Basic Stats

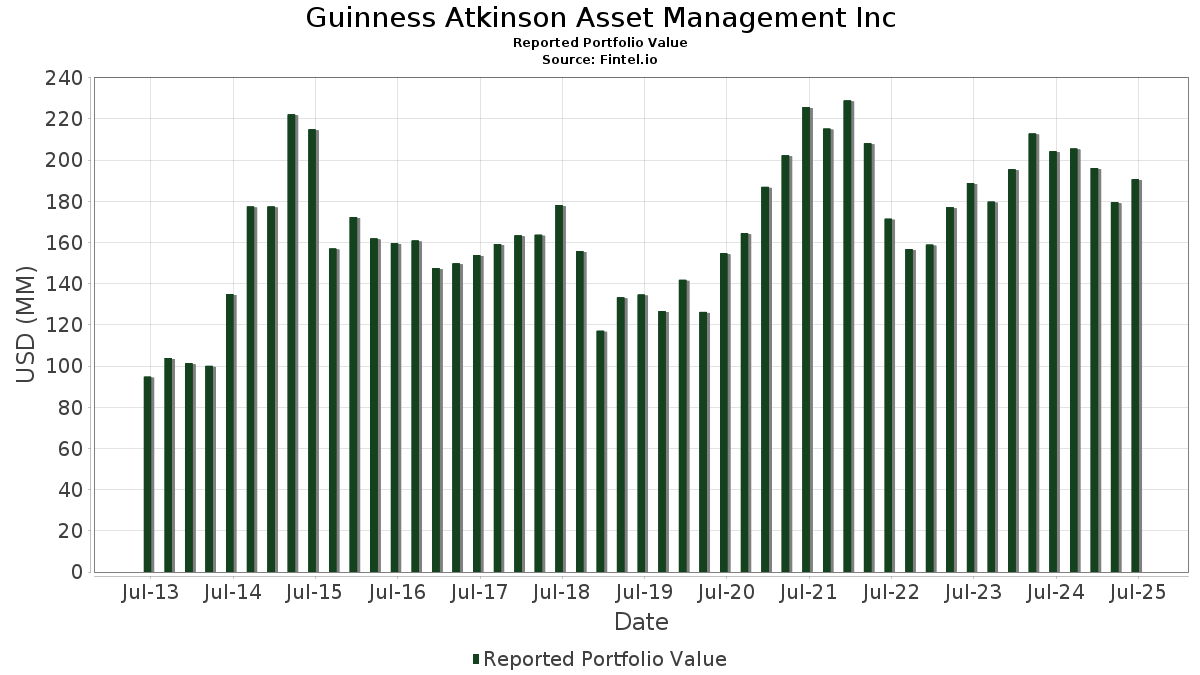

| Portfolio Value | $ 190,679,687 |

| Current Positions | 84 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Guinness Atkinson Asset Management Inc has disclosed 84 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 190,679,687 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Guinness Atkinson Asset Management Inc’s top holdings are Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) (US:TSM) , Amphenol Corporation (US:APH) , NVIDIA Corporation (US:NVDA) , Netflix, Inc. (US:NFLX) , and Microsoft Corporation (US:MSFT) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 9.78 | 5.1273 | 0.9055 | |

| 0.10 | 9.40 | 4.9291 | 0.9004 | |

| 0.05 | 8.40 | 4.4038 | 0.7711 | |

| 0.02 | 8.14 | 4.2669 | 0.6204 | |

| 0.07 | 6.76 | 3.5439 | 0.5096 | |

| 0.01 | 7.32 | 3.8389 | 0.4994 | |

| 0.01 | 8.33 | 4.3711 | 0.4493 | |

| 0.01 | 7.56 | 3.9654 | 0.4225 | |

| 0.01 | 7.63 | 3.9993 | 0.4196 | |

| 0.01 | 2.08 | 1.0893 | 0.2696 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 4.19 | 2.1974 | -0.8937 | |

| 0.02 | 5.07 | 2.6573 | -0.6407 | |

| 0.01 | 5.74 | 3.0126 | -0.5790 | |

| 0.02 | 7.21 | 3.7793 | -0.4971 | |

| 0.01 | 7.34 | 3.8482 | -0.4545 | |

| 0.02 | 4.97 | 2.6062 | -0.3339 | |

| 0.01 | 4.66 | 2.4423 | -0.3330 | |

| 0.04 | 6.47 | 3.3918 | -0.3070 | |

| 0.04 | 7.21 | 3.7823 | -0.2944 | |

| 0.00 | 0.54 | 0.2855 | -0.2021 |

13F and Fund Filings

This form was filed on 2025-08-01 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.04 | -5.45 | 9.78 | 29.01 | 5.1273 | 0.9055 | |||

| APH / Amphenol Corporation | 0.10 | -13.68 | 9.40 | 29.97 | 4.9291 | 0.9004 | |||

| NVDA / NVIDIA Corporation | 0.05 | -11.66 | 8.40 | 28.79 | 4.4038 | 0.7711 | |||

| NFLX / Netflix, Inc. | 0.01 | -17.55 | 8.33 | 18.40 | 4.3711 | 0.4493 | |||

| MSFT / Microsoft Corporation | 0.02 | -6.19 | 8.14 | 24.31 | 4.2669 | 0.6204 | |||

| META / Meta Platforms, Inc. | 0.01 | -7.33 | 7.63 | 18.68 | 3.9993 | 0.4196 | |||

| INTU / Intuit Inc. | 0.01 | -7.32 | 7.56 | 18.90 | 3.9654 | 0.4225 | |||

| MA / Mastercard Incorporated | 0.01 | -7.33 | 7.34 | -5.00 | 3.8482 | -0.4545 | |||

| FTXP / Foothills Exploration, Inc. | 0.01 | -7.33 | 7.32 | 22.11 | 3.8389 | 0.4994 | |||

| ICE / Intercontinental Exchange, Inc. | 0.04 | -7.34 | 7.21 | -1.44 | 3.7823 | -0.2944 | |||

| V / Visa Inc. | 0.02 | -7.34 | 7.21 | -6.12 | 3.7793 | -0.4971 | |||

| LRCX / Lam Research Corporation | 0.07 | -7.34 | 6.76 | 24.07 | 3.5439 | 0.5096 | |||

| AMZN / Amazon.com, Inc. | 0.03 | -7.33 | 6.69 | 6.85 | 3.5111 | 0.0206 | |||

| AME / AMETEK, Inc. | 0.04 | -7.34 | 6.47 | -2.59 | 3.3918 | -0.3070 | |||

| AMAT / Applied Materials, Inc. | 0.03 | -8.59 | 6.10 | 15.30 | 3.1984 | 0.2520 | |||

| GOOGL / Alphabet Inc. | 0.03 | -7.34 | 5.96 | 5.60 | 3.1245 | -0.0185 | |||

| ROP / Roper Technologies, Inc. | 0.01 | -7.33 | 5.74 | -10.90 | 3.0126 | -0.5790 | |||

| DHR / Danaher Corporation | 0.03 | 10.05 | 5.52 | 6.06 | 2.8935 | -0.0050 | |||

| AAPL / Apple Inc. | 0.02 | -7.34 | 5.07 | -14.41 | 2.6573 | -0.6407 | |||

| CRM / Salesforce, Inc. | 0.02 | -7.33 | 4.97 | -5.84 | 2.6062 | -0.3339 | |||

| ADBE / Adobe Inc. | 0.01 | -7.33 | 4.66 | -6.52 | 2.4423 | -0.3330 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | -7.33 | 4.19 | -24.48 | 2.1974 | -0.8937 | |||

| AVGO / Broadcom Inc. | 0.01 | -14.26 | 2.08 | 41.20 | 1.0893 | 0.2696 | |||

| NTES / NetEase, Inc. - Depositary Receipt (Common Stock) | 0.01 | -10.71 | 1.91 | 16.78 | 1.0041 | 0.0905 | |||

| AFL / Aflac Incorporated | 0.01 | 6.29 | 1.45 | 0.83 | 0.7621 | -0.0409 | |||

| MDLZ / Mondelez International, Inc. | 0.02 | 0.00 | 1.28 | -0.62 | 0.6730 | -0.0462 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 0.00 | 1.28 | 15.61 | 0.6718 | 0.0541 | |||

