Basic Stats

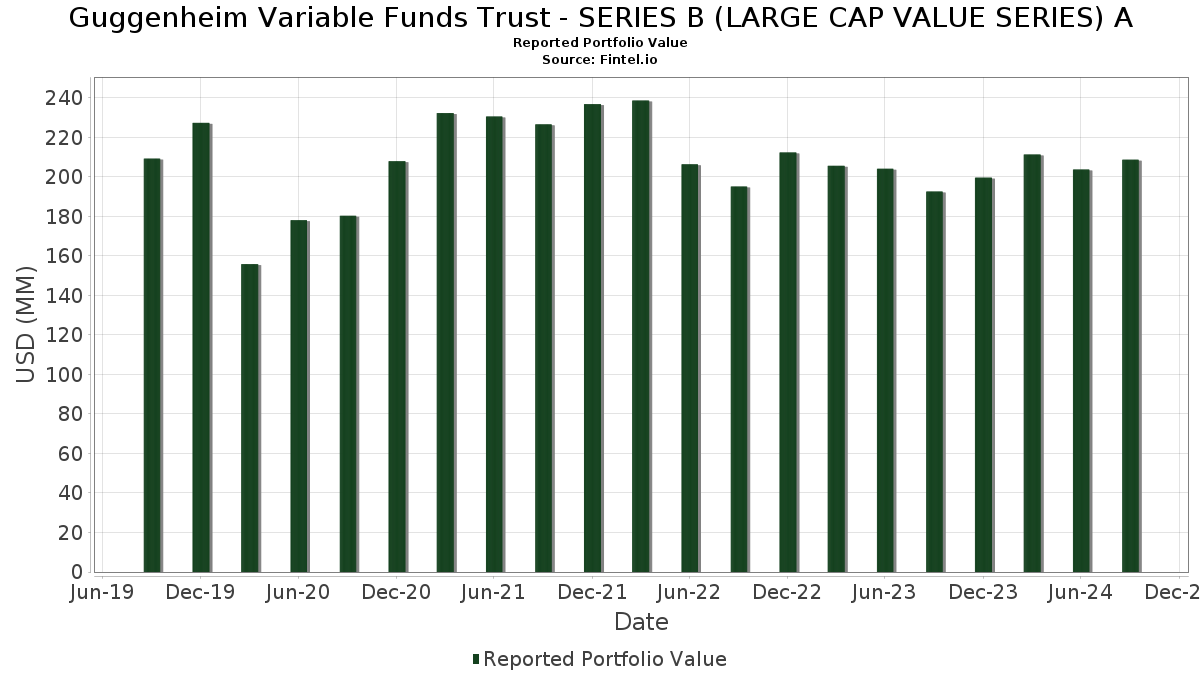

| Portfolio Value | $ 208,680,403 |

| Current Positions | 83 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Guggenheim Variable Funds Trust - SERIES B (LARGE CAP VALUE SERIES) A has disclosed 83 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 208,680,403 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Guggenheim Variable Funds Trust - SERIES B (LARGE CAP VALUE SERIES) A’s top holdings are iShares Trust - iShares Russell 1000 Value ETF (US:IWD) , Berkshire Hathaway Inc. (US:BRK.B) , Walmart Inc. (US:WMT) , Verizon Communications Inc. (US:VZ) , and Bank of America Corporation (US:BAC) . Guggenheim Variable Funds Trust - SERIES B (LARGE CAP VALUE SERIES) A’s new positions include Ferguson Enterprises Inc. (US:FERG) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 2.14 | 1.0275 | 1.0275 | |

| 0.07 | 5.58 | 2.6736 | 0.3773 | |

| 0.04 | 3.05 | 1.4614 | 0.3482 | |

| 0.07 | 4.07 | 1.9496 | 0.3351 | |

| 0.01 | 4.17 | 1.9995 | 0.3110 | |

| 0.04 | 2.97 | 1.4246 | 0.2905 | |

| 0.01 | 5.96 | 2.8556 | 0.2703 | |

| 0.04 | 3.47 | 1.6621 | 0.2583 | |

| 0.01 | 2.18 | 1.0454 | 0.2359 | |

| 0.01 | 2.49 | 1.1928 | 0.2270 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 3.67 | 3.67 | 1.7588 | -2.5391 | |

| 0.01 | 0.82 | 0.3940 | -0.4874 | |

| 0.02 | 3.31 | 1.5840 | -0.3000 | |

| 0.02 | 3.96 | 1.8981 | -0.2372 | |

| 0.01 | 2.24 | 1.0752 | -0.2240 | |

| 0.04 | 3.99 | 1.9104 | -0.2156 | |

| 0.03 | 4.90 | 2.3462 | -0.2063 | |

| 0.01 | 1.90 | 0.9096 | -0.1786 | |

| 0.03 | 2.22 | 1.0631 | -0.1750 | |

| 0.01 | 0.54 | 0.2579 | -0.1712 |

13F and Fund Filings

This form was filed on 2024-11-29 for the reporting period 2024-09-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.04 | 0.00 | 8.03 | 8.79 | 3.8475 | 0.2248 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | 0.00 | 5.96 | 13.14 | 2.8556 | 0.2703 | |||

| WMT / Walmart Inc. | 0.07 | 0.00 | 5.58 | 19.26 | 2.6736 | 0.3773 | |||

| VZ / Verizon Communications Inc. | 0.12 | 0.00 | 5.57 | 8.90 | 2.6679 | 0.1585 | |||

| BAC / Bank of America Corporation | 0.14 | 0.00 | 5.49 | -0.24 | 2.6281 | -0.0700 | |||

| CVX / Chevron Corporation | 0.03 | 0.00 | 4.90 | -5.85 | 2.3462 | -0.2063 | |||

| CW / Curtiss-Wright Corporation | 0.01 | 0.00 | 4.17 | 21.31 | 1.9995 | 0.3110 | |||

| OGE / OGE Energy Corp. | 0.10 | 0.00 | 4.09 | 14.89 | 1.9599 | 0.2127 | |||

| JEF / Jefferies Financial Group Inc. | 0.07 | 0.00 | 4.07 | 23.68 | 1.9496 | 0.3351 | |||

| COP / ConocoPhillips | 0.04 | 0.00 | 3.99 | -7.96 | 1.9104 | -0.2156 | |||

| GOOGL / Alphabet Inc. | 0.02 | 0.00 | 3.96 | -8.96 | 1.8981 | -0.2372 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | 0.00 | 3.80 | 4.25 | 1.8218 | 0.0318 | |||

| DIRXX / Dreyfus Treasury Securities Cash Management - Dreyfus Treasury Securities Cash Management Institutional Shares | 3.67 | -58.08 | 3.67 | -58.08 | 1.7588 | -2.5391 | |||

| JNJ / Johnson & Johnson | 0.02 | 0.00 | 3.53 | 10.87 | 1.6906 | 0.1288 | |||

| LDOS / Leidos Holdings, Inc. | 0.02 | 0.00 | 3.49 | 11.71 | 1.6734 | 0.1394 | |||

| FHN / First Horizon Corporation | 0.22 | 0.00 | 3.48 | -1.50 | 1.6687 | -0.0670 | |||

| EIX / Edison International | 0.04 | 0.00 | 3.47 | 21.29 | 1.6621 | 0.2583 | |||

| FANG / Diamondback Energy, Inc. | 0.02 | 0.00 | 3.31 | -13.88 | 1.5840 | -0.3000 | |||

| TSN / Tyson Foods, Inc. | 0.06 | 0.00 | 3.30 | 4.26 | 1.5815 | 0.0274 | |||

| AMT / American Tower Corporation | 0.01 | 0.00 | 3.27 | 19.63 | 1.5682 | 0.2256 | |||

| MSFT / Microsoft Corporation | 0.01 | 0.00 | 3.20 | -3.73 | 1.5314 | -0.0979 | |||

| MDT / Medtronic plc | 0.03 | 0.00 | 3.12 | 14.35 | 1.4927 | 0.1560 | |||

| PYPL / PayPal Holdings, Inc. | 0.04 | 0.00 | 3.05 | 34.48 | 1.4614 | 0.3482 | |||

| FTNT / Fortinet, Inc. | 0.04 | 0.00 | 2.97 | 28.65 | 1.4246 | 0.2905 | |||

| FI / Fiserv, Inc. | 0.02 | 0.00 | 2.83 | 20.55 | 1.3545 | 0.2035 | |||

| KNX / Knight-Swift Transportation Holdings Inc. | 0.05 | 0.00 | 2.81 | 8.08 | 1.3456 | 0.0703 | |||

| EHC / Encompass Health Corporation | 0.03 | 0.00 | 2.78 | 12.69 | 1.3318 | 0.1208 | |||

| PNW / Pinnacle West Capital Corporation | 0.03 | 0.00 | 2.74 | 16.00 | 1.3129 | 0.1534 | |||

| LHX / L3Harris Technologies, Inc. | 0.01 | 0.00 | 2.60 | 5.91 | 1.2450 | 0.0410 | |||

| T / AT&T Inc. | 0.12 | 0.00 | 2.58 | 15.13 | 1.2356 | 0.1362 | |||

| LEVI / Levi Strauss & Co. | 0.12 | 0.00 | 2.55 | 13.06 | 1.2199 | 0.1148 | |||

| EXC / Exelon Corporation | 0.06 | 0.00 | 2.50 | 17.19 | 1.1953 | 0.1503 | |||

| HCA / HCA Healthcare, Inc. | 0.01 | 0.00 | 2.49 | 26.47 | 1.1928 | 0.2270 | |||

| INGR / Ingredion Incorporated | 0.02 | 0.00 | 2.46 | 19.81 | 1.1792 | 0.1711 | |||

| FCX / Freeport-McMoRan Inc. | 0.05 | 0.00 | 2.44 | 2.69 | 1.1712 | 0.0033 | |||

| AEIS / Advanced Energy Industries, Inc. | 0.02 | 0.00 | 2.43 | -3.23 | 1.1639 | -0.0682 | |||

| KO / The Coca-Cola Company | 0.03 | 0.00 | 2.39 | 12.93 | 1.1428 | 0.1060 | |||

| UNM / Unum Group | 0.04 | 0.00 | 2.32 | 16.32 | 1.1129 | 0.1327 | |||

| WLK / Westlake Corporation | 0.02 | 0.00 | 2.32 | 3.76 | 1.1119 | 0.0144 | |||

| SNV / Synovus Financial Corp. | 0.05 | 0.00 | 2.31 | 10.65 | 1.1056 | 0.0821 | |||

| WFC / Wells Fargo & Company | 0.04 | 0.00 | 2.26 | -4.89 | 1.0807 | -0.0831 | |||

| HUM / Humana Inc. | 0.01 | 0.00 | 2.24 | -15.22 | 1.0752 | -0.2240 | |||

| LVS / Las Vegas Sands Corp. | 0.04 | 0.00 | 2.22 | 13.72 | 1.0644 | 0.1060 | |||

| SCHW / The Charles Schwab Corporation | 0.03 | 0.00 | 2.22 | -12.05 | 1.0631 | -0.1750 | |||

| EXP / Eagle Materials Inc. | 0.01 | 0.00 | 2.18 | 32.32 | 1.0454 | 0.2359 | |||

| DUK / Duke Energy Corporation | 0.02 | 0.00 | 2.16 | 15.02 | 1.0346 | 0.1134 | |||

| FERG / Ferguson Enterprises Inc. | 0.01 | 2.14 | 1.0275 | 1.0275 | |||||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 2.11 | 11.92 | 1.0127 | 0.0860 | |||

| MRK / Merck & Co., Inc. | 0.02 | 0.00 | 2.05 | -8.26 | 0.9842 | -0.1148 | |||

| COG / Cabot Oil & Gas Corp. | 0.08 | 0.00 | 2.03 | -10.21 | 0.9733 | -0.1369 | |||

| ADM / Archer-Daniels-Midland Company | 0.03 | 0.00 | 2.02 | -1.13 | 0.9663 | -0.0352 | |||

| TDY / Teledyne Technologies Incorporated | 0.00 | 0.00 | 1.99 | 12.80 | 0.9546 | 0.0878 | |||

