Basic Stats

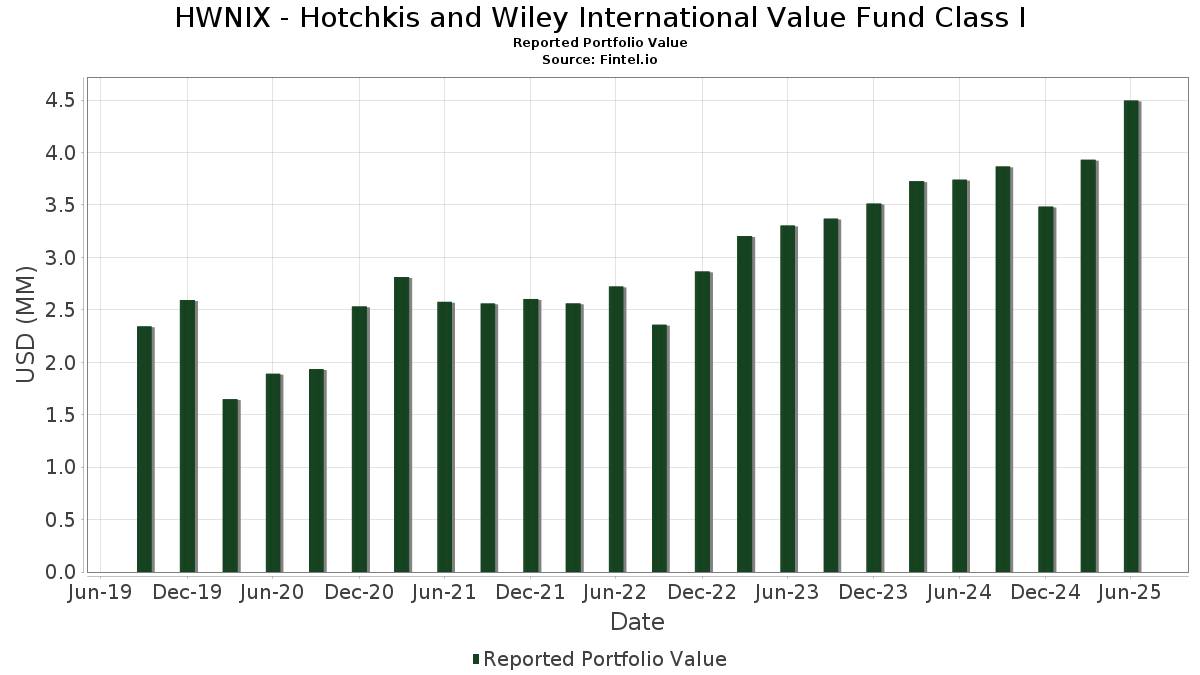

| Portfolio Value | $ 4,494,711 |

| Current Positions | 56 |

Latest Holdings, Performance, AUM (from 13F, 13D)

HWNIX - Hotchkis and Wiley International Value Fund Class I has disclosed 56 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 4,494,711 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). HWNIX - Hotchkis and Wiley International Value Fund Class I’s top holdings are Siemens Aktiengesellschaft (AT:SIE) , Telefonaktiebolaget LM Ericsson (publ) (DE:ERCB) , Henkel AG & Co. KGaA (CH:HEN) , Heineken Holding N.V. (NL:HEIO) , and Akzo Nobel N.V. (NL:AKZA) . HWNIX - Hotchkis and Wiley International Value Fund Class I’s new positions include National Grid plc (GB:NG.) , Arca Continental, S.A.B. de C.V. (MX:AC) , Burberry Group plc (US:BBRYF) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.20 | 4.1938 | 4.1938 | ||

| 0.00 | 0.07 | 1.4537 | 1.4537 | |

| 0.01 | 0.07 | 1.4064 | 1.4064 | |

| 0.00 | 0.18 | 3.7900 | 1.1518 | |

| 0.00 | 0.12 | 2.6339 | 1.0855 | |

| 0.00 | 0.08 | 1.7181 | 1.0427 | |

| 0.00 | 0.10 | 2.0148 | 0.9938 | |

| 0.00 | 0.04 | 0.8215 | 0.8215 | |

| 0.00 | 0.12 | 2.4516 | 0.8048 | |

| 0.04 | 0.06 | 1.3187 | 0.6014 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.05 | 1.0288 | -2.5608 | |

