | 3.33 | 1.6679 | 1.6679 | |||||

| SLB / Schlumberger Limited | 0.09 | 260.17 | 3.04 | 191.20 | 1.5239 | 0.8805 | |||

| COP / ConocoPhillips | 0.02 | -10.00 | 2.02 | -23.09 | 1.0110 | -0.6054 | |||

| NTDOY / Nintendo Co., Ltd. - Depositary Receipt (Common Stock) | 0.07 | 1.72 | 0.8611 | 0.8611 | |||||

| AMR / Alpha Metallurgical Resources, Inc. | 0.01 | 1.57 | 0.7885 | 0.7885 | |||||

| CVX / Chevron Corporation | 0.01 | 1.43 | 0.7170 | 0.7170 | |||||

| NEU / NewMarket Corporation | 0.02 | -69.23 | 1.17 | -62.87 | 0.5834 | -1.3487 | |||

| IVANHOE MINES LTD / CL A (45679R104) | 0.15 | 1.13 | 0.0000 | ||||||

| EWZ / iShares, Inc. - iShares MSCI Brazil ETF | 0.03 | 0.98 | 0.4912 | 0.4912 | |||||

| HBM / Hudbay Minerals Inc. | 0.07 | 0.76 | 0.3816 | 0.3816 | |||||

| TNA / Direxion Shares ETF Trust - Direxion Daily Small Cap Bull 3X Shares | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WFG / West Fraser Timber Co. Ltd. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MTN / Vail Resorts, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |