Basic Stats

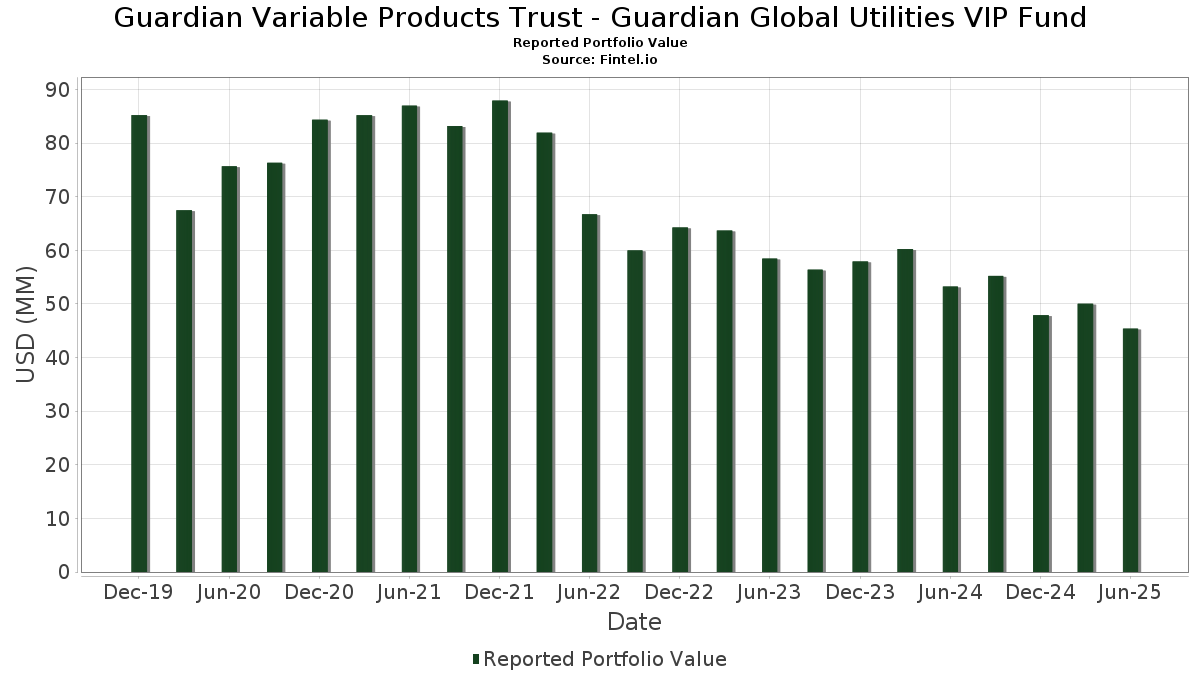

| Portfolio Value | $ 45,391,423 |

| Current Positions | 27 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Guardian Variable Products Trust - Guardian Global Utilities VIP Fund has disclosed 27 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 45,391,423 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Guardian Variable Products Trust - Guardian Global Utilities VIP Fund’s top holdings are NextEra Energy, Inc. (US:NEE) , American Electric Power Company, Inc. (US:AEP) , E.ON SE (DE:EOAN) , Engie SA (FR:ENGI) , and Sempra (US:SRE) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 1.96 | 4.3051 | 1.4862 | |

| 0.52 | 1.1389 | 1.1389 | ||

| 0.00 | 1.12 | 2.4626 | 0.8007 | |

| 0.15 | 2.81 | 6.1593 | 0.7040 | |

| 0.11 | 2.62 | 5.7607 | 0.6094 | |

| 0.13 | 2.49 | 5.4624 | 0.4981 | |

| 0.08 | 1.67 | 3.6636 | 0.4333 | |

| 0.24 | 2.31 | 5.0782 | 0.3879 | |

| 0.00 | 0.28 | 0.6237 | 0.2255 | |

| 0.15 | 0.64 | 1.3945 | 0.2211 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.04 | 2.93 | 6.4425 | -1.2009 | |

| 0.03 | 2.93 | 6.4294 | -0.8878 | |

| 0.02 | 1.86 | 4.0929 | -0.5332 | |

| 0.02 | 1.93 | 4.2266 | -0.4947 | |

| 0.04 | 0.62 | 1.3577 | -0.4506 | |

| 0.03 | 1.34 | 2.9442 | -0.4326 | |

| 0.01 | 2.02 | 4.4369 | -0.3723 | |

| 0.02 | 1.22 | 2.6874 | -0.3677 | |

| 0.02 | 2.02 | 4.4278 | -0.3635 | |

| 0.15 | 1.22 | 2.6854 | -0.3358 |

13F and Fund Filings

This form was filed on 2025-08-15 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NEE / NextEra Energy, Inc. | 0.04 | -21.80 | 2.93 | -23.41 | 6.4425 | -1.2009 | |||

| AEP / American Electric Power Company, Inc. | 0.03 | -15.93 | 2.93 | -20.17 | 6.4294 | -0.8878 | |||

| EOAN / E.ON SE | 0.15 | -15.93 | 2.81 | 2.60 | 6.1593 | 0.7040 | |||

| ENGI / Engie SA | 0.11 | -15.93 | 2.62 | 1.59 | 5.7607 | 0.6094 | |||

| SRE / Sempra | 0.03 | -15.93 | 2.59 | -10.71 | 5.6933 | -0.1011 | |||

| IBE / Iberdrola, S.A. | 0.13 | -15.93 | 2.49 | -0.04 | 5.4624 | 0.4981 | |||

| ENEL / Enel SpA | 0.24 | -15.93 | 2.31 | -1.66 | 5.0782 | 0.3879 | |||

| NG. / National Grid plc | 0.14 | -15.93 | 2.11 | -5.68 | 4.6323 | 0.1718 | |||

| D / Dominion Energy, Inc. | 0.04 | -12.53 | 2.04 | -11.83 | 4.4685 | -0.1359 | |||

| ATO / Atmos Energy Corporation | 0.01 | -15.93 | 2.02 | -16.18 | 4.4369 | -0.3723 | |||

| SO / The Southern Company | 0.02 | -15.93 | 2.02 | -16.07 | 4.4278 | -0.3635 | |||

| VST / Vistra Corp. | 0.01 | -15.92 | 1.96 | 38.71 | 4.3051 | 1.4862 | |||

| DUK / Duke Energy Corporation | 0.02 | -15.93 | 1.93 | -18.64 | 4.2266 | -0.4947 | |||

| WEC / WEC Energy Group, Inc. | 0.02 | -15.93 | 1.86 | -19.62 | 4.0929 | -0.5332 | |||

| SBSP3 / Companhia de Saneamento Básico do Estado de São Paulo - SABESP | 0.08 | -16.00 | 1.67 | 3.03 | 3.6636 | 0.4333 | |||

| EXC / Exelon Corporation | 0.03 | -15.93 | 1.34 | -20.80 | 2.9442 | -0.4326 | |||

| 1038 / CK Infrastructure Holdings Limited | 0.20 | -16.03 | 1.32 | -7.19 | 2.8932 | 0.0620 | |||

| OGS / ONE Gas, Inc. | 0.02 | -15.94 | 1.22 | -20.12 | 2.6874 | -0.3677 | |||

| 2688 / ENN Energy Holdings Limited | 0.15 | -15.90 | 1.22 | -19.22 | 2.6854 | -0.3358 | |||

| CEG / Constellation Energy Corporation | 0.00 | -15.90 | 1.12 | 34.57 | 2.4626 | 0.8007 | |||

| IDA / IDACORP, Inc. | 0.01 | -15.93 | 1.12 | -16.48 | 2.4605 | -0.2163 | |||

| KAEPF / The Kansai Electric Power Company, Incorporated | 0.08 | -15.79 | 0.97 | -15.72 | 2.1202 | -0.1653 | |||

| TOG / Tokyo Gas Co.,Ltd. | 0.02 | -15.33 | 0.73 | -11.46 | 1.6131 | -0.0419 | |||

| EDPFY / EDP - Energias de Portugal, S.A. - Depositary Receipt (Common Stock) | 0.15 | -15.93 | 0.64 | 7.99 | 1.3945 | 0.2211 | |||

| PCG / PG&E Corporation | 0.04 | -15.93 | 0.62 | -31.79 | 1.3577 | -0.4506 | |||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 0.52 | 1.1389 | 1.1389 | ||||||

| NRG / NRG Energy, Inc. | 0.00 | -15.40 | 0.28 | 42.71 | 0.6237 | 0.2255 |