Basic Stats

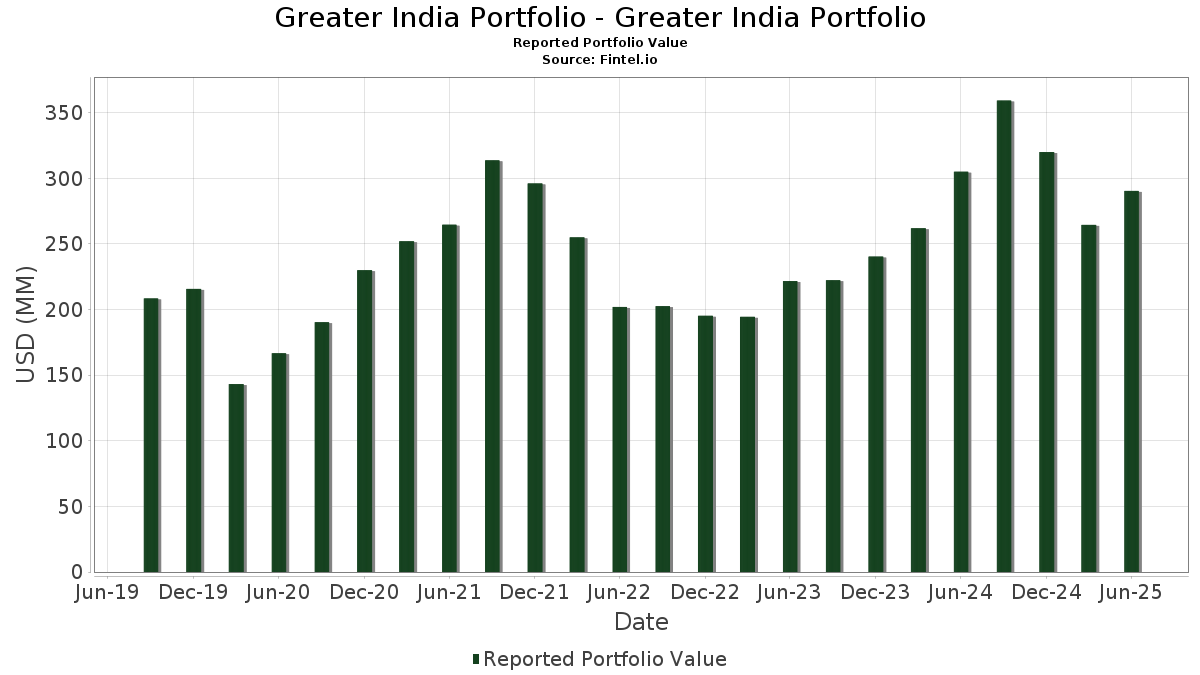

| Portfolio Value | $ 290,407,949 |

| Current Positions | 70 |

Latest Holdings, Performance, AUM (from 13F, 13D)

Greater India Portfolio - Greater India Portfolio has disclosed 70 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 290,407,949 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Greater India Portfolio - Greater India Portfolio’s top holdings are ICICI Bank Limited (IN:ICICIBANK) , Reliance Industries Limited (IN:RELIANCE) , Infosys Limited - Depositary Receipt (Common Stock) (US:INFY) , HDFC Bank Ltd (IN:HDFCB) , and Mahindra & Mahindra Limited (IN:M&M) . Greater India Portfolio - Greater India Portfolio’s new positions include Grasim Industries Limited (IN:GRASIM) , MakeMyTrip Limited (US:MMYT) , Aditya Birla Capital Limited (IN:540691) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.79 | 8.59 | 3.1225 | 3.1225 | |

| 0.12 | 3.89 | 1.4148 | 1.4148 | |

| 0.17 | 3.75 | 1.3643 | 1.3643 | |

| 0.13 | 3.68 | 1.3393 | 1.3393 | |

| 0.19 | 3.29 | 1.1948 | 1.1948 | |

| 0.03 | 2.69 | 0.9796 | 0.9796 | |

| 0.53 | 12.31 | 4.4744 | 0.8184 | |

| 0.05 | 1.62 | 0.5906 | 0.5906 | |

| 0.49 | 1.58 | 0.5735 | 0.5735 | |

| 0.97 | 17.03 | 6.1929 | 0.4610 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.39 | 9.14 | 3.3225 | -1.7512 | |

| 0.00 | 0.00 | -1.3514 | ||

| 1.32 | 22.26 | 8.0936 | -1.2224 | |

| 0.37 | 7.16 | 2.6029 | -0.9801 | |

| 0.04 | 3.26 | 1.1861 | -0.9350 | |

| 0.76 | 14.19 | 5.1586 | -0.8133 | |

| 0.00 | 1.69 | 0.6129 | -0.7351 | |

| 0.94 | 3.69 | 1.3398 | -0.6104 | |

| 0.07 | 5.17 | 1.8808 | -0.6082 | |

| 0.65 | 5.27 | 1.9172 | -0.6073 |

13F and Fund Filings

This form was filed on 2025-08-25 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| ICICIBANK / ICICI Bank Limited | 1.32 | -11.95 | 22.26 | -5.33 | 8.0936 | -1.2224 | |||

| RELIANCE / Reliance Industries Limited | 0.97 | 0.00 | 17.03 | 17.73 | 6.1929 | 0.4610 | |||

| INFY / Infosys Limited - Depositary Receipt (Common Stock) | 0.76 | -7.68 | 14.19 | -5.87 | 5.1586 | -0.8133 | |||

| HDFCB / HDFC Bank Ltd | 0.53 | 21.76 | 12.31 | 33.36 | 4.4744 | 0.8184 | |||

| M&M / Mahindra & Mahindra Limited | 0.30 | -4.99 | 11.18 | 13.63 | 4.0656 | 0.1665 | |||

| AXISBANK / Axis Bank Limited | 0.66 | 4.59 | 9.27 | 14.03 | 3.3699 | 0.1498 | |||

| BHARTIARTL / Bharti Airtel Limited | 0.39 | -38.47 | 9.14 | -28.64 | 3.3225 | -1.7512 | |||

| BAJFINANCE / Bajaj Finance Limited | 0.79 | 8.59 | 3.1225 | 3.1225 | |||||

| ZOMATO / Eternal Limited | 2.56 | -5.21 | 7.90 | 24.28 | 2.8718 | 0.3538 | |||

| SUNPHARMA / Sun Pharmaceutical Industries Limited | 0.37 | -17.94 | 7.16 | -20.84 | 2.6029 | -0.9801 | |||

| KOTAKBANK / Kotak Mahindra Bank Limited | 0.28 | 13.80 | 7.11 | 13.42 | 2.5852 | 0.1014 | |||

| SBILIFE / SBI Life Insurance Company Limited | 0.30 | 0.15 | 6.33 | 19.03 | 2.3013 | 0.1945 | |||

| TATAGLOBAL / Tata Consumer Products Ltd | 0.45 | 0.00 | 5.83 | 9.82 | 2.1197 | 0.0164 | |||

| HINDALCO / Hindalco Industries Limited | 0.65 | -18.84 | 5.27 | -17.25 | 1.9172 | -0.6073 | |||

| APOLLOHOSP / Apollo Hospitals Enterprise Limited | 0.06 | 0.00 | 5.22 | 9.39 | 1.8973 | 0.0072 | |||

| TRENT / Trent Limited | 0.07 | -29.59 | 5.17 | -17.65 | 1.8808 | -0.6082 | |||

| TVSMOTOR / TVS Motor Company Limited | 0.14 | 0.00 | 4.76 | 20.71 | 1.7316 | 0.1685 | |||

| PERSISTENT / Persistent Systems Limited | 0.07 | 0.00 | 4.68 | 9.84 | 1.7006 | 0.0134 | |||

| GPL / Godrej Properties Ltd | 0.17 | 0.00 | 4.56 | 10.64 | 1.6563 | 0.0250 | |||

| TRP / Torrent Pharmaceuticals Ltd | 0.11 | 0.00 | 4.29 | 5.62 | 1.5584 | -0.0494 | |||

| 532424 / Godrej Consumer Products Limited | 0.30 | -9.60 | 4.11 | -8.13 | 1.4955 | -0.2783 | |||

| AUBANK / AU Small Finance Bank Limited | 0.41 | 0.00 | 3.90 | 53.22 | 1.4184 | 0.4096 | |||

| GRASIM / Grasim Industries Limited | 0.12 | 3.89 | 1.4148 | 1.4148 | |||||

| MOTHERSON / Samvardhana Motherson International Limited | 2.15 | 0.00 | 3.88 | 18.90 | 1.4115 | 0.1178 | |||

| SUZLON / Suzlon Energy Limited | 4.90 | 0.00 | 3.87 | 20.13 | 1.4083 | 0.1308 | |||

| COLPAL / Colgate-Palmolive (India) Limited | 0.13 | 0.00 | 3.75 | 0.56 | 1.3649 | -0.1140 | |||

| COFORGE / Coforge Limited | 0.17 | 3.75 | 1.3643 | 1.3643 | |||||

| INE417T01026 / PB Fintech Ltd | 0.17 | 0.00 | 3.69 | 15.11 | 1.3408 | 0.0715 | |||

| NTPC / NTPC Limited | 0.94 | -20.30 | 3.69 | -25.13 | 1.3398 | -0.6104 | |||

| 500790 / Nestlé India Limited | 0.13 | 3.68 | 1.3393 | 1.3393 | |||||

| INE081A01020 / Tata Steel Ltd | 1.91 | 0.00 | 3.56 | 4.40 | 1.2934 | -0.0565 | |||

| 544274 / Hyundai Motor India Limited | 0.14 | -13.89 | 3.55 | 11.57 | 1.2906 | 0.0300 | |||

| Info Edge India Ltd / EC (INE663F01032) | 0.19 | 3.29 | 1.1948 | 1.1948 | |||||

| DIVISLAB / Divi's Laboratories Limited | 0.04 | -60.90 | 3.26 | -51.90 | 1.1861 | -0.9350 | |||

| INE935N01020 / Dixon Technologies India Ltd | 0.02 | -31.00 | 3.24 | -21.38 | 1.1784 | -0.4544 | |||

| INE466L01038 / 360 ONE WAM Ltd | 0.20 | 0.00 | 2.80 | 26.86 | 1.0168 | 0.1432 | |||

| INE531F01015 / Nuvama Wealth Management Ltd | 0.03 | 0.00 | 2.79 | 35.75 | 1.0135 | 0.1999 | |||

| APAT / APL Apollo Tubes Ltd | 0.14 | 0.00 | 2.76 | 13.84 | 1.0020 | 0.0429 | |||

| RECLTD / REC Limited | 0.58 | 0.00 | 2.72 | -5.73 | 0.9876 | -0.1541 | |||

| MMYT / MakeMyTrip Limited | 0.03 | 2.69 | 0.9796 | 0.9796 | |||||

| CTSH / Cognizant Technology Solutions Corporation | 0.03 | 0.00 | 2.66 | 2.03 | 0.9683 | -0.0661 | |||

| INE303R01014 / KALYAN JEWELLERS INDIA LTD | 0.40 | 0.00 | 2.61 | 19.31 | 0.9482 | 0.0822 | |||

| 539437 / IDFC First Bank Limited | 2.92 | 20.94 | 2.48 | 60.54 | 0.9026 | 0.2901 | |||

| NHPC / NHPC Limited | 2.41 | 0.00 | 2.41 | 4.78 | 0.8760 | -0.0351 | |||

| SIEMENS / Siemens Limited | 0.06 | 32.76 | 2.36 | -17.97 | 0.8569 | -0.2813 | |||

| CENTURYTEX / Aditya Birla Real Estate Limited | 0.08 | 0.00 | 2.29 | 24.63 | 0.8335 | 0.1048 | |||

| NTPCGREEN / NTPC Green Energy Limited | 1.88 | 0.00 | 2.29 | 4.72 | 0.8319 | -0.0336 | |||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 2.19 | 79.20 | 2.19 | 79.23 | 0.7971 | 0.3124 | |||

| ZENSAR / Zensar Technologies Ltd | 0.22 | -17.60 | 2.17 | -0.41 | 0.7888 | -0.0743 | |||

| INE128S01021 / Five-Star Business Finance Ltd | 0.23 | -2.52 | 2.09 | 4.09 | 0.7595 | -0.0355 | |||

| 542141 / Techno Electric & Engineering Company Limited | 0.11 | 0.00 | 2.05 | 60.16 | 0.7455 | 0.2384 | |||

| SONACOMS / Sona BLW Precision Forgings Limited | 0.35 | 0.00 | 1.99 | 4.68 | 0.7232 | -0.0296 | |||

| Go Digit General Insurance Ltd / EC (INE03JT01014) | 0.47 | 0.00 | 1.99 | 24.41 | 0.7230 | 0.0898 | |||

| NFIL / Navin Fluorine International Ltd | 0.03 | 0.00 | 1.72 | 14.32 | 0.6239 | 0.0292 | |||

| SHREECEM / Shree Cement Limited | 0.00 | -51.32 | 1.69 | -50.47 | 0.6129 | -0.7351 | |||

| ENRIN / Siemens Energy India Limited | 0.05 | 1.62 | 0.5906 | 0.5906 | |||||

| 540691 / Aditya Birla Capital Limited | 0.49 | 1.58 | 0.5735 | 0.5735 | |||||

| INE03QK01018 / Suven Pharmaceuticals Ltd | 0.14 | -6.37 | 1.54 | -21.36 | 0.5610 | -0.2164 | |||

| PFIZER / Pfizer Limited | 0.02 | 0.00 | 1.53 | 41.98 | 0.5571 | 0.1295 | |||

| 500238 / Whirlpool of India Limited | 0.09 | 0.00 | 1.43 | 41.85 | 0.5189 | 0.1201 | |||

| KAJARIACER / Kajaria Ceramics Limited | 0.11 | 0.00 | 1.34 | 26.01 | 0.4863 | 0.0657 | |||

| INE804L01022 / Medplus Health Services Ltd | 0.12 | 0.00 | 1.27 | 19.07 | 0.4633 | 0.0393 | |||

| BrainBees Solutions Ltd / EC (INE02RE01045) | 0.27 | 0.00 | 1.22 | 4.91 | 0.4434 | -0.0171 | |||

| INE872J01023 / Devyani International Ltd. | 0.58 | 0.00 | 1.14 | 12.81 | 0.4133 | 0.0141 | |||

| INE317I01021 / Metro Brands Ltd | 0.08 | 0.00 | 1.03 | 13.39 | 0.3758 | 0.0147 | |||

| INE732I01013 / Angel Broking Ltd | 0.03 | 0.00 | 1.01 | 26.86 | 0.3661 | 0.0516 | |||

| 517569 / KEI Industries Limited | 0.02 | 0.00 | 0.91 | 31.46 | 0.3315 | 0.0566 | |||

| INE0LMW01024 / CELLO WORLD LTD /INR/ 0.00000000 | 0.09 | 0.00 | 0.65 | 11.98 | 0.2345 | 0.0062 | |||

| IFSC NIFTY 50 FUT JUL25 / DE (000000000) | 0.04 | 0.0142 | 0.0142 | ||||||

| HEXT / Hexaware Technologies Limited | 0.00 | 0.00 | 0.01 | 20.00 | 0.0025 | 0.0002 | |||

| 532777 / Info Edge (India) Limited | 0.00 | -100.00 | 0.00 | -100.00 | -1.3514 |