| 0.00 | 0.16 | 3.3444 | -0.5702 | |

| 0.00 | 0.09 | 1.9201 | -0.5207 | |

| 0.01 | 0.04 | 0.9196 | -0.5089 | |

| 0.02 | 0.11 | 2.3293 | -0.4920 | |

| 0.01 | 0.07 | 1.4308 | -0.4536 | |

| 0.02 | 0.19 | 3.9333 | -0.3888 | |

| 0.00 | 0.12 | 2.6160 | -0.3255 | |

| 0.01 | 0.03 | 0.5334 | -0.3199 | |

| 0.00 | 0.06 | 1.3606 | -0.3097 |

13F and Fund Filings

This form was filed on 2025-08-19 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SIE / Siemens Aktiengesellschaft | 0.00 | 12.86 | 0.20 | 25.47 | 4.2758 | 0.1648 | |||

| Royal Bank of Canada / STIV (N/A) | 0.20 | 4.1938 | 4.1938 | ||||||

| ERCB / Telefonaktiebolaget LM Ericsson (publ) | 0.02 | 0.00 | 0.19 | 10.06 | 3.9333 | -0.3888 | |||

| HEN / Henkel AG & Co. KGaA | 0.00 | 72.22 | 0.18 | 73.79 | 3.7900 | 1.1518 | |||

| HEIO / Heineken Holding N.V. | 0.00 | 0.00 | 0.16 | 3.27 | 3.3444 | -0.5702 | |||

| AKZA / Akzo Nobel N.V. | 0.00 | 0.00 | 0.16 | 13.97 | 3.2674 | -0.1937 | |||

| SHEL / Shell plc | 0.00 | 54.15 | 0.15 | 47.96 | 3.0652 | 0.5647 | |||

| LLOY / Lloyds Banking Group plc | 0.13 | 0.00 | 0.14 | 12.40 | 2.8804 | -0.2202 | |||

| FP / TotalEnergies SE | 0.00 | 116.40 | 0.12 | 106.67 | 2.6339 | 1.0855 | |||

| BNP / BNP Paribas SA | 0.00 | 0.00 | 0.12 | 7.83 | 2.6160 | -0.3255 | |||

| GLE / Société Générale Société anonyme | 0.00 | 0.00 | 0.12 | 26.80 | 2.5928 | 0.1251 | |||

| QAN / Qantas Airways Limited | 0.02 | 0.00 | 0.12 | 24.21 | 2.5009 | 0.0653 | |||

| 4091 / Nippon Sanso Holdings Corporation | 0.00 | 0.00 | 0.12 | 24.47 | 2.4719 | 0.0806 | |||

| AC / Accor SA | 0.00 | 56.34 | 0.12 | 81.25 | 2.4516 | 0.8048 | |||

| 4368 / Fuso Chemical Co.,Ltd. | 0.00 | 10.53 | 0.11 | 28.74 | 2.3720 | 0.1375 | |||

| 0WP / WPP plc | 0.02 | 7.53 | 0.11 | 0.00 | 2.3293 | -0.4920 | |||

| INGA / ING Groep N.V. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.11 | 11.22 | 2.3125 | -0.1820 | |||

| BCLYF / Barclays PLC | 0.02 | 0.00 | 0.10 | 24.05 | 2.0658 | 0.0371 | |||

| QS2A / Smiths Group plc | 0.00 | 93.75 | 0.10 | 137.50 | 2.0148 | 0.9938 | |||

| RAND / Randstad N.V. | 0.00 | 0.00 | 0.09 | 10.59 | 1.9966 | -0.1703 | |||

| JDEP / JDE Peet's N.V. | 0.00 | -27.33 | 0.09 | -4.21 | 1.9201 | -0.5207 | |||

| AIR / Airbus SE | 0.00 | 0.00 | 0.09 | 18.92 | 1.8735 | -0.0296 | |||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.09 | 29.85 | 1.8412 | 0.1266 | |||

| BMPS / Banca Monte dei Paschi di Siena S.p.A. | 0.01 | 0.00 | 0.09 | 6.25 | 1.8051 | -0.2376 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | 125.00 | 0.08 | 211.54 | 1.7181 | 1.0427 | |||

| LTMC / Lottomatica Group S.p.A. | 0.00 | 0.00 | 0.08 | 37.93 | 1.6963 | 0.2076 | |||