| CME / CME Group Inc. | 0.00 | 0.00 | 1.28 | 3.90 | 0.6710 | -0.0151 | |||

| CSCO / Cisco Systems, Inc. | 0.02 | 0.00 | 1.24 | 12.45 | 0.6490 | 0.0358 | |||

| BLK / BlackRock, Inc. | 0.00 | 0.00 | 1.20 | 10.85 | 0.6268 | 0.0262 | |||

| KO / The Coca-Cola Company | 0.02 | 0.00 | 1.18 | -1.26 | 0.6187 | -0.0466 | |||

| EMR / Emerson Electric Co. | 0.01 | 0.00 | 1.18 | 21.59 | 0.6176 | 0.0781 | |||

| OTIS / Otis Worldwide Corporation | 0.01 | 0.00 | 1.15 | -4.02 | 0.6017 | -0.0644 | |||

| AJG / Arthur J. Gallagher & Co. | 0.00 | 0.00 | 1.11 | -7.28 | 0.5814 | -0.0847 | |||

| PAYX / Paychex, Inc. | 0.01 | 0.00 | 1.11 | -5.71 | 0.5802 | -0.0735 | |||

| JNJ / Johnson & Johnson | 0.01 | 0.00 | 1.10 | -7.87 | 0.5776 | -0.0885 | |||

| ABBV / AbbVie Inc. | 0.01 | 0.00 | 1.10 | -11.41 | 0.5743 | -0.1143 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | 0.00 | 1.07 | -0.28 | 0.5634 | -0.0369 | |||

| PG / The Procter & Gamble Company | 0.01 | 0.00 | 1.06 | -6.51 | 0.5578 | -0.0760 | |||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 0.03 | 0.00 | 1.06 | -20.63 | 0.5553 | -0.1878 | |||

| PEP / PepsiCo, Inc. | 0.01 | 0.00 | 1.02 | -11.97 | 0.5362 | -0.1106 | |||

| BIDU / Baidu, Inc. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 1.02 | -6.84 | 0.5357 | -0.0750 | |||

| HUBB / Hubbell Incorporated | 0.00 | -9.28 | 0.91 | 11.99 | 0.4753 | 0.0244 | |||

| NEE / NextEra Energy, Inc. | 0.01 | -13.08 | 0.83 | -14.89 | 0.4351 | -0.1079 | |||

| ITRI / Itron, Inc. | 0.01 | -17.83 | 0.77 | 3.20 | 0.4057 | -0.0117 | |||

| ORA / Ormat Technologies, Inc. | 0.01 | -13.72 | 0.73 | 2.11 | 0.3817 | -0.0154 | |||

| ON / ON Semiconductor Corporation | 0.01 | -8.79 | 0.65 | 17.41 | 0.3433 | 0.0329 | |||

| FSLR / First Solar, Inc. | 0.00 | -9.58 | 0.56 | 18.32 | 0.2951 | 0.0303 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | -27.48 | 0.54 | -37.83 | 0.2855 | -0.2021 | |||

| CSL / Carlisle Companies Incorporated | 0.00 | -7.47 | 0.53 | 1.54 | 0.2765 | -0.0130 | |||

| CVX / Chevron Corporation | 0.00 | 0.00 | 0.52 | -14.38 | 0.2720 | -0.0656 | |||

| XOM / Exxon Mobil Corporation | 0.00 | 0.00 | 0.51 | -9.30 | 0.2661 | -0.0457 | |||

| IBP / Installed Building Products, Inc. | 0.00 | -8.33 | 0.50 | -3.46 | 0.2634 | -0.0268 | |||

| OC / Owens Corning | 0.00 | -8.36 | 0.45 | -11.87 | 0.2379 | -0.0485 | |||

| KMI / Kinder Morgan, Inc. | 0.01 | 0.00 | 0.43 | 3.11 | 0.2261 | -0.0070 | |||

| IMO / Imperial Oil Limited | 0.01 | 0.00 | 0.43 | 9.77 | 0.2244 | 0.0076 | |||

| VLO / Valero Energy Corporation | 0.00 | 0.00 | 0.40 | 1.77 | 0.2118 | -0.0093 | |||

| SU / Suncor Energy Inc. | 0.01 | 0.00 | 0.40 | -3.13 | 0.2110 | -0.0207 | |||

| COP / ConocoPhillips | 0.00 | 0.00 | 0.39 | -14.60 | 0.2029 | -0.0493 | |||

| ENB / Enbridge Inc. | 0.01 | 0.00 | 0.37 | 2.21 | 0.1944 | -0.0075 | |||

| PWR / Quanta Services, Inc. | 0.00 | -14.26 | 0.35 | 27.54 | 0.1848 | 0.0309 | |||

| EOG / EOG Resources, Inc. | 0.00 | 0.00 | 0.35 | -6.70 | 0.1829 | -0.0254 | |||

| CNQ / Canadian Natural Resources Limited | 0.01 | 0.00 | 0.35 | 2.37 | 0.1809 | -0.0073 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | 58.36 | 0.34 | 64.56 | 0.1779 | 0.0628 | |||

| ATHM / Autohome Inc. - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.32 | -6.76 | 0.1664 | -0.0236 | |||

| FANG / Diamondback Energy, Inc. | 0.00 | 0.00 | 0.28 | -14.02 | 0.1481 | -0.0350 | |||

| TSLA / Tesla, Inc. | 0.00 | -14.26 | 0.28 | 4.91 | 0.1463 | -0.0016 | |||

| GOOG / Alphabet Inc. | 0.00 | -14.29 | 0.27 | -2.51 | 0.1429 | -0.0131 | |||

| CSIQ / Canadian Solar Inc. | 0.02 | -19.64 | 0.27 | 2.71 | 0.1390 | -0.0050 | |||

| SLB / Schlumberger Limited | 0.01 | 0.00 | 0.26 | -19.24 | 0.1345 | -0.0422 | |||

| CVE / Cenovus Energy Inc. | 0.02 | 0.00 | 0.26 | -1.92 | 0.1338 | -0.0114 | |||

| BKR / Baker Hughes Company | 0.01 | 0.00 | 0.25 | -12.94 | 0.1310 | -0.0285 | |||

| ADI / Analog Devices, Inc. | 0.00 | -14.29 | 0.24 | 1.24 | 0.1281 | -0.0064 | |||

| DVN / Devon Energy Corporation | 0.01 | 0.00 | 0.23 | -14.98 | 0.1194 | -0.0297 | |||

| AMRC / Ameresco, Inc. | 0.01 | -7.24 | 0.23 | 16.58 | 0.1183 | 0.0106 | |||

| HAL / Halliburton Company | 0.01 | 0.00 | 0.20 | -19.76 | 0.1048 | -0.0338 | |||

| ENPH / Enphase Energy, Inc. | 0.00 | -4.74 | 0.18 | -39.27 | 0.0969 | -0.0722 | |||

| DAN / Dana Incorporated | 0.01 | -14.29 | 0.17 | 10.46 | 0.0887 | 0.0033 | |||

| POWI / Power Integrations, Inc. | 0.00 | -14.29 | 0.14 | -5.30 | 0.0755 | -0.0090 | |||

| SWKS / Skyworks Solutions, Inc. | 0.00 | -14.29 | 0.12 | -0.82 | 0.0635 | -0.0048 | |||

| DAR / Darling Ingredients Inc. | 0.00 | -14.29 | 0.11 | 3.70 | 0.0592 | -0.0012 | |||

| THRM / Gentherm Incorporated | 0.00 | -68.91 | 0.10 | -67.12 | 0.0504 | -0.1123 | |||

| MBLY / Mobileye Global Inc. | 0.01 | -14.29 | 0.09 | 6.90 | 0.0492 | 0.0004 | |||

| HLX / Helix Energy Solutions Group, Inc. | 0.01 | 0.00 | 0.06 | -25.93 | 0.0319 | -0.0132 | |||

| SEDG / SolarEdge Technologies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |