Basic Stats

| Portfolio Value | $ 440,173,382 |

| Current Positions | 54 |

Latest Holdings, Performance, AUM (from 13F, 13D)

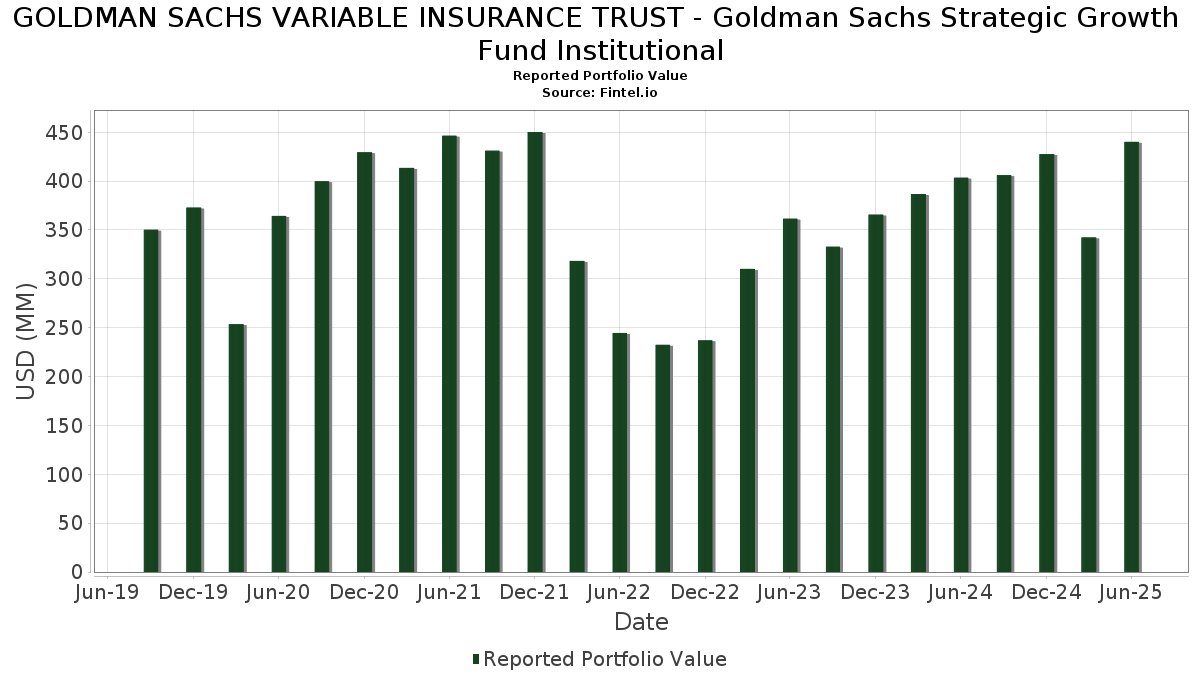

GOLDMAN SACHS VARIABLE INSURANCE TRUST - Goldman Sachs Strategic Growth Fund Institutional has disclosed 54 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 440,173,382 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). GOLDMAN SACHS VARIABLE INSURANCE TRUST - Goldman Sachs Strategic Growth Fund Institutional’s top holdings are Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , Amazon.com, Inc. (US:AMZN) , and Meta Platforms, Inc. (US:META) . GOLDMAN SACHS VARIABLE INSURANCE TRUST - Goldman Sachs Strategic Growth Fund Institutional’s new positions include General Electric Company (US:GE) , Bank of America Corporation (US:BAC) , Cloudflare, Inc. (US:NET) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.34 | 54.39 | 12.3268 | 3.4308 | |

| 0.11 | 56.81 | 12.8745 | 1.7559 | |

| 0.02 | 6.26 | 1.4179 | 1.4179 | |

| 0.07 | 18.18 | 4.1208 | 0.9711 | |

| 0.05 | 8.70 | 1.9715 | 0.8672 | |

| 0.07 | 3.51 | 0.7962 | 0.7962 | |

| 0.01 | 2.92 | 0.6618 | 0.6618 | |

| 0.01 | 2.83 | 0.6422 | 0.6422 | |

| 0.02 | 8.42 | 1.9083 | 0.5818 | |

| 0.01 | 13.21 | 2.9933 | 0.4823 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.20 | 40.08 | 9.0825 | -4.3406 | |

| 0.11 | 23.17 | 5.2513 | -2.1808 | |

| 0.03 | 5.56 | 1.2606 | -1.6263 | |

| 0.02 | 13.44 | 3.0448 | -1.1854 | |

| 0.02 | 12.26 | 2.7784 | -0.4697 | |

| 0.01 | 2.20 | 0.4986 | -0.3363 | |

| 0.04 | 4.49 | 1.0178 | -0.2900 | |

| 0.06 | 4.67 | 1.0573 | -0.2863 | |

| 0.00 | 1.94 | 0.4392 | -0.2338 | |

| 0.03 | 6.77 | 1.5338 | -0.2222 |

13F and Fund Filings

This form was filed on 2025-08-26 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.11 | 12.62 | 56.81 | 49.23 | 12.8745 | 1.7559 | |||

| NVDA / NVIDIA Corporation | 0.34 | 22.50 | 54.39 | 78.58 | 12.3268 | 3.4308 | |||

| AAPL / Apple Inc. | 0.20 | -5.59 | 40.08 | -12.80 | 9.0825 | -4.3406 | |||

| AMZN / Amazon.com, Inc. | 0.11 | -21.03 | 23.17 | -8.94 | 5.2513 | -2.1808 | |||

| META / Meta Platforms, Inc. | 0.03 | -1.47 | 22.21 | 26.17 | 5.0327 | -0.1079 | |||

| AVGO / Broadcom Inc. | 0.07 | 2.42 | 18.18 | 68.62 | 4.1208 | 0.9711 | |||

| MA / Mastercard Incorporated | 0.02 | -9.52 | 13.44 | -7.24 | 3.0448 | -1.1854 | |||

| NFLX / Netflix, Inc. | 0.01 | 6.99 | 13.21 | 53.64 | 2.9933 | 0.4823 | |||

| LLY / Eli Lilly and Company | 0.02 | 16.80 | 12.26 | 10.24 | 2.7784 | -0.4697 | |||

| COST / Costco Wholesale Corporation | 0.01 | 26.28 | 9.89 | 32.18 | 2.2424 | 0.0559 | |||

| ABBV / AbbVie Inc. | 0.05 | 159.72 | 8.70 | 130.13 | 1.9715 | 0.8672 | |||

| SNOW / Snowflake Inc. | 0.04 | 6.97 | 8.48 | 63.78 | 1.9212 | 0.4093 | |||

| GEV / GE Vernova Inc. | 0.02 | 6.96 | 8.42 | 85.42 | 1.9083 | 0.5818 | |||

| TSLA / Tesla, Inc. | 0.02 | 38.67 | 7.82 | 69.98 | 1.7732 | 0.4287 | |||

| GOOG / Alphabet Inc. | 0.04 | 6.96 | 7.60 | 21.45 | 1.7218 | -0.1053 | |||

| LNG / Cheniere Energy, Inc. | 0.03 | 6.97 | 6.77 | 12.56 | 1.5338 | -0.2222 | |||

| GE / General Electric Company | 0.02 | 6.26 | 1.4179 | 1.4179 | |||||

| APP / AppLovin Corporation | 0.02 | -7.08 | 6.21 | 22.77 | 1.4069 | -0.0701 | |||

| SPF / Spotify Technology S.A. | 0.01 | 7.00 | 5.75 | 49.27 | 1.3032 | 0.1780 | |||

| GOOGL / Alphabet Inc. | 0.03 | -50.62 | 5.56 | -43.73 | 1.2606 | -1.6263 | |||

| KLAC / KLA Corporation | 0.01 | -6.42 | 5.20 | 23.33 | 1.1778 | -0.0532 | |||

| GSAXX / Goldman Sachs Trust - Goldman Sachs Financial Square Government Fund | 5.17 | 56.30 | 5.17 | 56.34 | 1.1717 | 0.3981 | |||

| CRM / Salesforce, Inc. | 0.02 | 6.96 | 5.05 | 8.69 | 1.1447 | -0.2127 | |||

| ISRG / Intuitive Surgical, Inc. | 0.01 | 7.02 | 4.87 | 17.41 | 1.1034 | -0.1076 | |||

| MRVL / Marvell Technology, Inc. | 0.06 | -19.33 | 4.67 | 1.41 | 1.0573 | -0.2863 | |||

| ROK / Rockwell Automation, Inc. | 0.01 | 6.95 | 4.64 | 37.49 | 1.0515 | 0.0659 | |||

| BSX / Boston Scientific Corporation | 0.04 | -5.80 | 4.49 | 0.31 | 1.0178 | -0.2900 | |||

| SHW / The Sherwin-Williams Company | 0.01 | 6.97 | 4.33 | 5.20 | 0.9818 | -0.2212 | |||

| DDOG / Datadog, Inc. | 0.03 | 6.97 | 4.22 | 44.84 | 0.9569 | 0.1054 | |||

| ETN / Eaton Corporation plc | 0.01 | 6.96 | 3.94 | 40.48 | 0.8934 | 0.0738 | |||

| DASH / DoorDash, Inc. | 0.02 | 6.95 | 3.86 | 44.26 | 0.8739 | 0.0931 | |||

| BAC / Bank of America Corporation | 0.07 | 3.51 | 0.7962 | 0.7962 | |||||

| NET / Cloudflare, Inc. | 0.01 | 2.92 | 0.6618 | 0.6618 | |||||

| HUBS / HubSpot, Inc. | 0.01 | 95.17 | 2.88 | 90.22 | 0.6527 | 0.2103 | |||

| ZS / Zscaler, Inc. | 0.01 | 2.83 | 0.6422 | 0.6422 | |||||

| MLM / Martin Marietta Materials, Inc. | 0.01 | 6.98 | 2.83 | 22.80 | 0.6411 | -0.0316 | |||

| DT / Dynatrace, Inc. | 0.05 | 6.97 | 2.77 | 25.28 | 0.6279 | -0.0181 | |||

| TEAM / Atlassian Corporation | 0.01 | 6.95 | 2.70 | 2.35 | 0.6125 | -0.1587 | |||

| ALNY / Alnylam Pharmaceuticals, Inc. | 0.01 | -8.76 | 2.69 | 10.18 | 0.6086 | -0.1033 | |||

| TXN / Texas Instruments Incorporated | 0.01 | -11.25 | 2.59 | -1.71 | 0.5859 | -0.0294 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 6.96 | 2.44 | 1.76 | 0.5519 | -0.1472 | |||

| AME / AMETEK, Inc. | 0.01 | 6.96 | 2.40 | 12.46 | 0.5443 | -0.0796 | |||

| CAVA / CAVA Group, Inc. | 0.03 | 67.54 | 2.37 | 63.29 | 0.5374 | 0.1133 | |||

| ABT / Abbott Laboratories | 0.02 | 6.96 | 2.31 | 9.64 | 0.5232 | -0.0916 | |||

| ODFL / Old Dominion Freight Line, Inc. | 0.01 | -21.54 | 2.20 | -23.02 | 0.4986 | -0.3363 | |||

| MU / Micron Technology, Inc. | 0.02 | -22.31 | 2.12 | 10.15 | 0.4800 | -0.0814 | |||

| SPGI / S&P Global Inc. | 0.00 | 6.94 | 2.06 | 10.96 | 0.4660 | -0.0752 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.03 | 6.96 | 2.04 | 1.70 | 0.4618 | -0.1234 | |||

| WCN / Waste Connections, Inc. | 0.01 | 6.97 | 1.96 | 2.35 | 0.4440 | -0.1152 | |||

| ARGX / argenx SE - Depositary Receipt (Common Stock) | 0.00 | -9.68 | 1.94 | -15.89 | 0.4392 | -0.2338 | |||

| NBIX / Neurocrine Biosciences, Inc. | 0.02 | 6.96 | 1.91 | 21.51 | 0.4329 | -0.0261 | |||

| ROST / Ross Stores, Inc. | 0.01 | 6.97 | 1.78 | 6.77 | 0.4043 | -0.0836 | |||

| LEN / Lennar Corporation | 0.02 | 6.96 | 1.71 | 3.07 | 0.3875 | -0.0970 | |||

| IOT / Samsara Inc. | 0.04 | 6.96 | 1.59 | 10.99 | 0.3593 | -0.0578 |