| NUE / Nucor Corporation | 0.01 | 0.00 | 1.98 | -4.86 | 0.9481 | -0.0730 | |||

| TER / Teradyne, Inc. | 0.01 | 0.00 | 1.96 | -9.69 | 0.9382 | -0.1258 | |||

| DD / DuPont de Nemours, Inc. | 0.02 | 0.00 | 1.95 | 10.73 | 0.9344 | 0.0699 | |||

| AMAT / Applied Materials, Inc. | 0.01 | 0.00 | 1.90 | -14.39 | 0.9096 | -0.1786 | |||

| KLAC / KLA Corporation | 0.00 | 0.00 | 1.87 | -6.08 | 0.8956 | -0.0811 | |||

| EQT / EQT Corporation | 0.05 | 0.00 | 1.85 | -0.91 | 0.8841 | -0.0299 | |||

| DAL / Delta Air Lines, Inc. | 0.04 | 0.00 | 1.84 | 7.02 | 0.8839 | 0.0382 | |||

| KMI / Kinder Morgan, Inc. | 0.08 | 0.00 | 1.82 | 11.17 | 0.8726 | 0.0686 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | 0.00 | 1.78 | -14.64 | 0.8550 | -0.1708 | |||

| LEA / Lear Corporation | 0.02 | 0.00 | 1.70 | -4.39 | 0.8131 | -0.0584 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 0.00 | 1.67 | 9.41 | 0.8024 | 0.0515 | |||

| MRO / Marathon Oil Corporation | 0.06 | 0.00 | 1.66 | -7.15 | 0.7966 | -0.0819 | |||

| NXPI / NXP Semiconductors N.V. | 0.01 | 0.00 | 1.64 | -10.80 | 0.7875 | -0.1169 | |||

| RS / Reliance, Inc. | 0.01 | 0.00 | 1.60 | 1.27 | 0.7645 | -0.0088 | |||

| CH1300646267 / Bunge Global SA | 0.02 | 0.00 | 1.58 | -9.46 | 0.7565 | -0.0996 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 0.00 | 1.55 | 17.17 | 0.7422 | 0.0932 | |||

| LUV / Southwest Airlines Co. | 0.05 | 0.00 | 1.40 | 3.56 | 0.6698 | 0.0073 | |||

| STAG / STAG Industrial, Inc. | 0.03 | 0.00 | 1.36 | 8.40 | 0.6494 | 0.0358 | |||

| JCI / Johnson Controls International plc | 0.02 | 0.00 | 1.23 | 16.75 | 0.5882 | 0.0722 | |||

| EEFT / Euronet Worldwide, Inc. | 0.01 | 0.00 | 1.19 | -4.10 | 0.5712 | -0.0391 | |||

| HUN / Huntsman Corporation | 0.05 | 0.00 | 1.18 | 6.22 | 0.5648 | 0.0205 | |||

| MGPI / MGP Ingredients, Inc. | 0.01 | 0.00 | 1.05 | 11.88 | 0.5007 | 0.0424 | |||

| HEES / H&E Equipment Services, Inc. | 0.02 | 0.00 | 1.04 | 10.15 | 0.4996 | 0.0353 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 0.00 | 1.04 | 1.86 | 0.4990 | -0.0030 | |||

| BWA / BorgWarner Inc. | 0.03 | 0.00 | 1.00 | 12.51 | 0.4784 | 0.0431 | |||

| RRC / Range Resources Corporation | 0.03 | 0.00 | 0.92 | -8.26 | 0.4420 | -0.0515 | |||

| DIS / The Walt Disney Company | 0.01 | 0.00 | 0.85 | -3.08 | 0.4073 | -0.0233 | |||

| CROX / Crocs, Inc. | 0.01 | -53.85 | 0.82 | -54.23 | 0.3940 | -0.4874 | |||

| PFE / Pfizer Inc. | 0.03 | 0.00 | 0.75 | 3.43 | 0.3613 | 0.0035 | |||

| AAP / Advance Auto Parts, Inc. | 0.01 | 0.00 | 0.54 | -38.44 | 0.2579 | -0.1712 | |||

| INTC / Intel Corporation | 0.01 | 0.00 | 0.30 | -24.38 | 0.1460 | -0.0514 |