Basic Stats

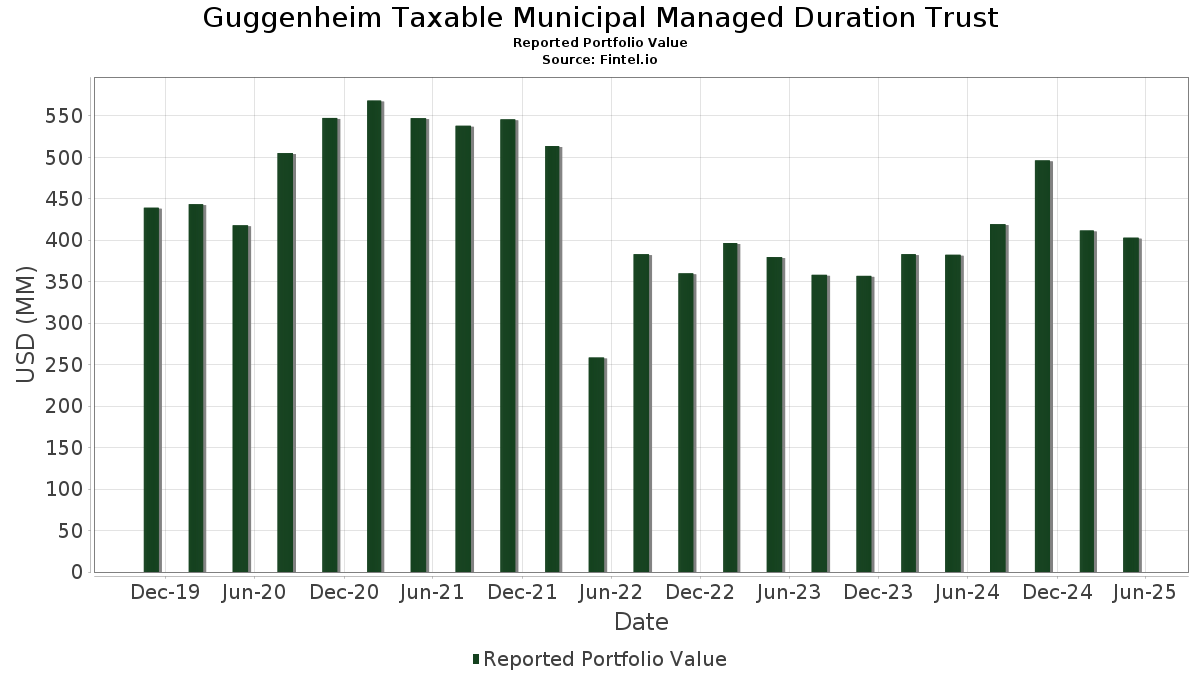

| Portfolio Value | $ 402,999,545 |

| Current Positions | 589 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Guggenheim Taxable Municipal Managed Duration Trust has disclosed 589 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 402,999,545 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Guggenheim Taxable Municipal Managed Duration Trust’s top holdings are State of West Virginia, Higher Education Policy Commission, Revenue Bonds, Federally Taxable Build A (US:US95639RDX44) , Dallas, Texas, Convention Center Hotel Development Corporation, Hotel Revenue Bonds, Taxable Build A (US:US235417AA07) , School District of Philadelphia, Pennsylvania, General Obligation Bonds, Series 2011A, Qualified Sch (US:US717883LV27) , Oklahoma Development Finance Authority Revenue Bonds (US:US67884XCP06) , and Oakland Unified School District, County of Alameda, California, Taxable General Obligation Bonds, El (US:US672325WR49) . Guggenheim Taxable Municipal Managed Duration Trust’s new positions include State of West Virginia, Higher Education Policy Commission, Revenue Bonds, Federally Taxable Build A (US:US95639RDX44) , Dallas, Texas, Convention Center Hotel Development Corporation, Hotel Revenue Bonds, Taxable Build A (US:US235417AA07) , School District of Philadelphia, Pennsylvania, General Obligation Bonds, Series 2011A, Qualified Sch (US:US717883LV27) , Oklahoma Development Finance Authority Revenue Bonds (US:US67884XCP06) , and Oakland Unified School District, County of Alameda, California, Taxable General Obligation Bonds, El (US:US672325WR49) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 6.33 | 1.5817 | 1.5817 | ||

| 6.33 | 1.5817 | 1.5817 | ||

| 4.12 | 1.0305 | 1.0305 | ||

| 3.80 | 0.9502 | 0.9502 | ||

| 3.75 | 0.9380 | 0.9380 | ||

| 2.88 | 0.7190 | 0.7190 | ||

| 2.83 | 0.7080 | 0.7080 | ||

| 4.07 | 1.0169 | 0.6781 | ||

| 2.42 | 0.6051 | 0.6051 | ||

| 1.90 | 0.4755 | 0.4755 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| -10.55 | -2.6365 | -2.6365 | ||

| -7.33 | -1.8320 | -1.8320 | ||

| -7.29 | -1.8229 | -1.8229 | ||

| -5.60 | -1.3996 | -1.3996 | ||

| -4.45 | -1.1129 | -1.1129 | ||

| -4.09 | -1.0216 | -1.0216 | ||

| -3.88 | -0.9693 | -0.9693 | ||

| -3.60 | -0.9007 | -0.9007 | ||

| -3.52 | -0.8798 | -0.8798 | ||

| -3.33 | -0.8315 | -0.8315 |

13F and Fund Filings

This form was filed on 2025-07-29 for the reporting period 2025-05-31. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US95639RDX44 / State of West Virginia, Higher Education Policy Commission, Revenue Bonds, Federally Taxable Build A | 11.45 | -2.98 | 2.8606 | 0.0127 | |||||

| US235417AA07 / Dallas, Texas, Convention Center Hotel Development Corporation, Hotel Revenue Bonds, Taxable Build A | 10.88 | -3.88 | 2.7195 | -0.0131 | |||||

| US717883LV27 / School District of Philadelphia, Pennsylvania, General Obligation Bonds, Series 2011A, Qualified Sch | 10.81 | -0.39 | 2.7018 | 0.0820 | |||||

| US67884XCP06 / Oklahoma Development Finance Authority Revenue Bonds | 10.62 | -1.86 | 2.6532 | 0.0422 | |||||

| US672325WR49 / Oakland Unified School District, County of Alameda, California, Taxable General Obligation Bonds, El | 10.06 | -0.01 | 2.5145 | 0.0856 | |||||

| US957366BR72 / Westchester County Health Care Corporation, Revenue Bonds, Taxable Build America Bonds | 9.63 | -3.07 | 2.4058 | 0.0086 | |||||

| US299620EW06 / Evansville-Vanderburgh School Building Corp. Revenue Bonds | 8.84 | 0.00 | 2.2105 | 0.0755 | |||||

| US801155VM11 / Santa Ana Unified School District, California, General Obligation Bonds, Federal Taxable Build Ameri | 8.64 | -3.40 | 2.1588 | 0.0003 | |||||

| US725277DR53 / Pittsburgh, Pennsylvania, School District, Taxable Qualified School Construction Bonds | 7.44 | -0.28 | 1.8597 | 0.0585 | |||||

| US414008CU49 / HARRIS CNTY TX CULTURAL EDU FACS FIN CORP MED FACS | 7.39 | -3.60 | 1.8477 | -0.0035 | |||||

| Lightning A / ABS-O (N/A) | 6.33 | 1.5817 | 1.5817 | ||||||

| Thunderbird A / ABS-O (N/A) | 6.33 | 1.5817 | 1.5817 | ||||||

| US155431AA74 / Central Storage Safety Project Trust | 5.70 | -2.83 | 1.4252 | 0.0085 | |||||

| US44066MEB28 / County of Horry South Carolina Airport Revenue Bonds, Build America Bonds | 5.66 | -3.31 | 1.4153 | 0.0016 | |||||

| US167727SW76 / Chicago, Illinois, Second Lien Wastewater Transmission Revenue Project Bonds, Taxable Build America | 5.54 | -2.86 | 1.3843 | 0.0079 | |||||

| US353187EV56 / County of Franklin, Hospital Facilities Improvement Bonds, Nationwide Children's Hospital Project | 5.53 | -7.41 | 1.3809 | -0.0598 | |||||

| US87638QRJ03 / Tarrant County Cultural Education Facilities Finance Corporation, Texas, Hospital Revenue Bonds, Hendrick Medical Center, Taxable Series 2021 | 5.50 | -5.95 | 1.3755 | -0.0372 | |||||

| US155839DL43 / Central Washington University Revenue Bonds | 5.41 | -3.20 | 1.3527 | 0.0030 | |||||

| US155839DK69 / Central Washington University, System Revenue Bonds, 2010, Taxable Build America Bonds | 5.23 | -0.29 | 1.3082 | 0.0409 | |||||

| US91823AAY73 / VB-S1 Issuer LLC - VBTEL | 4.75 | -1.84 | 1.1880 | 0.0188 | |||||

| US93976AAH59 / Washington State Convention Center Public Facilities District, Lodging Tax Bonds, Taxable Build Amer | 4.59 | -3.33 | 1.1477 | 0.0009 | |||||

| US2350367A26 / DALLAS-FORT WORTH TX INTERNATIONAL ARPT REVENUE | 4.36 | -6.30 | 1.0894 | -0.0336 | |||||

| US452152GS43 / Illinois, General Obligation Bonds, Taxable Build America Bonds | 4.16 | -2.69 | 1.0409 | 0.0079 | |||||

| City of New York New York General Obligation Unlimited / DBT (US64966SNJ14) | 4.12 | 1.0305 | 1.0305 | ||||||

| Idaho Housing & Finance Association Revenue Bonds / DBT (US45129Y7Y65) | 4.07 | 189.95 | 1.0169 | 0.6781 | |||||

| US02765UEP57 / American Municipal Power, Inc., Combined Hydroelectric Projects Revenue Bonds, New Clean Renewable E | 4.01 | -0.50 | 1.0011 | 0.0293 | |||||

| US155498JN96 / Central Texas Regional Mobility Authority Revenue Bonds | 3.98 | -6.80 | 0.9942 | -0.0361 | |||||

| Nevada Housing Division Revenue Bonds / DBT (US641279F415) | 3.80 | 0.9502 | 0.9502 | ||||||

| US880591ES79 / Tennessee Valley Authority | 3.75 | 0.9380 | 0.9380 | ||||||

| US9400932M81 / Washington State University, Housing and Dining System Revenue Bonds, Taxable Build America Bonds | 3.56 | -0.34 | 0.8897 | 0.0276 | |||||

| US13080SL931 / California Statewide Communities Development Authority Revenue Bonds | 3.54 | -3.01 | 0.8853 | 0.0037 | |||||

| US73358XDP42 / Port Authority of New York & New Jersey | 3.49 | -5.29 | 0.8722 | -0.0172 | |||||

| US584556GW80 / Medical Center Educational Building Corp. Revenue Bonds | 3.34 | -5.73 | 0.8341 | -0.0205 | |||||

| US13057EEK64 / California Public Finance Authority Revenue Bonds | 3.33 | -5.05 | 0.8316 | -0.0144 | |||||

| US167736YU53 / Chicago, Illinois, Second Lien Water Revenue Bonds, Taxable Build America Bonds | 3.19 | -3.48 | 0.7966 | -0.0007 | |||||

| US63609WAR34 / New Hampshire Business Finance Authority Revenue Bonds | 3.18 | -6.59 | 0.7940 | -0.0270 | |||||

| US720653QG23 / County of Pierce Washington Sewer Revenue Revenue Bonds | 3.10 | -4.58 | 0.7754 | -0.0096 | |||||

| US01F0226344 / Uniform Mortgage-Backed Security, TBA | 2.88 | 0.7190 | 0.7190 | ||||||

| US499396AV17 / County of Knox Indiana Revenue Bonds | 2.86 | -0.97 | 0.7143 | 0.0178 | |||||

| Pennsylvania Housing Finance Agency Revenue Bonds / DBT (US70879QK361) | 2.83 | 0.7080 | 0.7080 | ||||||

| US6460667K08 / NEW JERSEY ST EDUCTNL FACS AUTH REVENUE | 2.83 | -3.11 | 0.7076 | 0.0022 | |||||

| US251130EC04 / Detroit, Michigan, School District, School Building and Site Bonds, Unlimited Tax General Obligation | 2.82 | -0.91 | 0.7042 | 0.0178 | |||||

| US2511295D01 / Detroit City School District General Obligation Unlimited | 2.74 | -4.40 | 0.6845 | -0.0071 | |||||

| US19668QDM42 / Colorado, Building Excellent Schools Today, Certificates of Participation, Taxable Qualified School | 2.65 | -0.49 | 0.6612 | 0.0195 | |||||

| US899647TS01 / Tulsa Airports Improvement Trust Revenue Bonds | 2.63 | -5.40 | 0.6571 | -0.0137 | |||||

| US558090HQ27 / Madison Local School District, Richland County, Ohio, School Improvement, Taxable Qualified School C | 2.50 | 0.00 | 0.6258 | 0.0214 | |||||

| Maryland Department of Housing & Community Development Revenue Bonds / DBT (US57419UDH86) | 2.47 | -2.99 | 0.6164 | 0.0027 | |||||

| US801155VL38 / Santa Ana Unified School District, California, General Obligation Bonds, Federal Taxable Build Ameri | 2.45 | -0.45 | 0.6127 | 0.0183 | |||||

| US575896WR27 / Massachusetts Port Authority Revenue Bonds | 2.44 | -4.80 | 0.6105 | -0.0090 | |||||

| AP Grange Holdings / DBT (N/A) | 2.42 | 0.6051 | 0.6051 | ||||||

| EQH.PRC / Equitable Holdings, Inc. - Preferred Stock | 0.14 | 0.00 | 2.31 | -10.22 | 0.5773 | -0.0438 | |||

| US90932LAH06 / United Airlines Inc | 2.09 | -1.46 | 0.5223 | 0.0103 | |||||

| US114259AX24 / Brooklyn Union Gas Co/The | 2.09 | -1.83 | 0.5222 | 0.0083 | |||||

| TLWND / GAIA Aviation Ltd | 2.05 | -1.30 | 0.5112 | 0.0107 | |||||

| US674599DP72 / OCCIDENTAL PETROLEUM COR SR UNSECURED 11/27 7 | 2.04 | -0.82 | 0.5109 | 0.0131 | |||||

| FLO / Flowers Foods, Inc. | 1.99 | -5.50 | 0.4986 | -0.0108 | |||||

| Illinois Housing Development Authority Revenue Bonds / DBT (US45203MYF21) | 1.99 | -2.87 | 0.4985 | 0.0029 | |||||

| Blue Owl Finance LLC / DBT (US09581JAS50) | 1.97 | -2.62 | 0.4926 | 0.0041 | |||||

| US44148HAE36 / Hotwire Funding LLC | 1.95 | -0.56 | 0.4883 | 0.0140 | |||||

| US97263CAA99 / Wilton RE Ltd. | 1.94 | 0.88 | 0.4845 | 0.0206 | |||||

| Obra Longevity / ABS-O (N/A) | 1.90 | 0.4755 | 0.4755 | ||||||

| US45823TAL08 / Intact Financial Corp | 1.90 | -1.76 | 0.4747 | 0.0079 | |||||

| US672325P508 / Oakland Unified School District/Alameda County General Obligation Unlimited | 1.89 | -3.18 | 0.4714 | 0.0010 | |||||

| US64971PKP98 / NEW YORK CITY INDUSTRIAL DEVELOPMENT AGENCY | 1.87 | -1.16 | 0.4670 | 0.0107 | |||||

| US646140EA70 / New Jersey Turnpike Authority | 1.83 | -5.15 | 0.4562 | -0.0085 | |||||

| XS2392997255 / Pershing Square Tontine Holdings, Ltd. | 1.80 | -0.06 | 0.4497 | 0.0150 | |||||

| US56781RJX61 / Marin Community College District General Obligation Unlimited | 1.79 | -3.44 | 0.4485 | -0.0000 | |||||

| US039936AA70 / Ares Finance Co. IV LLC | 1.79 | -7.18 | 0.4463 | -0.0182 | |||||

| US00452AAA88 / Accident Fund Insurance Company of America | 1.74 | 0.06 | 0.4340 | 0.0151 | |||||

| Idaho Housing & Finance Association Revenue Bonds / DBT (US45129Y5P76) | 1.73 | -10.49 | 0.4332 | -0.0342 | |||||

| US231266GC59 / CURATORS OF THE UNIV OF MISSOURI MO SYS FACS REVENUE | 1.73 | -4.16 | 0.4324 | -0.0035 | |||||

| US91913YBE95 / Valero Energy Corp | 1.69 | -7.70 | 0.4221 | -0.0197 | |||||

| US53079EBL74 / Liberty Mutual Group, Inc. | 1.67 | -3.86 | 0.4171 | -0.0020 | |||||

| US565130AA94 / Maple Grove Funding Trust I | 1.67 | -5.87 | 0.4171 | -0.0107 | |||||

| Virginia Housing Development Authority Revenue Bonds / DBT (US92812U5G94) | 1.60 | -5.45 | 0.3989 | -0.0085 | |||||

| HV Eight LLC / ABS-O (N/A) | 1.59 | 0.3977 | 0.3977 | ||||||

| US45276PAC05 / Imperial Fund Mortgage Trust 2022-NQM2 | 1.59 | -1.30 | 0.3974 | 0.0085 | |||||

| US366133SL18 / City of Garland Texas Electric Utility System Revenue Revenue Bonds | 1.59 | -7.84 | 0.3970 | -0.0191 | |||||

| US616871MF32 / Moreno Valley Unified School District General Obligation Unlimited | 1.58 | -5.62 | 0.3944 | -0.0093 | |||||

| US899042AC92 / Tufts Medical Center, Inc. | 1.57 | 1.09 | 0.3935 | 0.0176 | |||||

| Southern Veterinary Partners LLC / LON (N/A) | 1.57 | 0.3928 | 0.3928 | ||||||

| Colorado Housing and Finance Authority Revenue Bonds / DBT (US19648GHV77) | 1.56 | -8.44 | 0.3907 | -0.0214 | |||||

| US052451BH39 / City of Austin Texas Rental Car Special Facility Revenue Revenue Bonds | 1.55 | -5.44 | 0.3867 | -0.0082 | |||||

| US11102AAG67 / British Telecommunications PLC | 1.55 | -1.40 | 0.3863 | 0.0079 | |||||

| DIRXX / Dreyfus Treasury Securities Cash Management - Dreyfus Treasury Securities Cash Management Institutional Shares | 1.54 | -63.11 | 1.54 | -63.11 | 0.3859 | -0.6246 | |||

| WRB.PRH / W. R. Berkley Corporation - Corporate Bond/Note | 0.10 | 0.00 | 1.51 | -13.41 | 0.3764 | -0.0432 | |||

| US08661UAB26 / Beth Israel Lahey Health Inc | 1.50 | -8.74 | 0.3761 | -0.0218 | |||||

| US57584YD306 / Massachusetts Development Finance Agency Revenue Bonds | 1.49 | -8.85 | 0.3734 | -0.0221 | |||||

| US47232MAF95 / Jefferies Finance LLC | 1.42 | -0.77 | 0.3552 | 0.0093 | |||||

| US37959GAC15 / Global Atlantic Fin Co | 1.41 | -0.21 | 0.3515 | 0.0113 | |||||

| Cerberus Loan Funding XLIV LLC / ABS-O (US15674DAE40) | 1.40 | -1.48 | 0.3495 | 0.0069 | |||||

| District of Columbia Revenue Bonds / DBT (US94985XAF69) | 1.31 | -1.80 | 0.3283 | 0.0053 | |||||

| Oxnard School District General Obligation Unlimited / DBT (US692020U998) | 1.31 | -6.77 | 0.3273 | -0.0117 | |||||

| INWI / Inwido AB (publ) | 1.27 | -1.09 | 0.3180 | 0.0075 | |||||

| US48255KAA43 / KKR Core Holding Company LLC | 1.27 | -0.16 | 0.3174 | 0.0104 | |||||

| Brown University Health / DBT (US53229UAA51) | 1.25 | 0.3126 | 0.3126 | ||||||

| US15675CAE57 / Cerberus Loan Funding XLII LLC | 1.25 | -1.58 | 0.3120 | 0.0059 | |||||

| FR Refuel LLC / LON (N/A) | 1.25 | 0.3113 | 0.3113 | ||||||

| Colorado Housing and Finance Authority Revenue Bonds / DBT (US19648GHU94) | 1.23 | -3.00 | 0.3068 | 0.0013 | |||||

| Zephyr Bidco Ltd. / LON (N/A) | 1.21 | 0.3032 | 0.3032 | ||||||

| FirstDigital Communications LLC / LON (N/A) | 1.21 | 0.3029 | 0.3029 | ||||||

| Florida Housing Finance Corp. Revenue Bonds / DBT (US34074MY703) | 1.20 | -2.67 | 0.3006 | 0.0022 | |||||

| US86038AAA07 / STEWART INFORMATION SERVICES CORP 3.600000% 11/15/2031 | 1.20 | -0.66 | 0.2989 | 0.0082 | |||||

| Cerberus Loan Funding XLVII LLC / ABS-O (US156945AE77) | 1.19 | -1.65 | 0.2986 | 0.0053 | |||||

| US737446AR57 / Post Holdings, Inc. | 1.19 | -0.08 | 0.2963 | 0.0098 | |||||

| US636792AA19 / National Life Insurance Co | 1.17 | -0.85 | 0.2923 | 0.0075 | |||||

| US45074JAA25 / ITT Holdings LLC | 1.17 | -1.93 | 0.2917 | 0.0042 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1.15 | 0.00 | 1.16 | -1.19 | 0.2898 | 0.0065 | |||

| US744320BJ04 / Prudential Financial Inc | 1.15 | 0.88 | 0.2882 | 0.0124 | |||||

| Total Webhosting Solutions B.V. / LON (N/A) | 1.14 | 0.2848 | 0.2848 | ||||||

| US05609JAL61 / BXHPP TRUST 2021-FILM BXHPP 2021-FILM C | 1.14 | -4.05 | 0.2845 | -0.0019 | |||||

| BX Trust / ABS-MBS (US05612TAG04) | 1.14 | -0.79 | 0.2840 | 0.0074 | |||||

| Inspired Finco Holdings, Ltd. / LON (N/A) | 1.13 | 0.2831 | 0.2831 | ||||||

| US44989MAA27 / IP Lending X Ltd. | 1.12 | 0.00 | 0.2812 | 0.0096 | |||||

| US448579AJ19 / Hyatt Hotels Corp | 1.12 | -0.97 | 0.2802 | 0.0068 | |||||

| US91153LAA52 / United Shore Financial Services LLC | 1.10 | 0.09 | 0.2745 | 0.0095 | |||||

| US302635AL16 / FS KKR Capital Corp. | 1.09 | -0.73 | 0.2729 | 0.0074 | |||||

| US913903BA74 / Universal Health Services Inc | 1.08 | -1.28 | 0.2701 | 0.0057 | |||||

| US25471MAC29 / Denali Water Solutions T/L B | 1.08 | 3.35 | 0.2700 | 0.0177 | |||||

| Eisner Advisory Group / LON (US28259HAG65) | 1.07 | 7.96 | 0.2680 | 0.0282 | |||||

| 69511JD28 / PACIFICORP | 1.07 | 0.2670 | 0.2670 | ||||||

| US56453RBL78 / Manteca Redevelopment Agency Successor Agency Tax Allocation | 1.06 | -3.19 | 0.2658 | 0.0006 | |||||

| US798189RS76 / San Jose Evergreen Community College District General Obligation Unlimited | 1.06 | -5.53 | 0.2651 | -0.0060 | |||||

| US11135FBQ37 / Broadcom Inc | 1.06 | -1.21 | 0.2643 | 0.0059 | |||||

| US556079AD36 / Macquarie Bank Ltd | 1.06 | 0.09 | 0.2638 | 0.0092 | |||||

| US761713BA36 / Reynolds American Inc | 1.05 | -1.31 | 0.2633 | 0.0057 | |||||

| Owl Rock CLO I LLC / ABS-O (US69121XAD84) | 1.05 | -1.50 | 0.2623 | 0.0050 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 1.00 | 0.00 | 1.04 | -0.57 | 0.2603 | 0.0073 | |||

| Pacific Bells LLC / LON (N/A) | 1.04 | 0.2603 | 0.2603 | ||||||

| US013822AG68 / Alcoa Nederland Holding BV | 1.03 | 0.00 | 0.2586 | 0.0088 | |||||

| Project Onyx I / ABS-O (N/A) | 1.03 | 0.2573 | 0.2573 | ||||||

| Flutter Treasury Designated Activity Co. / DBT (US344045AA72) | 1.02 | 0.00 | 0.2558 | 0.0087 | |||||

| GXO / GXO Logistics, Inc. | 1.02 | -1.35 | 0.2555 | 0.0053 | |||||

| J1EF34 / Jefferies Financial Group Inc. - Depositary Receipt (Common Stock) | 1.02 | -1.92 | 0.2552 | 0.0038 | |||||

| Nuveen LLC / DBT (US67080LAD73) | 1.02 | -0.97 | 0.2551 | 0.0064 | |||||

| US67059TAH86 / NuStar Logistics LP | 1.02 | -0.29 | 0.2546 | 0.0081 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1.00 | 0.00 | 1.01 | -0.98 | 0.2533 | 0.0063 | |||

| US02209SBN27 / Altria Group Inc | 1.01 | -4.26 | 0.2530 | -0.0022 | |||||

| Endo Luxembourg Finance Co I SARL / Endo US, Inc. / ABS-O (US037984AA91) | 0.35 | 0.00 | 1.01 | -1.27 | 0.2517 | 0.0053 | |||

| US725894KL20 / Placentia-Yorba Linda Unified School District (Orange County, California), General Obligation Bonds, | 1.01 | -0.30 | 0.2517 | 0.0078 | |||||

| Connecticut Housing Finance Authority Revenue Bonds / DBT (US20775JBJ79) | 1.00 | 0.2510 | 0.2510 | ||||||

| Maryland Department of Housing & Community Development Revenue Bonds / DBT (US57419UVF29) | 1.00 | 0.2508 | 0.2508 | ||||||

| Idaho Housing & Finance Association Revenue Bonds / DBT (US45130BBB80) | 1.00 | 0.2500 | 0.2500 | ||||||

| US34964CAG15 / Fortune Brands Home & Security, Inc. | 1.00 | -5.50 | 0.2494 | -0.0055 | |||||

| US489399AM73 / Kennedy-Wilson Inc | 1.00 | -4.23 | 0.2492 | -0.0023 | |||||

| Cerberus Loan Funding XLV LLC / ABS-O (US15675FAE88) | 1.00 | -2.06 | 0.2491 | 0.0035 | |||||

| Jane Street Group / JSG Finance, Inc. / DBT (US47077WAC29) | 0.99 | 0.71 | 0.2480 | 0.0101 | |||||

| US501889AF63 / LKQ Corp | 0.99 | -0.50 | 0.2476 | 0.0072 | |||||

| US33768EAC66 / FirstKey Homes 2022-SFR3 Trust | 0.99 | -0.20 | 0.2474 | 0.0078 | |||||

| US12510HAT77 / CARS-DB7 LP, Series 2023-1A, Class A2 | 0.99 | -0.80 | 0.2474 | 0.0064 | |||||

| US161175CK86 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.99 | -0.50 | 0.2472 | 0.0070 | |||||

| US87089NAA81 / Swiss Re Finance Luxembourg SA | 0.99 | -0.90 | 0.2465 | 0.0062 | |||||

| Higginbotham Insurance Agency, Inc. / LON (N/A) | 0.99 | 0.2464 | 0.2464 | ||||||

| US03115AAC71 / AmFam Holdings Inc | 0.99 | -4.00 | 0.2462 | -0.0015 | |||||

| US50203UAA16 / LBJ Infrastructure Group LLC | 0.98 | -7.08 | 0.2461 | -0.0095 | |||||

| US835898AH05 / SOTHEBYS 7.375% 10/15/2027 144A | 0.98 | -0.71 | 0.2461 | 0.0068 | |||||

| Virginia Housing Development Authority Revenue Bonds / DBT (US92812U7L61) | 0.98 | -3.63 | 0.2458 | -0.0005 | |||||

| H1FC34 / HF Sinclair Corporation - Depositary Receipt (Common Stock) | 0.98 | -3.82 | 0.2454 | -0.0010 | |||||

| Amazon Conservation DAC / DBT (US02315JAA25) | 0.98 | -1.60 | 0.2452 | 0.0044 | |||||

| Citadel Securities, LP / LON (N/A) | 0.98 | 0.2445 | 0.2445 | ||||||

| US46647PDK93 / JPMORGAN CHASE & CO REGD V/R 5.71700000 | 0.98 | -0.71 | 0.2441 | 0.0068 | |||||

| Sitecore Holding III A/S / LON (N/A) | 0.98 | 0.2438 | 0.2438 | ||||||

| US87612BBS07 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 0.98 | -0.61 | 0.2437 | 0.0067 | |||||

| US03789XAE85 / Applebee's Funding LLC / IHOP Funding LLC | 0.97 | -0.82 | 0.2430 | 0.0064 | |||||

| Aston FinCo SARL / LON (N/A) | 0.97 | 0.2424 | 0.2424 | ||||||

| US78487JAB26 / SVC ABS LLC | 0.97 | -0.31 | 0.2422 | 0.0075 | |||||

| US83546DAQ16 / Sonic Capital LLC, Series 2021-1A, Class A2II | 0.97 | -0.41 | 0.2422 | 0.0074 | |||||

| Subway Funding LLC / ABS-O (US864300AE83) | 0.96 | -3.12 | 0.2402 | 0.0006 | |||||

| US440327AL82 / Horace Mann Educators Corp | 0.96 | -1.13 | 0.2402 | 0.0056 | |||||

| US01627AAA60 / Aligned Data Centers Issuer LLC, Series 2021-1A, Class A2 | 0.96 | 0.21 | 0.2402 | 0.0088 | |||||

| XS2397447884 / BCP V Modular Services Finance II PLC | 0.96 | 4.69 | 0.2399 | 0.0184 | |||||

| US97815UAH77 / Women's Care Holdings, Inc., LLC, First Lien Term Loan | 0.96 | -1.24 | 0.2397 | 0.0053 | |||||

| US775109CJ87 / Rogers Communications Inc | 0.96 | -3.13 | 0.2396 | 0.0006 | |||||

| US677347CH71 / Ohio Edison Co | 0.96 | -1.54 | 0.2393 | 0.0044 | |||||

| Alexander Mann / LON (N/A) | 0.96 | 0.2391 | 0.2391 | ||||||

| Homestead Spe Issuer LLC / DBT (US009A9T9IW6) | 0.96 | -6.37 | 0.2388 | -0.0074 | |||||

| US014916AA85 / CORP. NOTE | 0.95 | -0.42 | 0.2385 | 0.0071 | |||||

| US15118JAA34 / Cellnex Finance Co SA | 0.95 | -3.05 | 0.2383 | 0.0009 | |||||

| Cerberus Loan Funding XLVI, LP / ABS-O (US15675BAC19) | 0.95 | -1.87 | 0.2366 | 0.0038 | |||||

| US654579AE17 / Nippon Life Insurance Co | 0.94 | -3.09 | 0.2355 | 0.0007 | |||||

| STLD / Steel Dynamics, Inc. | 0.94 | 0.2349 | 0.2349 | ||||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 0.94 | -6.94 | 0.2349 | -0.0087 | |||||

| US404119CL13 / HCA Inc | 0.94 | -3.79 | 0.2345 | -0.0009 | |||||

| MT / ArcelorMittal S.A. - Depositary Receipt (Common Stock) | 0.93 | -0.85 | 0.2333 | 0.0061 | |||||

| 40467AAH2 / Help At Home, Inc. | 0.93 | 0.2325 | 0.2325 | ||||||

| US817743AA56 / N/A | 0.93 | 0.00 | 0.2315 | 0.0078 | |||||

| Safehold GL Holdings LLC / DBT (US785931AA40) | 0.92 | -2.03 | 0.2292 | 0.0031 | |||||

| US219350BF12 / Corning Inc | 0.92 | -6.15 | 0.2289 | -0.0066 | |||||

| Capstone Acquisition Holdings, Inc. / LON (N/A) | 0.92 | 0.2288 | 0.2288 | ||||||

| Syndigo LLC / LON (N/A) | 0.91 | 0.2282 | 0.2282 | ||||||

| US031162DG24 / Amgen Inc | 0.91 | -6.97 | 0.2267 | -0.0088 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 0.91 | 0.2265 | 0.2265 | ||||||

| US46590XAQ97 / JBS USA LUX S.A. / JBS USA Food Company / JBS USA Finance, Inc. | 0.90 | -4.14 | 0.2257 | -0.0017 | |||||

| Top Pressure Recovery Turbines / ABS-MBS (N/A) | 0.89 | 0.2229 | 0.2229 | ||||||

| Recess Holdings, Inc. / LON (N/A) | 0.89 | 0.2228 | 0.2228 | ||||||

| TRTX Issuer Ltd. / ABS-O (US897764AE66) | 0.88 | 0.2210 | 0.2210 | ||||||

| Metis Issuer, LLC / ABS-O (N/A) | 0.88 | 0.2202 | 0.2202 | ||||||

| Quirch Foods Holdings LLC / LON (N/A) | 0.88 | 0.2190 | 0.2190 | ||||||

| U.S. Treasury Notes / DBT (US91282CMM00) | 0.88 | 0.2190 | 0.2190 | ||||||

| SNX / TD SYNNEX Corporation | 0.87 | -2.24 | 0.2180 | 0.0025 | |||||

| US63943BAA17 / Navigator Aircraft ABS Ltd | 0.87 | -3.11 | 0.2178 | 0.0007 | |||||

| US054989AC24 / BAT CAPITAL CORP 7.079000% 08/02/2043 | 0.87 | -2.37 | 0.2162 | 0.0023 | |||||

| MB2 Dental Solutions LLC / LON (N/A) | 0.86 | 0.2162 | 0.2162 | ||||||

| Farmers Insurance Exchange / DBT (US309601AG75) | 0.86 | -6.62 | 0.2150 | -0.0075 | |||||

| US639057AG33 / NatWest Group PLC | 0.86 | -0.81 | 0.2149 | 0.0058 | |||||

| US21871XAP42 / Corebridge Financial Inc | 0.85 | -1.27 | 0.2131 | 0.0046 | |||||

| US57767XAB64 / Mav Acquisition Corp. | 0.85 | -0.12 | 0.2130 | 0.0069 | |||||

| Switch ABS Issuer LLC / ABS-O (US871044AE30) | 0.85 | -0.24 | 0.2118 | 0.0066 | |||||

| Aretec Group, Inc. / LON (N/A) | 0.85 | 0.2115 | 0.2115 | ||||||

| US92857WBX74 / Vodafone Group PLC | 0.81 | -4.12 | 0.2035 | -0.0016 | |||||

| GoldenTree Loan Management US CLO 1 Ltd. / ABS-O (US38138JAW36) | 0.81 | -0.86 | 0.2013 | 0.0051 | |||||

| TeamSystem SpA / DBT (XS2864287540) | 0.80 | 9.32 | 0.1997 | 0.0232 | |||||

| US92332YAD31 / Venture Global LNG Inc | 0.80 | -2.80 | 0.1994 | 0.0014 | |||||

| Carlyle Direct Lending CLO LLC / ABS-O (US14310QAU22) | 0.80 | -0.50 | 0.1992 | 0.0056 | |||||

| US155498MR63 / Central Texas Regional Mobility Authority Revenue Bonds | 0.80 | -8.93 | 0.1989 | -0.0118 | |||||

| US494791TB20 / King County Public Hospital District No. 2 General Obligation Limited | 0.79 | -4.57 | 0.1985 | -0.0025 | |||||

| LG Energy Solution Ltd. / DBT (US50205MAG42) | 0.79 | 0.1982 | 0.1982 | ||||||

| Connecticut Housing Finance Authority Revenue Bonds / DBT (US20775HT602) | 0.79 | -4.00 | 0.1980 | -0.0012 | |||||

| Navigator Aviation Ltd. / ABS-O (US63943DAB55) | 0.79 | -3.07 | 0.1977 | 0.0007 | |||||

| PREJF / PartnerRe Ltd. - Preferred Stock | 0.05 | 0.00 | 0.79 | 2.08 | 0.1967 | 0.0107 | |||

| US68389XCA19 / Oracle Corp | 0.79 | -5.07 | 0.1966 | -0.0035 | |||||

| US89117F8Z56 / Toronto-Dominion Bank/The | 0.79 | 0.64 | 0.1963 | 0.0079 | |||||

| US432272GE61 / Hillsborough City School District General Obligation Unlimited | 0.78 | -2.73 | 0.1960 | 0.0013 | |||||

| GrafTech Global Enterprises, Inc. / DBT (US38431AAB26) | 0.78 | -5.24 | 0.1943 | -0.0036 | |||||

| US46590XAY22 / JBS USA LUX SA / JBS USA Food Co. / JBS USA Finance, Inc. | 0.77 | -0.39 | 0.1932 | 0.0059 | |||||

| CNO.PRA / CNO Financial Group, Inc. - Corporate Bond/Note | 0.77 | -2.65 | 0.1930 | 0.0014 | |||||

| US02156LAH42 / Altice France SA/France | 0.76 | 8.68 | 0.1911 | 0.0214 | |||||

| AASET Ltd. / ABS-O (US00038QAA67) | 0.76 | -3.79 | 0.1902 | -0.0009 | |||||

| US487312AD23 / Keenan Fort Detrick Energy LLC | 0.76 | -4.04 | 0.1902 | -0.0012 | |||||

| US698299BS24 / Panama Government International Bond | 0.75 | -2.72 | 0.1879 | 0.0014 | |||||

| Illinois Housing Development Authority Revenue Bonds / DBT (US45203MYE55) | 0.75 | -2.59 | 0.1878 | 0.0015 | |||||

| CA008911BJ76 / Air Canada | 0.75 | 4.02 | 0.1877 | 0.0133 | |||||

| OBX Trust / ABS-MBS (US67448NAD03) | 0.75 | -0.66 | 0.1877 | 0.0053 | |||||

| US15675AAE91 / Cerberus Loan Funding XL LLC | 0.75 | -0.27 | 0.1873 | 0.0059 | |||||

| Wayne State University Revenue Bonds / DBT (US946303C446) | 0.75 | -6.40 | 0.1865 | -0.0061 | |||||

| US55903VBE20 / Warnermedia Holdings Inc | 0.75 | -16.01 | 0.1863 | -0.0280 | |||||

| US452152BM28 / State of Illinois General Obligation Unlimited | 0.74 | -1.33 | 0.1861 | 0.0039 | |||||

| First Brands Group LLC / LON (N/A) | 0.74 | 0.1850 | 0.1850 | ||||||

| US51807KAC71 / LaserAway Intermediate Holdings II LLC | 0.73 | -1.08 | 0.1831 | 0.0044 | |||||

| US12513GBJ76 / CDW LLC / CDW Finance Corp | 0.73 | 0.28 | 0.1813 | 0.0068 | |||||

| Blue Ribbon LLC / LON (N/A) | 0.72 | 0.1806 | 0.1806 | ||||||

| Blue Ribbon LLC / LON (N/A) | 0.72 | 0.1806 | 0.1806 | ||||||

| US46651NAA28 / JOL Air Ltd., Series 2019-1, Class A | 0.72 | -2.46 | 0.1789 | 0.0019 | |||||

| US845743BR32 / Southwestern Public Service Co. | 0.71 | 0.1778 | 0.1778 | ||||||

| Omnis Funding Trust / DBT (US68218WAA27) | 0.70 | 0.1760 | 0.1760 | ||||||

| Mill City Securities Ltd. / ABS-MBS (US599920AA30) | 0.70 | -1.68 | 0.1755 | 0.0029 | |||||

| US611594KH47 / Monrovia Unified School District, Los Angeles County, California, Election of 2006 General Obligatio | 0.69 | -0.43 | 0.1724 | 0.0052 | |||||

| Meiji Yasuda Life Insurance Co. / DBT (US585270AE15) | 0.69 | 0.1718 | 0.1718 | ||||||

| Lazard Group LLC / DBT (US52107QAL95) | 0.68 | -0.73 | 0.1707 | 0.0045 | |||||

| LVNV Funding LLC / ABS-O (N/A) | 0.68 | 0.1700 | 0.1700 | ||||||

| LVNV Funding LLC / ABS-O (N/A) | 0.68 | 0.1700 | 0.1700 | ||||||

| XS2351481028 / Deuce Finco Plc | 0.67 | 7.22 | 0.1671 | 0.0166 | |||||

| US29977LAA98 / EverArc Escrow Sarl | 0.67 | 1.22 | 0.1662 | 0.0075 | |||||

| Fortress Credit BSL XV Ltd. / ABS-O (US34964WAS17) | 0.65 | -0.31 | 0.1630 | 0.0050 | |||||

| Belrose Funding Trust II / DBT (US08079KAA25) | 0.65 | 0.1628 | 0.1628 | ||||||

| US90320BAA70 / UPC Broadband Finco BV | 0.65 | -0.46 | 0.1625 | 0.0048 | |||||

| AZ Battery Property LLC / DBT (N/A) | 0.64 | 0.1598 | 0.1598 | ||||||

| US48275RAC16 / KREF, Series 2021-FL2, Class AS | 0.63 | -2.16 | 0.1586 | 0.0021 | |||||

| Datix Bidco Ltd. / LON (N/A) | 0.63 | 0.1579 | 0.1579 | ||||||

| Grant Thornton Advisors LLC / LON (N/A) | 0.63 | 0.1573 | 0.1573 | ||||||

| US50212YAF16 / LPL Holdings Inc | 0.62 | 0.00 | 0.1545 | 0.0051 | |||||

| US85208UAA25 / Sprite 2021-1 Ltd | 0.60 | -8.66 | 0.1503 | -0.0088 | |||||

| OWL Rock Clo XXI LLC / ABS-O (US69120UAC71) | 0.60 | 0.1500 | 0.1500 | ||||||

| Owl Rock CLO XVI LLC / ABS-O (US69120YAE59) | 0.60 | -1.81 | 0.1496 | 0.0025 | |||||

| US78397UAA88 / SCIL IV LLC / SCIL USA Holdings LLC | 0.60 | 0.34 | 0.1492 | 0.0057 | |||||

| Scientific Games Corp. / LON (N/A) | 0.59 | 0.1483 | 0.1483 | ||||||

| FS Rialto Issuer LLC / ABS-O (US30338WAE93) | 0.59 | -1.50 | 0.1481 | 0.0029 | |||||

| US432272GD88 / Hillsborough City School District General Obligation Unlimited | 0.59 | -2.17 | 0.1465 | 0.0020 | |||||

| AS Mileage Plan IP Ltd. / DBT (US00218QAB68) | 0.58 | -2.18 | 0.1459 | 0.0020 | |||||

| US0641598S88 / Bank of Nova Scotia/The | 0.58 | 0.00 | 0.1448 | 0.0048 | |||||

| US71677KAA60 / PetSmart Inc / PetSmart Finance Corp | 0.58 | 1.76 | 0.1447 | 0.0072 | |||||

| US644274AG71 / New Enterprise Stone & Lime Co., Inc. | 0.58 | -0.69 | 0.1446 | 0.0039 | |||||

| AASET Trust / ABS-O (US00255JAA88) | 0.57 | -3.04 | 0.1435 | 0.0005 | |||||

| Dyal Capital Partners IV / DBT (N/A) | 0.57 | 0.1431 | 0.1431 | ||||||

| Dyal Capital Partners IV / DBT (N/A) | 0.57 | 0.1431 | 0.1431 | ||||||

| Foundry JV Holdco LLC / DBT (US350930AE32) | 0.57 | -3.07 | 0.1423 | 0.0004 | |||||

| Merlin Buyer, Inc. / LON (N/A) | 0.56 | 0.1403 | 0.1403 | ||||||

| US891279BF73 / Toronto City School District, Ohio, Qualified School Construction Bonds General Obligation Bonds | 0.56 | 0.00 | 0.1402 | 0.0048 | |||||

| ANG.PRD / American National Group Inc. - Preferred Stock | 0.56 | 0.54 | 0.1398 | 0.0055 | |||||

| US85572RAA77 / Start Ltd/Bermuda | 0.56 | -2.96 | 0.1397 | 0.0007 | |||||

| US43734LAA44 / Home Point Capital Inc | 0.56 | 0.18 | 0.1395 | 0.0051 | |||||

| Dyal Capital Partners III (A), LP / DBT (N/A) | 0.56 | 0.1390 | 0.1390 | ||||||

| US07284RAA05 / Baylor College of Medicine | 0.55 | -4.81 | 0.1386 | -0.0019 | |||||

| US89680YAC93 / Triton Container International Ltd | 0.55 | -1.95 | 0.1386 | 0.0022 | |||||

| US00439CBC73 / Accuride Corp. | 0.55 | 0.1380 | 0.1380 | ||||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.54 | -0.37 | 0.1361 | 0.0042 | |||||

| Stack Infrastructure Issuer LLC / ABS-O (US85236KAP75) | 0.54 | 0.1345 | 0.1345 | ||||||

| Subway Funding LLC / ABS-O (US864300AL27) | 0.54 | -4.12 | 0.1337 | -0.0011 | |||||

| ECPG / Encore Capital Group, Inc. | 0.53 | 0.19 | 0.1332 | 0.0048 | |||||

| Modena Buyer LLC / LON (N/A) | 0.53 | 0.1325 | 0.1325 | ||||||

| Freddie Mac Military Housing Bonds Resecuritization Trust Certificates / ABS-MBS (35563CAK4) | 0.52 | -1.14 | 0.1298 | 0.0030 | |||||

| ESGRF / Enstar Group Limited - Preferred Stock | 0.51 | 0.1265 | 0.1265 | ||||||

| US355514MD99 / Fraser Public School District, Macomb County, Michigan, General Obligation Federally Taxable School | 0.51 | -50.05 | 0.1264 | -0.1178 | |||||

| US016066BK77 / Alhambra Unified School District General Obligation Unlimited | 0.50 | -0.59 | 0.1262 | 0.0036 | |||||

| Kentucky Housing Corp. Revenue Bonds / DBT (US491309MJ61) | 0.50 | -3.47 | 0.1250 | -0.0001 | |||||

| US50149XAA28 / Kuvare US Holdings Inc | 0.50 | 0.00 | 0.50 | -0.20 | 0.1246 | 0.0040 | |||

| Golub Capital Partners CLO 46M Ltd. / ABS-O (US38178UAE91) | 0.50 | -1.78 | 0.1245 | 0.0021 | |||||

| Tennessee Housing Development Agency Revenue Bonds / DBT (US88046KNH58) | 0.49 | -3.92 | 0.1225 | -0.0007 | |||||

| Iowa Finance Authority Revenue Bonds / DBT (US46247EAY14) | 0.49 | -4.70 | 0.1219 | -0.0016 | |||||

| Switch ABS Issuer LLC / ABS-O (US871044AL72) | 0.49 | 0.1218 | 0.1218 | ||||||

| Tennessee Housing Development Agency Revenue Bonds / DBT (US88046KLA24) | 0.49 | -4.32 | 0.1218 | -0.0013 | |||||

| US629377CT71 / NRG Energy Inc | 0.49 | -0.82 | 0.1213 | 0.0032 | |||||

| US081331AH35 / Belvoir Land LLC | 0.48 | -1.63 | 0.1207 | 0.0022 | |||||

| The Facilities Group / LON (N/A) | 0.48 | 0.1205 | 0.1205 | ||||||

| Tennessee Housing Development Agency Revenue Bonds / DBT (US88046KRU24) | 0.48 | 0.1204 | 0.1204 | ||||||

| Kentucky Housing Corp. Revenue Bonds / DBT (US491309GY03) | 0.48 | -5.51 | 0.1201 | -0.0026 | |||||

| ECPG / Encore Capital Group, Inc. | 0.48 | 0.85 | 0.1192 | 0.0049 | |||||

| US575896WS00 / Massachusetts Port Authority Revenue Bonds | 0.48 | -7.21 | 0.1190 | -0.0049 | |||||

| AMNGL / American National Group, Inc. - Preferred Stock | 0.02 | 0.00 | 0.48 | -4.43 | 0.1188 | -0.0013 | |||

| NFM & J LLC / LON (N/A) | 0.47 | 0.1185 | 0.1185 | ||||||

| US12530GAB41 / CFMT 2022-HB9 LLC | 0.47 | 0.43 | 0.1177 | 0.0046 | |||||

| Global Partners Limited Partnership / GLP Finance Corp. / DBT (US37954FAK03) | 0.47 | -0.21 | 0.1169 | 0.0037 | |||||

| US731068AA07 / Polaris Inc | 0.47 | -1.89 | 0.1167 | 0.0018 | |||||

| US36168WAC55 / GCAT 2022-NQM5 Trust | 0.47 | -2.92 | 0.1165 | 0.0005 | |||||

| Gibson Brands, Inc. / LON (N/A) | 0.47 | 0.1163 | 0.1163 | ||||||

| Xerox Corp. / DBT (US984121CS05) | 0.46 | 0.1156 | 0.1156 | ||||||

| CHEST / ABS-O (N/A) | 0.46 | 0.1151 | 0.1151 | ||||||

| US30015DAA90 / Evergreen Acqco 1 LP/TVI, Inc. | 0.46 | -0.22 | 0.1138 | 0.0036 | |||||

| US12510HAJ95 / CARS-DB4 LP | 0.45 | -2.83 | 0.1119 | 0.0008 | |||||

| Gilead Aviation LLC / ABS-O (US37556TAA43) | 0.44 | -2.84 | 0.1111 | 0.0007 | |||||

| GoldenTree Loan Management US CLO 24 Ltd. / ABS-O (US38139WAA18) | 0.44 | 0.1103 | 0.1103 | ||||||

| US62482BAB80 / MOZART DEBT MERGER SUB INC | 0.44 | 0.69 | 0.1099 | 0.0046 | |||||

| Dyal Capital Partners III (B), LP / DBT (N/A) | 0.44 | 0.1092 | 0.1092 | ||||||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 0.43 | 0.1079 | 0.1079 | ||||||

| US929566AL19 / Wabash National Corp | 0.43 | -5.54 | 0.1066 | -0.0023 | |||||

| US410345AQ54 / Hanesbrands Inc | 0.42 | -0.71 | 0.1056 | 0.0028 | |||||

| VFH Parent LLC / Valor Company-Issuer, Inc. / DBT (US91824YAA64) | 0.42 | 0.97 | 0.1042 | 0.0044 | |||||

| US798136YE10 / Norman Y Mineta San Jose International Airport SJC Revenue Bonds | 0.41 | -1.67 | 0.1031 | 0.0019 | |||||

| US33830JAE55 / Five Guys Holdings Inc | 0.41 | 0.1024 | 0.1024 | ||||||

| SLAM 2025-1 Ltd. / ABS-O (US78450TAA51) | 0.41 | 0.1020 | 0.1020 | ||||||

| Mill City Securities Ltd. / ABS-MBS (US59982DAA72) | 0.41 | -1.46 | 0.1015 | 0.0020 | |||||

| Madison Park Funding LVIII Ltd. / ABS-O (US55817BAD47) | 0.40 | -0.74 | 0.1009 | 0.0027 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0.40 | -0.25 | 0.1007 | 0.0033 | |||||

| US350930AA10 / Foundry JV Holdco LLC | 0.40 | -2.20 | 0.1002 | 0.0014 | |||||

| Dai-ichi Life Insurance Company Ltd. / DBT (US23381LAA26) | 0.40 | -2.93 | 0.0992 | 0.0005 | |||||

| US33767JBE10 / FirstKey Homes 2020-SFR2 Trust | 0.40 | 0.00 | 0.0989 | 0.0035 | |||||

| US33767JBC53 / FirstKey Homes 2020-SFR2 Trust | 0.40 | 0.25 | 0.0988 | 0.0036 | |||||

| Michael Baker International LLC / LON (N/A) | 0.40 | 0.0988 | 0.0988 | ||||||

| ALTDE Trust / ABS-O (US00166NAA72) | 0.40 | -2.47 | 0.0987 | 0.0009 | |||||

| US49456BAX91 / Kinder Morgan, Inc. | 0.39 | -0.76 | 0.0987 | 0.0027 | |||||

| US13077DBY76 / California State University Revenue Bonds | 0.39 | -8.16 | 0.0986 | -0.0051 | |||||

| US513075BW03 / Lamar Media Corp | 0.39 | 0.00 | 0.0985 | 0.0033 | |||||

| Stolthaven Houston, Inc. / DBT (N/A) | 0.39 | 0.0971 | 0.0971 | ||||||

| LAFL / Labrador Aviation Finance Ltd 2016-1A | 0.39 | -16.20 | 0.0970 | -0.0149 | |||||

| Blue Owl Capital GP LLC / DBT (N/A) | 0.38 | 0.0959 | 0.0959 | ||||||

| Blue Owl Capital GP LLC / DBT (N/A) | 0.38 | 0.0956 | 0.0956 | ||||||

| US55336V3087 / MPLX LP | 0.37 | 0.0923 | 0.0923 | ||||||

| US35563CAB46 / FREDDIE MAC MILITARY HOUSING B FMMHR 2015 R1 XA1 144A | 0.37 | -2.13 | 0.0922 | 0.0013 | |||||

| US682695AA94 / OneMain Finance Corp | 0.37 | -0.81 | 0.0917 | 0.0025 | |||||

| US67117YAC84 / OBX 2022-NQM8 Trust | 0.36 | -3.49 | 0.0901 | -0.0001 | |||||

| Ascot Group Ltd. / DBT (US04365XAB47) | 0.36 | 0.0888 | 0.0888 | ||||||

| US03969YAB48 / Ardagh Metal Packaging Finance USA LLC / Ardagh Metal Packaging Finance PLC | 0.35 | 1.43 | 0.0887 | 0.0044 | |||||

| H1AS34 / Hasbro, Inc. - Depositary Receipt (Common Stock) | 0.35 | -1.67 | 0.0886 | 0.0016 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0.35 | -0.28 | 0.0876 | 0.0028 | |||||

| US673853GP64 / Oakridge, Michigan, Public Schools, Unlimited Tax General Obligation Bonds | 0.35 | -48.96 | 0.0864 | -0.0769 | |||||

| HighTower Holding LLC / LON (N/A) | 0.34 | 0.0857 | 0.0857 | ||||||

| US33774UAC27 / Fiserv Investment Solutions Inc | 0.34 | -0.59 | 0.0847 | 0.0025 | |||||

| SIGIP / Selective Insurance Group, Inc. - Preferred Stock | 0.02 | 0.00 | 0.34 | -6.42 | 0.0839 | -0.0026 | |||

| C1MS34 / CMS Energy Corporation - Depositary Receipt (Common Stock) | 0.34 | -0.30 | 0.0839 | 0.0026 | |||||

| US44332PAG63 / HUB International Ltd | 0.33 | -38.48 | 0.0828 | -0.0472 | |||||

| Venture Global LNG, Inc. / EP (US92332YAF88) | 0.35 | 0.00 | 0.33 | -7.04 | 0.0825 | -0.0034 | |||

| Dye & Durham Ltd. / DBT (US267486AA63) | 0.32 | -0.93 | 0.0804 | 0.0021 | |||||

| GrafTech Finance, Inc. / LON (N/A) | 0.31 | 0.0784 | 0.0784 | ||||||

| GrafTech Finance, Inc. / LON (N/A) | 0.31 | 0.0784 | 0.0784 | ||||||

| US00258BAA26 / Aaset 2021-2 Trust | 0.31 | -2.49 | 0.0783 | 0.0008 | |||||

| Florida Food Products LLC / LON (N/A) | 0.30 | 0.0758 | 0.0758 | ||||||

| AP Grange Holdings / DBT (N/A) | 0.30 | 0.0757 | 0.0757 | ||||||

| NEE.PRU / NextEra Energy Capital Holdings, Inc. - Preferred Security | 0.01 | 0.30 | 0.0750 | 0.0750 | |||||

| E1XC34 / Exelon Corporation - Depositary Receipt (Common Stock) | 0.30 | -0.33 | 0.0749 | 0.0023 | |||||

| US57767XAA81 / Mav Acquisition Corp | 0.30 | 0.68 | 0.0741 | 0.0030 | |||||

| US02156LAF85 / Altice France SA/France | 0.30 | 8.86 | 0.0738 | 0.0083 | |||||

| OHA Credit Partners VII Ltd. / ABS-O (US67102UAK51) | 0.30 | 0.0738 | 0.0738 | ||||||

| Greensaif Pipelines Bidco SARL / DBT (US39541EAE32) | 0.29 | -2.00 | 0.0737 | 0.0013 | |||||

| Merlin Buyer, Inc. / LON (N/A) | 0.29 | 0.0731 | 0.0731 | ||||||

| US357155CA60 / Fremont Unified School District/Alameda County California General Obligation Unlimited | 0.29 | -3.99 | 0.0724 | -0.0005 | |||||

| Ceamer Finance LLC / ABS-O (N/A) | 0.29 | 0.0723 | 0.0723 | ||||||

| Ceamer Finance LLC / ABS-O (N/A) | 0.29 | 0.0723 | 0.0723 | ||||||

| Service Experts Issuer LLC / ABS-O (US81758FAA84) | 0.29 | -6.23 | 0.0716 | -0.0022 | |||||

| Project Onyx II / ABS-O (N/A) | 0.28 | 0.0712 | 0.0712 | ||||||

| US12510MAB54 / CCRR Parent, Inc Term Loan B | 0.28 | 7.58 | 0.0711 | 0.0071 | |||||

| US46285MAA80 / Iron Mountain Information Management Services Inc | 0.28 | 0.71 | 0.0709 | 0.0030 | |||||

| US70137WAL28 / Parkland Corp | 0.28 | 0.00 | 0.0704 | 0.0025 | |||||

| US864486AL98 / Suburban Propane Partners LP/Suburban Energy Finance Corp | 0.28 | 1.45 | 0.0698 | 0.0034 | |||||

| OBX Trust / ABS-MBS (US67118XAC92) | 0.26 | -7.45 | 0.0654 | -0.0029 | |||||

| Global Atlantic Finance Co. / DBT (US37959GAF46) | 0.26 | -5.86 | 0.0644 | -0.0017 | |||||

| US19075Q6070 / COBANK ACB | 0.25 | 0.00 | 0.25 | -0.39 | 0.0635 | 0.0018 | |||

| Fortitude Group Holdings LLC / DBT (US34966XAA63) | 0.25 | 0.0633 | 0.0633 | ||||||

| Ares Direct Lending CLO 1 LLC / ABS-O (US04020RAC25) | 0.25 | -0.79 | 0.0626 | 0.0016 | |||||

| HPS Private Credit CLO 2025-3 LLC / ABS-O (US40445YAG98) | 0.25 | 0.0625 | 0.0625 | ||||||

| Kentucky Housing Corp. Revenue Bonds / DBT (US491309NM81) | 0.25 | 0.0622 | 0.0622 | ||||||

| Elmwood CLO VI Ltd. / ABS-O (US29001WAJ62) | 0.25 | 0.0620 | 0.0620 | ||||||

| US126307BM89 / CSC Holdings LLC | 0.25 | 1.65 | 0.0618 | 0.0031 | |||||

| US33767JBA97 / FirstKey Homes 2020-SFR2 Trust | 0.25 | 0.41 | 0.0616 | 0.0023 | |||||

| Texas Department of Housing & Community Affairs Revenue Bonds / DBT (US882750K843) | 0.25 | 0.0615 | 0.0615 | ||||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0.24 | -3.24 | 0.0600 | 0.0001 | |||||

| Nevada Housing Division Revenue Bonds / DBT (US641279XN92) | 0.24 | -5.16 | 0.0600 | -0.0010 | |||||

| Beacon Funding Trust / DBT (US073952AB93) | 0.24 | -5.53 | 0.0599 | -0.0013 | |||||

| US76009NAL47 / Rent-A-Center Inc/TX | 0.24 | -2.05 | 0.0598 | 0.0008 | |||||

| US86828LAC63 / Superior Plus LP / Superior General Partner Inc | 0.24 | 2.60 | 0.0594 | 0.0034 | |||||

| FIGRE Trust / ABS-MBS (US31684HAA86) | 0.23 | -7.63 | 0.0575 | -0.0026 | |||||

| US097023CQ64 / Boeing Co/The | 0.23 | -3.43 | 0.0563 | -0.0001 | |||||

| LPL Holdings, Inc. / DBT (US50212YAK01) | 0.22 | -1.33 | 0.0558 | 0.0012 | |||||

| US79307TDB35 / City of State Paul Minnesota Sales & Use Tax Revenue Tax Allocation | 0.22 | -1.33 | 0.0555 | 0.0009 | |||||

| US76913ALL51 / Riverside County Redevelopment Successor Agency Tax Allocation | 0.22 | -3.11 | 0.0547 | 0.0004 | |||||

| US432272GG10 / Hillsborough City School District General Obligation Unlimited | 0.21 | -4.46 | 0.0537 | -0.0004 | |||||

| US205759GX52 / Comstock Park Public Schools General Obligation Unlimited | 0.21 | -49.40 | 0.0526 | -0.0478 | |||||

| NDOI / Endo, Inc. | 0.01 | 0.00 | 0.21 | -25.98 | 0.0522 | -0.0158 | |||

| US260543DH36 / Dow Chemical Co/The | 0.21 | 0.0521 | 0.0521 | ||||||

| US67777JAM09 / OhioHealth Corp | 0.21 | -6.33 | 0.0520 | -0.0015 | |||||

| US092113AV12 / Black Hills Corp | 0.21 | 0.00 | 0.0517 | 0.0017 | |||||

| US39541EAC75 / Greensaif Pipelines Bidco Sarl | 0.20 | -2.40 | 0.0510 | 0.0006 | |||||

| US92328MAE30 / Venture Global Calcasieu Pass LLC | 0.20 | -0.98 | 0.0507 | 0.0013 | |||||

| TNETBB / Telenet Finance Luxembourg Notes Sarl | 0.20 | 1.03 | 0.0492 | 0.0022 | |||||

| US7593518852 / Reinsurance Group of America Inc | 0.20 | -1.51 | 0.0491 | 0.0009 | |||||

| Integrated Power Services Holdings, Inc. / LON (N/A) | 0.19 | 0.0484 | 0.0484 | ||||||

| Integrated Power Services Holdings, Inc. / LON (N/A) | 0.19 | 0.0484 | 0.0484 | ||||||

| US190335MB24 / Coast Community College District General Obligation Unlimited | 0.19 | -4.02 | 0.0479 | -0.0004 | |||||

| US798136YN19 / Norman Y Mineta San Jose International Airport SJC Revenue Bonds | 0.19 | -4.06 | 0.0475 | -0.0003 | |||||

| County of Fond Du Lac Wisconsin Revenue Bonds / DBT (US34446ACA43) | 0.19 | -6.44 | 0.0475 | -0.0015 | |||||

| LSTAR Securities Investment Ltd. / ABS-MBS (US54916LAA17) | 0.19 | -2.08 | 0.0472 | 0.0007 | |||||

| US914073BD24 / University of Arkansas Revenue Bonds | 0.19 | -5.08 | 0.0468 | -0.0009 | |||||

| US857691AH24 / Station Casinos LLC | 0.18 | -0.54 | 0.0458 | 0.0013 | |||||

| US232723HV19 / Cypress Elementary School District (Orange County, California), General Obligation Bonds, Direct-Pay | 0.18 | -0.55 | 0.0451 | 0.0013 | |||||

| US154915AA07 / Central Parent LLC/CDK Global II LLC/CDK Financing Co., Inc. | 0.18 | -5.29 | 0.0448 | -0.0009 | |||||

| US167505KH89 / Chicago Board of Education General Obligation Unlimited | 0.18 | -3.26 | 0.0446 | 0.0000 | |||||

| US052528AM81 / Australia & New Zealand Banking Group Ltd | 0.17 | 0.00 | 0.0434 | 0.0015 | |||||

| US07586PAA93 / Becle SAB de CV | 0.16 | 1.86 | 0.0411 | 0.0021 | |||||

| US452152FA44 / State of Illinois General Obligation Unlimited | 0.16 | -10.06 | 0.0403 | -0.0030 | |||||

| US92763MAB19 / Viper Energy Partners LP | 0.16 | -23.44 | 0.0401 | -0.0105 | |||||

| Switch ABS Issuer LLC / ABS-O (US871044AA18) | 0.15 | -1.31 | 0.0379 | 0.0008 | |||||

| US963320AV88 / Whirlpool Corp. | 0.14 | 0.0362 | 0.0362 | ||||||

| US29336UAC18 / EnLink Midstream Partners LP | 0.13 | -5.67 | 0.0335 | -0.0007 | |||||

| MB2 Dental Solutions LLC / LON (N/A) | 0.12 | 0.0308 | 0.0308 | ||||||

| US12662PAD06 / CVR Energy Inc | 0.12 | 0.85 | 0.0297 | 0.0011 | |||||

| US679191GZ37 / Oklahoma State University Revenue Bonds | 0.12 | -5.60 | 0.0296 | -0.0008 | |||||

| Sitecore Holding III A/S / LON (N/A) | 0.11 | 0.0266 | 0.0266 | ||||||

| Sitecore Holding III A/S / LON (N/A) | 0.11 | 0.0266 | 0.0266 | ||||||

| Hotwire Funding LLC / ABS-O (US44148JAK51) | 0.10 | -0.98 | 0.0254 | 0.0007 | |||||

| Elmwood CLO 16 Ltd. / ABS-O (US29003DAE76) | 0.10 | 0.0251 | 0.0251 | ||||||

| AP Grange Holdings LLC / DBT (N/A) | 0.10 | 0.0246 | 0.0246 | ||||||

| US45236FAF45 / Ilpea Parent Inc | 0.10 | 0.00 | 0.0245 | 0.0007 | |||||

| US842587DJ36 / Southern Co/The | 0.10 | 1.04 | 0.0244 | 0.0010 | |||||

| MB2 Dental Solutions LLC / LON (N/A) | 0.10 | 0.0243 | 0.0243 | ||||||

| US963320AZ92 / WHIRLPOOL CORPORATION | 0.09 | 0.0230 | 0.0230 | ||||||

| US93878LBJ52 / Washington Convention & Sports Authority Revenue Bonds | 0.09 | -4.40 | 0.0219 | -0.0003 | |||||

| US72650RBE18 / Plains All American Pipeline LP / PAA Finance Corp | 0.08 | 0.0200 | 0.0200 | ||||||

| BNPIP / BNPP IP CLO Ltd. | 0.07 | -6.85 | 0.0172 | -0.0005 | |||||

| US35563CAY49 / Freddie Mac Military Housing Bonds Resecuritization Trust Certificates 2015-R1 | 0.07 | -2.94 | 0.0166 | 0.0002 | |||||

| US798136YP66 / San Jose, California, Airport Revenue Bonds, Refunding Series 2021C | 0.05 | -3.70 | 0.0130 | -0.0002 | |||||

| FDX / FedEx Corporation - Depositary Receipt (Common Stock) | 0.05 | 0.0129 | 0.0129 | ||||||

| Amsted Industries, Inc. / DBT (US032177AK30) | 0.05 | 0.0127 | 0.0127 | ||||||

| US92763MAA36 / Viper Energy Partners LP 5.375% 11/01/2027 144A | 0.05 | 0.0127 | 0.0127 | ||||||

| US817743AE78 / SERVPRO Master Issuer LLC | 0.04 | 0.00 | 0.0111 | 0.0004 | |||||

| US55336VBW90 / MPLX LP | 0.04 | 0.0111 | 0.0111 | ||||||

| US2619081076 / DREYFUS TREASURY PRIME CASH MANAGEMENT/ CLASS A | 0.04 | 93.33 | 0.04 | 90.91 | 0.0107 | 0.0053 | |||

| US14856GAB68 / Castlelake Aircraft Structured Trust 2021-1 | 0.04 | -74.05 | 0.0103 | -0.0280 | |||||

| 3-Month SOFR Futures Contracts / DIR (N/A) | 0.04 | 0.0097 | 0.0097 | ||||||

| US963320AX45 / Whirlpool Corp | 0.04 | 0.0089 | 0.0089 | ||||||

| US96524XAA00 / WhiteHorse VIII Ltd. | 0.03 | -49.02 | 0.0066 | -0.0059 | |||||

| FIGS / FIGS, Inc. | 0.00 | 0.00 | 0.02 | -5.88 | 0.0041 | -0.0001 | |||

| BP Holdco LLC / EC (N/A) | 0.02 | 0.01 | 0.0032 | 0.0032 | |||||

| MB2 Dental Solutions LLC / LON (N/A) | 0.01 | 0.0013 | 0.0013 | ||||||

| MB2 Dental Solutions LLC / LON (N/A) | 0.01 | 0.0013 | 0.0013 | ||||||

| YAK BLOCKER 2 LLC / EC (N/A) | 0.00 | 0.00 | 0.0009 | 0.0009 | |||||

| YAK BLOCKER 2 LLC / EC (N/A) | 0.00 | 0.00 | 0.0009 | 0.0009 | |||||

| XS1078200430 / Mirabela Nickel Ltd. | 0.00 | 0.0001 | 0.0000 | ||||||

| Vector Phoenix Holdings, LP / EC (N/A) | 0.02 | 0.00 | 0.0001 | 0.0001 | |||||

| Targus, Inc. / EC (N/A) | 0.02 | 0.00 | 0.0001 | 0.0001 | |||||

| DNA.WS / Soaring Eagle Acquisition Corp. - Equity Warrant | 0.01 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| US00439CBC73 / Accuride Corp. | 0.40 | 0.00 | 0.0000 | 0.0000 | |||||

| Endo Luxembourg Finance Co I SARL / Endo US, Inc. / EC (N/A) | 0.35 | 0.00 | 0.0000 | 0.0000 | |||||

| FRCLL / First Republic Bank - Preferred Stock | 0.03 | 0.00 | 0.00 | 0.0000 | -0.0000 | ||||

| FRCCL / First Republic Bank - Preferred Stock | 0.02 | 0.00 | 0.00 | 0.0000 | -0.0000 | ||||

| US715ESC0184 / ESC PERSHING SQUARE | 0.02 | 0.00 | 0.0000 | 0.0000 | |||||

| Pershing Square SPARC Holdings, Ltd. / DE (N/A) | 0.01 | 0.00 | 0.0000 | 0.0000 | |||||

| Targus, Inc. / EC (N/A) | 0.02 | 0.00 | 0.0000 | 0.0000 | |||||

| Datix Bidco Ltd. / LON (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Datix Bidco Ltd. / LON (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Cliffwater LLC / LON (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| TK Elevator Midco GmbH / LON (N/A) | 0.00 | -0.0000 | -0.0000 | ||||||

| Cliffwater LLC / LON (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| Datix Bidco Ltd. / LON (N/A) | 0.00 | 0.0000 | 0.0000 | ||||||

| US00439CBC73 / Accuride Corp. | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| Integrated Power Services Holdings, Inc. / LON (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| MB2 Dental Solutions LLC / LON (N/A) | -0.00 | -0.0006 | -0.0006 | ||||||

| U.S. Treasury Long Bond Futures Contracts / DIR (N/A) | -0.01 | -0.0018 | -0.0018 | ||||||

| U.S. Treasury Long Bond Futures Contracts / DIR (N/A) | -0.01 | -0.0018 | -0.0018 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.01 | -0.0029 | -0.0029 | ||||||

| Polaris Newco LLC / LON (N/A) | -0.04 | -0.0108 | -0.0108 | ||||||

| Polaris Newco LLC / LON (N/A) | -0.04 | -0.0108 | -0.0108 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0.06 | -0.0144 | -0.0144 | ||||||

| CURRENCY CONTRACT - Rec USD / Deliver EUR / DFE (N/A) | -0.08 | -0.0198 | -0.0198 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.16 | -0.0402 | -0.0402 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.19 | -0.0475 | -0.0475 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.19 | -0.0486 | -0.0486 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.22 | -0.0548 | -0.0548 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.23 | -0.0564 | -0.0564 | ||||||

| BNP / BNP Paribas SA | -0.23 | -0.0571 | -0.0571 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.27 | -0.0670 | -0.0670 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.27 | -0.0686 | -0.0686 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.30 | -0.0755 | -0.0755 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.30 | -0.0758 | -0.0758 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.32 | -0.0805 | -0.0805 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.33 | -0.0818 | -0.0818 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.36 | -0.0901 | -0.0901 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0.36 | -0.0906 | -0.0906 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.39 | -0.0976 | -0.0976 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.41 | -0.1015 | -0.1015 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.43 | -0.1063 | -0.1063 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.49 | -0.1215 | -0.1215 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.52 | -0.1308 | -0.1308 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.53 | -0.1330 | -0.1330 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.55 | -0.1371 | -0.1371 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.56 | -0.1392 | -0.1392 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.56 | -0.1407 | -0.1407 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.58 | -0.1454 | -0.1454 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.59 | -0.1472 | -0.1472 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.59 | -0.1479 | -0.1479 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.60 | -0.1507 | -0.1507 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.64 | -0.1606 | -0.1606 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.64 | -0.1606 | -0.1606 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.64 | -0.1606 | -0.1606 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.67 | -0.1684 | -0.1684 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.72 | -0.1792 | -0.1792 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.73 | -0.1815 | -0.1815 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.75 | -0.1886 | -0.1886 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.76 | -0.1899 | -0.1899 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.76 | -0.1901 | -0.1901 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.77 | -0.1914 | -0.1914 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.77 | -0.1920 | -0.1920 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.80 | -0.1994 | -0.1994 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.80 | -0.1995 | -0.1995 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.80 | -0.2008 | -0.2008 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.82 | -0.2060 | -0.2060 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.85 | -0.2121 | -0.2121 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.86 | -0.2143 | -0.2143 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.88 | -0.2196 | -0.2196 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.88 | -0.2205 | -0.2205 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.89 | -0.2213 | -0.2213 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.89 | -0.2220 | -0.2220 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.91 | -0.2265 | -0.2265 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.91 | -0.2280 | -0.2280 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.91 | -0.2280 | -0.2280 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.91 | -0.2280 | -0.2280 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.91 | -0.2280 | -0.2280 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.91 | -0.2287 | -0.2287 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.93 | -0.2313 | -0.2313 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.93 | -0.2319 | -0.2319 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.93 | -0.2328 | -0.2328 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.93 | -0.2335 | -0.2335 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.94 | -0.2346 | -0.2346 | ||||||

| BofA Securities, Inc. / RA (N/A) | -0.94 | -0.2347 | -0.2347 | ||||||

| BNP / BNP Paribas SA | -0.95 | -0.2376 | -0.2376 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.96 | -0.2389 | -0.2389 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -0.97 | -0.2416 | -0.2416 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.97 | -0.2423 | -0.2423 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -0.98 | -0.2449 | -0.2449 | ||||||

| BofA Securities, Inc. / RA (N/A) | -1.00 | -0.2511 | -0.2511 | ||||||

| BofA Securities, Inc. / RA (N/A) | -1.00 | -0.2511 | -0.2511 | ||||||

| BofA Securities, Inc. / RA (N/A) | -1.00 | -0.2511 | -0.2511 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -1.01 | -0.2529 | -0.2529 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -1.02 | -0.2546 | -0.2546 | ||||||

| BofA Securities, Inc. / RA (N/A) | -1.02 | -0.2558 | -0.2558 | ||||||

| BofA Securities, Inc. / RA (N/A) | -1.02 | -0.2560 | -0.2560 | ||||||

| BNP / BNP Paribas SA | -1.03 | -0.2585 | -0.2585 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -1.06 | -0.2648 | -0.2648 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -1.12 | -0.2805 | -0.2805 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -1.14 | -0.2852 | -0.2852 | ||||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -1.15 | -0.2880 | -0.2880 | ||||||

| Goldman Sachs & Co. LLC / RA (N/A) | -1.25 | -0.3117 | -0.3117 | ||||||

| Barclays Capital, Inc. / RA (N/A) | -1.32 | -0.3296 | -0.3296 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -1.34 | -0.3346 | -0.3346 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -1.66 | -0.4138 | -0.4138 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -1.72 | -0.4310 | -0.4310 | ||||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -1.83 | -0.4566 | -0.4566 | ||||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -1.83 | -0.4566 | -0.4566 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -1.83 | -0.4581 | -0.4581 | ||||||

| BofA Securities, Inc. / RA (N/A) | -1.84 | -0.4595 | -0.4595 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -1.99 | -0.4974 | -0.4974 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -2.00 | -0.4997 | -0.4997 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -2.02 | -0.5051 | -0.5051 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -2.04 | -0.5098 | -0.5098 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -2.10 | -0.5245 | -0.5245 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -2.29 | -0.5727 | -0.5727 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -2.65 | -0.6618 | -0.6618 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -2.79 | -0.6977 | -0.6977 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -3.33 | -0.8315 | -0.8315 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -3.52 | -0.8798 | -0.8798 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -3.60 | -0.9007 | -0.9007 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -3.88 | -0.9693 | -0.9693 | ||||||

| RBC Capital Markets LLC / RA (N/A) | -4.09 | -1.0216 | -1.0216 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -4.45 | -1.1129 | -1.1129 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -5.60 | -1.3996 | -1.3996 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -7.29 | -1.8229 | -1.8229 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -7.33 | -1.8320 | -1.8320 | ||||||

| TD Securities (USA) LLC / RA (N/A) | -10.55 | -2.6365 | -2.6365 |