Basic Stats

| Portfolio Value | $ 1,346,292,665 |

| Current Positions | 108 |

Latest Holdings, Performance, AUM (from 13F, 13D)

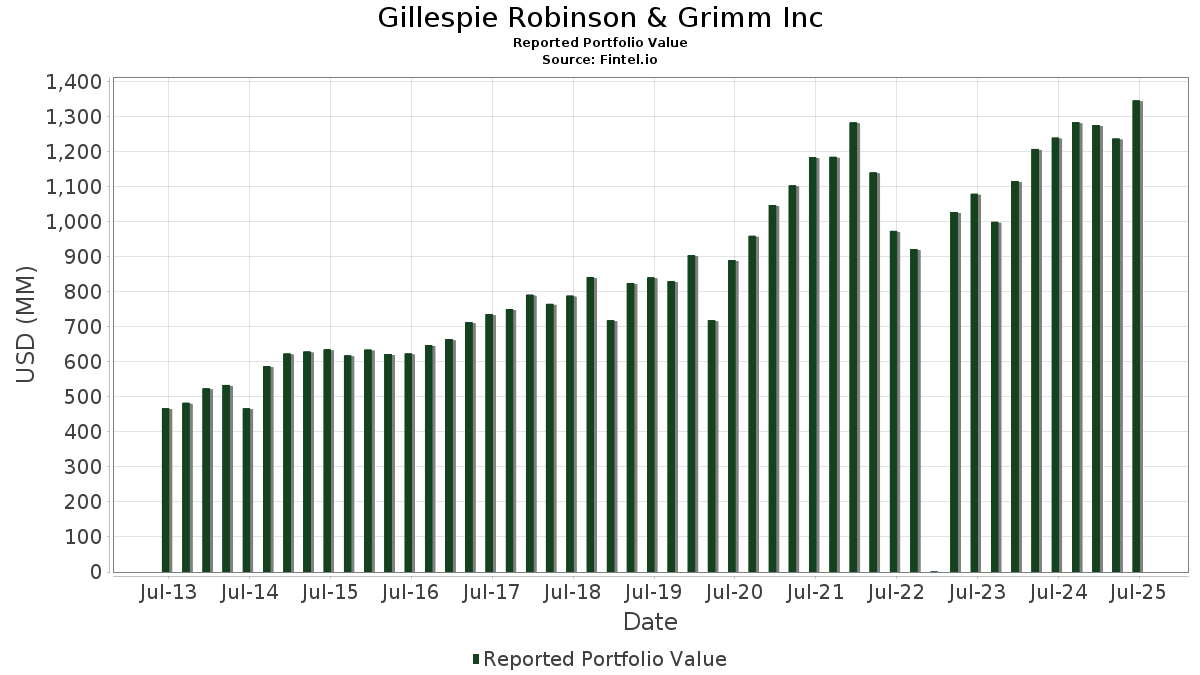

Gillespie Robinson & Grimm Inc has disclosed 108 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 1,346,292,665 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). Gillespie Robinson & Grimm Inc’s top holdings are Meta Platforms, Inc. (US:META) , Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , Amphenol Corporation (US:APH) , and Amazon.com, Inc. (US:AMZN) . Gillespie Robinson & Grimm Inc’s new positions include MercadoLibre, Inc. (US:MELI) , Nelnet, Inc. (US:NNI) , DraftKings Inc. (US:DKNG) , Zscaler, Inc. (US:ZS) , and .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 31.77 | 2.3595 | 2.3595 | |

| 0.65 | 64.07 | 4.7588 | 1.1472 | |

| 0.31 | 48.75 | 3.6214 | 1.0051 | |

| 0.04 | 13.31 | 0.9885 | 0.9660 | |

| 0.18 | 37.18 | 2.7618 | 0.9453 | |

| 0.13 | 64.25 | 4.7720 | 0.9345 | |

| 0.09 | 67.33 | 5.0015 | 0.6464 | |

| 0.43 | 31.15 | 2.3141 | 0.6294 | |

| 0.26 | 41.34 | 3.0708 | 0.6286 | |

| 0.05 | 11.85 | 0.8801 | 0.5989 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.12 | 9.11 | 0.6770 | -1.8279 | |

| 0.03 | 1.63 | 0.1208 | -1.7717 | |

| 0.32 | 64.97 | 4.8259 | -1.2027 | |

| 0.15 | 26.02 | 1.9329 | -1.0922 | |

| 0.11 | 31.71 | 2.3554 | -0.7950 | |

| 0.14 | 49.92 | 3.7079 | -0.7720 | |

| 0.04 | 15.90 | 1.1807 | -0.6998 | |

| 0.20 | 44.01 | 3.2692 | -0.6995 | |

| 0.05 | 22.05 | 1.6380 | -0.5125 | |

| 0.20 | 35.08 | 2.6056 | -0.4433 |

13F and Fund Filings

This form was filed on 2025-07-08 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| META / Meta Platforms, Inc. | 0.09 | -2.43 | 67.33 | 24.95 | 5.0015 | 0.6464 | |||

| AAPL / Apple Inc. | 0.32 | -5.71 | 64.97 | -12.91 | 4.8259 | -1.2027 | |||

| MSFT / Microsoft Corporation | 0.13 | 2.11 | 64.25 | 35.30 | 4.7720 | 0.9345 | |||

| APH / Amphenol Corporation | 0.65 | -4.78 | 64.07 | 43.36 | 4.7588 | 1.1472 | |||

| AMZN / Amazon.com, Inc. | 0.28 | -0.96 | 61.36 | 14.21 | 4.5578 | 0.2159 | |||

| NOW / ServiceNow, Inc. | 0.05 | -3.52 | 50.25 | 24.59 | 3.7328 | 0.4732 | |||

| V / Visa Inc. | 0.14 | -11.11 | 49.92 | -9.95 | 3.7079 | -0.7720 | |||

| NVDA / NVIDIA Corporation | 0.31 | 3.31 | 48.75 | 50.60 | 3.6214 | 1.0051 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.20 | 0.03 | 44.01 | -10.38 | 3.2692 | -0.6995 | |||

| RTX / RTX Corporation | 0.29 | -5.71 | 41.70 | 3.94 | 3.0971 | -0.1449 | |||

| PG / The Procter & Gamble Company | 0.26 | 46.34 | 41.34 | 36.81 | 3.0708 | 0.6286 | |||

| TXN / Texas Instruments Incorporated | 0.20 | -1.64 | 41.05 | 13.64 | 3.0492 | 0.1298 | |||

| TJX / The TJX Companies, Inc. | 0.33 | -2.62 | 41.01 | -1.27 | 3.0464 | -0.3107 | |||

| AMAT / Applied Materials, Inc. | 0.22 | 4.09 | 40.43 | 31.32 | 3.0029 | 0.5148 | |||

| ECL / Ecolab Inc. | 0.14 | 0.47 | 38.90 | 6.78 | 2.8891 | -0.0547 | |||

| JNJ / Johnson & Johnson | 0.25 | 5.26 | 38.85 | -3.05 | 2.8860 | -0.3527 | |||

| PANW / Palo Alto Networks, Inc. | 0.18 | 37.94 | 37.18 | 65.43 | 2.7618 | 0.9453 | |||

| NEE / NextEra Energy, Inc. | 0.51 | 1.72 | 35.16 | -0.39 | 2.6118 | -0.2409 | |||

| GOOG / Alphabet Inc. | 0.20 | -18.11 | 35.08 | -7.02 | 2.6056 | -0.4433 | |||

| MELI / MercadoLibre, Inc. | 0.01 | 31.77 | 2.3595 | 2.3595 | |||||

| ACN / Accenture plc | 0.11 | -15.08 | 31.71 | -18.66 | 2.3554 | -0.7950 | |||

| CARR / Carrier Global Corporation | 0.43 | 29.46 | 31.15 | 49.45 | 2.3141 | 0.6294 | |||

| AMGN / Amgen Inc. | 0.11 | 3.54 | 29.64 | -7.21 | 2.2012 | -0.3797 | |||

| JPM / JPMorgan Chase & Co. | 0.10 | -6.71 | 29.05 | 10.25 | 2.1579 | 0.0284 | |||

| CVX / Chevron Corporation | 0.19 | 8.72 | 27.43 | -6.94 | 2.0372 | -0.3446 | |||

| BDX / Becton, Dickinson and Company | 0.15 | -7.55 | 26.02 | -30.48 | 1.9329 | -1.0922 | |||

| RJF / Raymond James Financial, Inc. | 0.16 | 6.65 | 24.19 | 17.75 | 1.7966 | 0.1365 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.05 | -9.14 | 22.05 | -17.13 | 1.6380 | -0.5125 | |||

| UBER / Uber Technologies, Inc. | 0.17 | 6.14 | 16.33 | 35.92 | 1.2126 | 0.2419 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.04 | -16.16 | 15.90 | -31.69 | 1.1807 | -0.6998 | |||

| TFC / Truist Financial Corporation | 0.31 | 8.41 | 13.47 | 13.26 | 1.0008 | 0.0394 | |||

| ETN / Eaton Corporation plc | 0.04 | 3,536.98 | 13.31 | 4,687.05 | 0.9885 | 0.9660 | |||

| ORCL / Oracle Corporation | 0.05 | 117.78 | 11.85 | 240.56 | 0.8801 | 0.5989 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.02 | 3.28 | 9.93 | 14.16 | 0.7379 | 0.0346 | |||

| GOOG / Alphabet Inc. | 0.06 | -22.70 | 9.72 | -11.91 | 0.7217 | -0.1697 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.12 | -67.96 | 9.11 | -70.60 | 0.6770 | -1.8279 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | -0.27 | 7.47 | 10.15 | 0.5548 | 0.0068 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.07 | 421.95 | 6.22 | 471.17 | 0.4621 | 0.3740 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.01 | -1.77 | 6.18 | 15.51 | 0.4592 | 0.0266 | |||

| FLRN / SPDR Series Trust - SPDR Bloomberg Investment Grade Floating Rate ETF | 0.14 | 17.65 | 4.39 | 17.70 | 0.3260 | 0.0246 | |||

| HON / Honeywell International Inc. | 0.01 | -0.33 | 3.47 | 9.61 | 0.2575 | 0.0019 | |||

| KO / The Coca-Cola Company | 0.04 | -1.49 | 3.18 | -2.69 | 0.2364 | -0.0279 | |||

| ODFL / Old Dominion Freight Line, Inc. | 0.02 | -0.36 | 3.13 | -2.25 | 0.2327 | -0.0263 | |||

| HD / The Home Depot, Inc. | 0.01 | -13.83 | 2.64 | -13.79 | 0.1960 | -0.0514 | |||

| PEP / PepsiCo, Inc. | 0.02 | -6.84 | 2.42 | -17.97 | 0.1797 | -0.0586 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.12 | 2.22 | 43.73 | 0.1651 | 0.0402 | |||

| UNP / Union Pacific Corporation | 0.01 | 0.00 | 2.21 | -2.61 | 0.1638 | -0.0192 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 0.00 | 2.11 | -4.87 | 0.1568 | -0.0225 | |||

| XOM / Exxon Mobil Corporation | 0.02 | -1.29 | 2.07 | -10.53 | 0.1540 | -0.0333 | |||

| GSCE / GS Connect S&P GSCI Enhanced Commodity Total Return ETN | 0.00 | 0.00 | 2.07 | 29.62 | 0.1538 | 0.0246 | |||

