Basic Stats

| Portfolio Value | $ 273,450,792 |

| Current Positions | 72 |

Latest Holdings, Performance, AUM (from 13F, 13D)

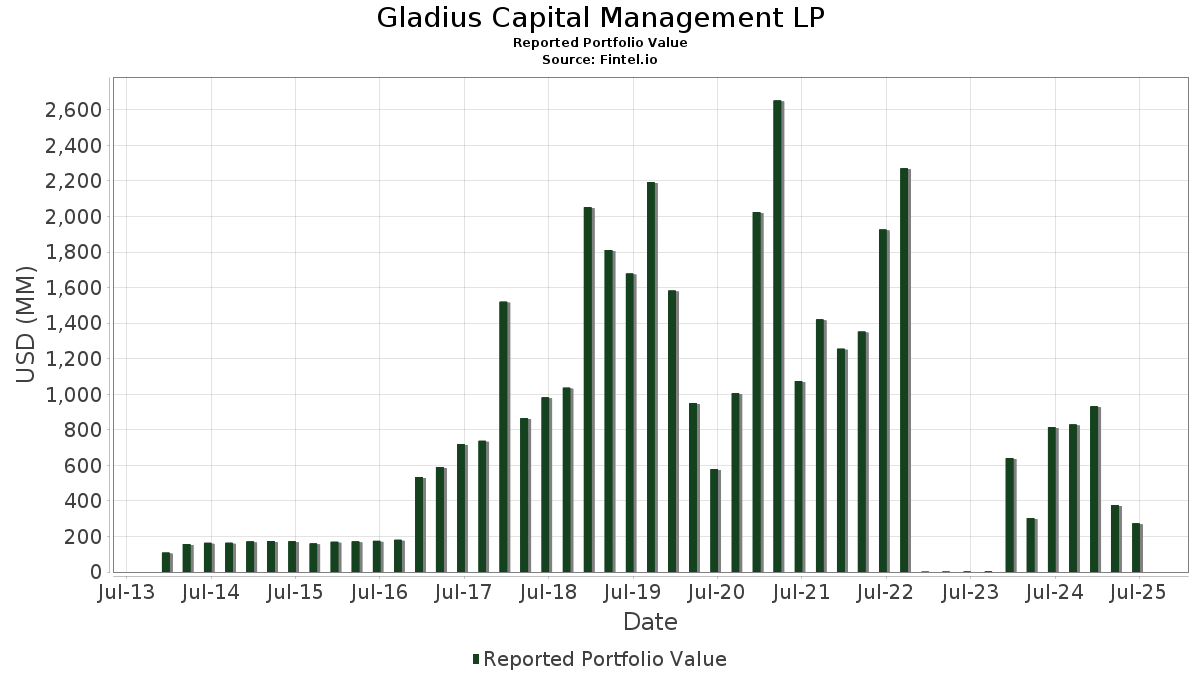

Gladius Capital Management LP has disclosed 72 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 273,450,792 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Gladius Capital Management LP’s top holdings are SPDR S&P 500 ETF (US:SPY) , SPDR S&P 500 ETF (US:SPY) , NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , and Apple Inc. (US:AAPL) . Gladius Capital Management LP’s new positions include Palantir Technologies Inc. (US:PLTR) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.10 | 61.78 | 22.5946 | 22.5946 | |

| 0.07 | 43.28 | 15.8261 | 15.8261 | |

| 0.02 | 6.26 | 2.2883 | 0.1512 | |

| 0.00 | 0.21 | 0.0756 | 0.0756 | |

| 0.01 | 2.95 | 1.0794 | 0.0272 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.07 | 14.71 | 5.3796 | -3.6282 | |

| 0.00 | 2.11 | 0.7722 | -2.4580 | |

| 0.01 | 2.21 | 0.8070 | -2.4566 | |

| 0.01 | 0.97 | 0.3544 | -2.3713 | |

| 0.02 | 2.42 | 0.8861 | -2.0360 | |

| 0.00 | 1.12 | 0.4114 | -1.5119 | |

| 0.01 | 1.75 | 0.6389 | -1.4841 | |

| 0.06 | 10.16 | 3.7171 | -1.3928 | |

| 0.05 | 11.10 | 4.0596 | -1.3740 | |

| 0.01 | 4.95 | 1.8120 | -1.2329 |

13F and Fund Filings

This form was filed on 2025-08-05 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | Put | 0.10 | 61.78 | 22.5946 | 22.5946 | ||||

| SPY / SPDR S&P 500 ETF | 0.07 | 43.28 | 15.8261 | 15.8261 | |||||

| NVDA / NVIDIA Corporation | Put | 0.12 | -52.14 | 18.91 | -30.23 | 6.9158 | -0.2920 | ||

| MSFT / Microsoft Corporation | Put | 0.03 | -53.59 | 17.36 | -38.51 | 6.3483 | -1.1583 | ||

| AAPL / Apple Inc. | Put | 0.07 | -52.98 | 14.71 | -56.57 | 5.3796 | -3.6282 | ||

| AMZN / Amazon.com, Inc. | Put | 0.05 | -52.89 | 11.10 | -45.67 | 4.0596 | -1.3740 | ||

| GOOG / Alphabet Inc. | Put | 0.06 | -53.41 | 10.16 | -47.11 | 3.7171 | -1.3928 | ||

| META / Meta Platforms, Inc. | Put | 0.01 | -53.28 | 8.93 | -40.18 | 3.2660 | -0.7035 | ||

| AVGO / Broadcom Inc. | Put | 0.02 | -52.71 | 6.26 | -22.14 | 2.2883 | 0.1512 | ||

| BRK.B / Berkshire Hathaway Inc. | Put | 0.01 | -52.56 | 4.95 | -56.73 | 1.8120 | -1.2329 | ||

| TSLA / Tesla, Inc. | Put | 0.02 | -52.62 | 4.89 | -41.93 | 1.7890 | -0.4508 | ||

| JPSSZ / JPMorgan Chase & Co. | Put | 0.01 | -52.84 | 3.86 | -44.27 | 1.4101 | -0.4294 | ||

| WMT / Walmart Inc. | Put | 0.04 | -53.27 | 3.71 | -47.96 | 1.3552 | -0.5380 | ||

| LLY / Eli Lilly and Company | Put | 0.00 | -53.12 | 3.51 | -55.76 | 1.2828 | -0.8256 | ||

| V / Visa Inc. | Put | 0.01 | -54.59 | 3.34 | -54.00 | 1.2205 | -0.7086 | ||

| ORCL / Oracle Corporation | Put | 0.01 | -52.30 | 2.95 | -25.40 | 1.0794 | 0.0272 | ||

| NFLX / Netflix, Inc. | Put | 0.00 | -53.49 | 2.68 | -33.20 | 0.9794 | -0.0869 | ||

| NVDA / NVIDIA Corporation | 0.02 | -84.87 | 2.42 | -77.95 | 0.8861 | -2.0360 | |||

| MA / Mastercard Incorporated | Put | 0.00 | -52.75 | 2.42 | -51.55 | 0.8836 | -0.4427 | ||

| XOM / Exxon Mobil Corporation | Put | 0.02 | -52.21 | 2.21 | -56.70 | 0.8082 | -0.5486 | ||

| AAPL / Apple Inc. | 0.01 | -80.53 | 2.21 | -82.03 | 0.8070 | -2.4566 | |||

| MSFT / Microsoft Corporation | 0.00 | -86.88 | 2.11 | -82.62 | 0.7722 | -2.4580 | |||

| COST / Costco Wholesale Corporation | Put | 0.00 | -52.27 | 2.08 | -50.06 | 0.7602 | -0.3464 | ||

| AMZN / Amazon.com, Inc. | 0.01 | -81.02 | 1.75 | -78.12 | 0.6389 | -1.4841 | |||

| JNJ / Johnson & Johnson | Put | 0.01 | -52.70 | 1.74 | -56.43 | 0.6368 | -0.4260 | ||

| PG / The Procter & Gamble Company | Put | 0.01 | -53.22 | 1.74 | -56.27 | 0.6351 | -0.4208 | ||

| HD / The Home Depot, Inc. | Put | 0.00 | -53.00 | 1.72 | -52.97 | 0.6302 | -0.3444 | ||

| BAC / Bank of America Corporation | Put | 0.04 | -52.80 | 1.71 | -46.50 | 0.6264 | -0.2247 | ||

| ABBV / AbbVie Inc. | Put | 0.01 | -52.27 | 1.56 | -57.72 | 0.5702 | -0.4104 | ||

| PALANTIR TECHNOLOGIES INC / PUT (69608A958) | Put | 0.01 | 1.53 | 0.0000 | |||||

| KO / The Coca-Cola Company | Put | 0.02 | -53.15 | 1.42 | -53.71 | 0.5200 | -0.2970 | ||

| UNH / UnitedHealth Group Incorporated | Put | 0.00 | -52.69 | 1.37 | -71.83 | 0.5020 | -0.7933 | ||

| PM / Philip Morris International Inc. | Put | 0.01 | -51.92 | 1.37 | -44.87 | 0.4995 | -0.1589 | ||

| CSCO / Cisco Systems, Inc. | Put | 0.02 | -53.37 | 1.30 | -47.57 | 0.4745 | -0.1836 | ||

| IBM / International Business Machines Corporation | Put | 0.00 | -52.69 | 1.30 | -43.90 | 0.4743 | -0.1406 | ||

| TMUS / T-Mobile US, Inc. | Put | 0.01 | -52.63 | 1.29 | -57.70 | 0.4705 | -0.3380 | ||

| CRM / Salesforce, Inc. | Put | 0.00 | -53.06 | 1.25 | -52.30 | 0.4587 | -0.2406 | ||

| WFC / Wells Fargo & Company | Put | 0.02 | -53.15 | 1.25 | -47.74 | 0.4571 | -0.1786 | ||

| CVX / Chevron Corporation | Put | 0.01 | -52.57 | 1.19 | -59.41 | 0.4346 | -0.3439 | ||

| META / Meta Platforms, Inc. | 0.00 | -87.86 | 1.12 | -84.46 | 0.4114 | -1.5119 | |||

| ABT / Abbott Laboratories | Put | 0.01 | -53.45 | 1.10 | -52.30 | 0.4029 | -0.2109 | ||

| MCD / McDonald's Corporation | Put | 0.00 | -52.78 | 0.99 | -55.85 | 0.3633 | -0.2348 | ||

| GOOG / Alphabet Inc. | 0.01 | -91.67 | 0.97 | -90.55 | 0.3544 | -2.3713 | |||

| AVGO / Broadcom Inc. | 0.00 | -81.07 | 0.94 | -68.86 | 0.3456 | -0.4607 | |||

| TSLA / Tesla, Inc. | 0.00 | -78.65 | 0.82 | -73.83 | 0.2984 | -0.5307 | |||

| V / Visa Inc. | 0.00 | -62.42 | 0.81 | -61.96 | 0.2958 | -0.2691 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -78.96 | 0.71 | -80.81 | 0.2604 | -0.7264 | |||

| LLY / Eli Lilly and Company | 0.00 | -73.57 | 0.60 | -75.05 | 0.2195 | -0.4203 | |||

| WMT / Walmart Inc. | 0.01 | -64.82 | 0.53 | -60.82 | 0.1947 | -0.1666 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -81.55 | 0.51 | -78.21 | 0.1878 | -0.4383 | |||

| XOM / Exxon Mobil Corporation | 0.00 | -73.69 | 0.42 | -76.20 | 0.1532 | -0.3139 | |||

| CRM / Salesforce, Inc. | 0.00 | -64.48 | 0.36 | -63.93 | 0.1317 | -0.1337 | |||

| HD / The Home Depot, Inc. | 0.00 | -58.88 | 0.34 | -58.84 | 0.1251 | -0.0960 | |||

| ORCL / Oracle Corporation | 0.00 | -89.02 | 0.33 | -82.87 | 0.1191 | -0.3855 | |||

| PM / Philip Morris International Inc. | 0.00 | -42.24 | 0.28 | -33.89 | 0.1024 | -0.0099 | |||

| BAC / Bank of America Corporation | 0.01 | -81.42 | 0.28 | -78.93 | 0.1006 | -0.2466 | |||

| MA / Mastercard Incorporated | 0.00 | -86.91 | 0.27 | -86.61 | 0.0982 | -0.4339 | |||

| COST / Costco Wholesale Corporation | 0.00 | -71.78 | 0.26 | -70.47 | 0.0967 | -0.1413 | |||

| NFLX / Netflix, Inc. | 0.00 | -88.90 | 0.23 | -84.10 | 0.0833 | -0.2966 | |||

| PG / The Procter & Gamble Company | 0.00 | -81.00 | 0.22 | -82.26 | 0.0809 | -0.2504 | |||

| ABBV / AbbVie Inc. | 0.00 | -78.54 | 0.22 | -81.05 | 0.0796 | -0.2250 | |||

| PLTR / Palantir Technologies Inc. | 0.00 | 0.21 | 0.0756 | 0.0756 | |||||

| JNJ / Johnson & Johnson | 0.00 | -78.43 | 0.20 | -80.18 | 0.0726 | -0.1932 | |||

| CSCO / Cisco Systems, Inc. | 0.00 | -71.99 | 0.19 | -68.51 | 0.0710 | -0.0929 | |||

| KO / The Coca-Cola Company | 0.00 | -66.80 | 0.18 | -67.20 | 0.0673 | -0.0819 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -61.35 | 0.18 | -76.95 | 0.0658 | -0.1421 | |||

| CVX / Chevron Corporation | 0.00 | -73.90 | 0.17 | -77.76 | 0.0606 | -0.1367 | |||

| IBM / International Business Machines Corporation | 0.00 | -78.98 | 0.16 | -75.08 | 0.0575 | -0.1102 | |||

| TMUS / T-Mobile US, Inc. | 0.00 | -85.20 | 0.15 | -86.85 | 0.0555 | -0.2498 | |||

| MCD / McDonald's Corporation | 0.00 | -76.58 | 0.14 | -78.18 | 0.0503 | -0.1167 | |||

| WFC / Wells Fargo & Company | 0.00 | -82.90 | 0.14 | -80.97 | 0.0503 | -0.1413 | |||

| ABT / Abbott Laboratories | 0.00 | -81.48 | 0.11 | -81.14 | 0.0402 | -0.1137 | |||

| MRK / Merck & Co., Inc. | Put | 0.00 | -100.00 | 0.00 | 0.0000 | ||||

| MRK / Merck & Co., Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |