Basic Stats

| Portfolio Value | $ 198,318,782 |

| Current Positions | 60 |

Latest Holdings, Performance, AUM (from 13F, 13D)

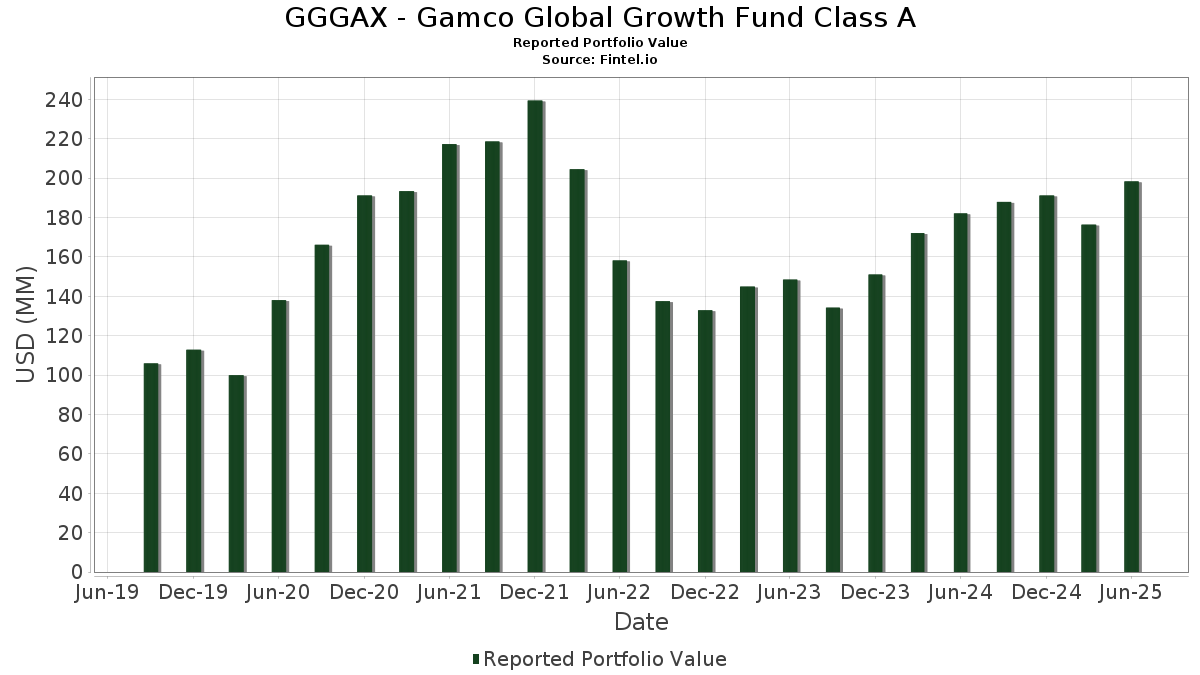

GGGAX - Gamco Global Growth Fund Class A has disclosed 60 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 198,318,782 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). GGGAX - Gamco Global Growth Fund Class A’s top holdings are Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Netflix, Inc. (US:NFLX) , Amazon.com, Inc. (US:AMZN) , and Eli Lilly and Company (US:LLY) . GGGAX - Gamco Global Growth Fund Class A’s new positions include Saab AB (SE:SAABB) , MercadoLibre, Inc. (US:MELI) , Deutsche Börse AG (DE:DB1) , Rheinmetall AG (DE:RHM) , and Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München (DE:MUV2) .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 4.72 | 2.3803 | 2.3803 | ||

| 4.67 | 2.3558 | 2.3558 | ||

| 0.07 | 11.61 | 5.8598 | 1.3689 | |

| 0.02 | 6.31 | 3.1854 | 1.3542 | |

| 2.52 | 1.2693 | 1.2693 | ||

| 2.50 | 1.2611 | 1.2611 | ||

| 0.04 | 2.02 | 1.0215 | 1.0215 | |

| 0.01 | 8.66 | 4.3721 | 0.9707 | |

| 0.02 | 12.14 | 6.1245 | 0.9607 | |

| 0.01 | 4.97 | 2.5100 | 0.8922 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.01 | 2.26 | 1.1386 | -1.3997 | |

