Basic Stats

| Portfolio Value | $ 2,873,618,968 |

| Current Positions | 28 |

Latest Holdings, Performance, AUM (from 13F, 13D)

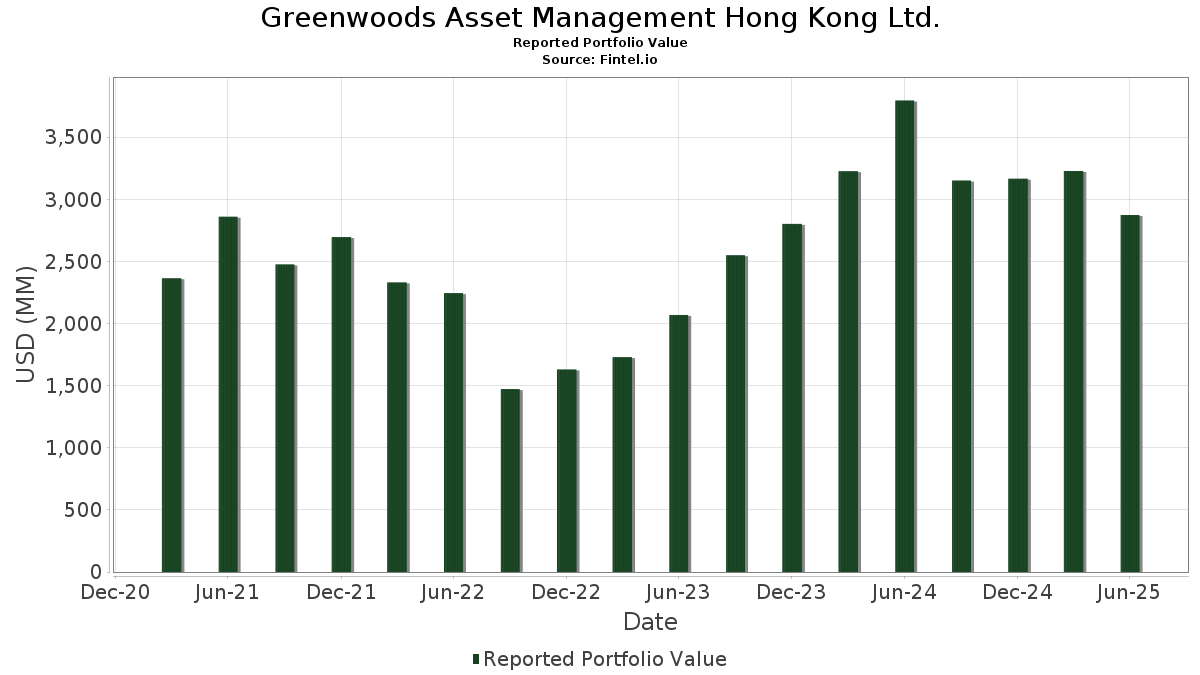

Greenwoods Asset Management Hong Kong Ltd. has disclosed 28 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 2,873,618,968 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Greenwoods Asset Management Hong Kong Ltd.’s top holdings are Meta Platforms, Inc. (US:META) , NetEase, Inc. - Depositary Receipt (Common Stock) (US:NTES) , Full Truck Alliance Co. Ltd. - Depositary Receipt (Common Stock) (US:YMM) , PDD Holdings Inc. - Depositary Receipt (Common Stock) (US:PDD) , and Futu Holdings Limited - Depositary Receipt (Common Stock) (US:FUTU) . Greenwoods Asset Management Hong Kong Ltd.’s new positions include Atour Lifestyle Holdings Limited - Depositary Receipt (Common Stock) (US:ATAT) , H World Group Limited - Depositary Receipt (Common Stock) (US:HTHT) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 3.49 | 469.15 | 16.3260 | 4.9270 | |

| 0.63 | 99.60 | 2.2800 | 2.2800 | |

| 1.28 | 70.62 | 2.4575 | 1.0069 | |

| 0.18 | 32.59 | 1.1342 | 0.9139 | |

| 0.18 | 28.75 | 0.6581 | 0.2913 | |

| 0.21 | 6.85 | 0.2384 | 0.2384 | |

| 0.18 | 6.00 | 0.2087 | 0.2087 | |

| 2.04 | 45.59 | 1.5863 | 0.0526 | |

| 0.02 | 3.75 | 0.0859 | 0.0072 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.13 | 29.73 | 0.6805 | -7.4168 | |

| 3.22 | 336.99 | 11.7270 | -5.2689 | |

| 28.79 | 340.06 | 7.7844 | -2.4996 | |

| 1.53 | 189.26 | 4.3324 | -1.6972 | |

| 0.47 | 52.74 | 1.2072 | -1.2554 | |

| 4.64 | 82.33 | 1.8845 | -1.0854 | |

| 2.67 | 40.54 | 0.9279 | -0.5713 | |

| 0.99 | 731.70 | 16.7493 | -0.5576 | |

| 3.30 | 142.89 | 3.2709 | -0.4703 | |

| 1.33 | 71.66 | 1.6403 | -0.4274 |

13F and Fund Filings

This form was filed on 2025-08-08 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.