Basic Stats

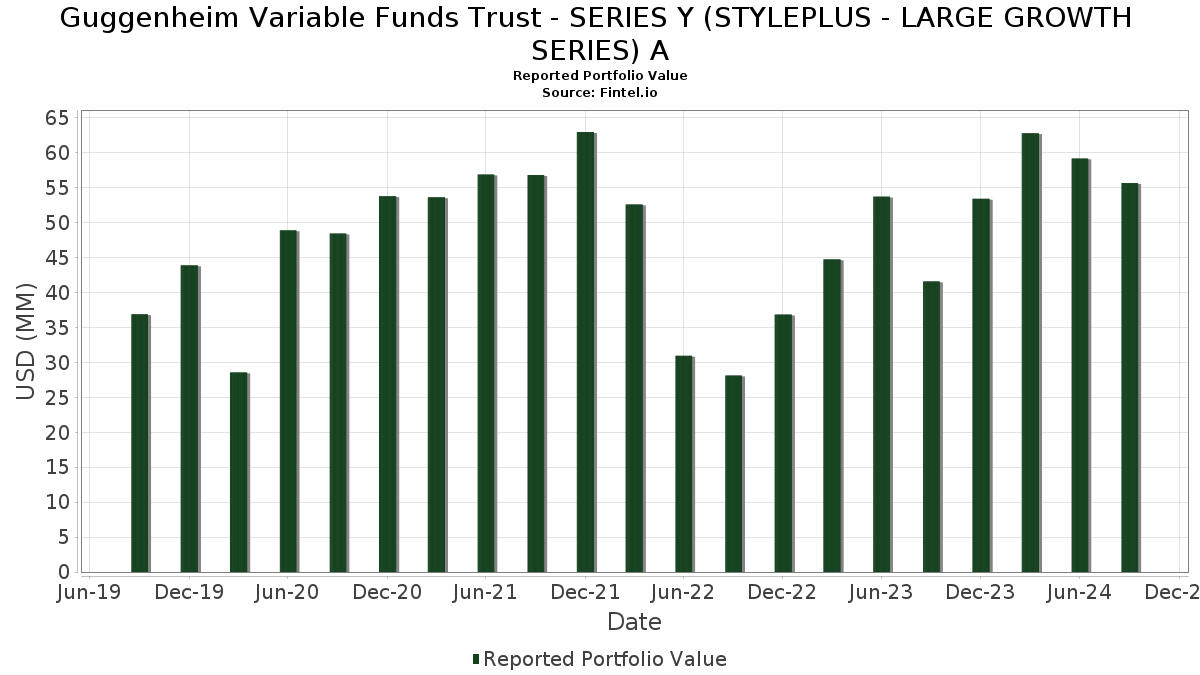

| Portfolio Value | $ 55,660,343 |

| Current Positions | 68 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Guggenheim Variable Funds Trust - SERIES Y (STYLEPLUS - LARGE GROWTH SERIES) A has disclosed 68 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 55,660,343 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Guggenheim Variable Funds Trust - SERIES Y (STYLEPLUS - LARGE GROWTH SERIES) A’s top holdings are Guggenheim Ultra Short Duration Fund - Institutional Class (US:US40169J5231) , Dreyfus Treasury Securities Cash Management - Dreyfus Treasury Securities Cash Management Institutional Shares (US:DIRXX) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , and NVIDIA Corporation (US:NVDA) . Guggenheim Variable Funds Trust - SERIES Y (STYLEPLUS - LARGE GROWTH SERIES) A’s new positions include Amphenol Corporation (US:APH) , GoDaddy Inc. (US:GDDY) , Ralph Lauren Corporation (US:RL) , Vistra Corp. (US:VST) , and Monster Beverage Corporation (US:MNST) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.58 | 14.48 | 26.5126 | 26.5126 | |

| 0.27 | 6.60 | 12.0805 | 12.0805 | |

| 3.42 | 3.42 | 6.2538 | 2.3616 | |

| 1.27 | 2.3252 | 2.3252 | ||

| 0.52 | 12.87 | 23.5691 | 0.9440 | |

| 0.00 | 0.26 | 0.4761 | 0.3949 | |

| 0.00 | 0.18 | 0.3312 | 0.3312 | |

| 0.42 | 4.25 | 7.7764 | 0.3173 | |

| 0.01 | 1.34 | 2.4522 | 0.2898 | |

| 0.00 | 0.15 | 0.2719 | 0.2719 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.45 | 0.8320 | -0.4170 | |

| 0.00 | 0.05 | 0.0995 | -0.2953 | |

| 0.00 | 0.10 | 0.1747 | -0.2540 | |

| 0.00 | 0.00 | -0.2292 | ||

| 0.00 | 0.06 | 0.1054 | -0.1473 | |

| 0.00 | 0.05 | 0.0846 | -0.1250 | |

| 0.00 | 0.11 | 0.2084 | -0.1080 | |

| 0.00 | 0.15 | 0.2778 | -0.1069 | |

| 0.00 | 0.12 | 0.2234 | -0.0882 | |

| 0.00 | 0.10 | 0.1912 | -0.0803 |

13F and Fund Filings

This form was filed on 2024-11-29 for the reporting period 2024-09-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Guggenheim Strategy Fund III / EC (N/A) | 0.58 | 14.48 | 26.5126 | 26.5126 | |||||

| Guggenheim Variable Insurance Strategy Fund III / EC (N/A) | 0.52 | 1.39 | 12.87 | 2.05 | 23.5691 | 0.9440 | |||

| Guggenheim Strategy Fund II / EC (N/A) | 0.27 | 6.60 | 12.0805 | 12.0805 | |||||

| US40169J5231 / Guggenheim Ultra Short Duration Fund - Institutional Class | 0.42 | 1.31 | 4.25 | 2.12 | 7.7764 | 0.3173 | |||

| DIRXX / Dreyfus Treasury Securities Cash Management - Dreyfus Treasury Securities Cash Management Institutional Shares | 3.42 | 57.39 | 3.42 | 57.37 | 6.2538 | 2.3616 | |||

| MSFT / Microsoft Corporation | 0.00 | 9.93 | 1.52 | 5.78 | 2.7826 | 0.2071 | |||

| AAPL / Apple Inc. | 0.01 | -1.78 | 1.42 | 8.60 | 2.5924 | 0.2554 | |||

| NVDA / NVIDIA Corporation | 0.01 | 13.00 | 1.34 | 11.12 | 2.4522 | 0.2898 | |||

| Russell 1000 Growth Total Return Index / DE (N/A) | 1.27 | 2.3252 | 2.3252 | ||||||

| GOOG / Alphabet Inc. | 0.00 | 6.59 | 0.78 | -2.86 | 1.4307 | -0.0117 | |||

| META / Meta Platforms, Inc. | 0.00 | 5.53 | 0.46 | 19.84 | 0.8405 | 0.1533 | |||

| AMZN / Amazon.com, Inc. | 0.00 | -32.33 | 0.45 | -34.77 | 0.8320 | -0.4170 | |||

| AVGO / Broadcom Inc. | 0.00 | 1,453.85 | 0.31 | 67.38 | 0.5742 | 0.2373 | |||

| CRM / Salesforce, Inc. | 0.00 | 555.17 | 0.26 | 504.65 | 0.4761 | 0.3949 | |||

| LLY / Eli Lilly and Company | 0.00 | 22.75 | 0.25 | 20.48 | 0.4639 | 0.0856 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 0.20 | 17.37 | 0.3595 | 0.0596 | |||

| AXP / American Express Company | 0.00 | 0.18 | 0.3312 | 0.3312 | |||||

| TSLA / Tesla, Inc. | 0.00 | 0.74 | 0.18 | 33.08 | 0.3257 | 0.0862 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | 23.18 | 0.17 | 4.88 | 0.3160 | 0.0217 | |||

| MRK / Merck & Co., Inc. | 0.00 | 8.31 | 0.17 | -0.59 | 0.3090 | 0.0043 | |||

| URI / United Rentals, Inc. | 0.00 | -4.61 | 0.17 | 19.29 | 0.3069 | 0.0552 | |||

| DE / Deere & Company | 0.00 | -2.57 | 0.16 | 8.97 | 0.2896 | 0.0289 | |||

| AMAT / Applied Materials, Inc. | 0.00 | -17.38 | 0.15 | -29.44 | 0.2778 | -0.1069 | |||

| BLDR / Builders FirstSource, Inc. | 0.00 | -9.65 | 0.15 | 26.50 | 0.2726 | 0.0616 | |||

| PHM / PulteGroup, Inc. | 0.00 | -8.80 | 0.15 | 18.40 | 0.2725 | 0.0480 | |||

| APH / Amphenol Corporation | 0.00 | 0.15 | 0.2719 | 0.2719 | |||||

| PCAR / PACCAR Inc | 0.00 | 18.37 | 0.15 | 14.06 | 0.2678 | 0.0366 | |||

| NXPI / NXP Semiconductors N.V. | 0.00 | 14.56 | 0.14 | 2.14 | 0.2628 | 0.0109 | |||

| FTV / Fortive Corporation | 0.00 | 2.84 | 0.14 | 10.00 | 0.2620 | 0.0277 | |||

| HCA / HCA Healthcare, Inc. | 0.00 | -11.39 | 0.14 | 12.70 | 0.2604 | 0.0328 | |||

| JBL / Jabil Inc. | 0.00 | 12.11 | 0.14 | 23.68 | 0.2600 | 0.0538 | |||

| AOS / A. O. Smith Corporation | 0.00 | 7.43 | 0.14 | 17.50 | 0.2594 | 0.0441 | |||

| CCL / Carnival Corporation & plc | 0.01 | 0.14 | 0.2584 | 0.2584 | |||||

| AMP / Ameriprise Financial, Inc. | 0.00 | 0.14 | 0.2563 | 0.2563 | |||||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -8.28 | 0.14 | -8.55 | 0.2560 | -0.0173 | |||

| ACGL / Arch Capital Group Ltd. | 0.00 | -8.03 | 0.14 | 1.46 | 0.2558 | 0.0101 | |||

| EXPE / Expedia Group, Inc. | 0.00 | -13.01 | 0.14 | 2.22 | 0.2537 | 0.0105 | |||

| LEN / Lennar Corporation | 0.00 | -9.14 | 0.14 | 13.22 | 0.2526 | 0.0349 | |||

| MAS / Masco Corporation | 0.00 | -10.99 | 0.13 | 11.67 | 0.2464 | 0.0310 | |||

| DVA / DaVita Inc. | 0.00 | -1.69 | 0.13 | 16.67 | 0.2446 | 0.0386 | |||

| CF / CF Industries Holdings, Inc. | 0.00 | -2.47 | 0.13 | 12.82 | 0.2424 | 0.0321 | |||

| GDDY / GoDaddy Inc. | 0.00 | 0.13 | 0.2408 | 0.2408 | |||||

| TE Connectivity plc / EC (IE000IVNQZ81) | 0.00 | 0.13 | 0.2408 | 0.2408 | |||||

| ALLE / Allegion plc | 0.00 | -11.29 | 0.13 | 9.24 | 0.2391 | 0.0251 | |||

| NTAP / NetApp, Inc. | 0.00 | 5.82 | 0.13 | 1.56 | 0.2386 | 0.0083 | |||

| SNA / Snap-on Incorporated | 0.00 | 0.22 | 0.13 | 11.11 | 0.2382 | 0.0281 | |||

| AKAM / Akamai Technologies, Inc. | 0.00 | -6.52 | 0.12 | 5.08 | 0.2281 | 0.0148 | |||

| ABBV / AbbVie Inc. | 0.00 | -38.99 | 0.12 | -29.48 | 0.2234 | -0.0882 | |||

| CBOE / Cboe Global Markets, Inc. | 0.00 | -19.09 | 0.12 | 38.37 | 0.2194 | 0.0594 | |||

| KLAC / KLA Corporation | 0.00 | -31.31 | 0.11 | -35.80 | 0.2084 | -0.1080 | |||

| LRCX / Lam Research Corporation | 0.00 | -24.26 | 0.10 | -21.21 | 0.1912 | -0.0803 | |||

| ORCL / Oracle Corporation | 0.00 | -66.92 | 0.10 | -60.25 | 0.1747 | -0.2540 | |||

| GNRC / Generac Holdings Inc. | 0.00 | 2.76 | 0.09 | 23.94 | 0.1623 | 0.0336 | |||

| RL / Ralph Lauren Corporation | 0.00 | 0.07 | 0.1267 | 0.1267 | |||||

| VST / Vistra Corp. | 0.00 | 0.06 | 0.1155 | 0.1155 | |||||

| V / Visa Inc. | 0.00 | 67.19 | 0.06 | 75.76 | 0.1077 | 0.0475 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | -64.93 | 0.06 | -59.29 | 0.1054 | -0.1473 | |||

| ADBE / Adobe Inc. | 0.00 | -75.06 | 0.05 | -74.53 | 0.0995 | -0.2953 | |||

| WYNN / Wynn Resorts, Limited | 0.00 | -63.09 | 0.05 | -60.34 | 0.0846 | -0.1250 | |||

| HD / The Home Depot, Inc. | 0.00 | 14.94 | 0.04 | 21.21 | 0.0742 | 0.0122 | |||

| SNPS / Synopsys, Inc. | 0.00 | 8.45 | 0.04 | -9.52 | 0.0714 | -0.0044 | |||

| MNST / Monster Beverage Corporation | 0.00 | 0.04 | 0.0713 | 0.0713 | |||||

| NFLX / Netflix, Inc. | 0.00 | -3.64 | 0.04 | 0.00 | 0.0688 | 0.0023 | |||

| MA / Mastercard Incorporated | 0.00 | -5.06 | 0.04 | 8.82 | 0.0678 | 0.0053 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | 0.04 | 0.0651 | 0.0651 | |||||

| EW / Edwards Lifesciences Corporation | 0.00 | 0.03 | 0.0631 | 0.0631 | |||||

| Russell 2000 Index Mini Futures Contracts / DE (N/A) | 0.01 | 0.0238 | 0.0238 | ||||||

| S&P 500 Index Mini Futures Contracts / DE (N/A) | 0.01 | 0.0229 | 0.0229 | ||||||

| AMD / Advanced Micro Devices, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0617 | ||||

| MCHP / Microchip Technology Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.2292 |