Basic Stats

| Portfolio Value | $ 148,777,643 |

| Current Positions | 39 |

Latest Holdings, Performance, AUM (from 13F, 13D)

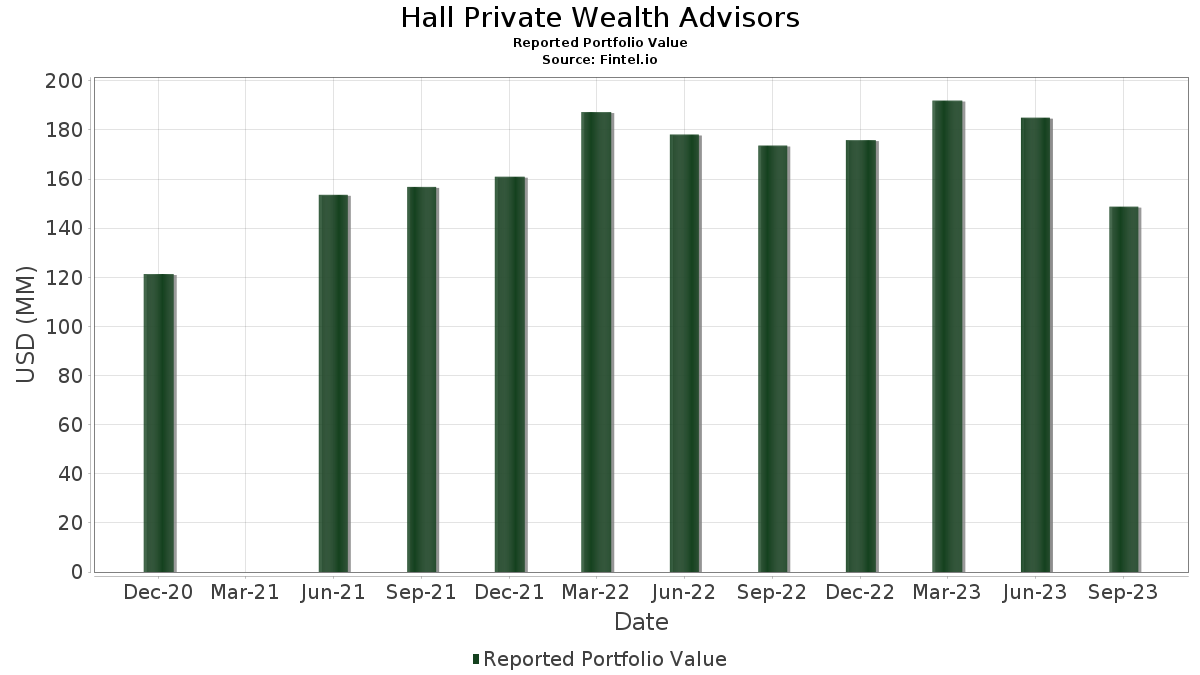

Hall Private Wealth Advisors has disclosed 39 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 148,777,643 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Hall Private Wealth Advisors’s top holdings are Apple Inc. (US:AAPL) , SPDR Series Trust - SPDR Bloomberg Convertible Securities ETF (US:CWB) , Digital Realty Trust, Inc. (US:DLR) , Vanguard World Fund - Vanguard Information Technology ETF (US:VGT) , and Amazon.com, Inc. (US:AMZN) . Hall Private Wealth Advisors’s new positions include Wells Fargo & Company (US:WFC) , Nektar Therapeutics (US:NKTR) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 17.79 | 11.9604 | 3.6860 | |

| 0.26 | 17.54 | 11.7872 | 2.2490 | |

| 0.10 | 12.62 | 8.4838 | 2.1226 | |

| 0.02 | 9.37 | 6.2994 | 1.7233 | |

| 0.08 | 10.46 | 7.0307 | 1.2888 | |

| 0.05 | 6.52 | 4.3845 | 1.1449 | |

| 0.03 | 10.52 | 7.0741 | 0.8488 | |

| 0.01 | 4.33 | 2.9104 | 0.7576 | |

| 0.12 | 7.41 | 4.9831 | 0.7012 | |

| 0.06 | 4.37 | 2.9362 | 0.6201 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.00 | -5.5979 | ||

| 0.03 | 1.02 | 0.6884 | -3.7938 | |

| 0.11 | 5.41 | 3.6333 | -2.2380 | |

| 0.00 | 0.00 | -1.1919 | ||

| 0.03 | 2.03 | 1.3623 | -0.8750 | |

| 0.08 | 2.65 | 1.7787 | -0.7336 | |

| 0.02 | 0.14 | 0.0971 | -0.5924 | |

| 0.03 | 1.05 | 0.7070 | -0.5900 | |

| 0.01 | 1.31 | 0.8803 | -0.4728 | |

| 0.00 | 0.27 | 0.1835 | -0.3646 |

13F and Fund Filings

This form was filed on 2023-11-15 for the reporting period 2023-09-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.10 | 31.69 | 17.79 | 16.24 | 11.9604 | 3.6860 | |||

| CWB / SPDR Series Trust - SPDR Bloomberg Convertible Securities ETF | 0.26 | 2.53 | 17.54 | -0.63 | 11.7872 | 2.2490 | |||

| DLR / Digital Realty Trust, Inc. | 0.10 | 0.91 | 12.62 | 7.25 | 8.4838 | 2.1226 | |||

| VGT / Vanguard World Fund - Vanguard Information Technology ETF | 0.03 | -2.62 | 10.52 | -8.62 | 7.0741 | 0.8488 | |||