| ABT / Abbott Laboratories | 0.01 | -6.23 | 1.94 | -3.87 | 0.1440 | -0.0190 | |||

| BAC / Bank of America Corporation | 0.04 | -33.52 | 1.80 | -24.59 | 0.1337 | -0.0593 | |||

| BX / Blackstone Inc. | 0.01 | 0.00 | 1.73 | 6.98 | 0.1287 | -0.0022 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.01 | 3.38 | 1.72 | 9.07 | 0.1277 | 0.0003 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.03 | -93.79 | 1.63 | -93.06 | 0.1208 | -1.7717 | |||

| MRK / Merck & Co., Inc. | 0.02 | 0.00 | 1.46 | -11.81 | 0.1082 | -0.0253 | |||

| SCHG / Schwab Strategic Trust - Schwab U.S. Large-Cap Growth ETF | 0.05 | -0.47 | 1.44 | 16.06 | 0.1069 | 0.0067 | |||

| NTRS / Northern Trust Corporation | 0.01 | 0.00 | 1.27 | 28.50 | 0.0942 | 0.0145 | |||

| SCHV / Schwab Strategic Trust - Schwab U.S. Large-Cap Value ETF | 0.04 | -0.03 | 1.14 | 4.00 | 0.0850 | -0.0039 | |||

| GE / General Electric Company | 0.00 | 0.00 | 1.12 | 28.60 | 0.0829 | 0.0128 | |||

| IBM / International Business Machines Corporation | 0.00 | 5.81 | 1.07 | 25.47 | 0.0798 | 0.0106 | |||

| LLY / Eli Lilly and Company | 0.00 | -4.22 | 1.04 | -9.61 | 0.0776 | -0.0158 | |||

| AES / The AES Corporation | 0.09 | -10.00 | 0.95 | -23.83 | 0.0703 | -0.0300 | |||

| IWB / iShares Trust - iShares Russell 1000 ETF | 0.00 | -18.47 | 0.94 | -9.72 | 0.0697 | -0.0143 | |||

| CPRT / Copart, Inc. | 0.02 | 0.00 | 0.92 | -13.26 | 0.0685 | -0.0175 | |||

| EMR / Emerson Electric Co. | 0.01 | 0.00 | 0.88 | 21.58 | 0.0654 | 0.0069 | |||

| AVGO / Broadcom Inc. | 0.00 | 22.67 | 0.80 | 102.03 | 0.0593 | 0.0273 | |||

| DIS / The Walt Disney Company | 0.01 | -8.80 | 0.78 | 14.62 | 0.0582 | 0.0029 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.78 | 14.68 | 0.0581 | 0.0030 | |||

| ABBV / AbbVie Inc. | 0.00 | -1.40 | 0.66 | -12.55 | 0.0487 | -0.0119 | |||

| NNI / Nelnet, Inc. | 0.01 | 0.61 | 0.0451 | 0.0451 | |||||

| SPOT / Spotify Technology S.A. | 0.00 | -4.74 | 0.60 | 32.74 | 0.0446 | 0.0081 | |||

| MAR / Marriott International, Inc. | 0.00 | 0.00 | 0.59 | 14.65 | 0.0436 | 0.0022 | |||

| DELL / Dell Technologies Inc. | 0.00 | -9.83 | 0.56 | 21.38 | 0.0418 | 0.0043 | |||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.56 | -6.55 | 0.0413 | -0.0067 | |||

| GWW / W.W. Grainger, Inc. | 0.00 | -4.55 | 0.55 | 0.55 | 0.0406 | -0.0033 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.46 | 0.55 | 11.00 | 0.0405 | 0.0008 | |||

| CAT / Caterpillar Inc. | 0.00 | -1.75 | 0.54 | 15.78 | 0.0404 | 0.0024 | |||

| OKTA / Okta, Inc. | 0.01 | 167.90 | 0.54 | 154.46 | 0.0403 | 0.0231 | |||

| AEP / American Electric Power Company, Inc. | 0.01 | 0.99 | 0.53 | -4.15 | 0.0395 | -0.0053 | |||

