Basic Stats

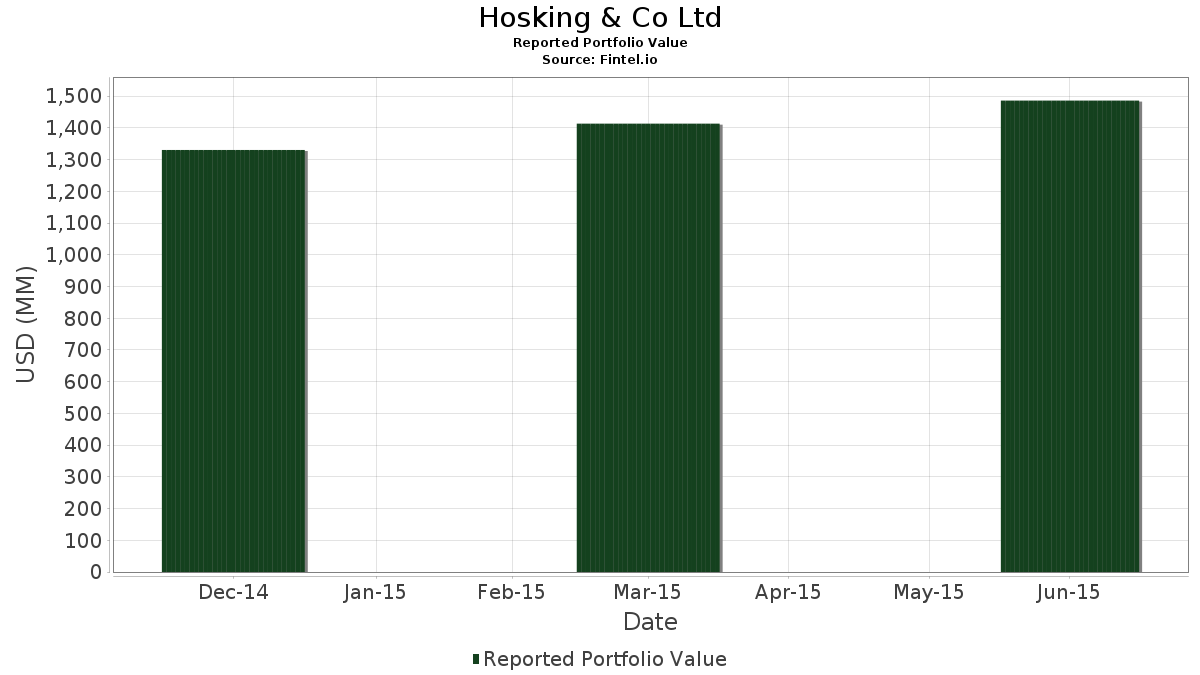

| Portfolio Value | $ 1,486,268,000 |

| Current Positions | 137 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Hosking & Co Ltd has disclosed 137 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,486,268,000 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Hosking & Co Ltd’s top holdings are Delta Air Lines, Inc. (US:DAL) , American Airlines Group Inc. (US:AAL) , American International Group, Inc. (US:AIG) , Amazon.com, Inc. (US:AMZN) , and Citigroup Inc. (US:C) . Hosking & Co Ltd’s new positions include NII Holdings, Inc. (US:NIHD) , Liberty Broadband Corporation (US:LBRDA) , Qurate Retail Inc - Series A (US:QRTEA) , Vipshop Holdings Limited - Depositary Receipt (Common Stock) (US:VIPS) , and Energizer Holdings, Inc. (US:ENR) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.40 | 13.11 | 0.8821 | 0.7455 | |

| 0.40 | 13.22 | 0.8893 | 0.7265 | |

| 0.13 | 56.09 | 3.7736 | 0.6111 | |

| 1.03 | 63.95 | 4.3027 | 0.5753 | |

| 0.48 | 29.21 | 1.9654 | 0.4629 | |

| 1.06 | 25.32 | 1.7039 | 0.4310 | |

| 0.98 | 54.30 | 3.6532 | 0.4073 | |

| 2.89 | 49.23 | 3.3123 | 0.3372 | |

| 0.29 | 4.71 | 0.3166 | 0.3166 | |

| 0.31 | 27.08 | 1.8219 | 0.2260 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.67 | 66.74 | 4.4902 | -1.7350 | |