| MGA / Magna International Inc. | 0.00 | 0.00 | 0.08 | 13.43 | 1.6166 | -0.1009 | |||

| NG. / National Grid plc | 0.00 | 0.07 | 1.4537 | 1.4537 | |||||

| BCDRF / Banco Santander, S.A. | 0.01 | -25.45 | 0.07 | -9.46 | 1.4308 | -0.4536 | |||

| AC / Arca Continental, S.A.B. de C.V. | 0.01 | 0.07 | 1.4064 | 1.4064 | |||||

| PHIA / Koninklijke Philips N.V. | 0.00 | 4.22 | 0.06 | -1.54 | 1.3606 | -0.3097 | |||

| PCRFF / Panasonic Holdings Corporation | 0.01 | 136.00 | 0.06 | 117.24 | 1.3302 | 0.5718 | |||

| JP70 / Havas N.V. - Depositary Receipt (Common Stock) | 0.04 | 83.84 | 0.06 | 121.43 | 1.3187 | 0.6014 | |||

| VOD / Vodafone Group Public Limited Company | 0.05 | 0.00 | 0.05 | 14.89 | 1.1491 | -0.0682 | |||

| CAP / Capgemini SE | 0.00 | 0.00 | 0.05 | 13.33 | 1.0825 | -0.0638 | |||

| BCKIF / Babcock International Group PLC | 0.00 | -79.33 | 0.05 | -65.96 | 1.0288 | -2.5608 | |||

| CCEP / COCA COLA EUROPACIFIC COMPANY GUAR REGS 11/27 1.5 | 0.00 | 0.00 | 0.05 | 6.82 | 0.9964 | -0.1323 | |||

| RYSD / NatWest Group plc | 0.01 | -34.69 | 0.04 | -23.21 | 0.9196 | -0.5089 | |||

| MH6 / Tokio Marine Holdings, Inc. | 0.00 | 0.00 | 0.04 | 10.53 | 0.8930 | -0.0962 | |||

| ZURN / Zurich Insurance Group AG | 0.00 | 0.00 | 0.04 | 0.00 | 0.8699 | -0.1773 | |||

| SU / Suncor Energy Inc. | 0.00 | 0.00 | 0.04 | -2.38 | 0.8683 | -0.2148 | |||

| UNA / Unilever PLC | 0.00 | 0.00 | 0.04 | 2.56 | 0.8590 | -0.1546 | |||

| BMW3 / Bayerische Motoren Werke Aktiengesellschaft - Preferred Stock | 0.00 | 0.00 | 0.04 | 11.43 | 0.8330 | -0.0802 | |||

| SOC / Subsea 7 S.A. | 0.00 | 0.00 | 0.04 | 18.18 | 0.8307 | -0.0232 | |||

| BBRYF / Burberry Group plc | 0.00 | 0.04 | 0.8215 | 0.8215 | |||||

| MDT / Medtronic plc | 0.00 | 0.00 | 0.04 | -2.70 | 0.7715 | -0.1883 | |||

| MBG / Mercedes-Benz Group AG | 0.00 | 0.00 | 0.04 | 0.00 | 0.7611 | -0.1702 | |||

| GSK / GSK plc | 0.00 | 0.00 | 0.03 | 0.00 | 0.6617 | -0.1387 | |||

| RRTL / RTL Group S.A. | 0.00 | 0.00 | 0.03 | 16.67 | 0.5917 | -0.0254 | |||

| KOS / Kosmos Energy Ltd. | 0.01 | 0.00 | 0.03 | -24.24 | 0.5334 | -0.3199 | |||

| CVE / Cenovus Energy Inc. | 0.00 | 0.00 | 0.02 | -4.35 | 0.4788 | -0.1114 | |||

| GLCNF / Glencore plc | 0.01 | 0.00 | 0.02 | 10.00 | 0.4680 | -0.0625 | |||

| NOKIA / Nokia Oyj | 0.00 | 0.00 | 0.02 | 0.00 | 0.4483 | -0.1009 | |||

| CNH / CNH Industrial N.V. | 0.00 | 0.00 | 0.02 | 5.56 | 0.4077 | -0.0585 | |||

| BTE / Baytex Energy Corp. | 0.01 | 0.00 | 0.01 | -22.22 | 0.3134 | -0.1545 | |||

| PKIUF / Parkland Corporation | 0.00 | 0.00 | 0.01 | 10.00 | 0.2444 | -0.0166 |