| VGK / Vanguard International Equity Index Funds - Vanguard FTSE Europe ETF | 0.01 | -31.58 | 0.50 | -24.47 | 0.0374 | -0.0165 | |||

| GEV / GE Vernova Inc. | 0.00 | -0.64 | 0.49 | 72.38 | 0.0366 | 0.0135 | |||

| MA / Mastercard Incorporated | 0.00 | -10.26 | 0.49 | -8.05 | 0.0365 | -0.0067 | |||

| COST / Costco Wholesale Corporation | 0.00 | -1.01 | 0.49 | 3.62 | 0.0361 | -0.0018 | |||

| WMT / Walmart Inc. | 0.00 | -2.17 | 0.44 | 8.91 | 0.0327 | 0.0000 | |||

| MTD / Mettler-Toledo International Inc. | 0.00 | -4.31 | 0.42 | -4.79 | 0.0310 | -0.0044 | |||

| DOV / Dover Corporation | 0.00 | 0.00 | 0.38 | 4.36 | 0.0285 | -0.0012 | |||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | 15.18 | 0.37 | 22.48 | 0.0271 | 0.0030 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.00 | 0.00 | 0.36 | 44.72 | 0.0265 | 0.0065 | |||

| WFC / Wells Fargo & Company | 0.00 | -11.52 | 0.34 | -1.17 | 0.0251 | -0.0026 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.31 | 0.99 | 0.0228 | -0.0018 | |||

| SCHF / Schwab Strategic Trust - Schwab International Equity ETF | 0.01 | 0.00 | 0.30 | 11.76 | 0.0227 | 0.0006 | |||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.00 | 0.00 | 0.30 | 18.40 | 0.0220 | 0.0018 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.00 | -10.75 | 0.29 | 1.05 | 0.0216 | -0.0016 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.28 | -4.11 | 0.0209 | -0.0028 | |||

| DGX / Quest Diagnostics Incorporated | 0.00 | -11.94 | 0.26 | -6.71 | 0.0197 | -0.0032 | |||

| DKNG / DraftKings Inc. | 0.01 | 0.26 | 0.0192 | 0.0192 | |||||

| DE / Deere & Company | 0.00 | 0.00 | 0.24 | 8.52 | 0.0180 | -0.0001 | |||

| CSCO / Cisco Systems, Inc. | 0.00 | -5.85 | 0.24 | 5.86 | 0.0175 | -0.0005 | |||

| CTVA / Corteva, Inc. | 0.00 | 0.23 | 0.0173 | 0.0173 | |||||

| CNMD / CONMED Corporation | 0.00 | -19.77 | 0.23 | -30.95 | 0.0173 | -0.0099 | |||

| ZS / Zscaler, Inc. | 0.00 | 0.23 | 0.0169 | 0.0169 | |||||

| SCHA / Schwab Strategic Trust - Schwab U.S. Small-Cap ETF | 0.01 | -3.87 | 0.21 | 3.96 | 0.0156 | -0.0008 | |||

| STE / STERIS plc | 0.00 | 0.21 | 0.0156 | 0.0156 | |||||

| SCHW / The Charles Schwab Corporation | 0.00 | 0.20 | 0.0149 | 0.0149 | |||||

| TSLA / Tesla, Inc. | 0.00 | 0.20 | 0.0149 | 0.0149 | |||||

| HBAN / Huntington Bancshares Incorporated | 0.01 | 0.00 | 0.17 | 11.33 | 0.0124 | 0.0003 | |||

| CRVS / Corvus Pharmaceuticals, Inc. | 0.03 | 0.00 | 0.13 | 26.21 | 0.0097 | 0.0013 | |||

| NKE / NIKE, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PFE / Pfizer Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0177 |