| 1.83 | 75.28 | 5.0650 | -0.7209 | |

| 0.77 | 39.16 | 2.6345 | -0.5833 | |

| 0.69 | 12.93 | 0.8699 | -0.3546 | |

| 0.18 | 20.24 | 1.3619 | -0.3504 | |

| 0.83 | 44.76 | 3.0118 | -0.3108 | |

| 2.77 | 16.63 | 1.1191 | -0.2767 | |

| 0.32 | 16.82 | 1.1318 | -0.2722 | |

| 0.26 | 34.55 | 2.3243 | -0.2245 | |

| 0.30 | 23.62 | 1.5893 | -0.2164 |

13F and Fund Filings

This form was filed on 2015-08-13 for the reporting period 2015-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| DAL / Delta Air Lines, Inc. | 1.83 | 0.74 | 75.28 | -7.96 | 5.0650 | -0.7209 | |||

| AAL / American Airlines Group Inc. | 1.67 | 0.23 | 66.74 | -24.16 | 4.4902 | -1.7350 | |||

| AIG / American International Group, Inc. | 1.03 | 7.57 | 63.95 | 21.37 | 4.3027 | 0.5753 | |||

| AMZN / Amazon.com, Inc. | 0.13 | 7.54 | 56.09 | 25.46 | 3.7736 | 0.6111 | |||

| C / Citigroup Inc. | 0.98 | 10.37 | 54.30 | 18.34 | 3.6532 | 0.4073 | |||

| BAC / Bank of America Corporation | 2.89 | 5.85 | 49.23 | 17.06 | 3.3123 | 0.3372 | |||

| LBTYA / Liberty Global Ltd. | 0.83 | -9.27 | 44.76 | -4.69 | 3.0118 | -0.3108 | |||

| LBTYK / Liberty Global Ltd. | 0.77 | -15.31 | 39.16 | -13.92 | 2.6345 | -0.5833 | |||

| CBRE / CBRE Group, Inc. | 0.96 | 7.54 | 35.36 | 2.79 | 2.3790 | -0.0544 | |||

| COST / Costco Wholesale Corporation | 0.26 | 7.55 | 34.55 | -4.12 | 2.3243 | -0.2245 | |||

| GOOG / Alphabet Inc. | 0.06 | 7.74 | 30.58 | 2.34 | 2.0573 | -0.0564 | |||

| EBAY / eBay Inc. | 0.48 | 31.69 | 29.21 | 37.54 | 1.9654 | 0.4629 | |||

| COF / Capital One Financial Corporation | 0.31 | 7.55 | 27.08 | 20.04 | 1.8219 | 0.2260 | |||

| LAZ / Lazard, Inc. | 0.45 | 7.56 | 25.38 | 15.02 | 1.7076 | 0.1466 | |||

| CVC / Cablevision Systems Corp. | 1.06 | 7.59 | 25.32 | 40.74 | 1.7039 | 0.4310 | |||

| WFC / Wells Fargo & Company | 0.45 | 7.52 | 25.31 | 11.16 | 1.7029 | 0.0921 | |||

| BKNG / Booking Holdings Inc. | 0.02 | 7.58 | 25.22 | 6.40 | 1.6971 | 0.0200 | |||

| CX / CEMEX, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 2.74 | 11.74 | 25.10 | 8.08 | 1.6885 | 0.0459 | |||

| AXP / American Express Company | 0.30 | -6.98 | 23.62 | -7.46 | 1.5893 | -0.2164 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.16 | 7.52 | 22.11 | 1.40 | 1.4878 | -0.0549 | |||

| BEL / Belmond Ltd. | 1.66 | 2.12 | 20.68 | 3.87 | 1.3915 | -0.0171 | |||

| SLG / SL Green Realty Corp. | 0.18 | -2.30 | 20.24 | -16.37 | 1.3619 | -0.3504 | |||

| MGM / MGM Resorts International | 0.93 | 2.75 | 16.96 | -10.84 | 1.1409 | -0.2045 | |||

| UAL / United Airlines Holdings, Inc. | 0.32 | 7.53 | 16.82 | -15.24 | 1.1318 | -0.2722 | |||

