Basic Stats

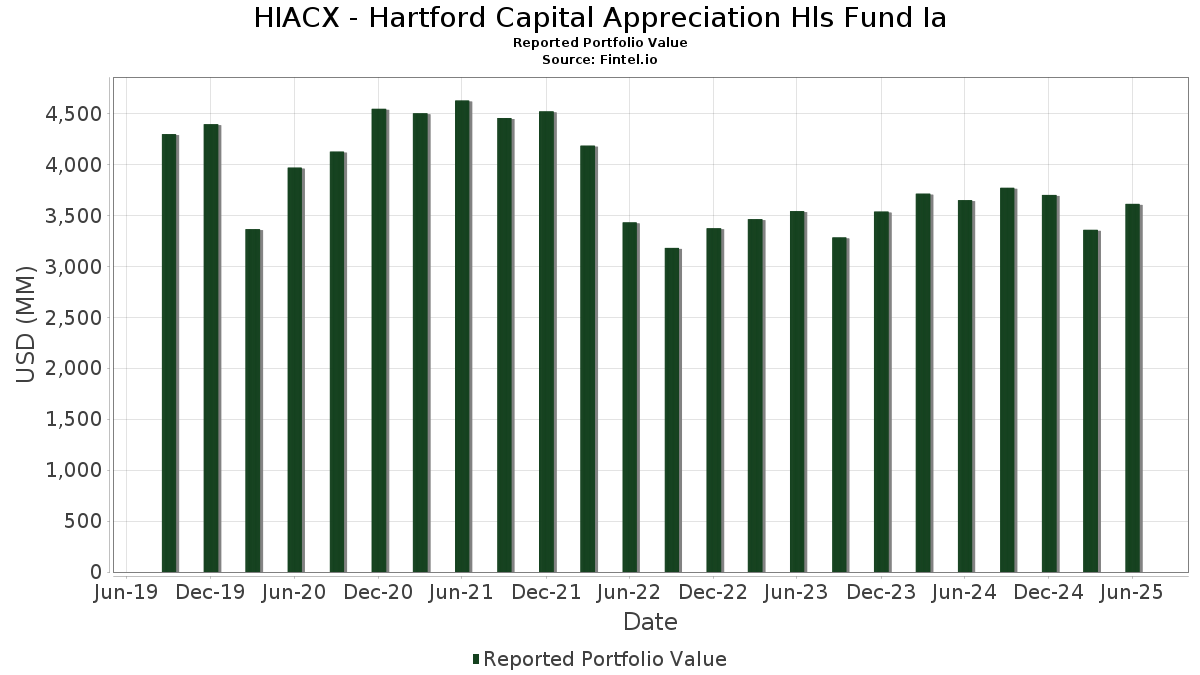

| Portfolio Value | $ 3,612,105,941 |

| Current Positions | 161 |

Latest Holdings, Performance, AUM (from 13F, 13D)

HIACX - Hartford Capital Appreciation Hls Fund Ia has disclosed 161 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 3,612,105,941 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). HIACX - Hartford Capital Appreciation Hls Fund Ia’s top holdings are Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , Broadcom Inc. (US:AVGO) , and Alphabet Inc. (US:GOOGL) . HIACX - Hartford Capital Appreciation Hls Fund Ia’s new positions include Flutter Entertainment plc (US:FLUT) , Interactive Brokers Group, Inc. (US:IBKR) , State Street Navigator Securities Lending Government Money Market Portfolio (US:US8575093013) , Somnigroup International Inc. (US:SGI) , and The Cooper Companies, Inc. (US:COO) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 1.45 | 229.72 | 6.3153 | 1.6457 | |

| 0.55 | 152.07 | 4.1806 | 1.5817 | |

| 0.48 | 238.95 | 6.5690 | 1.2925 | |

| 0.79 | 138.63 | 3.8112 | 1.1186 | |

| 0.07 | 56.28 | 1.5473 | 0.5392 | |

| 0.18 | 19.22 | 0.5284 | 0.5284 | |

| 0.12 | 86.06 | 2.3660 | 0.5078 | |

| 0.09 | 29.40 | 0.8081 | 0.4731 | |

| 0.06 | 16.65 | 0.4578 | 0.4578 | |

| 0.15 | 13.48 | 0.3706 | 0.3706 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.80 | 163.89 | 4.5057 | -1.4704 | |

| 0.27 | 18.98 | 0.5218 | -0.7806 | |

| 0.05 | 25.60 | 0.7039 | -0.7210 | |

| 0.06 | 20.12 | 0.5531 | -0.5744 | |

| 0.14 | 41.37 | 1.1374 | -0.4621 | |

| 0.05 | 15.11 | 0.4155 | -0.3543 | |

| 0.12 | 43.39 | 1.1928 | -0.3203 | |

| 0.28 | 13.12 | 0.3608 | -0.2320 | |

| 0.10 | 23.39 | 0.6431 | -0.2243 | |

| 0.06 | 9.11 | 0.2504 | -0.2175 |

13F and Fund Filings

This form was filed on 2025-08-25 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.48 | 0.19 | 238.95 | 32.76 | 6.5690 | 1.2925 | |||

| NVDA / NVIDIA Corporation | 1.45 | -1.07 | 229.72 | 44.22 | 6.3153 | 1.6457 | |||

| AAPL / Apple Inc. | 0.80 | -12.95 | 163.89 | -19.60 | 4.5057 | -1.4704 | |||

| AVGO / Broadcom Inc. | 0.55 | 4.19 | 152.07 | 71.54 | 4.1806 | 1.5817 | |||

| GOOGL / Alphabet Inc. | 0.79 | 32.45 | 138.63 | 50.94 | 3.8112 | 1.1186 | |||

| AMZN / Amazon.com, Inc. | 0.55 | -12.75 | 119.86 | 0.61 | 3.2953 | -0.1974 | |||

| META / Meta Platforms, Inc. | 0.12 | 6.03 | 86.06 | 35.78 | 2.3660 | 0.5078 | |||

| CB / Chubb Limited | 0.20 | 22.83 | 57.40 | 17.84 | 1.5780 | 0.1500 | |||

| LLY / Eli Lilly and Company | 0.07 | 73.41 | 56.28 | 63.68 | 1.5473 | 0.5392 | |||

| V / Visa Inc. | 0.12 | -17.02 | 43.39 | -15.94 | 1.1928 | -0.3203 | |||

| ACN / Accenture plc | 0.14 | -20.83 | 41.37 | -24.17 | 1.1374 | -0.4621 | |||

| INTU / Intuit Inc. | 0.05 | -20.41 | 40.55 | 2.10 | 1.1147 | -0.0496 | |||

| TJX / The TJX Companies, Inc. | 0.31 | -3.65 | 38.83 | -2.31 | 1.0675 | -0.0978 | |||

| TXN / Texas Instruments Incorporated | 0.18 | -0.91 | 37.22 | 14.48 | 1.0231 | 0.0701 | |||

| LIN / Linde plc | 0.08 | -3.76 | 37.21 | -3.03 | 1.0229 | -0.1020 | |||

| MCD / McDonald's Corporation | 0.12 | 0.73 | 35.73 | -5.79 | 0.9822 | -0.1295 | |||

| NFLX / Netflix, Inc. | 0.03 | -12.35 | 35.55 | 25.87 | 0.9774 | 0.1493 | |||

| MA / Mastercard Incorporated | 0.06 | -7.57 | 35.50 | -5.24 | 0.9759 | -0.1223 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.16 | 4.05 | 35.13 | -6.78 | 0.9657 | -0.1390 | |||

| KO / The Coca-Cola Company | 0.49 | -0.36 | 34.86 | -1.58 | 0.9585 | -0.0800 | |||

