Basic Stats

| Portfolio Value | $ 10,523,935 |

| Current Positions | 51 |

Latest Holdings, Performance, AUM (from 13F, 13D)

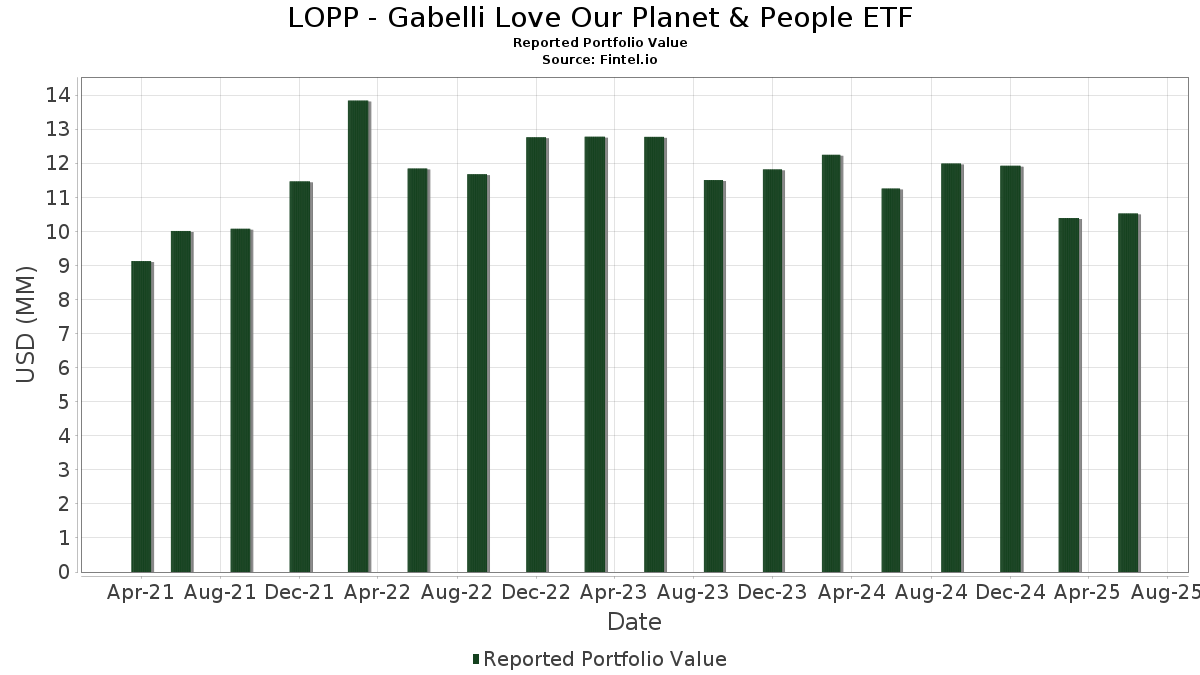

LOPP - Gabelli Love Our Planet & People ETF has disclosed 51 total holdings in their latest SEC filings. Most recent portfolio value is calculated to be $ 10,523,935 USD. Actual Assets Under Management (AUM) is this value plus cash (which is not disclosed). LOPP - Gabelli Love Our Planet & People ETF’s top holdings are Mirion Technologies, Inc. (US:MIR) , Republic Services, Inc. (US:RSG) , Xylem Inc. (US:XYL) , Hubbell Incorporated (US:HUBB) , and Waste Connections, Inc. (US:WCN) . LOPP - Gabelli Love Our Planet & People ETF’s new positions include Veralto Corporation (US:VLTO) , .

Top Increases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.19 | 1.7853 | 1.7853 | ||

| 0.15 | 1.4576 | 1.4576 | ||

| 0.00 | 0.32 | 2.9943 | 1.4236 | |

| 0.03 | 0.56 | 5.3261 | 1.3144 | |

| 0.00 | 0.38 | 3.6161 | 1.2861 | |

| 0.10 | 0.9488 | 0.9488 | ||

| 0.00 | 0.11 | 1.0330 | 0.5307 | |

| 0.00 | 0.05 | 0.4791 | 0.4791 | |

| 0.00 | 0.33 | 3.0977 | 0.4731 | |

| 0.00 | 0.44 | 4.1671 | 0.3944 |

Top Decreases This Quarter

We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.

| Security | Shares (MM) |

Value (MM$) |

Portfolio % | ΔPortfolio % |

|---|---|---|---|---|

| 0.00 | 0.42 | 3.9769 | -1.2280 | |

| 0.01 | 0.07 | 0.6295 | -0.6648 | |

| 0.01 | 0.25 | 2.4110 | -0.6618 | |

| 0.00 | 0.26 | 2.5020 | -0.4690 | |

| 0.00 | 0.47 | 4.4917 | -0.4408 | |

| 0.00 | 0.09 | 0.8529 | -0.4095 | |

| 0.00 | 0.20 | 1.9198 | -0.3646 | |

| 0.00 | 0.31 | 2.8983 | -0.3626 | |

| 0.00 | 0.07 | 0.6729 | -0.3304 | |

| 0.00 | 0.20 | 1.9275 | -0.3234 |

13F and Fund Filings

This form was filed on 2025-08-29 for the reporting period 2025-06-30. Click the link icon to see the full transaction history.

Upgrade to unlock premium data and export to Excel ![]() .

.

| Security | Type | Avg Share Price | Shares (MM) |

ΔShares (%) |

ΔShares (%) |

Value ($MM) |

Portfolio (%) |

ΔPortfolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MIR / Mirion Technologies, Inc. | 0.03 | -10.12 | 0.56 | 33.57 | 5.3261 | 1.3144 | |||

| RSG / Republic Services, Inc. | 0.00 | -10.12 | 0.47 | -8.51 | 4.4917 | -0.4408 | |||

| XYL / Xylem Inc. | 0.00 | -10.13 | 0.46 | -2.55 | 4.3587 | -0.1431 | |||

| HUBB / Hubbell Incorporated | 0.00 | -10.04 | 0.44 | 11.14 | 4.1671 | 0.3944 | |||

| WCN / Waste Connections, Inc. | 0.00 | -19.71 | 0.42 | -23.30 | 3.9769 | -1.2280 | |||

| GEV / GE Vernova Inc. | 0.00 | -10.00 | 0.38 | 55.74 | 3.6161 | 1.2861 | |||

| SPGI / S&P Global Inc. | 0.00 | -10.00 | 0.38 | -6.65 | 3.6034 | -0.2746 | |||

| CCK / Crown Holdings, Inc. | 0.00 | -3.60 | 0.35 | 11.22 | 3.2978 | 0.3173 | |||

| CMI / Cummins Inc. | 0.00 | -10.34 | 0.34 | -6.34 | 3.2328 | -0.2361 | |||

| TYIA / Johnson Controls International plc | 0.00 | -10.02 | 0.33 | 18.55 | 3.0977 | 0.4731 | |||

| ACA / Arcosa, Inc. | 0.00 | -10.15 | 0.32 | 0.95 | 3.0319 | 0.0153 | |||

| CCJ / Cameco Corporation | 0.00 | 6.25 | 0.32 | 92.07 | 2.9943 | 1.4236 | |||

| IDA / IDACORP, Inc. | 0.00 | -10.06 | 0.31 | -10.56 | 2.8983 | -0.3626 | |||

| VMI / Valmont Industries, Inc. | 0.00 | -10.09 | 0.30 | 2.72 | 2.8733 | 0.0664 | |||

| AZZ / AZZ Inc. | 0.00 | -10.24 | 0.28 | 1.43 | 2.7037 | 0.0243 | |||

| AWK / American Water Works Company, Inc. | 0.00 | -10.23 | 0.26 | -15.43 | 2.5020 | -0.4690 | |||

| DE / Deere & Company | 0.00 | -9.84 | 0.26 | -2.62 | 2.4759 | -0.0720 | |||

| WY / Weyerhaeuser Company | 0.01 | -10.11 | 0.25 | -21.12 | 2.4110 | -0.6618 | |||

| REZI / Resideo Technologies, Inc. | 0.01 | -5.83 | 0.22 | 17.84 | 2.0703 | 0.2973 | |||

| ROCK / Gibraltar Industries, Inc. | 0.00 | -10.14 | 0.22 | -9.58 | 2.0652 | -0.2315 | |||

| 37C / CNH Industrial N.V. | 0.02 | -10.14 | 0.21 | -5.02 | 1.9798 | -0.1186 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | -10.00 | 0.20 | -13.62 | 1.9275 | -0.3234 | |||

| LNT / Alliant Energy Corporation | 0.00 | -10.10 | 0.20 | -15.48 | 1.9198 | -0.3646 | |||

| BLBD / Blue Bird Corporation | 0.00 | -10.08 | 0.19 | 20.50 | 1.8418 | 0.2977 | |||

| MATW / Matthews International Corporation | 0.01 | -10.13 | 0.19 | -3.50 | 1.8355 | -0.0741 | |||

| BBVA / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 0.01 | -10.15 | 0.19 | 1.59 | 1.8279 | 0.0157 | |||

| United States Treasury Bill / DBT (US912797PY71) | 0.19 | 1.7853 | 1.7853 | ||||||

| FCX / Freeport-McMoRan Inc. | 0.00 | -10.21 | 0.17 | 2.37 | 1.6499 | 0.0368 | |||

| FLS / Flowserve Corporation | 0.00 | -10.02 | 0.17 | -3.91 | 1.6412 | -0.0694 | |||

| TKR / The Timken Company | 0.00 | -10.00 | 0.17 | -8.99 | 1.6368 | -0.1741 | |||

| BEPC / Brookfield Renewable Corporation | 0.01 | -10.07 | 0.17 | 5.59 | 1.6228 | 0.0779 | |||

| United States Treasury Bill / DBT (US912797PX98) | 0.15 | 1.4576 | 1.4576 | ||||||

| GOOG / Alphabet Inc. | 0.00 | -10.39 | 0.12 | 1.67 | 1.1617 | 0.0140 | |||

| MWA / Mueller Water Products, Inc. | 0.00 | -10.18 | 0.12 | -15.11 | 1.1272 | -0.2067 | |||

| GRC / The Gorman-Rupp Company | 0.00 | 97.60 | 0.11 | 107.69 | 1.0330 | 0.5307 | |||

| United States Treasury Bill / DBT (US912797NX17) | 0.10 | 0.9488 | 0.9488 | ||||||

| ING / ING Groep N.V. - Depositary Receipt (Common Stock) | 0.00 | -10.18 | 0.10 | 0.00 | 0.9374 | -0.0023 | |||

| FLEX / Flex Ltd. | 0.00 | -55.00 | 0.09 | -32.58 | 0.8529 | -0.4095 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.00 | -10.36 | 0.09 | -8.33 | 0.8442 | -0.0773 | |||

| NXT / Nextracker Inc. | 0.00 | -10.25 | 0.08 | 15.28 | 0.7952 | 0.1049 | |||

| CARR / Carrier Global Corporation | 0.00 | -10.45 | 0.08 | 4.17 | 0.7141 | 0.0197 | |||

| GLW / Corning Incorporated | 0.00 | -41.31 | 0.07 | -33.33 | 0.6729 | -0.3304 | |||

| XIFR / XPLR Infrastructure, LP - Limited Partnership | 0.01 | -43.36 | 0.07 | -51.11 | 0.6295 | -0.6648 | |||

| AMBP / Ardagh Metal Packaging SA | 0.01 | -38.86 | 0.06 | -13.64 | 0.5476 | -0.0876 | |||

| FSTR / L.B. Foster Company | 0.00 | -10.16 | 0.05 | 0.00 | 0.5137 | -0.0035 | |||

| RPRX / Royalty Pharma plc | 0.00 | -20.04 | 0.05 | -8.93 | 0.4924 | -0.0424 | |||

| PLPC / Preformed Line Products Company | 0.00 | -11.17 | 0.05 | 0.00 | 0.4823 | 0.0039 | |||

| VLTO / Veralto Corporation | 0.00 | 0.05 | 0.4791 | 0.4791 | |||||

| CTRI / Centuri Holdings, Inc. | 0.00 | -10.24 | 0.05 | 25.00 | 0.4779 | 0.0870 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | -12.80 | 0.05 | -20.00 | 0.4606 | -0.1176 | |||

| PACK / Ranpak Holdings Corp. | 0.01 | 6.18 | 0.04 | -30.51 | 0.3958 | -0.1730 |