| AMZN / Amazon.com, Inc. | 0.08 | 0.97 | 10.46 | -1.53 | 7.0307 | 1.2888 | |||

| COST / Costco Wholesale Corporation | 0.02 | 5.49 | 9.37 | 10.70 | 6.2994 | 1.7233 | |||

| IRM / Iron Mountain Incorporated | 0.14 | -26.43 | 8.15 | -23.02 | 5.4787 | -0.2444 | |||

| K / Kellanova | 0.12 | 5.99 | 7.41 | -6.43 | 4.9831 | 0.7012 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.05 | 12.12 | 6.52 | 8.84 | 4.3845 | 1.1449 | |||

| MSFT / Microsoft Corporation | 0.02 | -0.52 | 6.23 | -7.77 | 4.1901 | 0.5372 | |||

| IHI / iShares Trust - iShares U.S. Medical Devices ETF | 0.11 | -42.07 | 5.41 | -50.24 | 3.6333 | -2.2380 | |||

| F / Ford Motor Company | 0.38 | 2.51 | 4.69 | -15.85 | 3.1541 | 0.1401 | |||

| VICSX / Vanguard Scottsdale Funds - Vanguard IT Corporate Bond Index Fund Admiral | 0.06 | 6.03 | 4.37 | 1.94 | 2.9362 | 0.6201 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.01 | 12.09 | 4.33 | 8.71 | 2.9104 | 0.7576 | |||

| VZ / Verizon Communications Inc. | 0.08 | -34.67 | 2.65 | -43.07 | 1.7787 | -0.7336 | |||

| NAC / Nuveen California Quality Municipal Income Fund | 0.23 | 44.94 | 2.25 | 28.14 | 1.5090 | 0.5616 | |||

| GSL / Global Ship Lease, Inc. | 0.12 | -23.75 | 2.23 | -27.93 | 1.4972 | -0.1731 | |||

| MDT / Medtronic plc | 0.03 | -44.95 | 2.03 | -51.05 | 1.3623 | -0.8750 | |||

| TLRY / Tilray Brands, Inc. | 0.79 | -2.03 | 1.88 | 50.12 | 1.2627 | 0.5862 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | -43.93 | 1.31 | -47.70 | 0.8803 | -0.4728 | |||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.00 | -1.56 | 1.29 | -4.16 | 0.8683 | 0.1402 | |||

| INTC / Intel Corporation | 0.03 | -58.77 | 1.05 | -56.19 | 0.7070 | -0.5900 | |||

| ICVT / iShares Trust - iShares Convertible Bond ETF | 0.01 | 0.00 | 1.04 | -2.80 | 0.7000 | 0.1208 | |||

| NEP / XPLR Infrastructure, LP - Limited Partnership | 0.03 | -75.62 | 1.02 | -87.65 | 0.6884 | -3.7938 | |||

| VIGI / Vanguard Whitehall Funds - Vanguard International Dividend Appreciation ETF | 0.01 | -5.80 | 0.91 | -10.46 | 0.6097 | 0.0618 | |||

| EQIX / Equinix, Inc. | 0.00 | 0.00 | 0.83 | -7.37 | 0.5580 | 0.0736 | |||

| NOK / Nokia Oyj - Depositary Receipt (Common Stock) | 0.21 | -36.55 | 0.80 | -42.94 | 0.5378 | -0.2203 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.60 | -2.75 | 0.4050 | 0.0702 | |||

| DIS / The Walt Disney Company | 0.01 | -2.39 | 0.60 | -11.44 | 0.4012 | 0.0371 | |||

| CMF / iShares Trust - iShares California Muni Bond ETF | 0.01 | 24.20 | 0.46 | 19.48 | 0.3097 | 0.1015 | |||

| WFC / Wells Fargo & Company | 0.01 | 0.40 | 0.2664 | 0.2664 | |||||

| AFRM / Affirm Holdings, Inc. | 0.02 | -12.50 | 0.37 | 21.57 | 0.2502 | 0.0845 | |||

| TFC / Truist Financial Corporation | 0.01 | -21.04 | 0.36 | -25.56 | 0.2447 | -0.0197 | |||

| RIVN / Rivian Automotive, Inc. | 0.01 | -37.50 | 0.30 | -9.01 | 0.2040 | 0.0239 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | -50.30 | 0.29 | -59.61 | 0.1951 | -0.1935 | |||

| BUD / Anheuser-Busch InBev SA/NV - Depositary Receipt (Common Stock) | 0.00 | -72.38 | 0.27 | -73.08 | 0.1835 | -0.3646 | |||

| MCD / McDonald's Corporation | 0.00 | -1.50 | 0.26 | -13.13 | 0.1739 | 0.0131 | |||

| EVVAQ / Enviva Inc. | 0.02 | -83.56 | 0.14 | -88.71 | 0.0971 | -0.5924 | |||

| NKTR / Nektar Therapeutics | 0.01 | 0.01 | 0.0040 | 0.0040 | |||||

| NVDA / NVIDIA Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1461 | ||||

| STEM / Stem, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0550 | ||||

| APPH / AppHarvest Inc | 0.00 | -100.00 | 0.00 | -100.00 | -0.0084 | ||||

| C.WSA / Citigroup, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1121 | ||||

| SPY / SPDR S&P 500 ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.1125 | ||||

| GILD / Gilead Sciences, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1813 | ||||

| ATVI / Activision Blizzard Inc | 0.00 | -100.00 | 0.00 | -100.00 | -5.5979 | ||||

| DNMR / Danimer Scientific, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0480 | ||||

| D / Dominion Energy, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1919 |