| AMT / American Tower Corporation | 0.15 | 25.76 | 34.24 | 27.74 | 0.9413 | 0.1555 | |||

| SPGI / S&P Global Inc. | 0.06 | -0.95 | 33.56 | 2.79 | 0.9225 | -0.0345 | |||

| WFC / Wells Fargo & Company | 0.41 | -2.74 | 32.47 | 8.55 | 0.8926 | 0.0157 | |||

| AXP / American Express Company | 0.10 | 6.14 | 32.41 | 25.83 | 0.8909 | 0.1359 | |||

| HON / Honeywell International Inc. | 0.14 | -13.68 | 31.47 | -5.07 | 0.8651 | -0.1067 | |||

| PG / The Procter & Gamble Company | 0.19 | -7.25 | 30.89 | -13.29 | 0.8493 | -0.1952 | |||

| DHR / Danaher Corporation | 0.15 | -1.34 | 30.56 | -4.93 | 0.8402 | -0.1023 | |||

| TSLA / Tesla, Inc. | 0.09 | 109.87 | 29.40 | 157.26 | 0.8081 | 0.4731 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.15 | 21.78 | 28.98 | 19.52 | 0.7968 | 0.0859 | |||

| SYK / Stryker Corporation | 0.07 | -5.09 | 28.65 | 0.87 | 0.7877 | -0.0450 | |||

| NOC / Northrop Grumman Corporation | 0.06 | 27.57 | 28.04 | 24.57 | 0.7710 | 0.1110 | |||

| RJF / Raymond James Financial, Inc. | 0.17 | -2.74 | 26.84 | 7.39 | 0.7379 | 0.0051 | |||

| DIS / The Walt Disney Company | 0.21 | -2.74 | 25.69 | 22.20 | 0.7064 | 0.0900 | |||

| LYV / Live Nation Entertainment, Inc. | 0.17 | -2.68 | 25.66 | 12.75 | 0.7056 | 0.0382 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.05 | -42.24 | 25.60 | -47.32 | 0.7039 | -0.7210 | |||

| GOOG / Alphabet Inc. | 0.14 | -7.84 | 24.72 | 4.64 | 0.6795 | -0.0130 | |||

| TMUS / T-Mobile US, Inc. | 0.10 | -11.50 | 23.39 | -20.94 | 0.6431 | -0.2243 | |||

| FCX / Freeport-McMoRan Inc. | 0.54 | -2.74 | 23.30 | 11.36 | 0.6405 | 0.0272 | |||

| MTB / M&T Bank Corporation | 0.11 | -2.73 | 21.78 | 5.56 | 0.5989 | -0.0061 | |||

| EMR / Emerson Electric Co. | 0.16 | -2.74 | 21.53 | 18.28 | 0.5918 | 0.0582 | |||

| ANET / Arista Networks Inc | 0.21 | 36.78 | 21.42 | 80.62 | 0.5889 | 0.2412 | |||

| EQIX / Equinix, Inc. | 0.03 | 0.76 | 20.97 | -1.70 | 0.5765 | -0.0489 | |||

| MS / Morgan Stanley | 0.15 | -16.90 | 20.50 | 0.33 | 0.5635 | -0.0354 | |||

| UNH / UnitedHealth Group Incorporated | 0.06 | -12.18 | 20.12 | -47.69 | 0.5531 | -0.5744 | |||

| CAH / Cardinal Health, Inc. | 0.12 | -2.73 | 20.02 | 18.62 | 0.5503 | 0.0556 | |||

| UNA / Unilever PLC | 0.32 | -2.92 | 19.63 | -0.70 | 0.5396 | -0.0399 | |||

| TSN / Tyson Foods, Inc. | 0.35 | 7.23 | 19.51 | -5.99 | 0.5363 | -0.0721 | |||

| KKR / KKR & Co. Inc. | 0.15 | 105.22 | 19.50 | 136.15 | 0.5361 | 0.2940 | |||

| VLO / Valero Energy Corporation | 0.14 | 10.33 | 19.39 | 12.29 | 0.5332 | 0.0269 | |||

| PLD / Prologis, Inc. | 0.18 | 19.22 | 0.5284 | 0.5284 | |||||

| DOV / Dover Corporation | 0.10 | -2.75 | 19.13 | 1.43 | 0.5259 | -0.0270 | |||

| NXPI / NXP Semiconductors N.V. | 0.09 | -2.75 | 19.08 | 11.80 | 0.5246 | 0.0242 | |||

| NKE / NIKE, Inc. | 0.27 | -61.82 | 18.98 | -57.28 | 0.5218 | -0.7806 | |||

| SPF / Spotify Technology S.A. | 0.02 | -12.31 | 18.75 | 22.33 | 0.5153 | 0.0661 | |||

| IBE / Iberdrola, S.A. | 0.97 | -14.29 | 18.71 | 2.11 | 0.5143 | -0.0228 | |||

| COP / ConocoPhillips | 0.21 | -2.74 | 18.67 | -16.89 | 0.5132 | -0.1453 | |||

| KR / The Kroger Co. | 0.25 | -2.73 | 17.68 | 3.07 | 0.4861 | -0.0168 | |||

| ABNB / Airbnb, Inc. | 0.13 | -2.74 | 17.53 | 7.74 | 0.4820 | 0.0049 | |||

| SLB / Schlumberger Limited | 0.51 | -8.23 | 17.40 | -25.80 | 0.4784 | -0.2091 | |||

| XOM / Exxon Mobil Corporation | 0.16 | -19.48 | 17.03 | -27.02 | 0.4683 | -0.2159 | |||

| TPG / TPG Inc. | 0.32 | 53.04 | 16.89 | 69.25 | 0.4644 | 0.1718 | |||

| FLUT / Flutter Entertainment plc | 0.06 | 16.65 | 0.4578 | 0.4578 | |||||

| DGX / Quest Diagnostics Incorporated | 0.09 | -13.12 | 16.60 | -7.76 | 0.4562 | -0.0712 | |||

| RS / Reliance, Inc. | 0.05 | -2.74 | 16.54 | 5.73 | 0.4548 | -0.0039 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.23 | -12.25 | 16.40 | -16.57 | 0.4507 | -0.1254 | |||

| ORCL / Oracle Corporation | 0.07 | -53.38 | 15.64 | -3.33 | 0.4300 | -0.0188 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.32 | -2.74 | 15.61 | -15.28 | 0.4291 | -0.1110 | |||

| ALLY / Ally Financial Inc. | 0.40 | 26.82 | 15.49 | 35.45 | 0.4259 | 0.0906 | |||

| ES / Eversource Energy | 0.24 | -15.29 | 15.47 | -13.24 | 0.4254 | -0.0974 | |||

| SRE / Sempra | 0.20 | 29.64 | 15.41 | 37.65 | 0.4237 | 0.0955 | |||

| FWONK / Formula One Group | 0.14 | -2.60 | 15.13 | 13.09 | 0.4160 | 0.0237 | |||

| CME / CME Group Inc. | 0.05 | -44.60 | 15.11 | -42.44 | 0.4155 | -0.3543 | |||

| KDP / Keurig Dr Pepper Inc. | 0.44 | -9.68 | 14.68 | -12.74 | 0.4035 | -0.0896 | |||

| A / Agilent Technologies, Inc. | 0.12 | -2.74 | 14.60 | -1.89 | 0.4013 | -0.0349 | |||

| EXC / Exelon Corporation | 0.34 | -2.74 | 14.56 | -8.35 | 0.4002 | -0.0655 | |||

| T / AT&T Inc. | 0.49 | 6.79 | 14.17 | 9.28 | 0.3895 | 0.0094 | |||

| TRU / TransUnion | 0.16 | -2.73 | 13.70 | 3.14 | 0.3767 | -0.0128 | |||

| AVB / AvalonBay Communities, Inc. | 0.07 | -2.38 | 13.62 | -7.44 | 0.3744 | -0.0569 | |||

| SBUX / Starbucks Corporation | 0.15 | 13.48 | 0.3706 | 0.3706 | |||||

| EG / Everest Group, Ltd. | 0.04 | -2.74 | 13.23 | -9.02 | 0.3637 | -0.0626 | |||

| DKNG / DraftKings Inc. | 0.31 | -2.60 | 13.21 | 25.80 | 0.3632 | 0.0553 | |||

| BMY / Bristol-Myers Squibb Company | 0.28 | -14.48 | 13.12 | -35.09 | 0.3608 | -0.2320 | |||

| ADM / Archer-Daniels-Midland Company | 0.25 | 51.98 | 13.02 | 67.09 | 0.3581 | 0.1295 | |||

| WTY / Willis Towers Watson Public Limited Company | 0.04 | 9.50 | 12.99 | -0.69 | 0.3570 | -0.0263 | |||

| CNQ / Canadian Natural Resources Limited | 0.41 | -2.74 | 12.98 | -0.85 | 0.3568 | -0.0269 | |||

| MU / Micron Technology, Inc. | 0.11 | -2.74 | 12.96 | 37.97 | 0.3562 | 0.0809 | |||

| NOW / ServiceNow, Inc. | 0.01 | -2.54 | 12.94 | 25.85 | 0.3557 | 0.0543 | |||

| UDR / UDR, Inc. | 0.31 | -2.74 | 12.77 | -12.08 | 0.3511 | -0.0748 | |||

| CACI / CACI International Inc | 0.03 | -33.46 | 12.74 | -13.55 | 0.3503 | -0.0818 | |||

| B / Barrick Mining Corporation | 0.60 | -10.01 | 12.48 | -3.62 | 0.3432 | -0.0365 | |||

| 669 / Techtronic Industries Company Limited | 1.13 | -2.09 | 12.44 | -9.85 | 0.3419 | -0.0625 | |||

| ADBE / Adobe Inc. | 0.03 | -2.75 | 12.43 | -1.90 | 0.3416 | -0.0297 | |||

| GEV / GE Vernova Inc. | 0.02 | -2.63 | 12.36 | 68.79 | 0.3399 | 0.1251 | |||

| CRL / Charles River Laboratories International, Inc. | 0.08 | 9.52 | 12.35 | 10.41 | 0.3395 | 0.0116 | |||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 12.34 | 0.3393 | 0.3393 | ||||||

| GD / General Dynamics Corporation | 0.04 | -2.76 | 12.24 | 4.05 | 0.3364 | -0.0084 | |||

| TW / Tradeweb Markets Inc. | 0.08 | -2.02 | 12.13 | -3.37 | 0.3334 | -0.0346 | |||

| BAH / Booz Allen Hamilton Holding Corporation | 0.12 | 94.20 | 12.08 | 93.37 | 0.3322 | 0.1490 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.01 | -2.73 | 11.98 | 17.64 | 0.3292 | 0.0308 | |||

| BSX / Boston Scientific Corporation | 0.11 | -2.60 | 11.95 | 3.71 | 0.3285 | -0.0093 | |||

| MET / MetLife, Inc. | 0.15 | -2.74 | 11.94 | -2.59 | 0.3282 | -0.0311 | |||

| PPG / PPG Industries, Inc. | 0.10 | -2.73 | 11.92 | 1.18 | 0.3276 | -0.0177 | |||

| NBIX / Neurocrine Biosciences, Inc. | 0.09 | -2.72 | 11.66 | 10.55 | 0.3207 | 0.0114 | |||

| IBKR / Interactive Brokers Group, Inc. | 0.21 | 11.65 | 0.3203 | 0.3203 | |||||

| ZTS / Zoetis Inc. | 0.07 | 65.90 | 11.36 | 49.24 | 0.3124 | 0.1090 | |||

| NTRA / Natera, Inc. | 0.07 | -3.12 | 11.28 | 15.73 | 0.3101 | 0.0244 | |||

| GNTX / Gentex Corporation | 0.51 | -2.73 | 11.21 | -8.21 | 0.3082 | -0.0498 | |||

| CRH / CRH plc | 0.12 | -2.92 | 11.13 | 2.25 | 0.3060 | -0.0131 | |||

| ROK / Rockwell Automation, Inc. | 0.03 | -2.76 | 11.11 | 25.01 | 0.3053 | 0.0449 | |||

| BLDR / Builders FirstSource, Inc. | 0.09 | -2.74 | 10.80 | -9.16 | 0.2970 | -0.0517 | |||

| UNP / Union Pacific Corporation | 0.05 | -5.09 | 10.76 | -7.56 | 0.2958 | -0.0455 | |||

| IJF / ICON Public Limited Company | 0.07 | 42.18 | 10.66 | 18.17 | 0.2932 | 0.0286 | |||

| FSLR / First Solar, Inc. | 0.06 | -2.75 | 10.53 | 27.33 | 0.2895 | 0.0471 | |||

| CRM / Salesforce, Inc. | 0.04 | -38.13 | 10.49 | -37.14 | 0.2884 | -0.2009 | |||

| FLEX / Flex Ltd. | 0.21 | -1.46 | 10.34 | 48.71 | 0.2841 | 0.0804 | |||

| UBER / Uber Technologies, Inc. | 0.11 | -47.73 | 10.23 | -33.07 | 0.2814 | -0.1669 | |||

| WH / Wyndham Hotels & Resorts, Inc. | 0.12 | -2.74 | 10.02 | -12.73 | 0.2756 | -0.0612 | |||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.23 | -2.74 | 9.98 | -1.08 | 0.2743 | -0.0214 | |||

| STZ / Constellation Brands, Inc. | 0.06 | -35.62 | 9.11 | -42.93 | 0.2504 | -0.2175 | |||

| CTRA / Coterra Energy Inc. | 0.35 | -2.74 | 8.81 | -14.59 | 0.2421 | -0.0602 | |||

| HD / The Home Depot, Inc. | 0.02 | 8.71 | 0.2394 | 0.2394 | |||||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.15 | -15.20 | 8.69 | -17.68 | 0.2388 | -0.0705 | |||

| EXAS / Exact Sciences Corporation | 0.16 | 7.50 | 8.60 | 31.96 | 0.2365 | 0.0454 | |||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 8.47 | 8.47 | 0.2328 | 0.2328 | |||||

| GDDY / GoDaddy Inc. | 0.05 | -3.13 | 8.15 | -3.17 | 0.2239 | -0.0227 | |||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | 0.05 | -1.46 | 8.11 | 49.24 | 0.2228 | 0.0636 | |||

| D / Dominion Energy, Inc. | 0.14 | 7.85 | 0.2159 | 0.2159 | |||||

| QCOM / QUALCOMM Incorporated | 0.05 | -2.76 | 7.69 | 0.81 | 0.2114 | -0.0122 | |||

| MAMMOTH BRANDS / EC (000000000) | 0.35 | 7.68 | 0.2112 | 0.2112 | |||||

| MAMMOTH BRANDS / EC (000000000) | 0.35 | 7.68 | 0.2112 | 0.2112 | |||||

| GL / Globe Life Inc. | 0.06 | -2.74 | 7.48 | -8.21 | 0.2055 | -0.0333 | |||

| SHOP / Shopify Inc. | 0.06 | -22.94 | 7.15 | -16.41 | 0.1966 | -0.0308 | |||

| TRGP / Targa Resources Corp. | 0.04 | -3.04 | 7.14 | -15.81 | 0.1962 | -0.0523 | |||