| 0.00 | 2.25 | 1.1364 | -1.0282 | |

| 0.01 | 6.49 | 3.2728 | -0.6011 | |

| 0.02 | 4.99 | 2.5159 | -0.5272 | |

| 0.01 | 3.73 | 1.8813 | -0.4699 | |

| 0.04 | 8.27 | 4.1737 | -0.3849 | |

| 0.17 | 5.00 | 2.5217 | -0.3198 | |

| 0.02 | 6.04 | 3.0458 | -0.3130 | |

| 0.01 | 3.20 | 1.6162 | -0.2659 | |

| 0.00 | 1.40 | 0.7059 | -0.2619 |

13F and Fund Filings

This form was filed on 2025-08-29 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.02 | 0.00 | 12.14 | 32.50 | 6.1245 | 0.9607 | |||

| NVDA / NVIDIA Corporation | 0.07 | 0.00 | 11.61 | 45.79 | 5.8598 | 1.3689 | |||

| NFLX / Netflix, Inc. | 0.01 | 0.00 | 8.66 | 43.61 | 4.3721 | 0.9707 | |||

| AMZN / Amazon.com, Inc. | 0.04 | -11.29 | 8.27 | 2.29 | 4.1737 | -0.3849 | |||

| LLY / Eli Lilly and Company | 0.01 | 0.00 | 6.49 | -5.62 | 3.2728 | -0.6011 | |||

| META / Meta Platforms, Inc. | 0.01 | -16.15 | 6.44 | 7.37 | 3.2478 | -0.1315 | |||

| AVGO / Broadcom Inc. | 0.02 | 18.04 | 6.31 | 94.33 | 3.1854 | 1.3542 | |||

| V / Visa Inc. | 0.02 | 0.00 | 6.04 | 1.31 | 3.0458 | -0.3130 | |||

| GE / General Electric Company | 0.02 | 0.00 | 5.11 | 28.63 | 2.5782 | 0.3384 | |||

| 1INVEB / Investor AB (publ) | 0.17 | 0.00 | 5.00 | -0.85 | 2.5217 | -0.3198 | |||

| AAPL / Apple Inc. | 0.02 | 0.00 | 4.99 | -7.63 | 2.5159 | -0.5272 | |||

| GEV / GE Vernova Inc. | 0.01 | 0.00 | 4.97 | 73.37 | 2.5100 | 0.8922 | |||

| United States Treasury Bill / DBT (US912797PQ48) | 4.72 | 2.3803 | 2.3803 | ||||||

| United States Treasury Bill / DBT (US912797NL78) | 4.67 | 2.3558 | 2.3558 | ||||||

| SPF / Spotify Technology S.A. | 0.01 | 0.00 | 4.16 | 39.52 | 2.1006 | 0.4184 | |||

| ETN / Eaton Corporation plc | 0.01 | 0.00 | 4.07 | 31.33 | 2.0518 | 0.3064 | |||

| TT / Trane Technologies plc | 0.01 | 0.00 | 3.85 | 29.86 | 1.9424 | 0.2709 | |||

| MA / Mastercard Incorporated | 0.01 | 0.00 | 3.76 | 2.51 | 1.8999 | -0.1705 | |||

| BSX / Boston Scientific Corporation | 0.04 | 0.00 | 3.76 | 6.49 | 1.8970 | -0.0935 | |||

| AON / Aon plc | 0.01 | 0.00 | 3.73 | -10.60 | 1.8813 | -0.4699 | |||

| SU / Schneider Electric S.E. | 0.01 | 0.00 | 3.59 | 15.21 | 1.8120 | 0.0550 | |||

| KKR / KKR & Co. Inc. | 0.03 | 0.00 | 3.39 | 15.06 | 1.7118 | 0.0498 | |||

| SYK / Stryker Corporation | 0.01 | 0.00 | 3.35 | 6.27 | 1.6930 | -0.0866 | |||

| 6861 / Keyence Corporation | 0.01 | 0.00 | 3.29 | 2.14 | 1.6620 | -0.1558 | |||

| CB / Chubb Limited | 0.01 | 0.00 | 3.20 | -4.07 | 1.6162 | -0.2659 | |||

| ISRG / Intuitive Surgical, Inc. | 0.01 | 0.00 | 3.02 | 9.72 | 1.5219 | -0.0277 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.05 | 0.00 | 2.92 | 11.84 | 1.4734 | 0.0015 | |||

| GOOGL / Alphabet Inc. | 0.02 | 0.00 | 2.85 | 13.93 | 1.4407 | 0.0283 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 2.84 | 20.92 | 1.4356 | 0.1095 | |||

| ORCL / Oracle Corporation | 0.01 | 22.86 | 2.82 | 92.10 | 1.4232 | 0.5956 | |||

| INTU / Intuit Inc. | 0.00 | 21.99 | 2.80 | 56.55 | 1.4110 | 0.4037 | |||

| NOW / ServiceNow, Inc. | 0.00 | 0.00 | 2.74 | 29.13 | 1.3852 | 0.1868 | |||

| OR / L'Oréal S.A. | 0.01 | 0.00 | 2.54 | 15.06 | 1.2842 | 0.0374 | |||

| United States Treasury Bill / DBT (US912797PE18) | 2.52 | 1.2693 | 1.2693 | ||||||

| United States Treasury Bill / DBT (US912797MG92) | 2.50 | 1.2611 | 1.2611 | ||||||

| GOOG / Alphabet Inc. | 0.01 | -55.86 | 2.26 | -49.89 | 1.1386 | -1.3997 | |||

| MC / LVMH Moët Hennessy - Louis Vuitton, Société Européenne | 0.00 | -30.65 | 2.25 | -41.36 | 1.1364 | -1.0282 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.00 | -34.21 | 2.15 | -4.98 | 1.0871 | -0.1910 | |||

| SPGI / S&P Global Inc. | 0.00 | 0.00 | 2.12 | 3.77 | 1.0696 | -0.0819 | |||

| SAABB / Saab AB | 0.04 | 2.02 | 1.0215 | 1.0215 | |||||

| LIN / Linde plc | 0.00 | 0.00 | 1.83 | 0.77 | 0.9234 | -0.1004 | |||

| CDNS / Cadence Design Systems, Inc. | 0.01 | 34.64 | 1.80 | 63.12 | 0.9066 | 0.2857 | |||

| United States Treasury Bill / DBT (US912797PY71) | 1.73 | 0.8742 | 0.8742 | ||||||

| United States Treasury Bill / DBT (US912797NU77) | 1.71 | 0.8651 | 0.8651 | ||||||

| United States Treasury Bill / DBT (US912797PN17) | 1.63 | 0.8207 | 0.8207 | ||||||

| United States Treasury Bill / DBT (US912797PP64) | 1.61 | 0.8100 | 0.8100 | ||||||

| United States Treasury Bill / DBT (US912797MH75) | 1.49 | 0.7511 | 0.7511 | ||||||

| United States Treasury Bill / DBT (US912797QR12) | 1.48 | 0.7446 | 0.7446 | ||||||

| United States Treasury Bill / DBT (US912797QS94) | 1.47 | 0.7435 | 0.7435 | ||||||

| MELI / MercadoLibre, Inc. | 0.00 | 1.46 | 0.7386 | 0.7386 | |||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 0.00 | 1.40 | -18.53 | 0.7059 | -0.2619 | |||

| DB1 / Deutsche Börse AG | 0.00 | 1.37 | 0.6913 | 0.6913 | |||||

| RHM / Rheinmetall AG | 0.00 | 1.06 | 0.5341 | 0.5341 | |||||

| CDI / CANDOVER INVESTMENTS | 0.00 | 0.00 | 1.00 | -12.82 | 0.5048 | -0.1420 | |||

| MUV2 / Münchener Rückversicherungs-Gesellschaft Aktiengesellschaft in München | 0.00 | 0.81 | 0.4091 | 0.4091 | |||||

| WCN / Waste Connections, Inc. | 0.00 | 0.78 | 0.3957 | 0.3957 | |||||

| AMAT / Applied Materials, Inc. | 0.00 | 0.00 | 0.73 | 26.21 | 0.3695 | 0.0423 | |||

| HWM / Howmet Aerospace Inc. | 0.00 | 0.52 | 0.2630 | 0.2630 | |||||

| United States Treasury Bill / DBT (US912797PG65) | 0.40 | 0.2012 | 0.2012 | ||||||

| United States Treasury Bill / DBT (US912797PF82) | 0.10 | 0.0528 | 0.0528 |