| MBI / MBIA Inc. | 2.77 | 30.44 | 16.63 | -15.70 | 1.1191 | -0.2767 | |||

| IT / Gartner, Inc. | 0.19 | 7.61 | 16.47 | 10.09 | 1.1081 | 0.0498 | |||

| TSCO / Tractor Supply Company | 0.18 | 7.57 | 15.79 | 13.74 | 1.0625 | 0.0803 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.67 | 7.56 | 15.20 | 4.04 | 1.0228 | -0.0109 | |||

| F / Ford Motor Company | 1.01 | 7.45 | 15.19 | -0.07 | 1.0220 | -0.0533 | |||

| INTC / Intel Corporation | 0.50 | 2.27 | 15.11 | -0.53 | 1.0163 | -0.0579 | |||

| LVLT / Level 3 Financing Inc. - Corporate Bond/Note | 0.27 | 7.55 | 14.17 | 5.21 | 0.9532 | 0.0006 | |||

| DISCA / Discovery Inc - Class A | 0.40 | 431.25 | 13.22 | 474.40 | 0.8893 | 0.7265 | |||

| QRTEA / Qurate Retail Inc - Series A | 0.47 | 7.56 | 13.12 | 2.25 | 0.8826 | -0.0250 | |||

| SYF / Synchrony Financial | 0.40 | 525.88 | 13.11 | 578.97 | 0.8821 | 0.7455 | |||

| MU / Micron Technology, Inc. | 0.69 | 7.56 | 12.93 | -25.30 | 0.8699 | -0.3546 | |||

| 891894107 / Towers Watson & Co. | 0.10 | 7.53 | 12.65 | 2.34 | 0.8515 | -0.0234 | |||

| MS / Morgan Stanley | 0.32 | 7.55 | 12.54 | 16.89 | 0.8441 | 0.0848 | |||

| HBI / Hanesbrands Inc. | 0.33 | 7.54 | 11.01 | 6.94 | 0.7406 | 0.0124 | |||

| L / Loews Corporation | 0.28 | 7.55 | 10.84 | 1.44 | 0.7291 | -0.0266 | |||

| SCHW / The Charles Schwab Corporation | 0.32 | 7.46 | 10.48 | 15.27 | 0.7051 | 0.0619 | |||

| US21871D1037 / Corelogic Inc | 0.26 | 1.18 | 10.19 | 13.86 | 0.6855 | 0.0525 | |||

| BID / Sotheby's | 0.21 | -13.61 | 9.56 | -7.52 | 0.6430 | -0.0880 | |||

| EPAM / EPAM Systems, Inc. | 0.13 | 7.54 | 9.44 | 24.99 | 0.6350 | 0.1008 | |||

| SHW / The Sherwin-Williams Company | 0.03 | 7.51 | 8.90 | 3.92 | 0.5987 | -0.0070 | |||

| WDC / Western Digital Corporation | 0.11 | 7.55 | 8.63 | -7.33 | 0.5805 | -0.0781 | |||

| AMX / América Móvil, S.A.B. de C.V. - Depositary Receipt (Common Stock) | 0.40 | 7.57 | 8.43 | 12.05 | 0.5670 | 0.0349 | |||

| LOW / Lowe's Companies, Inc. | 0.12 | 7.57 | 7.99 | -3.16 | 0.5378 | -0.0461 | |||

| STX / Seagate Technology Holdings plc | 0.16 | 7.49 | 7.79 | -1.88 | 0.5240 | -0.0375 | |||

| TRIP / Tripadvisor, Inc. | 0.09 | 7.56 | 7.70 | 12.68 | 0.5178 | 0.0346 | |||

| SBRCY / Sberbank of Russia. - ADR | 1.42 | 3.15 | 7.55 | 25.34 | 0.5078 | 0.0818 | |||

| CFG / Citizens Financial Group, Inc. | 0.27 | 7.44 | 7.40 | 21.59 | 0.4980 | 0.0673 | |||

| MO / Altria Group, Inc. | 0.14 | 6.90 | 7.05 | 4.53 | 0.4747 | -0.0028 | |||

| HCKT / The Hackett Group, Inc. | 0.52 | 8.49 | 6.92 | 62.98 | 0.4654 | 0.1652 | |||

| / Delphi Technologies PLC | 0.08 | 7.60 | 6.92 | 14.83 | 0.4653 | 0.0392 | |||

| ANTM / Anthem Inc | 0.04 | 7.61 | 6.87 | 14.40 | 0.4625 | 0.0374 | |||

| NTES / NetEase, Inc. - Depositary Receipt (Common Stock) | 0.05 | 7.55 | 6.87 | 47.95 | 0.4619 | 0.1336 | |||

| TRCO / Tribune Media Company | 0.13 | 7.50 | 6.85 | -5.61 | 0.4610 | -0.0525 | |||

| MCO / Moody's Corporation | 0.06 | 2.29 | 6.78 | 6.38 | 0.4564 | 0.0053 | |||

| MHK / Mohawk Industries, Inc. | 0.04 | 7.57 | 6.76 | 10.55 | 0.4549 | 0.0222 | |||

| ADS / Bread Financial Holdings Inc | 0.02 | 7.57 | 6.67 | 6.00 | 0.4491 | 0.0036 | |||

| DNOW / DNOW Inc. | 0.33 | 7.52 | 6.64 | -1.07 | 0.4470 | -0.0281 | |||

| CAR / Avis Budget Group, Inc. | 0.15 | 7.51 | 6.49 | -19.70 | 0.4367 | -0.1351 | |||

| MSFT / Microsoft Corporation | 0.14 | -5.61 | 6.28 | 2.50 | 0.4226 | -0.0109 | |||

| FWONK / Formula One Group | 0.17 | 7.58 | 6.24 | 1.10 | 0.4198 | -0.0168 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.10 | 7.55 | 6.21 | 5.32 | 0.4181 | 0.0007 | |||

| JPM / JPMorgan Chase & Co. | 0.09 | 7.55 | 6.17 | 20.29 | 0.4149 | 0.0522 | |||

| ANDV / Andeavor Corp. | 0.07 | 7.56 | 6.13 | -0.55 | 0.4122 | -0.0236 | |||

| KKR / KKR & Co. Inc. | 0.26 | 7.59 | 6.03 | 7.79 | 0.4059 | 0.0100 | |||

| JEF / Jefferies Financial Group Inc. | 0.25 | 7.60 | 5.99 | 17.22 | 0.4027 | 0.0415 | |||

| MKL / Markel Group Inc. | 0.01 | 7.53 | 5.81 | 11.97 | 0.3908 | 0.0238 | |||

| BMY / Bristol-Myers Squibb Company | 0.09 | 7.60 | 5.73 | 10.98 | 0.3855 | 0.0203 | |||

| SIG / Signet Jewelers Limited | 0.04 | 7.54 | 5.71 | -0.64 | 0.3843 | -0.0224 | |||

| 772739207 / Rock-Tenn | 0.09 | 7.55 | 5.68 | 0.37 | 0.3823 | -0.0182 | |||

| HPQ / HP Inc. | 0.19 | 7.58 | 5.57 | 3.63 | 0.3749 | -0.0055 | |||

| ATVI / Activision Blizzard Inc | 0.23 | 7.55 | 5.57 | 14.58 | 0.3744 | 0.0308 | |||

| PM / Philip Morris International Inc. | 0.07 | 6.89 | 5.48 | 13.77 | 0.3686 | 0.0279 | |||

| COTY / Coty Inc. | 0.17 | -27.21 | 5.45 | -4.11 | 0.3670 | -0.0354 | |||

| BIDU / Baidu, Inc. - Depositary Receipt (Common Stock) | 0.03 | 7.56 | 5.40 | 2.74 | 0.3634 | -0.0085 | |||

| KR / The Kroger Co. | 0.07 | 7.57 | 5.17 | 1.73 | 0.3479 | -0.0117 | |||

| VRSK / Verisk Analytics, Inc. | 0.07 | 7.54 | 4.99 | 9.58 | 0.3355 | 0.0136 | |||

| BIO / Bio-Rad Laboratories, Inc. | 0.03 | 7.50 | 4.72 | 19.77 | 0.3175 | 0.0388 | |||

| NIHD / NII Holdings, Inc. | 0.29 | 4.71 | 0.3166 | 0.3166 | |||||

| GRMN / Garmin Ltd. | 0.11 | 7.52 | 4.67 | -0.60 | 0.3139 | -0.0181 | |||

| INDA / iShares Trust - iShares MSCI India ETF | 0.15 | 42.82 | 4.44 | 35.12 | 0.2987 | 0.0663 | |||

| FWONA / Formula One Group | 0.12 | 7.48 | 4.42 | 0.48 | 0.2974 | -0.0138 | |||

| EL / The Estée Lauder Companies Inc. | 0.05 | 7.54 | 4.35 | 12.06 | 0.2927 | 0.0181 | |||

| CSCO / Cisco Systems, Inc. | 0.15 | 7.50 | 4.21 | 7.24 | 0.2832 | 0.0055 | |||

| MAS / Masco Corporation | 0.16 | 7.59 | 4.14 | 7.47 | 0.2788 | 0.0060 | |||

| SMG / The Scotts Miracle-Gro Company | 0.07 | 7.58 | 4.14 | -5.17 | 0.2788 | -0.0303 | |||

| GGG / Graco Inc. | 0.06 | 7.56 | 4.07 | 5.87 | 0.2740 | 0.0019 | |||

| LBRDA / Liberty Broadband Corporation | 0.02 | 4.05 | 0.2727 | -0.0279 | |||||

| CF / CF Industries Holdings, Inc. | 0.06 | 437.51 | 4.04 | 21.82 | 0.2716 | 0.0372 | |||

| HRI / Herc Holdings Inc. | 0.22 | 7.52 | 4.02 | -10.13 | 0.2703 | -0.0459 | |||

| VVI / Pursuit Attractions and Hospitality, Inc. | 0.14 | 7.65 | 3.77 | 4.90 | 0.2534 | -0.0006 | |||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 0.11 | 7.54 | 3.69 | 24.84 | 0.2482 | 0.0392 | |||

| AMCX / AMC Networks Inc. | 0.04 | 7.52 | 3.66 | 14.82 | 0.2460 | 0.0207 | |||

| LGF.A / Lions Gate Entertainment Corp. | 0.08 | 7.57 | 3.59 | 39.78 | 0.2416 | 0.0599 | |||

| HBAN / Huntington Bancshares Incorporated | 0.31 | 7.60 | 3.47 | 10.12 | 0.2336 | 0.0106 | |||

| SNDK / Sandisk Corporation | 0.06 | 7.55 | 3.39 | -1.57 | 0.2281 | -0.0156 | |||

| LBRDK / Liberty Broadband Corporation | 0.07 | 7.21 | 3.37 | -3.10 | 0.2270 | -0.0193 | |||

| LBRDA / Liberty Broadband Corporation | 0.06 | 7.50 | 3.27 | -3.00 | 0.2198 | -0.0185 | |||

| KSU / Kansas City Southern | 0.03 | 7.54 | 3.11 | -3.95 | 0.2094 | -0.0198 | |||

| US09175M1018 / Blue Nile, Inc. | 0.10 | 7.59 | 3.10 | 2.69 | 0.2082 | -0.0050 | |||

| QRTEA / Qurate Retail Inc - Series A | 0.08 | 3.02 | 0.2030 | -0.0094 | |||||

| RTN / Raytheon Co. | 0.03 | 7.51 | 2.92 | -5.87 | 0.1963 | -0.0230 | |||

| USG / USCF ETF Trust - USCF Gold Strategy Plus Income Fund | 0.10 | 7.60 | 2.82 | 11.99 | 0.1897 | 0.0116 | |||

| VZ / Verizon Communications Inc. | 0.06 | 7.51 | 2.59 | 3.03 | 0.1741 | -0.0036 | |||

| MIC / Macquarie Infrastructure Holdings LLC - Units | 0.03 | 7.44 | 2.53 | 7.89 | 0.1702 | 0.0043 | |||

| PSMT / PriceSmart, Inc. | 0.03 | 7.55 | 2.38 | 15.47 | 0.1602 | 0.0143 | |||

| BK / The Bank of New York Mellon Corporation | 0.06 | 7.55 | 2.37 | 12.22 | 0.1595 | 0.0100 | |||

| GOOGL / Alphabet Inc. | 0.00 | 7.50 | 2.26 | 4.68 | 0.1521 | -0.0007 | |||

| SOHU / Sohu.com Limited - Depositary Receipt (Common Stock) | 0.04 | 7.56 | 2.18 | 19.15 | 0.1469 | 0.0173 | |||