| Z / Zillow Group, Inc. | 0.10 | -1.46 | 7.12 | 0.68 | 0.1958 | -0.0116 | |||

| CH1134540470 / On Holding AG | 0.13 | -2.97 | 6.93 | 15.00 | 0.1906 | 0.0138 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.02 | -3.32 | 6.85 | -11.22 | 0.1884 | -0.0379 | |||

| VOYA / Voya Financial, Inc. | 0.10 | -36.56 | 6.83 | -33.52 | 0.1878 | -0.1135 | |||

| CNC / Centene Corporation | 0.12 | -1.49 | 6.70 | -11.92 | 0.1842 | -0.0388 | |||

| MAR / Marriott International, Inc. | 0.02 | 6.62 | 0.1820 | 0.1820 | |||||

| RTX / RTX Corporation | 0.05 | 6.58 | 0.1808 | 0.1808 | |||||

| FMC / FMC Corporation | 0.15 | -2.73 | 6.47 | -3.75 | 0.1778 | -0.0192 | |||

| SGI / Somnigroup International Inc. | 0.09 | 6.43 | 0.1768 | 0.1768 | |||||

| GILD / Gilead Sciences, Inc. | 0.06 | 6.31 | 0.1734 | 0.1734 | |||||

| TORY BURCH PRIVATE PLACE / EC (000000000) | 0.12 | 6.22 | 0.1710 | 0.1710 | |||||

| TORY BURCH PRIVATE PLACE / EC (000000000) | 0.12 | 6.22 | 0.1710 | 0.1710 | |||||

| DOCU / DocuSign, Inc. | 0.07 | -1.49 | 5.84 | -5.73 | 0.1605 | -0.0211 | |||

| CHWY / Chewy, Inc. | 0.14 | 5.82 | 0.1599 | 0.1599 | |||||

| ISRG / Intuitive Surgical, Inc. | 0.01 | -42.96 | 5.78 | -37.42 | 0.1589 | -0.1119 | |||

| LVS / Las Vegas Sands Corp. | 0.13 | -6.81 | 5.54 | 4.96 | 0.1523 | -0.0024 | |||

| BRBR / BellRing Brands, Inc. | 0.09 | -1.46 | 4.99 | -23.35 | 0.1373 | -0.0537 | |||

| AIR / Airbus SE | 0.02 | 0.00 | 4.85 | 18.81 | 0.1332 | 0.0136 | |||

| KMX / CarMax, Inc. | 0.07 | 80.64 | 4.72 | 55.79 | 0.1298 | 0.0410 | |||

| HUM / Humana Inc. | 0.02 | -5.40 | 4.64 | -12.61 | 0.1276 | -0.0281 | |||

| APP / AppLovin Corporation | 0.01 | -0.37 | 4.58 | 31.62 | 0.1260 | 0.0239 | |||

| COO / The Cooper Companies, Inc. | 0.05 | 3.28 | 0.0902 | 0.0902 | |||||

| JHX / James Hardie Industries plc - Depositary Receipt (Common Stock) | 0.09 | 2.43 | 0.0669 | 0.0669 | |||||

| JHX / James Hardie Industries plc - Depositary Receipt (Common Stock) | 0.09 | 2.43 | 0.0669 | 0.0669 | |||||

| S+P500 EMINI FUT SEP25 / DE (000000000) | 2.21 | 0.0608 | 0.0608 | ||||||

| S+P500 EMINI FUT SEP25 / DE (000000000) | 2.21 | 0.0608 | 0.0608 | ||||||

| MAGIC LEAP CL A COMMON / EC (000000000) | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| MAGIC LEAP CL A COMMON / EC (000000000) | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| FI / Fiserv, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1776 | ||||

| TEAM / Atlassian Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1584 |