| DISCK / Warner Bros.Discovery Inc - Series C | 0.06 | 7.45 | 1.97 | 13.27 | 0.1327 | 0.0095 | |||

| HOG / Harley-Davidson, Inc. | 0.03 | 7.55 | 1.95 | -0.20 | 0.1313 | -0.0070 | |||

| BKU / BankUnited, Inc. | 0.05 | 7.54 | 1.94 | 17.99 | 0.1302 | 0.0142 | |||

| IHRT / iHeartMedia, Inc. | 0.24 | 8.92 | 1.75 | 66.29 | 0.1175 | 0.0432 | |||

| VIPS / Vipshop Holdings Limited - Depositary Receipt (Common Stock) | 0.08 | 1.72 | 0.1157 | 0.1157 | |||||

| TCOM / Trip.com Group Limited - Depositary Receipt (Common Stock) | 0.02 | 7.56 | 1.72 | 33.26 | 0.1157 | 0.0244 | |||

| ENR / Energizer Holdings, Inc. | 0.01 | 1.68 | 0.1132 | 0.1132 | |||||

| REV / Revlon, Inc. - Class A | 0.05 | -16.86 | 1.67 | -25.94 | 0.1124 | -0.0472 | |||

| LPX / Louisiana-Pacific Corporation | 0.10 | 7.57 | 1.64 | 11.00 | 0.1100 | 0.0058 | |||

| ERJ / Embraer S.A. - Depositary Receipt (Common Stock) | 0.05 | 7.56 | 1.48 | 5.93 | 0.0998 | 0.0007 | |||

| BYD / Boyd Gaming Corporation | 0.09 | 7.55 | 1.41 | 13.22 | 0.0945 | 0.0067 | |||

| RMBS / Rambus Inc. | 0.09 | 7.55 | 1.27 | 23.90 | 0.0854 | 0.0129 | |||

| EAF / GrafTech International Ltd. | 0.25 | 7.51 | 1.26 | 37.17 | 0.0849 | 0.0198 | |||

| HAL / Halliburton Company | 0.03 | 7.56 | 1.17 | 5.59 | 0.0789 | 0.0003 | |||

| FLR / Fluor Corporation | 0.02 | 7.57 | 1.14 | -0.26 | 0.0769 | -0.0042 | |||

| LXFT / Luxoft Holding, Inc. | 0.02 | 7.56 | 1.02 | 17.55 | 0.0690 | 0.0073 | |||

| WBA / Walgreens Boots Alliance, Inc. | 0.01 | 7.63 | 1.02 | 7.36 | 0.0687 | 0.0014 | |||

| X / United States Steel Corporation | 0.04 | 7.50 | 0.86 | -9.15 | 0.0581 | -0.0091 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | 7.52 | 0.71 | -2.88 | 0.0476 | -0.0039 | |||

| XRX / Xerox Holdings Corporation | 0.04 | 7.53 | 0.43 | -10.91 | 0.0291 | -0.0052 | |||

| FNMA / Federal National Mortgage Association | 0.19 | 7.54 | 0.43 | 6.40 | 0.0291 | 0.0003 | |||

| 87270T106 / Tribune Publishing Co | 0.02 | 7.47 | 0.32 | -13.93 | 0.0212 | -0.0047 | |||

| RYAAY / Ryanair Holdings plc - Depositary Receipt (Common Stock) | 0.00 | 3.50 | 0.28 | 10.32 | 0.0187 | 0.0009 | |||

| LTRPA / Liberty TripAdvisor Holdings, Inc. | 0.01 | 7.30 | 0.25 | 8.70 | 0.0168 | 0.0005 | |||

| CTCM / CTC Media, Inc. | 0.10 | 7.68 | 0.23 | -38.17 | 0.0155 | -0.0108 | |||

| EPC / Edgewell Personal Care Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.1161 | ||||

| 19041P105 / CBS Corp. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1653 | ||||

| DTV / DTE Energy Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.0681 | ||||

| SSA / Sistema PJSFC | 0.00 | -100.00 | 0.00 | -100.00 | -0.0545 | ||||

| US61179L1008 / Mindray Medical International Limited | 0.00 | -100.00 | 0.00 | -100.00 | -0.1668 |